|

시장보고서

상품코드

1589863

캐리어 빌링 시장(2024-2029년)Global Carrier Billing Market: 2024-2029 |

||||||

| 주요 통계 | |

|---|---|

| 2024년 캐리어 빌링에 의한 최종사용자 지출 총액: | 751억 달러 |

| 2029년 캐리어 빌링에 의한 최종사용자 지출 총액: | 1,369억 달러 |

| 예측 데이터 포인트: | 34,200 |

| 예측 기간: | 2024-2029년 |

이 보고서는 세계 캐리어 빌링 시장을 조사하고, 디지털 지갑, 신용카드, BNPL(Buy Now, Pay Later), A2A(Account-to-Account) 결제 등 다양한 결제 수단이 캐리어 빌링의 보급에 미치는 영향을 평가합니다. 또한 향후 예상되는 PSD3(Payment Service Directory 3)가 통신사 청구서 결제에 미치는 영향에 대한 가설을 세우고 있습니다.

이 보고서는 API 표준화 등 진화하는 기술이 캐리어 빌링의 미래에 어떤 영향을 미칠지에 대한 상세한 분석을 제공하여 네트워크 사업자, 가맹점, 규제 당국, 애그리게이터 등 이해관계자들이 주요 영향요인, 트렌드, 투자 기회를 파악할 수 있도록 돕습니다. 또한, 이번 조사에서는 캐리어 빌링 사용자 수, 지출 및 수익에 대한 종합적인 예측을 다음과 같은 분야별로 구분하여 제공합니다.

- 기기별:

- 피처폰

- 스마트폰

- 태블릿

- 시장별:

- 디지털 컨텐츠

- 디지털 게임

- 디지털 비디오

- 디지털 음악

- 디지털 라이프스타일

- 전자 출판

- 물리적 상품별:

- 갬블

- 티켓

주요 특징

- 주요 요점 및 전략적 제언 : 이 보고서는 캐리어 빌링 시장의 주요 발전 기회와 조사 결과를 상세히 분석하여 모바일 네트워크 사업자와 캐리어 빌링 애그리게이터에게 어떤 지역, 시장, 서비스를 어떻게 공략해야 하는지에 대한 전략적 제언을 제공합니다. 전략적인 제안을 하고 있습니다.

- 미래 성장 기회 : 캐리어 빌링의 향후 성장 전략에 대해 시장별 평가뿐만 아니라 결제, 보안, API 현황을 평가하고, 부정행위, 핀테크, 생태계 상호운용성 향상 등의 요인이 향후 5년 동안 시장에 어떤 영향을 미칠 것인지 어떻게 영향을 미칠지 밝혔습니다.

- Juniper Research의 경쟁사 리더보드 : 주요 캐리어 빌링 애그리게이터 12곳의 능력과 역량을 평가합니다.

- 벤치마크 산업 예측 : 캐리어 빌링 사용자 수, 캐리어 빌링을 통한 최종사용자 지출 총액, 캐리어 빌링 결제를 통한 총 수익에 대한 5년 예측을 제공합니다. 이 예측은 3개의 주요 디바이스 및 8개의 주요 시장으로 분류되어 있습니다.

샘플 보기

시장 데이터 및 예측 보고서:

시장 동향 및 전략 보고서:

시장 데이터 및 예측 보고서

이 조사 제품군에는 75개의 표와 34,000개 이상의 데이터 포인트에 대한 예측 데이터 세트에 대한 액세스가 포함되어 있습니다. 주요 지표는 다음과 같습니다.

- 캐리어 빌링 총 사용자 수

- 캐리어 빌링 총 지출액

- 캐리어 빌링을 통한 통신사 청구 총수입

Juniper Research의 인터랙티브 예측(Excel)은 다음과 같은 기능을 제공합니다.

- 통계 분석 : 데이터 기간 동안 모든 지역과 국가에 대해 표시됩니다. 그래프를 쉽게 수정하고 클립보드로 내보낼 수 있습니다.

- 국가별 데이터 도구 : 이 도구에서는 예측 기간 동안 모든 지역 및 국가의 지표를 살펴볼 수 있습니다. 검색창을 통해 표시되는 지표를 좁힐 수 있습니다.

- 국가별 비교 도구 : 특정 국가를 선택하여 비교할 수 있습니다. 이 도구에는 그래프를 내보내는 기능이 포함되어 있습니다.

- What-if 분석 : 5가지 대화형 시나리오를 통해 사용자는 예측의 가정과 비교할 수 있습니다.

목차

시장 동향·전략

제1장 중요 포인트와 전략적 추천사항

- 중요 포인트

- 전략적 추천사항

제2장 시장 전망과 향후 기회

- 소개

- 현재 시장 전망

- 캐리어 빌링 시장 동향

- 리치 메시징

- 컨텐츠 전송 채널

- 캐리어 빌링 시장 과제

제3장 향후 성장 기회

- 캐리어 빌링 시장 부문별 기회

- 디지털 게임

- 디지털 비디오

- 디지털 음악

- 디지털 라이프스타일 컨텐츠

- 자선 기부·크라우드펀딩

- 디지털 티켓

- 피지컬 상품

제4장 결제·보안·API 상황

- API 상황 : 소개

- GSMA 오픈 게이트웨이와 CAMARA

- 캐리어 결제 사기

- 캐리어 결제와 결제 상황

- 기타 결제 방법이 캐리어 결제에 미치는 영향

경쟁 리더보드

제1장 Juniper Research 경쟁 리더보드

제2장 벤더 개요

- Allopass

- Bango

- Boku

- Degica

- Digital Virgo

- DIMOCO Payments

- Fonix

- Infomedia

- NTH Mobile

- PM Connect

- SLA Digital

- Telecoming

- 리더보드 평가 방법

데이터·예측

제1장 소개·예측 방법

제2장 전체 시장 가치

- 캐리어 결제 사용자 총수

- 캐리어 결제에 의한 총 지출액

- 캐리어 결제에 의한 총 지출액(업계별)

- 캐리어 빌링 오퍼레이터에 의한 오퍼레이터 청구 매출

제3장 디바이스 사용 상황 분할

- 캐리어 결제에 의한 최종사용자 총 지출액(디바이스 유형별)

제4장 디지털 컨텐츠 & 커머스

- 디지털 컨텐츠에서 캐리어 빌링 매출

- 디지털 게임

- 디지털 비디오

- 디지털 라이프스타일

- 전자 출판

제5장 신흥 산업 카테고리

- 원격 피지컬 상품

- 캐리어 결제로 구입된 원격 피지컬 상품

- 캐리어 결제로 구입된 원격 피지컬 상품에 대한 최종사용자 총 지출액

- 모바일 갬블

- 디지털 티켓

| KEY STATISTICS | |

|---|---|

| Total end user spend via carrier billing in 2024: | $75.1bn |

| Total end user spend via carrier billing in 2029: | $136.9bn |

| Forecast datapoints: | 34,200 |

| Forecast period: | 2024-2029 |

Overview

Our new "Carrier Billing" research suite provides an in-depth analysis on how this payment technology is developing in both mature and evolving markets. Its utility across key market verticals, including digital content (music, video, games, lifestyle, and ePublishing), is quantified in our accompanying market forecasts. Additionally, emerging market opportunities across developing verticals, including digital ticketing, gambling, and physical goods, are also discussed.

The report assesses how other established payment methods, including digital wallets, credit cards, BNPL (Buy Now, Pay Later), and A2A (Account-to-Account) payments, are impacting the penetration of carrier billing across multiple markets. Furthermore, Juniper Research leverages its expertise to hypothesise the impact of the anticipated PSD3 (Payment Service Directory 3) on carrier billing payments.

The carrier billing research reports provide a detailed analysis on how evolving technologies, including the standardisation of APIs, will impact the future of carrier billing; enabling stakeholders from networks operators, merchants, regulators and aggregators to understand the major factors, trends and investment opportunities available. The carrier billing market growth research also features a comprehensive forecast suite, with total carrier billing users, spend and operator-billed revenue split by:

- Device:

- Featurephones

- Smartphones

- Tablets

- Market Vertical:

- Digital Content

- Digital Games

- Digital Videos

- Digital Music

- Digital Lifestyle

- ePublishing

- Physical Goods:

- Gambling

- Ticketing

This report provides in-depth forecasts on how carrier billing adoption is impacting the payments market in 60 key countries over the next five years and leverages interviews with key carrier billing aggregators to quantify this growth.

Key Features

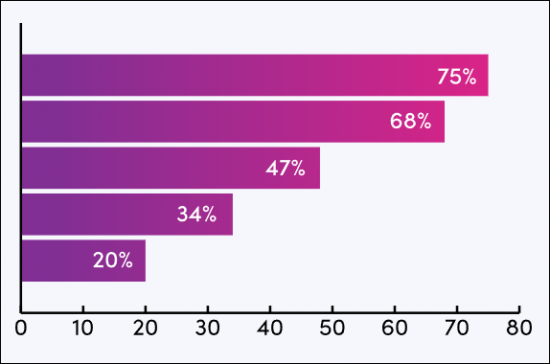

- Key Takeaways & Strategic Recommendations:An in-depth analysis of key development opportunities and findings within the carrier billing market, accompanied by strategic recommendations for mobile network operators and carrier billing aggregators on which regions, markets and services to target and how.

- Future Growth Opportunities: Not only does this report suite assess the future growth strategies of carrier billing via market vertical, (digital games, digital video, digital music, digital lifestyle content, charity donations, digital ticketing, and physical goods), but it also evaluates the payments, security and API landscape to uncover how factors such as fraud, fintech and increased ecosystem interoperability will impact the carrier billing market over the next five years.

- Juniper Research Competitor Leaderboard: As the carrier billing market undergoes consolidation, our Competitor Leaderboard assesses key players' capabilities and capacity for 12 leading carrier billing aggregators.

- Benchmark Industry Forecasts: 5-year forecasts are provided for total carrier billing users, total end-user spend via carrier billing, and total operator-billing revenue from carrier billing transactions. These forecasts are split by three key devices (smartphones, featurephones and tablets) and eight key markets (digital games, music, video, lifestyle, ePublishing, and physical goods, gambling and ticketing).

SAMPLE VIEW

Market Data & Forecasting Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

MMarket Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the carrier billing market includes access to the full set of forecast data of 75 tables and over 34,000 datapoints. Key metrics in the research suite include:

- Total Carrier Billing Users

- Total Carrier Billing Spend

- Total Operator-billed Revenue from Carrier Billing

Additionally, this forecast splits total end-user spend via carrier billing and operator-billed revenue by:

- Device:

- Featurephones

- Smartphones

- Tablets

- Market Vertical:

- Digital Content

- Digital Games

- Digital Videos

- Digital Music

- Digital Lifestyle

- ePublishing

- Physical Goods:

- Gambling

- Ticketing

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users explore metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, featuring five interactive scenarios.

Market Trends & Strategies Report

This report thoroughly examines the carrier billing market landscape in detail; assessing key market trends, industries, and factors shaping its evolution. Additionally, this research report provides an assessment on the impact of fraud, APIs and the wider fintech landscape in the carrier billing market over the next five years, leveraging expertise from leading carrier billing aggregators.

The report delivers a comprehensive analysis on the future trends impacting this market, including the subscription economy, super bundling, rich messaging, content distribution channels, the regulation landscape, and challenges including payment limitations, high transaction fees and merchant adoption.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 12 leading vendors in the carrier billing space. The following vendors are positioned as established leaders, leading challengers, or disruptors and challengers, based on capacity and capability assessments:

|

|

This report is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a specific market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Outlook & Future Opportunities

- 2.1. Introduction

- Table 2.1: Key Differences Between Carrier Billing and DCB

- Figure 2.2: Global Number of SIMs (m) & Proportion of the Global Population that are Banked (%), Split by 8 Key Regions, 2024-2029

- Figure 2.3: Carrier Billing Stakeholder Ecosystem & Benefits

- Table 2.4: Key Differences Between Carrier Billing Platforms and Aggregators

- Figure 2.5: Global Smartphone Users (m) & Proportion of the Population That Are Internet Users (%), Split by 8 Key Regions, 2024-2029

- 2.1.1. Current Market Outlook

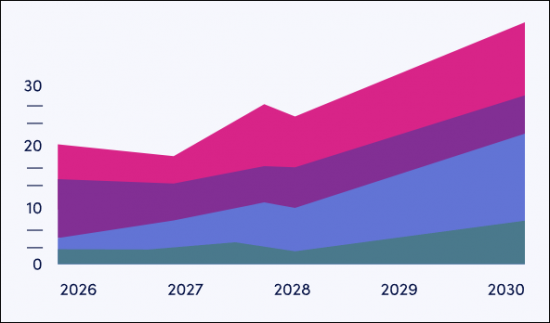

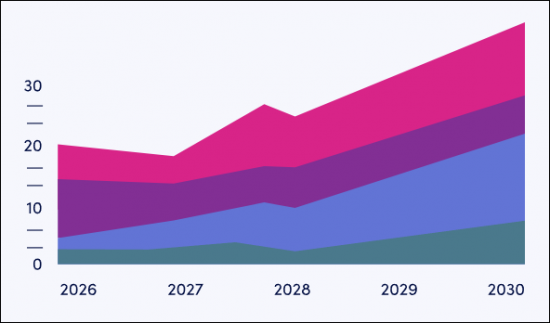

- Figure 2.6: Total End-user Spend via Carrier Billing ($m), Split by 8 Key Regions, 2024-2029

- 2.1.2. Carrier Billing Market Trends

- i. Growth in Subscriptions

- Figure 2.7: Total Subscription Revenue per Annum in 2024 ($593 billion), Split by Category

- ii. Super Bundling

- Figure 2.8: Super Bundling

- i. Growth in Subscriptions

- 2.1.3. Rich Messaging

- Figure 2.9: Total Number of RCS Business Messages (m), Split by Message Type

- 2.1.4. Content Distribution Channels

- Figure 2.10: Total End-user Spend via Carrier Billing ($m), Split by 5 Key Categories, 2024-2029

- 2.1.5. Carrier Billing Market Challenges

- i. Payment Limitations & Regulation Landscape

- Table 2.11: Key Differences Between PS2 and PSD3

- ii. High Transaction Fees

- Figure 2.12: Global Operator-billed Revenue from Carrier Billing Transactions

- iii. Merchant Adoption

- i. Payment Limitations & Regulation Landscape

3. Future Growth Opportunities

- 3.1. Carrier Billing Market Segment Opportunities

- Figure 3.1: Total End-user Spend via Carrier Billing ($m), Split by Market Segment, 2024-2029

- 3.1.1. Digital Games

- Figure 3.2: Mobile Game Monetisation Methods

- i. iGaming

- Figure 3.3: Total End-user Carrier Billing Spend on Digital Games in 2024 ($30.8 billion), Split by 8 Key Regions

- 3.1.2. Digital Video

- 3.1.3. Digital Music

- 3.1.4. Digital Lifestyle Content

- 3.1.5. Charity Donations & Crowdfunding

- 3.1.6. Digital Ticketing

- Figure 3.4: Total Ticketing Spend Made via Carrier Billing in 2029 ($16.0 billion), Split by 8 Key Regions

- 3.1.7. Physical Goods

- i. Asia

- ii. Germany

- Figure 3.5: Total End-user Carrier Billing Spend on Remote Physical Goods ($m), Split by 7 Key Countries, 2023-2029

- iii. Growth in Transport Infrastructure

4. Payments, Security & API Landscape

- 4.1. Introduction to the API Landscape

- 4.1.1. GSMA Open Gateway & CAMARA

- Figure 4.1: GSMA Open Gateway Architecture

- Figure 4.2: Mobile Operators Signed Up to Open Gateway

- Figure 4.3: Average Carrier Billing Spend per User per Annum ($), Split by 8 Key Regions, 2024-2029

- i. Potential Challenges in the Deployment of CAMARA APIs

- 4.1.2. Carrier Billing Fraud

- 4.1.3. Carrier Billing and the Payment Landscape

- Figure 4.4: Advantages and Disadvantages of Different Payment Types

- Figure 4.5: Total Number of Unique Mobile Subscribers & Global Banked Individuals in 2024 (m), Split by 8 Key Regions

- 4.1.4. Influence of Other Payment Types on Carrier Billing

- i. The impact of A2A Payments on Carrier Billing

- Figure 4.6: Card-based Payments vs A2A Payments Ecosystems

- ii. BNPL (Buy Now, Pay Later)

- iii. Digital Wallets

- Figure 4.7: Digital Wallet Funding Types

- i. The impact of A2A Payments on Carrier Billing

- 4.1.1. GSMA Open Gateway & CAMARA

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard Carrier Billing Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: Carrier Billing Vendors

- Table 1.3: Juniper Research Competitor Leaderboard: Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Carrier Billing Vendors

2. Vendor Profiles

- 2.1. Carrier Billing Providers Vendor Profiles

- 2.1.1. Allopass

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Allopass' Payment Platform

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Bango

- i. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Boku

- i. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Degica

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Digital Virgo

- i. Corporate

- ii. Geographical Spread

- Figure 2.2: Map of Digital Virgo's Locations, Split by Locations (Dark) and Connections (Light)

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. DIMOCO Payments

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Fonix

- i. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Infomedia

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. NTH Mobile

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- Table 2.3: NTH Mobile's Most Recent Publicised Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. PM Connect

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. SLA Digital

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. Telecoming

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Allopass

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretation

- Table 2.4: Juniper Research Competitor Leaderboard Scoring Criteria

- 2.2.1. Limitations & Interpretation

Data & Forecasting

1. Introduction & Forecast Methodology

- 1.1. Introduction

- Figure 1.1: Proportion of the Population who Use Carrier Billing Services (%), Split by 8 Key Regions, 2024-2029

- 1.2. Methodology and Assumptions

- Figure 1.2: Carrier Billing in Content & Commerce: Forecast Methodology

- Figure 1.3: Carrier Billing Ticketing: Forecast Methodology

- Figure 1.4: Carrier Billing for Physical Goods: Forecast Methodology

- Figure 1.5: Carrier billing for Gambling: Forecast Methodology

2. Total Market Value

- 2.1. Total Carrier Billing Users

- Figure & Table 2.1: Total Carrier Billing Users (m), Split by 8 Key Regions, 2024-2029

- 2.2. Total Carrier Billing Spend

- Figure & Table 2.2: Total End-user Spend via Carrier Billing ($m), Split by 8 Key Regions, 2024-2029

- 2.3. Total Carrier Billing Spend, Split by Industry

- Figure & Table 2.3: Total End-user Spend via Carrier Billing ($m), Split by Category, 2024-2029

- 2.4. Operator-billed Revenue from Carrier Billing

- Figure & Table 2.4: Total Operator-billed Revenue from Carrier Billing Spend ($m), Split by 8 Key Regions, 2024-2029

3. Device Usage Splits

- 3.1. Total End-user Spend via Carrier Billing, Split by Device Type

- Figure & Table 3.1: Total End-user Carrier Billing Spend ($m), Split by Device, 2024-2029

- Table 3.2: All Carrier Billed Spend as a Percentage of Global Spend, By Country and Region (%), 2024-2029

4. Digital Content & Commerce

- 4.1. Total Carrier Billing Revenue from Digital Content

- Figure & Table 4.1: Total End-user Carrier Billing Spend on Digital Content and Commerce ($m), Split by 8 Key Regions 2024-2029

- Table 4.2: Share of End-user Carrier Billing Spend on Content & Commerce (%), Split by Category, 2024-2029

- 4.1.1. Total Digital Games Spend via Carrier Billing

- Figure & Table 4.3: Total End-user Carrier Billing Spend on Digital Games ($m), Split by 8 Key Regions, 2024-2029

- 4.1.2. Total Digital Video Spend via Carrier Billing

- Figure & Table 4.4: Total End-user Carrier Billing Spend on Digital Videos ($m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Total Digital Video Spend via Carrier Billing

- Figure 4.5: Total End-user Carrier Billing Spend on Digital Music ($m), Split by Key Regions, 2024-2029

- Table 4.6: Average Digital Music Spend per User ($), Split by 8 Key Regions, 2024-2028

- 4.1.4. Total Digital Lifestyle Spend via Carrier Billing

- Figure & Table 4.7: Total End-user Carrier Billing Spend on Digital Lifestyle Content ($m), Split by 8 Key Regions, 2024-2029

- Figure 4.8: Average Digital Lifestyle Spend per Person ($), Split by 8 Key Regions, 2024-2029

- 4.1.5. Total ePublishing Spend via Carrier Billing

- Figure & Table 4.9: Total End-user Carrier Billing Spend on ePublishing ($m), Split by 8 Key Regions, 2024-2029

- Table 4.10: Proportion of End-user Carrier Billing Spend on Content and Commerce Attributable to ePublishing (%), Split by 8 Key Regions, 2024-2029

5. Emerging Industry Categories

- 5.1. Remote Physical Goods

- 5.1.1. Total Remote Physical Goods Purchased via Carrier Billing

- Figure & Table 5.1: Total Volume of Remote Physical Goods Purchases Made via Carrier Billing (m), Split by 8 Key Regions, 2024-2029

- Table 5.2: Proportion of Remote Physical Goods Purchases Made via Carrier Billing (%), Split by 8 Key Regions, 2024-2029

- 5.1.2. Total End-users' Spend on Remote Physical Goods via Carrier Billing

- Figure & Table 5.3: Total End-user Carrier Billing Spend on Remote Physical Goods ($m), Split by 8 Key Regions, 2024-2029

- 5.1.1. Total Remote Physical Goods Purchased via Carrier Billing

- 5.2. Total Mobile Gambling Spend via Carrier Billing

- Figure & Table 5.4: Total Mobile Casino Gambling Wager Value Made via Carrier Billing per Annum ($m), Split by 8 Key Regions, 2024-2029

- 5.3. Total Digital Ticketing Spend via Carrier Billing

- Figure & Table 5.5: Total Digital Ticketing Spend Made via Carrier Billing per Annum ($m), Split by 8 Key Regions, 2024-2029