|

시장보고서

상품코드

1822664

렌터카 시장 기회, 성장 촉진요인, 산업 동향 분석과 예측(2025-2034년)Car Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

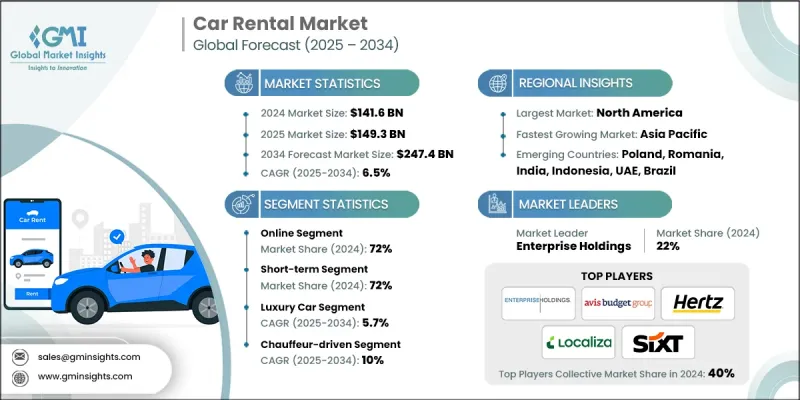

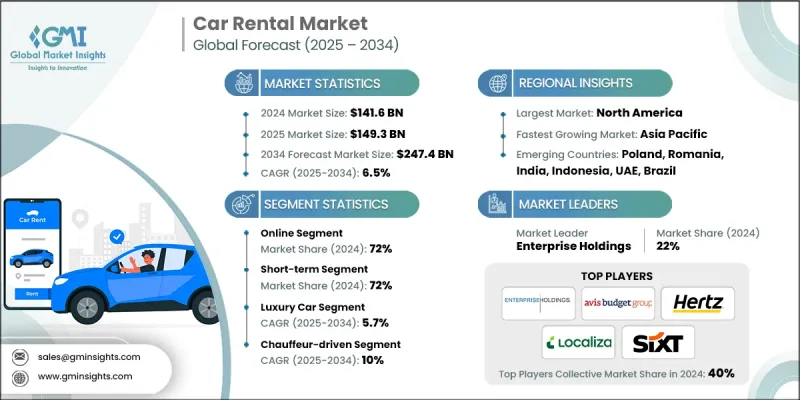

Global Market Insights Inc.가 발행한 최신 리포트에 따르면 세계의 렌터카 시장은 2024년에 1,416억 달러로 추정되며, CAGR 6.5%로 2025년 1,493억 달러에서 2034년에는 2,474억 달러로 성장할 것으로 예측됩니다.

국내 여행과 국제 여행의 꾸준한 성장은 렌터카 시장의 중요한 촉진요인입니다. 레저와 비즈니스를 위해 새로운 여행지를 찾는 사람들이 늘어남에 따라 유연하고 편리한 교통수단에 대한 요구가 증가하고 있습니다. 렌터카는 대중교통 시간표나 비싼 택시에 의존하지 않고, 여행자가 자신의 속도에 맞추어 자유롭게 관광할 수 있는 기회를 제공합니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시장 규모 | 1,416억 달러 |

| 예측 금액 | 2,474억 달러 |

| CAGR | 6.5% |

온라인 부문에서 수요 증가

2024년에는 웹사이트와 모바일 앱을 통해 고객에게 원활하고 편리한 예약 경험을 제공하는 온라인 부문이 두드러진 점유율을 차지할 것으로 예측됩니다. 이 부문은 인터넷 보급률과 스마트폰 이용률 증가로 혜택을 받고 있으며, 사용자는 실시간으로 가격 비교, 차량 선택, 예약 관리를 할 수 있습니다. 각 기업은 사용자 인터페이스 강화, AI를 활용한 개인화 통합, 즉각적인 고객 지원 제공 등 디지털 플랫폼에 많은 투자를 하고 있습니다.

단기 렌탈의 보급 확대

단기 렌터카 부문은 소유에 대한 부담 없이 유연하고 단기간 차량을 이용하고자 하는 여행자 및 도시 지역 고객에 힘입어 2024년 큰 매출을 창출했습니다. 이 부문의 성장은 관광과 출장 증가, 편의성과 경제성에 대한 소비자의 선호도 증가에 힘입어 성장세를 보이고 있습니다. 몇 시간에서 며칠 동안 대여를 통해 사용자는 당장의 이동 요구를 효율적으로 충족시킬 수 있습니다. 시장 세분화에서는 이 부문을 확보하기 위해 경쟁력 있는 가격, 다양한 차량 옵션, 신속한 차량 접근성 제공에 초점을 맞추었습니다.

고급차 채택 증가

2024년에는 가처분 소득 증가와 부유층의 프리미엄 경험에 대한 수요 증가에 힘입어 고급차 렌터카 부문이 큰 비중을 차지할 것으로 예측됩니다. 고급 렌터카는 고급 기능, 뛰어난 편안함, 브랜드 명성을 제공하며, 지위와 독점성을 우선시하는 고객들을 끌어들이고 있습니다. 렌탈 업체들은 고급 자동차 제조업체와 제휴하여 개인 맞춤형 서비스를 제공하고, 디지털 플랫폼을 활용하여 고급 지향적인 고객을 대상으로 타겟 마케팅을 펼치며 시장에서의 입지를 다지고 있습니다.

북미가 유리한 지역이 될 것

북미 렌터카 시장은 국내 여행 증가, 비즈니스 분야 확대, 기술 혁신이 결합되며, 2034년까지 강력한 성장세를 보일 것으로 예측됩니다. 기업은 데이터 분석과 모바일 기술을 활용하여 고객 경험 향상, 차량 관리 최적화, 비접촉식 렌탈 도입을 추진하고 있습니다. 라이드셰어링 플랫폼과의 전략적 제휴와 대여 차량에 전기자동차를 도입함으로써 시장에서의 입지를 더욱 강화하고 있습니다.

렌터카 시장의 주요 기업은 Movida, Advantage Rent-a-car, Uber, Sixt, Europcar, CAR Inc., Hertz, Localiza, Avis Budget Group, Enterprise Holdings입니다.

렌터카 시장에서 사업을 영위하는 기업은 시장에서의 입지를 강화하고 진화하는 고객의 기대에 부응하기 위해 다양한 전략적 노력을 기울이고 있습니다. 주요 초점은 디지털 혁신으로, 모바일 앱, 온라인 예약 플랫폼, AI를 활용한 고객 서비스 툴에 투자하여 편의성을 높이고 렌탈 경험을 간소화하는 데 주력하고 있습니다. 많은 업체들이 차량을 확장하고 이코노미부터 고급차, 전기자동차까지 다양한 선택지를 제공함으로써 다양한 고객층에 대응하고 있습니다.

목차

제1장 조사 방법

- 조사 디자인

- 조사 어프로치

- 데이터 수집 방법

- GMI 독자적인 AI 시스템

- AI를 활용한 조사 강화

- 소스 일관성 프로토콜

- 기본 추정과 계산

- 기준연도 계산

- 예측 모델

- 시장 예측의 주요 동향

- 정량화된 시장 영향 분석

- 성장 파라미터 예측에 대한 수학적 영향

- 시나리오 분석 프레임워크

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 유료 정보원

- 지역별 정보원

- 유료 정보원

- 조사 궤적과 신뢰도 스코어

- 조사 트레일 컴포넌트

- 스코어링 컴포넌트

- 조사 투명성에 관한 보충

- 소스 어트리뷰션 프레임워크

- 품질 보증 지표

- 신뢰에 대한 커미트먼트

제2장 개요

제3장 업계 인사이트

- 에코시스템 분석

- 공급업체 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 미치는 요인

- 파괴적 변화

- 업계에 대한 영향요인

- 촉진요인

- 관광과 비즈니스 여행의 증가

- 소유권으로부터 액세스로의 이동

- 디지털 플랫폼과 비접촉 렌탈

- 지속가능성의 추진

- 업계의 잠재적 리스크 & 과제

- 고액의 차량 정비 및 감가상각비

- 규제와 경쟁 압력

- 시장 기회

- 서브스크립션과 MaaS의 통합

- 신흥 시장의 성장

- 기업 파트너십

- 기술 차별화

- 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter의 산업 분석

- PESTEL 분석

- 테크놀러지와 혁신 상황

- 현재 기술 동향

- 신규 기술

- 가격 동향

- 지역별

- 제품별

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능 관행

- 폐기물 삭감 전략

- 생산에서의 에너지 효율

- 친환경 구상

- 탄소발자국 고려

- 사용 사례

- 최선 시나리오

- 매출 최적화와 부대 서비스

- 차량당 매출(RPV) 분석과 벤치마킹

- RPV : 차량 카테고리, 장소 유형, 계절

- 지역적 RPV 변동과 시장 역학

- 법인 부문과 레저 부문 RPV 비교

- 과거 RPV 동향과 향후 예측

- 보조적 수입원과 업셀 전략

- GPS 및 내비게이션 시스템 매출 기여

- 보험 및 보호 상품 판매

- 연료 서비스 및 수수료

- 액세서리 및 장비 렌탈 수입

- 업그레이드와 프리미엄 서비스 매출

- 동적 가격결정과 매출 관리

- AI를 활용한 가격 최적화와 퍼포먼스

- 수요 예측 정도와 매출에 대한 영향

- 경쟁력 있는 가격정보와 대응 전략

- 계절 및 이벤트에 기반한 가격 전략

- 크로스 셀과 고객 가치 향상

- 로열티 프로그램 매출과 고객 유지

- 법인 어카운트 확대와 서비스 통합

- 디지털 플랫폼 수익화와 수수료 수입

- 호텔과 여행 서비스의 제휴

- 차량당 매출(RPV) 분석과 벤치마킹

- 고객 획득과 생애 가치 분석

- 채널 및 부문별 고객 획득 비용(CAC)

- 디지털 마케팅 CAC와 컨버전율

- 기존 광고와 파트너십 채널의 비용

- 법인 고객 획득 투자와 ROI

- 소개 프로그램 유효성과 비용 분석

- 고객 생애 가치(LTV) 모델링과 세분화

- 고객 유형과 렌탈 빈도별 LTV

- 법인 고객과 레저 고객 가치 비교

- 지역적 LTV 변동과 시장 특성

- 로열티 프로그램이 LTV 향상에 미치는 영향

- 고객 유지와 해약 분석

- 고객 부문과 서비스 수준별 유지율

- 해약 예측과 방지 전략

- 서비스 회복 및 고객 회복 프로그램

- 넷 프로모터 스코어(NPS)가 유지와 성장에 미치는 영향

- 채널 및 부문별 고객 획득 비용(CAC)

- 보험과 리스크 관리 분석

- 보험 비용 구조와 경영전략

- 차량 손상과 분실 방지

- 사기 방지와 보안 대책

- 책임 관리와 법령 준수

- 차량 수명주기와 자산관리

- 차량 조달·취득 전략

- OEM 파트너십과 볼륨 교섭 전략

- 구입과 리스 의사결정 프레임워크와 재무에 대한 영향

- 플릿 믹스 최적화와 수요 조정

- 신차와 중고차 통합과 비용 분석

- 플릿 활용과 퍼포먼스 최적화

- 지역적 플릿 배분과 수요 밸런스

- 계절별 차량 관리와 커패시티 계획

- 차량 로테이션과 위치 전송 최적화

- 차량 정비와 수명주기관리

- 예방 유지보수 프로그램 최적화

- 유지보수 비용 분석과 벤더 관리

- 차량 다운타임 최소화와 서비스 효율

- 예지보전을 위한 기술 통합

- 잔존 가치 관리와 처분 전략

- 재판매 가치 최적화와 시장 타이밍

- 도매 vs.소매 폐기 채널 퍼포먼스

- 차량 상태와 개수 투자

- 폐기 비용 관리와 매출 최대화

- 차량 조달·취득 전략

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십과 협업

- 신제품 발매

- 확장 계획과 자금조달

- 서비스 품질과 고객 만족도 벤치마킹

- 입지 전략과 시장 커버리지 분석

- 브랜드 포지셔닝과 마케팅 효과 비교

제5장 시장 추산·예측 : 예약제, 2021-2034

- 주요 동향

- 온라인

- 오프라인

제6장 시장 추산·예측 : 렌탈 기간별, 2021-2034

- 주요 동향

- 단기

- 장기적

제7장 시장 추산·예측 : 차량별, 2021-2034

- 주요 동향

- 고급차

- 이그제큐티브 카

- 이코노미 카

- SUV

- 다목적 차량

제8장 시장 추산·예측 : 용도별, 2021-2034

- 주요 동향

- 레저/관광

- 비즈니스

제9장 시장 추산·예측 : 최종 용도별, 2021-2034

- 주요 동향

- 셀프 드리븐

- 쇼퍼 드리븐(Chauffeur-driven)

제10장 시장 추산·예측 : 지역별, 2021-2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트

제11장 기업 개요

- Global companies

- Alamo Rent-a-Car

- Avis Budget Group

- eHi Car Services

- Enterprise Holdings

- Europcar

- Hertz Global Holdings

- Localiza

- Sixt

- Uber Technologies

- Zipcar

- Regional companies

- Advantage Rent A Car

- CAR Inc.

- Fox Rent A Car

- Green Motion

- Movida

- Payless Car Rental

- Rent-A-Wreck

- Thrifty Car Rental

- U-Save Car &Truck Rental

- 신규 기업

- Book2wheel

- Drivezy

- Fluid Truck

- Getaround

- Gett

- HyreCar

- Maven

- Ola Cabs

- Rent Centric

- SHARE NOW

- Turo

- Zoomcar

The global car rental market was estimated at USD 141.6 billion in 2024 and is expected to grow from USD 149.3 billion in 2025 to USD 247.4 billion by 2034 at a CAGR of 6.5%, according to the latest report published by Global Market Insights Inc.

The steady growth in domestic and international travel is a significant driver of the car rental market. As more people explore new destinations for leisure or business, the need for flexible and convenient transportation solutions rises. Rental cars offer travelers the freedom to explore at their own pace without relying on public transit schedules or costly taxis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $141.6 Billion |

| Forecast Value | $247.4 Billion |

| CAGR | 6.5% |

Rising Demand in the Online Segment

The online segment held a notable share in 2024, driven by offering customers seamless, convenient booking experiences through websites and mobile apps. This segment benefits from rising internet penetration and smartphone usage, allowing users to compare prices, select vehicles, and manage reservations in real time. Companies are investing heavily in digital platforms to enhance user interface, integrate AI-driven personalization, and provide instant customer support.

Increasing Prevalence of Short-Term Rentals

The short-term car rental segment generated significant revenues in 2024, backed by travelers and urban customers seeking flexible, short-duration vehicle use without the burden of ownership. This segment's growth, driven by increasing tourism and business travel, is supported by rising consumer preference for convenience and affordability. Rentals spanning from a few hours to several days allow users to meet immediate transportation needs efficiently. Market players focus on offering competitive pricing, diverse fleet options, and quick vehicle access to capture this segment.

Increasing Adoption of Luxury Cars

The luxury car rental segment held a sizeable share in 2024, propelled by growing disposable incomes and rising demand for premium experiences among affluent consumers. Luxury rentals offer advanced features, superior comfort, and brand prestige, attracting customers who prioritize status and exclusivity. Rental companies are strengthening their market foothold by partnering with luxury car manufacturers, offering personalized services, and leveraging digital platforms for targeted marketing to upscale clientele.

North America to Emerge as a Lucrative Region

North America car rental market will witness robust growth through 2034, driven by a combination of rising domestic travel, expanding business sectors, and technological innovation. Companies are leveraging data analytics and mobile technology to enhance customer experience, optimize fleet management, and introduce contactless rentals. Strategic collaborations with ride-sharing platforms and the introduction of electric vehicles in rental fleets are further strengthening market positions.

Major players in the car rental market are Movida, Advantage Rent-a-car, Uber, Sixt, Europcar, CAR Inc., Hertz, Localiza, Avis Budget Group, and Enterprise Holdings.

Companies operating in the car rental market are implementing a range of strategic initiatives to strengthen their market position and meet evolving customer expectations. A major focus is on digital transformation, with investments in mobile apps, online booking platforms, and AI-powered customer service tools to enhance convenience and streamline the rental experience. Many firms are expanding their vehicle fleets, offering a wider variety of options-from economy to luxury and electric vehicles-to cater to different customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 GMI proprietary AI system

- 1.1.3.1 AI-Powered research enhancement

- 1.1.3.2 Source consistency protocol

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimation

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Booking

- 2.2.3 Rental length

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising tourism & business travel

- 3.2.1.2 Shift from ownership to access

- 3.2.1.3 Digital platforms & contactless rentals

- 3.2.1.4 Sustainability push

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High fleet maintenance & depreciation costs

- 3.2.2.2 Regulatory & competitive pressures

- 3.2.3 Market opportunities

- 3.2.3.1 Subscription & MaaS Integration

- 3.2.3.2 Emerging markets growth

- 3.2.3.3 Corporate partnerships

- 3.2.3.4 Technology differentiation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Revenue optimization and ancillary services

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.13.1.1 RPV: vehicle category, location type, and season

- 3.13.1.2 Geographic RPV variations and market dynamics

- 3.13.1.3 Corporate vs. Leisure segment RPV comparison

- 3.13.1.4 Historical RPV trends and future projections

- 3.13.2 Ancillary revenue streams and upselling strategies

- 3.13.2.1 GPS and navigation system revenue contribution

- 3.13.2.2 Insurance and protection product sales

- 3.13.2.3 Fuel service and convenience fees

- 3.13.2.4 Accessories and equipment rental revenue

- 3.13.2.5 Upgrade and premium service revenue

- 3.13.3 Dynamic pricing and revenue management

- 3.13.3.1 AI-powered pricing optimization and performance

- 3.13.3.2 Demand forecasting accuracy and revenue impact

- 3.13.3.3 Competitive pricing intelligence and response strategies

- 3.13.3.4 Seasonal and event-based pricing strategies

- 3.13.4 Cross-selling and customer value enhancement

- 3.13.4.1 Loyalty program revenue and customer retention

- 3.13.4.2 Corporate account expansion and service integration

- 3.13.4.3 Digital platform monetization and commission revenue

- 3.13.4.4 Hotel and travel service partnerships

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.14 Customer acquisition and lifetime value analysis

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.14.1.1 Digital marketing CAC and conversion rates

- 3.14.1.2 Traditional advertising and partnership channel costs

- 3.14.1.3 Corporate account acquisition investment and ROI

- 3.14.1.4 Referral program effectiveness and cost analysis

- 3.14.2 Customer lifetime value (LTV) modeling and segmentation

- 3.14.2.1 LTV by customer type and rental frequency

- 3.14.2.2 Corporate vs. Leisure customer value comparison

- 3.14.2.3 Geographic LTV variations and market characteristics

- 3.14.2.4 Loyalty program impact on LTV enhancement

- 3.14.3 Customer retention and churn analysis

- 3.14.3.1 Retention rate by customer segment and service level

- 3.14.3.2 Churn prediction and prevention strategies

- 3.14.3.3 Service recovery and customer win-back programs

- 3.14.3.4 Net promoter score (NPS) impact on retention and growth

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.15 Insurance and risk management analysis

- 3.15.1 Insurance cost structure and management strategies

- 3.15.2 Vehicle damage and loss prevention

- 3.15.3 Fraud prevention and security measures

- 3.15.4 Liability management and legal compliance

- 3.16 Fleet lifecycle and asset management

- 3.16.1 Vehicle procurement and acquisition strategy

- 3.16.1.1 OEM partnership and volume negotiation strategies

- 3.16.1.2 Purchase vs. Lease decision framework and financial impact

- 3.16.1.3 Fleet mix optimization and demand alignment

- 3.16.1.4 New vs. Used vehicle integration and cost analysis

- 3.16.2 Fleet utilization and performance optimization

- 3.16.2.1 Geographic fleet allocation and demand balancing

- 3.16.2.2 Seasonal fleet management and capacity planning

- 3.16.2.3 Vehicle rotation and location transfer optimization

- 3.16.3 Vehicle maintenance and lifecycle management

- 3.16.3.1 Preventive maintenance program optimization

- 3.16.3.2 Maintenance cost analysis and vendor management

- 3.16.3.3 Vehicle downtime minimization and service efficiency

- 3.16.3.4 Technology integration for predictive maintenance

- 3.16.4 Residual value management and disposal strategy

- 3.16.4.1 Resale value optimization and market timing

- 3.16.4.2 Wholesale vs. Retail disposal channel performance

- 3.16.4.3 Vehicle condition and refurbishment investment

- 3.16.4.4 Disposal cost management and revenue maximization

- 3.16.1 Vehicle procurement and acquisition strategy

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Service quality and customer satisfaction benchmarking

- 4.8 Location strategy and market coverage analysis

- 4.9 Brand positioning and marketing effectiveness comparison

Chapter 5 Market Estimates & Forecast, By Booking, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Online

- 5.3 Offline

Chapter 6 Market Estimates & Forecast, By Rental length, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Short term

- 6.3 Long term

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Luxury cars

- 7.3 Executive cars

- 7.4 Economy cars

- 7.5 SUVs

- 7.6 MUVs

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Leisure/ Tourism

- 8.3 Business

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Self-driven

- 9.3 Chauffeur-driven

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Alamo Rent-a-Car

- 11.1.2 Avis Budget Group

- 11.1.3 eHi Car Services

- 11.1.4 Enterprise Holdings

- 11.1.5 Europcar

- 11.1.6 Hertz Global Holdings

- 11.1.7 Localiza

- 11.1.8 Sixt

- 11.1.9 Uber Technologies

- 11.1.10 Zipcar

- 11.2 Regional companies

- 11.2.1 Advantage Rent A Car

- 11.2.2 CAR Inc.

- 11.2.3 Fox Rent A Car

- 11.2.4 Green Motion

- 11.2.5 Movida

- 11.2.6 Payless Car Rental

- 11.2.7 Rent-A-Wreck

- 11.2.8 Thrifty Car Rental

- 11.2.9 U-Save Car & Truck Rental

- 11.3 Emerging players

- 11.3.1 Book2wheel

- 11.3.2 Drivezy

- 11.3.3 Fluid Truck

- 11.3.4 Getaround

- 11.3.5 Gett

- 11.3.6 HyreCar

- 11.3.7 Maven

- 11.3.8 Ola Cabs

- 11.3.9 Rent Centric

- 11.3.10 SHARE NOW

- 11.3.11 Turo

- 11.3.12 Zoomcar