|

시장보고서

상품코드

1774597

사이버 보안 보험 시장 : 제공별, 보험 범위별, 보험 유형별, 프로바이더 유형별, 업계별, 지역별 - 예측(-2030년)Cybersecurity Insurance Market by Offering (Solutions, Services), Insurance Coverage (Data Breach, Cyber Liability), Insurance Type (Packaged, Standalone), Provider Type (Technology Providers, Insurance Providers) - Global Forecast to 2030 |

||||||

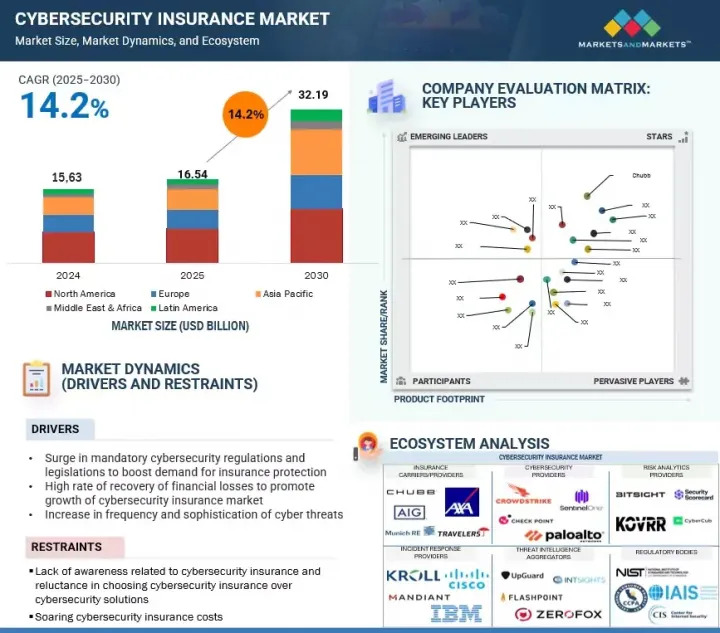

세계의 사이버 보안 보험 시장 규모는 2025년 165억 4,000만 달러에서 예측 기간 동안 CAGR 14.2%로 성장하여 2030년에는 321억 9,000만 달러에 달할 것으로 예상됩니다.

사이버 보안 보험 시장을 주도하는 것은 사이버 공격의 빈도와 교묘함이 증가함에 따라 기업은 잠재적 손실에 대한 경제적 보호를 요구하고 있으며, GDPR 및 기타 데이터 보호법과 같은 규제 압력이 증가함에 따라 사이버 보험은 컴플라이언스 준수에 필수적인 도구가 되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만/10억 달러) |

| 부문별 | 제공별, 보험 범위별, 보험 유형별, 프로바이더 유형별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

디지털 기술, 원격 근무, 클라우드 기반 인프라의 급속한 보급으로 공격 대상이 확대되고 보험의 필요성이 더욱 커지고 있습니다. 고도의 인지도가 높은 데이터 유출과 법적 책임에서 사업 중단에 이르기까지 관련 비용은 사이버 보험을 전략적 투자 대상으로 삼고 있습니다. 또한, AI를 활용한 리스크 분석의 발전으로 보험사들은 보다 맞춤화된 보험을 제공할 수 있게 되면서 시장의 매력은 더욱 커지고 있습니다. 그러나 시장은 몇 가지 억제요인에 직면해 있습니다. 과거 보험 계리 데이터의 부족은 가격 책정을 어렵게 하고, 보험금 청구 건수의 증가는 보험료 상승과 보상 범위의 제한으로 이어지고 있습니다. 보험계약의 복잡성과 모호한 면책조항으로 인해 클레임 분쟁이 자주 발생하고, 중소기업의 낮은 인지도는 보험 도입의 걸림돌로 작용하고 있습니다. 또한, 피보험자인 고객의 취약한 사이버 보안 대책이 손해율을 높이고 보험사의 진입을 가로막고 있습니다. 또한, 대규모 공격이나 국가적 차원의 공격으로 인한 시스템 리스크의 위협도 보험사의 재무 안정성에 영향을 미칠 수 있는 큰 과제입니다.

솔루션 분야는 사이버 보안 보험 분석 플랫폼, 재해 복구 및 비즈니스 연속성, 사이버 보안 솔루션으로 구성됩니다. 크고 작은 조직은 규모에 관계없이 특정 요구에 맞는 사이버 보안 보험 솔루션의 혜택을 누릴 수 있습니다. 이러한 솔루션은 프라이버시 침해, IT 포렌식, 규제 절차, 민사 처벌, 벌금으로 인한 잠재적 금전적 손실로부터 기업을 보호하도록 설계되어 있습니다. 이러한 보상 외에도 사이버 보안 보험에는 위기 관리, 고객 통지 비용, 사이버 협박, 해커 피해 비용, 컴퓨터 포렌식 조사, 프라이버시 및 보안에 대한 책임도 포함됩니다. 기술 제공업체(브로커 및 보험사)는 위험을 측정, 정량화 및 줄이기 위해 실시간 가시성 대시보드와 사이버 위험 점수를 제공하고 있습니다.

데이터 유출 보험은 사이버 보안 보험의 중요한 구성요소로, 민감한 개인 정보 및 기업 정보를 포함한 데이터 유출이 발생할 경우 기업에 금전적 보호와 대응 지원을 제공합니다. 이 보험은 법적 비용, 규제상의 벌금, 고객 통지, 신용 모니터링, 평판 관리 등 정보 유출과 관련된 막대한 비용을 기업이 관리할 수 있도록 설계되어 있습니다. 이 보험은 GDPR, HIPAA, CCPA와 같은 데이터 보호법을 준수해야 하는 오늘날의 규제 환경에서 특히 가치가 있습니다. 실무적으로 데이터 유출 보험은 법적 책임을 보장하고, 법의학 조사에 자금을 지원하고, 데이터 복구를 지원하며, 영향을 받는 당사자와 적시에 소통할 수 있도록 하기 위해 적용될 수 있습니다. 또한, 브랜드 피해를 최소화하기 위한 홍보 지원도 포함되며, 사업 중단으로 인한 손실을 보상하는 경우도 있습니다. 또한, 랜섬웨어 및 협박 사건과 관련된 제3자의 책임과 비용에 대한 보상도 포함될 수 있습니다. 금융, 의료, 소매, 교육 등 모든 분야의 조직이 사이버 위협의 증가에 직면하고 있는 가운데, 데이터 침해 보험은 위험 감소와 사고 복구에 필수적인 도구로 작용하고 있습니다.

아시아태평양의 사이버 보안 보험 시장은 빠르게 성장하고 있으며, 전 세계에서 가장 빠르게 성장하는 지역 시장으로 부상하고 있습니다. 이러한 성장의 원동력은 중국, 인도, 일본, 한국, 싱가포르, 호주 등의 경제권에서 디지털 전환의 진전과 랜섬웨어 공격, 데이터 침해, 규제 강화의 급증에 기인합니다. 인도, 중국 등의 국가에서는 특히 BFSI, 헬스케어, IT 부문에서 사이버 위협의 강화와 규제 당국의 감시 강화에 힘입어 사이버 보험의 도입이 크게 증가하고 있습니다. 싱가포르, 호주 등 성숙한 시장은 사이버 보안법, 개인정보 보호법 개정 등 법적 프레임워크가 확립되어 있어 도입을 선도하고 있습니다. 그러나 이 지역은 중소기업의 낮은 보급률, 과거 사이버 피해 데이터 부족, 정책의 명확성 부족 등의 문제에 직면해 있습니다. 이러한 상황에도 불구하고, 보험사에게는 분야 특화형 상품, 사이버 보안 벤더와의 제휴, AI를 활용한 인수 솔루션을 통해 보장을 확대할 수 있는 절호의 기회가 되고 있습니다. 그러나 규정 위반에 대한 벌금과 처벌이 급증하는 등 규제 강화로 인해 APAC의 사이버 보안 보험 시장 수요는 더욱 증가할 것으로 예상됩니다.

세계의 사이버 보안 보험 시장에 대해 조사했으며, 제공별, 보험 범위별, 보험 유형별, 공급자 유형별, 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 소개

- 시장 역학

- 업계 동향

- 공급망 분석

- 사이버 보안 보험 솔루션의 간단한 역사

- 생태계

- 사이버 보안 보험 시장의 툴, 기술, 프레임워크

- 현재 비즈니스 모델과 신흥 비즈니스 모델

- Porter's Five Forces 모델

- 주요 이해관계자와 구입 기준

- 기술 분석

- 사이버 보안 보험 시장 상황의 향후 전망

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 사이버 보안 보험 시장의 베스트 프랙티스

- 특허 분석

- 가격 모델 분석

- 이용 사례

- 2025년의 주요 회의와 이벤트

- 규제기관, 정부기관, 기타 조직

- 사이버 보안 보험 시장의 주요 컴플라이언스

- 투자와 자금 조달 시나리오

- 인공지능과 생성형 AI 소개

- 2025년 미국 관세의 영향 - 사이버 보안 보험 시장

제6장 사이버 보안 보험 시장(제공별)

- 소개

- 솔루션

- 서비스

제7장 사이버 보안 보험 시장(보험 범위별)

- 소개

- 데이터 침해

- 사이버 책임

제8장 사이버 보안 보험 시장(보험 유형별)

- 소개

- 패키지

- 독립형

제9장 사이버 보안 보험 시장(프로바이더 유형별)

- 소개

- 테크놀러지 프로바이더

- 보험회사

제10장 사이버 보안 보험 시장(업계별)

- 소개

- 금융 서비스

- IT·ITES

- 헬스케어·생명과학

- 소매·E-Commerce

- 통신

- 여행, 관광, 호스피탈리티

- 기타

제11장 사이버 보안 보험 시장(지역별)

- 소개

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 호주와 뉴질랜드

- 동남아시아

- 인도

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제12장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점, 2021-2024년

- 매출 분석, 2020-2024년

- 주요 기업의 시장 점유율 분석

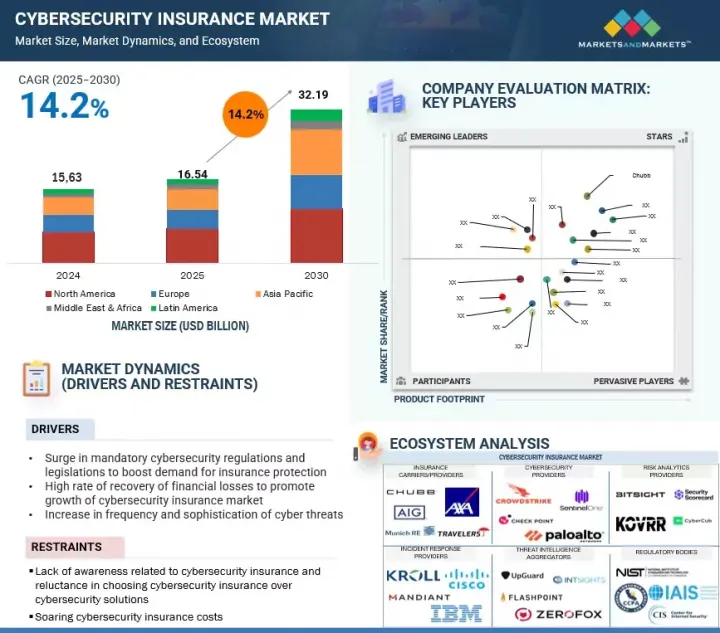

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오

제13장 기업 개요

- 기술 프로바이더

- BITSIGHT

- MITRATECH

- REDSEAL

- SECURITYSCORECARD

- UPGUARD

- CISCO

- MICROSOFT

- CHECK POINT

- ATTACKIQ

- SENTINELONE

- BROADCOM

- ACCENTURE

- CYLANCE

- TRELLIX

- CYBERARK

- CYE

- SECURIT360

- FOUNDER SHIELD

- 보험회사

- CHUBB

- AXA XL

- AIG

- TRAVELERS

- BEAZLEY

- ALLIANZ

- AON

- ARTHUR J. GALLAGHER

- AXIS CAPITAL

- CNA

- FAIRFAX

- LIBERTY MUTUAL

- LLOYD'S OF LONDON

- LOCKTON

- MUNICH RE

- SOMPO INTERNATIONAL

- 스타트업/중소기업

- AT-BAY

- CYBERNANCE

- COALITION

- RESILIENCE

- KOVRR

- SAYATA LABS

- ZEGURO

- IVANTI

- SAFEBREACH

- ORCHESTRA GROUP

제14장 인접 시장과 관련 시장

제15장 부록

ksm 25.07.29The global cybersecurity insurance market will grow from USD 16.54 billion in 2025 to USD 32.19 billion by 2030 at a compounded annual growth rate (CAGR) of 14.2% during the forecast period. The cybersecurity insurance market is driven by the escalating frequency and sophistication of cyberattacks, compelling businesses to seek financial protection against potential losses. Growing regulatory pressures, such as GDPR and other data protection laws, have made cyber insurance a necessary compliance tool.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Offering, Insurance Coverage, Insurance Type, Provider Type, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rapid adoption of digital technologies, remote work, and cloud-based infrastructure has expanded the attack surface, further emphasizing the need for coverage. High-profile data breaches and associated costs ranging from legal liabilities to business disruption have made cyber insurance a strategic investment. Additionally, advances in AI-driven risk analytics are enabling insurers to offer more tailored policies, enhancing market appeal. However, the market faces several restraints. A lack of historical actuarial data makes pricing difficult, and the increasing number of claims has led to rising premiums and restricted coverage. Policy complexity and vague exclusions often result in claim disputes, while low awareness among small and medium enterprises hampers adoption. Moreover, weak cybersecurity practices among insured clients increase loss ratios, discouraging insurer participation. The threat of systemic risks from large-scale or state-sponsored attacks also poses a significant challenge, potentially impacting the financial stability of insurers.

Based on offering, the solutions segment is expected to hold the largest market share during the forecast period.

The solutions segment comprises cybersecurity insurance analytics platforms, disaster recovery and business continuity, and cybersecurity solutions. Organizations, both large and small, can benefit from cybersecurity insurance solutions that cater to their specific needs. These solutions are designed to protect businesses from potential financial losses resulting from privacy breaches, IT forensics, regulatory proceedings, civil fines, and penalties. In addition to these coverages, cybersecurity insurance also includes crisis management, customer notification expenses, cyber extortion, hacker damage costs, computer forensic investigations, and liability for privacy and security. Technology providers (brokers and insurers) offer real-time visibility dashboards and cyber risk scores to measure, quantify, and reduce risks.

Based on insurance coverage, the data breach segment is expected to grow at the highest CAGR during the forecast period.

Data breach insurance is a critical component of cybersecurity insurance that offers financial protection and response support to organizations in the event of a data breach involving sensitive personal or business information. It is designed to help businesses manage the significant costs associated with breaches, including legal expenses, regulatory fines, customer notification, credit monitoring, and reputational management. This coverage is especially valuable in today's regulatory environment, where compliance with data protection laws such as GDPR, HIPAA, and CCPA is mandatory. In practical terms, data breach insurance is applied to cover legal liabilities, fund forensic investigations, support data recovery, and enable timely communication with affected parties. It also includes public relations support to minimize brand damage and may compensate for business interruption losses. Additionally, it can extend to third-party liabilities and costs related to ransomware or extortion incidents. As organizations across sectors, from finance and healthcare to retail and education, face growing cyber threats, data breach insurance serves as a vital tool in risk mitigation and incident recovery.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific cybersecurity insurance market is experiencing rapid expansion, positioning itself as the fastest-growing regional market globally. This growth is fueled by increasing digital transformation across economies such as China, India, Japan, South Korea, Singapore, and Australia, coupled with a sharp rise in ransomware attacks, data breaches, and regulatory mandates. Countries such as India and China are witnessing significant uptakes in cyber insurance adoption, particularly across BFSI, healthcare, and IT sectors, driven by escalating cyber threats and heightened regulatory scrutiny. Mature markets such as Singapore and Australia are leading in adoption due to well-established legal frameworks such as the Cybersecurity Act and Privacy Act reforms. However, the region faces challenges including low penetration among SMEs, a lack of historical cyber loss data, and limited policy clarity. Despite this, the market presents strong opportunities for insurers to expand coverage through sector-specific products, partnerships with cybersecurity vendors, and AI-driven underwriting solutions. However, the increase in regulatory developments, including surging fines and penalties for non-compliance, is expected to boost demand for the cybersecurity insurance market in APAC.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant cybersecurity insurance market companies.

- By Company: Tier I: 55%, Tier II: 30%, and Tier III: 15%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: North America: 60%, Europe: 20%, Asia Pacific: 12%, and Rest of the World: 8%

Some of the significant cybersecurity insurance market vendors are BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), UpGuard (US), Travelers (US), AXA XL (US), AIG (US), Beazley (UK), and Chubb (Switzerland).

Research coverage:

The market report covered the cybersecurity insurance market across segments. We estimated the market size and growth potential for many segments based on offerings, insurance coverage, insurance type, provider type, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole cybersecurity insurance industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection, high rate of recovery of financial losses to promote growth of cybersecurity insurance market, and increase in frequency and sophistication of cyber threats), restraints (Lack of awareness related to cyber insurance and reluctance to choose cybersecurity insurance over cybersecurity solutions, and soaring cybersecurity insurance costs), opportunities (Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance, and adoption of artificial intelligence and blockchain technology for risk analytics), and challenges (Despite soaring cybersecurity risks, cyber insurers grapple to gain traction, data privacy concerns, and lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting).

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and service and product introductions in the cybersecurity insurance market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global cybersecurity insurance market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the cybersecurity insurance market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the cybersecurity insurance industry, such as BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), and UpGuard (US), Cisco (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), Founder Shield (US), Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher (US), Travelers (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax (Canada), Liberty Mutual (US), Lloyds of London (UK), Lockton (US), Munich Re (Germany), Sompo International (Bermuda), At-Bay (US), Cybernance (US), Resilience (US), Coalition (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Orchestra Group (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 SUMMARY OF CHANGES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 CYBERSECURITY INSURANCE COVERAGE

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN CYBERSECURITY INSURANCE MARKET

- 4.2 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION AND INSURANCE COVERAGE, 2025

- 4.3 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION AND INSURANCE COVERAGE, 2025

- 4.4 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE

- 4.5 CYBERSECURITY INSURANCE MARKET, BY VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection

- 5.2.1.2 High rate of recovery of financial losses to promote cybersecurity insurance market growth

- 5.2.1.3 Increase in frequency and sophistication of cyber threats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness related to cybersecurity insurance and reluctance in choosing cybersecurity insurance over cybersecurity solutions

- 5.2.2.2 Soaring cybersecurity insurance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance

- 5.2.3.2 Adoption of artificial intelligence and blockchain technology for risk analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Cyber insurers grapple to gain traction despite soaring cybersecurity risks

- 5.2.4.2 Data privacy concerns

- 5.2.4.3 Lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 SUPPLY CHAIN ANALYSIS

- 5.3.2 BRIEF HISTORY OF CYBERSECURITY INSURANCE SOLUTIONS

- 5.3.2.1 1990-2000

- 5.3.2.2 2000-2010

- 5.3.2.3 2010-2020

- 5.3.2.4 2021-Present

- 5.3.3 ECOSYSTEM

- 5.3.4 TOOLS, TECHNIQUES, AND FRAMEWORKS IN CYBERSECURITY INSURANCE MARKET

- 5.3.5 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.6 PORTER'S FIVE FORCES MODEL

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of suppliers

- 5.3.6.4 Bargaining power of buyers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.7.1 Key stakeholders in buying process

- 5.3.7.2 Buying criteria

- 5.3.8 TECHNOLOGY ANALYSIS

- 5.3.8.1 Key technologies

- 5.3.8.1.1 Artificial Intelligence and Machine Learning

- 5.3.8.1.2 Big Data Analytics

- 5.3.8.1.3 Internet of Things

- 5.3.8.2 Adjacent technologies

- 5.3.8.2.1 Blockchain

- 5.3.8.2.2 Cloud

- 5.3.8.3 Complementary technologies

- 5.3.8.3.1 Threat Intelligence

- 5.3.8.3.2 Data Breach Response

- 5.3.8.3.3 Security Monitoring & Analytics

- 5.3.8.1 Key technologies

- 5.3.9 FUTURE OF CYBERSECURITY INSURANCE MARKET LANDSCAPE

- 5.3.9.1 Short-term roadmap (2025-2026)

- 5.3.9.2 Mid-term roadmap (2027-2028)

- 5.3.9.3 Long-term roadmap (2029-2030)

- 5.3.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.11 BEST PRACTICES IN CYBERSECURITY INSURANCE MARKET

- 5.3.12 PATENT ANALYSIS

- 5.3.12.1 Methodology

- 5.3.13 PRICING MODEL ANALYSIS

- 5.3.13.1 Average selling price trends

- 5.3.13.2 Cybersecurity insurance: Average selling price for smes

- 5.3.13.3 Indictive pricing analysis of cybersecurity insurance premiums, 2024

- 5.3.14 USE CASES

- 5.3.14.1 SecurityScorecard helped cyber insurance provider better understand customer risk

- 5.3.14.2 European financial service providers leveraged BitSight for security performance management

- 5.3.14.3 Country Mutual Insurance Company leveraged CyberArk's privileged security access platform

- 5.3.14.4 Global 500 insurance company chose Prevalent's third-party risk management solution

- 5.3.14.5 AON secured financial institution's funds and data from third-party cyber risks

- 5.3.14.6 Chubb's cybersecurity insurance cover assisted SME in recovering financial losses

- 5.3.15 KEY CONFERENCES AND EVENTS, 2025

- 5.3.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.16.1 General Data Protection Regulation

- 5.3.16.2 Payment Card Industry-Data Security Standard

- 5.3.16.3 Health Insurance Portability and Accountability Act

- 5.3.16.4 Federal Information Security Management Act

- 5.3.16.5 Gramm-Leach-Bliley Act

- 5.3.16.6 Sarbanes-Oxley Act

- 5.3.16.7 International Organization for Standardization 27001

- 5.3.17 KEY COMPLIANCES IN CYBERSECURITY INSURANCE MARKET

- 5.3.17.1 Introduction

- 5.3.17.2 Healthcare Compliance

- 5.3.17.3 Financial Services Compliance

- 5.3.17.4 GDPR Compliance

- 5.3.17.5 Other Compliances

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

- 5.3.19 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.19.1 Impact of generative AI on cybersecurity insurance

- 5.3.19.2 Use cases of generative AI in cybersecurity insurance

- 5.3.19.3 Future of generative AI in cybersecurity insurance

- 5.3.20 IMPACT OF 2025 US TARIFF - CYBERSECURITY INSURANCE MARKET

- 5.3.20.1 Introduction

- 5.3.20.2 Key tariff rates

- 5.3.20.3 Price impact analysis

- 5.3.20.4 Impact on country/region

- 5.3.20.4.1 US

- 5.3.20.4.2 Europe

- 5.3.20.4.3 Asia Pacific

- 5.3.20.5 Impact on cybersecurity insurance verticals

6 CYBERSECURITY INSURANCE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: CYBERSECURITY INSURANCE MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 CYBERSECURITY INSURANCE SOLUTIONS TO PROVIDE HIGH DATA SECURITY AND PREVENT DATA BREACHES

- 6.2.2 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS

- 6.2.3 DISASTER RECOVERY AND BUSINESS CONTINUITY

- 6.2.4 CYBERSECURITY SOLUTIONS

- 6.2.4.1 Cyber risk and vulnerability assessment

- 6.2.4.2 Cybersecurity resilience

- 6.3 SERVICES

- 6.3.1 NEED FOR PROFESSIONAL CONSULTANTS TO PROVIDE 24/7 SERVICE RESPONSE

- 6.3.2 CONSULTING/ADVISORY

- 6.3.3 SECURITY AWARENESS TRAINING

- 6.3.4 OTHER SERVICES

7 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE

- 7.1 INTRODUCTION

- 7.1.1 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 7.2 DATA BREACH

- 7.2.1 CYBERSECURITY INSURANCE COVERAGE TO PROTECT BUSINESSES AGAINST SECURITY AND CYBER BREACHES

- 7.2.2 DATA LOSS

- 7.2.3 DENIAL OF SERVICE AND DOWNTIME

- 7.2.4 RANSOMWARE ATTACKS

- 7.3 CYBER LIABILITY

- 7.3.1 CYBERSECURITY INSURANCE TO COVER CYBER LIABILITY, REDUCING DATA RECOVERY COSTS FROM DATA BREACHES AND CYBERATTACKS

- 7.3.2 TYPES OF CYBER LIABILITIES

- 7.3.2.1 Data protection and privacy costs

- 7.3.2.2 Non-compliance penalty

- 7.3.2.3 Brand and related intellectual property protection

- 7.3.2.4 Other cyber liability types

- 7.3.3 SOURCE/TARGET OF CYBER LIABILITIES

- 7.3.3.1 Internal

- 7.3.3.2 External

8 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE

- 8.1 INTRODUCTION

- 8.1.1 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 8.2 PACKAGED

- 8.2.1 PACKAGED INSURANCE TO ENHANCE DIGITAL TRANSFORMATION AND SUPPORT TRADITIONAL POLICIES

- 8.3 STANDALONE

- 8.3.1 STANDALONE INSURANCE TO MANAGE COMPLEX CYBER RISKS AND IMPROVE CYBER RISK PROTECTION

9 CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE

- 9.1 INTRODUCTION

- 9.1.1 PROVIDER TYPE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 9.2 TECHNOLOGY PROVIDER

- 9.2.1 TECHNOLOGY PROVIDERS TO HELP INSURANCE INDUSTRY ASSESS ITS CYBERSECURITY RISKS

- 9.3 INSURANCE PROVIDER

- 9.3.1 INSURANCE PROVIDERS TO UNDERWRITE INSURANCE POLICIES FOR IMPROVING CYBERSECURITY SYSTEMS OF ORGANIZATIONS

10 CYBERSECURITY INSURANCE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: CYBERSECURITY INSURANCE MARKET DRIVERS

- 10.2 FINANCIAL SERVICES

- 10.2.1 RISING FREQUENCY AND SOPHISTICATION OF FINANCIAL FRAUD AND RANSOMWARE ATTACKS ARE DRIVING THE MARKET

- 10.2.2 FINANCIAL SERVICES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.2.2.1 Risk Assessment and Mitigation

- 10.2.2.2 Cyber Extortion Coverage

- 10.2.2.3 Ransomware Protection

- 10.3 IT AND ITES

- 10.3.1 INCREASED RELIANCE ON OUTSOURCED DIGITAL SERVICES AND GROWING EXPOSURE TO THIRD-PARTY RISKS ARE FUELING DEMAND

- 10.3.2 IT AND ITES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.3.2.1 Protection for Sensitive Client Data

- 10.3.2.2 Intellectual Property Protection

- 10.3.2.3 Comprehensive Coverage for IT Infrastructure

- 10.4 HEALTHCARE AND LIFE SCIENCES

- 10.4.1 PROLIFERATION OF DIGITAL HEALTH RECORDS AND HEIGHTENED VULNERABILITY TO DATA BREACHES IS ACCELERATING ADOPTION

- 10.4.2 HEALTHCARE AND LIFE SCIENCES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.4.2.1 Protected Health Information (PHI) Data Breach Coverage

- 10.4.2.2 Regulatory Compliance Support

- 10.4.2.3 Cybersecurity Incident Response Support

- 10.5 RETAIL AND ECOMMERCE

- 10.5.1 SURGE IN DIGITAL TRANSACTIONS AND CONSUMER DATA HANDLING IS PROMPTING RETAILERS TO SEEK CYBER RISK PROTECTION

- 10.5.2 RETAIL AND ECOMMERCE: CYBERSECURITY INSURANCE APPLICATIONS

- 10.5.2.1 Ecommerce Website Protection

- 10.5.2.2 Supply Chain Cyber Risk Coverage

- 10.5.2.3 Brand Reputation Management

- 10.6 TELECOM

- 10.6.1 EXPANSION OF 5G AND CONNECTED INFRASTRUCTURE IS EXPOSING TELECOM OPERATORS TO NEW CYBERATTACK VECTORS, BOOSTING INSURANCE DEMAND

- 10.6.2 TELECOM: CYBERSECURITY INSURANCE APPLICATIONS

- 10.6.2.1 Network Security Coverage

- 10.6.2.2 Communication Infrastructure Protection

- 10.6.2.3 Customer Notification and Support

- 10.7 TRAVEL, TOURISM, AND HOSPITALITY

- 10.7.1 HIGH-VALUE CUSTOMER DATA AND INCREASING ONLINE BOOKING FRAUD ARE COMPELLING THE SECTOR TO ADOPT CYBERSECURITY INSURANCE

- 10.7.2 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE APPLICATIONS

- 10.7.2.1 Reservation System and Booking Protection

- 10.7.2.2 Payment Card Data Protection

- 10.7.2.3 Data Breach Notification Costs

- 10.8 OTHER VERTICALS

11 CYBERSECURITY INSURANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Numerous laws and regulations promoting proactive incorporation of cybersecurity insurance policy cover in US to drive market

- 11.2.3 CANADA

- 11.2.3.1 Presence of prominent cybersecurity insurance providers in Canada to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 UK

- 11.3.2.1 Cyber insurance in UK to be comparatively affordable measure against data breaches with cyber extortion cover, recovery, and compliance costs

- 11.3.3 GERMANY

- 11.3.3.1 Increasing instances of cybercrimes to drive market growth in Germany

- 11.3.4 FRANCE

- 11.3.4.1 Alarming cyber-attack rates and ransomware insurance coverage gaps in France to fuel demand for cybersecurity insurance

- 11.3.5 SPAIN

- 11.3.5.1 Rising cybersecurity incidents in Spain amidst 5G transition to drive market growth

- 11.3.6 ITALY

- 11.3.6.1 Ransomware surges and growing adoption of cybersecurity insurance in Italy to drive market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Increasing investments in advanced technologies and ascending rates of cybercrimes to drive growth in China

- 11.4.3 JAPAN

- 11.4.3.1 Growing security breaches across verticals to present opportunities for Japanese cybersecurity insurance market

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Enforcement of Notifiable Data Breach Scheme and Australian Prudential Regulatory Authority to help enterprises improve their business resiliency toward risks

- 11.4.5 SOUTHEAST ASIA

- 11.4.5.1 Growth prospects in Southeast Asia's evolving cybersecurity landscape to drive cybersecurity insurance market

- 11.4.6 INDIA

- 11.4.6.1 Rising cybersecurity risks to accelerate cyber insurance adoption in India

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.2 KSA

- 11.5.2.1 Growing awareness to lead to increase in inquiries and adoption of cyber insurance policies among organizations

- 11.5.3 UAE

- 11.5.3.1 Increasing adoption of advanced technologies and fast development in UAE to be major factors driving adoption of cybersecurity insurance

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Companies becoming potential targets for cybercriminals due to increased mobile and internet penetration to drive growth

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.2 BRAZIL

- 11.6.2.1 Increased automation and digitalization in businesses and fear of severe penalties to lead to market growth in Brazil

- 11.6.3 MEXICO

- 11.6.3.1 Data protection regulations expected to hold great scope for market growth in Mexico

- 11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CYBERSECURITY INSURANCE TECHNOLOGY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company Footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Provider Type Footprint

- 12.5.5.4 Offering Footprint

- 12.6 STARTUP/SME EVALUATION MATRIX, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 TECHNOLOGY PROVIDERS

- 13.1.1 BITSIGHT

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MITRATECH

- 13.1.2.1 Business overview

- 13.1.2.2 Products Offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices made

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 REDSEAL

- 13.1.3.1 Business overview

- 13.1.3.2 Platform offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices made

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 SECURITYSCORECARD

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices made

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 UPGUARD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices made

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CISCO

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 MICROSOFT

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 CHECK POINT

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 ATTACKIQ

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 SENTINELONE

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 BROADCOM

- 13.1.12 ACCENTURE

- 13.1.13 CYLANCE

- 13.1.14 TRELLIX

- 13.1.15 CYBERARK

- 13.1.16 CYE

- 13.1.17 SECURIT360

- 13.1.18 FOUNDER SHIELD

- 13.1.1 BITSIGHT

- 13.2 INSURANCE PROVIDERS

- 13.2.1 CHUBB

- 13.2.2 AXA XL

- 13.2.3 AIG

- 13.2.4 TRAVELERS

- 13.2.5 BEAZLEY

- 13.2.6 ALLIANZ

- 13.2.7 AON

- 13.2.8 ARTHUR J. GALLAGHER

- 13.2.9 AXIS CAPITAL

- 13.2.10 CNA

- 13.2.11 FAIRFAX

- 13.2.12 LIBERTY MUTUAL

- 13.2.13 LLOYD'S OF LONDON

- 13.2.14 LOCKTON

- 13.2.15 MUNICH RE

- 13.2.16 SOMPO INTERNATIONAL

- 13.3 STARTUPS/SMES

- 13.3.1 AT-BAY

- 13.3.2 CYBERNANCE

- 13.3.3 COALITION

- 13.3.4 RESILIENCE

- 13.3.5 KOVRR

- 13.3.6 SAYATA LABS

- 13.3.7 ZEGURO

- 13.3.8 IVANTI

- 13.3.9 SAFEBREACH

- 13.3.10 ORCHESTRA GROUP

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 CYBERSECURITY MARKET

- 14.2.1 MARKET DEFINITION

- 14.3 INSURANCE PLATFORM MARKET

- 14.3.1 MARKET DEFINITION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS