|

시장보고서

상품코드

1914123

지리공간 인텔리전스(GeoAI) 시장 예측(-2030년) : 지리공간 AI, 지리공간 애널리틱스, 취득 시스템, 기술Geospatial Intelligence Market by GeoAI, Geospatial Analytics, Acquisition Systems, Technology - Global Forecast to 2030 |

||||||

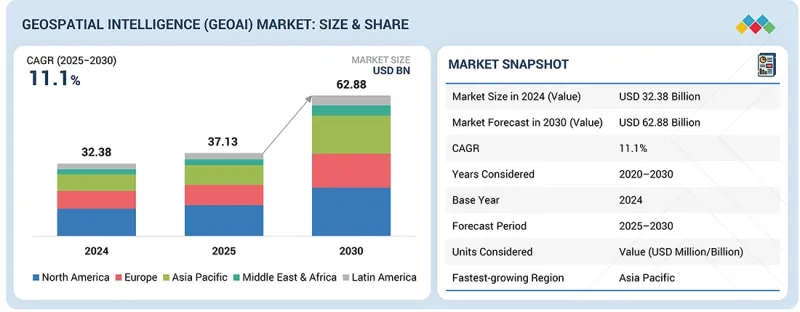

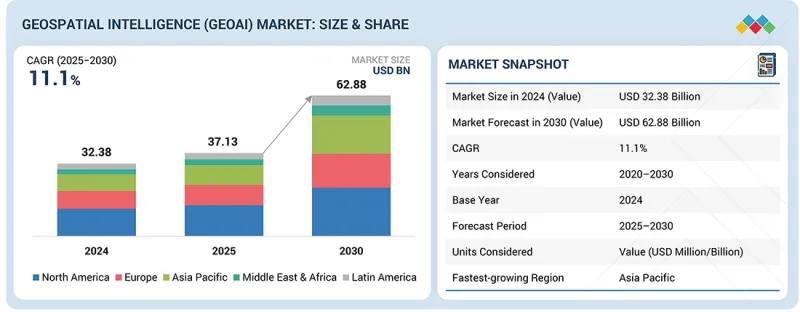

세계의 지리공간 인텔리전스(GeoAI) 시장 규모는 2025년 371억 3,000만 달러에서 2030년까지 628억 8,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 11.1%의 성장이 전망됩니다.

시장 성장은 위성, 드론, 센서, 커넥티드 디바이스에서 생성되는 복잡한 지형 공간 데이터세트를 분석하기 위한 AI와 머신러닝의 활용이 확대되면서 촉진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 제공, 코어 기술 아키텍처, 데이터 유형, 용도, 업계, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 라틴아메리카 |

국방, 인프라, 의료, 환경 모니터링 등의 분야의 조직들은 의사결정, 위험 평가, 업무 효율성 향상을 위해 지공간 인텔리전스 솔루션을 채택하고 있습니다. 클라우드 컴퓨팅, 데이터 융합, 실시간 분석의 발전으로 지공간 인텔리전스 플랫폼의 확장성과 접근성이 향상되고 있습니다. 이와 함께 스마트 인프라, 공공안전, 기후 변화 대응을 위한 투자가 증가하면서 첨단 GeoAI 기능에 대한 수요가 더욱 증가하고 있습니다.

"제품별로 보면 센싱 및 캡처 부문이 예측 기간 중 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

센싱 캡처는 지리공간 인텔리전스(GeoAI) 시장에서 지리공간 획득 시스템 중 가장 빠르게 성장하고 있는 분야입니다. 이 부문에는 지리공간 데이터를 수집하는 데 사용되는 위성, 항공 플랫폼, 드론, LiDAR 시스템, 지상 기반 센서가 포함됩니다. 지구관측위성 배치 확대, 무인항공시스템의 사용 증가, 고주파 데이터 수집 수요 증가로 인해 성장이 촉진되고 있습니다. 이러한 수집 시스템은 다운스트림의 지형공간 인텔리전스 분석에 필요한 기초 데이터를 제공합니다. 센서의 해상도, 범위, 비용 효율성이 지속적으로 개선되면서 국방, 인프라 모니터링, 환경 평가, 재난 대응 등 다양한 이용 사례에서 채택이 가속화되고 있습니다.

"이미지 데이터 부문이 지리공간지능(GeoAI) 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. "

이미지 데이터는 지리공간지능(GeoAI) 시장에서 가장 큰 데이터 유형 부문을 차지하고 있습니다. 위성 이미지와 항공 사진은 감시, 매핑, 변화 감지, 자산 모니터링 용도로 널리 활용되고 있습니다. 고해상도 이미지는 여러 부문의 AI를 통한 특징 추출, 물체 인식, 예측적 공간 분석을 지원합니다. 이미지 해상도, 재방문 빈도, 분석 능력의 지속적인 향상으로 이미지 기반 인텔리전스의 가치가 높아지고 있습니다. 국방, 도시 계획, 환경 모니터링, 상업용 용도의 강력한 채택으로 이미지 데이터 부문의 지배적 지위를 유지하고 있습니다.

"북미가 지리공간지능(GeoAI) 시장을 주도하고 있는 가운데, 아시아태평양이 가장 빠르게 성장하는 지역으로 부상하고 있습니다. "

북미는 예측 기간 중 지리공간지능(GeoAI) 시장에서 가장 큰 점유율을 유지할 것으로 예측됩니다. 이 지역은 지속적인 정부 지출과 성숙한 지리공간 기술 생태계를 바탕으로 국방, 공공안전, 인프라, 의료 분야에서의 강력한 채택의 혜택을 누리고 있습니다. 연방 기관 및 기업에서 위성 이미지, 지형 공간 분석, AI 지원 인텔리전스 플랫폼을 광범위하게 사용함으로써 시장에서의 선도적 지위를 확보하고 있습니다. 주요 지리공간 기술 프로바이더와 클라우드 서비스 플랫폼의 존재는 이러한 확산을 더욱 가속화하고 있습니다.

아시아태평양은 지리공간지능(GeoAI) 시장에서 가장 높은 성장률을 나타낼 것으로 예측됩니다. 급속한 도시화, 스마트 시티 구상에 대한 투자 증가, 중국, 인도, 동남아시아 국가 등에서의 지구관측 프로그램 확대가 채택을 촉진하고 있습니다. 이 지역 정부는 인프라 개발, 환경 모니터링, 재난 관리에 지공간 인텔리전스를 활용하고 있습니다. 위성 데이터의 가용성 향상과 분석 능력의 발전으로 아시아태평양은 예측 기간 중 중요한 성장 지역으로 자리매김하고 있습니다.

세계의 지리공간 인텔리전스 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- 지리공간 인텔리전스(GeoAI) 시장에서의 매력적인 기회

- 지리공간 인텔리전스(GeoAI) 시장 : 상위 3의 용도

- 북미의 지리공간 인텔리전스(GeoAI) 시장 : 제공별, 최종사용자별

- 지리공간 인텔리전스(GeoAI) 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 지리공간 인텔리전스(GeoAI) 시장에서의 미충족 요구

- 화이트 스페이스 기회

- 상호접속된 시장과 부문 횡단적인 기회

- 상호접속된 시장

- 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 지리공간 인텔리전스의 진화(GeoAI)

- Porter's Five Forces 분석

- 거시경제 전망

- GDP의 동향과 예측

- 세계의 빅데이터·애널리틱스 업계의 동향

- 세계의 사이버 보안 업계의 동향

- 공급망 분석

- 에코시스템 분석

- 지리공간 취득 시스템 프로바이더

- 소프트웨어 프로바이더

- 서비스 프로바이더

- 가격결정 분석

- 제품(지리공간 인텔리전스 취득 시스템)의 평균 판매 가격 : 주요 기업별(2025년)

- 소프트웨어·서비스의 평균 판매 가격(2025년)

- 무역 분석

- 수입 시나리오(HS 코드 9015)

- 수출 시나리오(HS 코드 9015)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 지리공간 인텔리전스(GeoAI) 시장

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 전략적 파괴 : 특허, 디지털, AI의 채택

- 주요 신기술

- 첨단 AI/ML 기술

- 원격탐사, EO, 멀티센서 데이터 퓨전

- 고충실도 3D 매핑, 디지털 트윈

- 클라우드 엣지 컴퓨팅

- 보완 기술

- IoT·센서 네트워크

- 5G 접속성

- 연합 학습(FL)·프라이버시 보호 AI

- 인접 기술

- 공간 컴퓨팅

- 생성형 AI·GeoLLM

- 블록체인

- 테크놀러지 로드맵

- 단기 : 기반 구축·표준화 단계(2025-2027년)

- 중기 : 컨버전스·자동화 단계(2028-2030년)

- 장기 : 자율형·인지형 상호운용성 단계(2031-2035년)

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별(2016-2025년)

- 혁신과 특허 출원

제7장 규제 상황

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 업계표준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 평가 기준

- 구매 프로세스에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 업계의 미충족 요구

제9장 지리공간 인텔리전스(GeoAI) 시장 : 제공별

- 소프트웨어

- 지리공간 취득 시스템

- 서비스

제10장 지리공간 인텔리전스(GeoAI) 시장 : 코어 기술 아키텍처별

- 벡터·GIS 분석

- 래스터·영상 분석

- 스트리밍·실시간 애널리틱스

- 지역 시각화

제11장 지리공간 인텔리전스(GeoAI) 시장 : 데이터 유형별

- 영상 데이터

- 비영상 데이터

- GEOTEMPORAL·퓨전

제12장 지리공간 인텔리전스(GeoAI) 시장 : 용도별

- 자산 모니터링·자산관리

- 리스크 평가·모델링

- 정밀농업

- 재해 관리·대응

- 도시계획·디지털 트윈

- 감시·보안

- 공급망·루트 최적화

- 환경·기후 모니터링

제13장 지리공간 인텔리전스(GeoAI) 시장 : 업계별

- 에너지·유틸리티

- 정부·방위

- 통신

- 보험·금융 서비스

- 부동산·건설

- 자동차·운송

- 의료·생명과학

- 광업

- 농업

- 기타 업계

제14장 지리공간 인텔리전스(GeoAI) 시장 : 지역별

- 북미

- 북미의 지리공간 인텔리전스(GeoAI) 시장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 지리공간 인텔리전스(GeoAI) 시장 촉진요인

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 지리공간 인텔리전스(GeoAI) 시장 촉진요인

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- ASEAN

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 지리공간 인텔리전스(GeoAI) 시장 촉진요인

- 중동 및 아프리카의 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 튀르키예

- 남아프리카공화국

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 지리공간 인텔리전스(GeoAI) 시장 촉진요인

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제15장 경쟁 구도

- 개요

- 주요 참여 기업의 전략(2020-2025년)

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 브랜드의 비교 분석

- 브랜드의 비교 분석 : 지리공간 인텔리전스 취득 시스템별

- 브랜드의 비교 분석 : 지리공간 인텔리전스(GeoAI) 소프트웨어별

- 기업 평가 매트릭스 : 주요 기업(소프트웨어·서비스 벤더)

- 기업 평가 매트릭스 : 주요 기업(지리공간 취득 시스템 벤더)

- 기업 평가 매트릭스 : 스타트업 기업/중소기업

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- HEXAGON AB

- TOMTOM

- ALTERYX

- IBM

- AIRBUS

- TRIMBLE

- CALIPER CORPORATION

- PRECISELY

- ESRI

- MICROSOFT

- BENTLEY SYSTEMS

- HERE TECHNOLOGIES

- NV5GEOSPATIAL

- TELEDYNE GEOSPATIAL

- RMSI

- LANTERIS SPACE SYSTEMS

- VANTOR

- MAPLARGE

- BAE SYSTEMS

- GENERAL ELECTRIC

- FUGRO

- PLANET LABS

- SBL

- ECS

- AWS

- CGI

- 스타트업/중소기업

- VEXEL IMAGING

- CAPELLA SPACE

- EARTHDAILY ANALYTICS

- MAPIDEA

- GEOSPIN(EMA SMARTSERVICE)

- SPARKGEO

- CARTO

- MAPBOX

- BLUE SKY ANALYTICS

- LATITUDO40

- ECOPIA.AI

- SPATIAL.AI

- DISTA

- EOS DATA ANALYTICS

- MAGNASOFT

- WHEROBOTS

- OUSTER

- GEOWGS84.AI

- EUROPA TECHNOLOGIES

- MAPULAR

제17장 조사 방법

제18장 인접 시장과 관련 시장

- 지리공간 영상 해석 시장 - 세계 예측(-2030년)

- 시장 정의

- 시장의 개요

- 위치정보 서비스(LBS)·실시간 위치추적 시스템(RTLS) 시장 - 세계 예측(-2028년)

- 시장 정의

- 시장의 개요

제19장 부록

KSA 26.01.29The geospatial intelligence (GeoAI) market is projected to grow from USD 37.13 billion in 2025 to USD 62.88 billion by 2030, at a CAGR of 11.1% during the forecast period. Market growth is driven by the increasing use of artificial intelligence and machine learning to analyze complex geospatial datasets generated from satellites, drones, sensors, and connected devices.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Offering, Core Technology Architecture, Data Type, Application, Vertical, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, Latin America |

Organizations across defense, infrastructure, healthcare, and environmental monitoring are adopting geospatial intelligence solutions to enhance decision-making, risk assessment, and operational efficiency. Advancements in cloud computing, data fusion, and real-time analytics are improving the scalability and accessibility of geospatial intelligence platforms. In parallel, growing investments in smart infrastructure, public safety, and climate resilience initiatives are further strengthening demand for advanced GeoAI capabilities.

"Sensing and capture segment, by offering, is projected to grow at the highest CAGR during the forecast period."

Sensing and capture represent the fastest-growing segment within geospatial acquisition systems in the geospatial intelligence (GeoAI) market. This segment includes satellites, aerial platforms, drones, LiDAR systems, and ground-based sensors used to collect geospatial data. Growth is driven by the expanding deployment of earth observation satellites, the increased use of unmanned aerial systems, and the demand for high-frequency data collection. These acquisition systems provide the foundational data required for downstream geospatial intelligence and analytics. Continuous improvements in sensor resolution, coverage, and cost efficiency are driving the acceleration of adoption across various use cases, including defense, infrastructure monitoring, environmental assessment, and disaster response.

"Imagery data segment is expected to hold the largest share of the geospatial intelligence (GeoAI) market."

Imagery data represents the largest data type segment in the geospatial intelligence (GeoAI) market. Satellite and aerial imagery are widely used for surveillance, mapping, change detection, and asset monitoring applications. High-resolution imagery supports AI-driven feature extraction, object recognition, and predictive spatial analysis across multiple sectors. Continuous improvements in image resolution, revisit rates, and analytics capabilities are enhancing the value of imagery-based intelligence. Strong adoption across defense, urban planning, environmental monitoring, and commercial applications sustains the dominant position of the imagery data segment.

"North America to lead the geospatial intelligence (GeoAI) market, while Asia Pacific emerges as the fastest-growing region."

North America is expected to hold the largest share of the geospatial intelligence (GeoAI) market during the forecast period. The region benefits from strong adoption across defense, public safety, infrastructure, and healthcare applications, supported by sustained government spending and a mature geospatial technology ecosystem. Widespread use of satellite imagery, geospatial analytics, and AI-enabled intelligence platforms across federal agencies and enterprises drives market leadership. The presence of major geospatial technology providers and cloud service platforms further accelerates deployment.

Asia Pacific is projected to register the highest growth rate in the geospatial intelligence (GeoAI) market. Rapid urbanization, increasing investments in smart city initiatives, and the expansion of earth observation programs across countries such as China, India, and Southeast Asian nations are driving the adoption. Governments in the region are leveraging geospatial intelligence for infrastructure development, environmental monitoring, and disaster management. The growing availability of satellite data and improving analytics capabilities position the Asia Pacific as a key growth region over the forecast period.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the geospatial intelligence (GeoAI) market.

- By Company: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, D-level Executives - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Middle East & Africa - 10%, and Latin America - 5%

The report includes the study of key players offering geospatial intelligence solutions and services. It profiles major vendors in the geospatial intelligence (GeoAI) market. The major players in the s market include Google (US), IBM (US), Alteryx (US), ESRI (US), Hexagon AB (Sweden), TomTom (Netherlands), Trimble (US), Ouster (US), Vantor (US), Lanteris Space Systems (US), Precisely (US), Caliper Corporation (US), RMSI (India), MapLarge (US), General Electric (US), Airbus (France), Fugro (Netherlands), Planet Labs (US), Microsoft (US), CGI (Canada), Teledyne Technologies (Canada), Bentley Systems (US), Here Technologies (US), NVS Geospatial (US), AWS (US), SBL (India), BAE Systems (UK), ECS (US), Vexcel Imaging (Austria), Mapbox (US), EOS Data Analytics (US), Magnasoft (India), EarthDaily Analytics (Canada), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Mapular (New Zealand), Carto (US), Blue Sky Analytics (Netherlands), Latitudo40 (Italy), Ecopia AI (Canada), Spatial AI (US), Dista (US), Capella Space (US), Whereobots (US), Geowgs84.ai (US), and Europa Technologies (UK).

Research coverage

This research report covers the geospatial intelligence (GeoAI) market and is segmented by offering, core technology architecture, data type, and vertical. The offering segment comprises software, geospatial acquisition systems, and services. The software segment contains GeoAI & ML platforms (agentic GIS & AI copilot, GeoAI cloud-native platform, GeoAI model catalogs, and others), geospatial analytics (traditional GIS solutions [desktop GIS, web/enterprise GIS, spatial databases, 3D/4D mapping tools), location intelligence (spatial query & indexing engines, geospatial visualization engines, location enrichment tools, and spatial apis & microservices), and data processing & ETL (geocoding engines, spatial data integration tools, raster/vector/crs data conversion). The geospatial acquisition systems segment is divided into sensing & capture (satellite imaging sensors, aerial cameras, and LIDAR/3D scanners) and positioning & tracking (GNSS receivers [RTK/PPP], inertial measurement units [IMU], and PNT [position, navigation, and timing] systems). The services segment comprises core services (consulting, deployment & integration, custom app development, training & enablement, and data integration services) and managed services. The core technology architecture segment covers vector & GIS analytics (geometric analysis, spatial statistics, network analysis), raster & imagery analytics (satellite/aerial image processing, computer vision, spectral analysis), streaming & real-time analytics (live data processing, event detection, dynamic optimization) and geovisualization (dashboard & reporting, thematic mapping, 3D/AR/VR overlays). The data type segment covers Imagery Data (satellite imagery, aerial/UAV imagery, hyperspectral data, SAR data), non-imagery data (vector data, 3D spatial data, crowd-sourced data, LiDAR data), and geotemporal & fusion (sensor/IoT data, social media geotagged data, mobile device location data). the application segment covers asset monitoring & management, risk assessment & modeling, precision agriculture, disaster management & response, urban planning & digital twins, surveillance & security, supply-chain & route optimization, and environmental & climate monitoring. The vertical segment is split into energy & utilities, government & defense, telecommunications, insurance & financial services, real estate & construction, automotive & transportation, healthcare & life sciences, mining, agriculture, and other verticals (including retail & e-commerce, media & entertainment, education, and tourism). The regional analysis of the geospatial intelligence (GeoAI) market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall geospatial intelligence (GeoAI) market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (compression of decision timelines across security, infrastructure, and commercial operations, proliferation of persistent earth observation and location-aware data sources, expansion of geospatial intelligence beyond defense into civilian and commercial decision-making, rising importance of spatial context for predictive and anticipatory intelligence), restraints (managing regulatory constraints and cross-border data controls, infrastructure and network constraints limiting real-time geospatial intelligence adoption), opportunities (unlocking new value with geo foundation models and transfer learning pipelines, scaling enterprise trust through data fusion and provenance services, delivering verticalized, compliance-aligned geospatial intelligence platforms, monetizing predictive geospatial intelligence through operational integration), and challenges (maintaining high-quality labels and validation at operational scale, enabling secure multi-party geospatial collaboration and federated analytics)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the geospatial intelligence (GeoAI) market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the geospatial intelligence (GeoAI) market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the geospatial intelligence (GeoAI) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Google (US), IBM (US), Alteryx (US), ESRI (US), Hexagon AB (Sweden), TomTom (Netherlands), Trimble (US), Ouster (US), Vantor (US), Lanteris Space Systems (US), Precisely (US), Caliper Corporation (US), RMSI (India), MapLarge (US), General Electric (US), Airbus (France), Fugro (Netherlands), Planet Labs (US), Microsoft (US), CGI (Canada), Teledyne Technologies (Canada), Bentley Systems (US), Here Technologies (US), NVS Geospatial (US), AWS (US), SBL (India), BAE Systems (UK), ECS (US), Vexcel Imaging (Austria), Mapbox (US), EOS Data Analytics (US), Magnasoft (India), EarthDaily Analytics (Canada), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Mapular (New Zealand), Carto (US), Blue Sky Analytics (Netherlands), Latitudo40 (Italy), Ecopia AI (Canada), Spatial AI (US), Dista (US), Capella Space (US), Wherobots (US), Geowgs84.ai (US), and Europa Technologies (UK) among others in the geospatial intelligence (GeoAI) market. The report also helps stakeholders understand the pulse of the Geospatial Intelligence (GeoAI) market, providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 STUDY YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET

- 3.2 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET: TOP THREE APPLICATIONS

- 3.3 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING AND END USER

- 3.4 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Compression of decision timelines across security, infrastructure, and commercial operations

- 4.2.1.2 Proliferation of persistent Earth observation and location-aware data sources

- 4.2.1.3 Expansion of geospatial intelligence beyond defense into civilian and commercial decision-making

- 4.2.1.4 Rising importance of spatial context for predictive and anticipatory intelligence

- 4.2.2 RESTRAINTS

- 4.2.2.1 Managing regulatory constraints and cross-border data controls

- 4.2.2.2 Infrastructure and network constraints limiting real-time geospatial intelligence adoption

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Unlocking new value with geo foundation models and transfer learning pipelines

- 4.2.3.2 Scaling enterprise trust through data fusion and provenance services

- 4.2.3.3 Delivering verticalized, compliance-aligned geospatial intelligence platforms

- 4.2.3.4 Monetizing predictive geospatial intelligence through operational integration

- 4.2.4 CHALLENGES

- 4.2.4.1 Maintaining high-quality labels and validation at operational scale

- 4.2.4.2 Enabling secure multi-party geospatial collaboration and federated analytics

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 EVOLUTION OF GEOSPATIAL INTELLIGENCE (GEOAI)

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL BIG DATA AND ANALYTICS INDUSTRY

- 5.3.4 TRENDS IN GLOBAL CYBERSECURITY INDUSTRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 GEOSPATIAL ACQUISITION SYSTEM PROVIDERS

- 5.5.1.1 Sensing & capture providers

- 5.5.1.2 Positioning & tracking providers

- 5.5.2 SOFTWARE PROVIDERS

- 5.5.2.1 Location intelligence providers

- 5.5.2.2 Traditional GIS providers

- 5.5.2.3 Data processing & ETL providers

- 5.5.2.4 GeoAI & ML platform providers

- 5.5.3 SERVICE PROVIDERS

- 5.5.3.1 Core services

- 5.5.3.1.1 Consulting services

- 5.5.3.1.2 Data integration services

- 5.5.3.2 Managed services

- 5.5.3.1 Core services

- 5.5.1 GEOSPATIAL ACQUISITION SYSTEM PROVIDERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF OFFERINGS (GEOSPATIAL ACQUISITION SYSTEMS), BY KEY PLAYER, 2025

- 5.6.2 AVERAGE SELLING PRICE OF SOFTWARE AND SERVICES, 2025

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9015)

- 5.7.2 EXPORT SCENARIO (HS CODE 9015)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CGI AND BELL CANADA TRANSFORM NETWORK WITH ENTERPRISE GEOSPATIAL PLATFORM

- 5.11.2 WHEROBOTS AND AARDEN.AI OVERCOME SCALING CHALLENGES WITH UNIFIED GEOSPATIAL PLATFORM

- 5.11.3 SOUTH KOREA AND NV5 INTEGRATE REMOTE SENSING TO IMPROVE FOREST GHG REPORTING

- 5.11.4 SYMAPS AND MAPBOX ENHANCE LOCATION INTELLIGENCE WITH GLOBAL MOVEMENT DATA

- 5.11.5 BAJAJ FINSERV IMPLEMENTS ESRI'S GEOSPATIAL PLATFORM SOLUTION TO IMPROVE CUSTOMER SERVICE

- 5.12 IMPACT OF 2025 US TARIFF - GEOSPATIAL INTELLIGENCE (GEOAI) MARKET

- 5.12.1 INTRODUCTION

- 5.12.1.1 Tariff/trade policy updates (August-December 2025)

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.3.1 Strategic shifts and emerging trends

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 China

- 5.12.4.3 Europe

- 5.12.4.4 Asia Pacific (excluding China)

- 5.12.5 IMPACT ON END-USE INDUSTRIES

- 5.12.5.1 Energy & utilities

- 5.12.5.2 Government & defense

- 5.12.5.3 Telecommunications

- 5.12.5.4 Insurance & financial services

- 5.12.5.5 Real estate & construction

- 5.12.5.6 Automotive & transportation

- 5.12.5.7 Healthcare & life sciences

- 5.12.5.8 Mining

- 5.12.5.9 Agriculture

- 5.12.5.10 Other verticals (retail & e-commerce, media & entertainment, education, tourism)

- 5.12.1 INTRODUCTION

6 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ADVANCED AI/ML TECHNIQUES

- 6.1.2 REMOTE SENSING, EO, & MULTI-SENSOR DATA FUSION

- 6.1.3 HIGH-FIDELITY 3D MAPPING & DIGITAL TWINS

- 6.1.4 CLOUD & EDGE COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 INTERNET OF THINGS (IOT) & SENSOR NETWORKS

- 6.2.2 5G CONNECTIVITY

- 6.2.3 FEDERATED LEARNING (FL) & PRIVACY-PRESERVING AI

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 SPATIAL COMPUTING

- 6.3.2 GENERATIVE AI & GEOLLMS

- 6.3.3 BLOCKCHAIN

- 6.4 TECHNOLOGY ROADMAP

- 6.4.1 SHORT TERM (2025-2027): FOUNDATION AND STANDARDIZATION PHASE

- 6.4.2 MID TERM (2028-2030): CONVERGENCE AND AUTOMATION PHASE

- 6.4.3 LONG TERM (2031-2035): AUTONOMOUS AND COGNITIVE INTEROPERABILITY PHASE

- 6.5 PATENT ANALYSIS

- 6.5.1 METHODOLOGY

- 6.5.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 6.5.3 INNOVATION AND PATENT APPLICATIONS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 KEY REGULATIONS

- 7.1.2.1 North America

- 7.1.2.1.1 Geospatial Data Act (GDA) of 2018 (US)

- 7.1.2.1.2 Open Government Directive of 2014 (Canada)

- 7.1.2.2 Europe

- 7.1.2.2.1 INSPIRE Directive 2007/2 (European Commission)

- 7.1.2.2.2 General Data Protection Regulation (European Union)

- 7.1.2.2.3 Copernicus Regulation 2021/696 (European Union)

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 Geospatial Information Regulation Act 2016 (India)

- 7.1.2.3.2 Surveying and Mapping Law 2002, Revised 2017 (China)

- 7.1.2.3.3 Basic Act on Advancement of Utilizing Geospatial Information, 2007 (Japan)

- 7.1.2.4 Middle East & Africa

- 7.1.2.4.1 Survey and Mapping Law (Saudi Arabia)

- 7.1.2.4.2 Spatial Data Infrastructure Act 54 of 2003 (South Africa)

- 7.1.2.5 Latin America

- 7.1.2.5.1 National Geospatial Data Infrastructure (INDE) Law (Brazil)

- 7.1.2.5.2 Geospatial Data Law 2020 (Mexico)

- 7.1.2.1 North America

- 7.1.3 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS INDUSTRY VERTICALS

9 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 OFFERING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 9.2 SOFTWARE

- 9.2.1 GEOAI & ML PLATFORMS

- 9.2.1.1 Advancing intelligent spatial analysis through integrated AI-driven platform capabilities

- 9.2.1.2 Agentic GIS & AI copilot

- 9.2.1.3 GeoAI cloud-native platform

- 9.2.1.4 GeoAI model catalogs

- 9.2.1.5 Other GeoAI & ML platforms

- 9.2.2 GEOSPATIAL ANALYTICS

- 9.2.2.1 Traditional GIS Solutions

- 9.2.2.1.1 Strengthening spatial decision-making through expanding demand for foundational GIS capabilities

- 9.2.2.1.2 Desktop GIS

- 9.2.2.1.3 Web/Enterprise GIS

- 9.2.2.1.4 Spatial databases

- 9.2.2.1.5 3D/4D mapping tools

- 9.2.2.2 Location intelligence (LI)

- 9.2.2.2.1 Enhancing spatial decision-making through advanced location intelligence capabilities

- 9.2.2.2.2 Spatial query & indexing engines

- 9.2.2.2.3 Geospatial visualization engines

- 9.2.2.2.4 Location enrichment tools

- 9.2.2.2.5 Spatial APIs & microservices

- 9.2.2.3 Data Processing & ETL

- 9.2.2.3.1 Advancing organizational security with unified policy enforcement

- 9.2.2.3.2 Geocoding engines

- 9.2.2.3.3 Spatial data integration tools

- 9.2.2.3.4 Raster/vector/CRS data conversion

- 9.2.2.1 Traditional GIS Solutions

- 9.2.1 GEOAI & ML PLATFORMS

- 9.3 GEOSPATIAL ACQUISITION SYSTEMS

- 9.3.1 SENSING & CAPTURE

- 9.3.1.1 Enhancing spatial data fidelity through advanced multimodal sensing innovations

- 9.3.1.2 Satellite imaging sensors

- 9.3.1.3 Aerial cameras

- 9.3.1.4 LiDAR/3D scanners

- 9.3.2 POSITIONING & TRACKING

- 9.3.2.1 Optimizing precision movement through advanced geospatial tracking technologies

- 9.3.2.2 GNSS receivers (RTK/PPP)

- 9.3.2.3 Inertial Measurement Units (IMU)

- 9.3.2.4 PNT (Position, Navigation, Timing) systems

- 9.3.1 SENSING & CAPTURE

- 9.4 SERVICES

- 9.4.1 CORE SERVICES

- 9.4.1.1 Accelerating adoption through expert-led integration and high-quality geospatial services

- 9.4.1.2 Consulting

- 9.4.1.3 Deployment & integration

- 9.4.1.4 Custom application development

- 9.4.1.5 Training & enablement

- 9.4.1.6 Data-integration services

- 9.4.2 MANAGED SERVICES

- 9.4.2.1 Accelerating scalable geospatial readiness through continuous cloud delivery and automation

- 9.4.2.2 Data-as-a-Service (DaaS)

- 9.4.2.3 Analytics-as-a-Service (AaaS)

- 9.4.1 CORE SERVICES

10 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE

- 10.1 INTRODUCTION

- 10.1.1 CORE TECHNOLOGY ARCHITECTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 10.2 VECTOR & GIS ANALYTICS

- 10.2.1 ACCELERATING PRECISION MAPPING THROUGH AI-ENHANCED VECTOR ANALYSIS AND AUTOMATED GEOPROCESSING

- 10.2.2 GEOMETRIC ANALYSIS

- 10.2.3 SPATIAL STATISTICS

- 10.2.4 NETWORK ANALYSIS

- 10.3 RASTER & IMAGERY ANALYTICS

- 10.3.1 DRIVING REAL-TIME INSIGHT THROUGH AI-POWERED IMAGERY INTERPRETATION AND AUTOMATED CHANGE DETECTION

- 10.3.2 SATELLITE/AERIAL IMAGE PROCESSING

- 10.3.3 COMPUTER VISION

- 10.3.4 SPECTRAL ANALYSIS

- 10.4 STREAMING & REAL-TIME ANALYTICS

- 10.4.1 ENHANCING SITUATIONAL AWARENESS THROUGH AI-OPTIMIZED REAL-TIME GEOSPATIAL DATA PROCESSING

- 10.4.2 LIVE DATA PROCESSING

- 10.4.3 EVENT DETECTION

- 10.4.4 DYNAMIC OPTIMIZATION

- 10.5 GEOVISUALIZATION

- 10.5.1 ELEVATING DECISION CLARITY THROUGH INTERACTIVE SPATIAL VISUALIZATION AND AI-DRIVEN VISUAL INSIGHTS

- 10.5.2 DASHBOARD & REPORTING

- 10.5.3 THEMATIC MAPPING

- 10.5.4 3D/AR/VR OVERLAYS

11 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE

- 11.1 INTRODUCTION

- 11.1.1 DATA TYPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 11.2 IMAGERY DATA

- 11.2.1 ADVANCING HIGH-PRECISION INSIGHTS THROUGH INTELLIGENT UTILIZATION OF RICH IMAGERY DATA

- 11.2.2 SATELLITE IMAGERY

- 11.2.3 AERIAL/UAV IMAGERY

- 11.2.4 HYPERSPECTRAL DATA

- 11.2.5 SAR DATA

- 11.3 NON-IMAGERY DATA

- 11.3.1 STRENGTHENING CONTEXT-AWARE DECISION INTELLIGENCE THROUGH NON-IMAGERY SPATIAL DATA UTILIZATION

- 11.3.2 VECTOR DATA

- 11.3.3 3D SPATIAL DATA

- 11.3.4 CROWD-SOURCED DATA

- 11.3.5 LIDAR DATA

- 11.4 GEOTEMPORAL & FUSION

- 11.4.1 ADVANCING PREDICTIVE INSIGHT THROUGH INTEGRATED GEOTEMPORAL ANALYSIS AND MULTIMODAL DATA FUSION

- 11.4.2 SENSOR/IOT DATA

- 11.4.3 SOCIAL MEDIA GEOTAGGED DATA

- 11.4.4 MOBILE DEVICE LOCATION DATA

12 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.1.1 APPLICATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 12.2 ASSET MONITORING & MANAGEMENT

- 12.2.1 DRIVING ASSET RELIABILITY THROUGH INTELLIGENT GEOSPATIAL MONITORING AND PREDICTIVE INSIGHT

- 12.3 RISK ASSESSMENT & MODELING

- 12.3.1 ENHANCING HAZARD FORESIGHT THROUGH INTELLIGENT GEOSPATIAL RISK MODELLING

- 12.4 PRECISION AGRICULTURE

- 12.4.1 ADVANCING FARM EFFICIENCY THROUGH INTELLIGENT GEOSPATIAL CROP OPTIMIZATION

- 12.5 DISASTER MANAGEMENT & RESPONSE

- 12.5.1 ENHANCING EMERGENCY PREPAREDNESS THROUGH ADVANCED GEOAI-DRIVEN DISASTER RESPONSE CAPABILITIES

- 12.6 URBAN PLANNING & DIGITAL TWINS

- 12.6.1 DRIVING ENTERPRISE EFFICIENCY, SECURITY, AND VISIBILITY IN SAAS OPERATIONS

- 12.7 SURVEILLANCE & SECURITY

- 12.7.1 ADVANCING THREAT DETECTION THROUGH GEOAI-ENABLED SURVEILLANCE AND SECURITY SYSTEMS

- 12.8 SUPPLY CHAIN & ROUTE OPTIMIZATION

- 12.8.1 BOOSTING LOGISTICS PERFORMANCE THROUGH GEOAI-ENABLED ROUTING AND SUPPLY CHAIN OPTIMIZATION

- 12.9 ENVIRONMENTAL & CLIMATE MONITORING

- 12.9.1 STRENGTHENING CLIMATE RESILIENCE THROUGH GEOAI-DRIVEN ENVIRONMENTAL MONITORING SYSTEMS

13 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL

- 13.1 INTRODUCTION

- 13.1.1 VERTICAL: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 13.2 ENERGY & UTILITIES

- 13.2.1 ENHANCING GRID RESILIENCE AND ASSET INTELLIGENCE THROUGH ADVANCED SPATIAL ANALYTICS

- 13.3 GOVERNMENT & DEFENSE

- 13.3.1 STRENGTHENING NATIONAL SECURITY THROUGH AI-DRIVEN SPATIAL INTELLIGENCE AND SURVEILLANCE

- 13.4 TELECOMMUNICATION

- 13.4.1 NETWORK DENSIFICATION AND 5G EXPANSION DRIVING ADVANCED SPATIAL INTELLIGENCE ADOPTION

- 13.5 INSURANCE & FINANCIAL SERVICES

- 13.5.1 CLIMATE RISK TRANSPARENCY AND CLAIMS AUTOMATION DRIVING LOCATION-CENTRIC INTELLIGENCE ADOPTION

- 13.6 REAL ESTATE & CONSTRUCTION

- 13.6.1 RAPID URBAN DENSITY AND REGULATORY COMPLIANCE PRESSURES ACCELERATING SPATIAL INTELLIGENCE ADOPTION

- 13.7 AUTOMOTIVE & TRANSPORTATION

- 13.7.1 RISING DEMAND FOR REAL-TIME TRAFFIC OPTIMIZATION AND SMART FLEET ORCHESTRATION

- 13.8 HEALTHCARE & LIFE SCIENCES

- 13.8.1 EXPANDING PREVENTIVE CARE MODELS AND OUTBREAK PREPAREDNESS STRENGTHENING SPATIAL ANALYTICS ADOPTION

- 13.9 MINING

- 13.9.1 RISING COMMODITY DEMAND AND AUTOMATION IMPERATIVES ACCELERATING SPATIAL INTELLIGENCE INTEGRATION

- 13.10 AGRICULTURE

- 13.10.1 CLIMATE VOLATILITY AND PRECISION YIELD OPTIMIZATION ACCELERATING SPATIAL INTELLIGENCE ADOPTION

- 13.11 OTHER VERTICALS

14 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 14.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 14.2.3 US

- 14.2.3.1 Smart infrastructure and BIM-led digitization to accelerate location-based intelligence adoption

- 14.2.4 CANADA

- 14.2.4.1 Open data mandates and startup-driven innovation powering nationwide geospatial adoption

- 14.3 EUROPE

- 14.3.1 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 14.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 14.3.3 UK

- 14.3.3.1 Government initiatives and defense partnerships to fuel advanced location Intelligence adoption

- 14.3.4 GERMANY

- 14.3.4.1 Satellite services, smart cities, and sustainability programs to drive advanced spatial innovation

- 14.3.5 FRANCE

- 14.3.5.1 Defense modernization, smart cities, and climate missions to support adoption of AI-driven spatial intelligence

- 14.3.6 ITALY

- 14.3.6.1 Satellite analytics and smart infrastructure programs accelerating digital location capabilities

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 14.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 14.4.3 CHINA

- 14.4.3.1 Advancements in satellite technology, telecom infrastructure, and national security to drive growth

- 14.4.4 INDIA

- 14.4.4.1 Government-led geospatial policy, international collaboration, and infrastructure digitization to drive market expansion

- 14.4.5 JAPAN

- 14.4.5.1 Increase in focus on disaster management and adoption of GIS-based mapping technologies to fuel market growth

- 14.4.6 ASEAN

- 14.4.6.1 Smart cities, climate resilience, and cross-border trade to drive GeoAI adoption

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 MIDDLE EAST & AFRICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 14.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 14.5.3 SAUDI ARABIA

- 14.5.3.1 Vision 2030, smart cities, and space investments to propel advanced spatial intelligence growth

- 14.5.4 UAE

- 14.5.4.1 Geospatial data leveraged for projects such as Smart Dubai and Abu Dhabi's TAMM platform

- 14.5.5 TURKEY

- 14.5.5.1 Smart infrastructure modernization and disaster risk management to fuel geospatial adoption

- 14.5.6 SOUTH AFRICA

- 14.5.6.1 Mining automation, climate risk, and smart cities to fuel spatial AI adoption

- 14.5.7 REST OF MIDDLE EAST & AFRICA

- 14.6 LATIN AMERICA

- 14.6.1 LATIN AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS

- 14.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 14.6.3 BRAZIL

- 14.6.3.1 Initiatives like National Institute for Space Research to monitor Amazon and other critical ecosystems to boost market

- 14.6.4 MEXICO

- 14.6.4.1 Strategic push for nearshoring and focus on environmental sustainability to amplify demand

- 14.6.5 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES, 2020-2025

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 MARKET RANKING ANALYSIS, 2024

- 15.5 BRAND COMPARATIVE ANALYSIS

- 15.5.1 BRAND COMPARATIVE ANALYSIS, BY GEOSPATIAL ACQUISITION SYSTEMS

- 15.5.1.1 Airbus (France)

- 15.5.1.2 Planet Labs (US)

- 15.5.1.3 Fugro (Netherlands)

- 15.5.1.4 Vexcel Imaging (Austria)

- 15.5.1.5 Capella Space (US)

- 15.5.2 BRAND COMPARATIVE ANALYSIS, BY GEOSPATIAL INTELLIGENCE (GEOAI) SOFTWARE

- 15.5.2.1 Google (US)

- 15.5.2.2 ESRI (US)

- 15.5.2.3 Hexagon AB (Sweden)

- 15.5.2.4 TomTom (Netherlands)

- 15.5.2.5 Carto (US)

- 15.5.1 BRAND COMPARATIVE ANALYSIS, BY GEOSPATIAL ACQUISITION SYSTEMS

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS (SOFTWARE & SERVICES VENDORS)

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS (SOFTWARE & SERVICES VENDORS)

- 15.6.5.1 Company footprint

- 15.6.5.2 Regional footprint

- 15.6.5.3 Offering footprint

- 15.6.5.4 Core technology architecture footprint

- 15.6.5.5 Application footprint

- 15.6.5.6 Vertical footprint

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (GEOSPATIAL ACQUISITION SYSTEMS VENDORS)

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS (GEOSPATIAL ACQUISITION SYSTEMS VENDORS)

- 15.7.5.1 Company footprint

- 15.7.5.2 Regional footprint

- 15.7.5.3 Offering footprint

- 15.7.5.4 Core technology architecture footprint

- 15.7.5.5 Application footprint

- 15.7.5.6 Vertical footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPANY VALUATION AND FINANCIAL METRICS

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 15.10.2 DEALS

16 COMPANY PROFILES

- 16.1 INTRODUCTION

- 16.2 KEY PLAYERS

- 16.2.1 GOOGLE

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 Recent developments

- 16.2.1.3.1 Product launches & enhancements

- 16.2.1.3.2 Deals

- 16.2.1.4 MnM view

- 16.2.1.4.1 Key strengths

- 16.2.1.4.2 Strategic choices

- 16.2.1.4.3 Weaknesses and competitive threats

- 16.2.2 HEXAGON AB

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 Recent developments

- 16.2.2.3.1 Product launches & enhancements

- 16.2.2.3.2 Deals

- 16.2.2.4 MnM view

- 16.2.2.4.1 Key strengths

- 16.2.2.4.2 Strategic choices

- 16.2.2.4.3 Weaknesses and competitive threats

- 16.2.3 TOMTOM

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 Recent developments

- 16.2.3.3.1 Product launches & enhancements

- 16.2.3.3.2 Deals

- 16.2.3.4 MnM view

- 16.2.3.4.1 Key strengths

- 16.2.3.4.2 Strategic choices

- 16.2.3.4.3 Weaknesses and competitive threats

- 16.2.4 ALTERYX

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 Recent developments

- 16.2.4.3.1 Product launches & enhancements

- 16.2.4.3.2 Deals

- 16.2.4.4 MnM view

- 16.2.4.4.1 Key strengths

- 16.2.4.4.2 Strategic choices

- 16.2.4.4.3 Weaknesses and competitive threats

- 16.2.5 IBM

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 Recent developments

- 16.2.5.3.1 Product launches & enhancements

- 16.2.5.3.2 Deals

- 16.2.5.4 MnM view

- 16.2.5.4.1 Key strengths

- 16.2.5.4.2 Strategic choices

- 16.2.5.4.3 Weaknesses and competitive threats

- 16.2.6 AIRBUS

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 Recent developments

- 16.2.6.3.1 Product launches & enhancements

- 16.2.6.3.2 Deals

- 16.2.7 TRIMBLE

- 16.2.7.1 Business overview

- 16.2.7.2 Products/Solutions/Services offered

- 16.2.7.3 Recent developments

- 16.2.7.3.1 Product launches & enhancements

- 16.2.7.3.2 Deals

- 16.2.8 CALIPER CORPORATION

- 16.2.8.1 Business overview

- 16.2.8.2 Products/Solutions/Services offered

- 16.2.8.3 Recent developments

- 16.2.8.3.1 Product launches & enhancements

- 16.2.8.3.2 Deals

- 16.2.9 PRECISELY

- 16.2.9.1 Business overview

- 16.2.9.2 Products/Solutions/Services offered

- 16.2.9.3 Recent developments

- 16.2.9.3.1 Product launches & enhancements

- 16.2.9.3.2 Deals

- 16.2.10 ESRI

- 16.2.10.1 Business overview

- 16.2.10.2 Products/Solutions/Services offered

- 16.2.10.3 Recent developments

- 16.2.10.3.1 Product launches & enhancements

- 16.2.10.3.2 Deals

- 16.2.11 MICROSOFT

- 16.2.11.1 Business overview

- 16.2.11.2 Products/Solutions/Services offered

- 16.2.11.3 Recent developments

- 16.2.11.3.1 Product launches & enhancements

- 16.2.11.3.2 Deals

- 16.2.12 BENTLEY SYSTEMS

- 16.2.12.1 Business overview

- 16.2.12.2 Products/Solutions/Services offered

- 16.2.12.3 Recent developments

- 16.2.12.3.1 Product launches

- 16.2.12.3.2 Deals

- 16.2.13 HERE TECHNOLOGIES

- 16.2.13.1 Business overview

- 16.2.13.2 Products/Solutions/Services offered

- 16.2.13.3 Recent developments

- 16.2.13.3.1 Product launches and enhancements

- 16.2.13.3.2 Deals

- 16.2.14 NV5 GEOSPATIAL

- 16.2.14.1 Business overview

- 16.2.14.2 Products/Solutions/Services offered

- 16.2.14.3 Recent developments

- 16.2.14.3.1 Product launches

- 16.2.15 TELEDYNE GEOSPATIAL

- 16.2.15.1 Business overview

- 16.2.15.2 Products/Solutions/Services offered

- 16.2.15.3 Recent developments

- 16.2.15.3.1 Product launches

- 16.2.15.3.2 Deals

- 16.2.16 RMSI

- 16.2.17 LANTERIS SPACE SYSTEMS

- 16.2.18 VANTOR

- 16.2.19 MAPLARGE

- 16.2.20 BAE SYSTEMS

- 16.2.21 GENERAL ELECTRIC

- 16.2.22 FUGRO

- 16.2.23 PLANET LABS

- 16.2.24 SBL

- 16.2.25 ECS

- 16.2.26 AWS

- 16.2.27 CGI

- 16.2.1 GOOGLE

- 16.3 STARTUPS/SMES

- 16.3.1 VEXEL IMAGING

- 16.3.2 CAPELLA SPACE

- 16.3.3 EARTHDAILY ANALYTICS

- 16.3.4 MAPIDEA

- 16.3.5 GEOSPIN (EMA SMARTSERVICE)

- 16.3.6 SPARKGEO

- 16.3.7 CARTO

- 16.3.8 MAPBOX

- 16.3.9 BLUE SKY ANALYTICS

- 16.3.10 LATITUDO40

- 16.3.11 ECOPIA.AI

- 16.3.12 SPATIAL.AI

- 16.3.13 DISTA

- 16.3.14 EOS DATA ANALYTICS

- 16.3.15 MAGNASOFT

- 16.3.16 WHEROBOTS

- 16.3.17 OUSTER

- 16.3.18 GEOWGS84.AI

- 16.3.19 EUROPA TECHNOLOGIES

- 16.3.20 MAPULAR

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Breakup of primary profiles

- 17.1.2.2 Key industry insights

- 17.2 DATA TRIANGULATION

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 TOP-DOWN APPROACH

- 17.3.2 BOTTOM-UP APPROACH

- 17.4 MARKET FORECAST

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 GEOSPATIAL IMAGERY ANALYTICS MARKET - GLOBAL FORECAST TO 2030

- 18.2.1 MARKET DEFINITION

- 18.2.2 MARKET OVERVIEW

- 18.2.2.1 Geospatial imagery analytics market, by offering

- 18.2.2.2 Geospatial imagery analytics market, by data modality

- 18.2.2.3 Geospatial imagery analytics market, by vertical

- 18.2.2.4 Geospatial imagery analytics market, by region

- 18.3 LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET - GLOBAL FORECAST TO 2028

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

- 18.3.2.1 LBS and RTLS Market, by offering

- 18.3.2.2 LBS and RTLS market, by location type

- 18.3.2.3 LBS and RTLS market, by application

- 18.3.2.4 LBS and RTLS market, by vertical

- 18.3.2.5 LBS and RTLS market, by region

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS