|

시장보고서

상품코드

1797739

전립선암 바이오마커 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Prostate Cancer Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

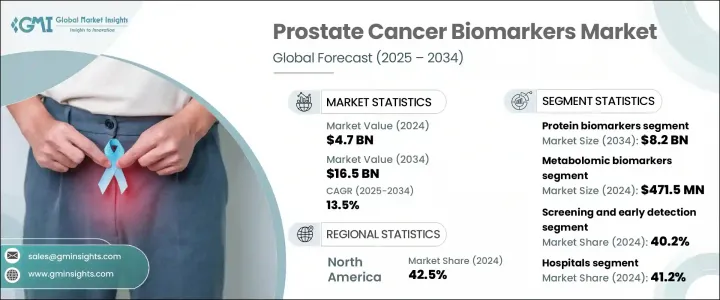

세계의 전립선암 바이오마커 시장은 2024년 47억 달러로 평가되었으며 CAGR 13.5%로 성장해 2034년까지 165억 달러에 이를 것으로 추정됩니다.

시장 성장을 뒷받침하는 것은 특히 남성 인구의 고령화에 수반하는 전립선암 환자 수 증가와 고급 진단법의 진화입니다. 조기 검진에 대한 의식의 높아짐과 정부가 후원하는 헬스 케어 프로그램 증가가 프라이머리 케어의 현장에서의 채용에 박차를 가하고 있습니다. 인공지능 주도의 평가, 액체생검, 유전체 해석 플랫폼 등 차세대 진단의 통합으로 조기 발견이 강화됨과 동시에 맞춤 치료 방침의 결정이 지원되게 되었습니다. 또한 신흥국에서는 의료 인프라에 대한 투자가 증가하고 있으며 정밀 기반 검사법에 대한 접근이 확대되고 있습니다. 이러한 바이오마커 주도 전략은 정밀도 향상, 침습성 저감, 진단 워크플로우의 신속화에 의해 암 의료를 재구성하고 있습니다.

OPKO Health, Beckman Coulter, Bio-Rad Laboratories 및 Bio-Techne과 같은 주요 업계 공헌 기업은 전립선 암 바이오 마커 시장의 혁신을 추진하는 최전선에 있습니다. 이러한 기업들은 최첨단 진단 플랫폼을 통해 감지의 정확성과 속도를 높일 뿐만 아니라 개별화된 암 치료의 미래를 형성하고 있습니다. 비침습적이고 민감한 바이오마커 분석을 개발하고 AI 기반 진단 시스템과 통합함으로써 질병의 조기 발견, 더 나은 진행 모니터링 및 보다 효과적인 치료 계획을 가능하게 합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 47억 달러 |

| 예측 금액 | 165억 달러 |

| CAGR | 13.5% |

단백질 바이오마커 분야는 2024년 24억 달러를 창출해, CAGR 13.1%로 성장하면서 2034년까지 82억 달러에 이를 것으로 예측되고 있습니다. 바이오 마커의 이점은 임상 적으로 널리 받아 들여지고 질병 검출 및 진행 추적에 일상적으로 사용되고 있습니다. 이 카테고리의 바이오마커는 표준 혈액 분석으로 쉽게 측정할 수 있으며, 신뢰성, 비용 효과, 전립선암 위험과 강한 상관성이 입증되었기 때문에 여전히 첫 번째 진단 도구입니다. 현재 진행 중인 조사를 통해 이러한 바이오마커 기술은 계속 개선되어 정확성을 유지하면서 불필요한 침습적 진단을 줄일 수 있습니다. 새로운 바이오마커를 기반으로 하는 스코어링 도구는 리스크 계층화 및 추가 검사를 위한 환자 선택을 개선하고 치료 경로를 최적화합니다.

용도별로는 스크리닝과 조기 발견의 분야가 2024년 시장에서 가장 높은 점유율 40.2%를 차지했습니다. 이는 공중 보건 시스템과 개인의 임상 진료 모두에서 조기 진단이 중요해졌기 때문입니다. 스크리닝 플랫폼은 현재 대량의 워크플로우를 위해 설계되었으며, 혈액 또는 소변을 기반으로 하는 바이오마커 측정을 활용하여 최소한의 처리로 빠르고 안정적인 결과를 제공합니다. 이러한 솔루션은 일상적인 건강 진단에 매우 적합하며 신속한 납기와 사용 편의성이 중요한 외래 환경에서 빠르게 확대되고 있습니다. 비침습적 검사의 편리성과 이용의 용이성은 전 세계적으로 전립선암 예방전략에 필수적입니다.

북미 전립선암 바이오마커 2024년 점유율은 42.5% 이 지역은 첨단 의료 인프라, 높은 이환율, 규제 당국의 승인 획득 가속화 등의 이점을 누리고 있습니다. 미국과 캐나다는 왕성한 건강 관리 지출과 계몽 활동이 증가함에 따라 최첨단 진단 플랫폼의 도입으로 계속 주도하고 있습니다. 연구에 대한 지속적인 투자, 정비된 진단용 에코시스템, 주요 시장 진출기업의 존재가 이 지역의 혁신을 더욱 강화하고 있습니다. 신뢰성이 높고 신속하며 침습이 적은 암 진단제에 대한 수요가 높아짐에 따라 이 주도적 지위는 지속될 것으로 예측됩니다.

Myriad Genetics, QIAGEN, Siemens, Veracyte, Genomic Health, F. Hoffmann-La Roche, MDxHealth, Thermo Fisher Scientific, Merck KGaA와 같은 경쟁 구도를 재구성하는 주요 기업이 있습니다. 이들 기업은 연구개발 투자를 통해 검사 포트폴리오를 확대하고 종양학 연구소, 학술기관, 병원과의 제휴를 강화하고 있습니다. 바이오마커 플랫폼의 감도와 특이성을 향상시키기 위해 기업은 첨단 유전체 및 단백질체학 기술을 활용하고 있습니다. 또한 세계 판매, 제조 규모 확대, 시장 투입까지의 시간을 단축하기 위한 약사 승인 취득을 위한 전략적 제휴도 진행하고 있습니다. 많은 기업들이 동반진단제 개발에 주력하고 있으며, 이것은 정밀의료에 직접 연결되어 있으며, 치료 조정과 환자 결과를 향상시키는 것입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전립선암의 발생률의 상승

- 바이오마커에 기초한 진단 기술의 진보

- 공공 부문과 민간 부문으로부터의 연구 개발 투자 증가

- 바이오마커 검사에 의한 맞춤형 의료의 도입 확대

- 업계의 잠재적 위험 및 과제

- 고급 진단 검사의 고비용

- 농촌이나 개발 도상 지역에서는 접근성과 인지도가 한정되어 있다.

- 시장 기회

- 비침습성 바이오마커 플랫폼에 대한 투자 증가

- 조기 진단을 위한 복합 바이오마커 패널의 사용 증가

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 진보

- 현재의 기술 동향

- 신흥기술

- 미래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTLE 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 유전자 바이오마커

- 단백질 바이오마커

- 세포 기반 바이오마커

- 대사체학 바이오마커

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 스크리닝 및 조기 발견

- 진단 및 위험층별화

- 예후 및 치료 모니터링

- 동반진단

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 진단 실험실

- 암 연구 기관

- 바이오의약품기업

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Beckman Coulter

- Bio-Rad Laboratories

- Bio-Techne

- F. Hoffmann-La Roche

- Genomic health

- MDxHealth

- Merck KGaA

- Myriad Genetics

- OPKO Health

- QIAGEN

- Siemens

- Thermo Fisher Scientific

- Veracyte

The Global Prostate Cancer Biomarkers Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 13.5% to reach USD 16.5 billion by 2034. The market growth is propelled by the rising number of prostate cancer cases, particularly in aging male populations, and the evolution of advanced diagnostics. Growing awareness of early screening, along with a rise in government-sponsored healthcare programs, is fueling adoption across primary care settings. The integration of next-generation diagnostics, such as artificial intelligence-driven assessments, liquid biopsies, and genomic analysis platforms, is enhancing early-stage detection while supporting personalized therapeutic decisions. Emerging economies are also increasing investments in health infrastructure, which is broadening access to precision-based testing methods. These biomarker-driven strategies are reshaping cancer care by offering better accuracy, reduced invasiveness, and faster diagnostic workflows.

Major industry contributors such as OPKO Health, Beckman Coulter, Bio-Rad Laboratories, and Bio-Techne are at the forefront of driving innovation in the prostate cancer biomarkers market. These companies are not only enhancing the accuracy and speed of detection through cutting-edge diagnostic platforms but also shaping the future of personalized cancer care. By developing non-invasive, highly sensitive biomarker assays and integrating them with AI-based diagnostic systems, they enable earlier identification of disease, better monitoring of progression, and more effective treatment planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $16.5 Billion |

| CAGR | 13.5% |

The protein biomarkers segment generated USD 2.4 billion in 2024 and is forecasted to reach USD 8.2 billion by 2034, growing at a CAGR of 13.1%. Their dominance is anchored in widespread clinical acceptance and their routine use for disease detection and progression tracking. Biomarkers in this category, which are easily measured through standard blood assays, remain the first-line diagnostic tools due to their proven reliability, cost-effectiveness, and strong correlation with prostate cancer risk. Ongoing research continues to refine these biomarker technologies, allowing them to reduce unnecessary invasive diagnostics while maintaining accuracy. New biomarker-based scoring tools are also improving risk stratification and patient selection for further testing, optimizing treatment pathways.

In terms of application, the screening and early detection segment held the highest share of the market in 2024, accounting for 40.2%. This is attributed to the growing emphasis on early diagnosis in both public health systems and individual clinical practices. Screening platforms are now designed for high-volume workflows and utilize blood or urine-based biomarker assays to deliver fast, reliable results with minimal processing. These solutions are highly suitable for routine health checks and are expanding rapidly in outpatient environments where fast turnaround and ease of use are critical. The convenience and accessibility of non-invasive tests are making them integral to prostate cancer prevention strategies globally.

North America Prostate Cancer Biomarkers Market held 42.5% share in 2024. The region benefits from advanced medical infrastructure, high rates of disease incidence, and accelerated pathways for regulatory approvals. The US and Canada continue to lead in adopting cutting-edge diagnostic platforms, driven by strong healthcare expenditure and rising public awareness campaigns. Continuous investment in research, a well-developed diagnostics ecosystem, and the presence of major market participants further support innovation in this region. This leadership position is expected to persist as demand grows for reliable, fast, and minimally invasive cancer diagnostics.

Companies such as Myriad Genetics, QIAGEN, Siemens, Veracyte, Genomic Health, F. Hoffmann-La Roche, MDxHealth, Thermo Fisher Scientific, and Merck KGaA are among the key players reshaping the competitive landscape. These include expanding their test portfolios through R&D investments and strengthening partnerships with oncology labs, academic institutions, and hospitals. Firms are leveraging advanced genomic and proteomic technologies to improve the sensitivity and specificity of their biomarker platforms. They're also entering strategic collaborations for global distribution, scaling up manufacturing, and securing regulatory approvals to speed up time-to-market. Many companies are focusing on companion diagnostics development, which ties directly into precision medicine, enhancing treatment alignment and patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of prostate cancer

- 3.2.1.2 Advancements in biomarker-based diagnostic technologies

- 3.2.1.3 Increased R and D investments from the public and private sectors

- 3.2.1.4 Growing adoption of personalized medicine through biomarker testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic tests

- 3.2.2.2 Limited access and awareness in rural and underdeveloped regions

- 3.2.3 Market opportunities

- 3.2.3.1 Rising investments in non-invasive biomarker platforms

- 3.2.3.2 Increasing use of combination biomarker panels for early diagnosis

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Genetic Biomarkers

- 5.3 Protein Biomarkers

- 5.4 Cell-based Biomarkers

- 5.5 Metabolomic Biomarkers

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Screening and early detection

- 6.3 Diagnosis and risk stratification

- 6.4 Prognosis and treatment monitoring

- 6.5 Companion diagnostics

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Cancer research institutes

- 7.5 Biopharmaceutical companies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Beckman Coulter

- 9.2 Bio-Rad Laboratories

- 9.3 Bio-Techne

- 9.4 F. Hoffmann-La Roche

- 9.5 Genomic health

- 9.6 MDxHealth

- 9.7 Merck KGaA

- 9.8 Myriad Genetics

- 9.9 OPKO Health

- 9.10 QIAGEN

- 9.11 Siemens

- 9.12 Thermo Fisher Scientific

- 9.13 Veracyte