|

시장보고서

상품코드

1431788

EaaS(Equipment as a Service) 시장(2024-2028년)Equipment as a Service Market Report 2024-2028 |

||||||

이 보고서는 EaaS(Equipment as a Service) 벤더와 최종 사용자에 대한 인터뷰 결과를 바탕으로 세계 EaaS 시장 동향을 조사했으며, EaaS의 정의, 시장 규모 추이 및 예측, 시장 촉진-저해요인 분석, 벤더 분석, 사례 연구 분석 등을 정리했습니다, 주요 동향 및 과제 등을 정리하였습니다.

샘플 보기

기업 소개 :

|

|

목차

제1장 주요 요약

제2장 토픽 개요

- 출발점 : '종량 빌링제'와 'EaaS' : OEM 디지털화 로드맵의 중요 동향

- EaaS 도입 기업의 대표적인 사례 4선

- EaaS란 무엇인가?

- 소비자가 EaaS로부터 혜택을 받는 이유는?

- EaaS는 최종사용자에 있어서 어떻게 기능하는가?

- OEM의 EaaS 일반 도입 경로

- 일반적인 EaaS 솔루션 작성 방법

- OEM가 EaaS를 제공하는 이유

제3장 시장 규모 및 전망

- EaaS 시장 구분 : 정의

- OEM 시장, EaaS 시장, EaaS 도입률 정의

- 세계 시장 규모와 전망 : 개요

- 세계의 EaaS 시장 규모 및 전망 : 시장 성장에 관한 애널리스트의 의견

- 세계 시장 규모 및 전망 : 지역별

- 딥 다이브 1 : 서비스로서의 기계

- 딥 다이브 2 : 컴퓨터, 주변기기, 서비스로서의 온프레미스 데이터센터

- 딥 다이브 3 : 상용차, 항공기 및 관련 부품 서비스-시장 예측

- 딥 다이브 4 : 서비스로서의 전기 조명 기기

- 딥 다이브 5 : 서비스로서의 발전, 송전, 배전

- 세계의 EaaS 시장 성장에 영향을 미치는 순풍과 역풍 : 개요

- 1. 인플레이션/금리 상승이 어셋 라이트형 구독 경제를 추진

- 2. 일손부족에 의해 시간 단위에서의 기기 사용 필요성이 높아진다

- 3. 정부의 설비 투자형 투자 보조

- 4. 유연성 향상에 대한 수요 증가

- 5. IIoT 기술 개선

- 시장 성장 분석

- 세계 시장 규모 및 전망 : 상세 정보

제4장 EaaS 도입

- EaaS 도입 촉진요인

- EaaS 도입률을 상세 구분별로 분할

- EaaS 기회 개요(1/2) : 현재 도입과 향후 도입

- EaaS 기회 개요(2/2) : 현재 도입과 향후 도입 - 기계 상세

제5장 기존 채택 기업과 벤더

- EaaS를 구현하는 인프라 상황

- 기존 채택 기업의 상황

- 딥 다이브 1 : Robotics as a Service

- 딥 다이브 2 : Compressor as a Service

- 딥 다이브 3 : EaaS pioneer

- 딥 다이브 4 : 성공 사례 : Heidelberger Druckmaschinen

- 딥 다이브 5 : 좌절 스토리 : Festo

제6장 EaaS 자금조달

- 금융기관 : EaaS 사양에 대응 하기 위해 종량 빌링제 금융 상품을 도입

- 배경 : Pay-per-use 파이낸싱은 off-balance sheet financing의 일종

- OEM는 일반적으로 기기 자금조달에 대해 어떻게 생각하고 있는가?

- EaaS에 자금 제공하는 3개 이론적 옵션 : 사용자 관점에서

- 전용 EaaS 서비스를 제공하는 금융기관 상황

- OEM의 자기 자금조달 EaaS 예(1/2) : Kaeser

- OEM의 자기 자금조달 EaaS 예(2/2) : Caterpillar

- 써드파티와 협력하여 EaaS에 자금을 제공하는 OEM 사례 : Trumpf

- SPV Symbotic를 사용해 OEM이 EaaS에 융자하는 사례

제7장 사례 연구

- EaaS 사례 연구(95건)

- 사례 연구 1 : Heller

- 사례 연구 2 : Carrier Commercial Refrigeration

- 사례 연구 3 : Kaeser Compressors

- 사례 연구 4 : Heidelberg Druckmaschinen

- 사례 연구 5 : Kaer

- 사례 연구 6 : Hewlett Packard Enterprise

- 사례 연구 7 : Signify

- 사례 연구 8 : Mitsubishi Elevator Europe

제8장 동향과 과제

- 트렌드 1: OEM은 EaaS를 사용하여 타사에 손실된 수익을 확보

- 트렌드 2: 성능 보장 계약으로 EaaS의 대안 제공

- 트렌드 3: 지속 가능성 아젠다를 추진하기 위해 EaaS를 사용하는 OEMS

- 트렌드 4: 상용 전기/수소 차량의 주요 비즈니스 모델로 부상한 EaaS

- 트렌드 5: 산업 클러스터에서 EaaS 도입 증가

- 트렌드 6: EaaS 설정의 일부로 예비 부품 재사용

- 트렌드 7: 상용 전기/수소 차량의 주요 비즈니스 모델로 부상하는 EaaS

- 과제 1: EaaS 가격 책정/계약 수립

- 과제 2: 기존 비즈니스 모델로부터의 전환

- 과제 3: 유연한 자금 조달 방안 마련

- 과제 4: 더 큰 규모의 대차 대조표 관리

- 도전 과제 5: 최종 사용자가 EaaS 장비를 잘 다루지 못함

- 과제 6: 자금 조달 모범 사례가 없음

제9장 조사 인사이트

- EaaS : OEM의 채택 상황(구분별)

- 고객의 EaaS 도입

- 고객이 EaaS를 채택하는 이유

- EaaS로의 성공적인 전환을 보장하기 위해 필요한 조치

- EaaS로 전환할 때 흔히 저지르는 실수

- 응답자 프로필 및 설문조사 개요

제7장 조사 방법

제8장 IoT Analytics에 대해

LSH 24.03.06Comprehensive 147-page analysis on OEMs' transition to pay-per-use models. Includes market forecasts, vendor analyses, adoption drivers, case studies, key trends, and challenges.

The "Equipment as a Service Market Report 2024-2028" is part of IoT Analytics' ongoing coverage of Industrial IoT. The information presented in this report is based on the results of multiple surveys, secondary research, and qualitative research, i.e., interviews with Equipment as a Service (EaaS) vendors and end users from between August 2023 and February 2024. The document includes a definition of EaaS, market projections, analysis of vendors, adoption drivers, case study analysis, key trends and challenges, and insights from relevant surveys.

SAMPLE VIEW

The main purpose of this document is to help our readers understand the current EaaS landscape by defining, sizing, and analyzing the market.

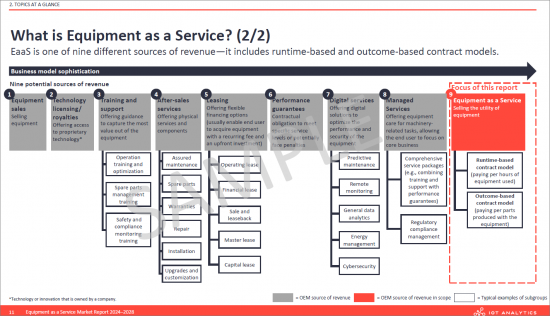

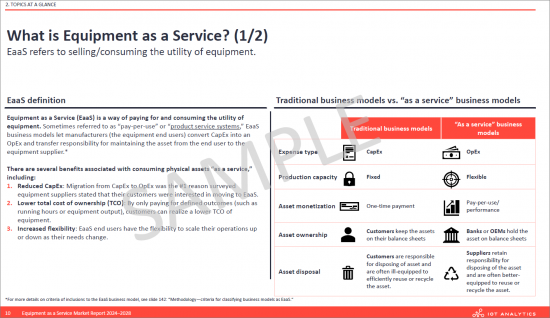

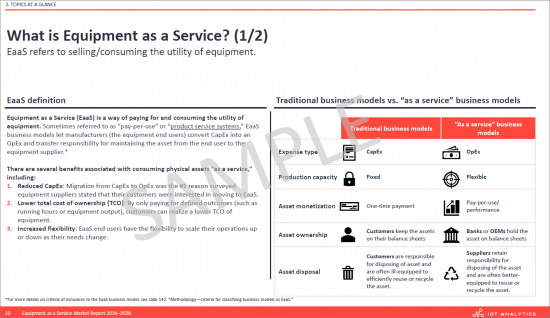

What is Equipment as a Service?

Equipment as a Service (EaaS) is a way of paying for and consuming the utility of equipment. Sometimes referred to as "pay-per-use" or "product service systems," EaaS business models let manufacturers (the equipment end users) convert CapEx into an OpEx and transfer responsibility for maintaining the asset from the end user to the equipment supplier.*

There are several benefits associated with consuming physical assets "as a service," including:

- 1. Reduced CapEx: Migration from CapEx to OpEx was the #1 reason surveyed equipment suppliers stated that their customers were interested in moving to EaaS.

- 2. Lower total cost of ownership (TCO): By only paying for defined outcomes (such as running hours or equipment output), customers can realize a lower TCO of equipment.

- 3. Increased flexibility: EaaS end users have the flexibility to scale their operations up or down as their needs change.

The Equipment as a Service (EaaS) market has been experiencing growth and is poised to continue growing in the coming years. This market encompasses a wide range of segments, with commercial vehicles, aircraft, and related parts leading the way. Closely followed by computers, peripheral equipment, and on-premises data centers, machinery, electric power generation, transmission, and distribution, and electrical lighting equipment.

Geographically, the Americas hold the largest share of the EaaS market, with EMEA and APAC regions also contributing substantial portions. The EaaS market's robust growth can be attributed to the increasing adoption of this business model across various industries, offering them the flexibility to use high-quality equipment without the upfront costs of ownership.

As we move forward, the EaaS market is expected to maintain its upward trajectory, driven by technological advancements, evolving business needs, and the increasing recognition of the benefits of this service model.

Questions answered:

- What is EaaS? (Definition, how it works for consumers and original equipment makers (OEMs), why and how consumers benefit from EaaS; and why OEMs offer EaaS)

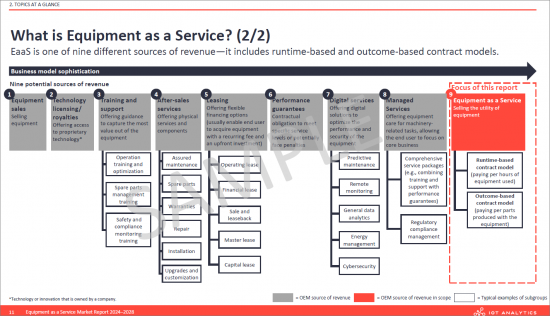

- Where does EaaS fit compared to other services provided by OEMs?

- How big is the EaaS market, and how is it expected to evolve?

- Who are the OEMs leading EaaS adoption, and what is their market share?

- What macro trends impact the market growth, and what are the headwinds/tailwinds?

- What are the drivers for EaaS adoption?

- How are EaaS solutions created?

- How are OEMs financing EaaS? How are they making EaaS successful?

- What are some best-in-class case studies of EaaS?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Executive summary

2. Topic at a glance

- 2.1. Starting point: "Pay-per-use" and "Equipment as a Service" are important trends on the OEM digitization roadmap

- 2.2. 4 prominent examples of companies that have introduced EaaS

- 2.3. What is Equipment as a Service (EaaS)?

- 2.4. Why do consumers theoretically benefit from EaaS?

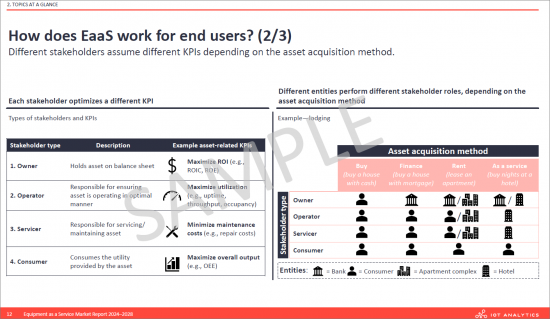

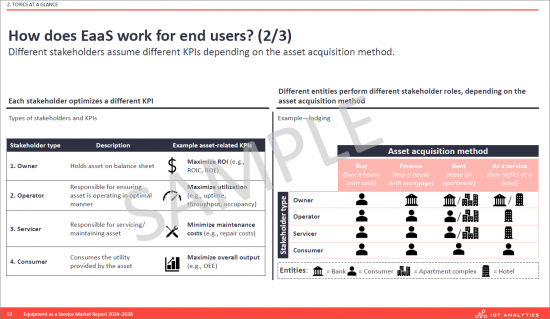

- 2.5. How does Equipment as a Service work for end users?

- 2.6. OEM's typical path towards Equipment as a Service

- 2.7. How typical EaaS solutions are created

- 2.8. Why do OEMs offer Equipment as a Service?

3. Market size & outlook

- 3.1. EaaS market segments definitions

- 3.2. Definitions of OEM market, EaaS market and EaaS adoption rate

- 3.3. Global market size and outlook - Overview

- 3.4. Global EaaS market size and outlook - Analyst's opinion on market growth

- 3.5. Global market size and outlook - by region

- 3.6. Deep-dive 1: Machinery as a Service

- 3.7. Deep-dive 2: Computers, peripheral equipment and on-premises data centers as a Service

- 3.8. Deep-dive 3: Commercial vehicle, aircrafts and related parts as a Service - Market forecast

- 3.9. Deep-dive 4: Electrical lighting equipment as a Service

- 3.10. Deep-dive 5: Electric power generation, transmission and distribution as a Service

- 3.11. Overview of headwinds and tailwinds impacting the global EaaS market growth

- 3.12. 1. Rising inflation/interest rates driving the asset-light subscription economy

- 3.13. 2. Labor shortages pushing the need for hourly equipment usage

- 3.14. 3. Governments subsidizing CAPEX-type investments

- 3.15. 4. Rising demand for increased flexibility

- 3.16. 5. IIoT technology improvements

- 3.17. Analysis of the market growth

- 3.18. Global market size and outlook - Further information

4. EaaS adoption

- 4.1. EaaS adoption drivers

- 4.2. EaaS adoption rate split by sub-segments

- 4.3. Overview of the EaaS opportunity (1/2): Current adoption vs future adoption

- 4.4. Overview of the EaaS opportunity (2/2): Current adoption vs future adoption - Deep dive on machinery

5. Known adopters & vendors

- 5.1. Landscape of the EaaS enabling infrastructure

- 5.2. Landscape of known adopters

- 5.3. Deep-dive 1: Robotics as a Service

- 5.4. Deep dive 2: Compressor as a Service

- 5.5. Deep dive 3: EaaS pioneer

- 5.6. Deep dive 4: Success story - Heidelberger Druckmaschinen

- 5.7. Deep dive 5: Setback story - Festo

6. Financing EaaS

- 6.1. Financial institutions are introducing pay-per-use financial products to cater to EaaS specifics

- 6.2. Background: Pay-per-use financing is a form of off-balance sheet financing

- 6.3. How OEMs generally think about equipment financing

- 6.4. 3 theoretical options to finance equipment as a service from the user's point of view

- 6.5. Landscape of financial institutions with dedicated EaaS offerings

- 6.6. Example of an OEM self-financing EaaS (1/2): Kaeser

- 6.7. Example of an OEM self-financing EaaS (2/2): Caterpillar

- 6.8. Example of an OEM financing EaaS with a 3rd party : Trumpf

- 6.9. Example of an OEM financing EaaS with an SPV Symbotic

7. Case studies

- 7.1. 95 EaaS case studies have been identified across variety of industries

- 7.2. Case study 1: Heller

- Successful OEMs focus on software add-ons with a freemium model

- 7.3. Case study 2: Carrier Commercial Refrigeration

- 7.4. Case study 3: Kaeser Compressors

- 7.5. Case study 4: Heidelberg Druckmaschinen

- 7.6. Case study 5: Kaer

- 7.7. Case study 6: Hewlett Packard Enterprise

- 7.8. Case study 7: Signify

- 7.9. Case study 8: Mitsubishi Elevator Europe

8. Trends & Challenges

- 8.1. Trend 1: OEMs are using EaaS to capture revenue lost to 3rd parties

- 8.2. Trend 2: Guaranteed performance contracts offer alternative to EaaS

- 8.3. Trend 3: OEMS are using EaaS to push their sustainability agenda

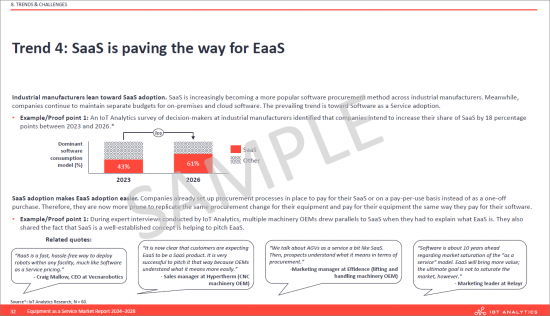

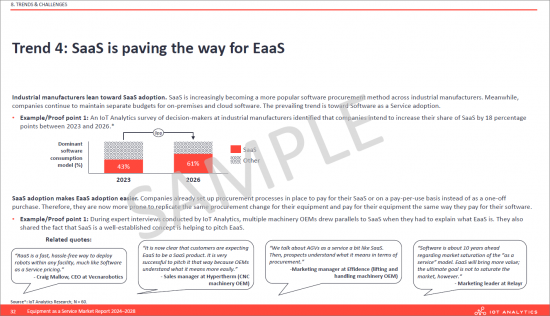

- 8.4. Trend 4: EaaS has become the prominent business model for commercial electric/hydrogen vehicles

- 8.5. Trend 5: EaaS adoption happens in industry cluster

- 8.6. Trend 6: Re-using spare parts as part of the EaaS setup

- 8.7. Trend 7: EaaS becoming the prominent business model for commercial electric/hydrogen vehicles

- 8.8. Challenge 1: Establishing EaaS pricing / contracts

- 8.9. Challenge 2: Transitioning from existing business models

- 8.10. Challenge 3: Procuring flexible financing sources

- 8.11. Challenge 4: Managing larger balance sheets

- 8.12. Challenge 5: End-users don't treat EaaS equipment well

- 8.13. Challenge 6: There are no financing best-practices

9. Survey insights

- 9.1. EaaS OEM adoption status-by segment

- 9.2. Customer adoption of EaaS

- 9.3. Reasons why customers adopt EaaS

- 9.4. Necessary actions to guarantee a successful pivot to EaaS

- 9.5. Common mistakes when transitioning to EaaS

- 9.6. Respondents' profile and survey overview