|

시장보고서

상품코드

1822605

동물용 주사기 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Veterinary Injectable Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

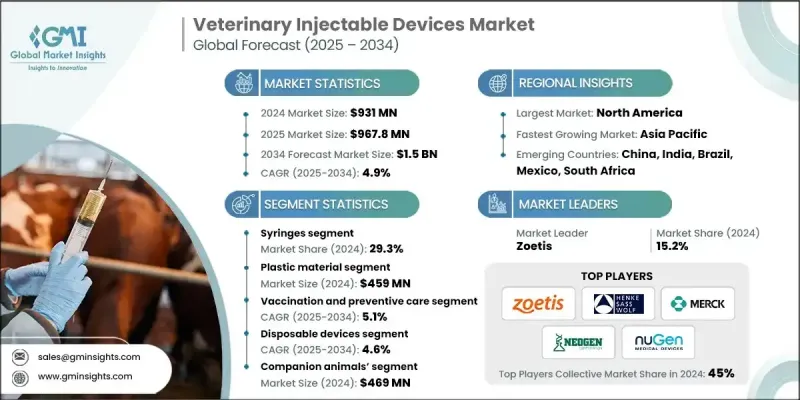

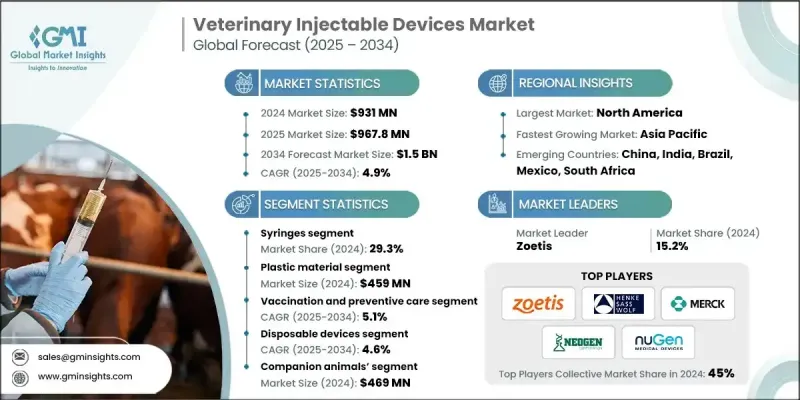

세계 동물용 주사기 시장은 2024년에는 9억 3,100만 달러로 평가되었으며 CAGR 4.9%로 성장하고 2034년에는 15억 달러에 이를 것으로 추정됩니다.

반려동물을 키우는 가정이 늘어나고 반려동물을 가족의 일원으로 취급하게 됨으로써 동물병원에의 진찰이나 예방의료에의 지출이 대폭 증가해, 예방접종, 치료 및 요법을 위한 효율적이고 안전한 주사기 수요가 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 9억 3,100만 달러 |

| 예측 금액 | 15억 달러 |

| CAGR | 4.9% |

주사기 채택 증가

주사기 부문은 반려동물 및 가축 동물 모두에 대한 약물, 백신 및 영양소의 투여에 대한 광범위한 적용성으로 2024년에 주목할만한 점유율을 차지했습니다. 이러한 장치는 정확성, 사용 편의성, 다양한 바늘 게이지 및 바늘 양과의 호환성을 평가합니다. 전염병 대책이 여전히 우선이기 때문에 업계에서는 동물용으로 멸균되고 안전성을 높인 주사기의 생산이 증가하고 있습니다.

견인력을 늘리는 플라스틱 소재

플라스틱 소재는 2024년에 비용 효율성, 경량성, 설계 유연성으로 큰 점유율을 얻었습니다. 일회용 주사기에서 다회 투여 주사기까지 플라스틱은 내구성과 안전성의 균형을 제공합니다. 시장 성장의 원동력이 되고 있는 것은 대량 생산 요구와 클리닉과 농장 환경 모두에서 위생적인 실천을 지원하는 일회용 기기에 대한 수요 증가입니다. 또한 환경에 대한 우려 증가에 대응하고 지속가능성의 목표에 부합하기 위해 제조업체는 친환경 바이오플라스틱과 재활용 가능한 폴리머를 모색하고 있습니다.

예방 접종 및 예방 의료에 대한 수요 증가

예방 접종과 예방 의료 분야는 반려동물과 가축 모두에서 질병 예방 의식이 높아지면서 2024 년에 큰 수익을 올렸습니다. 수의사와 동물 보건 프로그램은 특히 광견병, 구제역, 파보 바이러스 등의 질병에 대해 즉각적이고 높은 효능을 가진 주사 백신을 선호합니다. 신속성, 정확성 및 동물에 대한 스트레스 완화를 위해 설계된 주사기는 특히 대규모 백신 접종 활동에서 높은 수요가 있습니다.

지역별 인사이트

북미가 견인 역할로 상승

북미 동물용 주사기 시장은 고급 수의사 건강 관리 시스템, 높은 반려동물 사육률, 견고한 가축 관리 관행을 배경으로 2024 년에 상당한 점유율을 차지했습니다. 성장을 지원하는 것은 동물의 웰빙에 대한 투자 증가, 예방 의료 프로토콜의 보급, 좋은 규제 환경입니다. 주요 기업의 존재와 지속적인 R&D 노력도 복용량 정확성을 위한 정밀 장비 및 디지털 추적 시스템에 초점을 맞춘 이 지역의 우위에 기여합니다.

동물용 주사기 주요 시장 진출기업은 Neogen Corporation, Terumo Medical Corporation, Hamilton Company, Serumwerk Bernburg, Allflex USA, Medtronic plc, Zoetis, Henke-Sass, Wolf, Baxter International, NuGen Medical Devices, B. Braun Melsungen, Merck & Co., Micrel Medical Devices 등이 있습니다.

시장 포지션을 강화하기 위해 동물용 주사기 분야의 주요 기업은 기술 혁신, 지리적 확장 및 전략적 제휴에 주력하고 있습니다. 제품 개발의 핵심은 인간 오류 및 동물 스트레스를 줄이기위한 인체 공학적 디자인, 바늘없는 주사기 및 자동 투여 시스템입니다. 많은 기업들은 비용 절감과 도달범위 향상을 위해 현지에서 제조 및 판매 파트너십을 구축하여 신흥 시장에 진출하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 반려동물 수 증가와 동반 동물의 인간화

- 동물 의료비 증가와 대형 동물 생산의 요구

- 인수 공통 감염증 및 감염증 관리 프로그램의 보급률의 상승

- 신흥 시장에서 수의사 인프라와 서비스에 대한 접근 확대

- 업계의 잠재적 위험 및 과제

- 고급 장비 및 치료에 드는 높은 비용

- 바늘 찌르기 사고나 교차 오염의 위험

- 시장 기회

- 수의료의료에 있어서의 프리필드 주사기와 자동 주사기의 도입 증가

- 반려동물 보험 증가와 반려동물 소유자의 지출 의욕

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 현재의 기술 동향

- 신규 기술

- 장래 시장 동향

- 가격 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 세계

- 북미

- 유럽

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추정 및 예측 : 제품별, 2021-2034

- 주요 동향

- 주사기

- 바늘

- 원격 주사 장치

- 폴 주사기

- 다트

- 무침 주사기 시스템

- 스프링식

- 배터리 구동

- 가스 구동 제트 인젝터

- 자동 주사기

- 기타 주사기

제6장 시장 추정 및 예측 : 재료별, 2021-2034

- 주요 동향

- 플라스틱

- 금속

- 유리

- 기타 재료

제7장 시장 추정 및 예측 : 임상 응용별, 2021-2034

- 주요 동향

- 예방접종과 예방 케어

- 항감염제

- 마취와 진통

- 생식력 및 번식력

- 기타 임상 응용

제8장 시장추정 및 예측 : 용도별, 2021-2034

- 주요 동향

- 일회용 기기

- 재사용 가능한 장치

제9장 시장추정 및 예측 : 동물유형별, 2021-2034

- 주요 동향

- 반려동물

- 가축

- 기타 동물

제10장 시장 추정 및 예측 : 최종 용도별, 2021-2034

- 주요 동향

- 동물병원

- 수의사 클리닉

- 학술연구기관

- 기타 용도

제11장 시장추정 및 예측 : 지역별, 2021-2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- Allflex USA

- Baxter International

- B. Braun Melsungen

- Hamilton Company

- Henke-Sass, Wolf

- Merck &Co.

- Medtronic plc

- Micrel Medical Devices

- Neogen Corporation

- NuGen Medical Devices

- Serumwerk Bernburg

- Terumo Medical Corporation

- Zoetis

The Global Veterinary Injectable Devices Market was valued at USD 931 million in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 1.5 billion by 2034.

With more households adopting pets and treating them as family members, there is a significant rise in veterinary visits and preventive care spending-boosting demand for efficient, safe injectable devices for vaccinations, treatments, and therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.9% |

Rising adoption of Syringes

The syringes segment held a notable share in 2024, driven by its wide applicability in administering medications, vaccines, and nutrients to both companion and livestock animals. These devices are valued for their precision, ease of use, and compatibility with a range of needle gauges and volumes. As infection control remains a priority, the industry is witnessing increased production of pre-sterilized and safety-enhanced syringes tailored for veterinary use.

Plastic Material to Gain Traction

The plastic materials generated a significant share in 2024 owing to their cost-effectiveness, lightweight nature, and flexibility in design. From disposable syringes to multi-dose injectors, plastic offers a balance of durability and safety. The market growth is driven by high-volume production needs and the rising demand for single-use devices that support hygienic practices in both clinics and farm environments. Manufacturers are also exploring eco-friendly bioplastics and recyclable polymers to address growing environmental concerns and align with sustainability goals.

Rising Demand for Vaccination and Preventive Care

The vaccination and preventive care segment generated significant revenues in 2024, fueled by increasing awareness of disease prevention in both pets and livestock. Veterinarians and animal health programs are prioritizing injectable vaccines for their fast action and high efficacy, especially for diseases like rabies, foot-and-mouth, and parvovirus. Injectable devices designed for speed, accuracy, and reduced stress on animals are in high demand, particularly in large-scale vaccination drives.

Regional Insights

North America to Emerge as a Propelling Region

North America veterinary injectable devices market held a substantial share in 2024, backed by advanced veterinary healthcare systems, high pet ownership rates, and strong livestock management practices. Growth is supported by increased investments in animal wellness, widespread adoption of preventive care protocols, and a favorable regulatory environment. The presence of key players and ongoing R&D efforts also contributes to the region's dominance, with a focus on precision devices and digital tracking systems for dosage accuracy.

Major players involved in the veterinary injectable devices market are Neogen Corporation, Terumo Medical Corporation, Hamilton Company, Serumwerk Bernburg, Allflex USA, Medtronic plc, Zoetis, Henke-Sass, Wolf, Baxter International, NuGen Medical Devices, B. Braun Melsungen, Merck & Co., Micrel Medical Devices.

To strengthen their market position, leading companies in the veterinary injectable devices space are focusing on innovation, geographic expansion, and strategic collaborations. Product development is centered around ergonomic designs, needle-free injectors, and automated dosing systems to reduce human error and animal stress. Many players are expanding into emerging markets by setting up local manufacturing and distribution partnerships to lower costs and improve reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Clinical applications trends

- 2.2.5 Usage trends

- 2.2.6 Animal type trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet population and humanization of companion animals

- 3.2.1.2 Growing animal health spending and large animal production needs

- 3.2.1.3 Rising prevalence of zoonotic and infectious disease control programs

- 3.2.1.4 Increasing veterinary infrastructure and service access in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and treatment

- 3.2.2.2 Risk of needle-stick injuries and cross-contamination

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of prefilled syringes and autoinjectors in veterinary care

- 3.2.3.2 Rising pet insurance and willingness to spend by pet owners

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Syringes

- 5.3 Needles

- 5.4 Remote injectable devices

- 5.4.1 Pole syringes

- 5.4.2 Darts

- 5.5 Needle free injector systems

- 5.5.1 Spring-loaded

- 5.5.2 Battery-powered

- 5.5.3 Gas powered jet injector

- 5.6 Auto-injectors

- 5.7 Other injectable devices

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Glass

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Clinical Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Vaccination and preventive care

- 7.3 Anti-infectives

- 7.4 Anesthesia and analgesia

- 7.5 Fertility and reproduction

- 7.6 Other clinical applications

Chapter 8 Market Estimates and Forecast, By Usage, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Disposable devices

- 8.3 Reusable devices

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.3 Livestock animals

- 9.4 Other animals

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals

- 10.3 Veterinary clinics

- 10.4 Academic and research institutes

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Allflex USA

- 12.2 Baxter International

- 12.3 B. Braun Melsungen

- 12.4 Hamilton Company

- 12.5 Henke-Sass, Wolf

- 12.6 Merck & Co.

- 12.7 Medtronic plc

- 12.8 Micrel Medical Devices

- 12.9 Neogen Corporation

- 12.10 NuGen Medical Devices

- 12.11 Serumwerk Bernburg

- 12.12 Terumo Medical Corporation

- 12.13 Zoetis