|

시장보고서

상품코드

1775085

HVAC 단열재 시장 : 재료 유형별, 제품 유형별, 최종 이용 산업별, 지역별 - 예측(-2030년)HVAC Insulation Market by Product Type (Pipes, Ducts), Material Type (Mineral Wool (Glass Wool, Stone Wool)), Plastic Foam (Phenolic, Elastomeric Foam), End-use Industry (Commercial, Residential, Industrial), and Region - Global Forecast to 2030 |

||||||

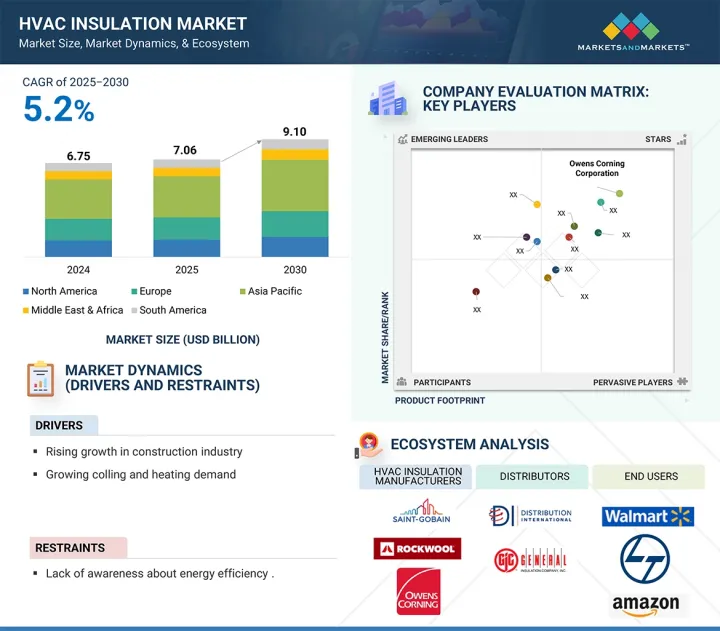

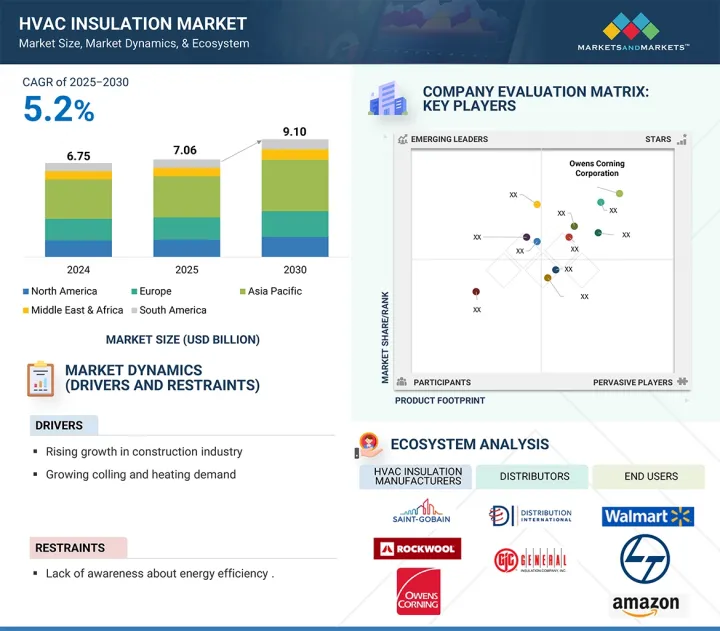

HVAC 단열재 시장 규모는 예측 기간 동안 5.2%의 CAGR로 확대되어 2025년 70억 6,000만 달러에서 2030년에는 91억 달러에 달할 것으로 예측됩니다.

HVAC 단열재 시장은 인프라 개발, 산업 확장, 신흥 경제국의 성장세에 힘입어 전 세계적으로 강력한 성장세를 보이고 있습니다. 각국이 주거, 상업, 공공시설 등 인프라 현대화에 많은 투자를 하고 있어 효율적인 난방, 환기, 공조(HVAC) 시스템에 대한 수요가 지속적으로 증가하고 있으며, HVAC 단열재는 열 손실과 열 상승을 최소화하고 열 성능을 향상시키며 운영 비용을 절감하여 이러한 시스템의 에너지 효율을 높이는데 중요한 역할을 하고 있습니다. 이러한 이유로 단열재는 지속가능한 건설 방식에 필수적인 요소로 자리 잡았으며, 현재 다양한 분야에서 널리 사용되고 있습니다. 특히 제조업, 제약, 식품 가공, 냉장 창고 등 온도 조절이 필수적인 분야에서는 산업의 확장이 이러한 성장에 더욱 기여하고 있습니다. 이러한 산업은 안정적이고 효율적으로 운영되어야 하는 대규모 HVAC 시스템이 필요하며, 이는 적절한 단열이 있어야만 가능합니다. 산업계가 엄격한 에너지 규제를 충족하고 환경에 미치는 영향을 줄이기 위해 첨단 단열재 채택이 확산되고 있습니다. 아시아태평양, 라틴아메리카, 중동의 신흥 경제권에서는 도시화, 소득 증가, 인구 증가로 인해 건설 붐이 일어나고 있습니다. 이들 지역에서는 인프라가 빠르게 구축되고 에너지 절약과 친환경 건물에 대한 관심이 높아지면서 HVAC 단열재에 대한 수요가 급증하고 있습니다. 이러한 요인들이 복합적으로 작용하여 세계 HVAC 단열재 시장은 지속적으로 성장하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 킬로톤 |

| 부문 | 재료 유형별, 제품 유형별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

플라스틱 폼 부문은 HVAC 단열재 시장에서 두드러진 소재 유형으로, 우수한 단열 특성, 경량성, 다용도성으로 유명합니다. 일반적으로 사용되는 플라스틱 폼에는 폴리우레탄(PU), 폴리이소시아뉼레이트(PIR), 발포 폴리스티렌(EPS) 등이 있으며, 각각 용도에 따라 특정 이점을 제공합니다. 이들 재료는 낮은 열전도율, 내습성, 장기간 안정된 성능을 유지할 수 있다는 점에서 널리 평가받고 있습니다. 플라스틱 폼은 HVAC 시스템의 열 전달을 최소화하여 에너지 효율을 높이고 운영 비용을 절감하는 데 특히 효과적입니다. 독립 기포 구조는 수분 흡수에 대한 강한 저항력을 가지고 있어 습한 환경이나 습도 조절이 중요한 곳에서 사용하기에 이상적입니다. 또한, 발포 플라스틱은 설치가 쉽고, 다양한 모양과 크기로 성형할 수 있으며, 기계적 강도가 높아 상업용 건물 및 주거용 덕트, 파이프, HVAC 유닛의 단열에 적합합니다.

발포 플라스틱 단열재는 산업 시설, 사무실 건물, 병원, 소매점, 주택 등 온도 제어 및 에너지 효율 개선이 우선시되는 다양한 분야에 적용되고 있습니다. 고성능의 비용 효율적인 단열재에 대한 수요가 증가함에 따라, 특히 에너지 절약형 건축물에 대한 수요가 증가함에 따라, 발포 플라스틱 부문은 HVAC 단열재 시장에서 세계 견인차 역할을 하고 있습니다.

산업 부문은 대규모 시설에서 효율적인 온도 조절, 에너지 절약 및 운영 비용 절감의 필요성으로 인해 HVAC 단열재 시장에서 최종 사용 산업으로서 중요한 역할을 하고 있습니다. 제조, 제약, 식음료, 석유화학, 콜드체인 물류와 같은 산업은 장비와 인력을 모두 통제된 환경에 유지하기 위해 견고한 HVAC 시스템에 크게 의존하고 있습니다. 이러한 시스템의 단열은 에너지 손실을 최소화하고 실내 조건을 일정하게 유지하며 냉난방 작동의 효율성을 보장하는 데 매우 중요합니다.

산업 환경에서의 HVAC 단열은 생산 품질, 안전 기준 또는 장비의 성능을 손상시킬 수 있는 열 변동을 방지하는 데 도움이 됩니다. 예를 들어, 제약 및 식품 산업에서는 제품의 안정성과 규정 준수를 위해 엄격한 온도 관리가 필수적입니다. 또한, 적절한 단열은 HVAC 시스템의 부담을 줄여 수명을 연장하고 유지보수 비용을 절감할 수 있습니다.

또한, 산업 시설은 종종 극한의 환경 조건(매우 덥거나 매우 추운)에서 운영되는 경우가 많기 때문에 고도의 단열재가 필요합니다. 에너지 효율성, 지속가능성 및 환경 규제 준수가 강조됨에 따라 산업계는 친환경 인증 기준을 충족하고 이산화탄소 배출량을 줄이기 위해 고성능 단열 솔루션의 채택을 늘리고 있습니다. 산업 인프라가 전 세계적으로, 특히 신흥 경제국에서 확대됨에 따라 이 부문의 HVAC 단열재에 대한 수요는 꾸준히 증가할 것으로 예상됩니다.

유럽의 HVAC 단열재 시장은 엄격한 에너지 효율 규제, 친환경 건축물의 채택 증가, 지속가능한 인프라에 대한 수요 증가로 인해 꾸준한 성장세를 보이고 있습니다. 이 지역에서는 이산화탄소 배출량 감소와 건물 에너지 성능 향상에 중점을 두고 있으며, HVAC 단열재는 이러한 목표를 달성하는 데 있어 중요한 요소로 작용하고 있습니다.

EU의 건물 에너지 성능 지침(EPBD) 및 유럽 그린딜과 같은 주요 규제 프레임워크는 회원국 전체에서 에너지 효율이 높은 건축 및 개보수를 의무화하고 있습니다. 이러한 정책은 주거용 및 상업용 건물 모두에서 에너지 소비와 온실가스 배출을 줄이기 위해 HVAC 시스템에서 고품질 단열재 사용을 장려하고 있습니다. 또한, 독일, 프랑스, 영국 등의 국가에서는 에너지 효율 개선에 대한 인센티브와 보조금을 제공하는 다양한 국가적 이니셔티브가 있어 시장 도입을 더욱 가속화하고 있습니다.

오래된 건물을 최신 단열 솔루션으로 개조하려는 움직임과 2050년까지 기후변화를 중립화하려는 이 지역의 노력은 첨단 HVAC 단열재에 대한 강력한 수요를 창출하고 있습니다. 유럽의 탄탄한 건설 산업은 소비자와 기업의 높은 환경 인식과 함께 시장을 지속적으로 뒷받침하고 있습니다. 지속적인 기술 혁신과 엄격한 규제 시행으로 유럽 HVAC 단열재 시장은 특히 고성능, 내구성 및 환경 규정 준수가 필요한 응용 분야에서 세계 성장의 주요 기여자가 될 것으로 예상됩니다.

세계의 HVAC 단열재 시장에 대해 조사했으며, 재료 유형별, 제품 유형별, 최종 이용 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 특허 분석

- Porter's Five Forces 분석

- 생태계 매핑

- 밸류체인 분석

- 가격 분석

- 무역 분석

- 거시경제 지표

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 2025-2026년의 주요 회의와 이벤트

- 투자와 자금 조달 시나리오

- 주요 이해관계자와 구입 기준

- 구입 결정에 영향을 미치는 주요 요인

- 기술 분석

- 규제 상황

- AI/생성형 AI가 HVAC 단열재 시장에 미치는 영향

- 사례 연구 분석

제6장 HVAC 단열재 시장(재료 유형별)

- 소개

- 미네랄울

- 플라스틱 폼

제7장 HVAC 단열재 시장(제품 유형별)

- 소개

- 파이프

- 덕트

제8장 HVAC 단열재 시장(최종 이용 산업별)

- 소개

- 주택

- 상업

- 산업

제9장 HVAC 단열재 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

제10장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 경쟁 평가 매트릭스 : 주요 진출 기업, 2024년

- 경쟁력 평가 매트릭스 : 스타트업 기업/중소기업(SMES), 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 진출 기업

- SAINT-GOBAIN

- OWENS CORNING

- ROCKWOOL INTERNATIONAL

- ARMACELL INTERNATIONAL SA

- KNAUF GROUP

- KINGSPAN GROUP PLC

- JOHNS MANVILLE CORPORATION

- GLASSROCK INSULATION CO S.A.E.

- L'ISOLANTE K-FLEX S.P.A.

- URSA INSULATION S.A.

- 기타 기업

- ARABIAN FIBREGLASS INSULATION CO. LTD.(AFICO)

- FLETCHER INSULATION

- COVESTRO AG

- PPG

- HUNTSMAN INTERNATIONAL LLC

- TROCELLEN

- LINDNER SE

- BRADFORD INSULATION PTY LIMITED

- SAGER AG

- UNION FOAM S.P.A.

- SEKISUI FOAM AUSTRALIA

- GILSULATE INTERNATIONAL, INC.

- PROMAT INTERNATIONAL

- WINCELL INSULATION CO. LTD.

- VISIONARY INDUSTRIAL INSULATION

제12장 부록

ksm 25.07.29The HVAC insulation market is projected to reach USD 9.10 billion by 2030 from USD 7.06 billion in 2025, at a CAGR of 5.2% during the forecast period. The HVAC insulation market is experiencing robust growth globally, significantly fueled by infrastructure development, industrial expansion, and the rising momentum of emerging economies. As nations invest heavily in modernizing their infrastructure-be it residential, commercial, or public facilities-the demand for efficient heating, ventilation, and air conditioning (HVAC) systems continues to grow. HVAC insulation plays a crucial role in enhancing the energy efficiency of these systems by minimizing heat loss or gain, improving thermal performance, and reducing operational costs. This makes insulation an integral component of sustainable construction practices, which are now being widely adopted across various regions. Industrial expansion further contributes to this growth, especially in sectors like manufacturing, pharmaceuticals, food processing, and cold storage, where temperature regulation is essential. These industries require large-scale HVAC systems that must operate reliably and efficiently, which is only possible with proper insulation. As industries aim to meet stringent energy regulations and lower their environmental impact, the adoption of advanced insulation materials is becoming more widespread. Emerging economies in the Asia Pacific, Latin America, and the Middle East are witnessing a construction boom driven by urbanization, rising incomes, and population growth. These regions are rapidly upgrading their infrastructure, and with a growing focus on energy conservation and green buildings, the demand for HVAC insulation is rising sharply. Collectively, these factors are propelling sustained growth in the global HVAC insulation market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Segments | Material Type, Product Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"Plastic foam segment is expected to be the second fastest-growing segment in the HVAC insulation market during the forecast period."

The plastic foam segment is a prominent material type in the HVAC insulation market, known for its excellent thermal insulation properties, lightweight nature, and versatility. Common types of plastic foams used include polyurethane (PU), polyisocyanurate (PIR), and expanded polystyrene (EPS), each offering specific advantages depending on the application. These materials are widely valued for their low thermal conductivity, moisture resistance, and ability to maintain consistent performance over time. Plastic foams are particularly effective in minimizing heat transfer in HVAC systems, which enhances energy efficiency and reduces operational costs. Their closed-cell structure provides strong resistance to water absorption, making them ideal for use in humid environments or where moisture control is critical. Additionally, plastic foams are easy to install, can be molded into various shapes and sizes, and offer good mechanical strength, making them suitable for insulating ducts, pipes, and HVAC units in both commercial and residential buildings.

Applications of plastic foam insulation span sectors such as industrial facilities, office buildings, hospitals, retail spaces, and homes, where controlling temperature and improving energy efficiency are priorities. As the demand for high-performance, cost-effective insulation materials grows-especially in energy-conscious construction-the plastic foam segment continues to gain traction in the HVAC insulation market globally.

"Industrial segment to be the second fastest-growing end-use industry in the HVAC insulation market during the forecast period"

The industrial segment plays a vital role as an end-use industry in the HVAC insulation market, driven by the need for efficient temperature regulation, energy conservation, and operational cost reduction in large-scale facilities. Industries such as manufacturing, pharmaceuticals, food and beverage processing, petrochemicals, and cold chain logistics heavily rely on robust HVAC systems to maintain controlled environments for both equipment and personnel. Insulation in these systems is crucial to minimizing energy loss, maintaining consistent indoor conditions, and ensuring the efficiency of heating and cooling operations.

HVAC insulation in industrial settings helps prevent thermal fluctuations that could compromise production quality, safety standards, or equipment performance. For instance, in the pharmaceutical and food industries, strict temperature control is essential for product stability and regulatory compliance. Proper insulation also reduces the strain on HVAC systems, thereby extending their lifespan and lowering maintenance costs.

Moreover, industrial facilities often operate in extreme environmental conditions-either very hot or very cold-making advanced insulation materials a necessity. With growing emphasis on energy efficiency, sustainability, and adherence to environmental regulations, industries are increasingly adopting high-performance insulation solutions to meet green certification standards and reduce their carbon footprint. As industrial infrastructure expands globally, especially in emerging economies, the demand for HVAC insulation in this segment is expected to grow steadily.

"Europe is projected to be the second-largest market for HVAC insulation during the forecast period"

The Europe HVAC insulation market is witnessing steady growth, driven by stringent energy efficiency regulations, increasing adoption of green building practices, and rising demand for sustainable infrastructure. The region places a strong emphasis on reducing carbon emissions and improving building energy performance, making HVAC insulation a critical component in achieving these goals.

Key regulatory frameworks such as the EU Energy Performance of Buildings Directive (EPBD) and the European Green Deal mandate energy-efficient construction and renovation across member states. These policies promote the use of high-quality insulation materials in HVAC systems to reduce energy consumption and greenhouse gas emissions in both residential and commercial buildings. Additionally, various national initiatives across countries like Germany, France, and the UK provide incentives and subsidies for energy-efficient upgrades, further accelerating market adoption.

The push for retrofitting older buildings with modern insulation solutions and the region's commitment to climate neutrality by 2050 are creating strong demand for advanced HVAC insulation materials. Europe's well-established construction industry, coupled with a high level of environmental awareness among consumers and businesses, continues to support the market. With ongoing innovation and strict regulatory enforcement, the European HVAC insulation market is expected to remain a key contributor to global growth, particularly in applications that require high performance, durability, and environmental compliance.

.

.

Extensive interviews were conducted with experts to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of interviews with experts is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L'ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia), Glassrock Insulation Company (Egypt), and Visionary Industrial Insulation (US), among others are some of the key players in the HVAC insulation market.

The study includes an in-depth competitive analysis of these key players in the HVAC insulation market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the HVAC insulation market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material type, product type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their positions in the HVAC insulation market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall HVAC insulation market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the positions of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising growth in construction industry, Rising cooling and heating demand), restraints (Lack of awareness of energy efficiency ), opportunities (Innovation in eco-friendly insulation materials, Technological advancements in HVAC), challenges (Fire safety & toxicity concerns, Requirements of skilled workforce to hinder market growth)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the HVAC insulation market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the HVAC insulation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L'ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia), Glassrock Insulation Company (Egypt), and Visionary Industrial Insulation (US), among others, are the top manufacturers covered in the HVAC insulation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC INSULATION MARKET

- 4.2 HVAC INSULATION MARKET, BY PRODUCT TYPE

- 4.3 HVAC INSULATION MARKET, BY MATERIAL TYPE

- 4.4 HVAC INSULATION MARKET, BY END-USE INDUSTRY

- 4.5 HVAC INSULATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Stringent energy efficiency regulations and government support

- 5.2.1.3 Rising demand for cooling and heating systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding energy savings and cost benefits associated with HVAC insulation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in eco-friendly insulation materials

- 5.2.3.2 Technological advancements in HVAC systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Fire safety and toxicity concerns

- 5.2.4.2 Requirement for skilled workforce

- 5.2.1 DRIVERS

- 5.3 PATENT ANALYSIS

- 5.3.1 METHODOLOGY

- 5.3.2 DOCUMENT TYPE

- 5.3.3 PUBLICATION TRENDS

- 5.3.4 INSIGHTS

- 5.3.5 JURISDICTION ANALYSIS

- 5.3.6 TOP 10 COMPANIES/APPLICANTS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 ECOSYSTEM MAPPING

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 680610)

- 5.8.2 EXPORT SCENARIO (HS CODE 680610)

- 5.9 MACROECONOMIC INDICATORS

- 5.9.1 GDP TRENDS AND FORECASTS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14 KEY FACTORS IMPACTING BUYING DECISIONS

- 5.14.1 QUALITY

- 5.14.2 SERVICE

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 ECOSE technology

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Smart thermostats and temperature control

- 5.15.2.2 Internet of Things (IoT) integration

- 5.15.1 KEY TECHNOLOGIES

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 ASTM C1696-20

- 5.16.2 ASTM C547

- 5.16.3 ISO 13787:2003(E)

- 5.16.4 US

- 5.16.5 EUROPE

- 5.16.6 OTHERS

- 5.16.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 IMPACT OF AI/GEN AI ON HVAC INSULATION MARKET

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 FLETCHER INSULATION

- 5.18.2 H.D. GAJRA BROS.

- 5.18.3 ROCKWOOL

6 HVAC INSULATION MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- 6.2 MINERAL WOOL

- 6.2.1 GLASS WOOL

- 6.2.1.1 Superior thermal and acoustic insulation properties to drive demand

- 6.2.2 STONE WOOL

- 6.2.2.1 Abundant and easy availability of raw materials to drive market

- 6.2.1 GLASS WOOL

- 6.3 PLASTIC FOAM

- 6.3.1 PHENOLIC FOAM, PIR, & PUR

- 6.3.1.1 Excellent thermal properties, lightweight structure, and adaptability to drive market

- 6.3.2 ELASTOMERIC FOAM

- 6.3.2.1 Excellent fire-resistance properties to propel market

- 6.3.3 POLYETHYLENE

- 6.3.3.1 Lightweight and cost-effectiveness to increase adoption

- 6.3.3.2 XLPE (Cross-linked PE)

- 6.3.1 PHENOLIC FOAM, PIR, & PUR

7 HVAC INSULATION MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 PIPES

- 7.2.1 GROWING EMPHASIS ON ENERGY EFFICIENCY TO DRIVE MARKET

- 7.3 DUCTS

- 7.3.1 STRINGENT REGULATORY COMPLIANCE TO DRIVE MARKET

8 HVAC INSULATION MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 STRONG GROWTH IN RESIDENTIAL SEGMENT TO DRIVE MARKET

- 8.3 COMMERCIAL

- 8.3.1 RAPID URBANIZATION TO DRIVE MARKET GROWTH

- 8.4 INDUSTRIAL

- 8.4.1 HIGH ENERGY EFFICIENCY OFFERED BY HVAC INSULATION TO DRIVE MARKET

9 HVAC INSULATION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Growth of construction industry to drive market

- 9.2.2 INDIA

- 9.2.2.1 Government-led initiatives aimed at developing infrastructure to drive demand

- 9.2.3 JAPAN

- 9.2.3.1 Strong focus on energy efficiency and energy conservation to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Favorable business environment and government policies to drive market

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Favorable business environments and industrial growth to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Stringent regulations to drive market

- 9.3.3 UK

- 9.3.3.1 Continuous innovations and technological advancements to support market growth

- 9.3.4 ITALY

- 9.3.4.1 Increasing number of infrastructure projects to propel market

- 9.3.5 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Stringent government regulations and rising consumer awareness for energy efficiency to propel market

- 9.4.2 CANADA

- 9.4.2.1 Booming construction industry to support market growth

- 9.4.3 MEXICO

- 9.4.3.1 High investments in construction industry to boost demand

- 9.4.1 US

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Rising commercial construction activities to fuel demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Government and private sector investments in construction industry to boost demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Government-led projects related to construction industry to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Robust growth of construction sector with government-led investments to boost demand

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Stringent regulations for building insulation to propel market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.7 COMPETITIVE EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Product type footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Material type footprint

- 10.7.5.5 Region footprint

- 10.8 COMPETITIVE EVALUATION MATRIX: STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2024

- 10.8.1 RESPONSIVE COMPANIES

- 10.8.2 PROGRESSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SAINT-GOBAIN

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 OWENS CORNING

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 ROCKWOOL INTERNATIONAL

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 ARMACELL INTERNATIONAL SA

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 KNAUF GROUP

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 KINGSPAN GROUP PLC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.7 JOHNS MANVILLE CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.7.4 MnM view

- 11.1.8 GLASSROCK INSULATION CO S.A.E.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 MnM view

- 11.1.9 L'ISOLANTE K-FLEX S.P.A.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.9.4 MnM view

- 11.1.10 URSA INSULATION S.A.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 MnM view

- 11.1.1 SAINT-GOBAIN

- 11.2 OTHER PLAYERS

- 11.2.1 ARABIAN FIBREGLASS INSULATION CO. LTD. (AFICO)

- 11.2.2 FLETCHER INSULATION

- 11.2.3 COVESTRO AG

- 11.2.4 PPG

- 11.2.5 HUNTSMAN INTERNATIONAL LLC

- 11.2.6 TROCELLEN

- 11.2.7 LINDNER SE

- 11.2.8 BRADFORD INSULATION PTY LIMITED

- 11.2.9 SAGER AG

- 11.2.10 UNION FOAM S.P.A.

- 11.2.11 SEKISUI FOAM AUSTRALIA

- 11.2.12 GILSULATE INTERNATIONAL, INC.

- 11.2.13 PROMAT INTERNATIONAL

- 11.2.14 WINCELL INSULATION CO. LTD.

- 11.2.15 VISIONARY INDUSTRIAL INSULATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS