|

시장보고서

상품코드

1698611

셀룰러 네트워크용 AI 시장(2025-2029년)Global AI in Cellular Networks Market: 2025-2029 |

||||||

'제로터치'에 초점이 맞춰지고, 통신사업자의 AI 투자는 향후 4년간 860억 달러를 넘을 전망

| 주요 통계 | |

|---|---|

| 2025년 셀룰러 네트워크에서 통신 사업자의 AI 투자액: | 135억 달러 |

| 2029년 셀룰러 네트워크에서 통신 사업자의 AI 투자액: | 229억 달러 |

| 통신 사업자의 디지털 변환에 대한 투자 금액: | 1,080억 달러 |

| 예측 기간: | 2025-2029년 |

본 조사 스위트는 통신 사업자와 네트워크 AI 벤더에 분석과 실용적인 통찰력을 제공합니다. Ooredoo Hutchison의 AI-RAN 전략에 대한 사례 연구를 게시합니다. 이 사례 연구에는 다음이 포함됩니다.

|

|

|

이러한 사례 연구에서는 주요 통신 사업자가 네트워크에 AI를 어떻게 도입하고, 어떻게 혁신하고 있는지, 그 도입과 혁신의 핵심적인 강점을 분석하고, 이러한 도입이 미래에 그 통신 사업자를 어떻게 배치할 것인가를 평가하고 있습니다. 이를 통해 다른 통신 사업자와 네트워크 AI 공급업체는 시장의 최첨단 사업자가 네트워크 AI에서 어떻게 작동하는지 이해하고 정보를 기반으로 의사 결정 및 전략 수립을 지원할 수 있습니다.

이 조사 제품군에는 통신 사업자의 네트워크 AI 도입의 주요 목표의 분류도 포함되어 있으며, 이러한 목표가 앞으로 어떻게 진화할 것으로 예상하는지 분석도 실시했습니다. AI, AI-RAN 얼라이언스, 수평 RAN 스택 개발, 소블린 AI, 네트워크 계획의 AI, 네트워크 유지보수의 AI, 네트워크 슬라이싱 및 차별화 연결의 AI 등 주요 개념과 기술의 전략적 분석도 실시했습니다.

또한 통신사업자가 AI를 활용하여 네트워크 보안을 향상시키는 방법, 사기꾼 및 악의적인 행위자로부터 자사의 AI 도입을 보호하는 방법, 사업자가 데이터센터와 클라우드 인프라에서 AI의 영향을 극대화하는 방법에 대한 전략적 분석에 관련 권고와 평가를 제공합니다. 이를 통해 통신 사업자, 네트워크 AI 공급업체 및 기타 이해 관계자는 AI 배포의 다양한 영역을 효과적으로 평가하고 충분한 정보를 기반으로 비즈니스 의사 결정을 내릴 수 있습니다.

이 외에도 본 보고서에서는 에이전트형 AI, TeleManagement(TM) 포럼의 자율형 네트워크, 6G, 대규모 언어 모델(LLM), GSMA의 Open-Telco LLM 벤치마크 등의 기술과 표준에 대한 지견도 제공합니다.

주요 특징

- 시장 역학 : AI-RAN 얼라이언스에 의한 AI-RAN 개발, 소블린 AI의 역할, 네트워크 보안에 있어서 AI의 이용 방법, 통신 사업자의 AI 이용 사례의 진전 등, 셀룰러 네트워크에 있어서의 AI 시장의 주요 동향과 기회에 관한 통찰, 대형 통신 사업자 8사의 네트워크에 있어서의 AI의 활용에 관한 전략적 분석, 각 통신 사업자의 도입 사례나 투자에 대해 게재했습니다.

- 주요 요점과 전략적 제안: 셀룰러 네트워크에서 AI 시장에서 주요 개발 기회와 지식을 상세하게 분석하여 수익 확대와 제품 제공의 우위를 얻으려는 통신 사업자와 AI 네트워크 벤더에 대한 전략적 제안을 제공합니다.

- 벤치마크 업계 예측 : SIM 총수, 통신 사업자의 수익, 통신 사업자의 디지털 전환에 대한 투자 총액, 통신 사업자의 AI에 대한 투자 총액, 통신 사업자의 네트워크 AI에 대한 투자 총액의 데이터를 제공합니다. 네트워크 AI에 대한 사업자의 투자 총액은, RAN용 네트워크 AI에 대한 투자 총액, 오케스트레이션 및 관리용 네트워크에 대한 투자 총액, 네트워크 보안용 네트워크 AI에 대한 투자 총액, 운용 및 보수(O&M)용 네트워크 AI에 대한 투자 총액을 분할하여 제공합니다.

- Juniper Research의 Future Leaders 'Index: 네트워크 AI 벤더 16사의 능력을 평가하고, 각 벤더 시장 규모와 상세한 분석 결과를 제공합니다.

SAMPLE VIEW

시장 데이터 및 예측

시장 데이터 및 예측

이 설문 조사 스위트에는 7,900 개 이상의 데이터 포인트로 구성된 예측 데이터 세트에 대한 액세스가 포함되어 있습니다.

- 통신 사업자의 총수익

- 디지털 전환에 대한 통신 사업자 투자 총액

- AI에 대한 통신 사업자 투자 총액

- 네트워크 AI에 대한 통신 사업자 투자 총액

- RAN용 네트워크 AI에 대한 통신 사업자 투자 총액

- 오케스트레이션 및 관리용 네트워크 AI에 대한 통신 사업자 투자 총액

- 네트워크 보안용 네트워크 AI에 대한 통신 사업자 투자 총액

- O&M용 네트워크 AI에 대한 통신 사업자 투자 총액

Juniper Research의 대화형 예측(Excel)에는 다음과 같은 기능이 있습니다.

- 통계 분석 : 데이터 기간 동안 모든 지역과 국가에 대해 표시되는 특정 메트릭을 검색할 수 있는 장점입니다.

- 국가별 데이터 도구: 이 도구를 사용하면 예측 기간 동안 모든 지역과 국가 지표를 볼 수 있습니다.

- 국가별 비교 도구: 특정 국가를 선택하고 비교할 수 있습니다. 이 도구에는 그래프를 내보내는 기능이 포함되어 있습니다.

- What-if 분석 : 세 가지 대화형 시나리오를 통해 사용자는 예측의 전제조건과 비교할 수 있습니다.

목차

시장 동향·전략

제1장 중요 포인트 및 전략적 제안

제2장 시장 상황

- 통신사업자가 자사 네트워크에 AI를 도입하려고 하는 이유

- AI를 활용한 네트워크 TCO의 삭감

- AI를 활용한 넷 제로 목표 달성

- AI를 활용한 오퍼레이터 서비스의 개선 및 확대

- 세계의 주요 통신 사업자가 자사의 네트워크에서 AI를 어떻게 활용하고 있는가

제3장 주요 기술과 미래의 기회

- 네트워크에서 AI의 주요 기술

- 에이전트 AI

- 6G

- LLM

- AI 네트워크 도입의 주요 기회

- AI RAN

- 네트워크 데이터센터와 클라우드 관리를 위한 AI

- 네트워크 보안을 위한 AI

- 네트워크 유지보수를 위한 AI

- 네트워크 계획을 위한 AI

- 네트워크 슬라이싱과 차별화된 연결을 위한 AI

경쟁 리더보드

제1장 경쟁 리더보드

제2장 벤더 프로파일

- 벤더 프로파일

- Blue Planet

- Cisco

- Ericsson

- Google Cloud

- Huawei

- IBM

- Jio Platforms

- Juniper Networks

- Mavenir

- Microsoft

- Netcracker

- Nokia

- NVIDIA

- Samsung

- Subex

- ZTE

- Juniper Research 리더보드 평가방법

- 제한과 해석

- 관련 조사

데이터 및 예측

제1장 서론·조사 방법

제2장 시장 요약과 향후 시장 전망

- 통신 사업자의 총 수익

- 네트워크 AI에 대한 통신 사업자 총 투자액

- RAN AI용 네트워크 AI에 대한 통신 사업자 총 투자액

- 네트워크 오케스트레이션 및 관리용 네트워크 AI에 대한 통신 사업자 총 투자액

- 네트워크 보안용 네트워크 AI에 대한 통신 사업자 총 투자액

- 운용 보수용 네트워크 AI에 대한 통신 사업자 총 투자액

'Operator AI Investment to Exceed $86bn Over the Next Four Years as 'Zero Touch' Becomes the Focus'

| KEY STATISTICS | |

|---|---|

| Total operator investment in AI in cellular networks in 2025: | $13.5bn |

| Total operator investment in AI in cellular networks in 2029: | $22.9bn |

| Total operator investment in digital transformation: | $108bn |

| Forecast period: | 2025-2029 |

Overview

Our "AI in Cellular Networks" research suite provides operators and AI in network vendors with analysis and actionable insights. It also includes data which enables stakeholders in the market, such as mobile network operators (MNOs) and network AI vendors, to make informed decisions on business strategy for their involvement with AI in networks. The research suite covers eight case studies into operators' AI in cellular networks deployments, as well as a further case study for Indosat Ooredoo Hutchison's AI-RAN strategy. These case studies include:

|

|

|

Each of these case studies breaks down how a leading operator is deploying and innovating with AI in their networks, with analysis from Juniper Research on the core strengths of their deployments and innovations, and evaluation of how these deployments position the operator in the future. This allows other operators and network AI vendors to understand how those at the forefront of the market are approaching network AI; supporting informed decision-making and strategy formulation.

The research suite also includes a breakdown of the key goals of operators' AI in networks deployments, with analysis of how Juniper Research expects these goals to evolve in the future. This is coupled with strategic analysis of key concepts and technologies, including AI in Radio Access Network (RAN), the AI-RAN Alliance, the development of horizontal RAN stacks, sovereign AI, AI in network planning, AI in network maintenance, and AI in network slicing and differentiated connectivity.

It further provides recommendations and assessments on how operators can use AI to improve their network security, as well as protect their own AI deployments from fraudsters and malicious actors, and strategic analysis of how operators can maximise the impact of AI in their datacentres and cloud infrastructure. Through this, operators, network AI vendors, and other stakeholders can effectively evaluate and make informed business decisions regarding different areas of AI deployments.

As well as this, the report offers insight into technologies and standards including agentic AI, TeleManagement (TM) Forum's Autonomous Networks, 6G, large language model (LLM), and the GSMA's Open-Telco LLM Benchmarks. Accompanied by Juniper Research's recommendations and analysis, each of these sections identifies future development opportunities and strategies, in addition to providing an understanding of key trends.

The market forecast suite includes several different options that can be purchased separately, including access to data mapping and a forecast document, a strategy and trends document detailing critical trends in the market, and strategic recommendations for monetising and innovating AI in cellular networks.

The research suite includes a Competitor Leaderboard, which can be purchased separately; containing analysis and market sizing for 16 leading network AI vendors, who each provide operators with software for AI in network deployments.

Collectively, the suite provides a critical tool for understanding the AI in cellular networks market allowing operators, AI in network vendors, and other stakeholders to optimise their future business and product development strategies for the market; providing a competitive advantage over their rivals.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Insights into the key trends and opportunities within the AI in cellular networks market, including the development of AI-RAN by the AI-RAN Alliance, the role of sovereign AI, how AI is being used in network security, and how operators are progressing their AI use cases. It also includes strategic analysis of eight leading operators' use of AI in their networks, with a case study into each operator's deployments and investments.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the AI in cellular networks market, accompanied by strategic recommendations for operators and AI in network vendors seeking to grow their revenue or gain an advantage in their product offerings.

- Benchmark Industry Forecasts: The suite provides four-year forecasts for the global AI in cellular networks market; providing data for the total number of SIMs, total operator revenue, total operator investment in digital transformation, total operator investment in AI, and total operator investment in network AI. Total operator investment in network AI is provided with splits for total operator investment in network AI for RAN, total operator investment in network AI for orchestration and management, total operator investment in network AI for network security, and total operator investment in network AI for operations and maintenance (O&M).

- Juniper Research Future Leaders' Index: Key player capability and capacity assessment for 16 AI in networks vendors, with market sizing and detailed analysis for each vendor's offering.

SAMPLE VIEW

Market Data & Forecasts

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Data & Forecasts

The market-leading research suite for the AI in networks market includes access to the full set of forecast data, comprising more than 7,900 datapoints. Metrics in the research suite include:

- Total Operator Revenue

- Total Operator Investment in Digital Transformation

- Total Operator Investment in AI

- Total Operator Investment in Network AI

- Total Operator Investment in Network AI for RAN

- Total Operator Investment in Network AI for Orchestration and Management

- Total Operator Investment in Network AI for Network Security

- Total Operator Investment in Network AI for O&M

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via three interactive scenarios.

Market Trends & Strategies Report

The report thoroughly examines the global "AI in Cellular Networks" market; assessing market trends, technological developments, and commercial opportunities which are shaping the market both in the present and the future. Alongside this analysis, the document includes a comprehensive analysis of the different areas of AI deployment, such as in RAN, datacentre management, and network slicing; with this analysis supporting stakeholders in evaluating how they can separate from their competition and become a market leader.

This innovative ecosystem report also includes a breakdown and evaluation of eight leading operators' investments and deployments for network AI. These case studies allow players in the network AI market to better understand the direction of leaders in the market, in turn providing insight into key trends and a foundation to develop their own business and product or technology development strategies.

Competitor Leaderboard Report

The Competitor Leaderboard included in this report provides detailed evaluation and market positioning for 16 network AI vendors. These key companies are positioned as established leaders, leading challengers, or disruptors and challengers, based on a capacity, capability, and product assessment. This includes analysis of their key advantages in the market, future development plans, and key partnerships.

The AI in Cellular Networks Competitor Leaderboard includes the following key vendors:

|

|

|

Table of Contents

Market Trends & Strategies

1. Key Takeaways Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Key Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- Figure 2.1: Total Operator Investment in Network AI ($m), Split By 8 Key Regions, 2024-2029

- 2.1.1. Why Are Operators Seeking to Deploy AI in Their Networks

- 2.1.2. Using AI to Reduce Network TCO

- Figure 2.2: Total Number of 5G Connections (m), Split By 8 Key Regions, 2024-2029

- 2.1.3. Using AI to Meet Net Zero Goals

- Figure 2.3: Total Operator Energy Savings (TWh), Split By 8 Key Regions, 2024-2029

- Table 2.4: Examples of Areas Explored for AI Use for Energy Efficiency in 5G

- 2.1.4. Using AI to Improve and Expand Operator Services

- Figure 2.5: Total Operator Revenue ($m), Split By 8 Key Regions, 2024-2029

- 2.2. How Leading Operators Are Using AI in Their Networks Around the World

3. Key Technologies and Future Opportunities

- 3.1. Key Technologies for AI in Networks

- 3.1.1. Agentic AI

- i. TM Forum's Autonomous Networks

- Figure 3.1: TM Forum's Autonomous Network Levels

- i. TM Forum's Autonomous Networks

- 3.1.2. 6G

- Figure 3.3: 3GPP Timeline and Ericsson Expectations for First Commercial System

- 3.1.3. LLMs

- Figure 3.4: Use Cases for LLMs in Operator Networks

- i. GSMA Open Telco LLM Benchmarks and Custom Operator LLMs

- Table 3.5: Accuracy Comparison Between GPT-3.5, GPT-4, and Active Professionals

- 3.1.1. Agentic AI

- 3.2. Key Opportunities for AI Network Deployments

- 3.2.1. AI RAN

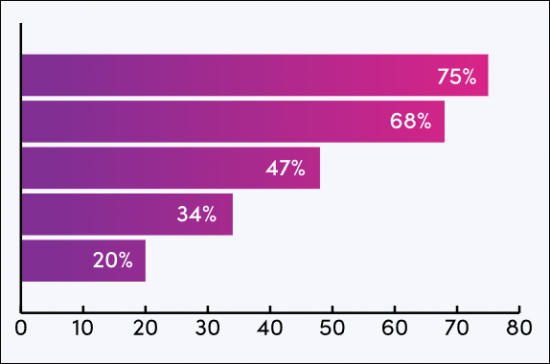

- Figure 3.6: Benefits Expected to be Provided by AI-RAN

- ii. AI Services and Multi-tenant RAN Infrastructure

- Table 3.7: NVIDIA and Softbank's Achievements With AI-RAN as of February 2025

- Figure 3.8: Schematic of Multi-tenant AI RAN Reference Architecture

- Figure 3.9: GPT-4 3-Shot Accuracy on MMLU Languages

- Tables 3.10: Examples of Sovereign AI Initiatives, Investments and Policies

- 3.2.2. AI for Network Datacentre and Cloud Management

- Figure 3.11: Total Operator Expenditure on Cloud ($m), Split by 8 Key Regions, 2023-2028

- 3.2.3. AI for Network Security

- i. Operator Strategies for Using AI to Protect Their Networks

- Figure 3.12: Key Use Cases for AI Security in Cellular Networks

- ii. The Threat of AI to Operator Networks

- i. Operator Strategies for Using AI to Protect Their Networks

- 3.2.4. AI for Network Maintenance

- 3.2.5. AI for Network Planning

- 3.2.6. AI for Network Slicing and Differentiated Connectivity

- Figure 3.13: Key Types of Network Slicing

- 3.2.1. AI RAN

Competitor Leaderboard

1. Competitor Leaderboard

- 1.1. Why Read This Report

- AI Development Must Be Focused on Creating Dynamic Infrastructure and Operations

- Table 1.1: Juniper Research Competitor Leaderboard Vendors and Product Portfolios

- Figure 1.2: Juniper Research Competitor Leaderboard: Network AI Vendors

- Source: Juniper ResearchTable 1.3: Juniper Research Competitor Leaderboard: Network AI Vendors

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Network AI Vendors (1 of 2)

- Table 1.5: Juniper Research Competitor Leaderboard Heatmap: Network AI Vendors (2 of 2)

- AI Development Must Be Focused on Creating Dynamic Infrastructure and Operations

2. Vendor Profiles

- 2.1. Vendor Profiles

- 2.1.1. Blue Planet

- i. Corporate Information

- Figure 2.1: Blue Planet Revenue ($m), Financial Year 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: Blue Planet 5G Network Planning and Deployment Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. Cisco

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.3: Cisco Crosswork Network Automation Tenets

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Ericsson

- i. Corporate Information

- Table 2.4. Ericsson's Financial Information ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: Ericsson Intelligent Automation Platform (EIAP)

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.4. Google Cloud

- i. Corporate Information

- ii. Geographical Spread

- Figure 2.6: Google Cloud Platform Regions

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Huawei

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. IBM

- i. Corporate Information

- Table 2.7: IBM's Select Financial Information ($m), 2021-2023

- ii. Geographical Spread

- Figure 2.8: IBM Datacentre and Machine-readable Zones (MZRs) Location Map

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.9: IBM Cloud Paks for Network Automation

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.7. Jio Platforms

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Juniper Networks

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.10: Juniper Networks' O-RAN Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Mavenir

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.11: Mavenir's AI & Analytics Solutions

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Microsoft

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.12: Azure Operator Nexus

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Netcracker

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.13: Netcracker Network Automation Suite

- Figure 2.14: E2E Service and Slice Automation

- Figure 2.15: Network Domain Orchestration

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. Nokia

- i. Corporate Information

- Table 2.16: Nokia's Select Financial Information ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.13. NVIDIA

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.17: NVIDIA Aerial CUDA-accelerated RAN Stack Diagram Showing Full-Stack Virtualised RAN Acceleration

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.14. Samsung

- Table 2.18: Samsung's Financial Information ($b), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.19: Samsung SMO

- Figure 2.20: Samsung VISTA

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Subex

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. ZTE

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Blue Planet

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

- Table 2.21: Juniper Research Competitor Leaderboard: Global AI in Cellular Networks Market

- 2.4. Related Research

Data & Forecasting

1. Introduction and Methodology

- 1.1. Introduction: AI in Networks Market

- Figure 1.1: Total Operator Investment in Digital Transformation ($m), 2024-2029

- 1.2. Forecast Methodology

- Figure 1.2: AI in Networks Forecast Methodology

2. Market Summary and Future Market Outlook

- 2.1. Total Operator Revenue

- Figure & Table 2.1: Total Operator Revenue ($m), Split By 8 Key Regions, 2024-2029

- 2.2. Total Operator Investment in Network AI

- Figure & Table 2.2: Total Operator Investment in Network AI ($m), Split By 8 Key Regions, 2024-2029

- 2.3. Total Operator Investment in Network AI for AI for RAN

- Figure & Table 2.3: Total Operator Investment in Network AI for AI for RAN ($m), Split By 8 Key Regions, 2024-2029

- 2.4. Total Operator Investment in Network AI for Network Orchestration and Management

- Figure & Table 2.4: Total Operator Investment in Network AI for Network Orchestration and Management ($m), Split By 8 Key Regions, 2024-2029

- 2.5. Total Operator Investment in Network AI for Network Security

- Figure & Table 2.5: Total Operator Investment in Network AI for Network Security ($m), Split By 8 Key Regions, 2024-2029

- 2.6. Total Operator Investment in Network AI for Operations and Maintenance

- Figure & Table 2.6: Total Operator Investment in Network AI for O&M ($m), Split By 8 Key Regions, 2024-2029