|

시장보고서

상품코드

1473280

IC 시장의 주목 분야 : 인공지능(AI), 5G, 자동차, 메모리 칩 시장 분석Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive and Memory Chips |

||||||

인공지능(AI), 5G 기술, 자동차 산업, 메모리 칩의 동향

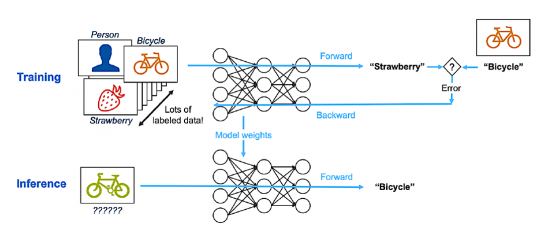

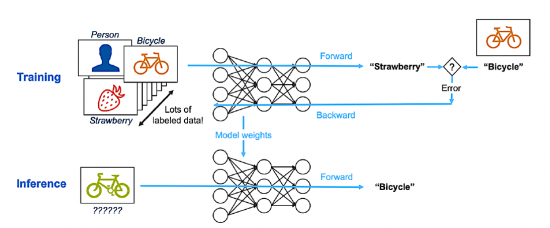

인공지능(AI) 분야에서는 AI 아키텍처 및 알고리즘의 발전, 엣지 AI의 확산, 다양한 산업 및 용도에 대한 AI의 통합 등 몇 가지 중요한 트렌드가 나타나고 있으며, AI 기술은 더욱 정교해져 자연어 처리, 컴퓨터 비전, 자율적 의사결정 등의 작업을 가능하게 하고 있습니다. 가능케 하고 있습니다.

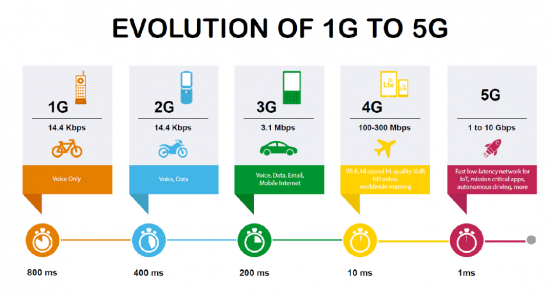

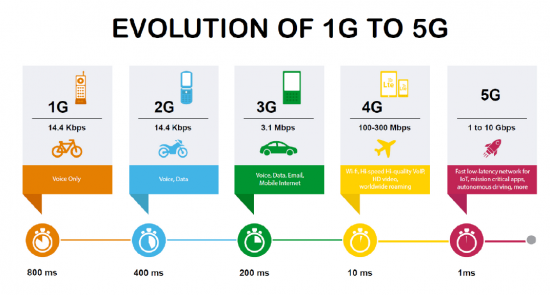

5G 기술의 보급은 산업 전반에 걸쳐 큰 변화를 가져올 것이며, 더 빠르고 안정적인 연결을 가능하게 하고, 사물인터넷(IoT) 기기의 보급을 지원하며, 증강현실(AR), 가상현실(VR), 자율주행차 등의 분야에서 혁신을 촉진할 것입니다.

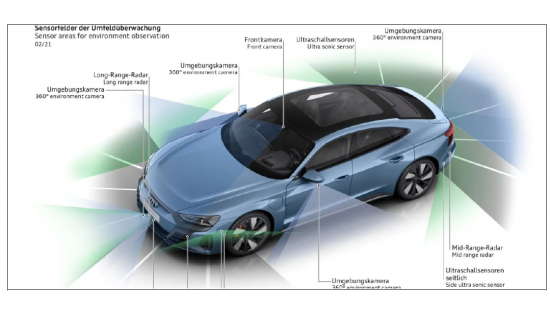

자동차 분야에서는 전기자동차(EV), 커넥티드카, 자율주행 기술 개발로 이어지는 전동화, 커넥티비티, 자율주행에 대한 관심이 높아지고 있습니다.

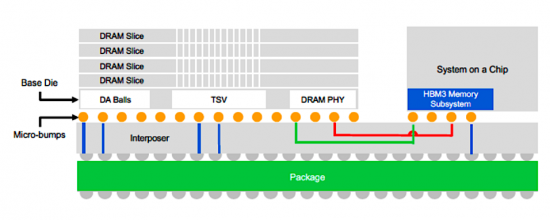

마지막으로 메모리 칩 분야에서는 클라우드 컴퓨팅, 인공지능, 빅데이터 분석 등 데이터 집약적인 용도 수요 증가에 대응하기 위해 스토리지 용량을 늘리고 성능을 향상시키며 전력 소비를 줄이는 데 초점을 맞추었습니다.

이 동향은 AI, 5G, 자동차, 메모리 칩 기술의 현재 진화 및 융합 상황을 나타내며, 이는 혁신과 세계 산업 구조조정을 촉진하고 있습니다.

기술의 융합

인공지능(AI), 5G 기술, 자동차 산업의 융합과 메모리 칩 기술의 발전은 세계 기술 전망의 큰 변화를 의미하며, 새로운 혁신과 연결성의 시대가 도래했음을 예고하고 있습니다. 이 보고서는 이 네 가지 핵심 부문의 교차하는 복잡한 역학관계를 밝히고, 이들이 총체적으로 현대 디지털 전환(DX)의 중추를 형성하고 다양한 산업에서 전례 없는 성장 기회를 창출할 수 있는 기반을 마련하고 있음을 보여줍니다.

인공지능은 이 기술 혁명의 최전선에 서서 보다 스마트하고 효율적인 시스템을 추진함으로써 우리의 생활, 업무, 교류 방식을 변화시키고 있습니다. 컴퓨팅 파워 강화부터 보다 정교한 데이터 분석 및 의사결정 프로세스 구현에 이르기까지 AI는 기술의 미래를 형성하는 데 있으며, 매우 중요한 역할을 하고 있습니다. 이 보고서에서는 산업 전반에 걸친 AI의 통합, 지능형 시스템 개발에 미치는 영향, 가전제품부터 복잡한 산업 운영까지 AI가 어떻게 혁명을 일으키고 있는지 분석합니다.

병행하여 5G 기술의 출시는 연결성, 속도, 신뢰성 측면에서 기존 기술을 훨씬 뛰어넘는 중요한 이정표가 될 것이며, 5G의 의미는 단순한 통신 기능 강화에 그치지 않고 사물인터넷(IoT), 자율주행차, 원격의료 서비스 등에 필요한 실시간 데이터 전송을 촉진할 것입니다. 전송을 촉진합니다. 생태계 분석은 5G 생태계에 대한 인사이트을 제공하고, 인프라 과제, 규제 현황, 기술 발전의 촉매제가 될 5G와 AI의 시너지를 검토합니다.

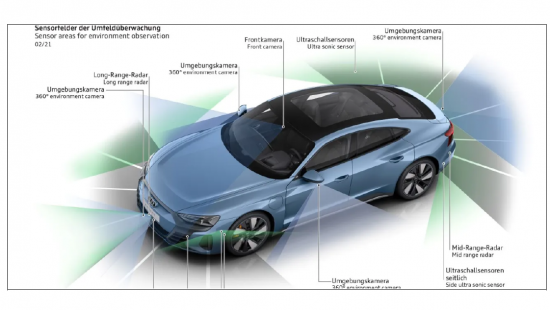

자동차 산업은 전동화, 자율주행, 커넥티드카가 모빌리티의 본질을 재정의하는 등 변화의 시기를 맞이하고 있습니다. 이 보고서는 첨단운전자보조시스템(ADAS), 차량용 인포테인먼트, V2X(Vehicle-to-Everything) 통신의 통합에 초점을 맞추어 AI와 5G가 어떻게 자동차 혁신을 가속화할 수 있는지를 평가합니다. 또한 제조업체, 소비자, 그리고 더 넓은 교통 인프라에 미치는 영향에 대해서도 살펴봅니다.

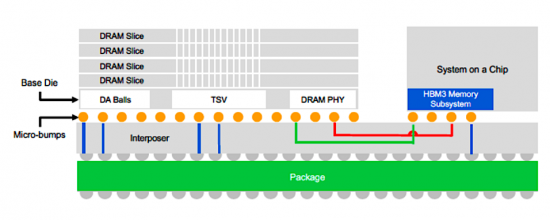

디지털 시대의 가장자리에 있는 메모리 칩은 AI, 5G, 자동차 기술의 성장을 지원하는 중요한 역할을 하고 있습니다. 이러한 분야가 빠르게 성장함에 따라 더 빠르고, 더 효율적이며, 더 큰 용량의 스토리지 솔루션에 대한 수요도 증가하고 있습니다. 이 섹션에서는 DRAM, NAND, NVRAM(비휘발성 메모리) 기술 등 메모리 칩 기술의 최신 동향을 평가하고, 최신 기술의 데이터 집약적 요구를 지원하는 데 있으며, 메모리 칩이 중요한 역할을 하고 있다는 점을 강조합니다.

세계 IC 시장의 주요 분야(인공지능(AI), 5G, 자동차, 메모리 칩)의 최신 상황에 대해 분석했으며, 각 분야의 기본적인 시장 구조 및 촉진요인, 최근 기술개발·보급 동향과 향후 방향성, 주요 공급업체의 개요와 주력 제품 등의 정보를 정리하여 전해드립니다.

목차

제1장 주요 요약

제2장 자동차

- 자동차 업계의 지표

- 자동차용 반도체 산업

- 자동차용 메모리 반도체

- 자동차용 반도체 : 종류별

- 주요 기술·컴포넌트 공급업체

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel(Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 자동차/첨단운전자보조시스템(ADAS)

- 기타 자동차용 AI 칩과의 경쟁

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- 기타 자동차용 AI 칩과의 경쟁

- LiDAR 센서

- LiDAR의 비용의 고려

- 자동차용 용도

- LiDAR 공급업체

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

제3장 5G

- 5G 칩 기술과 동향

- 활용 영역

- 휴대폰

- 학제적인 연결

- 시장 분석

- 시장 예측

- 5G와 4G의 새로운 컴포넌트

- 5G 칩·공급업체의 제품과 개요

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

제4장 인공지능(AI)

- AI 기술과 동향

- 클라우드 AI 컴퓨팅

- 엣지 AI 컴퓨팅

- 인공지능 요소

- 시장 분석

- AI 칩의 매출 예측

- 활용 영역

- AI의 산업 이용

- AI 탑재 디바이스

- 군/방위 용도

- AI 칩의 매출 예측

- AI 칩 기술

- GPU(영상 처리 유닛)

- FPGA(필드 프로그래머블 게이트 어레이)

- ASIC(특정 용도용 집적회로)

- 뉴로모픽 칩

- DPU(데이터 처리 유닛)

- AI 칩·공급업체의 제품과 개요

- IC벤더

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- 클라우드 프로바이더 : 기술 리더

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- IP벤더

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 세계 각국의 스타트업

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 중국의 스타트업

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- IC벤더

제5장 메모리 칩

- 메모리 기술과 동향

- 메모리

- NAND

- NVRAM : MRAM, RRAM, FERAM

- 활용 영역

- 메모리

- NAND

- 시장 분석

- 메모리 칩·공급업체의 제품과 개요

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba(Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC

Trends in Artificial Intelligence (AI), 5G technology, the automotive industry, and memory chips

In the realm of Artificial Intelligence (AI), several key trends are emerging, including advancements in AI architectures and algorithms, the proliferation of edge AI, and the integration of AI into various industries and applications. AI technologies are becoming more sophisticated, enabling tasks such as natural language processing, computer vision, and autonomous decision-making.

The adoption of 5G technology is driving significant transformations across industries, enabling faster and more reliable connectivity, supporting the proliferation of Internet of Things (IoT) devices, and facilitating innovations in areas like augmented reality (AR), virtual reality (VR), and autonomous vehicles.

In the automotive sector, there is a growing emphasis on electrification, connectivity, and autonomy, leading to the development of electric vehicles (EVs), connected cars, and selfdriving technologies.

Finally, in the realm of memory chips, there is a focus on increasing storage capacity, improving performance, and reducing power consumption to meet the growing demands of dataintensive applications such as cloud computing, artificial intelligence, and big data analytics.

These trends collectively represent the ongoing evolution and convergence of AI, 5G, automotive, and memory chip technologies, driving innovation and reshaping industries across the globe.

Convergence of Technology

The convergence of Artificial Intelligence (AI), 5G technology, the automotive industry, and advancements in memory chip technology represents a pivotal shift in the global technological landscape, heralding a new era of innovation and connectivity. This comprehensive report delves into the intricate dynamics at the intersection of these four critical sectors, unveiling how they collectively form the backbone of modern digital transformation and setting the stage for unprecedented growth opportunities across various industries.

Artificial Intelligence stands at the forefront of this technological revolution, driving smarter, more efficient systems that are transforming how we live, work, and interact. From enhancing computational power to enabling more sophisticated data analysis and decision-making processes, AI's role in shaping the future of technology cannot be overstated. This report explores AI's integration across industries, its impact on developing intelligent systems, and how it's revolutionizing everything from consumer electronics to complex industrial operations.

Parallelly, the rollout of 5G technology marks a significant milestone in connectivity, offering speeds and reliability that far surpass its predecessors. The implications of 5G extend beyond mere communication enhancements, facilitating the real-time data transmission necessary for the Internet of Things (IoT), autonomous vehicles, and remote healthcare services, among others. Our analysis provides insights into the 5G ecosystem, examining infrastructure challenges, regulatory landscapes, and the synergy between 5G and AI in catalyzing technological advancement.

The automotive sector is undergoing a transformative phase, with electrification, autonomous driving, and connected vehicles redefining the very essence of mobility. This report assesses how AI and 5G collectively accelerate automotive innovations, focusing on the integration of advanced driver-assistance systems (ADAS), in-vehicle infotainment, and vehicle-to-everything (V2X) communications. It also considers the implications for manufacturers, consumers, and the broader transportation infrastructure.

Memory chips, the unsung heroes of the digital age, play a crucial role in sustaining the growth of AI, 5G, and automotive technologies. As these sectors burgeon, so does the demand for faster, more efficient, and higher-capacity storage solutions. This section of the report evaluates the latest developments in memory chip technology, including DRAM, NAND, and emerging non-volatile memory technologies, highlighting their critical role in supporting the data-intensive needs of modern technologies.

In compiling this report, we aim to provide a holistic overview of how AI, 5G, the automotive sector, and advancements in memory chip technology are intricately linked, driving forward a new wave of innovation and industry growth. Through detailed market analysis, technological insights, and forward-looking projections, this report offers valuable intelligence for stakeholders across these sectors, enabling informed decision-making and strategic planning in an increasingly interconnected technological ecosystem.

About This Report

This report encompasses a broad spectrum of analyses, insights, and projections that illuminate the current state and future trajectory of these interlinked sectors. This report not only delves into individual technologies and their applications but also explores the synergies and intersections that are propelling innovation and market growth. Here's an expanded view of what such a report covers:

Artificial Intelligence (AI)

- Market Overview: Analysis of the global AI market, including size, growth trends, and forecasts. It examines key segments such as machine learning, natural language processing, and AI in robotics.

- Technology Trends: Exploration of cutting-edge AI technologies and methodologies, including deep learning, computer vision, and AI chips. The report assesses how these technologies are transforming industries.

- Application Areas: Detailed review of AI applications across various sectors, including healthcare, finance, retail, and more, highlighting case studies of successful AI integration.

- Challenges and Opportunities: Discussion on ethical considerations, data privacy issues, and the talent gap in AI. It also explores funding trends and governmental policies affecting AI development and adoption.

5G Technology

- Infrastructure and Deployment: Examination of the global rollout of 5G, including infrastructure requirements, spectrum allocation, and deployment strategies. It evaluates the progress in major regions and the challenges faced.

- Use Cases and Applications: Insight into the transformative potential of 5G across industries such as entertainment, manufacturing, and agriculture, emphasizing enhanced connectivity and IoT.

- Market Dynamics: Analysis of the competitive landscape, key players, and partnerships shaping the 5G ecosystem. It includes investment trends and regulatory impacts on market evolution.

- Future Prospects: Projection of the future of 5G, including the integration with satellite communications, development of 6G, and its role in enabling smart cities and autonomous systems.

Automotive Industry

- Electrification and Autonomous Driving: Overview of trends in electric vehicles (EVs) and autonomous driving technologies. This section covers advancements in battery technology, ADAS, and regulatory frameworks impacting vehicle automation and connectivity.

- Connectivity Solutions: Examination of the role of 5G in transforming automotive connectivity, including vehicle-to-everything (V2X) communication, in-car infotainment systems, and telematics.

- Market Players and Innovations: Analysis of leading automotive manufacturers, technology companies, and startups driving innovation in connected and autonomous vehicles.

- Sustainability and Challenges: Discussion on the automotive industry's move towards sustainability, including challenges in adoption, infrastructure development, and the impact on urban mobility.

Memory Chips

- Technology Evolution: Deep dive into the developments in memory chip technology, including DRAM, NAND flash, and emerging technologies like 3D XPoint and MRAM. It assesses the impact of these advancements on storage capacity, speed, and power efficiency.

- Industry Applications: Exploration of how memory chips support the data needs of AI, 5G, and automotive technologies, facilitating advancements in edge computing, data centers, and consumer electronics.

- Market Analysis: Review of the global memory chip market, including supply and demand dynamics, key manufacturers, and pricing trends. It also considers the impact of geopolitical factors on the semiconductor supply chain.

- Future Directions: Projections for the memory chip market, focusing on innovations in semiconductor materials, manufacturing processes, and the integration of memory technologies in next-generation computing architectures.

Table of Contents

Chapter 1. Executive Summary

Chapter 2. Automotive

- 2.1. Automotive Industry Metrics

- 2.2. Automotive Semiconductor Industry

- 2.2.1. Automotive Memory Semiconductors

- 2.2.2. Automotive Semiconductors By Type

- 2.2.2.1. Microcontrollers

- 2.2.2.2. ASSP/ASICs

- 2.2.2.3. Analog

- 2.2.2.4. Discrete

- 2.3. Key Technology And Component Suppliers

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel (Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 2.4. Automotive/ Advanced Driver Assistance Systems (ADAS)

- 2.4.1. Competition from Alternative Automotive AI Chips

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- 2.4.1. Competition from Alternative Automotive AI Chips

- 2.5. LiDAR Sensors

- 2.5.1. LiDAR - Cost Considerations

- 2.5.2. Automotive Applications

- 2.5.3. LiDAR Suppliers

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

Chapter 3 5G

- 3.1 5G Chip Technology and Trends

- 3.2. Applications

- 3.2.1. Mobile Handsets

- 3.2.2. Interdisciplinary Connections

- 3.3. Market Analysis

- 3.3.1. Market Forecasts

- 3.3.2. New Components For 5G vs 4G

- 3.3.2.1. 5G Modem Chip Overview

- 3.3.2.2. 5G Chips

- 3.3.2.3. mmWave Modules

- 3.3.2.4. Traditional MIMO Antennas

- 3.4. 5G Chip Supplier Products and Profiles

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

Chapter 4. Artificial Intelligence (AI)

- 4.1. AI Technology and Trends

- 4.1.1. Cloud AI Computing

- 4.1.2. Edge AI Computing

- 4.1.3. The Elements Of Artificial Intelligence

- 4.1.3.1. Importance Of Training And Inference

- 4.1.3.2. The Growing Importance Of Accelerators In Dc Spending

- 4.1.3.3. Training Costs

- 4.1.3.4. Generative AI

- 4.2. Market Analysis

- 4.2.1. AI Chip Revenue Forecast

- 4.3. Applications

- 4.3.1. Industry Applications of AI

- 4.3.1.1. Smart Healthcare

- 4.3.1.2. Smart Security

- 4.3.1.3. Smart Finance

- 4.3.1.4. Smart Grid

- 4.3.1.5. Smart Hone

- 4.3.2. AI-Powered Devices

- 4.3.2.1. Smart Speakers

- 4.3.2.2. Drones

- 4.3.2.3. Intelligent Robots

- 4.3.3. Military/Defense Applications

- 4.3.3.1. China's AI Plan

- 4.3.2.1. Driverless Vehicles

- 4.3.2.2. Computer Chips

- 4.3.2.3. Financial

- 4.3.2.4. Facial Recognition

- 4.3.2.5. Retail

- 4.3.2.6. Robots

- 4.3.3. AI Chip Revenue Forecast

- 4.3.1. Industry Applications of AI

- 4.4. AI Chip Technology

- 4.4.1. Graphics Processing Unit (GPU)

- 4.4.2. Field Programmable Gate Array (FPGA)

- 4.4.3. Application Specific Integrated Circuits (ASIC)

- 4.4.4. Neuromorphic Chips

- 4.4.5. Data Processing Units (DPUs)

- 4.5. AI Chip Supplier Products and Profiles

- 4.5.1. IC Vendors

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- 4.5.2. Cloud Providers - Tech Leaders

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- 4.5.3. IP Vendors

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 4.5.4. Startups Worldwide

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 4.5.5. Startups in China

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- 4.5.1. IC Vendors

Chapter 5. Memory Chips

- 5.1. Memory Technology and Trends

- 5.1.1. DRAM

- 5.1.2. NAND

- 5.1.3. NVRAM - MRAM, RRAM, and FERAM

- 5.2. Applications

- 5.2.1. DRAM

- 5.2.1.1. Server

- 5.2.1.2. PC

- 5.2.1.3. Graphics

- 5.2.1.4. Mobile

- 5.2.1.5. Consumer

- 5.2.2. NAND

- 5.2.2.1. SSD

- 5.2.2.2. PC

- 5.2.2.3. TV

- 5.2.2.4. Mobile

- 5.2.2.5. USB

- 5.2.1. DRAM

- 5.3. Market Analysis

- 5.4. Memory Chip Supplier Products and Profiles

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba (Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC