|

시장보고서

상품코드

1773405

비농축 오렌지주스 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Unconcentrated Orange Juice Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

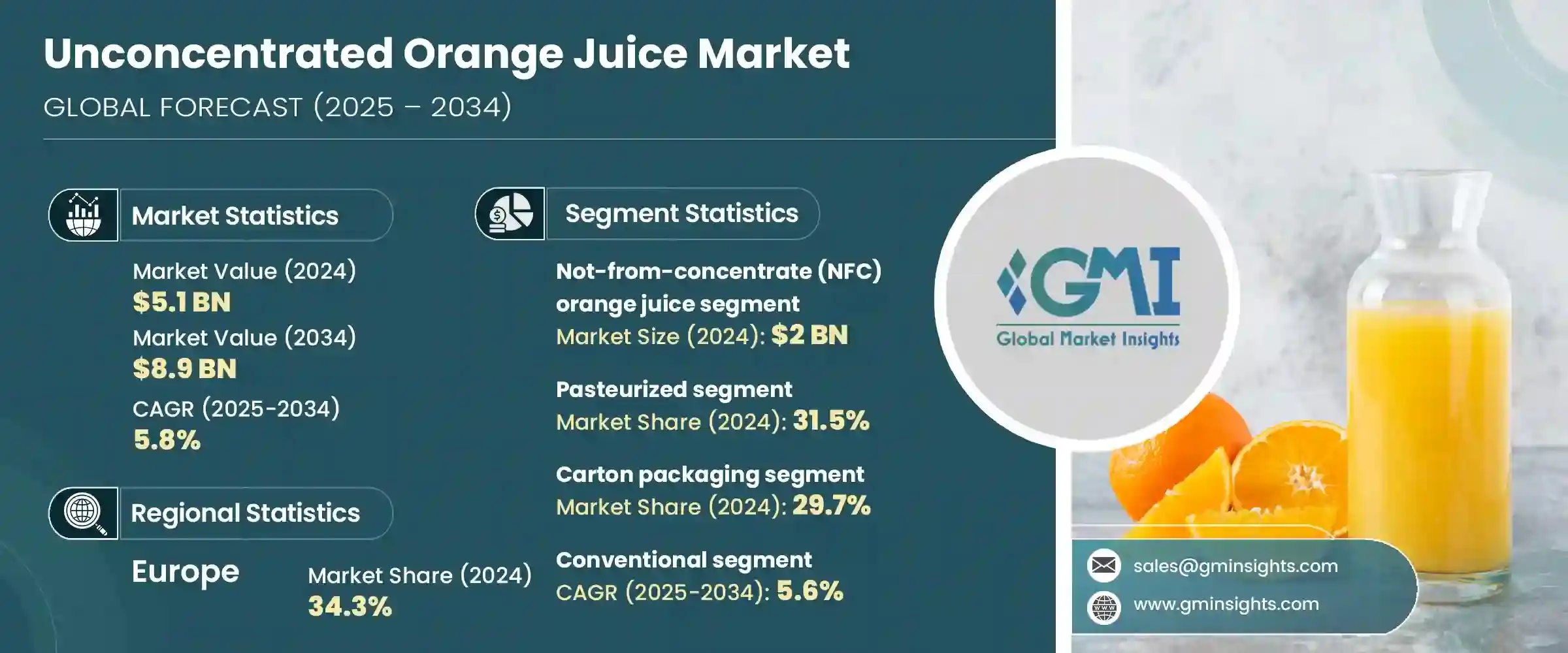

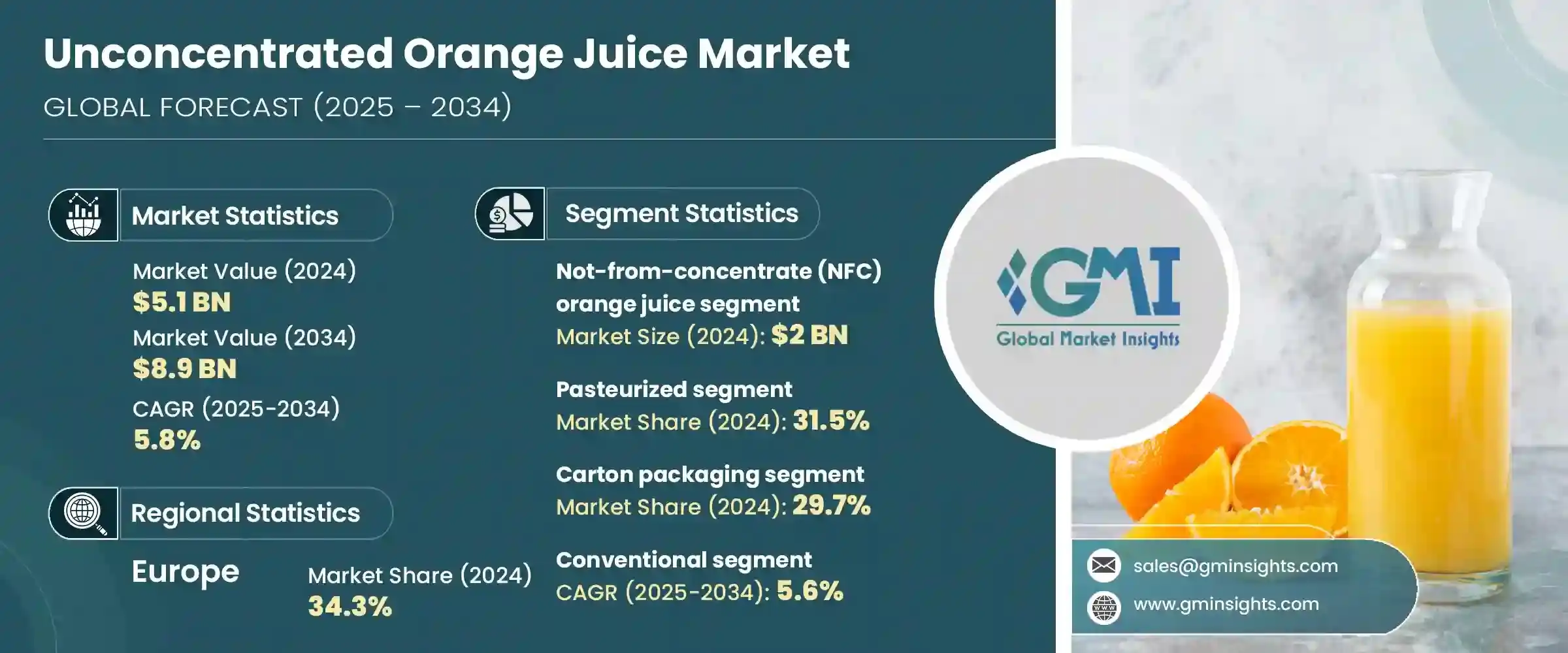

세계의 비농축 오렌지주스 시장 규모는 2024년에 51억 달러로 평가되었고, CAGR 5.8%를 나타내, 2034년에는 89억 달러에 이를 것으로 예측되고 있습니다.

이 성장의 원동력은 건강과 웰빙에 중점을 둔 신선하고 가공도가 낮은 오렌지주스 제품에 대한 소비자의 선호도 증가입니다. 북미와 유럽에서는 건강 지향 소비자가 자연스럽고 신선한 대체 음료로 오렌지주스를 선호합니다. 지난 10년간, 무첨가로 클린 라벨의 제품을 요구하는 동향이 기세를 늘리고, 보존이 효과가 있어, 냉장에서 바로 마실 수 있는 선택지에 대한 수요를 뒷받침하고 있습니다.

또한 농축 환원이 아닌 프리미엄 주스와 유기농 주스가 세계적으로 시장의 관심을 모으고 있습니다. 신흥 국가에서의 도시화의 진전과 콜드체인 물류의 진보도 유통상의 과제를 극복하고 시장 침투를 가능하게 하고 있습니다. 앞으로는 지속가능한 패키징, 투명한 조달, 전자상거래 전략의 혁신이 시장 기회를 확대할 것으로 예측됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 51억 달러 |

| 예측 금액 | 89억 달러 |

| CAGR | 5.8% |

오렌지 공급량의 변동이나 공급망 불확실성 등의 과제에도 불구하고, 비농축 오렌지주스 섹터는 역동적인 성장의 유망한 가능성을 지니고 있습니다. 콜드체인 기술의 진보와 생산자와의 보다 좋은 관계에 의해 기업은 지역적인 제약을 극복해, 높아지는 소비자 수요를 보다 효과적으로 채울 수 있게 되어 있습니다.

비농축 과즙(NFC) 부문은 2024년에 40%의 점유율을 차지했으며, 평가액은 20억 달러였습니다. 요구하는 소비자에게 강하게 어필하고, 여전히 지배적인 제품 유형입니다. 그 인기는 소매와 외식의 양 채널로 높아지고 있어 특히 신선하고 건강한 제품이 높게 평가되는 도심부에서는 현저합니다.

저온 살균 오렌지주스 분야는 2024년에 31.5%의 점유율을 차지했고 CAGR 5.2%를 나타내 소비자층을 확대할 것으로 예측됩니다. 저온 살균은 허용 가능한 풍미 프로파일과 영양 유지를 유지하면서 보존 기간을 연장하고 미생물의 안전성을 확보하는 능력이 있기 때문에 계속 지지되고 있습니다.

2024년 유럽의 비농축 오렌지주스 시장 점유율은 지역에 따라 수요가 크게 달라 지역 소비자의 기호, 오렌지의 가용성, 소매점의 개발에 의해 형성됩니다. 수요가 프리미엄, 유기농, NFC 주스로 점차 시프트하고 있으며, 견조하게 추이하고 있습니다.

비농축 오렌지주스 시장을 형성하는 주요 기업은 Louis Dreyfus Company(LDC), PepsiCo, Inc.(트로피카나), Florida 's Natural Growers, The Coca-Cola Company(심플리 오렌지, 미닛 메이드), Citrosuco 등이 있습니다. 이러한 대기업은 시장 점유율을 유지·확대하기 위해 기술 혁신, 유통망, 지속가능성에 대한 대처로 치열한 경쟁을 펼치고 있습니다. 건강 지향의 소비자에 대응하는 유기농 프리미엄 NFC 주스를 개발하고 있습니다. 특히 E-Commerce나 소비자 직접 판매 플랫폼을 통해 유통 채널을 확대하는 것으로, 시장에의 리치를 넓힐 수 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(주 : 무역 통계는 주요 국가만 제공)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- NFC 오렌지주스

- 갓 짜낸 오렌지주스

- 냉 압착 오렌지주스

- 프리미엄 비농축 오렌지주스

제6장 시장 추계·예측 : 가공 방법별(2021-2034년)

- 주요 동향

- 저온 살균

- 비살균

- 고압처리(HPP)

- 펄스 전기장(PEF)

- 기타

제7장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 카톤 포장

- 테트라 팩

- 퓨어 팩

- 기타

- 플라스틱 병

- 페트병

- HDPE 병

- 기타

- 유리병

- 벌크 포장

- 백인 박스

- 무균 탱크

- 드럼

- 기타

제8장 시장 추계·예측 : 성질별(2021-2034년)

- 주요 동향

- 기존

- 유기농

- 내추럴/클린 라벨

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 온라인 소매

- 전문점

- 푸드서비스

- HoReCa(호텔, 레스토랑, 카페)

- 기관

- 기타 푸드서비스

- 기타

제10장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 직접 소비

- 요리에의 응용

- 음료 블렌드

- 기능성 음료

- 기타

제11장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제12장 기업 프로파일

- The Coca-Cola Company(Minute Maid, Simply Orange)

- PepsiCo, Inc.(Tropicana)

- Florida's Natural Growers

- Citrosuco

- Louis Dreyfus Company(LDC)

- Sucocitrico Cutrale

- COFCO International

- Uncle Matt's Organic

- Rauch Fruchtsafte GmbH &Co OG

- Trade Winds Citrus Limited

- Ventura Coastal LLC

- Nestle SA

- ITC Limited

- Sumol Compal Marcas SA

- Huiyuan Juice Group Limited

The Global Unconcentrated Orange Juice Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 8.9 billion by 2034. This growth is driven by rising consumer preference for fresh, minimally processed orange juice products that emphasize health and wellness. In North America and Europe, health-conscious consumers increasingly favor orange juice as a natural, fresh beverage alternative. Over the last decade, the trend toward additive-free, clean-label products has gained momentum, fueling demand for shelf-stable, chilled, ready-to-drink options.

Additionally, premium and organic not-from-concentrate (NFC) juices are capturing greater market interest globally. The increasing urbanization in developing countries, paired with advancements in cold chain logistics, has also helped overcome distribution challenges, enabling wider market penetration. Looking ahead, innovations in sustainable packaging, transparent sourcing, and e-commerce strategies are expected to open market opportunities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 5.8% |

Despite challenges such as fluctuating orange supplies and supply chain uncertainties, the unconcentrated orange juice sector offers promising potential for dynamic growth. These obstacles, while significant, are being addressed through innovative sourcing strategies and improved logistics that help stabilize supply and ensure consistent product availability. Advances in cold chain technology and better relationships with growers are enabling companies to overcome regional limitations and meet rising consumer demand more effectively. Furthermore, evolving consumer preferences toward natural, additive-free beverages continue to drive expansion, encouraging producers to invest in premium quality and organic offerings.

The not-from-concentrate (NFC) segment accounted for a 40% share in 2024, with a valuation of USD 2 billion. NFC orange juice remains the dominant product type due to its minimal processing and high nutritional content, appealing strongly to consumers seeking natural beverage options. Its popularity is rising in both retail and food service channels, especially in urban centers where fresh, wholesome products are highly valued.

The pasteurized orange juice segment represented a 31.5% share in 2024 and is expected to grow at a CAGR of 5.2%, expanding its consumer base. Pasteurization continues to be favored for its ability to extend shelf life and ensure microbial safety while maintaining an acceptable flavor profile and nutrient retention. Though unpasteurized juice attracts health-conscious buyers looking for the freshest taste, its shorter shelf life restricts its broader distribution.

Europe Unconcentrated Orange Juice Market held a 34.3% share in 2024. Regional demand varies significantly, shaped by local consumer preferences, orange availability, and retail developments. In North America, demand remains steady, with a gradual shift towards premium, organic, and NFC juices reflecting consumers' interest in clean-label, health-oriented products. Europe exhibits robust consumption patterns in countries where cold-pressed and freshly squeezed orange juices have gained popularity across retail and food service sectors.

Among the leading companies shaping the Unconcentrated Orange Juice Market are Louis Dreyfus Company (LDC), PepsiCo, Inc. (Tropicana), Florida's Natural Growers, The Coca-Cola Company (Simply Orange, Minute Maid), and Citrosuco. These major players compete fiercely on innovation, distribution networks, and sustainability initiatives to maintain and grow their market shares. To strengthen their foothold in the unconcentrated orange juice market, companies focus on continuous product innovation, developing organic and premium NFC juices to cater to evolving health-conscious consumers. Expanding distribution channels, especially through e-commerce and direct-to-consumer platforms, helps broaden their market reach. Investments in sustainable and eco-friendly packaging not only appeal to environmentally aware buyers but also align with global regulatory trends.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Not-From-Concentrate (NFC) orange juice

- 5.3 Freshly squeezed orange juice

- 5.4 Cold-pressed orange juice

- 5.5 Premium unconcentrated orange juice

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Pasteurized

- 6.3 Unpasteurized

- 6.4 High-pressure processing (HPP)

- 6.5 Pulsed electric field (PEF)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Carton packaging

- 7.2.1 Tetra Pak

- 7.2.2 Pure-Pak

- 7.2.3 Others

- 7.3 Plastic bottles

- 7.3.1 PET bottles

- 7.3.2 HDPE bottles

- 7.3.3 Others

- 7.4 Glass bottles

- 7.5 Bulk packaging

- 7.5.1 Bag-in-Box

- 7.5.2 Aseptic tanks

- 7.5.3 Drums

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Organic

- 8.4 Natural/Clean label

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Online retail

- 9.5 Specialty stores

- 9.6 Foodservice

- 9.6.1 HoReCa (Hotel, Restaurant, Cafe)

- 9.6.2 Institutional

- 9.6.3 Other foodservice

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 Direct consumption

- 10.3 Culinary applications

- 10.4 Beverage blends

- 10.5 Functional beverages

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.3.7 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 The Coca-Cola Company (Minute Maid, Simply Orange)

- 12.2 PepsiCo, Inc. (Tropicana)

- 12.3 Florida's Natural Growers

- 12.4 Citrosuco

- 12.5 Louis Dreyfus Company (LDC)

- 12.6 Sucocitrico Cutrale

- 12.7 COFCO International

- 12.8 Uncle Matt's Organic

- 12.9 Rauch Fruchtsafte GmbH & Co OG

- 12.10 Trade Winds Citrus Limited

- 12.11 Ventura Coastal LLC

- 12.12 Nestle S.A.

- 12.13 ITC Limited

- 12.14 Sumol + Compal Marcas S.A.

- 12.15 Huiyuan Juice Group Limited