|

시장보고서

상품코드

1773408

고리 원유, 중간체 및 검 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Cyclic Crude, Intermediate, and Gum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

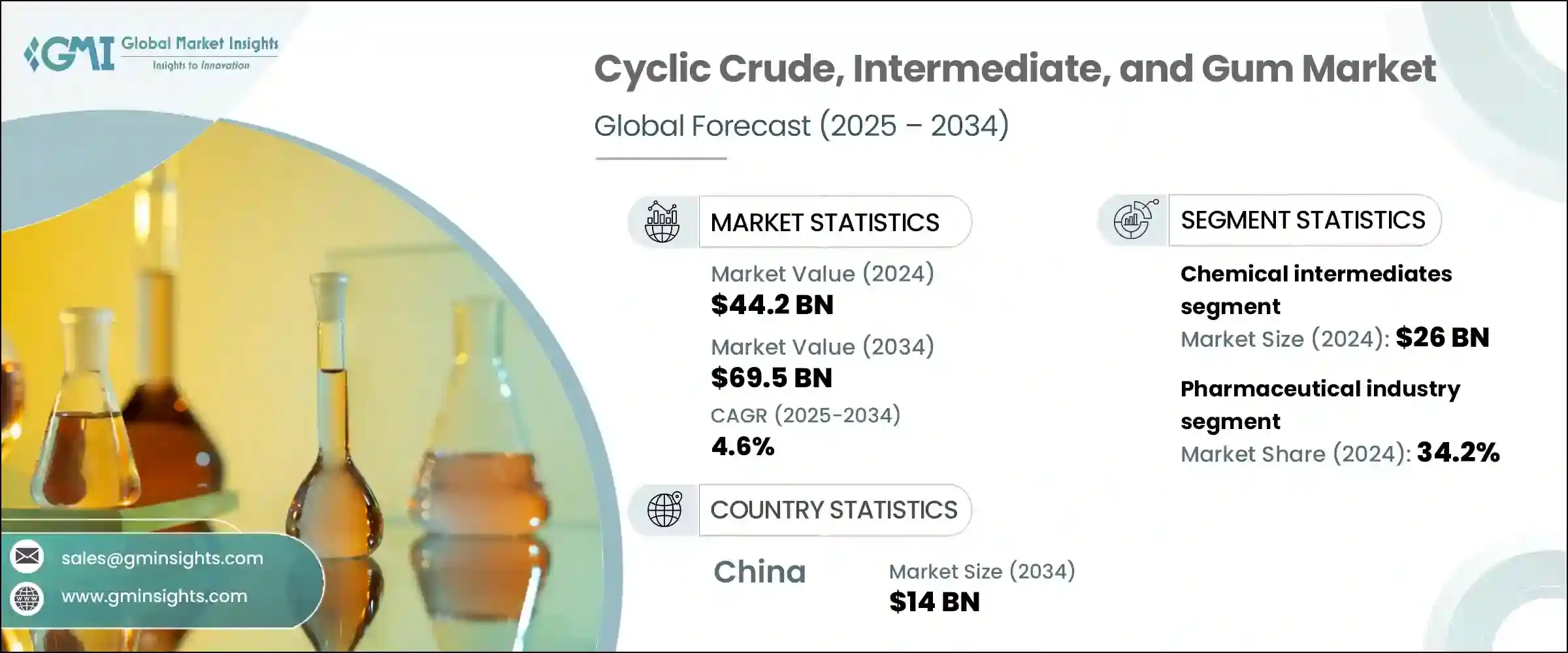

세계의 고리 원유, 중간체 및 검 시장은 2024년에는 442억 달러에 달하였고, CAGR 4.6%로 성장하여 2034년에는 695억 달러에 이를 것으로 예측되고 있습니다.

시장 확대의 주요 요인은 의약품, 식품 가공, 퍼스널케어, 화학 제조 등의 업계에서 발생하는 일관적인 수요입니다. 산업계가 더 복잡한 생산 프로토콜을 채택하고 제품 요구사항이 엄격해짐에 따라 고리 원유, 중간체 및 검에 대한 의존도가 계속 증가하고 있습니다.

이 시장을 견인하는 가장 주목할 만한 동향 중 하나는 천연 소재와 식물 유래 재료를 요구하는 움직임입니다. 이러한 소재는 안정성과 성능 모두가 요구되는 특수한 제제에 널리 사용되고 있습니다. 특히 천연 검은 다양한 다운스트림 용도에서 범용성이 높은 다기능 성분으로 인기를 모으면서 시장에서의 지위를 한층 더 확고히 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 442억 달러 |

| 예측금액 | 695억 달러 |

| CAGR | 4.6% |

시장에서 화학 중간체는 가장 지배적이며 급성장하는 제품 카테고리입니다. 다양한 분야에 널리 응용할 수 있기 때문에 많은 산업 및 상업활동에 필수적입니다.

최종 이용 산업의 관점에서 보면, 2024년에는 의약품 섹터가 고리 원유, 중간체 및 검의 주요 소비자로 부상하며 세계 시장 점유율의 34.2%를 차지하였습니다. 이러한 수요는 고리 원유, 중간체 및 검이 의약품의 합성, 제제화, 안정화에 중요한 역할을 하기 때문에 발생합니다. 고리 중간체는 복잡한 유기 화합물의 제조에 필수적이며 의약품 제조에는 높은 순도의 고리 중간체가 필요합니다. 또한 고급 약물 전달 시스템에 대한 의존도가 높아지고 생명공학에서 유래된 활성 성분의 사용이 확대되면서 시장 수요를 계속 견인하고 있습니다. 천연 검은 그 특성으로 인해 의약품 응용 분야에 널리 사용되고 있습니다.

중국은 주요 지역 시장으로 두드러지며 2024년 매출은 89억 달러에 달했습니다. 중국 시장은 CAGR 4.7%로 성장해 2034년에는 140억 달러에 이를 것으로 예측되고 있습니다. 중국 시장은 호기와 불확실성이 혼재하는 국면을 맞이하였으나 2024년 생산량이 급증하면서 외부 경제 압력에도 불구하고 제조업의 기세가 탄탄함을 보여주는 계기가 되었습니다.

경쟁 면에서 세계 시장은 다국적 대기업과 지역 기업이 혼재하여 형성되어 있으며, 각사는 성장을 유지하기 위해 독자적인 접근법을 채용하고 있습니다. 전략적 움직임은 경쟁구도 형성에 중요한 역할을 하고 있습니다. 이러한 제휴는 기술 혁신 사이클의 신속화, 원료 조달의 강화, 다양한 응용 분야에 걸친 첨단 성분의 안정적인 공급을 목표로 하고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권의 관세 영향 - 구조적 개요

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급체인 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장으로의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책 관여

- 향후 전망과 검토사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 최종 이용 산업에서의 수요 증가

- 의약품으로의 응용 확대

- 특수 화학제품 수요 증가

- 생산 공정 기술의 진보

- 업계의 잠재적 위험 및 과제

- 원재료 가격 변동

- 환경 문제와 규제

- 대체품의 이용 가능성

- 높은 생산 비용

- 성장 촉진요인

- 성장 가능성 분석

- 규제 프레임워크 분석

- 국제규제

- 지역의 규제 기준

- 검 제품에 관한 FDA 규제

- 환경 컴플라이언스 요건

- 품질 인증 시스템

- 기술의 상황

- 현재의 기술 동향

- 생산 신기술

- 제조업의 자동화와 로봇공학

- 연구개발 이니셔티브와 혁신 파이프라인

- 가격 분석

- 가격 동향 분석

- 비용구조 분석

- 가격에 영향을 미치는 요인

- 지역별 가격 차이

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 전략적 대시보드

- 주요 이해관계자와 시장 포지셔닝

- 경쟁 벤치마킹

- 경쟁 전략

- 신제품 개발

- 합병과 인수

- 파트너십 및 협업

- 능력 확장

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 고리 원유

- 방향족 탄화수소

- 지방족 고리 탄화수소

- 헤테로고리 화합물

- 화학 중간체

- 고리 중간체

- 시클로헥사논

- 시클로헥산

- 시클로펜탄

- 기타 고리 중간체

- 의약품 중간체

- 농약 중간체

- 기타 중간체

- 검 및 관련 제품

- 천연검

- 아라비아검

- 구아검

- 잔탄검

- 가티검

- 기타 천연검

- 합성검

- 츄잉검 베이스

- 카르복시메틸셀룰로오스(CMC)

- 기타 합성검

- 목재 화학약품

- 톨유

- 목탄

- 선박용품

- 기타 목재 화학약품

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 의약품

- 의약품 유효성분(API)

- 부형제

- 약물 전달 시스템

- 화학약품 및 재료

- 특수 화학제품

- 폴리머와 수지

- 페인트 및 코팅

- 접착제 및 실란트

- 식음료

- 유화제 및 안정제

- 증점제

- 과자류 제품

- 음료

- 석유 및 가스

- 드릴링 유체

- 석유 회수 증진

- 연료 첨가제

- 섬유

- 섬유 중간체

- 염료와 안료

- 섬유 보조제

- 화장품 및 퍼스널케어

- 에몰리언트제

- 계면활성제

- 레올로지 개질제

- 농업

- 살충제와 제초제

- 식물 성장 조정제

- 토양 개량제

- 기타

제7장 시장 추계 및 예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 제약업계

- 제네릭 의약품

- 브랜드 의약품

- 계약 제조

- 화학산업

- 기초 화학제품

- 특수 화학제품

- 미세 화학제품

- 식품가공업계

- 빵류 및 과자류

- 유제품

- 음료

- 가공식품

- 석유 및 가스

- 업스트림

- 미들스트림

- 다운스트림

- 섬유

- 의류

- 기능성 섬유

- 가정용 섬유

- 화장품 및 퍼스널케어

- 스킨케어

- 헤어케어

- 구강케어

- 농업

- 농작물 보호

- 종자 처리

- 토양 개량

- 기타

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제9장 기업 프로파일

- BASF SE

- Albemarle Corporation

- Alland &Robert

- BioAmber Inc.

- Boc Sciences

- Chevron Phillips Chemical Company

- Clariant AG

- ComWin

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Corporation

- Hefei TNJ Chemical

- Invista

- Kantilal Brothers

- Kerry Group

- Koninklijke DSM NV

- Lonza Group

- Manus Aktteva Biopharma LLP

- Myriant Corporation

- Nexira Inc.

- Realsun Chemical

- Reliance Industries Limited

- Reverdia

- Royal Dutch Shell plc

- Sinopec Limited

- Succinity GmbH

- The Dow Chemical Company

- TIC Gums

- Topas Advanced Polymers Inc.

- Wuxi Gum Base Manufacture Co., Ltd.

The Global Cyclic Crude, Intermediate, and Gum Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 69.5 billion by 2034. The market expansion is largely fueled by consistent demand from industries such as pharmaceuticals, food processing, personal care, and chemical manufacturing. These materials play a crucial role in production workflows by acting as core ingredients, solvents, and emulsifying agents that simplify processing and enhance formulation quality. As industrial operations adopt more sophisticated production protocols and stricter product requirements, the reliance on cyclic crude intermediates and gums continues to rise. In particular, the market is witnessing a shift toward eco-friendly solutions and higher-performing additives, with manufacturers increasingly opting for materials that align with environmental standards and deliver efficient, targeted results.

One of the most notable trends driving this market is the movement toward natural and plant-derived inputs. Companies are actively investing in product innovation and process optimization to offer bio-based intermediates and biodegradable gums that meet growing regulatory and consumer preferences. These materials are now widely used in specialized formulations that demand both stability and consistent performance. Natural gums, in particular, are gaining traction as versatile, multifunctional components in a range of downstream applications, further strengthening their market position. At the same time, the development of cyclic intermediates that meet exacting technical specifications is becoming more important in industries where consistency and precision are non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $69.5 Billion |

| CAGR | 4.6% |

Within the market, chemical intermediates represent the most dominant and fastest-growing product category. This segment generated USD 26 billion in revenue in 2024 and is anticipated to reach USD 41 billion by 2034, expanding at a CAGR of 4.7% during the forecast period. These intermediates are integral to the production of a wide range of high-value goods such as adhesives, polymers, specialty solvents, and medical formulations. Their widespread applicability across various sectors makes them essential for numerous industrial and commercial operations. As petrochemical companies continue to pivot from fuel-centric operations toward specialty chemical production, the importance of intermediates in their portfolio strategies has grown considerably. This evolution reflects broader trends in the global chemical sector, where innovation and value addition have become key growth drivers.

In terms of end-use industries, the pharmaceutical sector emerged as the leading consumer of cyclic crude, intermediates, and gums in 2024, accounting for 34.2% of the global market share. The demand stems from the essential role these materials play in drug synthesis, formulation, and stabilization. Cyclic intermediates are critical for producing complex organic compounds, and their high purity standards make them indispensable in pharmaceutical manufacturing. Additionally, the increasing reliance on advanced drug delivery systems, along with the expanding use of biotechnologically derived active ingredients, continues to drive market demand. Natural gums are also widely used in pharmaceutical applications due to their properties as stabilizers, excipients, and release-modifying agents. As healthcare spending grows globally and the population ages, this segment is expected to maintain its market dominance through the forecast period.

China stands out as a key regional market, contributing USD 8.9 billion in revenue in 2024. The country is projected to grow at a CAGR of 4.7% and is expected to reach USD 14 billion by 2034. The market in China is undergoing a mixed phase of opportunity and uncertainty. While macroeconomic factors such as a subdued real estate sector have introduced caution in industrial procurement, the production volume of cyclic hydrocarbons showed strong resilience. Output saw a sharp rise in 2024, suggesting that manufacturing momentum remains intact despite external economic pressures. The country's continued investment in chemical manufacturing and process efficiency is expected to fuel future growth across both intermediates and natural gums.

On the competitive front, the global market is shaped by a blend of large multinational firms and regional players, each adopting distinct approaches to sustain growth. Industry participants are focusing heavily on clean-label product development, aligning their offerings with the increasing consumer inclination toward health-conscious and sustainable options. Strategic moves such as mergers, acquisitions, and partnerships with technology providers are playing a critical role in shaping the competitive landscape. These collaborations aim to drive faster innovation cycles, enhance raw material sourcing, and ensure a robust supply of advanced ingredients across various application sectors. As the industry navigates through evolving consumer demands and stringent environmental mandates, innovation and strategic agility remain central to long-term market success.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand from end use industries

- 3.7.1.2 Increasing applications in pharmaceuticals

- 3.7.1.3 Rising demand for specialty chemicals

- 3.7.1.4 Technological advancements in production processes

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 Environmental concerns and regulations

- 3.7.2.3 Availability of substitutes

- 3.7.2.4 High production costs

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Regulatory framework analysis

- 3.9.1 International regulations

- 3.9.2 Regional regulatory standards

- 3.9.3 FDA regulations for gum products

- 3.9.4 Environmental compliance requirements

- 3.9.5 Quality certification systems

- 3.10 Technology landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies in production

- 3.10.3 Automation and robotics in manufacturing

- 3.10.4 R&D initiatives and innovation pipeline

- 3.11 Pricing analysis

- 3.11.1 Price trend analysis

- 3.11.2 Cost structure analysis

- 3.11.3 Factors affecting pricing

- 3.11.4 Regional price variations

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Strategic dashboard

- 4.6 Key stakeholders and market positioning

- 4.7 Competitive benchmarking

- 4.8 Competitive strategies

- 4.8.1 New product developments

- 4.8.2 Mergers and acquisitions

- 4.8.3 Partnerships and collaborations

- 4.8.4 Capacity expansions

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Cyclic crude

- 5.2.1 Aromatic hydrocarbons

- 5.2.2 Alicyclic hydrocarbons

- 5.2.3 Heterocyclic compounds

- 5.3 Chemical intermediates

- 5.3.1 Cyclic intermediates

- 5.3.2 Cyclohexanone

- 5.3.3 Cyclohexane

- 5.3.4 Cyclopentane

- 5.3.5 Other cyclic intermediates

- 5.3.6 Pharmaceutical intermediates

- 5.3.7 Agrochemical intermediates

- 5.3.8 Other intermediates

- 5.4 Gums and related products

- 5.4.1 Natural gums

- 5.4.2 Gum arabic

- 5.4.3 Guar gum

- 5.4.4 Xanthan gum

- 5.4.5 Ghatti gum

- 5.4.6 Other natural gums

- 5.4.7 Synthetic gums

- 5.4.8 Chewing gum base

- 5.4.9 Carboxymethyl cellulose (CMC)

- 5.4.10 Other synthetic gums

- 5.5 Wood chemicals

- 5.6 Tall oil

- 5.7 Charcoal

- 5.8 Naval stores

- 5.9 Other wood chemicals

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Pharmaceuticals

- 6.2.1 Active pharmaceutical ingredients (APIs)

- 6.2.2 Excipients

- 6.2.3 Drug delivery systems

- 6.3 Chemicals and materials

- 6.3.1 Specialty chemicals

- 6.3.2 Polymers and resins

- 6.3.3 Paints and coatings

- 6.3.4 Adhesives and sealants

- 6.4 Food and beverages

- 6.4.1 Emulsifiers and stabilizers

- 6.4.2 Thickening agents

- 6.4.3 Confectionery products

- 6.4.4 Beverages

- 6.5 Oil and gas

- 6.5.1 Drilling fluids

- 6.5.2 Enhanced oil recovery

- 6.5.3 Fuel additives

- 6.6 Textiles

- 6.6.1 Fiber intermediates

- 6.6.2 Dyes and pigments

- 6.6.3 Textile auxiliaries

- 6.7 Cosmetics and personal care

- 6.7.1 Emollients

- 6.7.2 Surfactants

- 6.7.3 Rheology modifiers

- 6.8 Agriculture

- 6.8.1 Pesticides and herbicides

- 6.8.2 Plant growth regulators

- 6.8.3 Soil conditioners

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Pharmaceutical industry

- 7.2.1 Generic drugs

- 7.2.2 Branded drugs

- 7.2.3 Contract manufacturing

- 7.3 Chemical industry

- 7.3.1 Basic chemicals

- 7.3.2 Specialty chemicals

- 7.3.3 Fine chemicals

- 7.4 Food processing industry

- 7.4.1 Bakery and confectionery

- 7.4.2 Dairy products

- 7.4.3 Beverages

- 7.4.4 Processed foods

- 7.5 Oil and gas industry

- 7.5.1 Upstream

- 7.5.2 Midstream

- 7.5.3 Downstream

- 7.6 Textile industry

- 7.6.1 Apparel

- 7.6.2 Technical textiles

- 7.6.3 Home textiles

- 7.7 Cosmetics and personal care industry

- 7.7.1 Skin care

- 7.7.2 Hair care

- 7.7.3 Oral care

- 7.8 Agricultural industry

- 7.8.1 Crop protection

- 7.8.2 Seed treatment

- 7.8.3 Soil enhancement

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Albemarle Corporation

- 9.3 Alland & Robert

- 9.4 BioAmber Inc.

- 9.5 Boc Sciences

- 9.6 Chevron Phillips Chemical Company

- 9.7 Clariant AG

- 9.8 ComWin

- 9.9 Eastman Chemical Company

- 9.10 Evonik Industries AG

- 9.11 ExxonMobil Corporation

- 9.12 Hefei TNJ Chemical

- 9.13 Invista

- 9.14 Kantilal Brothers

- 9.15 Kerry Group

- 9.16 Koninklijke DSM N.V.

- 9.17 Lonza Group

- 9.18 Manus Aktteva Biopharma LLP

- 9.19 Myriant Corporation

- 9.20 Nexira Inc.

- 9.21 Realsun Chemical

- 9.22 Reliance Industries Limited

- 9.23 Reverdia

- 9.24 Royal Dutch Shell plc

- 9.25 Sinopec Limited

- 9.26 Succinity GmbH

- 9.27 The Dow Chemical Company

- 9.28 TIC Gums

- 9.29 Topas Advanced Polymers Inc.

- 9.30 Wuxi Gum Base Manufacture Co., Ltd.