|

시장보고서

상품코드

1816000

HVAC 시스템 시장 : 냉방별, 난방별, 환기별, 기술별, 서비스별 - 예측(-2030년)HVAC System Market by Cooling, Heating, Ventilation, Technology, Service - Global Forecast to 2030 |

||||||

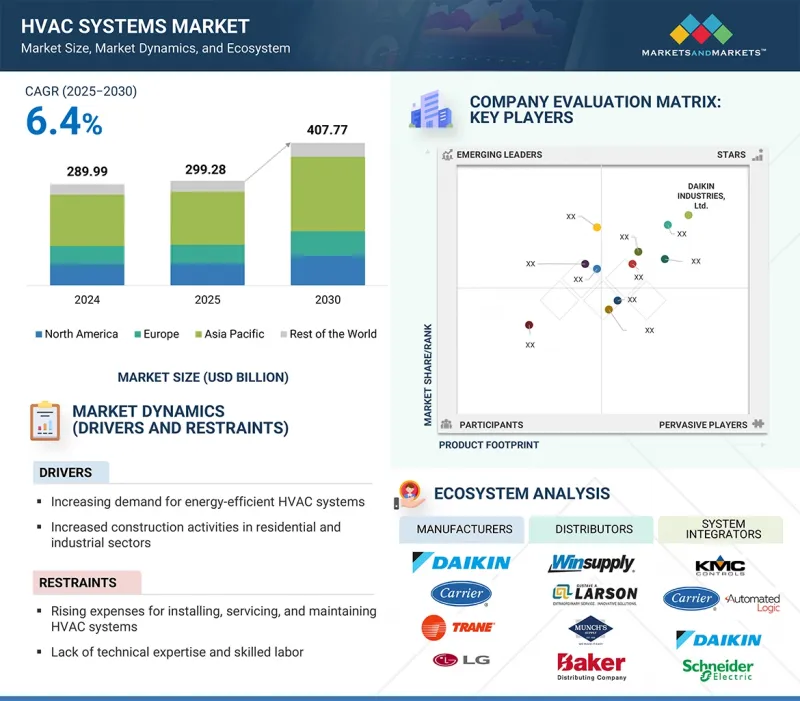

세계의 HVAC 시스템 시장 규모는 2025년 2,992억 8,000만 달러에서 2030년까지 4,077억 7,000만 달러에 이를 것으로 예측되며, 2025년-2030년에 CAGR은 6.4%를 보일 전망입니다.

HVAC 산업은 최근 몇 년 동안 괄목할만한 발전을 보여 왔으며, 혁신적인 HVAC 시스템에 대한 수요가 급증하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 난방 기기, 냉방 기기, 환기 기기, 기술, 도입 유형, 서비스 유형, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

에너지 효율에 대한 요구 증가, 실내 공기질 개선, 보다 스마트하고 연결성이 높은 시스템에 대한 요구 등 여러 요인이 이러한 발전을 촉진하고 있습니다. 스마트 HVAC 시스템은 센서와 고급 알고리즘을 사용하여 실내 및 실외 상태를 모니터링하고, 실시간으로 시스템 설정을 조정하고, 에너지 사용 및 시스템 성능에 대한 자세한 분석을 사용자에게 제공합니다.

"신축 건물 부문이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것입니다. "

정부의 참여는 HVAC 시장에서 매우 중요합니다. 정부의 참여는 규제 준수를 시행하는 동시에 도시화를 지원하기 위해 HVAC 시스템 채택을 장려하고 있기 때문입니다. 고효율 HVAC 장비의 보급, VRF 시스템 도입, 스마트 온도 조절기와 빌딩 자동화 제어의 통합, 첨단 공기 여과, 재생 에너지로 구동되는 냉난방 도입 등 에너지 효율과 친환경 건축법이 강조되면서 미국의 건물에 대한 에너지 효율 요건을 규정하는 ASHRAE Standard 90.1에 대한 에너지 효율 요건을 규정한 ASHRAE Standard 90.1과 같은 기준이 강화되고 있습니다.

"에어핸들링 유닛 부문은 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

공기처리장치(AHU) 부문은 실내 공기질 개선, 에너지 효율적인 환기, 엄격한 공기질 기준 준수에 대한 수요 증가로 인해 전체 HVAC 시스템 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 상업 공간 및 의료시설의 건설 증가는 효과적인 공기 분배 및 여과에 사용되는 AHU의 채택을 더욱 촉진할 것입니다.

"중국이 2025년 아시아태평양 HVAC 시스템 시장에서 가장 큰 점유율을 차지할 것으로 추정됩니다. "

중국은 아시아태평양에서 가장 큰 HVAC 시스템 시장입니다. 이 시장은 급속한 도시화, 대규모 인프라 및 주택 건설 프로젝트, 현대적 편의 솔루션을 찾는 중산층 인구 증가에 의해 주도되고 있습니다. 에너지 효율이 높은 기술을 장려하는 정부의 지원 정책, 기온 상승과 공조 시스템 채택 증가는 중국 HVAC 시장의 강력한 성장을 더욱 촉진하고 있습니다.

세계의 HVAC 시스템 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- HVAC 시스템(기기+서비스) 시장의 매력적인 기회

- 북미의 HVAC 시스템 시장 : 국가별, 기기 유형별

- 상업용 HVAC 시스템 시장 : 유형별

- HVAC 시스템 시장 : 지역별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- HVAC 시스템 기기 평균 판매 가격 : 주요 최종사용자별

- HVAC 시스템 기기 평균 판매 가격 동향 : 지역별

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- ERIKS, LG ELECTRONICS과 함께 AI-Druven VRF 솔루션으로 에너지 효율을 향상

- MITSUBISHI ELECTRIC CORPORATION, 도시형 멀티 VRF 지역설정계획 시스템, 히트펌프 급탕 시스템 'HEAT2O', 통합 제어 시스템을 개발

- TOWNSEND ENERGY의 AC 커패시터 교환

- NETR의 보조 냉난방용 덕트리스 미니 스플릿 시스템 설치

- DAIKIN의 철도 제어 시스템용 온도 제어 솔루션

- 복수 LG 고정압 덕트식 싱글 존 유닛이 남조지아주 대형 오픈 창고에서 연간 균일한 온도를 제공

- 투자 및 자금조달 시나리오

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 특허 분석

- 주요 컨퍼런스 및 이벤트

- 규제 상황

- 규제기관, 정부기관 및 기타 조직

- 기준과 규제

- HVAC 시스템 시장에 대한 생성형 AI의 영향

- HVAC 시스템 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 HVAC 시스템 시장 : 냉방 기기별

- 서론

- 단일형 에어컨

- VRF 시스템

- 칠러

- 룸 에어컨

- 쿨러

- 냉각탑

제7장 HVAC 시스템 시장 : 난방 기기별

- 서론

- 히트펌프

- 난로

- 단일형 히터

- 보일러

제8장 HVAC 시스템 시장 : 환기 기기별

- 서론

- 에어 핸들링 유닛

- 에어 필터

- 제습기

- 환기팬

- 가습기

- 공기청정기

제9장 HVAC 시스템 시장 : 기술별

- 서론

- 기존 HVAC 시스템

- 스마트 HVAC 시스템

- 지속가능한/그린 HVAC 시스템

제10장 HVAC 시스템 시장 : 도입 유형별

- 서론

- 신축 건물

- 개보수 건물

제11장 HVAC 시스템 시장 : 서비스 유형별

- 서론

- 설치 서비스

- 유지관리 및 수리 서비스

- 업그레이드 및 교체 서비스

- 컨설팅 서비스

제12장 HVAC 시스템 시장 : 최종사용자별

- 서론

- 상업

- 주택

- 산업

제13장 HVAC 시스템 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 폴란드

- 북유럽

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 남미

- 중동

- 아프리카

제14장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2022년 6월-2025년 7월

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표(2024년)

- 브랜드/제품 비교

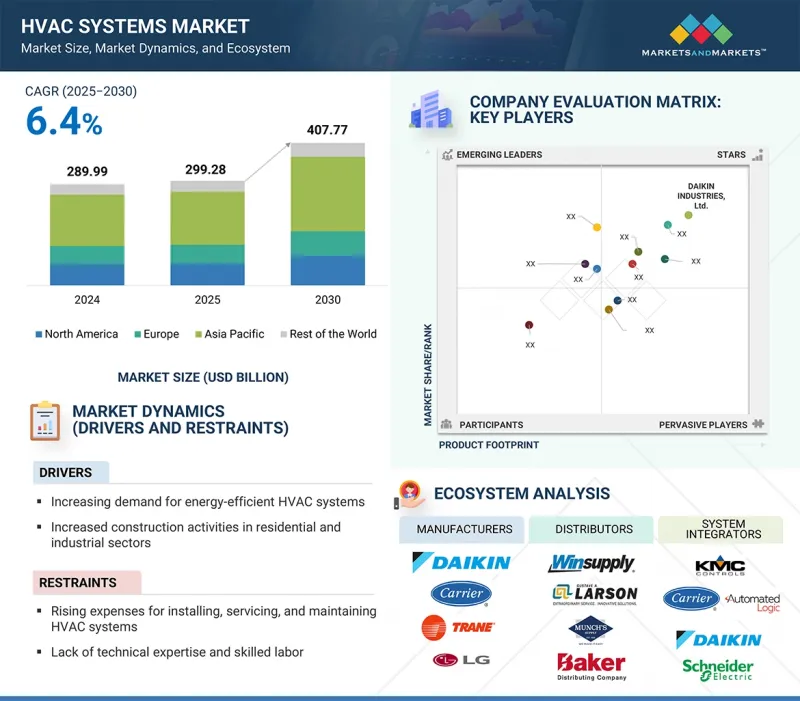

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제15장 기업 개요

- 주요 기업

- CARRIER

- DAIKIN INDUSTRIES, LTD.

- LG ELECTRONICS

- MIDEA

- TRANE TECHNOLOGIES PLC

- LENNOX INTERNATIONAL INC.

- JOHNSON CONTROLS

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- SAMSUNG

- GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI

- FUJITSU GENERAL

- PANASONIC HOLDINGS CORPORATION

- ROBERT BOSCH GMBH

- MODINE

- 기타 기업

- HAIER GROUP

- SYSTEMAIR AB

- AAON

- WHIRLPOOL CORPORATION

- ELECTROLUX

- FERROLI

- VAILLANT GROUP

- RHEEM MANUFACTURING COMPANY

- AMERICAN STANDARD HEATING AND AIR CONDITIONING

- WM TECHNOLOGIES LLC

제16장 부록

LSH 25.09.25The HVAC system market is projected to grow from USD 299.28 billion in 2025 to USD 407.77 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The HVAC industry has experienced significant advancements in recent years, leading to a surge in demand for innovative HVAC systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Heating Equipment, Cooling Equipment, Ventilation Equipment, Technology, Implementation Type, Service Type, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Several factors have driven these advancements, including the growing need for energy efficiency, improved indoor air quality, and the desire for smarter, more connected systems. Smart HVAC systems use sensors and advanced algorithms to monitor indoor and outdoor conditions, adjust system settings in real time, and provide users with detailed analytics on energy usage and system performance.

"The new construction buildings segment accounts for the largest market share during the forecast period."

Government involvement is pivotal in the HVAC market, as it encourages the adoption of HVAC systems to support urbanization while enforcing regulatory compliance. The growing emphasis on energy efficiency and environmentally friendly building practices, such as deployment of high-efficiency HVAC equipment, adoption of VRF systems, integration of smart thermostats and building automation controls, use of advanced air filtration, and incorporation of renewable energy-powered heating and cooling, has resulted in stricter standards, including ASHRAE Standard 90.1, which defines energy efficiency requirements for US buildings.

"The air handling unit segment is projected to register the highest CAGR during the forecast period."

The air handling unit (AHU) segment is projected to record the highest CAGR in the overall HVAC system market due to rising demand for improved indoor air quality, energy-efficient ventilation, and compliance with stricter air quality standards. Increasing construction of commercial spaces and healthcare facilities further drives the adoption of AHUs for effective air distribution and filtration.

"China is estimated to account for the largest share of the Asia Pacific HVAC system market in 2025."

China is the largest market for HVAC system in Asia Pacific. The market in the country is driven by rapid urbanization, massive infrastructure and residential construction projects, and a growing middle-class population demanding modern comfort solutions. Supportive government policies promoting energy-efficient technologies, along with rising temperatures and increased adoption of air conditioning systems, are further fueling the robust growth of China's HVAC market.

- By Company Type: Tier 1-35%, Tier 2-30%, and Tier 3-35%

- By Designation: C-level Executives-35%, D-level Executives-40%, and Others-25%

- By Region: North America-25%, Europe-35%, Asia Pacific-30%, and RoW-10%

Prominent players profiled in this report include Carrier (US), DAIKIN INDUSTRIES, Ltd. (Japan), LG Electronics (South Korea), Lennox International Inc. (US), Midea (China), Johnson Controls (Ireland), Trane Technologies plc (Ireland), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), SAMSUNG (South Korea), GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI (China), Fujitsu General (Japan), Panasonic Holdings Corporation (Japan), Robert Bosch Group (Germany), and Modine (US).

Research Coverage:

The report defines, describes, and forecasts the HVAC system market based on cooling equipment (unitary air conditioners, VRF systems, chillers, room air conditioners, coolers, and cooling towers), heating equipment (heat pumps, furnaces, boilers, and unitary heaters), ventilation equipment (air-handling units, air filters, dehumidifiers, ventilation fans, humidifiers, air purifiers), technology (traditional HVAC systems, smart HVAC systems, and sustainable/green HVAC systems), implementation type (new construction buildings, retrofit buildings), service type (installation services, maintenance & repair services, upgradation/replacement services, and consulting services), end user (commercial, residential, and industrial), and region (North America, Europe, Asia Pacific, and RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall HVAC system market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Increasing demand for energy-efficient HVAC systems), restraints (Rising expenses for installing, servicing, and maintaining HVAC systems), opportunities (Swift evolution of IoT within HVAC industry), and challenges (Lack of awareness about benefits of HVAC systems in developing countries) of the HVAC system market

- Product development /innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the HVAC system market

- Market development: Comprehensive information about lucrative markets; the report analyses the HVAC system market across various regions

- Market diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the HVAC system market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Carrier (US), DAIKIN INDUSTRIES, Ltd. (Japan), LG Electronics (South Korea), Midea (China), and Trane Technologies plc (Ireland) in the HVAC system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of major participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach for arriving at market size using bottom-up analysis

- 2.2.3 TOP-DOWN APPROACH

- 2.2.3.1 Approach for arriving at market size using top-down analysis

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 LIMITATIONS OF RESEARCH

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC SYSTEM (EQUIPMENT + SERVICE) MARKET

- 4.2 NORTH AMERICA: HVAC SYSTEM MARKET, BY COUNTRY AND EQUIPMENT TYPE

- 4.3 HVAC SYSTEM MARKET IN COMMERCIAL END USER, BY TYPE

- 4.4 HVAC SYSTEM MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for energy-efficient HVAC systems

- 5.2.1.2 Increased construction activities in residential and industrial sectors

- 5.2.1.3 Government policies and incentives promoting energy efficiency and natural resource conservation

- 5.2.1.4 Growing demand for indoor and outdoor air quality

- 5.2.1.5 Advancements in HVAC systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising expenses for installing, servicing, and maintaining HVAC systems

- 5.2.2.2 Limited space for large HVAC installations in commercial and residential buildings

- 5.2.2.3 Insufficient technical expertise and shortage of skilled labor

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Swift evolution of IoT within HVAC industry

- 5.2.3.2 Significant traction of VRF systems in residential and commercial applications

- 5.2.3.3 Growing emphasis on next-generation low-GWP refrigerants for HVAC systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness about benefits of HVAC systems in developing countries

- 5.2.4.2 Increasing environmental concerns and aging infrastructure

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF HVAC SYSTEM EQUIPMENT, BY KEY END USERS

- 5.6.2 AVERAGE SELLING PRICE TREND OF HVAC SYSTEM EQUIPMENT, BY REGION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Air conditioning units

- 5.7.1.2 Heating units

- 5.7.1.3 Ventilation systems

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Sensors

- 5.7.2.2 Building automation systems

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Software technologies

- 5.7.3.2 HVAC systems running on renewable energy

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ERIKS ADVANCES ENERGY EFFICIENCY WITH LG ELECTRONICS AI-DRIVEN VRF SOLUTION

- 5.10.2 MITSUBISHI ELECTRIC CORPORATION ADVANCES CITY MULTI VRF ZONING SYSTEMS, HEAT2O HEAT PUMP WATER HEATER SYSTEMS, AND INTEGRATED CONTROLS

- 5.10.3 AC CONDENSER REPLACEMENT BY TOWNSEND ENERGY

- 5.10.4 INSTALLATION OF DUCTLESS MINI-SPLIT SYSTEM FOR SUPPLEMENTAL HEATING AND COOLING BY NETR.

- 5.10.5 TEMPERATURE CONTROL SOLUTION FOR RAILWAY CONTROL SYSTEM BY DAIKIN

- 5.10.6 MULTIPLE LG HIGH STATIC DUCTED SINGLE-ZONE UNITS PROVIDE EVEN TEMPERATURE YEAR-ROUND IN LARGE OPEN WAREHOUSE IN SOUTH GEORGIA

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO

- 5.12.2 EXPORT SCENARIO

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS AND REGULATIONS

- 5.15.2.1 Standards

- 5.15.2.2 Regulations

- 5.16 IMPACT OF GEN AI ON HVAC SYSTEM MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFFS ON HVAC SYSTEM MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT

- 6.1 INTRODUCTION

- 6.2 UNITARY AIR CONDITIONERS

- 6.2.1 LOW INITIAL COST AND EASE OF INSTALLATION TO DRIVE DEMAND

- 6.2.2 DIFFERENCES IN AIR CONDITIONER STYLES, BY REGION

- 6.2.2.1 Split air conditioners

- 6.2.2.2 Packaged air conditioners

- 6.3 VRF SYSTEMS

- 6.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND FLEXIBLE HVAC SOLUTIONS TO DRIVE MARKET

- 6.4 CHILLERS

- 6.4.1 INCREASING INFRASTRUCTURE DEVELOPMENT AND RAPID EXPANSION OF DATA CENTERS FUELING DEMAND

- 6.4.1.1 Scroll chillers

- 6.4.1.2 Screw chillers

- 6.4.1.3 Centrifugal chillers

- 6.4.1.4 Reciprocating chillers

- 6.4.1.5 Absorption chillers

- 6.4.1 INCREASING INFRASTRUCTURE DEVELOPMENT AND RAPID EXPANSION OF DATA CENTERS FUELING DEMAND

- 6.5 ROOM AIR CONDITIONERS

- 6.5.1 INCREASING RESIDENTIAL COOLING NEEDS TO DRIVE STRONG DEMAND

- 6.6 COOLERS

- 6.6.1 DEMAND FOR LOW-COST, ENERGY-EFFICIENT, AND ECO-FRIENDLY COOLING SOLUTIONS TO FUEL GROWTH

- 6.6.1.1 Ducted coolers

- 6.6.1.2 Window coolers

- 6.6.1 DEMAND FOR LOW-COST, ENERGY-EFFICIENT, AND ECO-FRIENDLY COOLING SOLUTIONS TO FUEL GROWTH

- 6.7 COOLING TOWERS

- 6.7.1 RISING NEED FOR EFFICIENT COOLING IN INDUSTRIAL PROCESSES TO DRIVE DEMAND

- 6.7.1.1 Evaporative cooling towers

- 6.7.1.2 Dry cooling towers

- 6.7.1.3 Hybrid cooling towers

- 6.7.1 RISING NEED FOR EFFICIENT COOLING IN INDUSTRIAL PROCESSES TO DRIVE DEMAND

7 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT

- 7.1 INTRODUCTION

- 7.2 HEAT PUMPS

- 7.2.1 RISING DEMAND FOR LOW-CARBON HEATING SOLUTIONS TO PROPEL MARKET GROWTH

- 7.2.2 AIR-SOURCE HEAT PUMPS

- 7.2.2.1 Ducted

- 7.2.2.2 Ductless/Minisplit

- 7.2.3 WATER-SOURCE HEAT PUMPS

- 7.2.4 GROUND-SOURCE/GEOTHERMAL HEAT PUMPS

- 7.2.5 ADVANCED HEAT PUMP TECHNOLOGIES

- 7.2.5.1 Staged/Multi-speed compressors

- 7.2.5.2 Dual-speed motors

- 7.2.5.3 Desuperheater

- 7.2.5.4 Dual fuel/hybrid systems

- 7.2.5.5 Cold climate heat pumps

- 7.3 FURNACES

- 7.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT HEATING SOLUTIONS TO FUEL ADOPTION

- 7.3.1.1 Oil furnaces

- 7.3.1.2 Gas furnaces

- 7.3.1.3 Electric furnaces

- 7.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT HEATING SOLUTIONS TO FUEL ADOPTION

- 7.4 UNITARY HEATERS

- 7.4.1 ENERGY EFFICIENCY AND COST-EFFECTIVENESS TO BOOST DEMAND

- 7.4.1.1 Gas unit heaters

- 7.4.1.2 Oil-fired unit heaters

- 7.4.1.3 Electric unit heaters

- 7.4.1 ENERGY EFFICIENCY AND COST-EFFECTIVENESS TO BOOST DEMAND

- 7.5 BOILERS

- 7.5.1 GROWING FOCUS ON SUSTAINABILITY TO BOOST MARKET GROWTH

- 7.5.1.1 Steam boilers

- 7.5.1.2 Hot water boilers

- 7.5.1 GROWING FOCUS ON SUSTAINABILITY TO BOOST MARKET GROWTH

8 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT

- 8.1 INTRODUCTION

- 8.2 AIR-HANDLING UNITS

- 8.2.1 USE OF VARIABLE FREQUENCY DRIVES IN AIR-HANDLING UNITS FOR MOTOR SPEED CONTROL TO DRIVE DEMAND

- 8.3 AIR FILTERS

- 8.3.1 RISING DEMAND FOR CLEANER INDOOR ENVIRONMENTS TO BOOST MARKET

- 8.4 DEHUMIDIFIERS

- 8.4.1 STRINGENT GOVERNMENT REGULATIONS PROMOTING ENERGY-EFFICIENT APPLIANCES TO PROPEL MARKET GROWTH

- 8.4.1.1 Refrigeration dehumidifiers

- 8.4.1.2 Absorption dehumidifiers

- 8.4.1 STRINGENT GOVERNMENT REGULATIONS PROMOTING ENERGY-EFFICIENT APPLIANCES TO PROPEL MARKET GROWTH

- 8.5 VENTILATION FANS

- 8.5.1 INCREASING TEMPERATURES AND HUMIDITY LEVELS TO BOOST DEMAND FOR VENTILATION FANS

- 8.5.1.1 Crossflow fans

- 8.5.1.2 Axial fans

- 8.5.1.3 Centrifugal fans

- 8.5.1.4 Domestic fans

- 8.5.1.5 Range hood fans

- 8.5.1.6 Power roof fans

- 8.5.1 INCREASING TEMPERATURES AND HUMIDITY LEVELS TO BOOST DEMAND FOR VENTILATION FANS

- 8.6 HUMIDIFIERS

- 8.6.1 RISING INDOOR AIR POLLUTION AND CHANGING CLIMATE CONDITIONS TO ACCELERATE MARKET GROWTH

- 8.6.1.1 Warm-mist humidifiers

- 8.6.1.2 Ultrasonic humidifiers

- 8.6.1.3 Cool-mist humidifiers

- 8.6.1 RISING INDOOR AIR POLLUTION AND CHANGING CLIMATE CONDITIONS TO ACCELERATE MARKET GROWTH

- 8.7 AIR PURIFIERS

- 8.7.1 RISING CONCERNS OVER INDOOR AIR POLLUTION AND HEALTH SAFETY TO DRIVE MARKET

- 8.7.1.1 HEPA air purifiers

- 8.7.1.2 Activated carbon air purifiers

- 8.7.1.3 Electrostatic air purifiers

- 8.7.1.4 Ionic air purifiers

- 8.7.1 RISING CONCERNS OVER INDOOR AIR POLLUTION AND HEALTH SAFETY TO DRIVE MARKET

9 HVAC SYSTEM MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 TRADITIONAL HVAC SYSTEMS

- 9.2.1 GROWING DEMAND FOR ZONE-SPECIFIC COMFORT SOLUTIONS TO DRIVE ADOPTION

- 9.3 SMART HVAC SYSTEMS

- 9.3.1 INTEGRATION OF IOT AND ENERGY REGULATIONS TO DRIVE MARKET GROWTH

- 9.3.2 SMART HEATING & COOLING: FUTURE OUTLOOK

- 9.3.2.1 Remote monitoring & control

- 9.3.2.2 Smart zoning systems

- 9.3.2.3 Occupancy-based heating & cooling

- 9.3.2.4 Energy optimization

- 9.3.2.5 Heating & cooling system diagnostics

- 9.3.2.6 AI/ML integration

- 9.3.3 SMART VENTILATION: FUTURE OUTLOOK

- 9.3.3.1 Automated air-flow control

- 9.3.3.2 Demand-controlled ventilation

- 9.3.3.3 Integration with building automation systems

- 9.4 SUSTAINABLE/GREEN HVAC SYSTEM

- 9.4.1 INCREASING DEMAND FOR LOW-CARBON BUILDINGS TO ACCELERATE DEMAND

- 9.4.2 SUSTAINABLE HEATING SYSTEMS: FUTURE OUTLOOK

- 9.4.2.1 Solar-based heating

- 9.4.2.2 Geothermal heat pumps

- 9.4.2.3 Biomass heating systems

- 9.4.2.4 Low-emission furnaces

- 9.4.2.5 Electric heating systems

- 9.4.2.6 Hydronic heating systems

- 9.4.2.7 Dual fuel heat pump

- 9.4.3 SUSTAINABLE COOLING SYSTEMS: FUTURE OUTLOOK

- 9.4.3.1 Inverter-based air conditioning

- 9.4.3.2 Cooling using waste heat

- 9.4.3.3 VRF systems with low-GWP refrigerants

- 9.4.3.4 Solar-based cooling

- 9.4.4 SUSTAINABLE VENTILATION SYSTEMS: FUTURE OUTLOOK

- 9.4.4.1 Energy recovery ventilators

- 9.4.4.2 Low-energy DC ventilation fans

- 9.4.4.3 Eco-friendly air purifiers

- 9.4.4.4 HEPA & reusable air filters

- 9.4.4.5 Airflow optimization systems

10 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE

- 10.1 INTRODUCTION

- 10.2 NEW CONSTRUCTION BUILDINGS

- 10.2.1 GOVERNMENT INITIATIVES FOR ECO-FRIENDLY BUILDINGS TO DRIVE MARKET GROWTH

- 10.3 RETROFIT BUILDINGS

- 10.3.1 GREEN BUILDING INITIATIVE TO BOOST MARKET GROWTH

11 HVAC SYSTEM MARKET, BY SERVICE TYPE

- 11.1 INTRODUCTION

- 11.2 INSTALLATION SERVICES

- 11.2.1 RISING DEMAND FOR ENERGY-EFFICIENT SYSTEMS AND PROFESSIONAL INSTALLATION SERVICES TO DRIVE DEMAND

- 11.3 MAINTENANCE & REPAIR SERVICES

- 11.3.1 NEED FOR TIMELY MAINTENANCE AND REPAIRS TO GUARANTEE RELIABLE COMFORT AND PERFORMANCE TO DRIVE GROWTH

- 11.4 UPGRADATION/REPLACEMENT SERVICES

- 11.4.1 INCREASING NEED FOR ENERGY-EFFICIENT BUILDINGS TO PROPEL ADOPTION

- 11.5 CONSULTING SERVICES

- 11.5.1 INCREASING DEMAND FOR CUSTOMIZED HVAC DESIGN SOLUTIONS TO FUEL GROWTH

12 HVAC SYSTEM MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 COMMERCIAL

- 12.2.1 INCREASING ADOPTION OF ENERGY-EFFICIENT EQUIPMENT TO ACCELERATE GROWTH

- 12.2.1.1 Offices

- 12.2.1.2 Government buildings

- 12.2.1.3 Healthcare

- 12.2.1.4 Education

- 12.2.1.5 Retail

- 12.2.1.6 Airports

- 12.2.1.7 Data centers

- 12.2.1 INCREASING ADOPTION OF ENERGY-EFFICIENT EQUIPMENT TO ACCELERATE GROWTH

- 12.3 RESIDENTIAL

- 12.3.1 GOVERNMENT INCENTIVES AND ENERGY EFFICIENCY REGULATIONS DRIVING ADOPTION OF RESIDENTIAL HVAC SYSTEMS

- 12.4 INDUSTRIAL

- 12.4.1 DEMAND FOR ENERGY-EFFICIENT HVAC SYSTEMS INCREASING IN INDUSTRIAL SPACES TO REDUCE OPERATIONAL COSTS

- 12.4.1.1 Manufacturing facilities

- 12.4.1.2 Warehouses

- 12.4.1.3 Power plants

- 12.4.1 DEMAND FOR ENERGY-EFFICIENT HVAC SYSTEMS INCREASING IN INDUSTRIAL SPACES TO REDUCE OPERATIONAL COSTS

13 HVAC SYSTEM MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Increasing government initiatives and construction of energy-efficient buildings to drive market

- 13.2.3 CANADA

- 13.2.3.1 Government incentives for renewable heating and cooling to boost market

- 13.2.4 MEXICO

- 13.2.4.1 Increasing government rebates to propel market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Government-backed net-zero emission targets to accelerate market growth

- 13.3.3 GERMANY

- 13.3.3.1 Government-funded energy research and renovation incentives to bolster market growth

- 13.3.4 FRANCE

- 13.3.4.1 Rising focus on reducing greenhouse gases to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Regulatory reforms to drive market growth

- 13.3.6 ITALY

- 13.3.6.1 Government-backed retrofit incentives to drive market

- 13.3.7 POLAND

- 13.3.7.1 EU-aligned clean energy targets to drive market

- 13.3.8 NORDICS

- 13.3.8.1 Rising consumer demand for sustainable home heating technologies to propel market growth

- 13.3.9 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rising industrialization and urbanization to drive market growth

- 13.4.3 JAPAN

- 13.4.3.1 Stricter energy efficiency standards to foster market growth

- 13.4.4 INDIA

- 13.4.4.1 Rising focus on energy conservation to bolster market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Increasing awareness about energy conservation to bolster adoption

- 13.4.6 AUSTRALIA

- 13.4.6.1 Increasing sustainable construction practices to drive market demand

- 13.4.7 INDONESIA

- 13.4.7.1 Rising industrialization fueling market growth

- 13.4.8 MALAYSIA

- 13.4.8.1 Increasing government incentives to support market growth

- 13.4.9 THAILAND

- 13.4.9.1 Strong export capacity to increase demand during forecast period

- 13.4.10 VIETNAM

- 13.4.10.1 Growing hospitality and tourism sectors to drive market growth

- 13.4.11 REST OF ASIA PACIFIC

- 13.5 REST OF THE WORLD (ROW)

- 13.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Rising infrastructure investment to propel market growth

- 13.5.3 MIDDLE EAST

- 13.5.3.1 Stringent regulations for enhancing energy performance of buildings to drive market

- 13.5.3.2 Bahrain

- 13.5.3.3 Kuwait

- 13.5.3.4 Oman

- 13.5.3.5 Qatar

- 13.5.3.6 Saudi Arabia

- 13.5.3.7 United Arab Emirates (UAE)

- 13.5.3.8 Rest of Middle East

- 13.5.4 AFRICA

- 13.5.4.1 Rapid urbanization to drive market growth

- 13.5.4.2 South Africa

- 13.5.4.3 Other African countries

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JUNE 2022-JULY 2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Equipment footprint

- 14.7.5.4 Implementation type footprint

- 14.7.5.5 Service type footprint

- 14.7.5.6 End user footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 CARRIER

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product/Service launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 DAIKIN INDUSTRIES, LTD.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 LG ELECTRONICS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product/Service launches

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 MIDEA

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product/Service launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 TRANE TECHNOLOGIES PLC

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product/Service launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 LENNOX INTERNATIONAL INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product/Service launches

- 15.1.6.3.2 Deals

- 15.1.7 JOHNSON CONTROLS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product/Service launches

- 15.1.7.3.2 Deals

- 15.1.8 HONEYWELL INTERNATIONAL INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 MITSUBISHI ELECTRIC CORPORATION

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product/Service launches

- 15.1.9.3.2 Deals

- 15.1.10 SAMSUNG

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product/Service launches

- 15.1.11 GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 FUJITSU GENERAL

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product/Service launches

- 15.1.13 PANASONIC HOLDINGS CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product/Service launches

- 15.1.13.3.2 Deals

- 15.1.14 ROBERT BOSCH GMBH

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product/Service launches

- 15.1.14.3.2 Deals

- 15.1.15 MODINE

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.1 CARRIER

- 15.2 OTHER PLAYERS

- 15.2.1 HAIER GROUP

- 15.2.2 SYSTEMAIR AB

- 15.2.3 AAON

- 15.2.4 WHIRLPOOL CORPORATION

- 15.2.5 ELECTROLUX

- 15.2.6 FERROLI

- 15.2.7 VAILLANT GROUP

- 15.2.8 RHEEM MANUFACTURING COMPANY

- 15.2.9 AMERICAN STANDARD HEATING AND AIR CONDITIONING

- 15.2.10 WM TECHNOLOGIES LLC

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS