|

시장보고서

상품코드

1912460

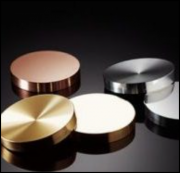

순금속 스퍼터링 코팅 재료 시장 예측 : 유형별, 성막 방법별, 장치 유형별, 용도별(2026-2032년)Sputtering Coating Pure Metal Material Market by Metal Type, Deposition Method, Equipment Type, Application - Global Forecast 2026-2032 |

||||||

순금속 스퍼터링 코팅 재료 시장은 2025년 24억 5,000만 달러로 평가되었고, 2026년에는 26억 1,000만 달러, CAGR 7.06%로 성장하고, 2032년까지 39억 5,000만 달러에 달할 것으로 예측되고 있습니다.

| 주요 시장 통계 | |

|---|---|

| 기준 연도 2025년 | 24억 5,000만 달러 |

| 추정 연도 2026년 | 26억 1,000만 달러 |

| 예측 연도 2032년 | 39억 5,000만 달러 |

| CAGR(%) | 7.06% |

진화하는 재료, 공정 및 공급망의 동향이 산업 전반에 걸친 순금속 스퍼터링 코팅 재료의 사용을 재구성하는 방법에 대한 명확한 도입

순금속 스퍼터링 코팅 재료 부문은 전문 실험실의 틈새 영역에서 중요한 산업 기반 기술로 발전해 왔습니다. 성막제어기술, 대상재료, 장치구조의 진보로 스퍼터링에 의한 순금속의 응용범위는 자동차도장, 첨단전자, 의료기기, 정밀광학기기로 확대되고 있습니다. 제조업체가 고성능화, 저결함률, 프로세스 재현성의 향상을 추구하는 중, 스퍼터링은 기능성과 미관을 겸비한 박막 금속을 성막하는 최적의 방법으로 선택되고 있습니다.

순금속 스퍼터링 코팅 재료의 급속한 변화를 견인하는 기술적 프로세스 통합, 수요측의 변화를 간결하게 총괄

최근, 스퍼터링 코팅용 순금속의 에코시스템 전체에 변혁적인 변화가 생기고 여러 레벨에서 혁신이 가속화되고 있습니다. 재료면에서는 순도 관리와 대상 제조 기술의 개량에 의해 오염물질의 저감과 전기, 광학 및 기계적 특성의 향상이 실현된 박막이 지지되고 있습니다. 동시에 마그네트론 구성에서 고주파 RF 시스템에 이르는 증착 제어 기술의 진보로 보다 엄격한 두께 제어와 박막 화학 조성의 개선이 가능해 성능이 중요한 용도에 직접적인 이익을 가져오고 있습니다.

2025년에 시행된 관세조치가 스퍼터링 밸류체인 전체의 조달전략, 구매행동, 자본계획에 어떤 영향을 미쳤는지를 명확히 평가

미국의 무역 시책 환경, 특히 2025년에 실시된 관세 조치는 스퍼터링 코팅용 순금속 부문에서의 조달, 가격 형성 동향, 공급망 전략에 중대한 영향을 미쳤습니다. 특정 원료, 장비 수입, 주변 부품에 대한 관세 조치는 고순도 대상, 전원 공급 장치 및 진공 시스템을 경계 조달에 의존하는 제조업체에 대한 비용 압력을 증가 시켰습니다. 이러한 비용 증가로 많은 바이어들이 공급업체 계약, 리드타임 버퍼, 현지 조달 전략의 재검토를 촉구했습니다.

금속 선정, 용도 요건, 성막 방법, 장치 구성을 기술 및 상업적 판단 요인과 연결시키는 통합적인 세분화 분석

수요와 경쟁의 역학을 이해하기 위해서는 재료, 용도, 성막 방법, 설비 선택을 기술 및 상업적 성과와 연결시키는 신중한 세분화가 필요합니다. 금속 유형(알루미늄, 크롬, 구리, 티타늄)별로 분석하면 각 원소가 특정 성능 요구에 부합하는 고유한 특성을 갖습니다. 알루미늄은 경량성, 반사성 및 내식성을 제공, 크롬은 장식성 및 내마모성이 있는 표면 마감를 실현, 구리는 전기 전도성 및 열 관리를 서포트, 티탄은 뛰어난 생체 적합성과 강도 대 중량비의 이점을 가져옵니다.

수요 및 공급 동향을 지역별로 고찰하면 미국 대륙, 유럽, 중동, 아프리카, 아시아태평양이 제조 투자, 지속가능성 우선순위, 채택 채널을 어떻게 형성하고 있는지를 밝혀

지역 동향은 스퍼터링 코팅 부문에서 공급망, 보급률 및 경쟁 구도를 형성하는데 결정적인 역할을 합니다. 미국 대륙에서는 자동차 및 전자기기 섹터로부터의 산업 수요와 제조 지원책이 함께 현지 생산 능력과 연구 개발(R&D) 협력에 대한 투자를 촉진하고 있습니다. 북미 바이어는 공급망의 탄력성과 현지 조달에 중점을 두고 있으며, 이로써 재료 공급업체와 장비 통합업체 간의 전략적 제휴가 진행되어 인증 사이클의 단축과 대응력의 향상을 도모하고 있습니다.

재료 전문성, 장비 혁신, 애프터마켓 서비스가 공급업체의 차별화와 고객 봉쇄를 결정하는 경쟁의 중점 검증

순금속 스퍼터링 코팅 재료 부문의 경쟁 구도는 깊은 재료 전문 지식, 견고한 장비 포트폴리오, 강력한 애프터마켓 서비스 능력을 결합한 기업에 의해 정의됩니다. 주요 기업은 목표 순도 프로세스, 고급 마그네트론 및 RF 모듈, 인사이트 진단 및 프로세스 재현성을 지원하는 시스템 아키텍처에 투자함으로써 차별화를 도모하고 있습니다. 이러한 투자는 고객의 인증 프로세스를 가속화하고 결함률을 줄이고 프로토타입 단계에서 대량 생산에 이르는 명확한 확장 채널을 제공합니다.

시장 리더가 장기적인 가치를 얻기 위한 실행 가능한 전략적 우선순위 : R&D, 장비 로드맵, 강인한 조달 시스템을 애프터마켓 서비스와 지속가능성과 일치시키는 것

산업 리더는 재료 R&D, 장비 로드맵, 공급망 탄력성을 결합한 전략을 추진하고, 요구가 점점 더 엄격해지는 용도 전반에 걸쳐 가치를 창출해야 합니다. 첫째, 불순물을 줄이고 보다 엄격한 박막 공차를 지원하는 재료 및 대상 제조 공정에 대한 투자를 선호합니다. 이러한 개선은 전자 및 광학 부문 고객에게 즉각적인 이익을 제공하는 동시에 의료 및 자동차 부문에 진입하는 길을 열어줍니다. 다음으로, 플라즈마 제어, 기판 핸들링, 내장 계측 기능을 통합한 성막 플랫폼의 개발을 가속해, 인정 기간의 단축과 스케일 업시의 편차 저감을 도모합니다.

문헌, 특허, 인터뷰, 공급망 매핑을 조합한 엄격한 다수법 조사 접근법으로 기술 및 상업적 결론을 상호 검증된 증거로 뒷받침

본 개요의 기반이 되는 분석은 기술문헌 검토, 1차 인터뷰, 공급망 매핑을 조합한 다각적인 조사 기법을 통합하여 확고한 실용적인 결론을 보장하고 있습니다. 기술문헌과 특허조사를 통해 대상재료기술, 마그네트론과 고주파(RF) 구성, 고도프로세스제어방법에 있어서 최근의 혁신동향을 파악했습니다. 재료과학자, 장비엔지니어, 조달책임자, 조업관리자 등 이해관계자에 대한 1차 인터뷰를 통해 실용상의 제약, 현실적인 트레이드오프, 채택촉진요인을 밝혀 2차 조사결과를 검증·보완했습니다.

결론적으로 재료, 공정 통합, 공급망의 탄력성 상호작용이 스퍼터링 에코시스템 전체의 경쟁 우위를 결정하는 것을 강조하는 통합 분석을 실시합니다.

요약하면, 순금속 스퍼터링 코팅 재료는 전환점에 서 있으며, 재료 과학의 진보, 공정 통합, 변화하는 무역 조건이 산업 횡단적인 전략적 우선순위를 재구성하고 있습니다. 대상 순도의 향상, 진화하는 성막 기술, 통합형 장치 아키텍처의 융합에 의해 엄격한 전기, 광학 및 기계적 특성과 생체 적합성 요건을 충족하는 고성능 박막의 실현이 가능하게 되었습니다. 동시에 무역 시책의 변화와 지역별 투자 동향이 공급의 현지화와 조달 탄력성 강화의 노력을 가속화하고 있습니다.

자주 묻는 질문

목차

제1장 서문

제2장 조사 방법

- 조사 디자인

- 조사 프레임워크

- 시장 규모 예측

- 데이터 트라이앵글레이션

- 조사 결과

- 조사의 전제

- 조사의 제약

제3장 주요 요약

- CXO 시점

- 시장 규모와 성장 동향

- 시장 점유율 분석, 2025년

- FPNV 포지셔닝 매트릭스, 2025년

- 새로운 수익 기회

- 차세대 비즈니스 모델

- 산업 로드맵

제4장 시장 개요

- 산업 생태계와 밸류체인 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 시장 전망

- GTM 전략

제5장 시장 인사이트

- 소비자 인사이트 및 최종 사용자 관점

- 소비자 체험 벤치마크

- 기회 매핑

- 유통 채널 분석

- 가격 동향 분석

- 규제 규정 준수 및 표준 프레임워크

- ESG와 지속가능성 분석

- 혁신과 리스크 시나리오

- ROI와 CBA

제6장 미국 관세의 누적 영향, 2025년

제7장 AI의 누적 영향, 2025년

제8장 순금속 스퍼터링 코팅 재료 시장 : 금속 유형별

- 알루미늄

- 크롬

- 구리

- 티타늄

제9장 순금속 스퍼터링 코팅 재료 시장 : 성막 방법별

- 직류(DC)

- 평면

- 회전

- 마그네트론

- 평형

- 비평형

- 고주파

- 광대역

- 라디오 주파수

제10장 순금속 스퍼터링 코팅 재료 시장 : 장치 유형별

- 배치식

- 인라인

- 롤투롤 (Roll-To-Roll)

- 싱글 웨이퍼

제11장 순금속 스퍼터링 코팅 재료 시장 : 용도별

- 자동차

- 장식용 코팅

- 기능성 코팅

- 전자기기

- 프린트 기판

- 반도체

- 의료

- 임플란트

- 수술 도구

- 광학

- 반사 방지

- 미러 코팅

제12장 순금속 스퍼터링 코팅 재료 시장 : 지역별

- 아메리카

- 북미

- 라틴아메리카

- 유럽, 중동 및 아프리카

- 유럽

- 중동

- 아프리카

- 아시아태평양

제13장 순금속 스퍼터링 코팅 재료 시장 : 그룹별

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

제14장 순금속 스퍼터링 코팅 재료 시장 : 국가별

- 미국

- 캐나다

- 멕시코

- 브라질

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 중국

- 인도

- 일본

- 호주

- 한국

제16장 미국의 순금속 스퍼터링 코팅 재료 시장

제17장 중국의 순금속 스퍼터링 코팅 재료 시장

제17장 경쟁 구도

- 시장 집중도 분석, 2025년

- 집중 비율(CR)

- 허핀달-허쉬만 지수(HHI)

- 최근의 동향과 영향 분석, 2025년

- 제품 포트폴리오 분석, 2025년

- 벤치마킹 분석, 2025년

- American Elements, Inc.

- DHF Technical Products, Inc.

- Goodfellow Ltd.

- GRIKIN Advanced Material Co., Ltd.

- Hitachi Metals, Ltd.

- Honeywell International Inc.

- JX Nippon Mining & Metals Corporation

- Kurt J. Lesker Company, LLC

- Linde Advanced Material Technologies(Linde AMT)

- Materion Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Plansee SE

- Plasmaterials, Inc.

- Stanford Advanced Materials, Inc.

- ULVAC, Inc.

The Sputtering Coating Pure Metal Material Market was valued at USD 2.45 billion in 2025 and is projected to grow to USD 2.61 billion in 2026, with a CAGR of 7.06%, reaching USD 3.95 billion by 2032.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2025] | USD 2.45 billion |

| Estimated Year [2026] | USD 2.61 billion |

| Forecast Year [2032] | USD 3.95 billion |

| CAGR (%) | 7.06% |

A clear introduction to how evolving material, process, and supply chain dynamics are reshaping sputtering coating pure metal material use across industries

The sputtering coating pure metal material domain has moved from a specialized laboratory niche to a critical industrial enabling technology. Advances in deposition control, target materials, and equipment architectures have expanded the reach of sputtered pure metals into automotive finishes, advanced electronics, medical devices, and precision optics. As manufacturers pursue higher performance, lower defect rates, and greater process reproducibility, sputtering has become a preferred route for depositing thin metallic films that deliver both functional and aesthetic properties.

Adoption has accelerated where application requirements converge on tight film thickness tolerances, adhesion strength, and surface uniformity. Suppliers and end users now prioritize integrated process solutions that pair material selection with deposition method and equipment type to reduce cycle times and improve yield. At the same time, pressures around sustainability, energy consumption, and circular material flows are shaping R&D priorities and procurement criteria in ways that were less prominent a decade ago.

This introduction frames the rest of the executive summary by underscoring three interdependent themes: material selection influences application fit and processing complexity; deposition method choices drive equipment and process architecture decisions; and regional and trade-policy dynamics increasingly affect supply chain continuity. Together, these forces create a landscape where technical performance, operational efficiency, and strategic sourcing align to determine competitive advantage.

A concise synthesis of technological, process integration, and demand-side shifts that are driving rapid change in sputtering coating pure metal materials

Recent years have ushered in transformative shifts across the sputtering coating pure metal ecosystem, with innovation accelerating at multiple levels. On the materials front, refinements in purity control and target fabrication now support films with reduced contamination and enhanced electrical, optical, and mechanical properties. Parallel progress in deposition control-ranging from magnetron configurations to high-frequency RF systems-enables tighter thickness control and improved film stoichiometry, which directly benefits performance-critical applications.

Process integration has also evolved. Equipment manufacturers increasingly design systems that integrate plasma management, substrate handling, and in-situ metrology to minimize variability and simplify scale-up. This integrated approach shortens development cycles and reduces technical risk for industrial adopters. Additionally, sustainability considerations are prompting suppliers to optimize power efficiency, consumable utilization, and end-of-life recycling of targets and substrates, which together influence total cost of ownership and regulatory compliance.

Finally, demand-side transformations are notable. The automotive sector seeks decorative and functional coatings that withstand harsher environmental regimes while supporting electrified vehicle architectures. Electronics manufacturers require films that meet escalating demands for miniaturization and thermal management. Medical device makers pursue biocompatible metals and surface finishes that improve implant integration and sterilization reliability. Optical component producers expect coatings with precise reflectance and anti-reflective characteristics. Taken together, these shifts create cascading opportunities for suppliers who can align material science advances with robust, scalable processing solutions.

A clear assessment of how tariff measures enacted in 2025 altered sourcing strategies, procurement behavior, and capital planning across the sputtering value chain

The trade-policy environment in the United States, particularly tariff actions implemented in 2025, has materially influenced sourcing, pricing dynamics, and supply chain strategies within the sputtering coating pure metal sector. Tariff measures on select raw materials, equipment imports, and ancillary components increased the cost pressure on manufacturers that rely on cross-border procurement of high-purity targets, power supplies, and vacuum systems. These costs prompted many buyers to re-evaluate supplier contracts, lead-time buffers, and local content strategies.

As a result, procurement teams accelerated supplier qualification efforts and expanded dual-sourcing arrangements to mitigate exposure to concentrated supply nodes. Some manufacturers shifted toward higher inventory buffers for critical consumables, while others invested in nearshoring or domestic supply partnerships to stabilize inputs. On the equipment side, higher import-related costs encouraged greater capital planning scrutiny and longer equipment life-cycle management, with organizations emphasizing preventive maintenance and upgrade paths to extend the usable lifetime of existing platforms.

Moreover, the tariff environment stimulated selective vertical integration among firms seeking to secure targets and downstream processing capabilities. This move toward greater control over inputs helped insulate certain players from intermittent tariff shocks, but it also required investment in new capabilities and expanded operational scope. Collectively, these responses reshaped contractual arrangements, capital allocation, and strategic collaboration patterns across the value chain.

Integrated segmentation insights linking metal selection, application requirements, deposition methods, and equipment architectures to technical and commercial decision drivers

Understanding demand and competitive dynamics requires careful segmentation that links material, application, deposition method, and equipment choices to technical and commercial outcomes. When analyzed by metal type-Aluminum, Chromium, Copper, and Titanium-each element brings distinct attributes that align with particular performance needs: aluminum offers lightweight reflectivity and corrosion resistance; chromium provides decorative and wear-resistant finishes; copper supports electrical conductivity and thermal management; and titanium delivers superior biocompatibility and strength-to-weight benefits.

Application segmentation further clarifies requirements. Automotive uses surface-decorative coatings and functional coatings that must withstand environmental stressors and support design aesthetics. Electronics adoption spans printed circuit boards and semiconductors, where film uniformity, purity, and electrical properties are critical for device reliability and performance. Medical applications include implants and surgical tools that require biocompatibility and sterilization resilience. Optics demand coatings for anti-reflective layers and mirror finishes that meet stringent optical tolerances. Each application drives unique material and process trade-offs, which in turn inform supplier selection and qualification timelines.

Deposition method segmentation-DC, magnetron, and RF-maps onto process-specific benefits and limitations. DC sputtering, whether planar or rotatable, often suits conductive targets and delivers consistent deposition for many industrial uses. Magnetron approaches, balanced or unbalanced, enhance plasma density and deposition rates, making them attractive where throughput and film quality must coexist. RF methods, including broad-band and high-frequency variants, address insulating targets and feature control advantages in challenging thin-film chemistries. Finally, equipment type-batch, inline, roll-to-roll, and single wafer-defines throughput models, substrate handling constraints, and integration pathways into existing production lines. Aligning these segmentations reveals where incremental process improvements yield outsized performance gains and where investments in equipment architecture most effectively reduce unit cost and defect rates.

A regional view of demand and supply dynamics revealing how the Americas, EMEA, and Asia-Pacific shape manufacturing investment, sustainability priorities, and adoption pathways

Regional dynamics play a decisive role in shaping supply chains, adoption rates, and the competitive landscape across the sputtering coating domain. In the Americas, a combination of industrial demand from automotive and electronics sectors and supportive manufacturing incentives has encouraged investment in local production capacity and R&D collaboration. North American buyers place a premium on supply chain resilience and localization, which has led to strategic partnerships between materials suppliers and equipment integrators to shorten qualification cycles and improve responsiveness.

Europe, Middle East & Africa present a diverse set of drivers where regulatory stringency, sustainability mandates, and a strong presence of high-precision manufacturing create demand for advanced deposition technologies and low-emission equipment. Regional priorities emphasize energy efficiency and lifecycle impact, prompting suppliers to demonstrate compliance and offer modular systems that reduce resource consumption. Additionally, specialized optics and medical device clusters in parts of this region continue to pull through high-performance metal films for niche, high-value applications.

Asia-Pacific remains a large-scale adopter across multiple end markets, driven by robust electronics manufacturing hubs and rapidly electrifying automotive industries. The region's ecosystem benefits from vertically integrated supply chains, scale-driven cost advantages, and aggressive capital investment in advanced processing equipment. As a result, suppliers that can deliver scalable systems with high uptime and rapid service support find receptive markets here. Across all regions, cross-border collaboration and localized service models are increasingly important for converting pilot success into sustained commercial production.

A focused review of competitive dynamics showing how material expertise, equipment innovation, and aftermarket services determine supplier differentiation and customer lock-in

Competitive dynamics in the sputtering coating pure metal materials space are defined by companies that combine deep materials expertise, robust equipment portfolios, and strong aftermarket service capabilities. Leading firms have differentiated by investing in target purity processes, advanced magnetron and RF modules, and system architectures that support in-situ diagnostics and process repeatability. These investments enable faster customer qualification, lower defect rates, and clearer pathways to scale from prototype to high-volume manufacturing.

Strategic partnerships and co-development agreements between materials suppliers, equipment OEMs, and end users have become common. Such relationships accelerate innovation by aligning technical performance targets with manufacturability and cost objectives. In addition, service ecosystems-covering spare parts, field maintenance, and remote diagnostics-create recurring revenue streams and strengthen customer lock-in. Companies that provide comprehensive lifecycle support and flexible financing options typically secure longer-term contracts and deeper operational visibility into customer processes.

Competition also arises from smaller, highly specialized players that focus on niche alloys, targeted deposition modules, or bespoke process recipes for demanding applications. These specialists often serve as innovation catalysts and acquisition targets for larger firms seeking to close capability gaps or enter adjacent market segments. Overall, the competitive environment rewards technical depth, field-proven reliability, and the ability to simplify customers' path to scale.

Actionable strategic priorities for market leaders to align R&D, equipment roadmaps, and resilient sourcing with aftermarket services and sustainability to capture long-term value

Industry leaders should pursue a coordinated strategy that aligns materials R&D, equipment roadmaps, and supply chain resilience to capture value across increasingly demanding applications. First, prioritize investment in materials and target fabrication processes that reduce impurities and support tighter film tolerances; these improvements yield immediate benefits for electronics and optics customers while opening doors in medical and automotive segments. Second, accelerate development of integrated deposition platforms that combine plasma control, substrate handling, and embedded metrology to shorten qualification time and reduce variability during scale-up.

Concurrently, strengthen supply chain resilience by diversifying target and component sourcing, exploring nearshoring opportunities where feasible, and formalizing dual-sourcing strategies for critical consumables. Leaders should also expand aftermarket services, offering predictive maintenance, rapid spare parts delivery, and remote process support to enhance uptime and total lifecycle value for customers. In commercial terms, consider modular pricing and financing schemes that reduce upfront capital barriers for adopters and enable smoother transitions from pilot to production.

Finally, embed sustainability and regulatory compliance into product development and customer engagements. Demonstrating reduced energy use, improved material recycling, and adherence to regional environmental standards will increasingly factor into procurement decisions and long-term partnerships. By integrating these tactics, companies can translate technical leadership into durable commercial advantage.

A rigorous multi-method research approach combining literature, patents, interviews, and supply chain mapping to validate technical and commercial conclusions with cross-validated evidence

The analysis underpinning this summary integrates a multi-method research approach combining technical literature review, primary interviews, and supply chain mapping to ensure robust, actionable conclusions. Technical literature and patent landscapes provided context for recent innovations in target metallurgy, magnetron and RF configurations, and advanced process control methods. Primary interviews with industry stakeholders-including materials scientists, equipment engineers, procurement leads, and operations managers-surfaced practical constraints, real-world trade-offs, and adoption drivers that validate and enrich secondary findings.

Supply chain mapping identified key nodes for targets, power systems, and vacuum components, while case studies illustrated successful qualification pathways across automotive, electronics, medical, and optics applications. Comparative equipment assessments evaluated throughput models, substrate handling approaches, and in-situ metrology capabilities to determine where system architecture materially influences cost and yield. Throughout the research, triangulation across sources ensured that conclusions reflect both technical feasibility and commercial realities.

Quality assurance steps included cross-validation of interview insights, careful review of manufacturer technical specifications, and iterative synthesis to reconcile divergent viewpoints. This layered methodology supports the practical recommendations offered and provides a defensible basis for strategic decision-making.

A concluding synthesis highlighting the interplay of materials, process integration, and supply resilience that will determine competitive advantage across the sputtering ecosystem

In summary, sputtering coating pure metal materials stand at an inflection point where material science advances, process integration, and shifting trade conditions are reshaping strategic priorities across industries. The confluence of improved target purity, evolving deposition technologies, and integrated equipment architectures enables higher-performing films that meet stringent electrical, optical, mechanical, and biocompatibility requirements. Simultaneously, trade-policy changes and regional investment patterns are accelerating efforts to localize supply and strengthen procurement resilience.

For stakeholders, the implication is clear: success depends on a systems view that links metal selection to deposition method and equipment architecture while accounting for regional supply dynamics and aftersales support. Firms that invest in materials innovation, modular scalable equipment, and robust service models will reduce time-to-scale and enhance customer retention. Process standardization, sustainability commitments, and strategic sourcing arrangements further compound competitive advantage and help organizations navigate evolving regulatory and commercial landscapes.

Moving forward, the industry will reward those who can translate laboratory performance into manufacturable, repeatable processes and who can do so with an eye toward operational efficiency and regulatory alignment. This balanced approach will be essential to converting current technical promise into enduring market leadership.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Definition

- 1.3. Market Segmentation & Coverage

- 1.4. Years Considered for the Study

- 1.5. Currency Considered for the Study

- 1.6. Language Considered for the Study

- 1.7. Key Stakeholders

2. Research Methodology

- 2.1. Introduction

- 2.2. Research Design

- 2.2.1. Primary Research

- 2.2.2. Secondary Research

- 2.3. Research Framework

- 2.3.1. Qualitative Analysis

- 2.3.2. Quantitative Analysis

- 2.4. Market Size Estimation

- 2.4.1. Top-Down Approach

- 2.4.2. Bottom-Up Approach

- 2.5. Data Triangulation

- 2.6. Research Outcomes

- 2.7. Research Assumptions

- 2.8. Research Limitations

3. Executive Summary

- 3.1. Introduction

- 3.2. CXO Perspective

- 3.3. Market Size & Growth Trends

- 3.4. Market Share Analysis, 2025

- 3.5. FPNV Positioning Matrix, 2025

- 3.6. New Revenue Opportunities

- 3.7. Next-Generation Business Models

- 3.8. Industry Roadmap

4. Market Overview

- 4.1. Introduction

- 4.2. Industry Ecosystem & Value Chain Analysis

- 4.2.1. Supply-Side Analysis

- 4.2.2. Demand-Side Analysis

- 4.2.3. Stakeholder Analysis

- 4.3. Porter's Five Forces Analysis

- 4.4. PESTLE Analysis

- 4.5. Market Outlook

- 4.5.1. Near-Term Market Outlook (0-2 Years)

- 4.5.2. Medium-Term Market Outlook (3-5 Years)

- 4.5.3. Long-Term Market Outlook (5-10 Years)

- 4.6. Go-to-Market Strategy

5. Market Insights

- 5.1. Consumer Insights & End-User Perspective

- 5.2. Consumer Experience Benchmarking

- 5.3. Opportunity Mapping

- 5.4. Distribution Channel Analysis

- 5.5. Pricing Trend Analysis

- 5.6. Regulatory Compliance & Standards Framework

- 5.7. ESG & Sustainability Analysis

- 5.8. Disruption & Risk Scenarios

- 5.9. Return on Investment & Cost-Benefit Analysis

6. Cumulative Impact of United States Tariffs 2025

7. Cumulative Impact of Artificial Intelligence 2025

8. Sputtering Coating Pure Metal Material Market, by Metal Type

- 8.1. Aluminum

- 8.2. Chromium

- 8.3. Copper

- 8.4. Titanium

9. Sputtering Coating Pure Metal Material Market, by Deposition Method

- 9.1. DC

- 9.1.1. Planar

- 9.1.2. Rotatable

- 9.2. Magnetron

- 9.2.1. Balanced

- 9.2.2. Unbalanced

- 9.3. RF

- 9.3.1. Broad-Band

- 9.3.2. High-Frequency

10. Sputtering Coating Pure Metal Material Market, by Equipment Type

- 10.1. Batch

- 10.2. Inline

- 10.3. Roll-To-Roll

- 10.4. Single Wafer

11. Sputtering Coating Pure Metal Material Market, by Application

- 11.1. Automotive

- 11.1.1. Decorative Coating

- 11.1.2. Functional Coating

- 11.2. Electronics

- 11.2.1. Printed Circuit Boards

- 11.2.2. Semiconductors

- 11.3. Medical

- 11.3.1. Implants

- 11.3.2. Surgical Tools

- 11.4. Optics

- 11.4.1. Anti-Reflective

- 11.4.2. Mirror Coating

12. Sputtering Coating Pure Metal Material Market, by Region

- 12.1. Americas

- 12.1.1. North America

- 12.1.2. Latin America

- 12.2. Europe, Middle East & Africa

- 12.2.1. Europe

- 12.2.2. Middle East

- 12.2.3. Africa

- 12.3. Asia-Pacific

13. Sputtering Coating Pure Metal Material Market, by Group

- 13.1. ASEAN

- 13.2. GCC

- 13.3. European Union

- 13.4. BRICS

- 13.5. G7

- 13.6. NATO

14. Sputtering Coating Pure Metal Material Market, by Country

- 14.1. United States

- 14.2. Canada

- 14.3. Mexico

- 14.4. Brazil

- 14.5. United Kingdom

- 14.6. Germany

- 14.7. France

- 14.8. Russia

- 14.9. Italy

- 14.10. Spain

- 14.11. China

- 14.12. India

- 14.13. Japan

- 14.14. Australia

- 14.15. South Korea

15. United States Sputtering Coating Pure Metal Material Market

16. China Sputtering Coating Pure Metal Material Market

17. Competitive Landscape

- 17.1. Market Concentration Analysis, 2025

- 17.1.1. Concentration Ratio (CR)

- 17.1.2. Herfindahl Hirschman Index (HHI)

- 17.2. Recent Developments & Impact Analysis, 2025

- 17.3. Product Portfolio Analysis, 2025

- 17.4. Benchmarking Analysis, 2025

- 17.5. American Elements, Inc.

- 17.6. DHF Technical Products, Inc.

- 17.7. Goodfellow Ltd.

- 17.8. GRIKIN Advanced Material Co., Ltd.

- 17.9. Hitachi Metals, Ltd.

- 17.10. Honeywell International Inc.

- 17.11. JX Nippon Mining & Metals Corporation

- 17.12. Kurt J. Lesker Company, LLC

- 17.13. Linde Advanced Material Technologies (Linde AMT)

- 17.14. Materion Corporation

- 17.15. Mitsui Mining & Smelting Co., Ltd.

- 17.16. Plansee SE

- 17.17. Plasmaterials, Inc.

- 17.18. Stanford Advanced Materials, Inc.

- 17.19. ULVAC, Inc.