|

시장보고서

상품코드

1478711

하드 디스크 드라이브(HDD) 및 솔리드 스테이트 드라이브(SSD) 산업 : 시장 분석 및 처리 동향The Hard Disk Drive (HDD) and Solid State Drive (SSD) Industries: Market Analysis and Processing Trends |

||||||

디지털 컨텐츠, 클라우드 컴퓨팅, 빅데이터 분석의 등장으로 인한 데이터 스토리지에 대한 끊임없는 수요로 인해 디지털 스토리지 환경은 큰 변화를 맞이하고 있습니다. 이 변화의 중심에는 하드 디스크 드라이브(HDD)와 솔리드 스테이트 드라이브(SSD)라는 두 가지 핵심 기술이 있으며, 이 두 가지 기술은 스토리지의 미래를 형성하는 데 있어 매우 중요한 역할을 하고 있습니다.

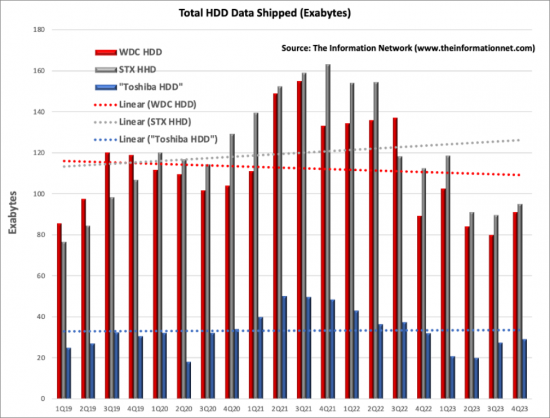

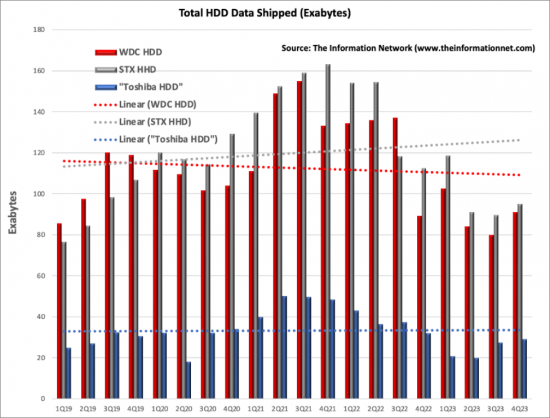

비용 효율적인 스토리지 솔루션을 제공해 온 오랜 역사를 가진 HDD 업계는 대용량 스토리지와 에너지 효율성에 대한 요구에 부응하기 위해 계속 진화하고 있습니다. SSD의 경쟁 압력에도 불구하고, HDD는 기가바이트당 비용과 용량 면에서 우위를 점하고 있어 데이터센터, 엔터프라이즈 스토리지 및 소비자 제품에서 여전히 필수적인 역할을 하고 있습니다.

반대로, 성능, 내구성, 에너지 효율성에 대한 끊임없는 추구에 힘입어 SSD 산업은 전례 없는 성장세를 보이고 있습니다. 움직이는 부품이 없는 SSD는 HDD보다 빠른 속도, 낮은 전력 소비, 높은 내구성을 제공하여 모바일 기기, 고성능 컴퓨팅 및 서버 애플리케이션에 적합한 선택이 되고 있습니다.

이 보고서는 하드 디스크 드라이브(HDD) 및 솔리드 스테이트 드라이브(SSD) 시장에 대한 종합적인 조사를 통해 디지털 스토리지 산업의 현황, 새로운 트렌드, 향후 전망, 시장 기회 및 향후 과제에 대해 정리했습니다.

목차

제1장 디스크 드라이브 시장 인프라

제2장 하드 디스크 드라이브 업계

- 하드 디스크 드라이브 동향

- 하드 디스크 폼팩터

- 하드 디스크 드라이브 시장 분석

- 경쟁 구조

제3장 솔리드 스테이트 드라이브 업계

- 솔리드 스테이트 드라이브(SSD) 동향

- 솔리드 스테이트 드라이브 시장 분석

- 3D NAND 예측

- SSD 용량 예측

제4장 레코딩 헤드

- 박막 판독/기입 헤드

- 동향

- 레코딩 헤드 시장 예측

제5장 가공 동향과 시장

- 헤드 처리

- 패턴화 자기 미디어

- 디스크리트 트랙 미디어 시장 분석

- NAND 처리

- 3D ReRAM 과제

제6장 미디어 시장

- 업계 동향

- 미디어 프로파일

- 미디어 시장 공급업체 점유율

Introduction

The digital storage landscape is undergoing a significant transformation, driven by the insatiable demand for data storage, fueled by the proliferation of digital content, cloud computing, and the advent of big data analytics. At the heart of this transformation are two critical technologies: Hard Disk Drives (HDDs) and Solid State Drives (SSDs), each playing a pivotal role in shaping the future of storage. This report provides an in-depth market analysis of the HDD and SSD industries, offering insights into the current trends, challenges, and advancements that are influencing the processing and manufacturing techniques within these sectors.

The HDD industry, with its long history of providing cost-effective storage solutions, continues to evolve in response to the demands for higher storage capacity and energy efficiency. Despite the competitive pressures from SSDs, HDDs remain integral in data centers, enterprise storage, and consumer products due to their advantages in cost-per-gigabyte and capacity. This report examines the technological advancements in areal density, energy-assisted magnetic recording technologies such as MAMR (Microwave-Assisted Magnetic Recording) and HAMR (Heat Assisted Magnetic Recording), and innovations in platter materials and design that are key to the future growth and sustainability of HDDs.

Conversely, the SSD industry, driven by the relentless pursuit of performance, durability, and energy efficiency, is witnessing unprecedented growth. SSDs, with their lack of moving parts, offer superior speed, lower power consumption, and greater durability over HDDs, making them the preferred choice for mobile devices, high-performance computing, and server applications.

Through a comprehensive analysis of both the HDD and SSD markets, this report aims to provide stakeholders with a thorough understanding of the current state, emerging trends, and future outlook of the digital storage industry. It is designed to equip manufacturers, technology developers, enterprise users, and investors with the critical insights needed to navigate the complexities of the storage market, capitalize on opportunities, and anticipate the challenges ahead in this rapidly evolving sector.

Trends in HDD and SSD

In the realm of Hard Disk Drives (HDDs) and Solid State Drives (SSDs), the landscape is continually evolving to meet the ever-increasing demands for data storage, characterized by a relentless pursuit of higher capacity, speed, and reliability. HDD manufacturers are pushing the limits of storage capacity through advanced technologies such as Shingled Magnetic Recording (SMR) and Heat-Assisted Magnetic Recording (HAMR), aiming to satisfy the burgeoning storage requirements of enterprises and cloud services. Alongside, energy-assisted recording methods are being explored to break through the physical limitations of conventional magnetic recording, enabling denser data storage.

On the SSD front, the narrative is about the reduction in cost per gigabyte alongside a surge in storage capacities, thanks to advancements in NAND flash technology. This trend is making high-capacity SSDs more attainable, encouraging their adoption over HDDs for primary storage roles. The SSD arena is also witnessing the rise of Quad-Level Cell (QLC) NAND technology, which packs more data into each cell, making SSDs a more compelling option for large-scale storage needs.

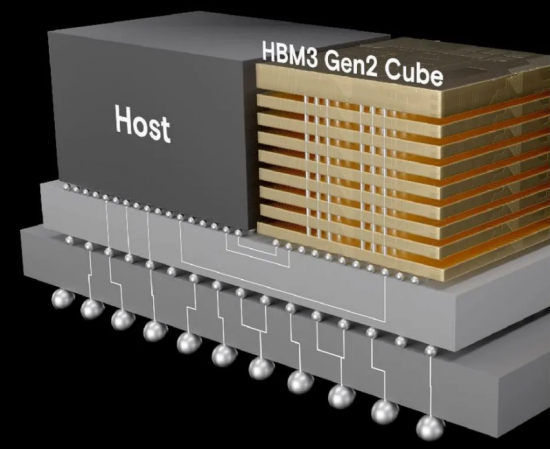

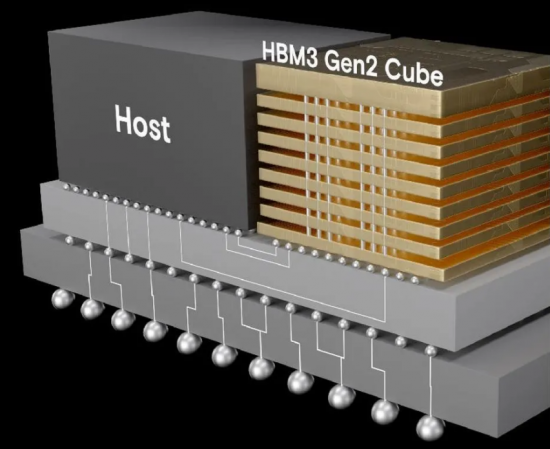

A significant highlight in the storage technology sphere is the advancement and integration of High Bandwidth Memory 3 (HBM3), which is setting new benchmarks in memory performance. HBM3, the latest iteration in the series, offers unprecedented data transfer speeds and bandwidth, markedly enhancing the performance of high-end computing systems. Its application is particularly notable in environments requiring rapid processing and analysis of vast data volumes, such as advanced AI algorithms and large-scale scientific computations.

The convergence of these technologies-HDDs evolving with smarter and denser recording techniques, SSDs becoming more accessible and capable, and the integration of cutting-edge solutions like HBM3-paints a picture of a storage industry that is not just about more space but about delivering faster, more efficient, and smarter data management and access solutions. This holistic advancement in storage technology underscores a future where data storage is not merely a repository but a critical component of computational efficiency and innovation.

Table of Contents

Chapter 1. The Disk Drive Market Infrastructure

Chapter 2. The Hard Disk Drive Industry

- 2.1. Hard Disk Drive Trends

- 2.2. Hard Disk Form Factors

- 2.3. Hard Disk Drive Market Analysis

- 2.3.1. Desktop PCs

- 2.3.2. Portable PCs

- 2.3.3. Enterprise

- 2.3.4. Consumer Electronics

- 2.4. Competitive Structure

- 2.4.1. HDD Market Share

Chapter 3. The Solid State Drive Industry

- 3.1. Solid-State Drives (SSD) Trends

- 3.2. Solid-State Drives Market Analysis

- 3.2.1. Client SSD Trends and Forecast

- 3.2.2. Enterprise SSD Trends and Forecast

- 3.2.3. Hybrid Hard Drives (HHD) Forecast

- 3.3 3D NAND Forecast

- 3.3.1. Comparison of 3D-NAND Structures

- 3.4. SSD Capacity Forecast

Chapter 4. Recording Heads

- 4.1. Thin Film Read/Write Heads

- 4.1.1. Thin Film (TF) Heads

- 4.1.2. Magnetoresistive (MR/AMR) Heads

- 4.1.3. Giant Magnetoresistive (GMR) Heads

- 4.1.4. Colossal Magnetoresistive (CMR) Heads

- 4.1.5. Current-Perpendicular-To-Place (CPP) Heads

- 4.1.6. Ballistic Magnetoresistance (BMR) Heads

- 4.2. Trends

- 4.3. Recording Head Market Forecast

Chapter 5. Processing Trends And Markets

- 5.1. Head Processing

- 5.1.1. Head Fabrication - CMP, Deposition, Lithography

- 5.1.1.1. CMP Challenges

- Ceria Slurry For Glass Disk Market

- Oxide Slurry For Metal Disk Market

- Oxide Slurry For Thin Film Head Market

- 5.1.1.2. Lithography Challenges

- 5.1.1.1. CMP Challenges

- 5.1.1. Head Fabrication - CMP, Deposition, Lithography

- 5.2. Patterned Magnetic Media

- 5.2.1. Conventional Media

- 5.2.2. Patterned Media

- 5.3. Market Analysis Of Discrete Track Media

- 5.3.1. The Perpendicular Recording Movement

- 5.3.2. Cost of Ownership (CoO) Analysis

- 5.4. NAND Processing

- 5.4.1. 2D NAND Processing

- 5.4.2. 3D NAND Processing

- 5.4.2.1. Etch Challenges and Market Forecast

- 5.4.2.2. Deposition Challenges and Market Forecast

- 5.5 3D ReRAM Challenges

Chapter 6. The Media Market

- 6.1. Industry Trends

- 6.2. Media Profiles

- 6.3. Media Market Supplier Shares

List Of Figures

- 1.1. Hard Disk Drive Infrastructure

- 2.1. Hard Disk Drive Roadmap

- 2.2. Decrease In Average Price Of Storage

- 2.3. Heads Per Drive

- 2.4. Increase In Areal Density

- 2.5. HDD Market Forecast By Form Factor

- 2.6. HDD Market Percentages By Form Factor

- 2.7 1.8. inch HDD Market Forecast

- 2.8. Platter Forecast

- 2.9. Ratio of Platter to HDDs

- 2.10. Forecast of Desktop Computers

- 2.11. Forecast of Portable Computers

- 3.1. Revenues For HDD and NAND

- 3.2. Change In Memory Cost For HDD and NAND

- 3.3. Growth Of SSD For Consumer Applications

- 3.4. Growth Of SSD For Enterprise Applications

- 3.5. Forecast Of SSDS HDDS And Hybrid SSDS

- 3.6. Western Digital's Thin Hybrid SSD

- 3.7. Process Steps For Samsung's 3D NAND

- 3.8. Technology Challenges for Planar NAND Manufacturing

- 4.1. Detailed Structure Diagram Of A GMR Head Assembly

- 4.2 (A) CIP Recording Head Structure (B) CPP Head Structure

- 4.3. Evolution Of Slider/Air Bearing Surface

- 4.4. Evolution Of HDD Recording Head Formats

- 4.5. Market Forecast Of Recording Head Consumption

- 4.6. Heads Per Drive Forecast

- 4.7. Market Share Of Head Suppliers

- 5.1. Thin Film Head Structure

- 5.2. Critical Features In Thin Film Head Structure

- 5.3. Spin Valve Head Structure

- 5.4. Cross-Sectional View TFH Stacks

- 5.5. Cross-Sectional View Of A TFH Design

- 5.6. CMP Slurry System For TFH Wafer Polishing

- 5.7. Total Slurry Consumption For HDD Forecast

- 5.8. Critical Lithography Trends In Thin Film Heads

- 5.9. Conventional Multigrain Media

- 5.10. Patterned Media

- 5.11a. Fabrication Of Patterned Media

- 5.11b. Fabrication Of Patterned Media

- 5.12. Nanoimprint Lithography Fabrication Of DTR Media

- 5.13. Magnetic Materials For DTR

- 5.14. Example Of A Thin Film Stack For DTR

- 5.15. Nanoimprint Lithography Process

- 5.16. DTR Film Deposition Alternatives

- 5.17. Ion Beam Etching Processes

- 5.18. Planarization By Etchback

- 5.19. Industry Wafer Capacity Additions

- 5.20. Building Blocks Of NAND Memory

- 5.21. Capped Cell Structured Memory

- 5.22 3D NAND Cell String

- 5.23 3D NAND Staircase Vias

- 5.24. Different 3D NAND Architectures

- 5.25. Steps In Making A Vertical String (BICS)

- 5.26. Steps In Making A Vertical String (TCAT)

- 5.27. Emerging Non-Volatile Memory Comparison

- 6.1. HDD Media Structure

- 6.2. Market Shares Of Media Suppliers

- 6.3. Market Shares Of Independent Media Suppliers