|

시장보고서

상품코드

1859657

발전기 시장(-2030년) : 연료 유형별(디젤, 가스, LPG, 바이오연료), 정격출력별(50kW 이하, 51-280kW, 281-500kW, 501-2,000kW, 2,001-3,500kW, 3,500kW 이상), 용도별, 최종사용자별, 설계별, 판매 채널별, 지역별Generator Market by Fuel Type (Diesel, Gas, LPG, Biofuel), Power Rating (Up to 50 kW, 51-280 kW, 281-500 kW, 501-2,000 kW, 2,001-3,500 kW, Above 3,500 kW), Application, End User, Design, Sales Channel, and Region - Global Forecast to 2030 |

||||||

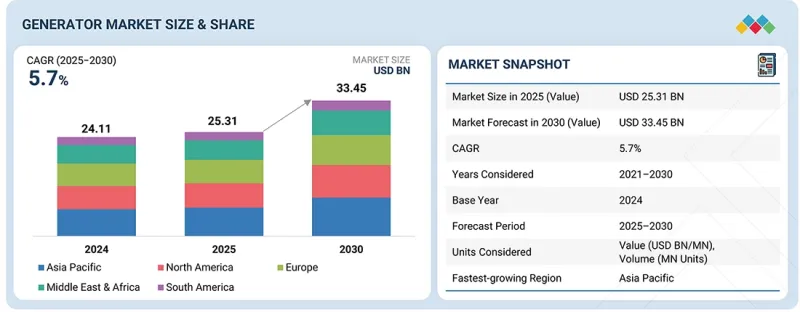

발전기 시장 규모는 2025년 253억 1,000만 달러에서 예측 기간 동안 CAGR 5.7%로 증가하여 2030년에는 334억 5,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러)·수량(유닛) |

| 부문 | 연료 유형, 용도, 판매 채널, 설계, 최종사용자, 정격출력, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

무정전, 안정적인 전력 공급에 대한 수요 증가, 급속한 산업화, 제조업의 지속적인 확대는 발전기 수요의 확대를 촉진하고 있습니다. 또한, 재생에너지 도입 촉진 및 에너지 효율 향상에 대한 정부의 지원 정책과 우대 정책은 산업 및 상업 분야에서의 도입을 촉진하고 전체 시장의 성장을 가속화하고 있습니다.

"연료 유형별로는 연료전지 부문이 2025-2030년 사이 가장 높은 CAGR을 기록할 것으로 예상됩니다."

연료전지 발전기는 고효율, 청정발전을 실현할 수 있다는 점에서 전 세계적으로 주목받고 있습니다. 이 시스템은 전기화학 반응을 통해 전력을 생산하고, 배출이 매우 적기 때문에 지속가능하고 분산된 에너지 생산에 이상적인 수단입니다. 연료전지 기술의 발전과 재생 수소의 공급 확대는 산업, 상업, 주거용 연료전지의 도입을 가속화하고 있습니다. 세계 각국이 탈탄소화와 에너지 전환 목표를 중시하는 가운데, 수소 연료전지 발전기의 수요는 앞으로 크게 증가할 것으로 전망됩니다. 이러한 시스템은 보다 깨끗하고 견고하며 지속가능한 전력 인프라를 구축하는 데 있어 매우 중요한 역할을 하고 있습니다.

"최종사용자별로 보면 상업용 부문이 2025년에 두 번째로 큰 최종사용자 부문이 될 것으로 예상됩니다."

이는 사업 활동의 지속에 필수적인 무정전 전력 공급에 대한 필요성이 높아지고 있기 때문입니다. IT 및 통신, 의료, 데이터센터, 호텔, 유통, 공공 인프라 등 다양한 상업 분야에서 신뢰할 수 있는 백업 전원 공급장치에 대한 수요가 증가하고 있습니다. 이러한 산업에서는 작은 정전에도 큰 경제적 손실, 데이터 장애, 안전 위험을 초래할 수 있기 때문에 발전기는 업무의 연속성과 운영의 안정성을 보장하기 위해 필수적인 설비입니다. 특히 전력 수요가 급증하거나 전력망의 신뢰성이 불안정한 지역에서는 발전기의 중요성이 더욱 커지고 있습니다. 발전기는 안정적이고 지속적인 전력 공급을 제공함으로써 사업 자산을 보호하고, 다운타임을 최소화하며, 운영 효율성을 향상시켜 상업 분야 전반의 생산성 유지에 핵심적인 역할을 하고 있습니다.

"아시아태평양에서는 중국이 예측 기간 동안 가장 높은 CAGR을 보일 것으로 예상됩니다."

중국은 구조적, 경제적, 인구통계학적 요인이 복합적으로 작용하여 세계에서 가장 높은 성장률을 보이는 발전기 시장입니다. 방대한 소비자 기반과 더불어 국내외 유력 제조업체의 강력한 존재감이 시장을 주도하고 있습니다. 급속한 도시화와 농촌에서 도시로의 인구 이동이 진행됨에 따라 탄탄한 인프라 구축에 대한 수요가 증가하고 있으며, 이에 따라 안정적이고 신뢰할 수 있는 전력 공급을 확보하는 것이 필수적입니다. 도시가 확장되고 산업단지가 증가함에 따라 연속 전력 및 백업 전력에 대한 수요가 빠르게 증가하고 있으며, 건설 현장, 제조 시설, 상업 단지, 에너지 집약적 도시 인프라 등 모든 분야에서 발전기에 대한 수요가 확대되고 있습니다. 이러한 추세는 중국의 인프라 개발 및 산업 현대화 추진을 뒷받침하는 원동력이 되고 있으며, 향후 중국의 발전기 시장 성장을 강력하게 견인할 것으로 보입니다.

세계의 발전기 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 주요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요와 공백

- 상호 접속된 시장과 분야 횡단적인 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 티어1/2/3플레이어 전략적 활동

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객의 사업에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세가 발전기 시장에 미치는 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 응용

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 발전기 시장에 미치는 영향

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 지속가능성에 대한 대처

- 지속가능성에 대한 영향과 규제 정책의 대처

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입 이해관계자와 구입 평가 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요

- 시장 수익성

제9장 연료별 발전기 시장

- 디젤

- 가스

- LPG

- 바이오연료

- 석탄 가스

- 가솔린

- 프로듀서 가스

- 연료전지

제10장 발전기 시장 : 설계별

- 고정형

- 휴대형

제11장 발전기 시장 : 출력별

- -50kW

- -10kW

- 11-20kW

- 21-30kW

- 31-40kW

- 41-50kW

- 51-280kW

- 281-500kW

- 501-2,000kW

- 2,001-3,500kW

- 3,500KW 이상

제12장 발전기 시장 : 판매 채널별

- 직접

- 간접

제13장 발전기 시장 : 용도별

- 대기용(스탠바이)

- 주력·연속 운전용(프라임 & 컨티뉴어스)

- 피크 쉐이빙

제14장 발전기 시장 : 최종사용자별

- 산업용

- 유틸리티/발전

- 석유 및 가스

- 화학·석유화학

- 금속·광업

- 제조

- 해운

- 건설

- 기타

- 주택

- 상업용

- 헬스케어

- IT·통신

- 데이터센터

- 기타

제15장 발전기 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 러시아

- 프랑스

- 영국

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 뉴질랜드

- 인도네시아

- 기타

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 나이지리아

- 알제리

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제16장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가와 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업

- CATERPILLAR

- CUMMINS INC.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ROLLS-ROYCE PLC

- GENERAC POWER SYSTEMS, INC.

- WARTSILA

- WACKER NEUSON SE

- SIEMENS ENERGY

- ATLAS COPCO AB

- KIRLOSKAR

- GREAVES COTTON LIMITED

- EVERLLENCE

- BRIGGS & STRATTON

- REHLKO

- AKSA POWER GENERATION

- 기타 기업

- HONDA INDIA POWER PRODUCTS LTD.

- DOOSAN PORTABLE POWER

- MULTIQUIP INC.

- TAYLOR GROUP INC.

- AB VOLVO PENTA

- SHANGHAI NEW POWER AUTOMOTIVE TECHNOLOGY COMPANY LIMITED

- DEERE & COMPANY

- AGGREKO

- DENYO CO., LTD

- YANMAR HOLDINGS CO., LTD.

제18장 조사 방법

제19장 부록

KSM 25.11.17The generator market was valued at USD 25.31 billion in 2025 and is estimated to reach USD 33.45 billion by 2030, registering a CAGR of 5.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Units) |

| Segments | Fuel type, application, sales channel, design, end user, power rating, and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The increasing demand for uninterrupted and reliable power supply, rapid industrialization, and the rapidly expanding manufacturing sector are expected to augment the demand for generators. Furthermore, supportive government policies and incentives for renewable energy integration and energy efficiency encourage industrial and commercial adoption, boosting overall market growth.

"Fuel cells segment is projected to grow at the highest CAGR between 2025 and 2030."

By fuel type, the fuel cells segment is projected to record the highest CAGR in the generator market. Fuel cell generators are gaining traction globally due to their ability to deliver efficient and clean power generation. These systems use electrochemical conversion to produce electricity with minimal emissions, making them an ideal solution for sustainable and decentralized energy production. Advancements in fuel cell technology and the expanding availability of renewable hydrogen accelerate their adoption across industrial, commercial, and residential applications. As global economies prioritize decarbonization and energy transition goals, the demand for hydrogen-based fuel cell generators is expected to rise significantly. These systems are crucial in shaping a cleaner, more resilient, and sustainable global power landscape.

"Commercial is expected to be the second-largest end user segment in 2025."

The commercial segment is anticipated to emerge as the second-largest end user segment in 2025, driven by the critical need for uninterrupted operations. Diverse commercial sectors-IT & telecommunications, healthcare, data centers, hospitality, retail, and public infrastructure-fuel the demand for reliable backup power solutions to ensure business continuity and operational resilience. In these industries, even brief power interruptions can result in significant financial losses, data disruption, and safety concerns. Consequently, generators have become indispensable for maintaining seamless operations, particularly during peak demand periods or in regions where grid reliability remains inconsistent. By providing a stable and continuous power supply, generators are vital in safeguarding business assets, minimizing downtime, and enhancing overall operational efficiency across the commercial landscape.

"China is likely to exhibit the highest CAGR in the Asia Pacific generator market during the forecast period."

China is witnessing the highest growth rate in the global generator market, driven by a combination of structural, economic, and demographic factors. The large customer base and the strong presence of established domestic and international manufacturers continue to propel the market. Rapid urbanization and the ongoing migration from rural to urban areas have intensified the demand for robust infrastructure development, which in turn necessitates a stable and reliable power supply. As cities expand and industrial zones proliferate, the need for continuous and backup power has become increasingly critical. Generators are in high demand across construction sites, manufacturing facilities, commercial complexes, and energy-intensive urban centers, supporting the ongoing development and industrial modernization efforts across the country.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-Level Executives - 25%, Directors - 35%, and Others - 40%

By Region: North America - 10%, Europe - 15%, Asia Pacific - 60%, the Middle East & Africa - 10%, and South America - 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), Wacker Neuson SE (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), and Kirloskar (India) are some key players in the generator market.

The study includes an in-depth competitive analysis of these key players in the generator market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the generator market by fuel type (Diesel, Gas, LPG, Biofuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells), Application (Standby, Peak Shaving, Prime & Continuous), Sales Channel (Direct, Indirect), Design (Stationary, Portable), Power Rating (Up to 50 KW, 51-280 KW, 281-500 KW, 501-2,000 KW, 2,001-3,500 KW, Above 3,500 KW), End User (Industrial, Commercial, and Residential), and region (North America, South America, Europe, Asia Pacific, and Middle East & Africa). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the generator market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, and key strategies, such as contracts, partnerships, agreements, product/solution/service launches, mergers & acquisitions, and recent developments within the generator market. Competitive analysis of upcoming startups in the generator ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing demand for uninterrupted and reliable power supply, Rapid industrialization, Growing concern about power outages, Integration of renewable energy and distributed energy resource management systems), restraints (High operational costs associated with diesel generators, Capital expenditure associated with hydrogen energy storage, Rise in investments in upgrading T&D infrastructure), opportunities (Rising adoption of fuel cell generators across several industries for backup power, Increasing deployment of hybrid, bi-fuel, and inverter generators, Government initiatives supporting development of hydrogen economy, Growing popularity of fuel cell generators), and challenges (Longer startup times of solid oxide fuel cells, Stringent government regulations pertaining to conventional fuel generators) that influences the growth of the generator market.

- Product Development/ Innovation: Developments such as hybrid generator systems are an emerging technology in the generator market due to their ability to combine traditional generators with renewable energy sources, including solar or wind power. This integration helps reduce fuel consumption and emissions by using renewable energy as a primary power source, with the generator providing backup power as needed, leading to cost savings and more efficient operation.

- Market Development: Fuel cells are gaining traction as a clean, versatile energy carrier, offering promising solutions for decarbonizing multiple sectors. Recognizing its potential, governments worldwide are introducing policies encouraging fuel cell production, distribution, and use. These initiatives foster a supportive environment for developing and adopting clean energy technologies, including fuel cell generators. Clean hydrogen production is crucial in advancing fuel cell generators as sustainable energy alternatives. With the increasing emphasis on hydrogen technologies, the demand for fuel cell generators is expected to grow, driving a shift from traditional fossil fuel-based power generation to cleaner, more sustainable solutions.

- Market Diversification: Cummins focuses on driving revenue growth and improving gross margins by strategically repositioning its product portfolio to maximize long-term shareholder value. In 2025, the company launched the S17 Centum generator set, a 17-liter engine platform delivering up to 1 MW of power in a compact design. Developed for space-constrained urban environments, it combines high performance with reliability across critical sectors.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), and Wacker Neuson SE (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), Kirloskar (India), in the generator market are covered.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

3 PREMIUM INSIGHTS

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing demand for uninterrupted and reliable power supply

- 4.2.1.2 Global focus on reducing carbon emissions and environmental impact

- 4.2.1.3 Rising need for consistent power supply in industrial sector

- 4.2.1.4 Mounting adoption of distributed energy resource management systems

- 4.2.1.5 Increasing power outages due to aging infrastructure

- 4.2.1.6 Rising integration of renewable energy sources

- 4.2.2 RESTRAINTS

- 4.2.2.1 High diesel generator operational costs

- 4.2.2.2 Rising capital expenditure associated with hydrogen energy storage technologies

- 4.2.2.3 Increasing investment in transmission and distribution infrastructure

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising adoption of fuel cell generators

- 4.2.3.2 Growing popularity of hybrid and bi-fuel generators and inverters

- 4.2.3.3 Government-led initiatives to promote and distribute hydrogen

- 4.2.3.4 Growing awareness about clean power generation solutions

- 4.2.3.5 Supportive government policies, incentives, and rebates on installation of fuel cell generators

- 4.2.4 CHALLENGES

- 4.2.4.1 Imposition of strict emission standards

- 4.2.4.2 Long start-up times of solid oxide fuel cells

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 INFLATION

- 5.2.4 MANUFACTURING VALUE ADDED (% OF GDP)

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF GENERATORS OFFERED BY KEY PLAYERS, BY POWER RATING, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF GENERATORS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 HS CODE 850161

- 5.6.1.1 Export scenario

- 5.6.1.2 Import scenario

- 5.6.2 HS CODE 850162

- 5.6.2.1 Export scenario

- 5.6.2.2 Import scenario

- 5.6.3 HS CODE 850163

- 5.6.3.1 Export scenario

- 5.6.3.2 Import scenario

- 5.6.1 HS CODE 850161

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.11 IMPACT OF 2025 US TARIFF ON GENERATOR MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END USERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI ON GENERATOR MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN GENERATOR MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN GENERATOR MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN GENERATOR MARKET

- 6.6.6 IMPACT OF GEN AI/AI, BY END USER AND REGION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GENERATORS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

9 GENERATOR MARKET, BY FUEL TYPE

- 9.1 INTRODUCTION

- 9.2 DIESEL

- 9.2.1 LONG LIFE AND HIGH AVAILABILITY TO FOSTER SEGMENTAL GROWTH

- 9.3 GAS

- 9.3.1 COST-EFFECTIVENESS AND EFFICIENCY TO ACCELERATE SEGMENTAL GROWTH

- 9.4 LPG

- 9.4.1 USE IN RURAL LOCATIONS WITH ERRATIC ELECTRICAL SUPPLIES TO FACILITATE SEGMENTAL GROWTH

- 9.5 BIOFUELS

- 9.5.1 PUSH FOR CLEAN AND SUSTAINABLE ENERGY SOLUTIONS TO FUEL SEGMENTAL GROWTH

- 9.6 COAL GAS

- 9.6.1 WIDESPREAD AVAILABILITY AND COST-EFFECTIVENESS TO BOLSTER SEGMENTAL GROWTH

- 9.7 GASOLINE

- 9.7.1 USE IN APPLICATIONS WHERE MOBILITY, CONVENIENCE, AND USER-FRIENDLINESS ARE CRUCIAL TO DRIVE MARKET

- 9.8 PRODUCER GAS

- 9.8.1 EMERGENCE AS ECONOMIC AND ENVIRONMENT-FRIENDLY ENERGY SOURCE TO SPUR DEMAND

- 9.9 FUEL CELLS

- 9.9.1 ABILITY TO REDUCE CLIMATE CHANGE AND IMPROVE AIR QUALITY TO PROMOTE SEGMENTAL GROWTH

10 GENERATOR MARKET, BY DESIGN

- 10.1 INTRODUCTION

- 10.2 STATIONARY

- 10.2.1 FOCUS ON ENSURING RELIABILITY AND REDUCING POWER INTERRUPTIONS TO BOOST SEGMENTAL GROWTH

- 10.3 PORTABLE 129 10.3.1 FLEXIBILITY, EASE OF INSTALLATION, AND QUICK DEPLOYMENT TO SPUR DEMAND

11 GENERATOR MARKET, BY POWER RATING

- 11.1 INTRODUCTION

- 11.2 UP TO 50 KW

- 11.2.1 UP TO 10 KW

- 11.2.1.1 Portability, ease of use, and low upfront cost to augment segmental growth

- 11.2.2 11-20 KW

- 11.2.2.1 Suitability for temporary installations to contribute to segmental growth

- 11.2.3 21-30 KW

- 11.2.3.1 Adoption to support sustained and higher-capacity backup power to foster segmental growth

- 11.2.4 31-40 KW

- 11.2.4.1 Adaptability and dependability to accelerate segmental growth

- 11.2.5 41-50 KW

- 11.2.5.1 Use to offer backup power to satisfy demands of residential and business environments to support market growth

- 11.2.1 UP TO 10 KW

- 11.3 51-280 KW

- 11.3.1 ADOPTION IN DISTRIBUTED GENERATION FACILITIES, UTILITY PEAKING PLANTS, AND POWER MANAGEMENT TO BOOST DEMAND

- 11.4 281-500 KW

- 11.4.1 USE TO SUPPORT OPERATIONS IN REMOTE AREAS TO BOLSTER SEGMENTAL GROWTH

- 11.5 501-2,000 KW

- 11.5.1 REQUIREMENT FOR RELIABLE AND CONTINUOUS POWER TO FUEL SEGMENTAL GROWTH

- 11.6 2,001-3,500 KW

- 11.6.1 USE IN CRITICAL INFRASTRUCTURE AND LARGE-SCALE MANUFACTURING FACILITIES TO DRIVE MARKET

- 11.7 ABOVE 3,500 KW

- 11.7.1 RESILIENCE TO HARSH AND VARIABLE WEATHER CONDITIONS TO FOSTER MARKET GROWTH

12 GENERATOR MARKET, BY SALES CHANNEL

- 12.1 INTRODUCTION

- 12.2 DIRECT

- 12.2.1 DEMAND FOR CUSTOMIZED, HIGH-CAPACITY GENERATOR SYSTEMS AND INTEGRATED POWER SOLUTIONS TO DRIVE MARKET

- 12.3 INDIRECT

- 12.3.1 WIDE ACCESSIBILITY AND LOCALIZED SUPPORT TO ACCELERATE SEGMENTAL GROWTH

13 GENERATOR MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 STANDBY

- 13.2.1 ABILITY TO PROVIDE IMMEDIATE BACKUP POWER DURING GRID OUTAGES TO BOOST DEMAND

- 13.3 PRIME & CONTINUOUS

- 13.3.1 IMPLEMENTATION IN REMOTE BUILDING SITES AND OFF-GRID LOCATIONS TO ACCELERATE SEGMENTAL GROWTH

- 13.4 PEAK SHAVING

- 13.4.1 USE TO AVOID HIGH TARIFFS CHARGED BY UTILITIES TO DRIVE MARKET

14 GENERATOR MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 INDUSTRIAL

- 14.2.1 UTILITIES/POWER GENERATION

- 14.2.1.1 Strong focus on addressing limited access to transmission networks to fuel segmental growth

- 14.2.2 OIL & GAS

- 14.2.2.1 power-intensive and operational complexity nature to accelerate segmental growth

- 14.2.3 CHEMICALS & PETROCHEMICALS

- 14.2.3.1 Requirement for stable power supply to avoid severe production losses and safety hazards to fuel segmental growth

- 14.2.4 METALS & MINING

- 14.2.4.1 Dependency on uninterrupted and high-capacity power supply to bolster segmental growth

- 14.2.5 MANUFACTURING

- 14.2.5.1 Emphasis on maintaining production volume and product quality to augment segmental growth

- 14.2.6 MARINE

- 14.2.6.1 Operation in isolated environments with no access to external grid infrastructure to boost segmental growth

- 14.2.7 CONSTRUCTION

- 14.2.7.1 Focus on providing power at remote locations to drive market

- 14.2.8 OTHER INDUSTRIAL END USERS

- 14.2.1 UTILITIES/POWER GENERATION

- 14.3 RESIDENTIAL

- 14.3.1 MOUNTING DEMAND FOR WHOLE-HOME BACKUP POWER SOLUTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 14.4 COMMERCIAL

- 14.4.1 HEALTHCARE

- 14.4.1.1 Requirement for continuous operation of life support machines and critical equipment to expedite segmental growth

- 14.4.2 IT & TELECOMMUNICATIONS

- 14.4.2.1 Need to keep customers connected without interruptions to augment segmental growth

- 14.4.3 DATA CENTERS

- 14.4.3.1 High demand for digital services to contribute to segmental growth

- 14.4.4 OTHER COMMERCIAL END USERS

- 14.4.1 HEALTHCARE

15 GENERATOR MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Increasing occurrence of weather-related incidents to boost market growth

- 15.2.2 CANADA

- 15.2.2.1 Mounting demand for reliable power solutions across various sectors to foster market growth

- 15.2.3 MEXICO

- 15.2.3.1 Rising infrastructure-related power disruptions to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Increasing need for reliable backup power solutions to fuel market growth

- 15.3.2 RUSSIA

- 15.3.2.1 Increase in crude oil exports to accelerate market growth

- 15.3.3 FRANCE

- 15.3.3.1 Energy transition and demand for reliable power to support market growth

- 15.3.4 UK

- 15.3.4.1 Advent of Industry 4.0 technology to offer lucrative market growth opportunities

- 15.3.5 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Vast population and manufacturing sector to boost market growth

- 15.4.2 INDIA

- 15.4.2.1 Increasing investment in clean energy to fuel market growth

- 15.4.3 JAPAN

- 15.4.3.1 Rising gas-based power generation to foster market growth

- 15.4.4 AUSTRALIA

- 15.4.4.1 Rapid expansion of renewable energy infrastructure to accelerate market growth

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Mounting demand for energy-efficient and LNG-powered vessels to drive market

- 15.4.6 NEW ZEALAND

- 15.4.6.1 Growing emphasis on achieving net-zero goals to bolster market growth

- 15.4.7 INDONESIA

- 15.4.7.1 Strong focus on generating clean and emission-free electricity to offer market growth opportunities

- 15.4.8 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 GCC

- 15.5.1.1 Saudi Arabia

- 15.5.1.1.1 Growing number of infrastructure megaprojects to fuel market growth

- 15.5.1.2 UAE

- 15.5.1.2.1 Increasing foreign direct investment in renewable energy to boost market growth

- 15.5.1.3 Rest of GCC

- 15.5.1.1 Saudi Arabia

- 15.5.2 SOUTH AFRICA

- 15.5.2.1 Rising need to address power outages to augment market growth

- 15.5.3 NIGERIA

- 15.5.3.1 Increasing demand for uninterrupted power supply to foster market growth

- 15.5.4 ALGERIA

- 15.5.4.1 Significant infrastructure investments and rising energy demand to drive market

- 15.5.5 REST OF MIDDLE EAST & AFRICA

- 15.5.1 GCC

- 15.6 SOUTH AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 High emphasis on net-zero emissions to boost market growth

- 15.6.2 ARGENTINA

- 15.6.2.1 Growing instances of power outages to drive market

- 15.6.3 REST OF SOUTH AMERICA

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Fuel type footprint

- 16.7.5.4 Application footprint

- 16.7.5.5 End user footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CATERPILLAR

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 CUMMINS INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 ROLLS-ROYCE PLC

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 GENERAC POWER SYSTEMS, INC.

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 WARTSILA

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Developments

- 17.1.7 WACKER NEUSON SE

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.8 SIEMENS ENERGY

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Developments

- 17.1.9 ATLAS COPCO AB

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.10 KIRLOSKAR

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.11 GREAVES COTTON LIMITED

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 EVERLLENCE

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.13 BRIGGS & STRATTON

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches

- 17.1.13.3.2 Deals

- 17.1.14 REHLKO

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent development

- 17.1.14.3.1 Product launches

- 17.1.15 AKSA POWER GENERATION

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.1 CATERPILLAR

- 17.2 OTHER PLAYERS

- 17.2.1 HONDA INDIA POWER PRODUCTS LTD.

- 17.2.2 DOOSAN PORTABLE POWER

- 17.2.3 MULTIQUIP INC.

- 17.2.4 TAYLOR GROUP INC.

- 17.2.5 AB VOLVO PENTA

- 17.2.6 SHANGHAI NEW POWER AUTOMOTIVE TECHNOLOGY COMPANY LIMITED

- 17.2.7 DEERE & COMPANY

- 17.2.8 AGGREKO

- 17.2.9 DENYO CO., LTD

- 17.2.10 YANMAR HOLDINGS CO., LTD.

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY AND PRIMARY RESEARCH

- 18.1.2 SECONDARY DATA

- 18.1.2.1 Key data from secondary sources

- 18.1.2.2 List of key secondary sources

- 18.1.3 PRIMARY DATA

- 18.1.3.1 Key data from primary sources

- 18.1.3.2 Key industry insights

- 18.1.3.3 List of primary interview participants

- 18.1.3.4 Breakdown of primaries

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 MARKET FORECAST APPROACH

- 18.3.1 DEMAND SIDE

- 18.3.1.1 Demand-side assumptions

- 18.3.1.2 Demand-side calculations

- 18.3.2 SUPPLY SIDE

- 18.3.2.1 Supply-side assumptions

- 18.3.2.2 Supply-side calculations

- 18.3.1 DEMAND SIDE

- 18.4 DATA TRIANGULATION

- 18.5 FACTOR ANALYSIS

- 18.6 RESEARCH ASSUMPTIONS

- 18.7 RESEARCH LIMITATIONS

- 18.8 RISK ANALYSIS

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS