|

시장보고서

상품코드

1877354

그래핀 시장 : 유형별, 원료별, 용도별, 최종 이용 산업, 지역별 예측(-2030년)Graphene Market by Type (Bulk Graphene and Monolayer Graphene), Source, Application, End-use Industry (Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, and Construction) and Region - Global Forecast to 2030 |

||||||

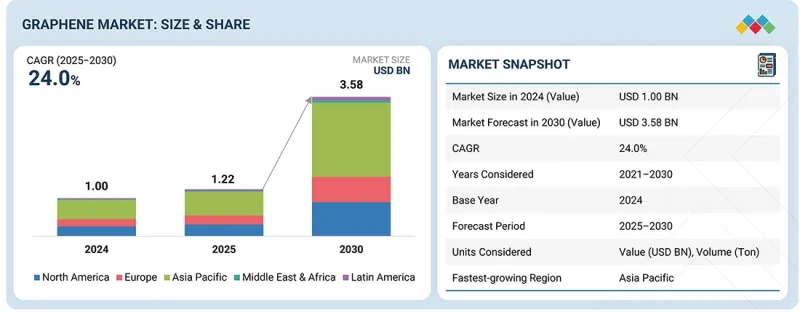

세계의 그래핀 시장 규모는 2024년 추정 10억 달러였고, 2030년까지 35억 8,000만 달러에 이를 것으로 예측되며, 2025-2030년에 CAGR 24.0%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 1,000달러/10억 달러, 톤 |

| 부문 | 유형, 원료, 용도, 최종 이용 산업, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

벌크 그래핀은 뛰어난 특성과 다양한 산업에서 잠재적인 응용 가능성의 독특한 조합으로 전체 시장을 독점했습니다. 벌크 그래핀은 특히 생산의 확장성, 비용 효율성, 적용 범위의 넓이 등 다양한 이유로 단층 그래핀보다 선호됩니다.

"원료별로는 흑연이 2024년에 그래핀 시장 전체의 최대 점유율을 차지했습니다."

흑연은 지구상에서 가장 널리 사용 가능한 탄소의 모습 중 하나입니다. 그 풍부한 매장량으로 흑연은 그래핀의 대량생산에서 가장 쉽게 입수할 수 있는 원재료의 하나가 되고 있습니다. 흑연 채굴에 종사하는 기업은 이 귀중한 자원공급을 장악하고 있기 때문에 우위적인 입장에 있습니다. 공급에 대한 접근을 결정할 수 있기 때문입니다. 기계적 또는 화학적 박리법에 의한 흑연으로부터의 그래핀의 합성은 다른 원료와 비교하여 비교적 용이합니다. 흑연은 초음파 처리 및 화학적 처리와 같은 간단한 기술로 단층 또는 여러 층의 시트로 박리할 수 있습니다.

"복합재료 부문이 예측 기간에 그래핀의 최대 응용 분야가 될 전망입니다."

복합재료 부문은 그래핀의 주요 용도입니다. 그래핀 강화 복합재료는 우수한 기계적 특성, 전기적 특성 및 열적 특성을 가지고 있습니다. 이 특성은 경량이면서 높은 강성이 요구되는 업계에서 특히 매력적입니다.

"전자 산업이 예측 기간에 금액 기준으로 가장 높은 성장률을 보일 것으로 예측됩니다."

전자 산업은 시장 전체에서 가장 빠르게 성장하는 최종 용도 부문입니다. 탁월한 전기 전도성과 높은 전자 이동도는 다양한 전자 부품에 이상적인 재료입니다. 이 특성은 성능과 속도를 중시하는 시장에서 심각해질 수 있는 보다 빠르고 효율적인 디바이스 개발을 가능하게 합니다.

끊임없는 연구 개발로 전자 부문에서 그래핀의 응용 가능성이 확대되고 있습니다. 그래핀 전계 효과 트랜지스터(GFET)와 같은 최근의 혁신 기술은 반도체 기술에 혁명을 가져오고 기존 실리콘 기반 장치에 비해 우수한 성능을 제공할 것으로 기대되고 있습니다. 이러한 돌파구가 계속되는 가운데, 새로운 전자 기술에서 그래핀의 채용은 한층 더 가속할 전망입니다.

"아시아태평양이 가장 큰 시장 점유율을 차지할 것으로 추정됩니다."

아시아태평양은 전자 및 자동차 산업을 비롯한 다양한 부문에서 수요가 증가함에 따라 그래핀 시장에서 가장 큰 점유율을 차지했습니다.

전자 부문은 아시아태평양에서 그래핀 채택을 촉진하는 중요한 성장 분야 중 하나입니다. 강도 대 중량비와 우수한 전기 전도성과 같은 그래핀의 독특한 특성은 자동차 부문과 항공우주 부문에서 점점 활용되고 있습니다.

아시아태평양의 경쟁 환경은 수많은 기업들이 자사 제품의 강화를 위해 연구 개발에 많은 투자를 하고 있는 것이 특징입니다. Ningbo Morsh Technology, First Graphene, The Sixth Element (Changzhou) Materials Technology와 같은 기업들은 전략적 파트너십 및 협업을 통해 시장 존재를 확대하고 있으며, 이는 시장의 추가 성장을 가속하고 있습니다.

본 보고서는 세계 그래핀 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요한 지견

- 그래핀 시장에서 기업에게 매력적인 기회

- 그래핀 시장 : 유형별, 지역별

- 그래핀 시장 : 원료별

- 그래핀 시장 : 형태별

- 그래핀 시장 : 용도별

- 그래핀 시장 : 최종 이용 산업별

- 그래핀 시장 : 국가별

제4장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 그래핀 시장에서의 미충족 요구

- 화이트 스페이스의 기회

- 상호접속된 시장과 부문 횡단적인 기회

- 상호연결된 시장

- 부문 횡단적인 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 새로운 비즈니스 모델

- 생태계의 변화

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 소개

- GDP의 동향과 예측

- 세계의 전자 업계 동향

- 세계의 자동차 및 운송 업계 동향

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별

- 평균 판매 가격의 동향 : 지역별

- 무역 분석

- 수입 시나리오(HS 코드 380190)

- 수출 시나리오(HS 코드 380190)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 사례 연구 분석

- 그래핀 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제6장 기술, 특허, 디지털, AI의 채용에 의한 전략적 파괴

- 주요 신기술

- 화학 증착(CVD)

- 박리

- 보완 기술

- 기술 및 제품 로드맵

- 단기(2025-2027년) | 창설 및 조기 상업화

- 중기(2027-2030년) | 확장 및 표준화

- 장기(2030-2035년 이후) | 대규모 상업화 및 파괴적 변화

- 특허 분석

- 소개

- 조사 방법

- 문서 유형

- 고찰

- 특허의 법적 지위

- 관할분석

- 주요 출원자

- UNIV ZHEJIANG 특허 목록

- NANOTEK INSTRUMENTS, INC. 특허 목록

- UNIV SOUTH CHINA TECH 특허 목록

- 미래의 용도

- RF 부품 : 차세대 무선 인프라

- 플렉서블 폴더블 디스플레이: 소비자 일렉트로닉스 혁명

- 뇌전극:신경 인터페이스 기술

- 첨단 스마트 전기 부품 : 에너지 저장 혁명

- 전자 피부(e-skin) : 휴먼 머신 인터페이스의 혁신

- 그래핀 시장에 대한 AI 및 생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 그래핀 가공에서의 베스트 프랙티스

- 그래핀 시장에서 AI 도입의 사례 연구

- 상호접속된 인접 생태계와 시장 기업에 미치는 영향

- 그래핀 시장에서 생성형 AI 채용에 대한 고객의 준비 상황

- 성공 사례와 실세계에의 응용

- SKELETON TECHNOLOGIES : 곡선 그래핀 슈퍼커패시터

- NAWA TECHNOLOGIES : 나노튜브 슈퍼커패시터

- Tesla(US) : 급속 충전 배터리와 그래핀의 잠재력

제7장 지속가능성과 규제정세

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업에서의 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용역학

- 주요 용도에 있어서의 마진 기회

제9장 그래핀 시장 : 유형별

- 소개

- 벌크 그래핀

- 단층 그래핀

제10장 그래핀 시장 : 원료별

- 소개

- 흑연

- 산화흑연

- 환원 산화흑연

- 기타 원료

제11장 그래핀 시장 : 형태별

- 소개

- 분말

- 잉크

- 필름 및 시트

- 기타 형태

제12장 그래핀 시장 : 용도별

- 소개

- 복합재료

- 에너지 수확 및 저장

- 페인트, 코팅 및 잉크

- 소비자 일렉트로닉스

- 기타 용도

제13장 그래핀 시장 : 최종 이용 산업별

- 소개

- 자동차 및 운송

- 항공우주 및 방위

- 전기 및 전자

- 건설

- 기타 최종 이용 산업

제14장 그래핀 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

제15장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스: 주요 기업(2024년)

- 기업 평가 매트릭스: 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 기업

- GRAPHENEA SA

- FIRST GRAPHENE

- NANOXPLORE INC.

- AVANZARE INNOVACION TECHNOLOGICA SL

- GLOBAL GRAPHENE GROUP

- DIRECTA PLUS SPA

- HAYDALE GRAPHENE INDUSTRIES PLC

- ACS MATERIAL

- THE SIXTH ELEMENT(CHANGZHOU)MATERIALS TECHNOLOGY CO., LTD.

- XIAMEN KNANO GRAPHENE TECHNOLOGY CO., LTD.

- UNIVERSAL MATTER, INC.

- NINGBO MORSH TECHNOLOGY CO., LTD.

- THOMAS SWAN & CO., LTD.

- DANISH GRAPHENE APS

- 기타 기업

- NANOTECH ENERGY

- GROLLTEX INC

- OTTO CHEMIE PVT. LTD.

- LHP NANOTECH LLP.

- CEYLON GRAPHENE TECHNOLOGIES(PVT) LTD.

- ALFA CHEMISTRY

- CARBON RIVERS

- TALGA GROUP

- MATEXCEL

- GRAPHITE CENTRAL

제17장 조사 방법

제18장 부록

JHS 25.12.03The graphene market is estimated at USD 1.00 billion in 2024 and is projected to reach USD 3.58 billion by 2030, at a CAGR of 24.0% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Thousand/Billion), Volume (Ton) |

| Segments | By Type, By Source, By Application, By End-use Industry, and By Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East & Africa |

Bulk graphene dominated the overall market due to its unique combination of extraordinary properties and potential applications across various industries. Bulk graphene is preferred over monolayer graphene for various reasons, specifically due to production scalability, cost-effectiveness, and application versatility.

''By source, graphite accounted for the largest share of the overall graphene market in 2024.''

Graphite is among the most widely available forms of carbon on earth. Due to its abundance, graphite is one of the most readily available raw materials for the mass production of graphene. Businesses involved in graphite mining have an upper hand as they are masters of the supply of this precious resource, since they determine who can access the supply. The synthesis of graphene from graphite through mechanical or chemical exfoliation methods is comparatively easier than other sources. Graphite can be cleaved into monolayers or few-layer sheets based on simple techniques like sonification or chemical treatments.

''The composites segment is estimated to be the largest application of graphene during the forecast period.''

The composites segment is the leading application of graphene. Graphene-enhanced composites possess attractive mechanical, electrical, and thermal properties. This makes graphene composites particularly appealing for industries where lightweight yet stiff materials are required.

''The electronics end-use industry is projected to register the highest growth, in terms of value, during the forecast period.'

The electronics industry is the fastest-growing end-use segment in the overall market. The outstanding electrical conductivity and high electron mobility make it an ideal material for various electronic components. This capability allows for the development of faster and more efficient devices that may be critical in a market focused on performance and speed.

Constant research and development are increasing the potential applications of graphene in electronics. Some of the recent innovations, like graphene field-effect transistors (GFETs), promise to revolutionize semiconductor technology and offer superior performance compared to conventional silicon-based devices. While breakthroughs continue, the reception of graphene in new electronic technologies should gain greater momentum.

"Asia Pacific is estimated to account for the largest market share."

Asia Pacific accounted for the largest share of the graphene market due to increasing demand for graphene across various sectors, especially in electronics and automotive industries.

The electronics sector is one of the key growth areas driving the adoption of graphene in the Asia Pacific region. Graphene's unique properties, such as strength-to-weight ratio and excellent electrical conductivity, are increasingly utilized in the automotive and aerospace sectors.

The competitive environment in Asia Pacific is characterized by numerous players investing heavily in R&D to enhance their product offerings. Companies such as Ningbo Morsh Technology Co., Ltd., First Graphene, and The Sixth Element (Changzhou) Materials Technology Co., Ltd. are expanding their market presence through strategic partnerships and collaborations, which further drives the market growth.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided based on the following three categories:

- By Company Type - Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation - C Level - 33%, Director Level - 33%, and Others - 34%

- By Region - North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa -20%, South America - 10%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Graphenea S.A (Spain), First Graphene (Australia), NanoXplore Inc. (Canada), Avanzare Innovacion Technologica S.L. (Spain), Global Graphene Group (US), Directa Plus S.P.A (Italy), Haydale Graphene Industries Plc (UK), ACS Material (US), The Sixth Element (Changzhou) Materials Technology Co. Ltd. (China), Xiamen Knano Graphene Technology Co., Ltd. (China), Universal Matter, Inc. (Canada), Petroliam Nasional Berhad (Petronas, Malaysia), Thomas Swan & Co. Ltd. (England), and Danish Graphene ApS (Denmark).

Research Coverage

This research report categorizes the graphene market by source (Graphite, Graphite Oxide, Reduced Graphite Oxide, and Other Sources), by type (Bulk Graphene and Monolayer Graphene), by application (Composite, Energy Harvesting & Storage, Paints, Coatings & Inks, Electronics, and Other Applications), by end-use industry (Automotive & Transportation, Aerospace & Defense, Electronics, Construction, and Other End-use Industries), and by region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the graphene market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers & acquisitions, and recent developments in the graphene market are all covered. This report includes a competitive analysis of upcoming startups in the graphene market ecosystem.

Reasons to buy this report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall graphene market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand in key end-use industries and supportive government policies in major graphite-exporting countries for boosting graphene production), restraints (Difficulty in mass production and lack of energy band-gap in graphene materials), opportunities (Rising demand in energy storage applications due to exceptional properties and rising use in next generation electronics due to exceptional properties), and challenges (Lack of standardization in graphene industry and high production cost) influencing the growth of the graphene market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the graphene market

- Market Development: Comprehensive information about lucrative markets - the report analyses the graphene market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the graphene market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players, such as Graphenea S.A (Spain), First Graphene (Australia), NanoXplore Inc. (Canada), Avanzare Innovacion Technologica S.L. (Spain), Global Graphene Group (US), Directa Plus S.P.A (Italy), Haydale Graphene Industries Plc (UK), ACS Material (US), The Sixth Element (Changzhou) Materials Technology Co. Ltd. (China), Xiamen Knano Graphene Technology Co., Ltd. (China), Universal Matter, Inc. (Canada), Petroliam Nasional Berhad (Petronas, Malaysia), Thomas Swan & Co. Ltd. (England), and Danish Graphene ApS (Denmark) in the graphene market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING GRAPHENE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GRAPHENE MARKET

- 3.2 GRAPHENE MARKET, BY TYPE AND REGION

- 3.3 GRAPHENE MARKET, BY SOURCE

- 3.4 GRAPHENE MARKET, BY FORM

- 3.5 GRAPHENE MARKET, BY APPLICATION

- 3.6 GRAPHENE MARKET, BY END-USE INDUSTRY

- 3.7 GRAPHENE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing demand in key end-use industries

- 4.2.1.2 Supportive government policies in major graphite-exporting countries

- 4.2.2 RESTRAINTS

- 4.2.2.1 Difficulty in mass production

- 4.2.2.2 Lack of energy bandgap in graphene materials

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand in energy storage applications

- 4.2.3.2 Increasing adoption in next-generation electronics

- 4.2.4 CHALLENGES

- 4.2.4.1 Lack of standardization

- 4.2.4.2 High production cost

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN GRAPHENE MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ELECTRONICS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 380190)

- 5.6.2 EXPORT SCENARIO (HS CODE 380190)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 FIRST GRAPHENE DESIGNED PUREGRAPH MB-EVA BITUMEN

- 5.9.2 AVANZARE INNOVACION TECNOLOGICA S.L. AND TECHNALIA PARTNERED TO CREATE DESIGN STRATEGIES FOR GRAPHENE PRODUCTION

- 5.9.3 GLOBAL GRAPHENE GROUP PARTNERED WITH TAIWAN-BASED MANUFACTURER TO DEVELOP GRAPHENE-BASED MATERIALS FOR SEMICONDUCTOR INDUSTRY

- 5.10 IMPACT OF 2025 US TARIFF ON GRAPHENE MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRIES/REGIONS

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CHEMICAL VAPOR DEPOSITION (CVD)

- 6.1.2 EXFOLIATION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 THERMAL DECOMPOSITION

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF PATENTS BY UNIV ZHEJIANG

- 6.4.9 LIST OF PATENTS BY INSTITUTE OF NANOTEK INSTRUMENTS, INC.

- 6.4.10 LIST OF PATENTS BY UNIV SOUTH CHINA TECH

- 6.5 FUTURE APPLICATIONS

- 6.5.1 RF COMPONENTS: NEXT-GENERATION WIRELESS INFRASTRUCTURE

- 6.5.2 FLEXIBLE AND FOLDABLE DISPLAYS: CONSUMER ELECTRONICS REVOLUTION

- 6.5.3 BRAIN ELECTRODES: NEURAL INTERFACE TECHNOLOGY

- 6.5.4 ADVANCED SMART ELECTRICAL COMPONENTS: ENERGY STORAGE REVOLUTION

- 6.5.5 ELECTRONIC SKINS (E-SKINS): HUMAN-MACHINE INTERFACE INNOVATION

- 6.6 IMPACT OF AI/GEN AI ON GRAPHENE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN GRAPHENE PROCESSING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN GRAPHENE MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN GRAPHENE MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 SKELETON TECHNOLOGIES: CURVED GRAPHENE SUPERCAPS

- 6.7.2 NAWA TECHNOLOGIES: NANOTUBE SUPERCAPACITORS

- 6.7.3 TESLA (US): FAST-CHARGE BATTERIES AND GRAPHENE POTENTIAL

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GRAPHENE

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GRAPHENE

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITIBILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 GRAPHENE MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 BULK GRAPHENE

- 9.2.1 INCREASING DEMAND IN ELECTRONICS AND AUTOMOTIVE INDUSTRIES TO FUEL MARKET GROWTH

- 9.3 MONOLAYER GRAPHENE

- 9.3.1 RISING DEMAND IN HIGH-PERFORMANCE COMPOSITES AND NEXT-GENERATION ELECTRONICS TO PROPEL MARKET

10 GRAPHENE MARKET, BY SOURCE

- 10.1 INTRODUCTION

- 10.2 GRAPHITE

- 10.2.1 LAYERED STRUCTURE AND HIGH CARBON CONTENT TO DRIVE DEMAND

- 10.3 GRAPHITE OXIDE

- 10.3.1 EASE OF EXFOLIATION AND PROCESSABILITY DRIVING ADOPTION

- 10.4 REDUCED GRAPHITE OXIDE

- 10.4.1 CONSTANT R&D AND INNOVATIONS TO FUEL MARKET GROWTH

- 10.5 OTHER SOURCES

11 GRAPHENE MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 POWDER

- 11.2.1 FOCUS ON SUSTAINABLE MATERIALS DRIVING GROWTH

- 11.3 INK

- 11.3.1 DEMAND FROM ELECTRONIC INDUSTRY PROPELLING GROWTH

- 11.4 FILMS & SHEETS

- 11.4.1 EXCEPTIONAL ELECTRICAL, MECHANICAL, AND THERMAL PROPERTIES DRIVING MARKET

- 11.5 OTHER FORMS

- 11.5.1 ONGOING R&D FUELING INNOVATION AND DEMAND

12 GRAPHENE MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 COMPOSITES

- 12.2.1 RISING DEMAND FOR LIGHTWEIGHT COMPONENTS ACROSS VARIOUS INDUSTRIES TO FUEL MARKET GROWTH

- 12.3 ENERGY HARVESTING & STORAGE

- 12.3.1 INNOVATIONS IN ENERGY HARVESTING TO FUEL DEMAND

- 12.3.2 BATTERIES

- 12.3.3 SUPER CAPACITORS

- 12.3.4 SMART GRIDS

- 12.3.5 ELECTRONICS

- 12.4 PAINTS, COATINGS & INKS

- 12.4.1 RAPID URBANIZATION AND INCREASING INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 12.5 CONSUMER ELECTRONICS

- 12.5.1 INCREASING DEMAND FOR CONSUMER AND NEXT-GENERATION ELECTRONICS TO DRIVE MARKET

- 12.6 OTHER APPLICATIONS

13 GRAPHENE MARKET, BY END-USE INDUSTRY

- 13.1 INTRODUCTION

- 13.2 AUTOMOTIVE & TRANSPORTATION

- 13.2.1 RAPID DIGITIZATION AND ELECTRIFICATION OF VEHICLES TO DRIVE MARKET

- 13.3 AEROSPACE & DEFENSE

- 13.3.1 SIGNIFICANT INVESTMENTS IN R&D FOR INTEGRATING GRAPHENE INTO AIRCRAFT TECHNOLOGIES TO PROPEL MARKET

- 13.4 ELECTRICAL & ELECTRONICS

- 13.4.1 DEVELOPMENT OF WEARABLE TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 13.5 CONSTRUCTION

- 13.5.1 RAPID URBANIZATION AND INDUSTRIALIZATION TO FUEL DEMAND

- 13.6 OTHER END-USE INDUSTRIES

14 GRAPHENE MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Robust manufacturing base and presence of established players to drive market

- 14.2.2 JAPAN

- 14.2.2.1 Growing research and development activities to drive market

- 14.2.3 INDIA

- 14.2.3.1 Rising demand from innovation centers and universities to support market growth

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Expanding electrical & electronics industry to propel market

- 14.2.5 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 NORTH AMERICA

- 14.3.1 US

- 14.3.1.1 Presence of large number of graphene manufacturers to drive market

- 14.3.2 CANADA

- 14.3.2.1 Technological advancements to propel market growth

- 14.3.1 US

- 14.4 EUROPE

- 14.4.1 GERMANY

- 14.4.1.1 Robust automotive manufacturing base to drive market

- 14.4.2 FRANCE

- 14.4.2.1 Rising use of environmentally friendly manufacturing technologies to drive market

- 14.4.3 UK

- 14.4.3.1 High demand from research institutions and universities to fuel market growth

- 14.4.4 ITALY

- 14.4.4.1 Growing investments and projects related to use of green technologies to propel market

- 14.4.5 SPAIN

- 14.4.5.1 Development of innovative technologies to drive demand

- 14.4.6 REST OF EUROPE

- 14.4.1 GERMANY

- 14.5 LATIN AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Large production of graphite to support market growth

- 14.5.2 ARGENTINA

- 14.5.2.1 Rising demand for lithium batteries to drive market

- 14.5.3 MEXICO

- 14.5.3.1 Strong presence of automotive industry to drive demand

- 14.5.4 REST OF LATIN AMERICA

- 14.5.1 BRAZIL

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 GCC COUNTRIES

- 14.6.2 SOUTH AFRICA

- 14.6.2.1 High raw material availability to support market growth

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS

- 15.5 BRAND/PRODUCT COMPARISON

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Region footprint

- 15.6.5.3 Type footprint

- 15.6.5.4 Source footprint

- 15.6.5.5 Application footprint

- 15.6.5.6 End-use industry footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.7.5.1 Detailed list of key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 GRAPHENEA S.A.

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 MnM view

- 16.1.1.3.1 Key strengths

- 16.1.1.3.2 Strategic choices

- 16.1.1.3.3 Weaknesses and competitive threats

- 16.1.2 FIRST GRAPHENE

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 NANOXPLORE INC.

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 AVANZARE INNOVACION TECHNOLOGICA S.L.

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Deals

- 16.1.4.3.2 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 GLOBAL GRAPHENE GROUP

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Key strengths

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 DIRECTA PLUS S.P.A.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 HAYDALE GRAPHENE INDUSTRIES PLC

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.4 MnM view

- 16.1.7.4.1 Key strengths

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 ACS MATERIAL

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.3.2 Deals

- 16.1.8.4 MnM view

- 16.1.8.4.1 Key strengths

- 16.1.8.4.2 Strategic choices

- 16.1.8.4.3 Weaknesses and competitive threats

- 16.1.9 THE SIXTH ELEMENT (CHANGZHOU) MATERIALS TECHNOLOGY CO., LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Expansions

- 16.1.9.4 MnM view

- 16.1.9.4.1 Key strengths

- 16.1.9.4.2 Strategic choices

- 16.1.9.4.3 Weaknesses and competitive threats

- 16.1.10 XIAMEN KNANO GRAPHENE TECHNOLOGY CO., LTD.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 MnM view

- 16.1.10.3.1 Key strengths

- 16.1.10.3.2 Strategic choices

- 16.1.10.3.3 Weaknesses and competitive threats

- 16.1.11 UNIVERSAL MATTER, INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Deals

- 16.1.11.4 MnM view

- 16.1.11.4.1 Key strengths

- 16.1.11.4.2 Strategic choices

- 16.1.11.4.3 Weaknesses and competitive threats

- 16.1.12 NINGBO MORSH TECHNOLOGY CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 MnM view

- 16.1.12.3.1 Key strengths

- 16.1.12.3.2 Strategic choices

- 16.1.12.3.3 Weaknesses and competitive threats

- 16.1.13 THOMAS SWAN & CO., LTD.

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.13.4 MnM view

- 16.1.13.4.1 Key strengths

- 16.1.13.4.2 Strategic choices

- 16.1.13.4.3 Weaknesses and competitive threats

- 16.1.14 DANISH GRAPHENE APS

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Expansions

- 16.1.14.3.2 Deals

- 16.1.14.4 MnM view

- 16.1.14.4.1 Key strengths

- 16.1.14.4.2 Strategic choices

- 16.1.14.4.3 Weaknesses and competitive threats

- 16.1.1 GRAPHENEA S.A.

- 16.2 OTHER PLAYERS

- 16.2.1 NANOTECH ENERGY

- 16.2.2 GROLLTEX INC

- 16.2.3 OTTO CHEMIE PVT. LTD.

- 16.2.4 LHP NANOTECH LLP.

- 16.2.5 CEYLON GRAPHENE TECHNOLOGIES (PVT) LTD.

- 16.2.6 ALFA CHEMISTRY

- 16.2.7 CARBON RIVERS

- 16.2.8 TALGA GROUP

- 16.2.9 MATEXCEL

- 16.2.10 GRAPHITE CENTRAL

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary interview participants

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.3 BASE NUMBER CALCULATION

- 17.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 17.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 17.4 MARKET FORECAST APPROACH

- 17.4.1 SUPPLY SIDE

- 17.4.2 DEMAND SIDE

- 17.5 DATA TRIANGULATION

- 17.6 FACTOR ANALYSIS

- 17.7 RESEARCH ASSUMPTIONS

- 17.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS