|

시장보고서

상품코드

1783249

항공우주용 복합재료 시장 예측(-2030년) : 섬유 유형별, 매트릭스 유형별, 제조 프로세스별, 항공기 유형별, 용도별, 지역별Aerospace Composites Market by Fiber Type, Matrix Type, Manufacturing Process, Aircraft Type, Applications & Region - Forecast to 2030 |

||||||

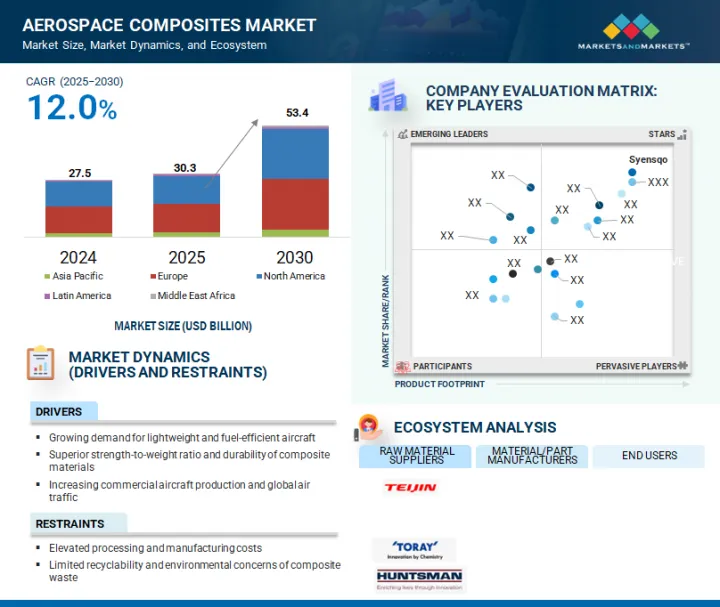

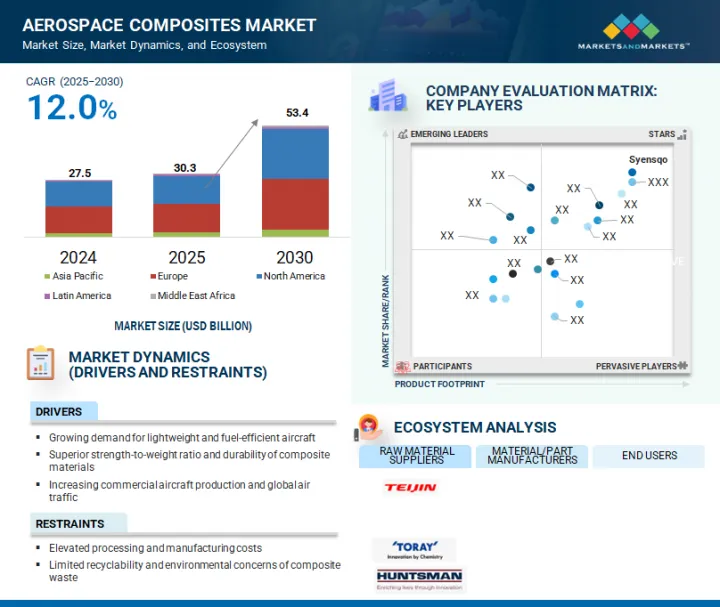

항공우주용 복합재료 시장 규모는 2025년에 303억 달러로 추정되며, 2025-2030년의 CAGR은 12.0%로 전망되고 있으며, 2030년에는 534억 달러에 달할 것으로 예측됩니다.

세라믹 섬유 복합재료는 세라믹 매트릭스에 내장된 세라믹 섬유로 만들어져 뛰어난 내열성, 저밀도, 높은 기계적 강도를 제공하며, 터빈 블레이드, 엔진 부품, 열 차폐 등 중요한 항공우주 용도에 이상적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액( 100만 달러/10억 달러), 킬로톤 |

| 부문별 | 섬유 유형별, 매트릭스 유형별, 제조 프로세스별, 항공기 유형별, 용도별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

항공기 및 우주 개발 분야에서 경량화 및 고성능 소재에 대한 수요가 증가함에 따라 CVI 및 PIP와 같은 제조 공정의 발전은 업계 전반에 걸쳐 세라믹 섬유 복합재료의 채택을 더욱 촉진하고 있습니다.

항공우주 산업은 뛰어난 성능 특성으로 인해 폴리머 매트릭스 복합재료(PMC)의 성장의 주요 원동력이 되고 있습니다. PMC는 기존 금속을 대체할 수 있는 가볍고 견고한 대체 소재를 제공하여 항공기의 연비를 크게 개선하고 배기가스 배출을 줄입니다. 높은 강도 대 중량비, 우수한 강성, 우수한 피로 저항성으로 동체 부분, 날개 어셈블리, 내부 패널 등 연속적인 응력을 받는 구조 부품에 적합합니다. 기계적 장점 외에도 PMC는 내식성이 우수하고 복잡한 형상으로 쉽게 성형할 수 있으며, 설계 유연성과 부품의 통합성이 향상됩니다. 수지 시스템 및 아웃 오브 오토클레이브(OOA) 경화 및 자동 섬유 배치(AFP)와 같은 가공 기술의 발전으로 PMC는 민간 및 군용 항공우주 플랫폼에서 점점 더 많이 채택되고 있으며, 성능, 비용 효율성 및 지속가능성을 추구하는 산업을 지원하고 있습니다.

2024년, 레이업 제조 공정 부문은 항공우주 복합재료 시장에서 금액 기준으로 3번째로 큰 비중을 차지할 것으로 예측됩니다. 이 전통적인 제조 방법은 복잡한 형상을 만들 수 있고 다양한 섬유 방향과 재료에 대응할 수 있는 다용도한 특성으로 인해 항공우주 산업에서 널리 사용되고 있습니다. 이 공정은 탄소섬유, 유리섬유 등 섬유강화재 층을 수동 또는 반자동으로 금형에 배치한 후 수지를 도포하여 경화시키는 공정입니다. 레이업은 페어링, 패널, 인테리어 부품과 같은 대형, 소량 생산, 맞춤형 복합 부품 제조에 특히 효과적입니다. 최근 자동화, 금형 및 경화 기술의 개선으로 레이업 공정의 일관성, 효율성 및 품질이 향상되어 정밀도와 성능이 중요한 최신 항공기 프로그램에서도 관련성이 확대되고 있습니다.

유럽에서 항공우주용 복합재료에 대한 수요 증가는 고성능 소재 연구개발에 대한 투자 증가, 우주개발 계획에 대한 정부 및 민간 지출 증가 등 몇 가지 중요한 요인에 의해 이루어지고 있습니다. 또한 지역 관광 및 항공 여행 산업의 확대로 민간 항공기 생산이 증가하면서 복합재 수요를 더욱 촉진하고 있습니다. 유럽은 또한 Airbus, Rolls-Royce, Dassault Aviation과 같은 주요 항공우주 제조업체가 존재하며, 첨단 복합재 기술에 초점을 맞춘 연구 기관 및 혁신 센터의 탄탄한 네트워크와 함께 강력한 산업 기반의 혜택을 누리고 있습니다.

Clean Sky 및 Horizon Europe과 같은 공동 프로그램은 차세대 경량 및 지속가능한 복합재료의 개발을 더욱 가속화하고 있습니다. 이러한 전략적 투자, 산업 역량, 혁신 인프라의 결합으로 유럽은 항공우주 복합소재 성장의 주요 거점으로서 입지를 굳건히 하고 있습니다.

세계의 항공우주용 복합재료 시장에 대해 조사했으며, 섬유 유형별, 매트릭스 유형별, 제조 프로세스별, 항공기 유형별, 용도별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 공급망 분석

- 에코시스템/시장 맵

- 가격 분석

- 밸류체인 분석

- 무역 분석

- 기술 분석

- 거시경제 전망

- 특허 분석

- 규제 상황

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- AI/생성형 AI가 항공우주 복합재료 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 항공우주용 복합재료 시장

제6장 항공우주용 복합재료 시장(섬유 유형별)

- 서론

- 탄소섬유 복합재료

- 세라믹 파이버 복합재료

- 유리섬유 복합재료

- 기타

제7장 항공우주용 복합재료 시장(매트릭스 유형별)

- 서론

- 폴리머

- 세라믹

- 금속

제8장 항공우주용 복합재료 시장(제조 프로세스별)

- 서론

- AFP/ATL

- 레이 업

- 수지 트랜스퍼 성형

- 필라멘트 와인딩

- 기타

제9장 항공우주 복합재료 시장(항공기 유형별)

- 서론

- 민간 항공기

- 비즈니스 및 일반 항공

- 민간 헬리콥터

- 군용기

- 기타

제10장 항공우주용 복합재료 시장(용도별)

- 서론

- 외장

- 내장

제11장 항공우주용 복합재료 시장(지역별)

- 서론

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점, 2019-2025년

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교 분석

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 항공우주 복합재 벤더의 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 주요 참여 기업

- HEXCEL CORPORATION

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED

- SGL CARBON

- MITSUBISHI CHEMICAL GROUP CORPORATION

- LEE AEROSPACE

- COLLINS AEROSPACE

- SPIRIT AEROSYSTEMS, INC.

- SYENSQO

- MATERION CORPORATION

- AVIOR PRODUITS INTEGRES INC.

- GENERAL DYNAMICS CORPORATION

- 3M

- AERNNOVA AEROSPACE, S.A.

- FDC COMPOSITES INC.

- 기타 기업

- ARRIS COMPOSITES, INC.

- NORTHROP GRUMMAN

- ABSOLUTE COMPOSITES

- GKN AEROSPACE

- SEKISUI AEROSPACE

- ACP COMPOSITES, INC.

- VX AEROSPACE

- PIRAN ADVANCED COMPOSITES

- GODREJ ENTERPRISES

- KINECO KAMAN COMPOSITES INDIA

제14장 부록

KSA 25.08.12The aerospace composites market is estimated at USD 30.3 billion in 2025 and is projected to reach USD 53.4 billion by 2030, at a CAGR of 12.0% from 2025 to 2030. Ceramic fiber composites, made from ceramic fibers embedded in a ceramic matrix, offer exceptional temperature resistance, low density, and high mechanical strength, making them ideal for critical aerospace applications such as turbine blades, engine components, and heat shields.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | By Fiber Type, By Matrix Type, By Manufacturing Process, By Aircraft Type, By Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

As demand rises for lightweight, high-performance materials in aviation and space exploration, advancements in manufacturing processes like CVI and PIP are further driving the adoption of ceramic fiber composites across the industry.

"Polymer matrix composites accounted for the largest share of the overall aerospace composites market in terms of value."

The aerospace industry is a key driver of growth for polymer matrix composites (PMCs), owing to their outstanding performance characteristics. PMCs provide a lightweight yet strong alternative to conventional metals, significantly improving fuel efficiency and reducing emissions in aircraft. Their high strength-to-weight ratio, excellent stiffness, and superior fatigue resistance make them ideal for structural components subjected to continuous stress, such as fuselage sections, wing assemblies, and interior panels. In addition to their mechanical advantages, PMCs offer excellent corrosion resistance and can be easily molded into complex geometries, allowing for greater design flexibility and parts integration. With advancements in resin systems and processing techniques such as out-of-autoclave (OOA) curing and automated fiber placement (AFP), PMCs are increasingly being adopted in both commercial and military aerospace platforms, supporting the industry's push for performance, cost-efficiency, and sustainability.

"The lay-up manufacturing process segment held the third-largest share of the overall aerospace composites market in terms of value."

In 2024, the lay-up manufacturing process segment held the third-largest share of the aerospace composites market in terms of value. This traditional fabrication method remains widely used in the aerospace industry due to its versatility in creating complex geometries and accommodating different fiber orientations and materials. The process involves manually or semi-automatically placing layers of fiber reinforcement, such as carbon or glass fiber, into a mold, followed by resin application and curing. Lay-up is particularly effective for producing large, low-volume, and custom composite parts such as fairings, panels, and interior components. Recent improvements in automation, tooling, and curing techniques have enhanced the consistency, efficiency, and quality of lay-up processes, extending their relevance even in modern aircraft programs where precision and performance are critical.

"Europe is projected to remain the largest market for aerospace composites during the forecast period."

The growing demand for aerospace composites in Europe is driven by several key factors, including increased investment in high-performance material R&D and rising government and private spending on space exploration initiatives. Additionally, the expansion of the regional tourism and air travel industry is prompting higher production of commercial aircraft, further fueling composite demand. Europe also benefits from a strong industrial base, with the presence of leading aerospace manufacturers such as Airbus, Rolls-Royce, and Dassault Aviation, alongside a robust network of research institutions and innovation centers focused on advanced composite technologies.

Collaborative programs like Clean Sky and Horizon Europe are further accelerating the development of next-generation, lightweight, and sustainable composite materials. This combination of strategic investment, industrial capability, and innovation infrastructure continues to position Europe as a leading hub for aerospace composites growth.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation - C Level - 50%, Director Level - 30%, and Others - 20%

- By Region - North America - 15%, Europe - 50%, Asia Pacific - 20%, Middle East & Africa (MEA) -5%, Latin America - 10%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Syensqo (Belgium), Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Carbon (Germany), Spirit AeroSystems (US), Materion Corporation (US), Lee Aerospace (US), General Dynamics Corporation (US), 3M (US), FDC Composites Inc. (Canada), Avior Produits Integres Inc. (Canada), Collins Aerospace (US), and Aernnova Aerospace S.A. (Spain).

Research Coverage

This research report categorizes the Aerospace Composites Market by Fiber Type (Glass Fiber, Carbon Fiber, Ceramic Fiber and Others), by Matrix Type (Polymer Matrix Composite, Metal Matrix Composite, Ceramic Matrix Composite), by Manufacturing Process (AFP/ATL, Lay-up, Resin Transfer Molding, Filament Winding, Others), by Aircraft Type (Commercial, Business & General, Civil Helicopter, Military Aircraft, Others), Application (Interior, Exterior) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the aerospace composites market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers & acquisitions, and recent developments in the aerospace composites market are all covered. This report includes a competitive analysis of upcoming startups in the aerospace composites market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aerospace composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Superior performance properties of composites and rising global demand for commercial and defense aircraft), restraints (Limited recyclability of composites and global trade disruptions), opportunities (Declining carbon fiber costs, advanced design software, and growing demand for fuel-efficient commercial aircraft), and challenges (Supply chain disruptions, production scalability issues, and liquidity constraints for smaller players) influencing the growth of the aerospace composites market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aerospace composites market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aerospace composites market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aerospace composites market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Syensqo (Belgium), Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Carbon (Germany), Spirit AeroSystems (US), Materion Corporation (US), Lee Aerospace (US), General Dynamics Corporation (US), 3M (US), FDC Composites Inc. (Canada), Avior Produits Integres Inc. (Canada), Collins Aerospace (US), and Aernnova Aerospace S.A. (Spain), among others, in the aerospace composites market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 FORECAST NUMBER CALCULATION

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AEROSPACE COMPOSITES MARKET

- 4.2 AEROSPACE COMPOSITES MARKET, BY FIBER TYPE AND REGION, 2024

- 4.3 AEROSPACE COMPOSITES MARKET, BY MATRIX TYPE

- 4.4 AEROSPACE COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 4.5 AEROSPACE COMPOSITES MARKET, BY APPLICATION

- 4.6 AEROSPACE COMPOSITES MARKET, BY AIRCRAFT TYPE

- 4.7 AEROSPACE COMPOSITES MARKET, BY KEY COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for new generation fuel-efficient air fleet

- 5.2.1.2 Rising demand for structural and performance-driven advanced composites in aerospace applications

- 5.2.1.3 High demand for lightweight composites from aerospace manufacturers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Surge in tariff due to global trade war

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Reduction in cost of carbon fibers

- 5.2.3.2 Development of advanced software tools for aerospace composites

- 5.2.3.3 Increased demand for commercial aircraft

- 5.2.4 CHALLENGES

- 5.2.4.1 Recycling of composite materials

- 5.2.4.2 Liquidity crunch plaguing airlines

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL

- 5.5.2 MANUFACTURING PROCESS

- 5.5.3 FINAL PRODUCT

- 5.6 ECOSYSTEM/MARKET MAP

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- 5.7.2 AVERAGE SELLING PRICE TREND

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 7019)

- 5.9.2 IMPORT SCENARIO (HS CODE 7019)

- 5.9.3 EXPORT SCENARIO (HS CODE 681511)

- 5.9.4 IMPORT SCENARIO (HS CODE 681511)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Additive manufacturing and robotics

- 5.10.1.2 Traditional molding

- 5.10.1.3 Automated lay-up

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Advanced placed ply

- 5.10.1 KEY TECHNOLOGIES

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 INTRODUCTION

- 5.11.2 GDP TRENDS AND FORECAST

- 5.11.3 TRENDS IN GLOBAL AEROSPACE INDUSTRY

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPES

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- 5.12.8 PATENTS BY BOEING

- 5.12.9 PATENTS BY AIRBUS OPERATIONS GMBH

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1: VELOCITY COMPOSITES EXPANDS INTO US MARKET AND SUPPORTS GKN AEROSTRUCTURES

- 5.15.2 CASE STUDY 2: GKN AEROSPACE AND GE AEROSPACE EXTEND PARTNERSHIP FOR AEROENGINE DEVELOPMENT AND PRODUCTION

- 5.15.3 CASE STUDY 3: HEXCEL INTRODUCES LATEST HEXTOW CARBON FIBER INNOVATION

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF AI/GEN AI ON AEROSPACE COMPOSITES MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.2 CASE STUDIES OF AI IMPLEMENTATION IN AEROSPACE COMPOSITES MARKET

- 5.19 IMPACT OF 2025 US TARIFF - AEROSPACE COMPOSITES MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRIES/REGIONS

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 AEROSPACE COMPOSITES MARKET, BY FIBER TYPE

- 6.1 INTRODUCTION

- 6.2 CARBON FIBER COMPOSITES

- 6.2.1 DECREASING COST OF AEROSPACE-GRADE CARBON FIBERS TO DRIVE MARKET

- 6.3 CERAMIC FIBER COMPOSITES

- 6.3.1 NEED FOR HIGH-TEMPERATURE RESISTANCE AND WEIGHT REDUCTION TO DRIVE MARKET

- 6.4 GLASS FIBER COMPOSITES

- 6.4.1 NON-FLAMMABILITY AND CORROSION RESISTANCE TO BOOST DEMAND

- 6.5 OTHER FIBER TYPES

7 AEROSPACE COMPOSITES MARKET, BY MATRIX TYPE

- 7.1 INTRODUCTION

- 7.2 POLYMER MATRIX

- 7.2.1 WIDE APPLICATION IN AIRCRAFT STRUCTURAL COMPONENTS AND ENGINE PARTS TO DRIVE MARKET

- 7.2.2 THERMOSET POLYMER MATRIX

- 7.2.2.1 Epoxy

- 7.2.2.2 Phenolic

- 7.2.2.3 Polyamide

- 7.2.2.4 Others

- 7.2.3 THERMOPLASTIC POLYMER MATRIX

- 7.2.3.1 PEEK

- 7.2.3.2 PEI

- 7.2.3.3 Others

- 7.3 CERAMIC MATRIX

- 7.3.1 INCREASING DEMAND FOR ENGINE COMPONENTS TO DRIVE MARKET

- 7.4 METAL MATRIX

- 7.4.1 HIGH STRENGTH AND STIFFNESS OF METALS TO BOOST DEMAND

8 AEROSPACE COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 AFP/ATL

- 8.2.1 NEED FOR PRECISION, SPEED, AND MATERIAL EFFICIENCY IN AEROSPACE COMPOSITES TO DRIVE MARKET

- 8.3 LAY-UP

- 8.3.1 EASY OPERATION AND COST-EFFECTIVENESS TO BOOST MARKET

- 8.4 RESIN TRANSFER MOLDING

- 8.4.1 INCREASING DEMAND IN PRODUCTION OF COMPOSITE FIBERGLASS TO DRIVE MARKET

- 8.5 FILAMENT WINDING

- 8.5.1 RISING USE IN SATELLITES AND ROCKET MOTOR CASES TO BOOST MARKET

- 8.6 OTHER MANUFACTURING PROCESSES

9 AEROSPACE COMPOSITES MARKET, BY AIRCRAFT TYPE

- 9.1 INTRODUCTION

- 9.2 COMMERCIAL AIRCRAFT

- 9.2.1 INCREASING DEMAND FOR NEW AIRPLANES TO DRIVE MARKET

- 9.2.2 SINGLE-AISLE AIRCRAFT

- 9.2.3 WIDE-BODY AIRCRAFT

- 9.2.4 REGIONAL JETS

- 9.3 BUSINESS & GENERAL AVIATION

- 9.3.1 SURGING DEMAND FOR COMPOSITES IN BUSINESS JETS TO BOOST MARKET

- 9.3.2 BUSINESS JETS

- 9.3.3 PISTON & TURBOPROP

- 9.4 CIVIL HELICOPTER

- 9.4.1 ADVANCE COMPOSITE INTEGRATION IN CIVIL HELICOPTERS AMID REGULATORY AND COST CHALLENGES TO DRIVE DEMAND

- 9.5 MILITARY AIRCRAFT

- 9.5.1 PRESSING NEED FOR ENHANCED AIRCRAFT PERFORMANCE TO DRIVE DEMAND FOR COMPOSITES

- 9.6 OTHER AIRCRAFT TYPES

- 9.6.1 UNMANNED AERIAL VEHICLE (UAV)

- 9.6.2 SPACECRAFT

10 AEROSPACE COMPOSITES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 EXTERIOR

- 10.2.1 RISING DEMAND FOR COMPOSITES IN AIRCRAFT WINGS AND FUSELAGE TO BOOST MARKET

- 10.2.2 FUSELAGE

- 10.2.3 ENGINE

- 10.2.4 WINGS

- 10.2.5 ROTOR BLADES

- 10.2.6 TAIL BOOM

- 10.3 INTERIOR

- 10.3.1 INCREASING DEMAND FOR LOW-MAINTENANCE COMPOSITES IN AIRCRAFT CABINS TO BOOST MARKET

- 10.3.2 SEATS

- 10.3.3 CABIN

- 10.3.4 SANDWICH PANELS

- 10.3.5 ENVIRONMENTAL CONTROL SYSTEM (ECS) DUCTING

11 AEROSPACE COMPOSITES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY FIBER TYPE

- 11.2.2 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY MATRIX TYPE

- 11.2.3 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY MANUFACTURING PROCESS

- 11.2.4 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY AIRCRAFT TYPE

- 11.2.5 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY APPLICATION

- 11.2.6 AEROSPACE COMPOSITES MARKET SIZE IN NORTH AMERICA, BY COUNTRY

- 11.2.6.1 US

- 11.2.6.1.1 Surging demand for composites in aerospace & defense sector to drive market

- 11.2.6.2 Canada

- 11.2.6.2.1 Increasing demand for aerospace composites from prominent airplane manufacturers to drive market

- 11.2.6.1 US

- 11.3 EUROPE

- 11.3.1 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY FIBER TYPE

- 11.3.2 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY MATRIX TYPE

- 11.3.3 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY MANUFACTURING PROCESS

- 11.3.4 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY AIRCRAFT TYPE

- 11.3.5 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY APPLICATION

- 11.3.6 AEROSPACE COMPOSITES MARKET SIZE IN EUROPE, BY COUNTRY

- 11.3.6.1 Germany

- 11.3.6.1.1 High demand for carbon fiber from commercial aircraft manufacturers to boost market

- 11.3.6.2 France

- 11.3.6.2.1 Presence of strong manufacturing base to boost market

- 11.3.6.3 UK

- 11.3.6.3.1 High volume of composite exports to drive market

- 11.3.6.4 Spain

- 11.3.6.4.1 Increasing demand for lightweight and durable materials in aerospace industry to foster growth

- 11.3.6.5 Italy

- 11.3.6.5.1 Rising demand for composites in aircraft designs to drive market

- 11.3.6.6 Russia

- 11.3.6.6.1 Increased production of defense helicopters and aircraft to fuel demand for composite material

- 11.3.6.7 Rest of Europe

- 11.3.6.1 Germany

- 11.4 ASIA PACIFIC

- 11.4.1 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY FIBER TYPE

- 11.4.2 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY MATRIX TYPE

- 11.4.3 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY MANUFACTURING PROCESS

- 11.4.4 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY AIRCRAFT TYPE

- 11.4.5 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY APPLICATION

- 11.4.6 AEROSPACE COMPOSITES MARKET SIZE IN ASIA PACIFIC, BY COUNTRY

- 11.4.6.1 China

- 11.4.6.1.1 Rising demand for composites from commercial airlines to drive market

- 11.4.6.2 Japan

- 11.4.6.2.1 High demand for carbon fiber composites from OEMs to drive market

- 11.4.6.3 India

- 11.4.6.3.1 Development of economic zones and aerospace parks to foster growth

- 11.4.6.4 Malaysia

- 11.4.6.4.1 Increased penetration in aerospace industry to boost market

- 11.4.6.5 South Korea

- 11.4.6.5.1 Surging demand for lightweight aircraft parts to drive market

- 11.4.6.6 Australia

- 11.4.6.6.1 Development of domestic space industry to boost demand for aerospace composites

- 11.4.6.7 Rest of Asia Pacific

- 11.4.6.1 China

- 11.5 LATIN AMERICA

- 11.5.1 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY FIBER TYPE

- 11.5.2 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY MATRIX TYPE

- 11.5.3 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY MANUFACTURING PROCESS

- 11.5.4 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY AIRCRAFT TYPE

- 11.5.5 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY APPLICATION

- 11.5.6 AEROSPACE COMPOSITES MARKET SIZE IN LATIN AMERICA, BY COUNTRY

- 11.5.6.1 Brazil

- 11.5.6.1.1 Increasing demand for lightweight and medium-sized airplanes to boost market

- 11.5.6.2 Mexico

- 11.5.6.2.1 Duty-free access to key aerospace segments to drive market

- 11.5.6.3 Rest of Latin America

- 11.5.6.1 Brazil

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 AEROSPACE COMPOSITES MARKET SIZE IN MIDDLE EAST & AFRICA, BY FIBER TYPE

- 11.6.2 AEROSPACE COMPOSITES MARKET SIZE MIDDLE EAST & AFRICA, BY MATRIX TYPE

- 11.6.3 AEROSPACE COMPOSITES MARKET SIZE IN MIDDLE EAST & AFRICA, BY MANUFACTURING PROCESS

- 11.6.4 AEROSPACE COMPOSITES MARKET SIZE IN MIDDLE EAST & AFRICA, BY AIRCRAFT TYPE

- 11.6.5 AEROSPACE COMPOSITES MARKET SIZE IN MIDDLE EAST & AFRICA, BY APPLICATION

- 11.6.6 AEROSPACE COMPOSITES MARKET SIZE IN MIDDLE EAST & AFRICA, BY COUNTRY

- 11.6.6.1 GCC countries

- 11.6.6.1.1 UAE

- 11.6.6.1.1.1 Privatization initiatives and infrastructural developments to boost market

- 11.6.6.1.2 Rest of GCC countries

- 11.6.6.1.1 UAE

- 11.6.6.2 Israel

- 11.6.6.2.1 Strong base of established manufacturing companies to drive market

- 11.6.6.3 South Africa

- 11.6.6.3.1 Local and international investments to boost market

- 11.6.6.4 Rest of Middle East & Africa

- 11.6.6.1 GCC countries

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2025

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Fiber type footprint

- 12.6.5.4 Matrix type footprint

- 12.6.5.5 Aircraft type footprint

- 12.6.5.6 Application footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 VALUATION AND FINANCIAL METRICS OF AEROSPACE COMPOSITE VENDORS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILE

- 13.1 KEY PLAYERS

- 13.1.1 HEXCEL CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 TORAY INDUSTRIES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 TEIJIN LIMITED

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SGL CARBON

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 LEE AEROSPACE

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 COLLINS AEROSPACE

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 SPIRIT AEROSYSTEMS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.3.3 Other developments

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 SYENSQO

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 MATERION CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 AVIOR PRODUITS INTEGRES INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.4 MnM view

- 13.1.11.4.1 Right to win

- 13.1.11.4.2 Strategic choices

- 13.1.11.4.3 Weaknesses and competitive threats

- 13.1.12 GENERAL DYNAMICS CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Other developments

- 13.1.12.4 MnM view

- 13.1.12.4.1 Right to win

- 13.1.12.4.2 Strategic choices

- 13.1.12.4.3 Weaknesses and competitive threats

- 13.1.13 3M

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 MnM view

- 13.1.13.3.1 Right to win

- 13.1.13.3.2 Strategic choices

- 13.1.13.3.3 Weaknesses and competitive threats

- 13.1.14 AERNNOVA AEROSPACE, S.A.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.4 MnM view

- 13.1.14.4.1 Right to win

- 13.1.14.4.2 Strategic choices

- 13.1.14.4.3 Weaknesses and competitive threats

- 13.1.15 FDC COMPOSITES INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 MnM view

- 13.1.15.3.1 Right to win

- 13.1.15.3.2 Strategic choices

- 13.1.15.3.3 Weaknesses and competitive threats

- 13.1.1 HEXCEL CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 ARRIS COMPOSITES, INC.

- 13.2.2 NORTHROP GRUMMAN

- 13.2.3 ABSOLUTE COMPOSITES

- 13.2.4 GKN AEROSPACE

- 13.2.5 SEKISUI AEROSPACE

- 13.2.6 ACP COMPOSITES, INC.

- 13.2.7 VX AEROSPACE

- 13.2.8 PIRAN ADVANCED COMPOSITES

- 13.2.9 GODREJ ENTERPRISES

- 13.2.10 KINECO KAMAN COMPOSITES INDIA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS