|

시장보고서

상품코드

1782113

장용성 공캡슐 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Enteric Empty Capsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

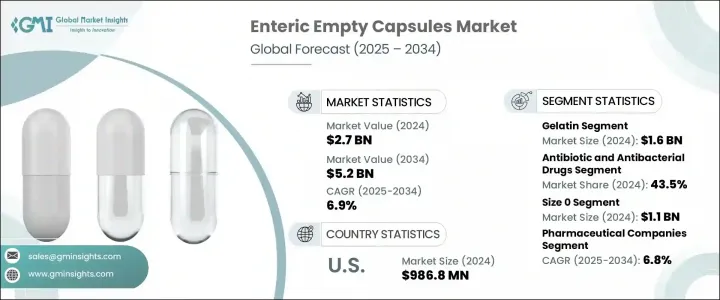

세계의 장용성 공캡슐 시장은 2024년에는 27억 달러로 평가되었고, CAGR 6.9%로 성장할 전망이며, 2034년에는 52억 달러에 이를 것으로 추정됩니다.

이 급성장의 배경은 의약품과 영양 보충제 활성 화합물의 표적을 좁힌 지연 방출을 보장하는 고급 약물 전달 시스템에 대한 요구 증가가 있습니다. 위산으로부터 민감한 성분을 보호하고 장에 직접 전달하는 장용성 캡슐은 위장약이나 산에 민감한 치료에 중요합니다. 그 범용성은 항생제, 제산제, 효소 치료에도 이르러 최신 제제에는 빼놓을 수 없는 요소가 되고 있습니다.

맞춤형 의료 및 환자 중심 설계의 급속한 성장은 제형의 유연성과 다양한 유효 성분의 적합성 덕분에 수요를 더욱 밀어 올리고 있습니다. 확대되는 영양 보조 식품의 분야에서는, 장용성 캡슐(특히 HPMC 기반의 비건 대응 타입)이 프로바이오틱스, 효소, 허브 보충제의 송달에 점점 지지되고 있습니다. 클린 라벨로 식물 유래 선택지가 선호되기 때문에 제조업체는 실리콘을 포함하지 않은 채식 캡슐에 대한 투자를 독려하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 27억 달러 |

| 예측 금액 | 52억 달러 |

| CAGR | 6.9% |

젤라틴 부문은 2024년에 16억 달러를 창출했습니다. 합리적인 가격, 필름 형성 품질 및 제조 용이성은 대규모 캡슐 제조, 특히 비채식 제형이 허용되는 경우 기본 옵션입니다. 그 규제 편의성 및 다양한 의약품의 적합성으로 인해 많은 의약품 및 보충제 제조업체에게 최선의 선택이 되었습니다.

장용성 공캡슐은 2024년에 43.5%의 점유율을 차지하는 항생제 및 항균제 부문에 채용되고 있습니다. 이 캡슐은 산에 약한 항생제를 위장에서 분해로부터 보호하고 장에서 최적의 흡수를 보장합니다. 또한 부작용을 최소화하고 특정 약물의 불쾌한 맛을 마스킹하여 환자의 복약 충동과 치료 성공을 향상시킵니다.

미국의 장용성 공캡슐 2024년 시장 규모는 9억 8,680만 달러로, 수천만 명의 사람들에게 영향을 미치는 위장 질환의 확산과 성인 건강보조식품 섭취의 견조함으로 견인되고 있습니다. FDA(미국 식품의약국) 및 USDA(미국 농무부)와 같은 기관에 의한 규제의 명확화는 pH 의존성 및 지연 방출 캡슐 기술의 신속한 개발과 채용을 뒷받침하고 있습니다.

이 업계의 주요 제조업체는 Lonza, Roquette Freres, Chemcaps, Bright Pharma Caps, Qingdao Yiqing, ACG Worldwide, Natural Capsules, Yiyang Pharma, Capsuline, Shaoxing Zhongya Capsule, Fortcaps Healthcare, Caps Canada, Suh Capsules 등이 있습니다. 시장 포지션을 강화하기 위해 장용성 공캡슐 분야의 주요 제조업체는 몇 가지 중요한 전략을 전개하고 있습니다. HPMC와 식물 유래 폴리머 등 건강 지향적인 소비자에게 어필하고 규제 기준을 충족하는 혁신적인 캡슐 소재를 개발하기 위해 연구개발에 투자하고 있습니다.

제약 회사 및 영양 보충제 회사와의 전략적 파트너십은 특정 원료 및 전달 시스템에 맞는 맞춤형 솔루션의 공동 개발을 촉진합니다. 많은 기업들은 공급망의 효율을 향상시키기 위해 생산 능력을 확대하고 지역 허브와 더 가까운 곳에 시설을 설립하고 있습니다. 클린 라벨, 비건 친화적 인증, 투명성 높은 제조 공정을 중시함으로써 윤리적이고 안전한 제품을 원하는 소비자의 요구에 부응하고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 표적 약물전달 수요 증가

- 채식 캡슐 대체품으로의 전환 증가

- 맞춤형 의료 솔루션의 확대

- 캡슐 코팅 기술의 진보

- 업계의 잠재적 위험 및 과제

- 장용 제제의 규제에 대한 복잡성

- 높은 제조 비용 및 코팅 비용

- 시장 기회

- 영양보조식품 소비의 세계적 증가

- 신흥 경제 국가에서의 시판약 및 보충제 수요 증가

- 성장 촉진요인

- 성장 가능성 분석

- 장래 시장 동향

- 소비자 행동 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 젤라틴 캡슐

- 비젤라틴 캡슐

- HPMC(히드록시프로파일메틸셀룰로오스)

- 풀루란 캡슐

- 전분 베이스 캡슐

- 기타 비젤라틴 캡슐

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 제산제 및 정장제

- 항생제 및 항균제

- 기타 용도

제7장 시장 추계 및 예측 : 캡슐 사이즈별(2021-2034년)

- 주요 동향

- 사이즈 00

- 사이즈 0

- 사이즈 1

- 기타 캡슐 사이즈

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 제약회사

- 영양 보조 식품 제조업체

- 기타 최종 용도

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- ACG Worldwide

- Bright Pharma Caps

- CapsCanada

- Capsuline

- Chemcaps

- Fortcaps Healthcare

- Lonza

- Natural Capsules

- Qingdao Yiqing

- Roquette Freres

- Shaoxing Zhongya Capsule

- Suheung

- Yiyang Pharma

- Zhejiang Huili Capsules

The Global Enteric Empty Capsules Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 5.2 billion by 2034. This surge is being driven by the increasing need for advanced drug delivery systems that ensure targeted, delayed release of active pharmaceutical and nutraceutical compounds. By shielding sensitive ingredients from stomach acidity and delivering them directly to the intestines, enteric capsules are critical for gastrointestinal medications and acid-sensitive therapies. Their versatility extends to antibiotics, antacids, and enzyme treatments, making them an essential component of modern formulations.

The rapid growth of personalized medicine and patient-centric design is further boosting demand, thanks to formulation flexibility and compatibility with diverse active ingredients. In the expanding nutraceutical arena, enteric capsules-especially HPMC-based, vegan-friendly types-are increasingly favored for probiotic, enzyme, and herbal supplement delivery. The preference for clean-label, plant-based options is prompting manufacturers to invest in silicone-free, vegetarian capsule alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.9% |

The Gelatin segment generated USD 1.6 billion in 2024. Its affordability, film-forming quality, and ease of production make it the default choice for large-scale capsule manufacturing, especially where non-vegetarian formulations are acceptable. Its regulatory convenience and compatibility with a variety of APIs make it a top choice for many pharmaceutical and supplement producers.

Enteric empty capsules are employed in the antibiotic and antibacterial drugs segment, which held a 43.5% share in 2024. These capsules protect acid-sensitive antibiotics from gastric degradation, ensuring optimal absorption in the intestines. They also help minimize side effects and mask the unpleasant taste of certain medications, improving patient adherence and treatment success.

U.S. Enteric Empty Capsules Market accounted for USD 986.8 million in 2024, driven by widespread gastrointestinal conditions affecting tens of millions of people, and a robust supplement intake among adults. Regulatory clarity from agencies like the FDA and USDA supports fast-track development and adoption of pH-dependent and delayed-release capsule technologies.

Key manufacturers in this industry include Lonza, Roquette Freres, Chemcaps, Bright Pharma Caps, Qingdao Yiqing, ACG Worldwide, Natural Capsules, Yiyang Pharma, Capsuline, Shaoxing Zhongya Capsule, Fortcaps Healthcare, CapsCanada, Suheung, and Zhejiang Huili Capsules. To bolster their market position, leading manufacturers in the enteric empty capsules space are deploying several key strategies. They're investing in R&D to develop innovative capsule materials-such as HPMC and plant-based polymers-that appeal to health-conscious consumers and meet regulatory standards.

Strategic partnerships with pharmaceutical and nutraceutical firms facilitate the co-development of customized solutions tailored to specific APIs and delivery systems. Many companies are expanding production capacities and establishing facilities closer to regional hubs to improve supply chain efficiency. Emphasis on clean-label, vegan-friendly certification, and transparent manufacturing processes addresses consumer demand for ethical and safe products.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Capsule size

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for targeted drug delivery

- 3.2.1.2 Growing shift toward vegetarian capsule alternatives

- 3.2.1.3 Expansion of personalized medicine solutions

- 3.2.1.4 Advancements in capsule coating technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity for enteric formulations

- 3.2.2.2 High production and coating costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing consumption of nutraceutical globally

- 3.2.3.2 Increasing demand for over-the-counter medications and supplements in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Consumer behaviour analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East and Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gelatin capsules

- 5.3 Non-gelatin capsules

- 5.3.1 HPMC (hydroxypropyl methylcellulose)

- 5.3.2 Pullulan capsules

- 5.3.3 Starch-based capsules

- 5.3.4 Other non-gelatin capsules

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antacid and antiflatulent preparations

- 6.3 Antibiotic and antibacterial drugs

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Capsule Size, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Size 00

- 7.3 Size 0

- 7.4 Size 1

- 7.5 Other capsule size

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Nutraceutical manufacturers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ACG Worldwide

- 10.2 Bright Pharma Caps

- 10.3 CapsCanada

- 10.4 Capsuline

- 10.5 Chemcaps

- 10.6 Fortcaps Healthcare

- 10.7 Lonza

- 10.8 Natural Capsules

- 10.9 Qingdao Yiqing

- 10.10 Roquette Freres

- 10.11 Shaoxing Zhongya Capsule

- 10.12 Suheung

- 10.13 Yiyang Pharma

- 10.14 Zhejiang Huili Capsules