|

시장보고서

상품코드

1773399

상용차용 디젤 엔진 배기 밸브 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Commercial Vehicle Diesel Engine Exhaust Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

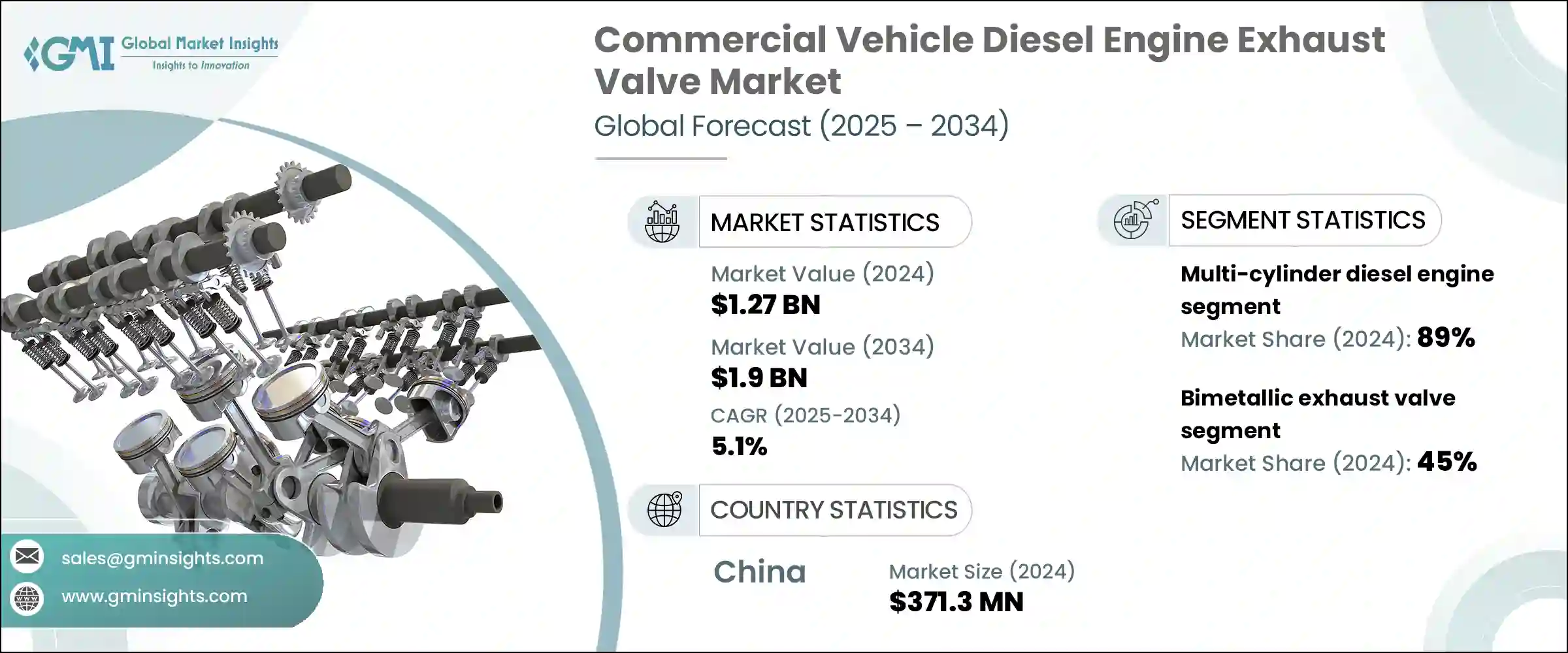

세계의 상용차용 디젤 엔진 배기 밸브 시장 규모는 2024년에 12억 7,000만 달러를 달성하였고, CAGR 5.1%로 성장하여 2034년에는 19억 달러에 이를 것으로 예측되고 있습니다.

상용차 제조의 꾸준한 증가와 디젤 엔진의 수명 연장은 이 시장의 성장을 견인하는 가장 중요한 두 가지 요인입니다. 디젤 엔진이 탑재된 트럭과 버스는 화물 운송 및 건설 작업의 핵심이며, 배기 밸브는 효율적인 엔진 성능과 배기 가스 컴플라이언스를 유지하는 데 필수적입니다. 이러한 차량은 가혹한 운전 부하를 견딜 수 있기 때문에 견고한 배기 밸브 시스템은 장기적인 내구성을 보장하고 엔진 마모를 줄이며 규제 기준을 준수하는 데 필수적입니다. 배기 가스 규제가 강화되고 가동 시간이 그 어느 때보다도 중요해지고 있는 가운데 OEM과 차량 운행 회사는 진화하는 수요에 대응하기 위해 기술적으로 선진적인 내열 밸브 솔루션에 주목하고 있습니다.

이 시장의 확대를 뒷받침하는 중요한 원동력 중 하나는 상용차의 생산 대수가 세계적으로 급증하고 있다는 것입니다. 제조업체는 현재 고장률을 최소화하고 시스템 전체의 효율을 높이는 고도의 재료와 설계 기술을 이용한 고내구성 밸브 부품 개발에 주력하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 12억 7,000만 달러 |

| 예측금액 | 19억 달러 |

| CAGR | 5.1% |

2024년에는 다기통 디젤 엔진 분야가 89%의 점유율을 차지하였고 2025년부터 2034년에 걸쳐 CAGR 5.2%를 보일 것으로 예측됩니다. 다기통 엔진은 내구성, 안정된 출력 공급, 엔진 밸런스가 필수적인 중형 및 대형상용차에서의 사용이 많기 때문에 이 분야를 지배하고 있습니다. 이 엔진은 장시간 운전과 변화가 풍부한 지형 조건에 대응하기 위해 만들어졌으며, 그 성능은 정확한 배기 밸브 피드백 메커니즘에 크게 의존합니다. 적절한 밸브 제어는 연소 효율을 유지하고 배출가스 프로파일을 개선하며 기계적 고장의 위험을 줄이는 데 도움이 됩니다. 이러한 결과는 차세대 트럭을 개발하는 OEM과 수천 대의 차량 성능을 관리하는 플릿 오퍼레이터에게 필수적입니다.

바이메탈 배기 밸브 부문은 2024년에 45%의 점유율을 차지하였고, 2025-2034년의 CAGR은 6.7%로 예측되고 있습니다. 이 밸브는 비용 효율성과 내구성의 균형을 맞추기 위해 두 개의 다른 금속(일반적으로 밸브 헤드에 내열 합금, 스템에 내식성 강을 사용함)을 사용합니다. 바이메탈 밸브는 구조적 강도를 손상시키지 않으면서 고온 및 반응성 화학물질에 대한 노출을 모두 견딜 수 있기 때문에 상업용 디젤 엔진에 특히 적합합니다. 바이메탈 밸브는 뛰어난 내산화성을 가지며 보다 우수한 열전도성을 제공하여 가혹한 작업 조건 하에서 엔진 사이클의 연장을 지원합니다. 운전 효율성과 예기치 않은 유지보수의 최소화를 선호하는 플릿의 경우 이러한 밸브는 성능과 수명을 모두 제공합니다.

중국의 2024년 상용차용 디젤 엔진 배기 밸브 시장 규모는 3억 7,130만 달러를 달성하였고 점유율은 57%를 차지하였습니다. 중국의 OEM 기업들은 센서 탑재 배기 밸브를 디젤 플랫폼에 통합함으로써 예측 유지보수를 촉진하고 배출가스를 줄여 대량 운전에서의 컴플라이언스를 유지하고 있습니다.

세계의 상용차용 디젤 엔진 배기 밸브 시장의 주요 기업으로는 Hitachi, Continental, Denso Corporation, Eaton Corporation, Knorr-Bremse AG, Mahle Group, Sinotruck Engine Valve 등이 있습니다. 이러한 기업은 시장에서의 지위를 강화하고 진화하는 업계의 요구에 적응하기 위해 다양한 접근법을 채용하고 있으며 주요 OEM과 장기 공급 계약을 맺고 있습니다. 주요 전략적 초점으로는 주요 수요 지대 근처에 생산시설을 현지화함으로써 보다 신속한 납품과 비용 효율을 실현하는 것을 들 수 있습니다.

목차

제1장 조사방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 상용차 생산 증가

- 디젤차의 수명 연장

- 밸브 재료의 기술적 진보

- 화물 및 물류업계 확대

- 업계의 잠재적 위험 및 과제

- 전기자동차 및 대체 연료 차량으로의 전환

- 고급 밸브 재료의 높은 비용

- 시장 기회

- 노후화된 차량군에 대한 애프터마켓 확대

- 오프하이웨이 차량 수요 급증

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 코스트 내역 분석

- 소프트웨어 개발 및 라이선싱 비용

- 도입 및 통합 비용

- 보수 및 지원 비용

- 사이버 보안 및 컴플라이언스 비용

- 교육 및 변경 관리 비용

- 특허 분석

- 지속 가능성과 환경 측면

- 지속 가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경친화적인 노력

- 탄소발자국의 고려

- 이용 사례

- 최상의 시나리오

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 엔진별(2021-2034년)

- 주요 동향

- 단기통 디젤 엔진

- 다기통 디젤 엔진

제6장 시장 추계 및 예측 : 밸브별(2021-2034년)

- 주요 동향

- 모노메탈 배기 밸브

- 바이메탈 배기 밸브

- 중공 스템 밸브

- 나트륨 충전 밸브

제7장 시장 추계 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 강철

- 티타늄

- 니켈합금

- 기타 고온 합금

제8장 시장 추계 및 예측 : 판매채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 운송 및 물류

- 건설 및 광업

- 농업

- 대중교통기관

- 긴급구조 서비스 및 유틸리티 서비스

- 군 및 방위

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Anhui Yuxi Industrial

- AVR Valves

- Continental AG

- Delphi Automotive AG

- Denso Corporation

- Eaton Corporation

- Federal-Mogul Holding Corp

- FTE Automotive

- FUJI OOZX

- Hitachi

- Knorr-Bremse

- Mahle Group

- MS Motorservice International

- Nanjing Shengpai Auto Parts

- Riken Corporation

- Shijiazhuang Advanced Valve

- Sinotruck Engine Valve

- Tenneco

- TRW Automotive

- Wuxi Volex Auto Parts

The Global Commercial Vehicle Diesel Engine Exhaust Valve Market was valued at USD 1.27 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.9 billion by 2034. The steady rise in commercial vehicle manufacturing and extended diesel engine lifespans are two of the most significant factors driving this market's growth. Diesel-powered trucks and buses remain the cornerstone of freight and construction operations, and exhaust valves are critical for maintaining efficient engine performance and emissions compliance. As these vehicles endure intense operational loads, robust exhaust valve systems are essential to ensure long-term durability, reduce engine wear, and uphold regulatory standards. With emission regulations tightening and uptime becoming more critical than ever, OEMs and fleet operators are turning to technologically advanced, heat-resistant valve solutions to meet evolving demands.

One of the key forces behind this market's expansion is the rapid increase in production of commercial vehicles globally. From delivery trucks to construction equipment, OEMs across North America, Asia, and parts of Europe are ramping up output to keep pace with rising logistics demand. These vehicles rely on exhaust valves that can withstand intense operating temperatures, pressure cycles, and mechanical stress over long distances. Manufacturers are now focused on developing high-durability valve components using advanced materials and design techniques that minimize failure rates and boost overall system efficiency. Dependable exhaust valve performance is directly tied to diesel engine health, which in turn affects downtime, fuel consumption, and emission output.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.27 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 5.1% |

In 2024, the multi-cylinder diesel engines segment accounted for 89% share and is forecast to grow at a CAGR of 5.2% from 2025 through 2034. Multi-cylinder engines dominate this space due to their prominent use in medium and heavy commercial vehicles, where durability, consistent power delivery, and engine balance are essential. These engines are built to manage extended operating hours and variable terrain conditions, and their performance heavily depends on precise exhaust valve feedback mechanisms. Proper valve control helps maintain combustion efficiency, improve emissions profiles, and reduce the risk of mechanical failure. These outcomes are vital for both OEMs developing next-gen trucks and fleet operators managing performance across thousands of vehicles.

The bimetallic exhaust valves segment held a 45% share in 2024 and is projected to register a CAGR of 6.7% during 2025-2034. These valves use two different metals-typically a heat-resistant alloy for the valve head and corrosion-resistant steel for the stem-to balance cost-efficiency and durability. They are especially suitable for commercial diesel engines due to their ability to endure both high temperatures and aggressive chemical exposure without compromising structural strength. Bimetallic valves offer superior resistance to oxidation, enable better thermal conductivity, and support prolonged engine cycles in the face of intensive work conditions. For fleets that prioritize operational efficiency and minimal unplanned maintenance, these valves deliver both performance and longevity.

China Commercial Vehicle Diesel Engine Exhaust Valve Market generated USD 371.3 million in 2024, representing a 57% share. China's dominance in the regional landscape stems from its massive commercial fleet, the enforcement of strict diesel emission standards, and the increased integration of digital technologies within powertrains. Leading Chinese OEMs are embedding sensor-enabled exhaust valves into diesel platforms to facilitate predictive maintenance, reduce emissions, and maintain compliance across high-volume operations. These technologies also enable better diagnostics and support cleaner combustion processes. The ongoing development of commercial transport infrastructure and regulatory enforcement further amplifies demand in this market.

Key players in the Global Commercial Vehicle Diesel Engine Exhaust Valve Market include Hitachi, Continental, Denso Corporation, Eaton Corporation, Knorr-Bremse AG, Mahle Group, and Sinotruck Engine Valve. These companies are adopting diverse approaches to strengthen their market position and adapt to evolving industry needs. To expand their market footprint, leading companies in this sector are investing heavily in R&D to engineer high-efficiency exhaust valves using advanced alloys and coating technologies. They are also forming long-term supply contracts with major OEMs to ensure consistent volume sales across global markets. A key strategic focus includes localizing production facilities near key demand zones, which allows for faster delivery and cost efficiency. Additionally, players are enhancing product portfolios with digital and sensor-integrated valve systems to meet the rising demand for predictive maintenance and emission monitoring.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engine

- 2.2.3 Valve

- 2.2.4 Material Type

- 2.2.5 Sales Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising commercial vehicle production

- 3.2.1.2 Growing diesel vehicle lifespan

- 3.2.1.3 Technological advancements in valve materials

- 3.2.1.4 Expansion of freight & logistics industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shift toward electric and alternative fuel vehicles

- 3.2.2.2 High cost of advanced valve materials

- 3.2.3 Market opportunities

- 3.2.3.1 Aftermarket expansion in aging vehicle fleets

- 3.2.3.2 Surge in off-highway vehicle demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Single cylinder diesel engine

- 5.3 Multi-cylinder diesel engine

Chapter 6 Market Estimates & Forecast, By Valve, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Mono-metallic exhaust valve

- 6.3 Bimetallic exhaust valve

- 6.4 Hollow stem valve

- 6.5 Sodium-filled valve

Chapter 7 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Titanium

- 7.4 Nickel-based alloys

- 7.5 Other high-temperature alloys

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction & mining

- 9.4 Agriculture

- 9.5 Public transportation

- 9.6 Emergency & utility services

- 9.7 Military & defense

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anhui Yuxi Industrial

- 11.2 AVR Valves

- 11.3 Continental AG

- 11.4 Delphi Automotive AG

- 11.5 Denso Corporation

- 11.6 Eaton Corporation

- 11.7 Federal-Mogul Holding Corp

- 11.8 FTE Automotive

- 11.9 FUJI OOZX

- 11.10 Hitachi

- 11.11 Knorr-Bremse

- 11.12 Mahle Group

- 11.13 MS Motorservice International

- 11.14 Nanjing Shengpai Auto Parts

- 11.15 Riken Corporation

- 11.16 Shijiazhuang Advanced Valve

- 11.17 Sinotruck Engine Valve

- 11.18 Tenneco

- 11.19 TRW Automotive

- 11.20 Wuxi Volex Auto Parts