|

시장보고서

상품코드

1804524

안과 수술기구 시장 : 시술 유형, 제품 유형, 재료 유형, 최종사용자, 유통 채널별 - 세계 예측(2025-2030년)Ophthalmic Surgery Instruments Market by Procedure Type, Product Type, Material Type, End User, Distribution Channel - Global Forecast 2025-2030 |

||||||

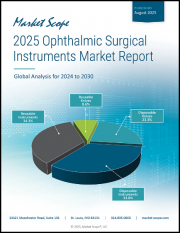

안과 수술기구 시장은 2024년에는 87억 3,000만 달러로 평가되었으며, 2025년에는 92억 7,000만 달러, CAGR 6.44%로 성장하여 2030년에는 127억 달러에 달할 것으로 예측됩니다.

| 주요 시장 통계 | |

|---|---|

| 기준 연도 2024년 | 87억 3,000만 달러 |

| 추정 연도 2025년 | 92억 7,000만 달러 |

| 예측 연도 2030년 | 127억 달러 |

| CAGR(%) | 6.44% |

안과 수술에 사용되는 기기는 정확도 향상과 환자 결과 개선이라는 두 가지 과제에 힘입어 최근 몇 년 동안 극적으로 진화하고 있습니다. 역사적으로 안과 수술은 손재주와 표준화된 기구에 크게 의존해 왔습니다. 그러나 첨단 마이크로 커팅 블레이드에서 통합 영상 시스템에 이르기까지 새로운 기술이 수술 프로토콜과 기기 설계 철학을 재정의하기 시작했습니다.

이 소개는 임상적 요구, 규제 프레임워크 및 기술적 혁신이 오늘날의 안과 수술기구 분야를 어떻게 형성하고 있는지 이해하는 데 도움이 될 것입니다. 최소침습 수술의 확산, 환자의 기대치 상승, 디지털 가이드 플랫폼의 통합 등 주요 동력을 검토하여 제조업체, 의료 서비스 제공자, 투자자 모두에게 새로운 기회와 도전 과제를 창출하는 동력을 밝힙니다.

첨단 레이저 및 로봇 지원 시스템과 디지털 통합이 안과 수술 프로토콜을 파괴하고 환자 치료 결과를 개선하는 방법

안과 수술은 레이저 기반 플랫폼, 로봇 지원, AI를 활용한 이미징이 융합되어 수술의 정확성과 효율성을 향상시킴으로써 큰 변화의 시기를 맞이하고 있습니다. 각막 및 백내장 수술에 펨토세컨드 레이저가 널리 사용되고 있는 것은 자동화가 수술의 일관성을 높이고, 수술 중 위험을 줄이며, 환자의 회복 시간을 단축할 수 있다는 것을 보여줍니다. 한편, 서브미크론 단위의 움직임이 가능한 수술용 로봇은 외과적으로 가능한 것의 경계를 넓혀 과거에는 수작업으로는 너무 섬세하거나 복잡하다고 여겨졌던 수술이 가능해졌습니다.

최근 미국 관세가 안과 수술기구의 공급체계와 비용구조에 미치는 파급효과 평가

최근 미국 정부가 특정 의료기기에 대한 관세를 도입함에 따라 안과 분야의 제조업체와 의료 서비스 제공자에게 새로운 복잡성을 가져왔습니다. 수입 관세로 인해 특정 고정밀 장비의 비용이 상승하고, 이해관계자들은 조달 전략과 재고 관리 방법을 재검토해야 합니다. 이에 따라 일부 공급업체들은 대체 생산기지를 찾거나 관세 변동 위험을 줄이기 위해 장기 계약을 체결하기도 합니다.

안과 수술기구의 수요를 규정하는 다양한 시술 기반 제품 소재와 최종사용자 부문의 촉진요인에 대한 이해

안과 수술기구 분야를 더 깊이 이해하기 위해서는 여러 차원의 세분화를 고려해야 하며, 각기 다른 수요 패턴과 성장 기회가 있습니다. 백내장수술, 각막성형술, 녹내장여과술, 안구형성재건술, 굴절교정술, 망막유리체복원술 등 수술식을 유형별로 분류하면 임상적 복잡성이나 환자의 특성을 반영하여 기구의 사양과 채택률이 명확해집니다.

아메리카, 유럽, 중동 및 아프리카, 아시아태평양의 시장 역학 분석을 통해 비즈니스 기회와 전략적 중요성을 파악할 수 있습니다.

아메리카의 지역적 역동성, 일류 학술 센터, 탄탄한 개인 개업의 생태계, 고급 수술 장비의 채택을 지원하는 선진적인 상환 정책을 특징으로 하는 정교한 의료 인프라를 확인할 수 있습니다. 특히 미국은 대규모 연구개발 투자와 기기 제조사와 안과 전문의와의 전략적 제휴를 통해 기술 혁신을 지속적으로 추진하고 있습니다.

안과 수술기구 분야에서 파트너십과 전략적 제휴를 통해 경쟁 우위를 창출하는 주요 혁신기업과 신생기업을 프로파일링합니다.

세계 유수의 안과 기기 제조사들은 전문 엔지니어링 회사 및 학술 연구 센터와의 전략적 제휴를 통해 차세대 기술에 대한 투자를 지속하고 있습니다. 전통 있는 브랜드는 광범위한 판매망과 임상의와의 관계를 활용하여 통합 영상, 촉각 피드백 등 독자적인 기술을 수술 포트폴리오에 통합하고 있습니다. 동시에 로봇 지원 플랫폼, 신규 폴리머 배합 일회용 소모품 등 틈새 분야에 집중하는 민첩한 진입 기업들도 진출하고 있습니다.

안과 수술기구의 기술적 진보를 활용하기 위한 업계 리더들을 위한 전략적 중요 사항과 실용적인 권고사항들

업계 리더는 수술 중 영상 처리, 분석, 실시간 의사결정 지원의 원활한 통합을 지원하는 디지털 인프라에 대한 투자를 우선시해야 합니다. 제품 로드맵을 로봇 공학 및 AI의 발전에 맞춰 제품 로드맵을 조정함으로써 기업은 제품을 차별화하고, 정밀한 가이드 개입에 대한 수요 증가에 대응할 수 있습니다.

1차 전문가 인터뷰 2차 데이터 소스 및 강력한 삼각측량 기술을 통합한 엄격한 조사 방법론에 대한 자세한 내용

이 분석은 일차 정보와 이차 정보를 모두 통합하는 견고한 조사 프레임워크를 기반으로 합니다. 안과 의사, 조달 관리자 및 업계 엔지니어와의 심층 인터뷰를 통해 시술 요건, 장비 성능 기준 및 새로운 사용자 선호도에 대한 직접적인 인사이트를 얻을 수 있었습니다. 이러한 질적 연구 결과와 더불어 업계 간행물, 규제 당국 신고, 특허 데이터베이스, 임상시험 등록을 종합적으로 검토하여 기술 궤적과 경쟁 동향을 파악했습니다.

이해관계자들이 진화하는 안과 수술기구 환경을 자신 있게 탐색할 수 있도록 주요 인사이트를 정리하고 미래 방향성을 제시합니다.

기술적 혁신, 관세에 미치는 영향, 세분화 분석을 통해 얻은 인사이트를 종합하면 안과 수술기구 분야가 변곡점에 도달했음이 분명합니다. 레이저 시스템, 로봇 공학, 디지털 플랫폼의 혁신이 새로운 기술의 가능성을 열어주는 한편, 진화하는 무역 정책은 공급망 민첩성의 필요성을 강조하고 있습니다. 수술 유형, 제품 형태, 재료, 최종사용자, 유통 채널별로 세분화하면 목표한 성장과 차별화를 위한 여러 경로를 찾을 수 있습니다.

목차

제1장 서문

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

제5장 시장 역학

제6장 시장 인사이트

- Porter's Five Forces 분석

- PESTEL 분석

제7장 미국 관세의 누적 영향 2025

제8장 안과 수술기구 시장 : 시술 유형별

- 백내장

- 각막

- 녹내장

- 눈 성형술

- 굴절

- 유리체망막

제9장 안과 수술기구 시장 : 제품 유형별

- 일회용 소모품

- 캐뉼라

- 팁

- 튜브

- 수동 기구

- 겸자

- 가위

- 스펙큘럼

- 전동 시스템

- 재사용 가능한 기구

- 블레이드

- 핸드피스

제10장 안과 수술기구 시장 : 재료 유형별

- 플라스틱

- 스테인리스강

- 티타늄

제11장 안과 수술기구 시장 : 최종사용자별

- 외래 수술 센터

- 병원과 진료소

제12장 안과 수술기구 시장 : 유통 채널별

- 오프라인

- 직접 판매

- 판매대리점 네트워크

- 온라인

제13장 아메리카의 안과 수술기구 시장

- 미국

- 캐나다

- 멕시코

- 브라질

- 아르헨티나

제14장 유럽, 중동 및 아프리카의 안과 수술기구 시장

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 아랍에미리트

- 사우디아라비아

- 남아프리카공화국

- 덴마크

- 네덜란드

- 카타르

- 핀란드

- 스웨덴

- 나이지리아

- 이집트

- 튀르키예

- 이스라엘

- 노르웨이

- 폴란드

- 스위스

제15장 아시아태평양의 안과 수술기구 시장

- 중국

- 인도

- 일본

- 호주

- 한국

- 인도네시아

- 태국

- 필리핀

- 말레이시아

- 싱가포르

- 베트남

- 대만

제16장 경쟁 구도

- 시장 점유율 분석, 2024

- FPNV 포지셔닝 매트릭스, 2024

- 경쟁 분석

- Bausch+Lomb Incorporated

- Beaver-Visitec International

- Carl Zeiss AG

- Duckworth & Kent Ltd.

- GE Healthcare

- Geuder AG

- Halma PLC

- HOYA Corporation

- Johnson & Johnson Services Inc.

- Mani, Inc.

- Medtronic plc

- Nidek Inc.

- Oertli Instrumente AG

- Rumex International Co.

- Sklar Surgical Instruments, Inc.

- Sontec Instruments, Inc.

- SurgiEdge Corporation

- Surgitrac Instruments(UK) Ltd.

- Topcon Corporation

제17장 리서치 AI

제18장 리서치 통계

제19장 리서치 컨택트

제20장 리서치 기사

제21장 부록

KSM 25.09.16The Ophthalmic Surgery Instruments Market was valued at USD 8.73 billion in 2024 and is projected to grow to USD 9.27 billion in 2025, with a CAGR of 6.44%, reaching USD 12.70 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 8.73 billion |

| Estimated Year [2025] | USD 9.27 billion |

| Forecast Year [2030] | USD 12.70 billion |

| CAGR (%) | 6.44% |

The landscape of instruments used in ophthalmic surgery has evolved dramatically over recent years, driven by the dual imperatives of enhancing precision and improving patient outcomes. Historically, surgical interventions in ophthalmology relied heavily on manual dexterity and standardized tools. However, emerging technologies-from advanced micro-cutting blades to integrated imaging systems-have begun to redefine both surgical protocols and instrument design philosophies.

This introduction sets the foundation for understanding how clinical needs, regulatory frameworks, and technological breakthroughs converge to shape today's ophthalmic surgery instruments sector. By examining the critical drivers, including the push toward minimally invasive procedures, rising patient expectations, and the integration of digital guidance platforms, this section illuminates the forces creating new opportunities and challenges for manufacturers, healthcare providers, and investors alike.

How Advanced Laser and Robot-Assisted Systems Combined with Digital Integration Are Disrupting Ophthalmic Surgery Protocols and Elevating Patient Outcomes

Ophthalmic surgery is undergoing a profound transformation as laser-based platforms, robotic assistance, and AI-augmented imaging converge to elevate surgical precision and efficiency. The widespread adoption of femtosecond lasers for corneal and cataract procedures exemplifies how automation can enhance procedural consistency, reduce intraoperative risks, and shorten patient recovery times. Meanwhile, surgical robots capable of sub-micron movements are expanding the boundaries of what is surgically possible, enabling interventions that were once deemed too delicate or complex for manual techniques.

Concurrently, the integration of digital operating theaters and real-time data analytics has redefined preoperative planning and postoperative evaluation. Cloud-based systems that aggregate patient imaging, biometric measurements, and surgical outcomes facilitate continuous learning loops, empowering surgeons to refine protocols and instrument designs iteratively. This shift toward data-driven workflows is not confined to elite institutions; telemedicine and remote proctoring are democratizing access to specialized expertise, thereby accelerating the global diffusion of advanced ophthalmic surgical methods.

Evaluating the Ripple Effects of Recent United States Tariffs on Ophthalmic Surgery Instrument Availability Supply Chains and Cost Structures

The recent implementation of tariffs on selected medical devices by the United States government has introduced a new layer of complexity for manufacturers and healthcare providers in the ophthalmic arena. Import duties have heightened the cost of certain high-precision instruments, prompting stakeholders to reassess sourcing strategies and inventory management practices. As a result, some suppliers have sought alternative manufacturing locations or negotiated long-term contracts to mitigate exposure to tariff volatility.

These trade measures have also underscored the importance of supply chain resilience. Facilities in Europe and Asia have ramped up local production capabilities, aiming to insulate critical consumables and motorized systems from future duties. For distributors and end users, the shift has translated into more proactive contract planning, enhanced collaboration with logistics partners, and a growing interest in reshoring components that were previously imported. Ultimately, the tariff landscape is catalyzing a more agile and geographically diversified approach to instrument procurement and deployment.

Unlocking Growth Drivers Across Diverse Procedure Based Product Material and End User Segments That Define Ophthalmic Surgical Instrument Demand

A nuanced understanding of the ophthalmic surgery instruments space requires examining multiple dimensions of segmentation, each revealing unique demand patterns and growth opportunities. When procedures are categorized by type-cataract extraction, corneal reshaping, glaucoma filtration, oculoplastic reconstruction, refractive adjustments, and vitreoretinal repairs-distinct instrument specifications and adoption rates emerge, reflecting clinical complexity and patient demographics.

The diversity of instrument form factors further bifurcates the landscape. Disposable consumables such as cannulas, precision tips, and specialized tubing have gained traction due to sterility assurances and reduced reprocessing burdens, while manual instruments including forceps, fine scissors, and eyelid speculums remain essential for versatile operative interventions. In parallel, motorized systems continue to advance, integrating digital feedback loops, and reusable instruments like surgical blades and handpieces persist thanks to cost efficiencies and material durability.

Material composition adds another layer of distinction, with plastic components offering lightweight disposability, stainless steel ensuring reliable performance, and titanium delivering superior biocompatibility for critical surgical tasks. End users-ranging from ambulatory surgery centers to hospital-based ophthalmology departments-differ in procedural volumes, capital budgets, and regulatory requirements, shaping procurement priorities accordingly. Finally, distribution channels split between offline pathways, encompassing direct sales and distributor networks, and an expanding online ecosystem, where digital procurement platforms foster greater transparency and speed of fulfillment.

Analyzing Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific Revealing Opportunities and Strategic Imperatives

Regional dynamics in the Americas reveal a sophisticated healthcare infrastructure characterized by leading academic centers, a robust private practice ecosystem, and progressive reimbursement policies that support adoption of premium surgical tools. The United States, in particular, continues to drive innovation through substantial R&D investment and strategic partnerships between instrument makers and ophthalmology specialists.

In Europe, Middle East, and Africa, regulatory harmonization efforts and expanding healthcare access programs are stimulating demand for both cost-effective disposables and advanced powered systems. Fragmented reimbursement landscapes coexist with centers of clinical excellence, creating pockets of rapid uptake alongside markets that remain price sensitive.

The Asia-Pacific region, fueled by growing middle-class populations and rising healthcare expenditure, is experiencing accelerated modernization of surgical suites. Local manufacturing hubs in East and South Asia are scaling production of both entry-level and state-of-the-art instruments, serving domestic needs while exporting to global markets. Across these diverse geographies, the interplay of policy, reimbursement, and infrastructure investment shapes the trajectory of ophthalmic instrument adoption and innovation.

Profiling Leading Innovators and Emerging Entrants Driving Competitive Advantage Through Partnerships and Strategic Collaborations in Ophthalmic Surgery Devices

Leading global ophthalmic device manufacturers continue to invest in next-generation technologies, often through strategic alliances with specialized engineering firms and academic research centers. Long-established brands have leveraged broad distribution networks and clinician relationships to embed proprietary technologies-such as integrated imaging and haptic feedback-into their surgical portfolios. At the same time, agile entrants are making inroads by focusing on niche segments, including robotic assistance platforms and single-use consumables with novel polymer formulations.

Collaborations between device makers and digital health startups are also reshaping the competitive landscape. Joint development agreements aim to expedite the integration of cloud-based analytics, remote procedure monitoring, and AI-driven quality control into instrument ecosystems. These partnerships not only accelerate innovation cycles but also foster new revenue models, such as subscription-based instrumentation services and outcome-based pricing structures.

As the pace of change accelerates, companies that can seamlessly combine engineering prowess with clinical insight stand to gain a decisive advantage, whether by delivering modular instrument suites that support multiple procedure types or by pioneering materials that enhance surgical safety and ergonomics.

Strategic Imperatives and Practical Recommendations for Industry Leaders to Harness Technological Advances in Ophthalmic Surgery Instruments

Industry leaders should prioritize investments in digital infrastructure that supports the seamless integration of imaging, analytics, and real-time decision support during surgical procedures. By aligning product roadmaps with advances in robotics and AI, organizations can differentiate their offerings and meet the growing demand for precision-guided interventions.

Simultaneously, diversifying manufacturing footprints and establishing flexible supply agreements will be critical to mitigating trade-related risks and ensuring continuity of instrument availability. Embracing a dual approach-balancing local production for core components with global sourcing of specialized elements-can enhance resilience without sacrificing cost efficiency.

Finally, engaging proactively with regulatory bodies to shape evolving standards and certification pathways can accelerate time to clinical adoption. By collaborating on best practices for device validation, post-market surveillance, and user training, companies can foster trust among providers and patients, laying the groundwork for sustained growth.

Detailing the Rigorous Research Methodology Incorporating Primary Expert Interviews Secondary Data Sources and Robust Triangulation Techniques

This analysis is grounded in a robust research framework that synthesizes both primary and secondary sources. In-depth interviews with ophthalmic surgeons, procurement managers, and industry engineers provided firsthand insights into procedural requirements, instrument performance criteria, and emerging user preferences. These qualitative findings were complemented by a comprehensive review of industry publications, regulatory filings, patent databases, and clinical trial registries to map technology trajectories and competitive developments.

To ensure the reliability of conclusions, a multi-stage triangulation process was employed. Data points from expert discussions were cross-verified against published case studies and company disclosures, while statistical validation techniques were applied to survey responses from healthcare institutions across key regions. Peer review sessions with domain specialists further refined the interpretation of trends and validated the strategic implications.

This methodological rigor ensures that the report's insights stand on a foundation of diverse evidence, delivering clarity and confidence to stakeholders navigating the evolving ophthalmic surgery instrument landscape.

Consolidating Key Insights and Highlighting Future Directions for Stakeholders to Navigate the Evolving Ophthalmic Surgical Instrument Landscape with Confidence

Bringing together the insights from technological breakthroughs, tariff impacts, and granular segmentation analysis, it becomes clear that the ophthalmic surgery instruments space is at an inflection point. Innovations in laser systems, robotics, and digital platforms are unlocking new procedural possibilities, while evolving trade policies underscore the need for supply chain agility. Segmentation by procedure type, product form, material, end user, and distribution channel reveals multiple pathways for targeted growth and differentiation.

Regional perspectives further illustrate how healthcare infrastructures and regulatory climates shape instrument adoption, with the Americas, EMEA, and Asia-Pacific each offering distinct opportunities and challenges. Meanwhile, the competitive landscape is being reshaped by collaborations between established manufacturers and nimble startups, accelerating the development of integrated solutions that span preoperative planning through postoperative analytics.

As stakeholders chart their next steps, this comprehensive view provides a strategic compass, highlighting where to focus innovation, optimize supply networks, and cultivate partnerships that will drive success in a rapidly evolving environment.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Rising demand for single-use disposable microinstruments to reduce infection risk during minimally invasive ocular surgeries

- 5.2. Technological advancement in micro-incision instrument design to facilitate sub-2 mm incision cataract procedures

- 5.3. Growing utilization of multifunctional ophthalmic instrument sets integrating vitrectomy and phacoemulsification tools

- 5.4. Integration of femtosecond laser compatibility in cataract surgical instrument kits to enhance precision and safety

- 5.5. Enhanced ergonomic handle designs in microsurgical instrument kits to minimize surgeon fatigue during prolonged ophthalmic procedures

- 5.6. Increasing incorporation of antimicrobial coatings on surgical blades and forceps to prevent postoperative endophthalmitis in eye surgeries

- 5.7. Emerging use of 3D printed customized instrument trays to optimize layout and sterilization workflows in ophthalmology centers

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Ophthalmic Surgery Instruments Market, by Procedure Type

- 8.1. Introduction

- 8.2. Cataract

- 8.3. Corneal

- 8.4. Glaucoma

- 8.5. Oculoplastic

- 8.6. Refractive

- 8.7. Vitreoretinal

9. Ophthalmic Surgery Instruments Market, by Product Type

- 9.1. Introduction

- 9.2. Disposable Consumables

- 9.2.1. Cannulas

- 9.2.2. Tips

- 9.2.3. Tubing

- 9.3. Manual Instruments

- 9.3.1. Forceps

- 9.3.2. Scissors

- 9.3.3. Speculums

- 9.4. Motorized Systems

- 9.5. Reusable Instruments

- 9.5.1. Blades

- 9.5.2. Handpieces

10. Ophthalmic Surgery Instruments Market, by Material Type

- 10.1. Introduction

- 10.2. Plastic

- 10.3. Stainless Steel

- 10.4. Titanium

11. Ophthalmic Surgery Instruments Market, by End User

- 11.1. Introduction

- 11.2. Ambulatory Surgery Centers

- 11.3. Hospitals & Clinics

12. Ophthalmic Surgery Instruments Market, by Distribution Channel

- 12.1. Introduction

- 12.2. Offline

- 12.2.1. Direct Sale

- 12.2.2. Distributor Network

- 12.3. Online

13. Americas Ophthalmic Surgery Instruments Market

- 13.1. Introduction

- 13.2. United States

- 13.3. Canada

- 13.4. Mexico

- 13.5. Brazil

- 13.6. Argentina

14. Europe, Middle East & Africa Ophthalmic Surgery Instruments Market

- 14.1. Introduction

- 14.2. United Kingdom

- 14.3. Germany

- 14.4. France

- 14.5. Russia

- 14.6. Italy

- 14.7. Spain

- 14.8. United Arab Emirates

- 14.9. Saudi Arabia

- 14.10. South Africa

- 14.11. Denmark

- 14.12. Netherlands

- 14.13. Qatar

- 14.14. Finland

- 14.15. Sweden

- 14.16. Nigeria

- 14.17. Egypt

- 14.18. Turkey

- 14.19. Israel

- 14.20. Norway

- 14.21. Poland

- 14.22. Switzerland

15. Asia-Pacific Ophthalmic Surgery Instruments Market

- 15.1. Introduction

- 15.2. China

- 15.3. India

- 15.4. Japan

- 15.5. Australia

- 15.6. South Korea

- 15.7. Indonesia

- 15.8. Thailand

- 15.9. Philippines

- 15.10. Malaysia

- 15.11. Singapore

- 15.12. Vietnam

- 15.13. Taiwan

16. Competitive Landscape

- 16.1. Market Share Analysis, 2024

- 16.2. FPNV Positioning Matrix, 2024

- 16.3. Competitive Analysis

- 16.3.1. Bausch+Lomb Incorporated

- 16.3.2. Beaver-Visitec International

- 16.3.3. Carl Zeiss AG

- 16.3.4. Duckworth & Kent Ltd.

- 16.3.5. GE Healthcare

- 16.3.6. Geuder AG

- 16.3.7. Halma PLC

- 16.3.8. HOYA Corporation

- 16.3.9. Johnson & Johnson Services Inc.

- 16.3.10. Mani, Inc.

- 16.3.11. Medtronic plc

- 16.3.12. Nidek Inc.

- 16.3.13. Oertli Instrumente AG

- 16.3.14. Rumex International Co.

- 16.3.15. Sklar Surgical Instruments, Inc.

- 16.3.16. Sontec Instruments, Inc.

- 16.3.17. SurgiEdge Corporation

- 16.3.18. Surgitrac Instruments (UK) Ltd.

- 16.3.19. Topcon Corporation