|

시장보고서

상품코드

1548967

KYC/KYB 시스템 시장(2024-2029년)Global KYC/KYB Systems Market: 2024-2029 |

||||||

| 주요 통계 | |

|---|---|

| 2024년 총 지출 금액 | 308억 달러 |

| 2029년 지출 총액 | 529억 달러 |

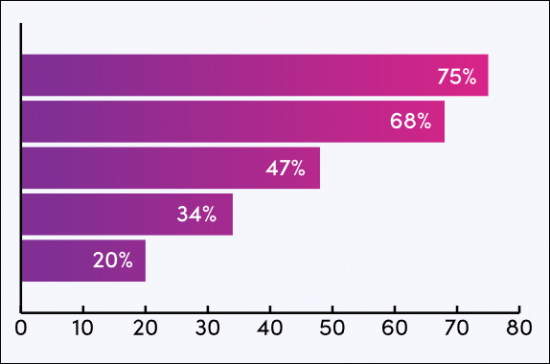

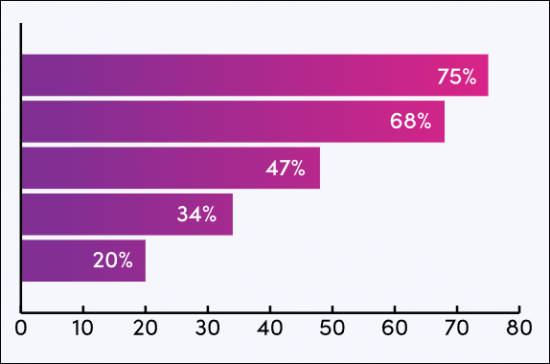

| 2024-2029년 시장 성장률 | 71% |

| 예측 기간 | 2024-2029년 |

이 조사 패키지는 금융기관, 전자상거래 플랫폼, 규제기관, 기술 공급업체 등 이해관계자들이 향후 성장, 주요 트렌드, 경쟁 환경을 이해할 수 있도록 진화하는 시장에 대한 심층적이고 통찰력 있는 분석을 제공합니다.

이 제품군에는 KYC/KYB 시스템 시장의 채택과 미래 성장에 대한 데이터에 대한 액세스, 시장의 최신 동향과 기회, ID 사기 및 자금세탁 방지를 위한 19개 시장 선도기업에 대한 광범위한 분석이 포함되어 있습니다.

주요 특징

- 시장 역학: KYC/KYB 시스템의 현재 개발 및 부문 성장에 대한 지역별 성장 분석, KYC/KYB 시스템 영역을 형성하는 세계 규제 프레임워크 평가, KYC/KYB 시스템 시장의 주요 동향, 시장 확대 과제, 미래 전망 및 통찰력, 온라인 거래 및 금융 범죄 증가로 인한 도전과 규제 당국의 강화된 관여로 인한 잠재적 이점, 차세대 기술을 통해 고객과 기업을 디지털로 끌어들이는 데 사용되는 다양한 신원 확인 접근 방식에 대한 평가 등을 다루고 있습니다.

- 주요 요점 및 전략적 제안: KYC/KYB 시스템 시장의 주요 성장 기회와 조사 결과를 상세하게 분석하고, 금융기관, 규제기관, 전자상거래 플랫폼 등 이해관계자를 위한 주요 전략적 제안도 함께 수록했습니다.

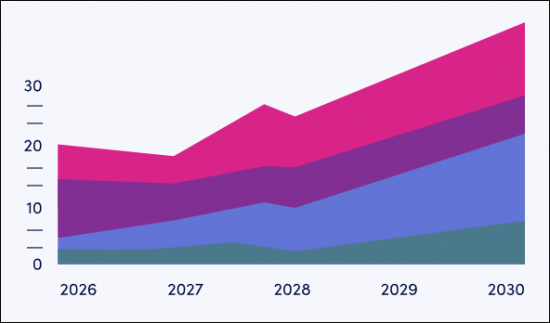

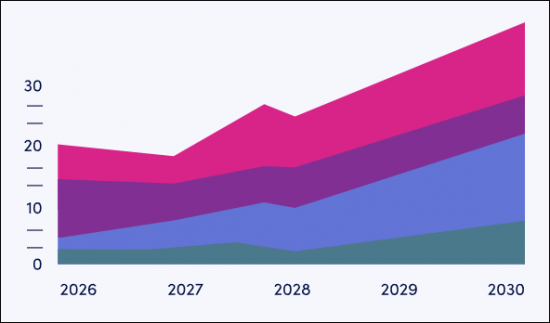

- 벤치마크 산업 예측 : 개요에는 KYC/KYB 시스템의 총 수익 예측이 포함되어 있으며, 소비자 및 기업용 이용 사례로 나뉘어져 있습니다. 또한 KYC/KYB 시스템에 대한 전 세계 지출액도 금융 5개 업종과 비금융 5개 업종으로 구분하여 제시합니다.

- Juniper Research의 경쟁사 리더보드: Juniper Research의 경쟁사 리더보드는 19개 KYC/KYB 시스템 벤더의 역량을 평가했습니다.

샘플

시장 데이터 및 예측 보고서 :

현재 시장 상황을 종합적으로 분석하여 전략적 제안과 예측 결과를 설명합니다.

시장 동향 및 전략 보고서 :

현재 시장 상황을 종합적으로 분석하여 전략적인 제안을 제공합니다.

시장 데이터 및 예측 보고서

이 조사 제품군에는 74개의 표와 26,720개 이상의 데이터 포인트에 대한 예측 데이터 세트에 대한 액세스가 포함되어 있습니다. 이 조사 제품군에는 다음과 같은 지표가 포함되어 있습니다.

- 제3자 KYC/KYB 시스템을 사용하는 총 기업 수

- KYC/KYB 시스템에 대한 총 지출액(금융업과 기타 업종 구분)

Juniper Research Interactive Forecast Excel에는 다음과 같은 기능이 있습니다.

- 통계 분석 : 데이터 기간 동안 모든 지역과 국가에 대해 표시되며, 특정 지표를 검색할 수 있습니다. 그래프는 쉽게 수정할 수 있으며, 클립보드로 내보내기도 가능합니다.

- 국가별 데이터 도구: 이 도구에서는 예측 기간 동안 모든 지역 및 국가의 지표를 볼 수 있습니다. 검색창을 통해 표시되는 지표를 좁힐 수 있습니다.

- 국가별 비교 도구: 사용자는 국가를 선택하고 특정 국가에 대해 각각을 비교할 수 있습니다. 그래프 내보내기 기능도 있습니다.

- What-if 분석 : 5가지 대화형 시나리오를 통해 사용자는 예측의 전제조건과 비교할 수 있습니다.

시장 동향 및 전략 보고서

이 보고서는 KYC/KYB 시스템 시장의 상황을 자세히 조사하고 빠르게 성장하는 시장 동향과 진화를 형성하는 요인을 평가했습니다. 온라인 금융 범죄와 부정행위 증가, 주요 지역의 KYC/KYB 법의 정비 및 개정, 고객 및 기업의 디지털 대응에 사용되는 다양한 차세대 기술 접근 방식 등이 야기하는 도전과제에 대응하고, KYC/KYB 시스템 제공업체가 직면한 전략적 기회를 종합적으로 분석합니다.

경쟁사 리더보드 보고서

경쟁사 리더보드 보고서는 KYC/KYB 시스템 분야의 19개 주요 벤더에 대한 상세한 평가와 시장 내 포지셔닝을 담고 있습니다.

목차

시장 동향과 전략

제1장 중요 포인트와 전략적 추천 사항

- 중요 포인트

- 전략적 추천 사항

제2장 시장 구도

- 서론

- 주요 동향과 촉진요인

- 향후 전망

- 본인 확인과 KYC/KYB 시스템

- 데이터베이스 검증

- 일반적인 생체인식

- 지문

- 얼굴

- 음성

- 생체 탐지

- 딥 페이크 탐지

- 행동 바이오메트릭스

- 새로운 생체인식

- 홍채

- 망막

- 어음

- 정맥 패턴 인식

- 일반적인 생체인식

경쟁 리더보드

제1장 KYC/KYB 시스템 : 경쟁 리더보드

- 이 보고서를 구독해야 하는 이유

- 벤더 개요

- AU10TIX

- Data Zoo

- Encompass Corporation

- Entrust

- Experian

- Fenergo

- Jumio

- Know Your Customer

- LexisNexis Risk Solutions

- Minerva

- Moody's

- Persona

- Sardine

- Shufti Pro

- Socure

- Sumsub

- Veriff

제2장 미래의 리더 인덱스 : KYC/KYB 시스템

- 미래의 리더 벤더 개요

- Baselayer

- Dotfile

- Gatenox

- Labrys

- Parcha

- Quadrata

- TransactionLink

- Vespia

- Juniper Research의 미래 리더 지수 평가 방법

- 제한 및 해석

데이터와 예측

제1장 세계의 KYC/KYB 시스템 예측

제2장 세계의 KYC/KYB 시스템 시장

- 세계의 KYC/KYB 시스템 시장

- 써드파티 KYC/KYB 시스템을 사용하고 있는 기업수

- 써드파티 KYC/KYB 시스템 총지출

제3장 금융 비즈니스 : 세계의 KYC/KYB 시스템 예측

- 써드파티 KYC/KYB 시스템을 사용하고 있는 금융 사업자 수

- 써드파티 KYC/KYB 시스템 총지출 : 금융 사업자별

- 써드파티 KYC/KYB 시스템을 사용하고 있는 은행 수

- 은행 업계의 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 사용하고 있는 핀테크 수

- 핀테크 업계의 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 사용하고 있는 보험 회사 수

- 보험 업계의 써드파티 AML 시스템 총지출

- 써드파티 KYC/KYB 시스템을 이용하는 투자 회사 수

- 투자 업계의 써드파티 KYC/KYB 시스템 총지출

- 써드파티 AML 시스템을 사용하고 있는 대출 회사 수

- 융자 업계의 써드파티 KYC/KYB 시스템 총지출

제4장 전문 기업 및 기타 기업 : 세계의 KYC/KYB 시스템 예측

- 써드파티 KYC/KYB 시스템을 사용하고 있는 전문 기업 및 기타 기업 합계수

- 써드파티 KYC/KYB 시스템 총지출 : 전문 기업과 기타 기업별

- 써드파티 KYC/KYB 시스템을 사용하고 있는 게임 및 갬블 사업자 수

- 게임 및 갬블 업계의 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 사용하고 있는 E-Commerce 기업 수

- E-Commerce 업계 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 사용하고 있는 통신사업자 수

- 통신 업계 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 사용하고 있는 헬스케어 사업자 수

- 헬스케어 업계 써드파티 KYC/KYB 시스템 총지출

- 써드파티 KYC/KYB 시스템을 도입하고 있는 부동산 사업자 수

- 부동산 업계 써드파티 KYC/KYB 시스템 총지출

| KEY STATISTICS | |

|---|---|

| Total spend in 2024: | $30.8bn |

| Total spend in 2029: | $52.9bn |

| 2024 to 2029 market growth: | 71% |

| Forecast period: | 2024-2029 |

'KYC/KYB Systems ~ LexisNexis Risk Solutions and Experian Revealed as Market Leaders'

Overview

Our "KYC/KYB Systems" research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

The suite includes several different options that can be purchased separately, including access to data that maps adoption and future growth of the KYC/KYB systems market. The research in this insightful study uncovers the latest trends and opportunities within the market, and provides extensive analysis of the 19 market leaders in the fight against identity fraud and money laundering. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, these documents provide a critical tool for understanding the rapidly evolving KYC/KYB systems market; allowing banks and technology vendors to shape their future strategy. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such an uncertain and rapidly growing market.

Key Features

- Market Dynamics: The banking market share research also includes a regional market growth analysis on the current development and segment growth of KYC/KYB systems; an assessment of the global regulatory frameworks that have shaped the KYC/KYB systems realm. Also provided are a future outlook of, and insights into, key trends and market expansion challenges within the KYC/KYB systems market. The research addresses challenges posed by the increase of online transactions and financial crime and the potential benefits of increasing regulatory involvement, and an assessment of the many identity verification approaches used to digitally onboard customers and businesses through next-generation technology.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and key findings within the KYC/KYB systems market, accompanied by key strategic recommendations for stakeholders including financial institutions, regulatory bodies, eCommerce platforms and more.

- Benchmark Industry Forecasts: The overview includes forecasts for total revenue for KYC/KYB systems, split by consumer vs business use cases. Also included is the global spend on KYC/KYB systems; split across five financial and five non-financial industry segments.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 19 KYC/KYB Systems vendors, via the Juniper Research Competitor Leaderboard.

- Juniper Research Future Leaders Index: Key player capability and capacity assessment for eight KYC/KYB Systems vendors, via the Juniper Research Future Leaders Index; including:

- Baselayer

- Dotfile

- Gatenox

- Labrys

- Parcha

- Quadrata

- TransactionLink

- Vespia

SAMPLE VIEW

Market Data & Forecasting Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

This market-leading research suite for the "KYC/KYB Systems" market includes access to the full set of forecast data of 74 tables and over 26,720 datapoints. Metrics in the research suite include:

- Total Number of Companies Using Third-party KYC/KYB Systems

- Total Spend on KYC/KYB Systems (split across the financial sector and other industries)

These metrics are provided for the following key market verticals:

- Financial Industries

- Banking

- Fintech

- Insurance

- Investment

- Lending

- Non-financial Industries

- Gaming & Gambling

- eCommerce

- Telco

- Healthcare

- Real Estate

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select countries and compare each of them for specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios

Market Trends & Strategies Report

This report examines the "KYC/KYB Systems" market landscape in detail; assessing market trends and factors shaping the evolution of the rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for KYC/KYB systems providers; addressing challenges posed by the increase in online financial crime and illicit activities, the development and revision of KYC/KYB laws across key regions, and the many next generation technological approaches used to digitally onboard customers and businesses.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 19 leading vendors in the "KYC/KYB Systems" space. These vendors are positioned as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.1.1. The History of Regulatory Frameworks

- Figure 2.1: Basel III Framework

- 2.1.2. The Current KYC Regulatory Landscape

- Figure 2.2: Factors Determining Customers' Potential Risk Level

- i. KYC (Know Your Customer)

- Figure 2.4: Verification Alternatives to KYC

- iii. KYI (Know Your Investor)

- iv. KYP (Know Your Patient)

- v. KYD (Know Your Data)

- vi. Age Verification

- 2.1.3. Shifting and Emerging Regulatory Landscape

- i. EU - AI Act

- Figure 2.6: Fundamental Aims of the EU's AI Act

- ii. China - Deepfake Legislation

- Figure 2.7: China's Deepfake Legislation Requirements

- iii. US - Texas HB (House Bill) 1181

- Figure 2.8: Texas House Bill 1181 Key Developments

- iv. India - Digital KYC

- v. UAE

- i. EU - AI Act

- 2.1.1. The History of Regulatory Frameworks

- 2.2. Key Trends and Driver

- 2.2.1. Combatting Financial Fraud and Corruption

- 2.2.2. Increase in Digital Nomads

- Figure 2.9: Scenarios that Utilise KYC Verification across Various Industries

- 2.2.3. Expansion of Remote Verification

- 2.2.4. Ongoing KYC Processes

- 2.3. Future Outlook

- 2.3.1. Increased Use of Advanced AI and Machine Learning

- 2.3.2. Greater Emphasis on Biometric Verification

- 2.3.3. Blockchain for Immutable Verification Records

- 2.3.4. Adoption of SSI (Self-sovereign Identity) Models

- Digital Onboarding: Verification Technologies

- 3.1. Identification Verification & KYC/KYB Systems

- 3.1.1. Document Verification

- i. Document Scanning

- ii. MRZ (Machine-readable Zones)

- iii. Embedded Chips

- 3.1.2. Document Reading

- 3.1.3. Using Documents for Verification

- i. Photo IDs

- ii. Age Verification

- iii. Linked Biometrics

- 3.1.1. Document Verification

- 3.2. Database Verification

- 3.2.1. Common Biometrics

- i. Fingerprint

- ii. Facial

- iii. Voice

- iv. Liveness Detection

- v. Deepfake Detection

- vi. Behavioural Biometrics

- 3.2.2. Emerging Biometrics

- i. Iris

- ii. Retina

- iii. Handprint

- iv. Vein Patter Recognition

- 3.2.1. Common Biometrics

Competitor Leaderboard

1. KYC/KYB Systems - Competitor Leaderboard

- 1.1.1. Why Read This Report

- KYC/KYB Systems Market Takeaways

- Table 1.1: Juniper Research Competitor Leaderboard KYC/KYB Systems Market Vendors & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard KYC/KYB Systems Vendors

- Table 1.3: Juniper Research Competitor Leaderboard Vendors and Positioning

- Table 1.4: Juniper Research Competitor Leaderboard for KYC/KYB Systems Heatmap

- Table 1.4: Juniper Research Competitor Leaderboard for KYC/KYB Systems Heatmap (Continued)

- KYC/KYB Systems Market Takeaways

- 1.2. Vendor Profiles

- 1.2.1. AU10TIX

- i. Corporate

- Table 1.5: AU10TIX's Investment Rounds ($m), 2019-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.2. ComplyAdvantage

- 1.2.3. Data Zoo

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.4. Encompass Corporation

- i. Corporate

- Table 1.7: Encompass' Investment Rounds ($m), 2016-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.5. Entrust

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.6. Experian

- i. Corporate

- Table 1.8: Experian's Financial Snapshot ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.7. Fenergo

- i. Corporate

- Table 1.9: Fenergo's Investment Rounds ($m), 2013-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.8. Jumio

- i. Corporate

- Table 1.10: Jumio's Investment Rounds ($m), 2010-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.9. Know Your Customer

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.10. LexisNexis Risk Solutions

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.11. Minerva

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.12. Moody's

- i. Corporate

- Table 1.11: Moody's Financial Snapshot ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.12: Moody's KYC ecosystem

- Figure 1.13: Moody's GRID PEP risk rating system

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.13. Persona

- i. Corporate

- Table 1.14: Persona's Investment Rounds ($m), 2019-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.14. Sardine

- i. Corporate

- Table 1.15: Sardine's Investment Rounds ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.15. Shufti Pro

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.16. Socure

- i. Corporate

- Table 1.16: Socure's Investment Rounds ($m), 2015-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.17. Sumsub

- i. Corporate

- Table 1.17: Sumsub's Investment Rounds ($m), 2017-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.18. Trulioo

- i. Corporate

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.19. Veriff

- i. Corporate

- Table 1.18: Veriff's Funding Rounds ($m), 2018-2022

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- Table 1.19: Juniper Research Competitor Leaderboard Scoring Criteria: KYC/KYB Systems

- i. Corporate

- 1.2.1. AU10TIX

2. Future Leaders Index: KYC/KYB Systems

- Table 2.1: Juniper Research Future Leaders Index - KYC/KYB Systems Vendors & Product Portfolio

- Figure 2.2: Juniper Research Future Leaders Index - KYC/KYB Systems

- Table 2.3: Juniper Research Future Leaders Vendors - KYC/KYB Systems

- Table 2.4: Juniper Research Future Leaders Index Heatmap: KYC/KYB Systems

- 2.1. Future Leaders Vendor Profiles

- 2.1.1. Baselayer

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Dotfile

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Gatenox

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Labrys

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Parcha

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Quadrata

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. TransactionLink

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Vespia

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Baselayer

- 2.1. Juniper Research Future Leader Index Assessment Methodology

- 2.2. Limitations & Interpretations

- Table 2.5: Juniper Research Future Leader Index: KYC/KYB Systems

Data & Forecasting

1. Global KYC/KYB Systems Forecast

- 1.1.1. Introduction

- 1.1.2. Methodology

- Figure 1.1: KYC/KYB Systems Forecast Methodology for Financial Businesses (Banks, Fintechs, Insurance, Investment, Lending)

- Figure 1.2: KYC/KYB Systems Forecast Methodology for Professional and Other Businesses (Gambling & Gaming, eCommerce, Telco, Healthcare, and Real Estate)

2. Global KYC/KYB Systems Market

- 2.1. Global KYC/KYB Systems Market

- 2.1.1. Number of Businesses Using Third-party KYC/KYB Systems

- Figure & Table 2.1: Total Number of Businesses using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 2.1.2. Total Spend of Third-party KYC/KYB Systems

- Figure & Table 2.2: Total Spend on Third-party AML Systems per annum ($m), Split by 8 Key Regions, 2024-2029

- 2.1.1. Number of Businesses Using Third-party KYC/KYB Systems

3. Financial Businesses: Global KYC/KYB Systems Forecast

- 3.1.1. Total Number of Financial Businesses Using Third-party KYC/KYB Systems

- Figure & Table 3.1: Total Number of Financial Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024 - 2029

- Table 3.2: Total Number of Financial Businesses Using Third-party KYC/KYB Systems per annum, Split by Industry 2024-2029

- 3.1.2. Total Spend on Third-party KYC/KYB Systems by Financial Businesses

- Figure & Table 3.3: Total Spend on Third-party AML Systems by Financial Businesses per annum ($m), Split by 8 Key Regions, 2024-2029

- Table 3.4: Total Spend on Third-party KYC/KYB Systems by Financial Businesses per annum ($m), Split by Industry, 2024-2029

- 3.1.3. Total Number of Banks Using Third-party KYC/KYB Systems

- Figure & Table 3.5: Total Number of Banks Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.4. Total Spend on Third-party KYC/KYB Systems in the Banking Industry

- Figure & Table 3.6: Total Spend on Third-party KYC/KYB Systems in the Banking Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.5. Total Number of Fintechs Using Third-party KYC/KYB Systems

- Figure & Table 3.7: Total Number of Fintechs Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions. 2024-2029

- 3.1.6. Total Spend on Third-party KYC/KYB Systems in the Fintech Industry

- Figure & Table 3.8: Total Spend on Third-party KYC/KYB Systems in the Fintech Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.7. Total Number of Insurance Companies Using Third-Party KYC/KYB Systems

- Figure & Table 3.9: Total Number of Insurance Companies Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.8. Total Spend on Third-party AML Systems in the Insurance Industry

- Figure & Table 3.10: Total Spend on Third-party KYC/KYB Systems in the Insurance Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.9. Total Number of Investment Companies Using Third-party KYC/KYB Systems

- Figure & Table 3.11: Total Number of Investment Companies Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.10. Total Spend on the Third-party KYC/KYB Systems in the Investment Industry

- Figure & Table 3.12: Total Spend on Third-party KYC/KYB Systems in the Investment Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.11. Total Number of Lending Companies Using Third-party AML Systems

- Figure & Table 3.13: Total Number of Lending Companies Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 3.1.12. Total Spend on the Third-party KYC/KYB Systems in the Lending Industry

- Figure & Table 3.14: Total Spend on Third-party KYC/KYB Systems in the Lending Industry per annum ($m), Split by 8 Key Regions, 2024-2029

4. Professional and Other Businesses: Global KYC/KYB Systems Forecast

- 4.1.1. Total Number of Professional and Other Businesses Using Third-Party KYC/KYB Systems

- Figure & Table 4.1: Total Number of Professional and Other Businesses using Third-Party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- Table 4.2: Total Number of Professional and Other Businesses Using Third-party KYC/KYB, Split by Industry, 2024-2029

- 4.1.2. The Total Spend on Third-party KYC/KYB System by Professional and Other Businesses

- Figure & Table 4.3: Total Spend on Third-party KYC/KYB System by Professional and Other Businesses ($m), Split by 8 Key Regions, 2024-2029

- Table 4.4: Total Spend on Third-party KYC/KYB System by Professional and Other Businesses ($m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Total Number of Gaming & Gambling Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.5: Total Number of Gaming & Gambling Businesses Using Third-party KYC/KYB Systems (m), Split by 8 Key Regions, 2024-2029

- 4.1.4. Total Spend on Third-party KYC/KYB Systems in the Gaming & Gambling Industry

- Figure & Table 4.6: Total Spend on Third-party KYC/KYB Systems in the Gaming & Gambling industry ($m), Split by 8 Key Regions, 2024 - 2029

- 4.1.5. Total Number of eCommerce Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.7: Total number of eCommerce Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.6. Total Spend on Third-party KYC/KYB Systems in the eCommerce Industry

- Figure & Table 4.8: Total Number of eCommerce Businesses Using Third-party KYC/KYB Systems in the eCommerce Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.7. Total Number of Telco Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.9: Total Number of Telco Businesses using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.8. Total Spend on Third-party KYC/KYB Systems in the Telco Industry

- Figure & Table 4.10: Total Spend on Third-party KYC/KYB Systems in the Telco Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.9. Total Number of Healthcare Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.11: Total number of Healthcare Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.10. Total Spend on Third-party KYC/KYB Systems in the Healthcare Industry

- Figure & Table 4.12: Total Spend on Third-party KYC/KYB Systems in the Healthcare Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.11. Total Number of Real Estate Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.13: Total Number of Real Estate Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.12. Total Spend on Third-party KYC/KYB Systems in the Real Estate Industry

- Figure & Table 4.14: Total Spend on Third-party KYC/KYB Systems in the Real Estate Industry ($m), Split by 8 Key Regions, 2024 - 2029