|

시장보고서

상품코드

1808969

저침습 수술 시장 : 제품별, 용도별, 최종 사용자별, 지역별 예측(-2030년)Minimally Invasive Surgery Market by Type (Surgical Device, Imaging System, Electrosurgical Device, Endoscopy Device, Medical Robotics), Application (Urological, Vascular, Oncological), End User (Hospital, Clinic, ASC) Region-Global Forecast to 2030 |

||||||

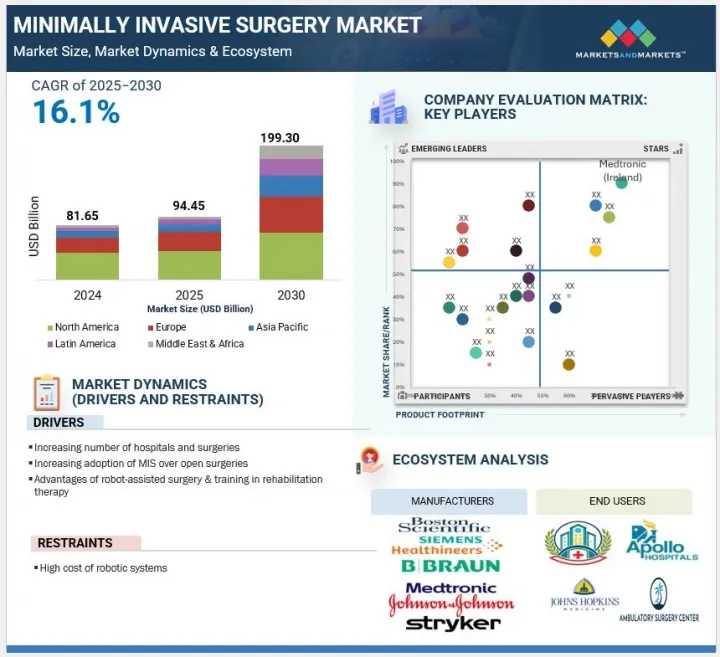

세계의 저침습 수술 시장 규모는 예측 기간 동안 16.1%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 2025년 9,445만 달러에서 2030년에는 1억 9,930만 달러에 이를 것으로 예측됩니다.

저침습 수술 시장의 성장은 수술적으로 수술 중재를 필요로 하는 소화기 질환, 암, 심혈관 질환 등 만성 질환의 유병률 증가에 의해 촉진되고 있습니다. 환자와 의료 제공업체는 회복 시간 단축, 합병증 감소, 입원 기간 단축 등 개복 수술에 대한 장점으로 MIS를 지지하는 경향이 강해지고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

또한 병원 수 증가, 헬스케어 인프라 정비, 입원 환자 수 증가 등 고급 수술 옵션에 대한 수요를 높이고 있습니다. 이러한 요인은 지속적인 기술 혁신과 함께 다양한 전문 분야에 걸쳐 MIS 수술의 세계 채용을 가속화하고 있습니다.

제품별로 세계의 저침습 수술 시장은 수술 장비, 이미지 및 시각화 시스템, 전기 수술 장비, 내시경 장비, 의료용 로봇으로 구분됩니다. 이 중 2024년에는 수술 장비 부문이 가장 큰 시장 점유율을 차지하고 있습니다. 이 부문은 또한 핸드헬드 기구, 가이딩 기구, 인플레이션 시스템, 복강경 검사 장비로 나뉩니다. 2024년에는 핸드헬드 기구 분야가 가장 높은 점유율을 차지했는데, 이는 그 용도의 넓이, 저렴한 가격, 다양한 수술 분야에서의 사용 용이성 때문입니다. 파지기, 리트랙터, 확장기, 집게, 봉합기 등의 이러한 기계적 기구는 복강경 수술, 심장 흉부 수술, 비뇨기과 수술, 신경 수술, 심장혈관 수술에 필수적입니다. 범용성이 높고 표준 MIS 시스템과 호환되므로 고급 의료 환경과 자원이 제한된 헬스케어 환경에서 필수적입니다. 이 수술 기구는 인체공학에 근거한 디자인, 촉각 피드백, 정확한 통제가 외과의사에게 지지되고 있습니다. 또한 재사용이 가능하고 유지보수 비용이 낮아 병원에서의 조달 효율이 향상됩니다. 특히 일반 수술과 특수 수술에서 MIS 수술의 세계 증가는 수요를 계속 밀어 올리고 이 분야 시장 리더를 유지하고 있습니다.

용도별로는 저침습 수술 시장은 심장외과, 혈관외과, 신경외과, 이비인후과 및 호흡기외과, 미용외과, 소화기외과 및 복부외과, 부인과외과, 비뇨기과 수술, 정형외과, 종양외과, 치과외과, 기타 용도로 구분됩니다. 2024년 현재 심장 및 흉부 수술 분야는 세계적인 심혈관 질환의 높은 부담에 견인되어 두 번째로 높은 시장 점유율을 차지하고 있습니다. CDC에 따르면 심장병은 여전히 미국의 주요 사인이며, 2023년 사망자 수는 91만 9,032명으로, 이는 사망자 3명 중 1명, 34초에 1명의 비율에 해당합니다. 이 우려할 만한 유병률은 효과적이며 저침습 수술 옵션에 대한 수요를 증가시키고 있습니다. 저침습 심장 흉부 수술은 외상 감소, 입원 기간 단축, 회복 속도 등 두드러진 이점을 제공하며 환자와 헬스케어 제공업체 모두에서 지원됩니다. 로봇 지원 시스템 및 저침습 밸브 대체술과 같은 기술 혁신이 더욱 채용을 뒷받침하고 MIS 시장 전체에서 이 부문의 중요한 역할이 강화되고 있습니다.

세계의 저침습 수술 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카의 다섯 가지 주요 지역으로 구분됩니다. 이 가운데 북미는 만성질환의 유병률 증가, 미용 성형 수술 수요 증가, 대기업 의료기기 제조업체의 존재 등을 배경으로 2024년 저침습 수술 시장에서 가장 큰 점유율을 차지하고 있습니다. CDC에 따르면 2024년 시점에서 1억 2,900만 명의 미국인이 적어도 하나의 만성 질환을 앓고 있으며, 10명에게 6명이 적어도 1명, 10명에 4명이 2개 이상의 만성 질환을 앓고 있습니다. 이러한 질병 부담 증가는 침습이 적고 효과적인 수술 옵션에 대한 수요를 증가시킵니다. 게다가 미용 목적의 저침습 수술은 강력한 성장을 이루고 있으며, 2024년에는 980만 건 이상의 신경조절제 주사(4% 증가)와 370만 건 이상의 피부표면치환술(6% 증가)이 실시되어 환자의 기호가 높아지고 있음을 보여주고 있습니다. 이 지역은 또한 고급 헬스케어 인프라, 유리한 상환 정책 및 혁신 기술의 광범위한 채택으로 혜택을 누리고 있습니다. 또한 Johnson & Johnson, Stryker, Boston Scientific, Abbott, Intuitive Surgical과 같은 업계 선도 기업들이 존재하기 때문에 제품의 혁신과 공급이 지속적으로 이루어지고 있으며, 세계 MIS 시장에서 북미의 리더십은 흔들리지 않습니다.

본 보고서에서는 세계의 저침습 수술 시장에 대해 조사했으며, 제품별, 용도별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서문

- 시장 역학

- 기술 분석

- 업계 동향

- 밸류체인 분석

- 생태계 분석

- 공급망 분석

- 무역 분석

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 규제 분석

- 특허 분석

- 가격 분석

- 주된 회의 및 이벤트(2025-2026년)

- 인접 시장 분석

- 언멧 니즈 및 최종 사용자의 기대

- 고객의 비즈니스에 영향을 미치는 동향 및 혼란

- 투자 및 자금조달 시나리오

- AI 및 생성형 AI가 저침습 수술 시장에 미치는 영향

- 미국 관세가 저침습 수술 시장에 미치는 영향(2025년)

제6장 저침습 수술 시장 : 제품별

- 서문

- 외과용 기기

- 이미징 및 시각화 시스템

- 전기수술 기기

- 내시경 장치

- 의료 로봇

제7장 저침습 수술 시장 : 용도별

- 서문

- 소화기 및 복부외과

- 심장흉부외과

- 정형외과

- 혈관 수술

- 부인과 수술

- 종양외과

- 신경외과

- 비뇨기과 수술

- 이비인후과 및 호흡기 외과

- 미용 성형

- 치과 수술

- 기타

제8장 저침습 수술 시장 : 최종 사용자별

- 서문

- 병원

- 외래수술센터(ASC)

- 클리닉

- 구급 및 외상 센터

- 기타

제9장 저침습 수술 시장 : 지역별

- 서문

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제10장 경쟁 구도

- 서문

- 주요 진입기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 진입기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무지표

- 브랜드 및 제품 비교

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- MEDTRONIC

- JOHNSON & JOHNSON

- STRYKER

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- ZIMMER BIOMET

- B. BRAUN SE

- GLOBUS MEDICAL

- INTEGRA LIFESCIENCES CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- KONINKLIJKE PHILIPS NV

- INTUITIVE SURGICAL OPERATIONS, INC.

- KARL STORZ SE & CO. KG

- GE HEALTHCARE

- 기타 기업

- NIPRO

- SMITH NEPHEW

- GETINGE

- CONMED CORPORATION

- TELEFLEX INCORPORATED

- OLYMPUS CORPORATION

- COOPERSURGICAL, INC.

- APPLIED MEDICAL RESOURCES CORPORATION

- OTU MEDICAL

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

제12장 부록

AJY 25.09.16The global minimally invasive surgery market is projected to reach USD 199.30 million by 2030 from USD 94.45 million in 2025, at a CAGR of 16.1% during the forecast period. The growth of the minimally invasive surgery market is fueled by the increasing prevalence of chronic diseases such as gastrointestinal disorders, cancer, and cardiovascular conditions, which often require frequent surgical intervention. Patients and providers are more and more favoring MIS because of its advantages over open surgery, including shorter recovery times, fewer complications, and reduced hospital stays.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa |

Furthermore, the expanding number of hospitals, better healthcare infrastructure, and rising hospital admissions are boosting the demand for advanced surgical options. These factors, along with continuous technological innovation, are speeding up the global adoption of MIS procedures across various specialties.

The handheld instruments segment of the minimally invasive surgery market, by type of surgical device, had the highest market share in 2024.

By product, the global minimally invasive surgery market is segmented into surgical devices, imaging & visualization systems, electrosurgical devices, endoscopy devices, and medical robotics. Among these, in 2024, the surgical devices segment held the largest market share. This segment is further broken down into handheld instruments, guiding devices, inflation systems, and laparoscopy devices. In 2024, the handheld instruments segment had the highest share, due to their wide application, affordability, and ease of use across various surgical fields. These mechanical tools-such as graspers, retractors, dilators, forceps, and suturing devices-are vital in laparoscopic, cardiothoracic, urological, neurological, and cardiovascular surgeries. Their versatility and compatibility with standard MIS systems make them essential in both advanced and resource-limited healthcare environments. Surgeons favor these instruments for their ergonomic design, tactile feedback, and precise control. Moreover, their reusability and lower maintenance costs improve hospital procurement efficiency. The global rise in MIS procedures, especially in general and specialized surgeries, continues to boost demand, maintaining this segment's market leadership.

The cardiothoracic surgery segment of the minimally invasive surgery market had the second-highest market share in 2024, based on application.

Based on application, the minimally invasive surgery market is segmented into cardiothoracic surgery, vascular surgery, neurological surgery, ENT & respiratory surgery, cosmetic surgery, gastrointestinal & abdominal surgery, gynecological surgery, urological surgery, orthopedic surgery, oncology surgery, dental surgery, and other applications. In 2024, the cardiothoracic surgery segment held the second-highest market share, driven by the global high burden of cardiovascular diseases. According to the CDC, heart disease remains the leading cause of death in the U.S., with 919,032 deaths in 2023, equal to one in every three deaths and one death every 34 seconds. This alarming rate of prevalence increases the demand for effective, less invasive surgical options. Minimally invasive cardiothoracic procedures provide notable advantages, such as less trauma, shorter hospital stays, and quicker recovery, making them more favored by both patients and healthcare providers. Innovations like robotic-assisted systems and minimally invasive valve replacements further boost adoption, strengthening this segment's prominent role in the overall MIS market.

In 2024, North America accounted for the largest share of the minimally invasive surgery market.

The global minimally invasive surgery market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Among these in 2024, the North American region held the largest share in the minimally invasive surgery market, driven by the high prevalence of chronic diseases, increasing demand for cosmetic procedures, and the presence of leading medical device manufacturers. According to the CDC, as of 2024, 129 million Americans have at least one chronic disease, with 6 in 10 Americans having at least one, and 4 in 10 having two or more chronic diseases. This growing disease burden drives demand for less invasive, more effective surgical options. Additionally, cosmetic minimally invasive procedures are experiencing strong growth, with over 9.8 million neuromodulator injections (up 4%) and 3.7 million skin resurfacing procedures (up 6%) performed in 2024, indicating rising patient preference. The region also benefits from advanced healthcare infrastructure, favorable reimbursement policies, and widespread adoption of innovative technologies. Furthermore, the presence of major industry players like Johnson & Johnson, Stryker, Boston Scientific, Abbott, and Intuitive Surgical ensures ongoing product innovation and availability, solidifying North America's leadership in the global MIS market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C-level- 50%, Director level- 30%, and Others- 20%

- By Region: North America- 30%, Europe- 25%, Asia Pacific- 20%, Latin America- 15%, and Middle East & Africa- 10%.

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the minimally invasive surgery market include Medtronic (Ireland), Johnson & Johnson (US), Stryker (US), Boston Scientific Corporation (US), Siemens Healthineers AG (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips N.V. (Netherland), Intuitive Surgical Operations, Inc. (US), FUJIFILM Corporation (Japan), B Braun SE (Germany), Globus Medical, Inc. (US), Integra LifeSciences Corporation (US), KARL STORZ SE & Co. KG (Germany), Nipro (Japan), Smith+Nephew (UK), Getinge AB (Sweden), CONMED Corporation (US), Teleflex Incorporated (US), Olympus Corporation (Japan), CooperSurgical, Inc. (US), Applied Medical Resources Corporation (US), OTU Medical Inc. (US), and ATMOS MedizinTechnik GmbH & Co. KG (Germany).

Research Coverage

This report examines the minimally invasive surgery market based on component, technology, end user, and region. It also analyzes factors such as drivers, restraints, opportunities, and challenges that influence market growth, and outlines the competitive landscape of market leaders. Additionally, the report reviews micro markets and their individual growth trends, and forecasts the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will help both established and smaller firms gauge the market pulse, which can, in turn, assist them in gaining a larger market share. Firms purchasing the report can use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing number of hospitals and surgeries, Increasing adoption of MIS over open surgeries, advantages of robot-assisted surgery & training in rehabilitation therapy), restraints (high cost of robotic systems), opportunities (emerging markets, increasing adoption of advanced robotics in ambulatory surgical centers), challenges (changing regulatory landscape in medical devices).

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the minimally invasive surgery market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the minimally invasive surgery market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the minimally invasive surgery industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Medtronic (Ireland), Johnson & Johnson (US), Stryker (US), Boston Scientific Corporation (US), Siemens Healthineers AG (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips N.V. (Netherland), Intuitive Surgical Operations, Inc. (US), FUJIFILM Corporation (Japan), and among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key objectives of secondary research

- 2.1.1.2 Key sources of secondary data

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 DEMAND-SIDE MODELLING

- 2.3 DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MINIMALLY INVASIVE SURGERY MARKET OVERVIEW

- 4.2 NORTH AMERICA: MINIMALLY INVASIVE SURGERY MARKET, BY END USER AND COUNTRY

- 4.3 MINIMALLY INVASIVE SURGERY MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 MINIMALLY INVASIVE SURGERY MARKET: REGIONAL MIX

- 4.5 MINIMALLY INVASIVE SURGERY MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising geriatric population and increasing number of surgeries

- 5.2.1.2 Growing adoption of minimally invasive surgeries over traditional open surgical procedures

- 5.2.1.3 Advantages of robot-assisted surgery and training in rehabilitation therapy

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of robotic systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging markets

- 5.2.3.2 Increasing adoption of advanced robotics in ambulatory surgery centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Changing regulatory landscape in medical device industry

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Laparoscopy

- 5.3.1.2 Electrosurgery

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Robotic surgery

- 5.3.2.2 Medical and surgical imaging

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Artificial intelligence and machine learning

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 INTEGRATION OF ARTIFICAL INTELLIGENCE AND MACHINE LEARNING

- 5.4.2 TECHNOLOGICAL ADVANCEMENTS IN IMAGING

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9018, 2019-2024

- 5.8.2 EXPORT SCENARIO FOR HS CODE 9018, 2019-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 Japan

- 5.11.2.3.2 China

- 5.11.2.3.3 India

- 5.11.2.4 Latin America

- 5.11.2.5 Middle East & Africa

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY KEY PLAYER

- 5.13.2 AVERAGE SELLING PRICE TREND OF MINIMALLY INVASIVE SURGICAL PRODUCTS, BY REGION, 2022-2024

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 ENDOSCOPY EQUIPMENT MARKET

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI ON MINIMALLY INVASIVE SURGERY MARKET

- 5.20 IMPACT OF 2025 US TARIFF ON MINIMALLY INVASIVE SURRGERY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 KEY IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.1.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.1 North America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 MINIMALLY INVASIVE SURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SURGICAL DEVICES

- 6.2.1 HANDHELD INSTRUMENTS

- 6.2.1.1 Tubular retractors

- 6.2.1.1.1 Minimized tissue trauma and better outcomes to support adoption

- 6.2.1.2 Dilators

- 6.2.1.2.1 Increased focus on safety and efficient surgical site access to boost segment growth

- 6.2.1.3 Suturing instruments

- 6.2.1.3.1 Rising demand and procedural volume for minimally invasive surgeries to drive market

- 6.2.1.4 Probes

- 6.2.1.4.1 Advancements in instrumentation to fuel adoption in diagnostic purposes

- 6.2.1.5 Laser fiber devices

- 6.2.1.5.1 Laser fiber devices to focus on precise and controlled procedures with minimal tissue trauma

- 6.2.1.1 Tubular retractors

- 6.2.2 LAPAROSCOPY DEVICES

- 6.2.2.1 Laparoscopes

- 6.2.2.1.1 Lower surgical infection risk to drive demand

- 6.2.2.2 Trocars & cannulas

- 6.2.2.2.1 Need to ensure accurate placement of medications during surgeries to support segment growth

- 6.2.2.3 Graspers & dissectors

- 6.2.2.3.1 Increased safety and better precision to fuel market growth

- 6.2.2.1 Laparoscopes

- 6.2.3 INFLATION SYSTEMS

- 6.2.3.1 Balloon catheters

- 6.2.3.1.1 Increasing prevalence of cardiovascular diseases to boost market growth

- 6.2.3.2 Balloon inflation systems

- 6.2.3.2.1 Growing adoption of minimally invasive coronary and peripheral procedures to accelerate market growth

- 6.2.3.1 Balloon catheters

- 6.2.4 GUIDING DEVICES

- 6.2.4.1 Guiding catheters

- 6.2.4.1.1 Rising demand for precise navigation and device placement in complex minimally invasive surgeries to drive demand

- 6.2.4.2 Guidewires

- 6.2.4.2.1 Rising PCTA and PTA procedural volumes to ensure demand growth

- 6.2.4.1 Guiding catheters

- 6.2.1 HANDHELD INSTRUMENTS

- 6.3 IMAGING & VISUALIZATION SYSTEMS

- 6.3.1 ULTRASOUND SYSTEMS

- 6.3.1.1 Rising chronic disease burden to drive demand for reliable, non-invasive ultrasound imaging

- 6.3.1.2 CT scanners

- 6.3.1.2.1 Rising demand for high-resolution imaging in complex minimally invasive surgeries to support market growth

- 6.3.2 MRI SYSTEMS

- 6.3.2.1 Rising cancer prevalence to increase reliance on MRI for early detection and image-guided surgeries

- 6.3.3 X-RAY SYSTEMS

- 6.3.3.1 Rapid, low-cost digital imaging and high patient throughput to favor market growth

- 6.3.4 OTHER IMAGING & VISUALIZATION SYSTEMS

- 6.3.1 ULTRASOUND SYSTEMS

- 6.4 ELECTROSURGAL DEVICES

- 6.4.1 ELECTROCAUTERY DEVICES

- 6.4.1.1 High demand for precise cutting and coagulation to boost electrocautery device use in minimally invasive procedures

- 6.4.2 ELECTROSURGICAL GENERATORS & ACCESSORIES

- 6.4.2.1 Growing use of disposables and reusable instruments to propel segment growth

- 6.4.1 ELECTROCAUTERY DEVICES

- 6.5 ENDOSCOPY DEVICES

- 6.5.1 RIGID ENDOSCOPES

- 6.5.1.1 Rising joint and urologic disorders to drive demand in high-volume minimally invasive surgeries

- 6.5.2 FLEXIBLE ENDOSCOPES

- 6.5.2.1 Increased preventive screening and early cancer detection to elevate flexible endoscope adoption

- 6.5.1 RIGID ENDOSCOPES

- 6.6 MEDICAL ROBOTICS

- 6.6.1 ROBOTIC SYSTEMS

- 6.6.1.1 Superior precision, enhanced control, and ability to perform complex procedures with greater dexterity to drive market

- 6.6.2 ROBOTIC INSTRUMENTS

- 6.6.2.1 Growing volume of robotic surgical procedures to augment market growth

- 6.6.3 ROBOTIC SOFTWARE & SERVICES

- 6.6.3.1 Rising robotic installations to increase demand for bundled training, maintenance, and technical support services

- 6.6.1 ROBOTIC SYSTEMS

7 MINIMALLY INVASIVE SURGERY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 GASTROINTESTINAL & ABDOMINAL SURGERY

- 7.2.1 RISING GLOBAL BURDEN OF GASTROINTESTINAL CANCERS AND DIGESTIVE DISORDERS TO DRIVE MARKET

- 7.3 CARDIOTHORACIC SURGERY

- 7.3.1 INCREASING CARDIOVASCULAR AND THORACIC CONDITIONS TO INCREASE PRECISION-BASED MINIMALLY INVASIVE PROCEDURES

- 7.4 ORTHOPEDIC SURGERY

- 7.4.1 RISING BURDEN OF MUSCULOSKELETAL DISORDERS AND GROWING GERIATRIC POPULATION TO AID MARKET GROWTH

- 7.5 VASCULAR SURGERY

- 7.5.1 MINIMALLY INVASIVE VASCULAR SURGERY PRODUCTS TO REPLACE CONVENTIONAL SUTURE-BASED METHODS

- 7.6 GYNECOLOGICAL SURGERY

- 7.6.1 HIGH INCIDENCE OF GYNECOLOGICAL DISORDERS TO FUEL SEGMENT GROWTH

- 7.7 ONCOLOGICAL SURGERY

- 7.7.1 HIGH CANCER INCIDENCE AND ADOPTION OF ADVANCED PRECISION SURGICAL TECHNOLOGIES TO BOOST MARKET GROWTH

- 7.8 NEUROLOGICAL SURGERY

- 7.8.1 INCREASING GERIATRIC POPULATION AND RISING OCCURRENCE OF NEURODEGENERATIVE DISORDERS TO PROPEL MARKET GROWTH

- 7.9 UROLOGICAL SURGERY

- 7.9.1 INCREASING PREVALENCE OF UROLOGICAL CANCERS TO AUGMENT MARKET GROWTH

- 7.10 ENT & RESPIRATORY SURGERY

- 7.10.1 GROWING GLOBAL BURDEN OF COPD AND HEAD & NECK CANCERS TO DRIVE MARKET

- 7.11 COSMETIC SURGERY

- 7.11.1 HIGH DEMAND FOR AESTHETIC ENHANCEMENT WITH MINIMAL DOWNTIME TO PROPEL MARKET GROWTH

- 7.12 DENTAL SURGERY

- 7.12.1 RISING PATIENT DEMAND FOR LESS PAINFUL AND TISSUE-PRESERVING TREATMENTS TO FAVOR MARKET GROWTH

- 7.13 OTHER SURGERIES

8 MINIMALLY INVASIVE SURGERY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RISING CHRONIC DISEASE BURDEN TO DRIVE PATIENT PREFERENCE FOR ADVANCED MINIMALLY INVASIVE SURGERIES IN HOSPITALS

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 GROWING PATIENT PREFERENCE FOR QUICKER DISCHARGE AND LOWER COSTS TO BOOST MARKET GROWTH

- 8.4 CLINICS

- 8.4.1 PREFERENCE FOR OUTPATIENT AND COST-EFFECTIVE MINIMALLY INVASIVE SURGICAL PROCEDURES TO AID MARKET GROWTH

- 8.5 EMERGENCY & TRAUMA CENTERS

- 8.5.1 INCREASING DEMAND FOR SAME-DAY SURGERIES TO AUGMENT MARKET GROWTH

- 8.6 OTHER END USERS

9 MINIMALLY INVASIVE SURGERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American minimally invasive surgery market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 High geriatric population with chronic diseases to propel market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Increased cancer incidence and strong healthcare infrastructure to fuel market growth

- 9.3.3 UK

- 9.3.3.1 Increasing geriatric population and rising need for oncological surgeries to stimulate market growth

- 9.3.4 FRANCE

- 9.3.4.1 High burden of non-communicable diseases to accelerate demand for minimally invasive procedures

- 9.3.5 ITALY

- 9.3.5.1 Increasing geriatric population to support adoption of minimally invasive procedures in degenerative conditions

- 9.3.6 SPAIN

- 9.3.6.1 Robust public healthcare and focus on reduced post-operative complications to augment market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Growing need for less invasive and high-precision surgical interventions to drive market

- 9.4.3 INDIA

- 9.4.3.1 Need for cost-effective and efficient surgical options in resource-constrained healthcare system to drive adoption

- 9.4.4 JAPAN

- 9.4.4.1 Advanced medical technology adoption and strong focus on patient-centric care to accelerate market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 High demand for plastic surgeries and adoption of advanced robotics to aid market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Increasing chronic disease burden and booming cosmetic surgery rates to fuel market expansion

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Substantial public health investment and advanced dual public-private healthcare system to favor market growth

- 9.5.3 MEXICO

- 9.5.3.1 Rising obesity across age groups to fuel demand for minimally invasive surgical procedures in Mexican healthcare system

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Increased government healthcare investments and adoption of advanced medical technologies to spur market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MINIMALLY INVASIVE SURGERY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 MEDTRONIC

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product approvals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 JOHNSON & JOHNSON

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product approvals

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 STRYKER

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 BOSTON SCIENTIFIC CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 ABBOTT

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ZIMMER BIOMET

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.7 B. BRAUN SE

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 GLOBUS MEDICAL

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 INTEGRA LIFESCIENCES CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 SIEMENS HEALTHINEERS AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Expansions

- 11.1.11 FUJIFILM CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches and approvals

- 11.1.11.3.2 Deals

- 11.1.12 KONINKLIJKE PHILIPS N.V.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches and approvals

- 11.1.12.3.2 Deals

- 11.1.13 INTUITIVE SURGICAL OPERATIONS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product approvals

- 11.1.14 KARL STORZ SE & CO. KG

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Expansions

- 11.1.15 GE HEALTHCARE

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.15.3.2 Deals

- 11.1.1 MEDTRONIC

- 11.2 OTHER PLAYERS

- 11.2.1 NIPRO

- 11.2.2 SMITH+NEPHEW

- 11.2.3 GETINGE

- 11.2.4 CONMED CORPORATION

- 11.2.5 TELEFLEX INCORPORATED

- 11.2.6 OLYMPUS CORPORATION

- 11.2.7 COOPERSURGICAL, INC.

- 11.2.8 APPLIED MEDICAL RESOURCES CORPORATION

- 11.2.9 OTU MEDICAL

- 11.2.10 ATMOS MEDIZINTECHNIK GMBH & CO. KG

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS