|

시장보고서

상품코드

1793327

엣지 컴퓨팅 시장 : 컴포넌트별, 용도별, 조직 규모별, 전개 유형별, 업계별, 지역별 예측(-2030년)Edge Computing Market by Component (Edge Hardware (Servers, Gateways, Sensors, Devices), Edge Software (Data Management)), Edge Application (Edge AI & Inference, Real-Time Processing & Control, Immersive & Interactive Experiences) - Forecast to 2030 |

||||||

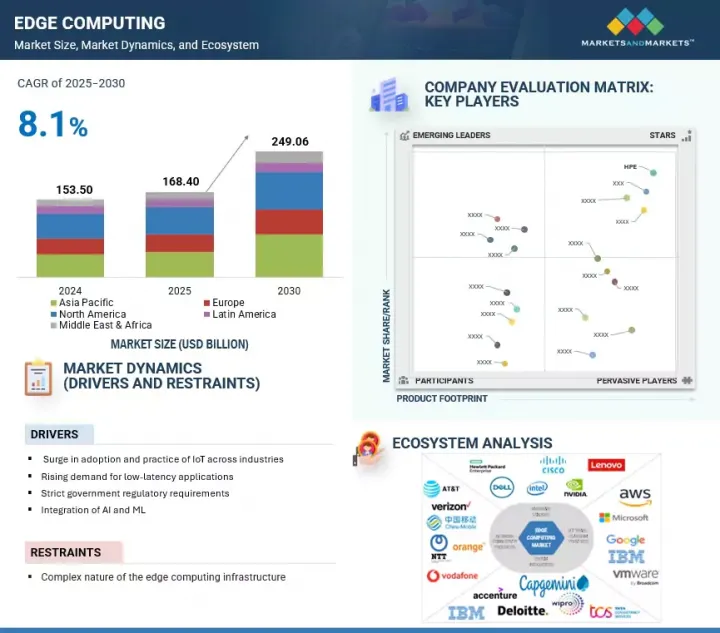

세계의 엣지 컴퓨팅 시장 규모는 급속히 확대되고 있으며, 2025년 약 1,684억 달러에서 2030년에는 2,490억 6,000만 달러에 이를 것으로 예측되며, CAGR 8.1%의 성장이 전망됩니다.

엣지 컴퓨팅 시장 성장을 촉진하는 주요 요인과 제약 요인이 존재합니다. 주요 요인으로는 사물인터넷(IoT) (IoT) 솔루션의 확산으로 네트워크의 엣지에서 실시간 데이터 처리 및 분석의 필요성이 촉진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 10억 달러 |

| 부문 | 컴포넌트별, 용도별, 조직 규모별, 전개 유형별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

저지연 용도에 대한 수요 증가가 시장 확장을 더욱 촉진하고 있으며, 안전한 및 준수 가능한 엣지 전개를 장려하는 엄격한 정부 규제 요건도 이에 기여하고 있습니다. 또한 인공지능(AI)과 머신 러닝(ML)의 통합은 조직이 엣지에서 직접 더 스마트하고 자율적인 운영을 실현할 수 있도록 지원합니다. 반면, 제약 요인은 엣지 컴퓨팅 인프라의 복잡한 특성으로, 전개, 관리, 기존 시스템과의 원활한 통합에 있어 심각한 도전 과제를 제기합니다.

엣지의 네트워크 관리는 연결성 관리, 성능 모니터링, 네트워크 최적화, 네트워크 보안 등을 포함하며, 분산된 인프라의 신뢰성과 효율성을 보장하는 데 필수적입니다. 조직이 다양한 환경에 많은 엣지 장치를 전개함에 따라, 데이터 병목 현상을 방지하고 위협을 조기에 탐지하며 지연 시간을 줄이기 위해 실시간 네트워크 가시성과 제어의 중요성이 점점 더 커지고 있습니다. 고급 네트워크 관리 솔루션을 제공하는 벤더들은 기업이 지속적인 워크플로우를 지원하고 문제 해결을 가속화하며, 원격 또는 대역폭 제약 환경에서도 높은 서비스 가용성을 보장할 수 있도록 지원합니다. 5G 채택의 증가와 IoT 및 AI의 산업 간 통합은 네트워크에 대한 압력을 가중시키며, 강력한 관리 도구는 전략적 투자로 부상하고 있습니다. 이는 솔루션 제공업체가 산업별 요구사항에 맞춤형으로 설계된 플랫폼 독립적, 보안 강화, 확장 가능한 네트워크 관리 기능을 제공하는 강력한 기회를 제공합니다. 자동화, 간소화된 오케스트레이션, 사전 예방적 문제 해결에 초점을 맞춘 업체들은 기업 수요를 충족시키고 확장되는 엣지 컴퓨팅 생태계에서 중심 역할을 할 것으로 예상됩니다.

온프레미스 엣지는 예측 기간 동안 엣지 컴퓨팅 시장 최대 시장 점유율을 유지할 것으로 예상됩니다. 이는 기업과 조직이 현지화된 데이터 처리, 강화된 개인정보 보호, 디지털 인프라에 대한 직접적인 통제를 요구하기 때문입니다. 이 성장 추세는 운영 연속성, 규제 준수, 신속한 대응이 필수적인 의료, 고급 제조, 핵심 인프라 등 분야에서 특히 두드러집니다. 조직은 시설 내 엣지 리소스를 전개함으로써 클라우드 의존성으로 인한 잠재적 위험(네트워크 중단, 데이터 주권 문제 등)을 회피하며, 실시간 분석과 같은 용도에 대해 최저의 지연 시간을 보장합니다. 자동화, 품질 관리와 같은 애플리케이션에 대해 가능한 가장 낮은 지연 시간을 확보할 수 있습니다. 디지털 전환이 가속화되면서 투자와 혜택의 균형이 변화하고 있으며, 온프레미스 엣지의 총 소유 비용은 보안, 신뢰성, 운영 유연성 측면의 실질적인 이점으로 정당화되고 있습니다. 현재의 엣지 솔루션은 점점 더 모듈화되고 확장 가능해져 모든 규모의 기업이 정확한 요구사항에 맞는 전용 엣지 노드를 도입할 수 있게 되었습니다. 벤더 및 솔루션 제공업체에게는 견고하고 상호운용 가능한 플랫폼, 원활한 통합 도구, 전개 및 라이프사이클 관리를 간소화하는 관리형 서비스에 대한 지속적인 수요가 발생합니다. 시장 추세는 고객 파트너십 강화, 산업별 맞춤형 엣지 솔루션 개발, 신뢰성, 성능, 복원력이 경쟁 우위를 결정하는 시장에서 리더십 확립의 지속적인 기회를 시사합니다. 기업들이 분산형 아키텍처에 투자함에 따라, 채택 용이성, 투명한 보안, 목적에 맞는 솔루션을 우선시하는 공급업체들은 차별화된 서비스를 제공하며 이 역동적인 환경에서 장기적인 성장을 확보할 것입니다.

북미는 고급 인프라, 강력한 5G 커버리지, 실시간 솔루션에 대한 기업 수요로 인해 엣지 컴퓨팅 시장을 선도하고 있으며, 아시아태평양 지역은 클라우드 채택 가속화, 대규모 IoT 전개, 정부 지원의 지역별 엣지 인프라 투자로 인해 가장 빠르게 성장하는 지역입니다.

북미는 기업들의 실시간 데이터 처리, 저지연 용도, 안전한 분산형 아키텍처에 대한 수요 증가에 의해 촉진되어 엣지 컴퓨팅 시장을 주도할 것으로 예상됩니다. 공급업체와 솔루션 제공업체에게는 제조, 의료, 통신, 자율주행 차량 등 산업에 확장 가능한 플랫폼과 서비스를 제공하는 데 중요한 기회를 제공합니다. 해당 지역의 성숙한 5G 인프라와 IoT 전개 확대는 중앙 집중형 클라우드에서 엣지 기반 처리로의 전환을 촉진하며, 데이터 주권 규정을 준수하는 현지화 솔루션에 대한 필수적인 수요를 창출합니다. 통신 네트워크에 엣지 기능을 통합하는 전략적 파트너십은 엣지 컴퓨팅이 운영 효율성과 사용자 경험을 향상시키는 방식을 보여줍니다. 이러한 동향을 활용하면 공급업체는 진화하는 고객 요구사항을 충족시키고 지연 문제를 줄이며, 급속한 성장과 혁신을 앞두고 있는 시장에서 강력한 입지를 구축할 수 있습니다.

본 보고서에서는 세계의 엣지 컴퓨팅 시장에 대해 조사했으며, 컴포넌트별, 용도별, 조직 규모별, 전개 유형별, 업계별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 소개

- 시장 역학

- 사례 연구 분석

- 생태계 분석

- 공급망 분석

- 기술 분석

- Porter's Five Forces 분석

- 가격 분석

- 특허 분석

- 규제 상황

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 주요 이해관계자와 구매 기준

- 주된 회의 및 이벤트(2025-2026년)

- 무역 분석

- 엣지 컴퓨팅 시장의 생성형 AI의 영향

- 비즈니스 모델

- 투자 상황과 자금 조달 시나리오

- 미국 관세의 영향(2025년)

- 엣지로 처리되는 데이터의 유형

제6장 엣지 컴퓨팅 시장(컴포넌트별)

- 소개

- 엣지 하드웨어

- 엣지 소프트웨어

- 서비스

제7장 엣지 컴퓨팅 시장(용도별)

- 소개

- 실시간 처리 및 제어

- 엣지 AI 및 추론

- IoT 및 산업 자동화

- 콘텐츠 전달 및 미디어

- 몰입형 및 상호작용형 경험

- 기타

제8장 엣지 컴퓨팅 시장(조직 규모별)

- 소개

- 대기업

- 중소기업(SMES)

제9장 엣지 컴퓨팅 시장(전개 유형별)

- 소개

- 클라우드 엣지

- On-Premise 엣지

- 디바이스 엣지

제10장 엣지 컴퓨팅 시장(업계별)

- 소개

- 제조

- 에너지 및 유틸리티

- 소프트웨어 및 IT 서비스

- 통신

- 자동차

- 미디어 및 엔터테인먼트

- 소매 및 소비재

- 운송 및 물류

- 의료 및 생명과학

- 기타

제11장 엣지 컴퓨팅 시장(지역별)

- 소개

- 북미

- 북미 : 엣지 컴퓨팅 시장 성장 촉진요인

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 엣지 컴퓨팅 시장 성장 촉진요인

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양 : 엣지 컴퓨팅 시장 성장 촉진요인

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 호주 및 뉴질랜드(ANZ)

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 엣지 컴퓨팅 시장 성장 촉진요인

- 중동 및 아프리카 : 거시경제 전망

- 걸프 협력 이사회(GCC)

- 남아프리카

- 기타

- 라틴아메리카

- 라틴아메리카 : 엣지 컴퓨팅 시장 성장 촉진요인

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제12장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 제품/브랜드 비교

- 수익 분석

- 기업평가 매트릭스 : 주요 진출기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 주요 벤더의 기업 평가 및 재무 지표

- 경쟁 시나리오와 동향

제13장 기업 프로파일

- 소개

- 주요 진출기업

- DELL TECHNOLOGIES

- AWS

- MICROSOFT

- CISCO

- HPE

- IBM

- NVIDIA

- INTEL

- HUAWEI

- 기타 기업

- NOKIA

- VMWARE

- FASTLY

- ADLINK

- ORACLE

- SEMTECH

- MOXA

- BELDEN

- GE DIGITAL

- DIGI INTERNATIONAL

- LITMUS AUTOMATION

- ZEDEDA

- CLEARBLADE

- VAPOR IO

- SIXSQ

- EDGEWORX

- SUNLIGHT.IO

- SAGUNA NETWORKS

- ALEF EDGE

- MUTABLE 326 13.3.21 ZTE CORPORATION

- ADVANTECH CO., LTD.

- LENOVO GROUP LTD

제14장 인접 시장과 관련 시장

제15장 부록

HBR 25.08.22The global edge computing market is expanding rapidly, with a projected market size expected to rise from about USD 168.40 billion in 2025 to USD 249.06 billion by 2030, at a CAGR of 8.1%. Several key drivers and restraints primarily shape the growth of the edge computing market. Drivers include the surge in adoption and practice of Internet of Things (IoT) solutions across various industries, driving the need for real-time data processing and analytics at the network's edge.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Component, application, organization size, deployment mode, and vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Rising demand for low-latency applications further propels market expansion, alongside strict government regulatory requirements that encourage secure and compliant edge deployments. Additionally, integrating artificial intelligence (AI) and machine learning (ML) empowers organizations to realize smarter, autonomous operations directly at the edge. On the other hand, restraints center around the complex nature of edge computing infrastructure, which poses significant challenges in deployment, management, and seamless integration with legacy systems.

By edge software, network management to account for the highest growth rate during the forecast period

Network management is expected to account for the highest growth rate during the forecast period. This growth is driven by edge deployments' rising complexity and scale, where maintaining seamless connectivity, secure communication, and consistent performance is critical to business operations. Network management at the edge includes connectivity management, performance monitoring, network optimization, and network security, all of which are essential to ensure the reliability and efficiency of distributed infrastructure. As organizations deploy many edge devices across diverse environments, real-time network visibility and control become increasingly important to prevent data bottlenecks, detect threats early, and reduce latency. Vendors that deliver advanced network management solutions enable enterprises to support continuous workflows, achieve faster issue resolution, and ensure high service availability even in remote or bandwidth-constrained locations. The increase in 5G adoption and the integration of IoT and AI across industries add to the pressure on networks, making robust management tools a strategic investment. This presents a strong opportunity for solution providers to offer platform-agnostic, secure, and scalable network management capabilities tailored to industry-specific needs. Those focusing on automation, simplified orchestration, and proactive troubleshooting are expected to be better positioned to meet enterprise demand and play a central role in the expanding edge computing ecosystem.

On-premises edge deployment mode to hold the largest market share during the forecast period

On-premises edge is expected to maintain the largest share of the edge computing market during the forecast period, reflecting a strong demand from enterprises and organizations that require localized data processing, heightened privacy, and direct control over their digital infrastructure. This growth is particularly evident in sectors where operational continuity, regulatory compliance, and rapid response are non-negotiable, such as healthcare, advanced manufacturing, and critical infrastructure. By deploying edge resources within their facilities, organizations bypass the potential risks of cloud dependency, such as network outages and data sovereignty concerns, while securing the lowest possible latency for applications such as real-time analytics, automation, and quality control. As digital transformation accelerates, the balance between investment and benefit shifts, with the total cost of ownership for on-premises edge being justified by tangible gains in security, reliability, and operational agility. Today's edge offerings are increasingly modular and scalable, making it feasible for enterprises of all sizes to adopt dedicated edge nodes that fit their precise requirements. For vendors and solution providers, this means steady demand for robust, interoperable platforms, seamless integration tools, and managed services that simplify deployment and lifecycle management. The market's trajectory signals ongoing opportunities to deepen client partnerships, develop sector-specific edge solutions, and establish leadership in markets where trust, performance, and resilience define competitive advantage. As enterprises invest in distributed architectures, vendors prioritizing ease of adoption, transparent security, and fit-for-purpose solutions will differentiate their offerings and secure long-term growth in this dynamic environment.

North America leads the edge computing market with advanced infrastructure, strong 5G coverage, and high enterprise demand for real-time solutions, while Asia Pacific is the fastest-growing region driven by rapid cloud adoption, large-scale IoT deployments, and government-backed investments in localized edge infrastructure.

North America is expected to lead the edge computing market, driven by increasing enterprise demand for real-time data processing, low-latency applications, and secure distributed architectures. For vendors and solution providers, this means significant opportunities to deliver scalable platforms and services that support industries such as manufacturing, healthcare, telecommunications, and autonomous vehicles. The region's mature 5G infrastructure and growing IoT deployments enable the shift from centralized cloud to edge-based processing, creating a critical need for localized solutions that ensure compliance with data sovereignty regulations. Strategic partnerships, such as integrating edge capabilities into telecommunications networks, demonstrate how edge computing enhances operational efficiency and user experience. Capitalizing on these trends allows vendors to address evolving customer requirements, reduce latency challenges, and establish strong footholds in a market poised for rapid growth and innovation.

Breakdown of Primary interviews

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the edge computing market.

- By Company: Tier I - 35%, Tier II - 25%, and Tier III - 40%

- By Designation: C-Level Executives - 25%, D-Level Executives -30%, and Others - 45%

- By Region: North America - 42%, Europe - 25%, Asia Pacific - 18%, and Rest of the World - 15%

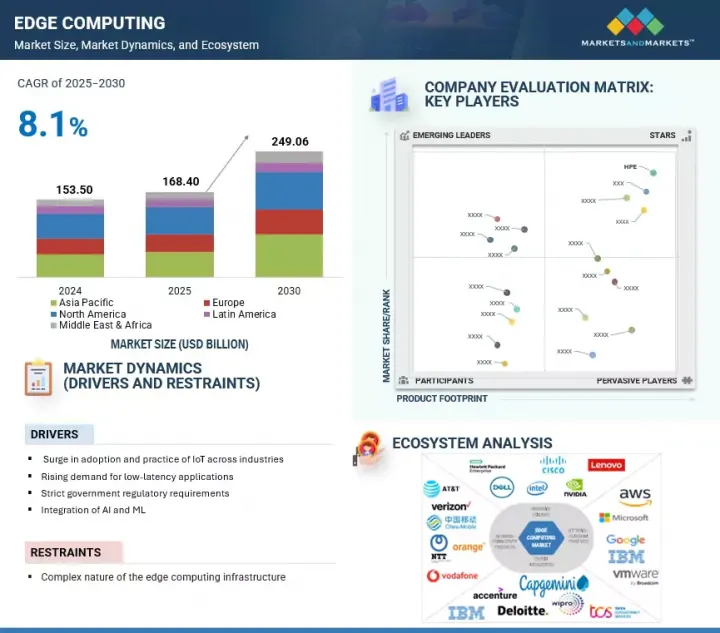

The report includes a study of key players offering edge computing services. It profiles major vendors in the edge computing market. The major market players include HPE (US), AWS (US), Dell Technologies (US), Cisco (US), Microsoft (US), IBM (US), Google (US), Nvidia (US), Intel (US), Huawei (China), Nokia (Finland), VMware (US), Fastly (US), Adlink (Taiwan), Oracle (US), Semtech (US), Moxa (US), Belden (US), GE Digital (US), DG International (US), Litmus Automation (US), Zededa (US), Clearblade (US), and Vapor IO (US).

Research Coverage

This research report categorizes the edge computing market based on Component (edge hardware (edge servers, edge gateways, edge sensors, edge devices)), edge software (data management, device management, application management, network management), and services (professional services, and managed services)), Application (real-time processing & control, edge-AI & inference, IoT & industrial automation, content delivery & media, immersive & interactive experiences, and other applications (security & access control, healthcare & telemedicine, consumer & smart living)), Organization size (large enterprises, small & medium sized enterprises), Deployment mode (cloud edge, on-premises edge, device edge), Vertical (manufacturing/industrial, energy & utilities, software & IT services, telecommunications, automotive, media & entertainment, retail & consumer goods, transportation & logistics, healthcare & life sciences, and other verticals (education, government & public sector, BFSI)) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the edge computing market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the edge computing market. This report also covers the competitive analysis of upcoming startups in the edge computing market ecosystem.

Reason to buy this Report

The report provides market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall edge computing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Surge in adoption and practice of IoT across industries, Rising demand for low-latency applications, Strict government regulatory requirements, Integration of AI and ML), restraints (Complex nature of the edge computing infrastructure ), opportunities (Advent of 5G network to provide open avenues for large-scale 5G network deployment, Proliferation of IoT, Rapid adoption of edge computing solutions across sectors, Emergence of autonomous automobiles and connected car infrastructure), and challenges (Increasing data privacy and security concerns, Challenges in compatibility or interoperability).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the edge computing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the edge computing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the edge computing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such HPE (US), AWS (US), Dell Technologies (US), Cisco (US), Microsoft (US), IBM (US), Google (US), Nvidia (US), Intel (US), Huawei (China), Nokia (Finland), VMware (US), Fastly (US), Adlink (Taiwan), Oracle (US), Semtech (US), Moxa (US), Belden (US), GE Digital (US), DG International (US), Litmus Automation (US), Zededa (US), Clearblade (US), and Vapor IO (US). The report also helps stakeholders understand the edge computing market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDGE COMPUTING MARKET

- 4.2 EDGE COMPUTING MARKET, BY COMPONENT (2025 VS 2030)

- 4.3 EDGE COMPUTING MARKET, BY APPLICATION (2025 VS 2030)

- 4.4 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE (2025 VS 2030)

- 4.5 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE (2025 VS 2030)

- 4.6 EDGE COMPUTING MARKET, BY VERTICAL (2025 VS 2030)

- 4.7 EDGE COMPUTING MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Exponential scale of IoT and endpoint intelligence

- 5.2.1.2 Rising demand for low-latency applications

- 5.2.1.3 Integration of edge AI/ML for autonomous decision-making

- 5.2.1.4 Stringent government regulatory requirements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Economic and policy constraints in emerging markets

- 5.2.2.2 Complex nature of edge computing infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of 5G network to provide open avenues for large-scale 5G network deployment

- 5.2.3.2 Remote and mission-critical edge deployment

- 5.2.3.3 Rapid adoption of edge computing solutions across sectors

- 5.2.3.4 Emergence of autonomous automobiles and connected car infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing data privacy and security concerns

- 5.2.4.2 Skill gap and operational expertise

- 5.2.4.3 Challenges in compatibility or interoperability

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 AKAMAI HELPED MATRIMONY.COM ACHIEVE WEBSITE OPTIMIZATION AND INCREASED USER RETENTION

- 5.3.2 ESPN ADOPTED MICROSOFT'S INNOVATIVE TECHNOLOGIES TO RESHAPE FUTURE OF SPORTS PRODUCTION

- 5.3.3 VMWARE HELPED NORTHERN BEACHES COUNCIL BE PACESETTER TO DRIVE AND DIGITALIZE REGIONAL MUNICIPAL SERVICES

- 5.3.4 MASERATI MSG RACING AUTOMATED WORKFLOW ENABLEMENT WITH HEWLETT-PACKARD ENTERPRISE TO OPTIMIZE TEAM PERFORMANCE

- 5.3.5 99BRIDGES HELPED HUMAN HABITS RESTORE AND PROTECT ENVIRONMENT WITH CISCO'S IOT OPERATIONS DASHBOARD

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 EDGE COMPUTING TECHNOLOGY PROVIDERS

- 5.5.2 EDGE COMPUTING HARDWARE VENDORS

- 5.5.3 NETWORK SERVICE PROVIDERS

- 5.5.4 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Edge AI

- 5.6.1.2 Virtual Network Functions

- 5.6.1.3 Content Delivery Network

- 5.6.1.4 Container Orchestration

- 5.6.1.5 Containerization

- 5.6.1.6 Zero-trust Security

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Internet of Things (IoT)

- 5.6.2.2 Digital Twin

- 5.6.2.3 Remote Device Management

- 5.6.2.4 Multi-access Edge Computing

- 5.6.2.5 Computer vision SDKs

- 5.6.2.6 Cybersecurity For Edge

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Cloud Computing

- 5.6.3.2 Blockchain

- 5.6.3.3 AR/VR

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2025

- 5.8.2 INDICATIVE PRICING ANALYSIS OF EDGE COMPUTING SOLUTIONS

- 5.9 PATENT ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 Regulatory implications and industry standards

- 5.10.1.2 General Data Protection Regulation

- 5.10.1.3 SEC Rule 17a-4

- 5.10.1.4 ISO/IEC 27001

- 5.10.1.5 System and Organization Controls 2 Type II compliance

- 5.10.1.6 Financial Industry Regulatory Authority

- 5.10.1.7 Freedom of Information Act

- 5.10.1.8 Health Insurance Portability and Accountability Act

- 5.10.2 REGULATIONS, BY REGION

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO

- 5.14.2 EXPORT SCENARIO

- 5.15 IMPACT OF GENERATIVE AI ON EDGE COMPUTING MARKET

- 5.15.1 TOP USE CASES & MARKET POTENTIAL

- 5.15.2 KEY USE CASES

- 5.15.3 CASE STUDIES

- 5.15.3.1 Case Study: McDonald's with Google Cloud: AI-powered Edge at Scale

- 5.15.4 VENDOR INITIATIVE

- 5.15.4.1 ADLINK Technology

- 5.16 BUSINESS MODELS

- 5.16.1 BUSINESS MODELS FOR HARDWARE VENDORS

- 5.16.2 BUSINESS MODELS FOR SOFTWARE PROVIDERS

- 5.16.3 BUSINESS MODELS FOR SERVICE PROVIDERS

- 5.17 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON COUNTRY/REGION

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.4 IMPACT ON END-USE INDUSTRIES

- 5.18.4.1 Manufacturing & Industrial (Industrial IoT)

- 5.18.4.2 Telecommunications & 5G Networks

- 5.18.4.3 Healthcare & Life Sciences

- 5.18.4.4 Retail

- 5.18.4.5 Transportation & Automotive

- 5.18.4.6 Energy & Utilities

- 5.18.4.7 Government & Defense

- 5.19 TYPES OF DATA PROCESSED AT EDGE

- 5.19.1 UNSTRUCTURED DATA

- 5.19.1.1 Text

- 5.19.1.2 Images

- 5.19.1.3 Audio

- 5.19.1.4 Video

- 5.19.1.5 Logs

- 5.19.1.6 Social Media Content

- 5.19.2 STRUCTURED DATA

- 5.19.2.1 Sensor Data

- 5.19.2.2 Transaction Data

- 5.19.2.3 Tabular Data

- 5.19.2.4 Temporal Data

- 5.19.2.5 Spatial Data

- 5.19.2.6 Multimedia Data

- 5.19.1 UNSTRUCTURED DATA

6 EDGE COMPUTING MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: EDGE COMPUTING MARKET DRIVERS

- 6.2 EDGE HARDWARE

- 6.2.1 NEED FOR REDUCING BURDEN ON CLOUD AND DATA CENTERS TO DRIVE ADOPTION OF EDGE COMPUTING HARDWARE

- 6.2.2 EDGE SERVERS

- 6.2.2.1 Enhancing data processing and security with strategically deployed edge servers

- 6.2.2.2 Edge compute nodes

- 6.2.2.3 Edge storage devices

- 6.2.3 EDGE GATEWAYS

- 6.2.3.1 Enabling efficient, secure data processing through advanced edge gateway solutions

- 6.2.3.2 Industrial edge gateways

- 6.2.3.3 IoT edge gateways

- 6.2.3.4 Cloud edge gateways

- 6.2.4 EDGE SENSORS

- 6.2.4.1 Driving innovation with real-time data processing using edge sensors efficiently

- 6.2.4.2 Temperature sensors

- 6.2.4.3 Humidity sensors

- 6.2.4.4 Pressure sensors

- 6.2.4.5 Motion sensors

- 6.2.5 EDGE DEVICES

- 6.2.5.1 Unlocking edge device potential for real-time, secure, and efficient computing

- 6.2.5.2 Industrial PCs (IPCs)

- 6.2.5.3 Single-board computers (SBCs)

- 6.2.5.4 Microcontrollers

- 6.3 EDGE SOFTWARE

- 6.3.1 EDGE COMPUTING SOFTWARE PROVIDES COMPREHENSIVE VISIBILITY AND CONTROL OVER REMOTE EDGE ENVIRONMENT

- 6.3.2 DATA MANAGEMENT

- 6.3.2.1 Empowering efficient edge data management for security, scalability, and innovation

- 6.3.2.2 Data processing

- 6.3.2.3 Data analytics

- 6.3.2.4 Data storage

- 6.3.2.5 Data security

- 6.3.3 DEVICE MANAGEMENT

- 6.3.3.1 Optimizing edge device management for reliability, performance, and operational insight

- 6.3.3.2 Device provisioning

- 6.3.3.3 Firmware and software updates

- 6.3.3.4 Device monitoring

- 6.3.3.5 Device security

- 6.3.4 APPLICATION MANAGEMENT

- 6.3.4.1 Centralized edge application deployment for enhanced reliability and operational efficiency

- 6.3.4.2 Application deployment

- 6.3.4.3 Workflow automation

- 6.3.4.4 Service orchestration

- 6.3.4.5 Application security

- 6.3.5 NETWORK MANAGEMENT

- 6.3.5.1 Maximizing edge network performance through proactive and efficient resource management

- 6.3.5.2 Connectivity management

- 6.3.5.3 Performance monitoring

- 6.3.5.4 Network optimization

- 6.3.5.5 Network security

- 6.4 SERVICES

- 6.4.1 FOCUS ON LOWERING RISKS ASSOCIATED WITH OPERATIONAL MISTAKES AND DELIVERING MAXIMUM PRODUCT ASSURANCE TO BOOST MARKET

- 6.4.2 PROFESSIONAL SERVICES

- 6.4.2.1 Maximizing edge computing success with specialized professional services and expertise

- 6.4.2.2 Consulting

- 6.4.2.3 Implementation

- 6.4.2.4 Support & maintenance

- 6.4.3 MANAGED SERVICES

- 6.4.3.1 Enhancing edge infrastructure efficiency through comprehensive managed services and support

7 EDGE COMPUTING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATIONS: EDGE COMPUTING MARKET DRIVERS

- 7.2 REAL-TIME PROCESSING & CONTROL

- 7.2.1 ENABLING INSTANT AUTONOMOUS DECISIONS THROUGH ON-PREMISES INTELLIGENCE FOR CRITICAL INDUSTRIAL AND FIELD APPLICATIONS

- 7.2.2 INDUSTRIAL PROCESS CONTROL

- 7.2.3 AUTONOMOUS ACTUATION

- 7.2.4 PRECISION AGRICULTURE

- 7.3 EDGE AI & INFERENCE

- 7.3.1 ENABLE LOCALIZED AI DECISIONS AT SCALE TO ACCELERATE RESPONSE TIME AND PRESERVE DATA PRIVACY

- 7.3.2 COMPUTER VISION

- 7.3.3 PREDICTIVE MAINTENANCE

- 7.3.4 LOCALIZED NLP

- 7.4 IOT & INDUSTRIAL AUTOMATION

- 7.4.1 STREAMLINE OPERATIONAL INTELLIGENCE BY EMBEDDING EDGE LOGIC ACROSS DISTRIBUTED IOT AND INDUSTRIAL AUTOMATION SYSTEMS

- 7.4.2 DEVICE MANAGEMENT & PROTOCOL BRIDGING

- 7.4.3 ROBOTICS COORDINATION

- 7.4.4 ASSET & INVENTORY TRACKING

- 7.5 CONTENT DELIVERY & MEDIA

- 7.5.1 ENHANCE CONTENT QUALITY AND REACH WITH EDGE-BASED MEDIA PROCESSING AND DISTRIBUTION INFRASTRUCTURE

- 7.5.2 VCDN CACHING

- 7.5.3 DYNAMIC SIGNAGE

- 7.5.4 LIVE-EVENT TRANSCODING

- 7.6 IMMERSIVE & INTERACTIVE EXPERIENCES

- 7.6.1 DELIVER REAL-TIME IMMERSION BY MOVING COMPUTE CLOSER TO USERS FOR AR/VR, DIGITAL TWINS, AND HAPTICS

- 7.6.2 AR/VR RENDERING

- 7.6.3 DIGITAL-TWIN COLLABORATION

- 7.6.4 HAPTIC-FEEDBACK SYSTEMS

- 7.7 OTHER APPLICATIONS

8 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZES: EDGE COMPUTING MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 ADOPTION OF EDGE COMPUTING SOLUTIONS TO ENHANCE OPERATIONAL EFFICIENCY IN LARGE ENTERPRISES

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- 8.3.1 DEMAND FOR SOLUTIONS TO RESOLVE COMPLEXITIES AND OPTIMIZE THE COST OF BUSINESS PROCESSES TO DRIVE MARKET

9 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT TYPES: EDGE COMPUTING MARKET DRIVERS

- 9.2 CLOUD EDGE

- 9.2.1 UNLOCKING SCALABILITY AND CONNECTIVITY BENEFITS THROUGH CLOUD EDGE INTEGRATION

- 9.3 ON-PREMISES EDGE

- 9.3.1 MAXIMIZING SECURITY AND CONTROL WITH LOCAL EDGE INFRASTRUCTURE SETUPS

- 9.4 DEVICE EDGE

- 9.4.1 ENABLE REAL-TIME DECISION-MAKING AT SOURCE WITH EMBEDDED PROCESSING AT EDGE OF DEVICES

10 EDGE COMPUTING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: EDGE COMPUTING MARKET DRIVERS

- 10.2 MANUFACTURING

- 10.2.1 EDGE COMPUTING OFFERS COST-EFFECTIVE WAYS OF ACHIEVING REMOTE MONITORING IN MANUFACTURING COMPANIES

- 10.2.2 MANUFACTURING: USE CASES

- 10.2.2.1 Quality control

- 10.2.2.2 Process optimization

- 10.2.2.3 Remote equipment monitoring

- 10.2.2.4 Condition-based monitoring

- 10.2.2.5 Supply chain optimization

- 10.3 ENERGY & UTILITIES

- 10.3.1 EDGE COMPUTING DEVICES HELP ADDRESS ISSUES IN MIDSTREAM SECTOR RELATED TO CRUDE OIL STORAGE AND TRANSPORTATION

- 10.3.2 ENERGY & UTILITIES: USE CASES

- 10.3.2.1 Smart grids

- 10.3.2.2 Fault detection

- 10.3.2.3 Distributed energy management

- 10.3.2.4 Energy optimization

- 10.3.2.5 Pipeline optimization

- 10.4 SOFTWARE & IT SERVICES

- 10.4.1 DELIVERING COMPREHENSIVE EDGE SOFTWARE AND IT SERVICE SOLUTIONS GLOBALLY

- 10.4.2 SOFTWARE & IT SERVICES: USE CASES

- 10.4.2.1 Infrastructure as Code (IaC) and edge orchestration

- 10.4.2.2 Low-latency content delivery & caching

- 10.4.2.3 Edge-based DevOps & CI/CD

- 10.4.2.4 Edge-based disaster recovery & failover

- 10.5 TELECOMMUNICATIONS

- 10.5.1 EDGE COMPUTING HELPS TELECOM PROVIDERS EXPAND NETWORK REACH WITH LOWER LATENCY

- 10.5.2 TELECOMMUNICATIONS: USE CASES

- 10.5.2.1 Network optimization

- 10.5.2.2 Mobile edge computing (MEC)

- 10.5.2.3 Content delivery networks (CDNs)

- 10.5.2.4 Network slicing

- 10.5.2.5 Edge caching

- 10.6 AUTOMOTIVE

- 10.6.1 DRIVING REAL-TIME INTELLIGENCE FOR SAFE, CONNECTED, AND AUTONOMOUS VEHICLES

- 10.6.2 AUTOMOTIVE: USE CASES

- 10.6.2.1 Autonomous driving and advanced driver assistance (ADAS)

- 10.6.2.2 Vehicle-to-everything (V2X) communication and smart mobility

- 10.6.2.3 In-vehicle infotainment and personalized experiences

- 10.7 MEDIA & ENTERTAINMENT

- 10.7.1 EDGE COMPUTING PROVIDES INSTANTANEOUS CONNECTION AND BETTER SCALABILITY FOR CONTENT CREATION AND DISTRIBUTION

- 10.7.2 MEDIA & ENTERTAINMENT: USE CASES

- 10.7.2.1 Personalized content recommendation

- 10.7.2.2 Real-time video streaming

- 10.7.2.3 Edge-based gaming

- 10.7.2.4 Virtual production

- 10.7.2.5 Interactive live events

- 10.8 RETAIL & CONSUMER GOODS

- 10.8.1 EDGE COMPUTING LEVERAGES NEW TECHNOLOGIES TO GATHER INSIGHTS ON PURCHASING PREFERENCES OF CONSUMERS

- 10.8.2 RETAIL & CONSUMER GOODS: USE CASES

- 10.8.2.1 Real-time inventory management

- 10.8.2.2 Personalized marketing

- 10.8.2.3 In-store analytics

- 10.8.2.4 Smart checkout

- 10.8.2.5 Dynamic pricing

- 10.9 TRANSPORTATION & LOGISTICS

- 10.9.1 EDGE COMPUTING REDUCES DATA SHARING AND LATENCY, FACILITATING EFFECTIVE AND EFFICIENT CONNECTION WITH DEVICES AND SENSORS IN VEHICLES AND DATABASES

- 10.9.2 TRANSPORTATION & LOGISTICS: USE CASES

- 10.9.2.1 Fleet management

- 10.9.2.2 Route optimization

- 10.9.2.3 Real-time cargo monitoring

- 10.9.2.4 Warehouse automation

- 10.10 HEALTHCARE & LIFE SCIENCES

- 10.10.1 IOT AND SMART WEARABLE EDGE DEVICES RECORD REAL-TIME VITAL INFORMATION

- 10.10.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.10.2.1 Remote patient monitoring

- 10.10.2.2 Smart hospitals

- 10.10.2.3 Secure data processing

- 10.10.2.4 Wearable health devices

- 10.10.2.5 Genomic analysis at the edge

- 10.11 OTHER VERTICALS

11 EDGE COMPUTING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: EDGE COMPUTING MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Higher adoption of edge computing solutions and associated services (professional, managed) to drive US market

- 11.2.4 CANADA

- 11.2.4.1 Enhanced data security and operational efficiency achieved by practicing edge computing software and services

- 11.3 EUROPE

- 11.3.1 EUROPE: EDGE COMPUTING MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Real-time data processing by companies to drive market in UK

- 11.3.4 GERMANY

- 11.3.4.1 Strong emphasis on Industry 4.0 and digital transformation initiatives taken to propel market

- 11.3.5 FRANCE

- 11.3.5.1 Real-time data processing and analytics, and personalized customer experiences to drive the French market

- 11.3.6 ITALY

- 11.3.6.1 Presence of key edge computing vendors with plans to implement smart cities and industrial automation to leverage market proliferation

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: EDGE COMPUTING MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Rapid proliferation and surge in adoption of edge computing solutions to drive Chinese market

- 11.4.4 JAPAN

- 11.4.4.1 Fusion of technologies such as AI & robotics with edge computing to propel market growth

- 11.4.5 AUSTRALIA & NEW ZEALAND (ANZ)

- 11.4.5.1 Extensive adoption of edge computing products to leverage market proliferation in ANZ, increasing agility in application deployment

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL (GCC)

- 11.5.3.1 kingdom of Saudi Arabia

- 11.5.3.1.1 Fueling Vision 2030 goals using edge computing software and services to drive market adoption

- 11.5.3.2 United Arab Emirates (UAE)

- 11.5.3.2.1 Edge computing products to leverage data-driven insights to gain competitive advantage for UAE businesses

- 11.5.3.3 Other GCC Countries

- 11.5.3.1 kingdom of Saudi Arabia

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Edge computing software solves challenges such as lower latency, bandwidth, and data sovereignty

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: EDGE COMPUTING MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Innovative edge computing practices across agriculture, healthcare, and urban infrastructure to fuel market growth

- 11.6.4 MEXICO

- 11.6.4.1 Comprehensive edge computing solutions designed to meet diverse needs of Mexican enterprises to drive market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 PRODUCT/BRAND COMPARISON

- 12.4.1 HEWLETT-PACKARD ENTERPRISE (HPE)

- 12.4.2 AMAZON WEB SERVICES (AWS)

- 12.4.3 DELL TECHNOLOGIES

- 12.4.4 CISCO

- 12.4.5 MICROSOFT

- 12.5 REVENUE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION OF KEY VENDORS

- 12.8.2 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 DELL TECHNOLOGIES

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 AWS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 MICROSOFT

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 CISCO

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 HPE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.4 Deals

- 13.2.5.5 MnM view

- 13.2.5.5.1 Right to win

- 13.2.5.5.2 Strategic choices

- 13.2.5.5.3 Weaknesses and competitive threats

- 13.2.6 IBM

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.7 GOOGLE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.8 NVIDIA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.9 INTEL

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.10 HUAWEI

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.1 DELL TECHNOLOGIES

- 13.3 OTHER COMPANIES

- 13.3.1 NOKIA

- 13.3.2 VMWARE

- 13.3.3 FASTLY

- 13.3.4 ADLINK

- 13.3.5 ORACLE

- 13.3.6 SEMTECH

- 13.3.7 MOXA

- 13.3.8 BELDEN

- 13.3.9 GE DIGITAL

- 13.3.10 DIGI INTERNATIONAL

- 13.3.11 LITMUS AUTOMATION

- 13.3.12 ZEDEDA

- 13.3.13 CLEARBLADE

- 13.3.14 VAPOR IO

- 13.3.15 SIXSQ

- 13.3.16 EDGEWORX

- 13.3.17 SUNLIGHT.IO

- 13.3.18 SAGUNA NETWORKS

- 13.3.19 ALEF EDGE

- 13.3.20 MUTABLE 326 13.3.21 ZTE CORPORATION

- 13.3.22 ADVANTECH CO., LTD.

- 13.3.23 LENOVO GROUP LTD

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 CLOUD COMPUTING MARKET

- 14.3 EDGE AI SOFTWARE MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS