|

시장보고서

상품코드

1822636

동물사료 단백질 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Animal Feed Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

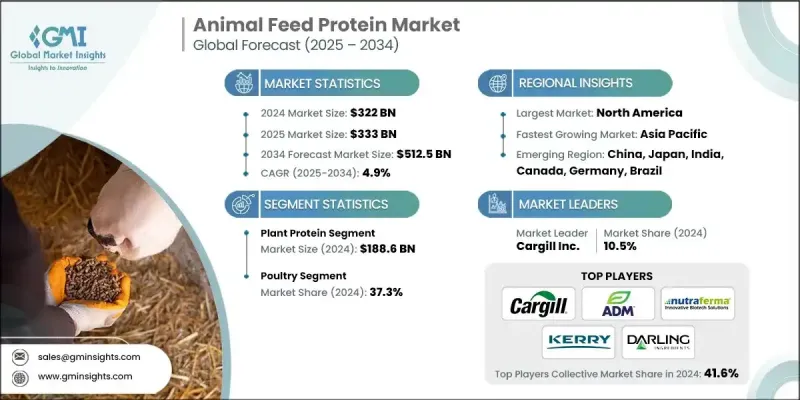

Global Market Insights Inc.가 발행한 최신 보고서에 따르면 세계의 동물사료 단백질 시장은 2024년에 3,220억 달러로 평가되었고, CAGR은 4.9%를 나타낼 것으로 예측되며 2025년 3,330억 달러에서 2034년에 5,125억 달러로 성장할 전망입니다.

특히 개발도상국을 중심으로 전 세계 인구가 증가하고 소득이 상승함에 따라 육류 및 유제품에 대한 수요가 증가하고 있습니다. 이는 건강한 가축의 성장과 생산성을 뒷받침하기 위한 고품질 동물 사료 단백질의 필요성을 촉진합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 3,220억 달러 |

| 예측 금액 | 5,125억 달러 |

| CAGR | 4.9% |

식물성 단백질의 채택 증가

식물성 단백질 부문은 비용 효과적, 풍부한 공급량, 지속 가능한 조달로 인해 2024년 주목할 만한 점유율을 기록했습니다. 대두박, 카놀라, 완두 단백질과 같은 원료는 높은 영양가와 다양한 가축 종에 걸친 소화 용이성으로 널리 사용됩니다. 기업들은 비유전자변형(Non-GMO) 및 유기농 식물성 단백질 개발과 함께, 특정 동물 건강 혜택을 위해 아미노산 프로필을 개선하고 생체 이용률을 향상시키는 가공 기술 혁신에 투자하고 있습니다.

가금류 부문 성장 가속화

가금류 부문은 2024년 지속 가능한 시장 점유율을 기록했으며, 이는 전 세계 닭고기와 계란의 경제성과 저지방 단백질 함량으로 인한 높은 수요에 뒷받침되었습니다. 시장 성장은 대규모 상업적 사육 운영과 1인당 가금류 소비 증가에 힘입었습니다. 주요 기업들은 사료 전환율을 높이고 질병 위험을 감축하는 맞춤형 사료 배합을 주력하고 있습니다. 브로일러, 산란계, 번식계의 고유한 요구 사항을 충족하기 위해 효소 향상된 단백질 혼합물과 지역별 영양 계획을 도입하는 전략이 포함됩니다.

지역별 인사이트

북미가 유리한 지역이 될 전망

북미의 동물사료 단백질 시장은 확고한 축산업 기반, 육류 및 유제품에 대한 높은 소비자 수요, 고급 농업 관행에 힘입어 2024년 상당한 매출을 기록했습니다. 북미에서 운영 중인 기업들은 사료 공장과의 합병, 생산 시설 확장, 지속 가능한 단백질 대체재에 대한 연구개발 투자 등 선제적 전략을 채택하고 있습니다. 또한 가축 성능 향상과 투입물 낭비 감축을 위해 정밀 영양 관리 및 디지털 사료 관리 시스템에 중점을 두고 있습니다.

동물사료 단백질 시장의 주요 기업은 Angel Yeast, Deep Branch Biotechnology, Archer Daniels Midland Company(ADM), Ynsect, Nutraferma LLC, CHS Inc., Unibio Group, Innovafeed, DuPont(EI DuPont De Nemours and Company), Darling Ingredients, Kerill Biotech, Imcopa Food Ingredients BV입니다.

시장 입지를 강화하기 위해 동물 사료 단백질 분야의 기업들은 혁신, 파트너십, 지속가능성을 결합한 전략을 추구하고 있습니다. 많은 기업들이 제품 포트폴리오를 다각화하고 기존 원료 의존도를 감축하기 위해 조류 및 곤충 단백질과 같은 대체 단백질 원료로 사업을 확대되고 있습니다. 축산 농장 및 영양 연구 센터와의 전략적 제휴를 통해 실제 현장 요구에 부합하는 제품 개발이 가능해졌습니다. 또한 업체들은 디지털 도구를 활용해 효율성을 극대화하는 데이터 기반 사료 공급 솔루션을 제공하고 있습니다. 브랜드 전략 역시 진화하는 소비자 및 규제 요구에 부응하기 위해 추적 가능성과 친환경 인증을 강조하는 방향으로 전환되고 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 출처

- 세계

- 지역 및 국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 장래 시장 동향

- 기술과 혁신 상황

- 현재 기술 동향

- 신흥 기술

- 특허 상황

- 무역 통계(HS코드)

(참고 : 무역 통계는 주요 국가에서만 제공됩니다)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산 과정의 에너지 효율성

- 환경 친화적인 노력

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 경향

- 식물성 단백질

- 동물성 단백질

- 대체 단백질

제6장 시장 추계 및 예측 : 가축별(2021-2034년)

- 주요 동향

- 가금류

- 돼지

- 소

- 양식업

- 반려동물 식품

- 말

제7장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제8장 기업 프로파일

- Cargill Inc.

- Archer Daniels Midland Company(ADM)

- DuPont(EI DuPont De Nemours and Company)

- Kerry Group

- Nutraferma LLC

- Darling Ingredient

- Lallemand Inc.

- Angel Yeast

- Imcopa Food Ingredients BV

- CHS Inc.

- Crescent Biotech

- Deep Branch Biotechnology

- Unibio Group

- Innovafeed

- Ynsect

The global animal feed protein market was estimated at USD 322 billion in 2024 and is expected to grow from USD 333 billion in 2025 to USD 512.5 billion by 2034, at a CAGR of 4.9%, according to the latest report published by Global Market Insights Inc.

As global populations grow and incomes rise, especially in developing countries, the demand for meat and dairy products increases. This drives the need for high-quality animal feed protein to support healthy livestock growth and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $322 Billion |

| Forecast Value | $512.5 Billion |

| CAGR | 4.9% |

Rising Adoption of Plant Protein

The plant protein segment held a notable share in 2024, driven by its cost-effectiveness, abundant availability, and sustainable sourcing. Ingredients like soybean meal, canola, and pea protein are widely used for their high nutritional value and ease of digestion across multiple livestock species. Companies are investing in non-GMO and organic plant-based protein development, as well as in processing innovations that improve amino acid profiles and enhance bioavailability for targeted animal health benefits.

Poultry to Gain Traction

The poultry segment held a sustainable share in 2024, supported by high global demand for chicken meat and eggs due to their affordability and lean protein content. The market growth is fueled by large-scale commercial farming operations and increasing per capita poultry consumption. Key industry players are focusing on tailored feed formulations that boost feed conversion ratios and reduce disease risks. Strategies include incorporating enzyme-enhanced protein blends and region-specific nutrition plans to meet the unique requirements of broilers, layers, and breeders.

Regional Insights

North America to Emerge as a Lucrative Region

North America animal feed protein market generated notable revenues in 2024, backed by a well-established livestock sector, high consumer demand for meat and dairy, and advanced agricultural practices. Companies operating in North America are adopting forward-looking strategies, including mergers with feed mills, expansion of production facilities, and R&D investments in sustainable protein alternatives. Emphasis is also being placed on precision nutrition and digital feed management systems to enhance animal performance and reduce input waste.

Major players in the animal feed protein market are Angel Yeast, Deep Branch Biotechnology, Archer Daniels Midland Company (ADM), Ynsect, Nutraferma LLC, CHS Inc., Unibio Group, Innovafeed, DuPont (E.I. DuPont De Nemours and Company), Darling Ingredients, Kerry Group, Cargill Inc., Lallemand Inc., Crescent Biotech, and Imcopa Food Ingredients B.V.

To strengthen their market presence, companies in the animal feed protein sector are pursuing a combination of innovation, partnerships, and sustainability. Many are expanding into alternative protein sources-like algae and insect protein-to diversify their offerings and reduce reliance on traditional raw materials. Strategic alliances with livestock farms and nutrition research centers help tailor product development to real-world needs. Additionally, players are leveraging digital tools to provide data-driven feeding solutions that maximize efficiency. Branding efforts now also emphasize traceability and eco-certifications to align with evolving consumer and regulatory expectations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Livestock

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Plant protein

- 5.3 Animal protein

- 5.4 Alternative protein

Chapter 6 Market Estimates & Forecast, By Livestock, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Poultry

- 6.3 Swine

- 6.4 Cattle

- 6.5 Aquaculture

- 6.6 Petfood

- 6.7 Equine

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Cargill Inc.

- 8.2 Archer Daniels Midland Company (ADM)

- 8.3 DuPont (E.I. DuPont De Nemours and Company)

- 8.4 Kerry Group

- 8.5 Nutraferma LLC

- 8.6 Darling Ingredient

- 8.7 Lallemand Inc.

- 8.8 Angel Yeast

- 8.9 Imcopa Food Ingredients B.V.

- 8.10 CHS Inc.

- 8.11 Crescent Biotech

- 8.12 Deep Branch Biotechnology

- 8.13 Unibio Group

- 8.14 Innovafeed

- 8.15 Ynsect