|

시장보고서

상품코드

1797826

양모 가공 기계 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Wool Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

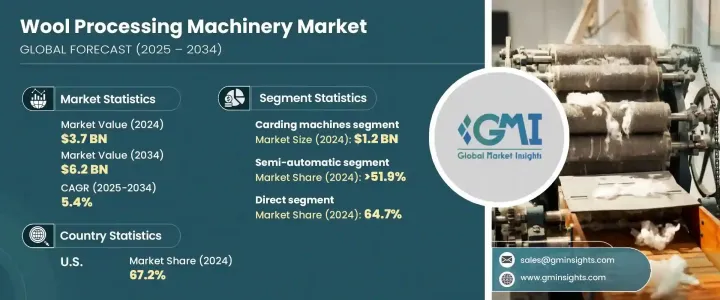

세계의 양모 가공 기계 시장은 2024년 37억 달러에 달했고, CAGR 5.4%로 성장해 2034년까지 62억 달러에 이를 것으로 추정되고 있습니다.

이 꾸준한 성장의 주요 요인은 양모 기반 제품에 대한 수요 증가, 섬유 기술의 발전, 전체 제조 부문의 자동화의 발전입니다. 특히 남아시아와 동남아의 섬유산업 부활은 기업들이 구식 시스템을 최신의 효율적이고 환경친화적인 기계로 대체하도록 촉구하고 있습니다. 특히 그린 오퍼레이션을 중시하는 기업에서는 지속 가능한 가공 방법에 대한 수요가 높아지고 있습니다. 물 소비량과 에너지 사용량을 줄이는 장비의 채택은 계속 지지를 모으고 있습니다.

게다가 단열재나 펠트 용도 등, 의류품 이외의 테크니컬 텍스타일의 용도가 확대되고 있는 것도, 기기 수요를 밀어 올리고 있습니다. 자동화와 스마트 제조 동향은 AI, IoT, 머신러닝에 대한 투자를 촉진하고 있으며, 이들은 공장이 실시간으로 성능을 모니터링하고, 예지 보전을 통해 가동 시간을 개선하고, 생산량을 극대화하는 데 도움이 됩니다. 섬유 기업은 또한 양모 재활용을 위해 설계된 기계에 투자하고 지속가능성과 순환 생산에 대한 광범위한 변화를 강조하고 있습니다. 정밀도, 효율성, 환경 친화적인 운영에 초점을 두어 세계 양모 가공 기계의 전망을 계속 형성합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 37억 달러 |

| 예측 금액 | 62억 달러 |

| CAGR | 5.4% |

2024년 반자동 기계 부문의 점유율은 51.9%로, 2034년까지 CAGR 5.3%로 예측됩니다. 이 기계들은 비용 효율성과 성능이 균형을 이루며 신흥국 시장 공장에 특히 매력적입니다. 완전 자동화로 인한 고비용을 피하면서 수동 설정을 능가하는 능력이 채용률의 상승을 뒷받침하고 있습니다. 노동력 부족과 예산 제한이 있는 지역에서는 반자동 시스템이 이상적인 솔루션이 되어 경쟁력 있는 가격으로 확실한 생산량과 신뢰성을 제공합니다.

북미 양모 가공기계 2024년의 점유율은 29.3%로, 2034년까지 CAGR 5.6%로 예상되어 꾸준히 성장하고 있습니다. 미국과 캐나다는 섬유의 육상 생산을 추진하고 수입품에 대한 의존도를 줄이고, 이는 최첨단 모직 가공 기술에 대한 투자를 촉진하고 있습니다. 재활용 양모 및 저환경 부하 섬유 제품의 생산을 지원하는 기계에 대한 수요가 증가하고 있습니다. 게다가 안전성에 중점을 둔 규제와 지속가능성의 목표는 북미의 섬유 제조업체에 최신 자동화 시스템으로의 업그레이드를 촉구하는 동기가 되고 있습니다. 특히 테크니컬 텍스타일과 의류 업계에서는 정밀 기반의 제조 공정도 이 수요 급증에 기여하고 있습니다.

세계 양모 가공 기계 시장을 적극적으로 형성하는 주요 기업으로는 Savio Macchine Tessili S.p.A., Tritschler Group, Rieter Holding AG, Lakshmi Machine Works Ltd., Marzoli - Camozzi Group 등이 있습니다. 양모 가공 기계의 주요 제조업체는 시장에서의 존재감을 높이기 위해 지속 가능한 혁신, 디지털 통합 및 지역 시장에의 침투에 주력하고 있습니다. 많은 기업들이 실시간 성능 모니터링, 자동 조정, 예지 보전을 가능하게 하는 AI 탑재 기기나 IoT 대응 기기로 포트폴리오를 업그레이드하고 있습니다. 모직 재활용, 에너지 절약 작업 및 저수 사용 공정으로 제품을 다양화하는 것은 지속가능성을 중시하는 고객 수요를 얻는 데 핵심적인 역할을 수행합니다. 섬유 제조업체와의 협업이 진행되어, 지역의 생산 요구에 맞추어 커스터마이즈 된 기계 솔루션을 제공하는 기업도 늘고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계의 모직 수요 증가

- 제품, 의류 및 섬유 산업의 성장

- 기계의 기술적 진보

- 업계의 잠재적 위험 및 과제

- 높은 초기 투자 비용

- 변동하는 원모 가격

- 기회

- 성장 촉진요인

- 성장 가능성 분석

- 미래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 기계유형별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 틀

- 인증기준

- 무역 통계(HS코드-84451950)

- 주요 수입국

- 주요 수출국

- Porter's Five Forces 분석

- PESTLE 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 기계 유형별, 2021-2034년

- 주요 동향

- 스카우어링 기계

- 카딩 기계

- 결합기

- 방적기

- 다잉 기계

- 블렌딩 기계

- 마무리 기계

- 전단기 및 포장기

제6장 시장 추계 및 예측 : 자동화 유형별, 2021-2034년

- 주요 동향

- 수동 및 기존 기계

- 반자동 기계

- 전자동 기계

제7장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 의류

- 홈 섬유(담요, 실내 장식품)

- 공업용 패브릭

- 카펫 및 러그

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 모직물 공장

- 섬유 제조업체

- 카펫 위빙 유닛

- 수출 지향형 유닛

제9장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 직접

- 간접

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제11장 기업 프로파일

- Camozzi

- Fangzheng

- Fong's

- Jingwei

- Lakshmi

- NSC

- Rieter

- Saurer

- Savio

- Shanghai Texmac

- Tatham

- Texpro

- Trutzschler

The Global Wool Processing Machinery Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.2 billion by 2034. This steady growth is largely fueled by increased demand for wool-based products, advancements in textile technologies, and rising automation across the manufacturing sector. The resurgence of the textile industry, particularly across South and Southeast Asia, has encouraged companies to replace older, outdated systems with modern, efficient, and eco-friendly machinery. Demand is rising for sustainable processing practices, especially in companies focusing on green operations. The adoption of equipment that reduces water consumption and energy usage continues to gain traction.

Additionally, the expanding use of technical textiles beyond clothing, such as in insulation and felting applications, is boosting equipment demand. The trend toward automation and smart manufacturing is driving investments in AI, IoT, and machine learning, which are helping mills monitor real-time performance, improve uptime through predictive maintenance, and maximize production output. Textile companies are also investing in machinery designed for wool recycling, highlighting a broader shift toward sustainability and circular production. The focus on precision, efficiency, and eco-conscious operations continues to reshape the global wool machinery landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

In 2024, the semi-automatic machinery segment held a 51.9% share 2024 and is projected to grow at a CAGR of 5.3% through 2034. These machines strike a balance between cost-efficiency and performance, making them especially appealing to mills in developing markets. Their rising adoption is driven by their ability to outperform manual setups while avoiding the high cost of full automation. In regions with labor shortages or budget limitations, semi-automatic systems offer an ideal solution, delivering solid output and reliability at a competitive price.

North America Wool Processing Machinery Market held 29.3% share in 2024 and is growing steadily at a CAGR of 5.6% through 2034. Both the US and Canada are pushing for onshore textile manufacturing and reducing dependence on imports, which is encouraging investments in cutting-edge wool processing technologies. There's increasing demand for machinery that supports the production of recycled wool and low-impact textiles. Additionally, safety-focused regulations and sustainability goals are motivating textile producers in North America to upgrade to modern, automated systems. Precision-based manufacturing processes, particularly in the technical textile and garment industries, are also contributing to this demand surge.

Key players actively shaping the Global Wool Processing Machinery Market include Savio Macchine Tessili S.p.A., Tritschler Group, Rieter Holding AG, Lakshmi Machine Works Ltd., and Marzoli - Camozzi Group. Leading wool processing machinery manufacturers are focusing on sustainable innovation, digital integration, and regional market penetration to enhance their market presence. Many companies are upgrading their portfolios with AI-powered and IoT-enabled equipment that allows real-time performance monitoring, automated adjustments, and predictive maintenance. Product diversification toward wool recycling, energy-saving operations, and low-water-use processes also plays a central role in capturing demand from sustainability-driven customers. Firms are increasingly collaborating with textile manufacturers to offer customized machinery solutions tailored to local production needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machinery type

- 2.2.3 Automation type

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.4 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global demand for wool

- 3.2.1.2 Products, growth of the apparel and textile industry

- 3.2.1.3 Technological advancements in machinery

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Fluctuating raw wool prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machinery type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84451950)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machinery Type, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Scouring machines

- 5.3 Carding machines

- 5.4 Combining machines

- 5.5 Spinning machines

- 5.6 Dying machines

- 5.7 Blending machines

- 5.8 Finishing machines

- 5.9 Shearing and baling machines

Chapter 6 Market Estimates & Forecast, By Automation Type, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Manual/traditional machinery

- 6.3 Semi-automatic machinery

- 6.4 Fully automatic machinery

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Apparel & garments

- 7.3 Home textiles (blankets, upholstery)

- 7.4 Industrial fabrics

- 7.5 Carpets and rugs

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Woolen mills

- 8.3 Textile manufacturers

- 8.4 Carpet weaving units

- 8.5 Export-oriented units

Chapter 9 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Camozzi

- 11.2 Fangzheng

- 11.3 Fong's

- 11.4 Jingwei

- 11.5 Lakshmi

- 11.6 NSC

- 11.7 Rieter

- 11.8 Saurer

- 11.9 Savio

- 11.10 Shanghai Texmac

- 11.11 Tatham

- 11.12 Texpro

- 11.13 Trutzschler