|

시장보고서

상품코드

1773398

소화성 궤양 치료 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Peptic Ulcers Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

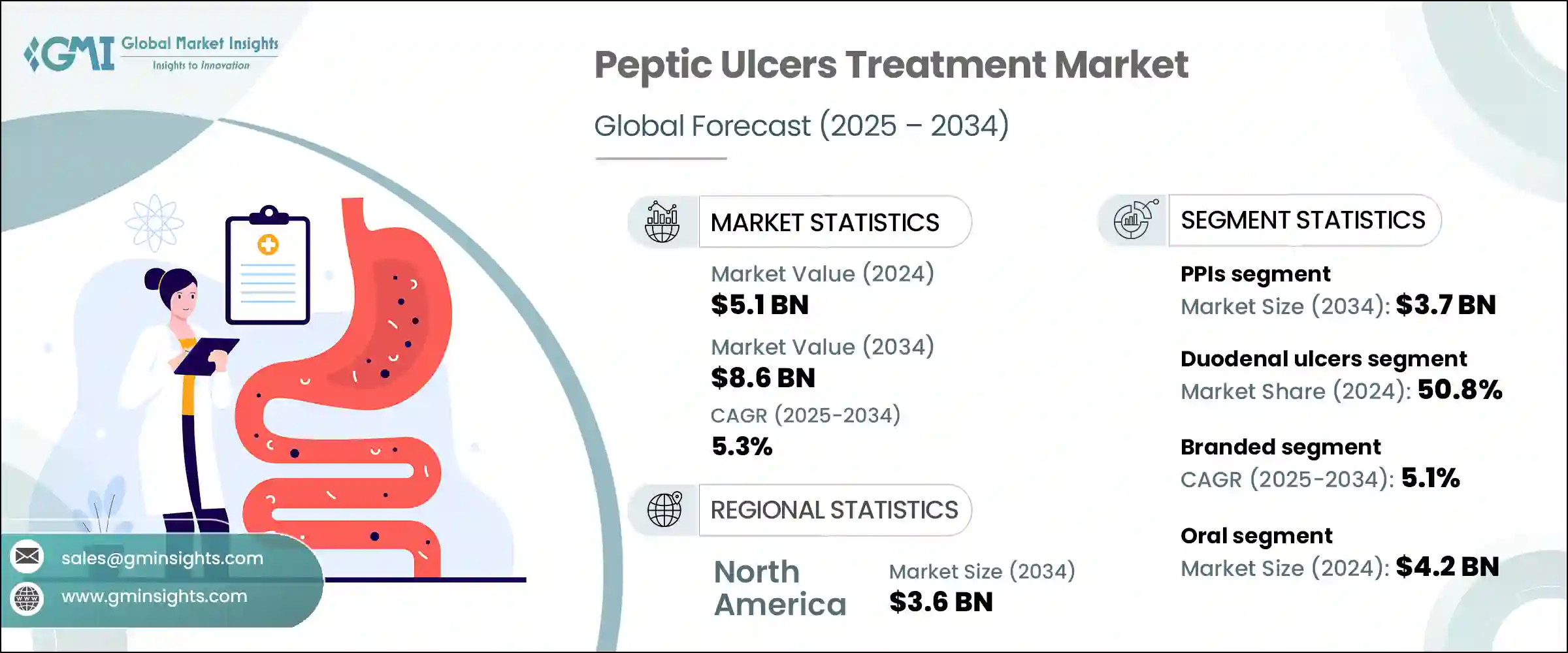

세계의 소화성 궤양 치료 시장 규모는 2024년에 51억 달러를 달성하였고, CAGR 5.3%로 성장하여 2034년에는 86억 달러에 이를 것으로 추정됩니다.

시장 성장의 주요 요인은 성인에게 발생하는 소화기 질환의 이환율이 증가하고 혁신적인 의약품 솔루션의 지속적인 개발에 대한 필요성이 증가하기 때문입니다. 세계 보건기구가 지적한 바와 같이, 이 감염증은 세계 인구의 절반 이상에게 발생하고 있으며 특히 저소득 및 중소득 지역에서의 이환율이 높습니다. 이러한 우려에 의해 소화성 궤양을 관리 및 제거하기 위한 보다 효과적인 치료 옵션에 대한 수요가 증가할 것으로 예측됩니다.

또한 비스테로이드성 항염증제의 오용이 증가하고 있는 것도 시장 확대를 뒷받침하는 요인 중 하나입니다. 그리고 진단과학의 발전과 혁신적인 치료법의 도입으로 환자의 회복률과 궤양 재발률이 개선되고 있으며 이러한 요인이 선진국 및 신흥 국가에서의 의식 상승과 건강 관리에 대한 접근성 향상과 결합되어 소화성 궤양 치료 솔루션에 대한 안정적인 수요로 이어질 것으로 예측됩니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 51억 달러 |

| 예측금액 | 86억 달러 |

| CAGR | 5.3% |

양성자 펌프 억제제(PPI) 분야는 2024년 23억 달러를 달성하였고 2034년까지 CAGR 5.1%로 37억 달러에 달할 것으로 예측되고 있습니다. PPI는 헬리코박터 제균을 위한 다제 병용 요법에 사용되면서 시장의 지배적 지위를 더욱 견고히 하고 있습니다.

십이지장궤양은 2024년에 50.8%의 점유율을 차지하였으며 예측기간 동안 큰 성장을 이룰 것으로 보입니다. 십이지장궤양은 NSAID약의 장기 사용으로 인해 발생합니다. 이 궤양은 광범위한 인구로 확산되어 명확한 증상을 보이기 때문에 신속한 진단과 개입이 가능하며 치료율이 높습니다.

북미의 소화성 궤양 치료 시장은 2024년 21억 달러를 창출하였고 2034년까지 CAGR 5.5%로 성장하여 36억 달러에 이를 것으로 예측되고 있습니다. 의료 인프라에 대한 접근성 향상과 소화관 관리나 예방 의료에 대한 의식 상승 등이 이 지역의 시장 지위 상승에 기여하고 있습니다. 또한, 주요 제약 기업의 적극적인 프레즌스가 이 지역의 성장을 지지하고 있습니다.

소화성 궤양 치료 분야의 주요 기업은 시장에서의 지위를 굳히기 위해 다양한 전략적 이니셔티브에 주력하고 있습니다.

각 회사는 또한 치료에 대한 광범위한 액세스를 보장하기 위해 제조 능력을 확대하고 세계 공급망을 강화하고 있습니다. 특히, 진단율과 치료율이 꾸준히 상승하고 있는 신흥 헬스케어 시장에서는 타겟을 좁힌 계발 캠페인이나 의사 교육 프로그램에 의해 제품의 인지도나 브랜드의 신뢰성이 한층 더 높아지고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 헬리코박터균 감염의 이환율 상승

- 고령화 인구 증가

- 연구개발 자금과 활동 확대

- 업계의 잠재적 위험 및 과제

- PPI의 장기 사용에 의한 부작용

- 시장 기회

- 새로운 치료법과 약물전달의 혁신

- 온라인 약국 확대

- 성장 촉진요인

- 성장 가능성 분석

- 파이프라인 분석

- 규제 상황

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 확장 계획

제5장 시장 추계 및 예측 : 약제 유형별(2021-2034년)

- 주요 동향

- 양성자 펌프 억제제(PPI)

- H2 수용체 길항제

- 제산제

- 항생제

- 세포보호제

- 기타 약제 유형

제6장 시장 추계 및 예측 : 궤양 유형별(2021-2034년)

- 주요 동향

- 위궤양

- 십이지장궤양

- 식도궤양

제7장 시장 추계 및 예측 : 의약품 유형별(2021-2034년)

- 주요 동향

- 브랜드

- 제네릭 의약품

제8장 시장 추계 및 예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 경구

- 비경구

제9장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 병원 약국

- 소매 약국

- 온라인 약국

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- AstraZeneca

- Aurobindo Pharma

- Azurity Pharmaceuticals

- Cadila Healthcare

- Dr. Reddy's Laboratories

- Eisai

- GlaxoSmithKline

- Granules India

- Pfizer

- Phathom Pharmaceuticals

- Ranbaxy Laboratories

- Strides Pharma

- Sun Pharma

- Takeda

The Global Peptic Ulcers Treatment Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 8.6 billion by 2034. The market growth is largely driven by the rising incidence of gastrointestinal conditions among adults and the continued development of innovative pharmaceutical solutions. A key contributor to this demand is the widespread prevalence of Helicobacter pylori infections, which remain a dominant cause of peptic ulcers globally. As noted by global health bodies, this infection affects more than half the world's population, with particularly high rates in low- and middle-income regions. This alarming prevalence is expected to accelerate the demand for more effective treatment options to manage and eliminate the condition.

Another factor fueling market expansion is the increasing misuse of non-steroidal anti-inflammatory drugs, which often damage the stomach lining and lead to ulcer formation. Alongside this, advancements in diagnostics and the rising adoption of innovative treatment regimens-including dual and triple combination therapies-are improving patient recovery rates and minimizing ulcer recurrence. These factors, combined with rising awareness and enhanced healthcare accessibility in both developed and emerging countries, are expected to sustain steady demand for peptic ulcer treatment solutions in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.3% |

The proton pump inhibitors (PPIs) segment generated USD 2.3 billion in 2024 and is forecasted to hit USD 3.7 billion by 2034, registering a CAGR of 5.1%. PPIs have become the cornerstone of ulcer therapy due to their effectiveness in reducing gastric acid levels, accelerating healing, and relieving pain. Their dependable efficacy and minimal side effects have made them widely preferred in treatment regimens. Their contribution to multi-drug therapy approaches for H. pylori eradication further cements their dominant market position. High healing success rates have been consistently reported in clinical settings, particularly when PPIs are administered over a treatment window of four to eight weeks.

The duodenal ulcers segment held a 50.8% share in 2024 and is set to experience significant growth throughout the forecast period. These ulcers typically form in the upper part of the small intestine and are primarily triggered by bacterial infection and long-term use of NSAIDs. They are prevalent across a broad population and frequently present with distinct symptoms that allow for quicker diagnosis and more immediate intervention, supporting higher treatment rates.

North America Peptic Ulcers Treatment Market generated USD 2.1 billion in 2024 and is expected to reach USD 3.6 billion by 2034, growing at a CAGR of 5.5%. This regional dominance can be attributed to the high burden of NSAID-related complications and H. pylori cases. A well-established healthcare framework, better access to advanced medications, and increasing awareness regarding gastrointestinal care and preventive health all contribute to the region's strong market position. Additionally, the active presence of leading pharmaceutical companies continues to support growth in this region.

Major players in the Global Peptic Ulcers Treatment Industry include Takeda, GlaxoSmithKline, Cadila Healthcare, Aurobindo Pharma, Ranbaxy Laboratories, Pfizer, Dr. Reddy's Laboratories, Strides Pharma, Phathom Pharmaceuticals, Granules India, AstraZeneca, Sun Pharma, Eisai, and Azurity Pharmaceuticals. To solidify their market positions, key players in the peptic ulcer treatment space are focusing on diverse strategic initiatives. Many are investing heavily in R&D to develop new therapies with higher efficacy and lower side effects. Formulation improvements, especially around combination drug regimens, are aimed at increasing treatment adherence and minimizing recurrence.

Companies are also expanding their manufacturing capabilities and strengthening their global supply chains to ensure wider access to treatment. Additionally, firms are entering strategic partnerships and engaging in mergers and acquisitions to broaden their portfolios and geographical presence. Targeted awareness campaigns and physician education programs further enhance product visibility and brand credibility, especially in emerging healthcare markets where diagnostic and treatment rates are steadily climbing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Ulcer type

- 2.2.4 Medication type

- 2.2.5 Route of administration

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of Helicobacter pylori Infections

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Expanding R&D fundings and activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of long-term PPI use

- 3.2.3 Market opportunities

- 3.2.3.1 Novel therapies & drug delivery innovations

- 3.2.3.2 Expansion of online pharmacies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proton pump inhibitors (PPIs)

- 5.3 H2-receptor antagonists

- 5.4 Antacids

- 5.5 Antibiotics

- 5.6 Cytoprotective agents

- 5.7 Other drug types

Chapter 6 Market Estimates and Forecast, By Ulcer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gastric ulcers

- 6.3 Duodenal ulcers

- 6.4 Esophageal ulcers

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral Parenteral

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Aurobindo Pharma

- 11.3 Azurity Pharmaceuticals

- 11.4 Cadila Healthcare

- 11.5 Dr. Reddy’s Laboratories

- 11.6 Eisai

- 11.7 GlaxoSmithKline

- 11.8 Granules India

- 11.9 Pfizer

- 11.10 Phathom Pharmaceuticals

- 11.11 Ranbaxy Laboratories

- 11.12 Strides Pharma

- 11.13 Sun Pharma

- 11.14 Takeda