|

시장보고서

상품코드

1773469

유화 쇼트닝 시장 기회와 성장 촉진요인, 업계 동향 분석, 예측(2025-2034년)Emulsified Shortenings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

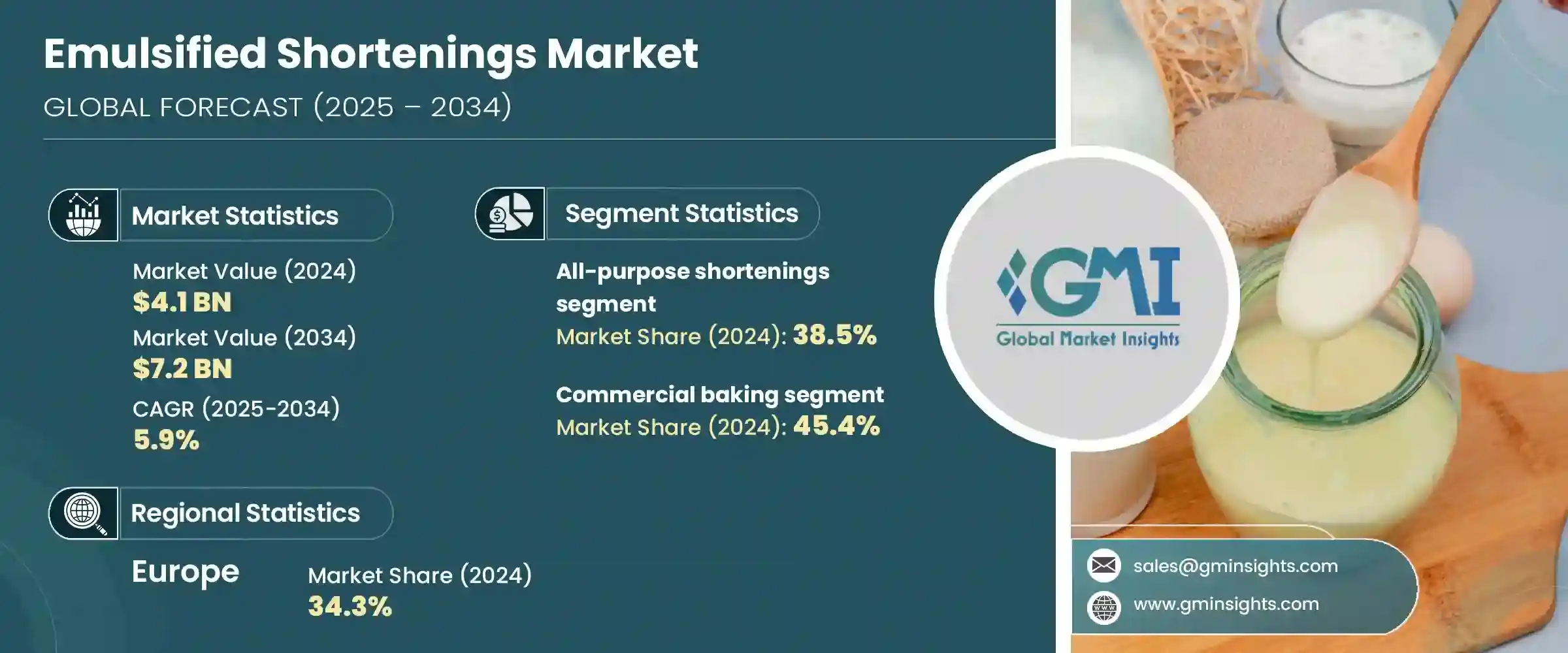

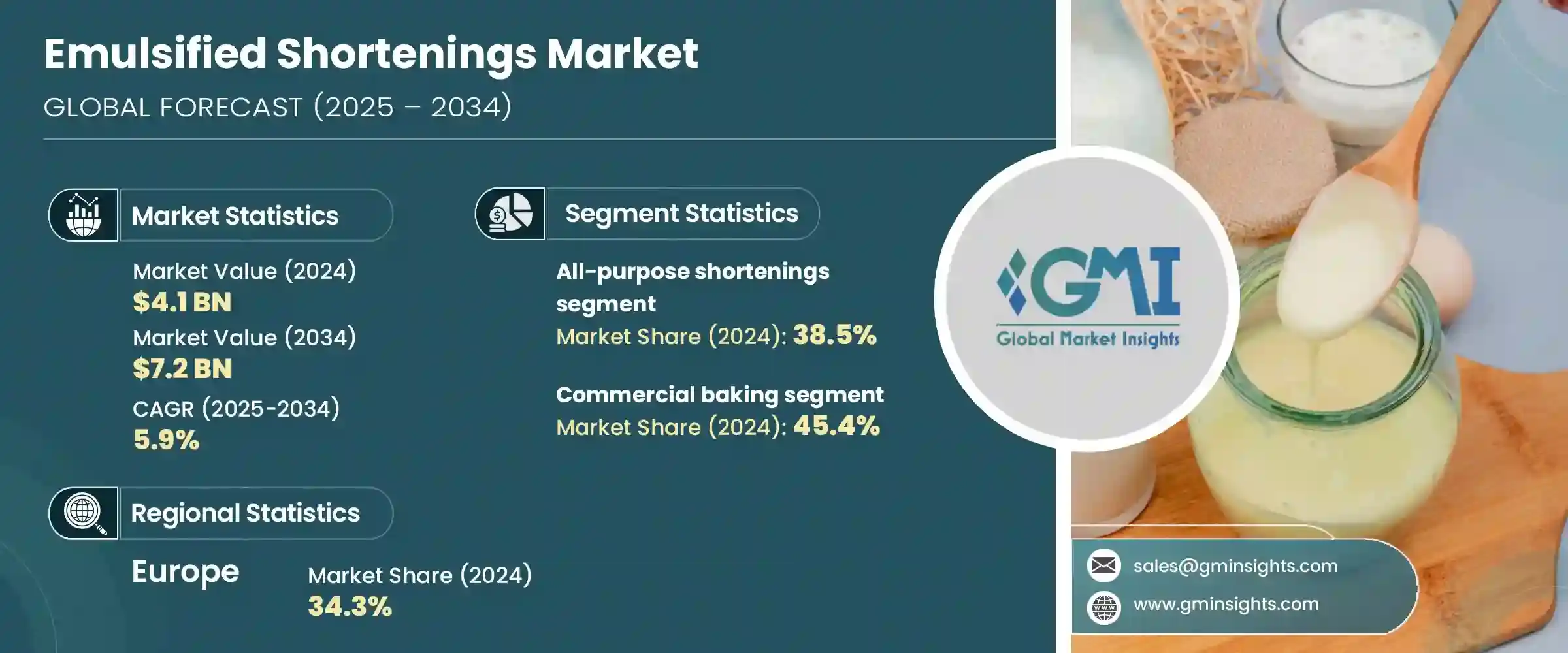

세계의 유화 쇼트닝 시장은 2024년에는 41억 달러로 평가되며, CAGR 5.9%로 성장하며, 2034년에는 72억 달러에 달할 것으로 추정되고 있습니다.

이 쇼트닝은 유화제가 포함된 특수하게 제조된 지방 혼합물로, 유중수형 혼합물의 안정성을 향상시킵니다. 통기성, 일관성, 질감 및 전반적인 보존성을 향상시키는 능력으로 인해 가공 식품 및 베이커리 분야에서 그 사용이 중요합니다. 편리하고 바로 먹을 수 있는 식품, 클린 라벨 대체 식품, 식물성 지방 대체 식품에 대한 수요가 증가함에 따라 시장은 꾸준히 발전하고 있습니다.

비수소 첨가 및 트랜스지방산 무첨가 쇼트닝과 같은 건강 지향적 배합으로의 전환은 제품 혁신을 지속적으로 촉진하고 있습니다. 기술 발전과 식품 규제 강화로 인해 제조업체들은 지속가능하고 소비자의 취향 변화에 대응할 수 있는 원재료 혁신을 추구하고 있습니다. 홈베이커리의 인기 증가와 개발도상국에서의 외식 체인의 급속한 확장은 수요를 더욱 증가시키는 원동력이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작 금액 | 41억 달러 |

| 예측 금액 | 72억 달러 |

| CAGR | 5.9% |

각 업체들은 다양한 지역의 맛에 대한 선호도, 진화하는 식습관, 투명하고 깨끗한 라벨이 부착된 원료에 대한 수요 증가에 대응하기 위해 제품 포트폴리오를 적극적으로 개선하고 있습니다. 문화적 취향과 건강 지향적인 소비자 동향에 맞추어 제품을 제공함으로써 제조업체들은 성숙한 시장과 빠르게 성장하는 신흥 시장 모두에서 사업 확장의 기회를 활용할 수 있도록 준비하고 있습니다. 이러한 지역 밀착형 접근 방식은 고객 충성도를 높일 뿐만 아니라, 전 세계에서 식품 규제가 강화되고 소비 패턴이 변화하는 가운데 각 브랜드가 경쟁력을 유지할 수 있도록 돕습니다.

다목적 쇼트닝 부문은 2024년 16억 달러로 38.5%의 점유율을 차지하며 가장 큰 비중을 차지했습니다. 다양한 가공식품 및 베이커리 용도에서 폭넓게 사용되는 이유는 신뢰할 수 있는 성능, 저렴한 가격, 다기능성 때문입니다. 이러한 특성으로 인해 다용도하고 안정적인 원료를 원하는 대규모 식품 제조업체에서 매우 선호하고 있습니다.

직접 판매 부문은 2024년 48.8%의 점유율을 차지하며 CAGR 5%를 보일 것으로 예측되며, 여전히 가장 선호되는 시장 경로로 남을 것입니다. 이 판매 방식은 맞춤형 제품 사양, 대량 공급 능력, 빠른 배송을 원하는 대규모 산업 바이어에게 매력적입니다. 또한 제조업체가 가격 관리, 기술 지원 및 간소화된 공급 물류를 유지할 수 있으므로 전략적 이점이 있으며, 이 분야에서 가장 빠르게 성장하는 판매 방식입니다.

2024년 유럽 유화 쇼트닝 시장 점유율은 34.3%를 차지했습니다. 이러한 리더십은 이 지역의 첨단인 식품 생산 생태계, 가공식품 및 특수 제과류 소비 증가, 건강한 지방 대체 식품에 대한 소비자 선호도 증가에 기인합니다. 유럽의 규제는 클린 라벨 제품과 윤리적으로 조달된 원료를 지지하고 있으며, 이는 시장 수요와 일치합니다. 지속가능한 방식으로 수확한 오일을 사용하는 등 신뢰할 수 있는 조달 방법이 유화 쇼트닝 분야의 지역적 성장을 더욱 가속화하고 있습니다.

AAK AB, Wilmar International, Archer Daniels Midland Company, Bunge, Cargill Incorporated 등의 주요 기업은 세계의 유화 쇼트닝 시장에서 매우 중요한 역할을 담당하고 있습니다. 이들 기업은 탄탄한 세계 네트워크와 다양한 포트폴리오를 통해 혁신과 유통의 최전선에 자리 잡고 있습니다. 유화 쇼트닝 시장의 주요 기업은 시장에서의 입지를 확보하고 확대하기 위해 몇 가지 전략적 접근 방식에 집중하고 있습니다.

맞춤형 제형 개발은 여전히 최우선 과제이며, 이를 통해 공급업체는 상업용이든 산업용이든 특정 고객 니즈를 충족시킬 수 있습니다. 규제와 소비자의 건강 기대에 부응하기 위해 많은 기업이 클린 라벨 기술과 건강한 대체 지방에 투자하고 있습니다. 지속가능성도 중요하게 여겨지고 있으며, 환경 친화적인 구매자에게 어필하기 위해 인증된 팜유와 식물성 원료를 사용하고 있습니다. 또한 기업은 제품의 일관성과 비용 효율성을 보장하기 위해 고객 직접 판매 채널을 강화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 개요

제3장 업계 인사이트

- 에코시스템 분석

- 공급업체의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 파괴적 변화

- 업계에 대한 영향요인

- 촉진요인

- 업계의 잠재적 리스크 & 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter의 산업 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 테크놀러지와 혁신의 상황

- 현재 기술 동향

- 신규 기술

- 특허 상황

- 무역통계(HS 코드)(주 : 무역통계는 주요 국가만 제공)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능 관행

- 폐기물 삭감 전략

- 생산에서의 에너지 효율

- 친환경 구상

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십과 협업

- 신제품 발매

- 확장 계획

제5장 시장 추산·예측 : 제품 유형별, 2021-2034

- 주요 동향

- 만능 쇼트닝

- 케이크와 아이싱 쇼트닝

- 프라잉 쇼트닝

- 특제 쇼트닝

제6장 시장 추산·예측 : 용도별, 2021-2034

- 주요 동향

- 상업용 베이킹

- 푸드서비스

- 식품 제조

- 소매·소비자

제7장 시장 추산·예측 : 유통 채널별, 2021-2034

- 주요 동향

- 직접 판매

- 판매업체 및 도매업체

- 소매 채널

- 식품 서비스 판매업체

제8장 시장 추산·예측 : 지역별, 2021-2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카 지역

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 아랍에미리트

- 기타 중동 및 아프리카 지역

제9장 기업 개요

- Cargill Incorporated

- Bunge

- Archer Daniels Midland Company

- AAK AB

- Wilmar International

- Fuji Oil Holdings

- IOI Group

- Musim Mas

- Olenex

- Intercontinental Specialty Fats

- Ventura Foods

- Apical Group

- Sime Darby Plantation

- Mewah International

- Carotino

- Liberty Oil Mills

- Felda IFFCO

- Oleo-Fats

- PT SMART

- Golden Agri-Resources

The Global Emulsified Shortenings Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 7.2 billion by 2034. These shortenings are specially formulated fat blends that incorporate emulsifiers, enhancing the stability of water-in-oil mixtures. Their use is critical in processed food and bakery sectors due to their ability to improve aeration, consistency, texture, and overall shelf life. The market is advancing steadily on the back of rising demand for convenient, ready-to-eat food products, clean-label alternatives, and plant-based fat replacements.

The shift towards health-conscious formulations, such as non-hydrogenated and trans-fat-free shortenings, continues to fuel product innovation. Technological progress and tighter food regulations are pushing manufacturers to innovate with ingredients that are both sustainable and adaptable to evolving consumer preferences. The growing popularity of home baking, along with the rapid expansion of food service chains in developing regions, is driving further demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 5.9% |

Companies are actively refining their product portfolios to cater to diverse regional flavor preferences, evolving dietary requirements, and the rising demand for transparent, clean-label ingredients. By aligning their offerings with cultural tastes and health-conscious consumer trends, manufacturers are positioning themselves to capitalize on expansion opportunities in both mature and high-growth developing markets. This localized approach not only enhances customer loyalty but also allows brands to stay competitive amid tightening food regulations and shifting consumption patterns worldwide.

The all-purpose shortenings segment represented the largest segment in 2024, contributing USD 1.6 billion and a 38.5% share. Their wide usage across various processed foods and bakery applications stems from their dependable performance, affordability, and multi-functionality. These attributes make them highly desirable among large-scale food manufacturers seeking versatile and consistent ingredients.

The direct sales segment accounted for a 48.8% share in 2024 and is anticipated to grow at a CAGR of 5%, remaining the most preferred route to the market. This sales approach appeals to large industrial buyers who seek tailored product specifications, bulk supply capabilities, and prompt delivery. It also offers a strategic advantage by enabling manufacturers to maintain pricing control, technical support, and streamlined supply logistics, making it the fastest-growing distribution method in the sector.

Europe Emulsified Shortenings Market held a 34.3% share in 2024. This leadership stems from the region's advanced food production ecosystem, increased consumption of processed and specialty baked goods, and rising consumer inclination toward healthier fat alternatives. European regulations favor clean-label products and ethically sourced ingredients, which align with market demands. Reliable sourcing practices, such as the use of sustainably harvested oils, have further accelerated regional growth in the emulsified shortenings space.

Key players such as AAK AB, Wilmar International, Archer Daniels Midland Company, Bunge, and Cargill Incorporated play a pivotal role in the global emulsified shortenings landscape. These companies have anchored themselves at the forefront of innovation and distribution through robust global networks and diversified portfolios. Leading companies in the emulsified shortenings market are focusing on several strategic approaches to secure and expand their market positions.

Custom formulation development remains a top priority, allowing suppliers to cater to specific client needs across commercial and industrial applications. Many are investing in clean-label technologies and healthier fat alternatives to align with regulatory and consumer health expectations. A strong emphasis is placed on sustainability, with firms adopting certified palm oils and plant-based inputs to appeal to environmentally conscious buyers. Additionally, firms are strengthening direct-to-customer distribution channels to ensure product consistency and cost efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 All-purpose shortenings

- 5.3 Cake and icing shortenings

- 5.4 Frying shortenings

- 5.5 Specialty shortenings

Chapter 6 Market Estimates and Forecast, By Applications, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Commercial baking

- 6.3 Food service

- 6.4 Food manufacturing

- 6.5 Retail and consumer

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors and wholesalers

- 7.4 Retail channels

- 7.5 Food service distributors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill Incorporated

- 9.2 Bunge

- 9.3 Archer Daniels Midland Company

- 9.4 AAK AB

- 9.5 Wilmar International

- 9.6 Fuji Oil Holdings

- 9.7 IOI Group

- 9.8 Musim Mas

- 9.9 Olenex

- 9.10 Intercontinental Specialty Fats

- 9.11 Ventura Foods

- 9.12 Apical Group

- 9.13 Sime Darby Plantation

- 9.14 Mewah International

- 9.15 Carotino

- 9.16 Liberty Oil Mills

- 9.17 Felda IFFCO

- 9.18 Oleo- Fats

- 9.19 PT SMART

- 9.20 Golden Agri- Resources