|

시장보고서

상품코드

1777934

보툴리눔톡신(보톡스) 시장 : 제품별, 유형별, 연령층별, 용도별, 최종사용자별, 지역별 - 예측(-2030년)Botulinum Toxins Market by Product, Application (Cosmetic, Therapeutic), Volume, End User, Region - Global Forecast to 2030 |

||||||

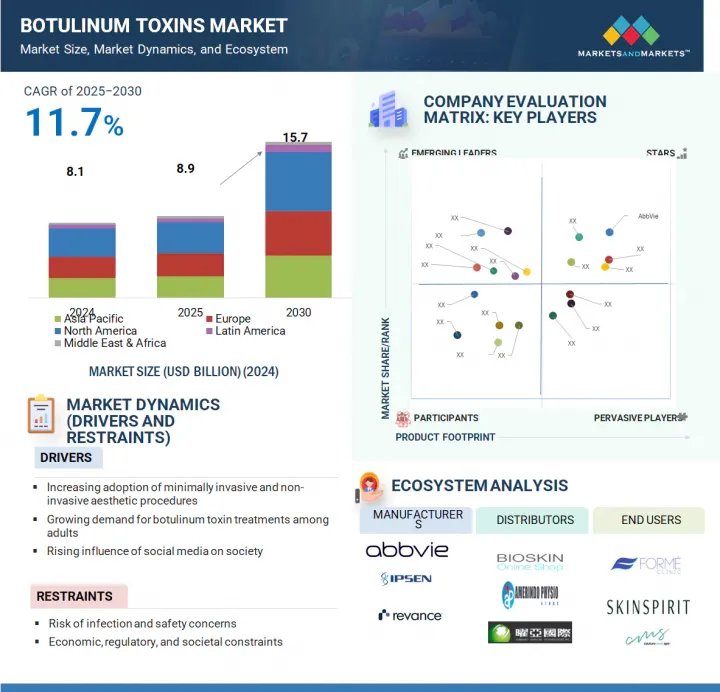

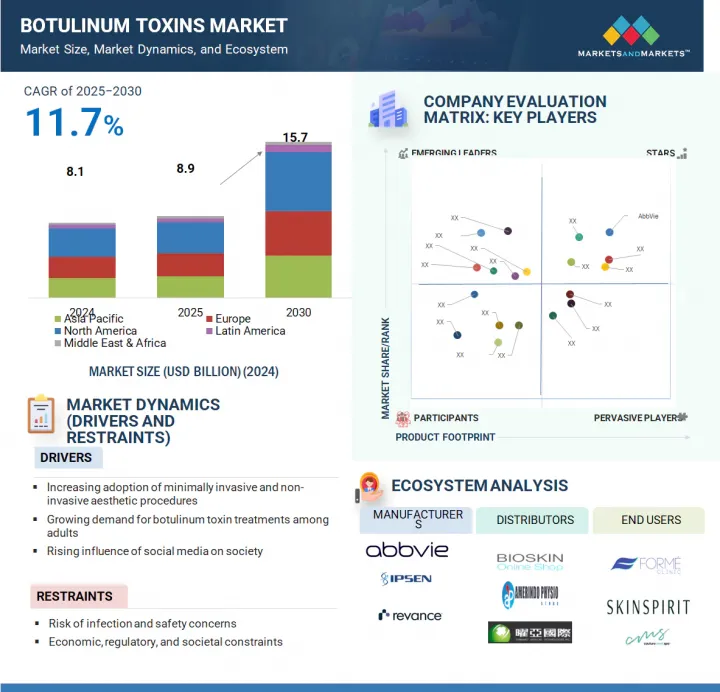

세계의 보툴리눔톡신(보톡스) 시장 규모는 예측 기간 중에 11.7%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 89억 달러에서 2030년에는 157억 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2024-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 유형별, 연령층별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

시장의 성장은 특히 도시 및 전문직 환경에서 젊어 보이는 것을 중시하는 사회-직업적 경향이 강화되고 있는 데 기인합니다. 이러한 추세에 따라 보툴리눔 톡신 사용을 포함한 미용성형을 찾는 사람들이 증가하고 있습니다. 신흥국에서는 가처분 소득 증가와 도시형 라이프스타일로 인해 새로운 환자층이 생겨나면서 보툴리눔 톡신에 대한 수요가 크게 증가하고 있습니다. 이러한 요인들은 예측 기간 동안 보툴리눔 톡신 시장을 견인할 것으로 예측됩니다.

보툴리눔 톡신 시장은 제품별로 BOTOX, DYSPORT, JEUVEAU, MYOBLOC, XEOMIN 등 주요 브랜드로 나뉩니다. 2024년에는 BOTOX가 가장 큰 점유율을 차지할 것으로 예측됩니다. 이 브랜드는 임상적 신뢰도에서 높은 평가를 받고 있으며, 미용사, 피부과 의사, 에스테티션의 신뢰를 얻고 있을 뿐만 아니라 클리닉, 스파, 병원 등 최종사용자의 신뢰도도 두텁다. BOTOX는 다양한 용도를 제공하며, 경쟁 제품 대비 안전하고 효과적인 프로파일을 보여줍니다.

BOTOX는 신경과, 피부과, 비뇨기과, 안과, 재활의학 등 다양한 의료 분야에서 활용되고 있어 수요 증가에 기여하고 있습니다. 또한, BOTOX는 광범위한 트레이닝 모듈과 환자 지원 프로그램을 제공합니다. 이러한 요인들로 인해 BOTOX는 경쟁사들을 제치고 보툴리눔 톡신 시장에서 선도적인 지위를 확보하고 있습니다.

보툴리눔 톡신 시장은 유형별로 크게 A형 보툴리눔 톡신과 B형 보툴리눔 톡신으로 나뉩니다. A형 보툴리눔 톡신이 세계 시장에서 큰 점유율을 차지하고 있는 주된 이유는 임상적 효과가 입증된 점과 오랜 규제 당국의 허가 역사가 있기 때문입니다. 이 카테고리의 첫 번째 혈청형인 A형은 치료와 미용 목적 모두에서 안전성과 효능을 입증하는 많은 증거에 의해 뒷받침되고 있습니다.

A형은 만성 편두통, 경련, 얼굴 주름 감소 등 전 세계적으로 다양한 용도로 승인되어 있으며, 이는 널리 채택되고 있는 요인입니다. 또한, A형은 효과가 오래 지속되며, 보통 3-6개월 정도 지속되기 때문에 치료 횟수가 줄어들어 환자의 편의성이 향상됩니다.

이러한 요인으로 인해 A형은 보툴리눔 톡신 산업에서 제조, 판매 및 수요에서 지배적인 위치를 차지하고 있습니다. 이에 비해 A형은 효과가 더 오래 지속되고(최대 6개월), 미용 및 치료 목적으로 광범위한 규제 당국의 승인을 받았기 때문에 B형에 비해 선호도가 높습니다. 또한, 소량으로 더 강력하고, 항체 내성이 생기기 쉽지 않습니다. 또한, A형은 의사들 사이에서 널리 인정받고 있으며, 광범위한 임상 경험과 연구가 뒷받침되어 전 세계적으로 선도적인 위치를 차지하고 있습니다.

미용 분야, 특히 주름 개선이 보툴리눔 톡신 시장을 독점할 것으로 예측됩니다. 2024년에도 주름 제거는 특히 비수술적 노화 방지 솔루션을 찾는 성인들 사이에서 보툴리눔 톡신의 인기 있고 인지도가 높은 용도가 될 것으로 예측됩니다. 클리닉에서는 주로 이마주름, 까마귀 발자국, 눈썹 사이 주름 치료에서 높은 환자 수가 보고되고 있습니다. 이러한 인기는 눈에 띄게 빠른 결과, 적은 치료 횟수, 다양한 계층에 폭넓게 받아들여지고 있다는 점 등이 그 원인으로 꼽히고 있습니다. 시술 시간이 짧고, 시술 후 바로 효과를 볼 수 있어 비수술적 대안 중 단연 돋보이는 존재입니다.

세계 보툴리눔 톡신 시장은 최종 사용자별로 피부과 클리닉-병원, 뷰티 센터, 메디컬 스파, 기타로 분류됩니다. 2024년, 피부과 병원은 미용 및 의료 시술의 주요 공급자로서 보툴리눔 톡신 제품에 대한 수요가 크게 증가할 것으로 예측됩니다.

피부과에서는 주로 보툴리눔 톡신의 가장 일반적인 용도 중 하나인 주름 개선, 얼굴 윤곽 성형 등의 미용 치료에 중점을 두고 있습니다. 한편, 병원에서는 근육 경련, 만성 편두통, 근긴장이상증 등 다양한 질환을 치료하기 위해 보툴리눔 톡신을 사용합니다. 잘 갖춰진 시설, 숙련된 전문가에 대한 접근성, 일상적인 사례와 복잡한 사례를 모두 관리할 수 있는 능력을 갖춘 병원 및 클리닉은 보툴리눔 톡신 제품의 일관된 사용을 촉진하는 주요 진입 기관입니다.

보툴리눔 톡신 시장은 5개 주요 지역(북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카)으로 구성되어 있습니다. 2024년에는 북미가 보툴리눔 톡신 시장 점유율을 차지할 것으로 예측됩니다. 이러한 성장의 주요 요인은 강력한 의료 인프라와 인구의 가처분 소득에 기인합니다. 또한, 북미에는 보툴리눔 톡신의 주요 업체들이 다수 존재하며, 구매자, 유통업체, 공급업체로 구성된 지속 가능한 생태계가 형성되어 있습니다. 이러한 요인들은 북미 보툴리눔 톡신 시장의 성장에 기여할 것으로 예측됩니다.

세계의 보툴리눔 톡신(Botulinum Toxin) 시장에 대해 조사했으며, 제품별/유형별/연령별/용도별/최종사용자별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 규제 분석

- 상환 시나리오 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 미충족 요구

- 2025년 미국 관세가 보툴리눔톡신(보톡스) 시장에 미치는 영향

- AI/생성형 AI가 보툴리눔톡신(보톡스) 시장에 미치는 영향

제6장 보툴리눔톡신(보톡스) 시장(제품별)

- 서론

- BOTOX

- DYSPORT

- JEUVEAU

- MYOBLOC

- XEOMIN

- 기타

제7장 보툴리눔톡신(보톡스) 시장(유형별)

- 서론

- A형 보툴리눔톡신(보톡스)

- B형 보툴리눔톡신(보톡스)

제8장 보툴리눔톡신(보톡스) 시장(연령층별)

- 서론

- 17세 이하

- 18-34세

- 35-50세

- 51-64세

- 65세 이상

제9장 보툴리눔톡신(보톡스) 시장(용도별)

- 서론

- 화장품

- 치료

- 기타

제10장 보툴리눔톡신(보톡스) 시장(최종사용자별)

- 서론

- 피부과 클리닉 및 병원

- 미용 센터

- 메디컬 스파

- 기타

제11장 보툴리눔톡신(보톡스) 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제12장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 시장 진출기업

- ABBVIE INC.

- IPSEN BIOPHARMACEUTICALS, INC.

- GALDERMA

- HUGEL, INC.

- REVANCE

- EVOLUS, INC.

- MEDYTOX

- MERZ PHARMA

- SUPERNUS PHARMACEUTICALS, INC.

- DAEWOONG PHARMACEUTICAL CO., LTD.

- HUONS

- EISAI CO., LTD.

- HUGH SOURCE(INTERNATIONAL) LTD.

- 기타 기업

- DERMAX CO., LTD.

- GUFIC BIOSCIENCES

- OCEAN PHARMACEUTICAL

- CROMA-PHARMA GMBH

- MICROGEN

- JDBIO CO., LTD.

- CKD BIO

- ATRAZIST ARAY CO.

- GUANGZHOU AOMA BUSINESS CO., LTD.

- JETEMA CO., LTD.

- SINOPHARM GROUP CO., LTD.

- QUFU HANTANG BIOTECHNOLOGY CO., LTD.

제14장 부록

LSH 25.08.01The global botulinum toxins market is projected to reach USD 15.7 billion by 2030 from USD 8.9 billion in 2025, at a CAGR of 11.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The growth of the market can be attributed to the increasing societal and occupational emphasis on looking youthful, especially in urban and professional environments. This trend encourages more individuals to seek cosmetic procedures, including the use of botulinum toxins. In developing countries, rising disposable incomes and exposure to urban lifestyles are creating new patient demographics, which significantly increases the demand for botulinum toxins. These factors are expected to drive the market for botulinum toxins during the forecast period.

"Based on product, Botox held the largest share of the botulinum toxins market in 2024."

The botulinum toxins market is divided by product into major brands, including Botox, Dysport, Jeuveau, Myobloc, Xeomin, and other products. In 2024, Botox held the largest share of the market. The brand has established a strong reputation for clinical reliability, which instills confidence among cosmetologists, dermatologists, and aestheticians, as well as trust from end users such as clinics, spas, and hospitals. Botox offers a wide range of applications and demonstrates a safe and effective profile compared to its competitors.

Botox is utilized in various medical fields, including neurology, dermatology, urology, ophthalmology, and rehabilitation medicine, contributing to its increasing demand. Additionally, Botox provides extensive training modules and patient support programs. These factors have enabled Botox to surpass its competitors and secure a leading position in the botulinum toxins market.

"Based on type, the type A botulinum toxins segment held the largest share of the market in 2024."

The botulinum toxins market is divided into two main categories based on type: type A and type B botulinum toxins. Type A botulinum toxins occupy a significant share of the global market, primarily due to their proven clinical effectiveness and long history of regulatory approvals. Being the first serotype in this category, type A is supported by substantial evidence demonstrating its safety and efficacy in both therapeutic and aesthetic applications.

Type A is authorized for a wide range of uses around the world, including treatments for chronic migraines, spasticity, and reducing facial wrinkles, which contributes to its widespread adoption. Additionally, type A offers a longer-lasting effect, typically lasting between three and six months, resulting in fewer treatment sessions and greater patient convenience.

These factors reinforce type A's dominant position in manufacturing, sales, and demand within the botulinum toxins industry. In comparison, type A is preferred over type B because it provides effects lasting longer (up to six months) and has more extensive regulatory approvals for aesthetic and therapeutic purposes. It is also more potent at smaller doses and less likely to develop antibody resistance. Furthermore, type A is widely recognized among physicians, supported by extensive clinical experience and research, which cements its leading market position globally.

"Based on applications, the aesthetics segment commanded the largest market share in 2024."

The aesthetics segment, particularly wrinkle removal, is expected to dominate the botulinum toxins market. In 2024, wrinkle removal continues to be a popular and well-recognized application of botulinum toxins, especially among adults seeking non-surgical anti-aging solutions. Clinics report high patient volumes, primarily for the treatment of forehead lines, crow's feet, and glabellar (frown) lines. This popularity is attributed to the visible and relatively quick results, along with fewer treatment cycles needed, making it widely accepted across diverse demographics. The procedure duration is short, and the results are noticeable quickly, leading to its prominence among non-surgical options.

"Based on end users, the dermatology clinics & hospitals segment accounted for the largest share in 2024."

The global botulinum toxins market is segmented by end user into dermatology clinics & hospitals, beauty centers, medical spas, and other end users. In 2024, dermatology clinics & hospitals witnessed a significant demand for botulinum toxin products, as they serve as primary providers for both aesthetic and medical procedures.

Dermatology clinics primarily focus on cosmetic treatments, such as wrinkle reduction and facial contouring, which are among the most common applications of botulinum toxins. In contrast, hospitals use these toxins to treat various medical conditions, including muscle spasticity, chronic migraines, and dystonia. With their well-equipped facilities, access to trained professionals, and capacity to manage both routine and complex cases, hospitals and clinics are key players that drive consistent usage of botulinum toxin products.

"The market in North America is expected to hold a significant market share for botulinum toxins throughout the forecast period."

The botulinum toxins market comprises five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America region held a significant market share for botulinum toxins. This growth is primarily attributed to a strong healthcare infrastructure and the considerable disposable income of the population. North America is also home to several major manufacturers of botulinum toxins, fostering a sustainable ecosystem of buyers, distributors, and suppliers. These factors are anticipated to contribute to the growth of the botulinum toxins market in North America.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (35%), Directors (25%), and Others (40%)

- By Region: North America (40%), Europe (30%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (5%)

The key players profiled in the botulinum toxins market are by AbbVie Inc. (US), Ipsen Biopharmaceuticals Inc. (France), Galderma (Switzerland), Hugel, Inc. (South Korea), Revance Therapeutics, Inc. (US), Evolus, Inc. (US), Medytox, Inc. (South Korea), Merz Pharmaceuticals GmbH (Germany), Supernus Pharmaceuticals, Inc. (US), Daewoong Pharmaceutical Co., Ltd. (South Korea), Huons Co., Ltd. (South Korea), Eisai Co., Ltd. (Japan) and Hugh Source (International) Ltd. (Hong Kong).

Research Coverage

The research report examines the botulinum toxins market by product, type, application, end user, and region. This research examines the factors contributing to market expansion, analyzes the challenges and opportunities currently faced by various industries, and provides details on the competitive landscape, including both market leaders and small to medium-sized enterprises. Additionally, it estimates the revenue generated by different market segments across five regions and includes a micromarket analysis.

Reasons to Buy the Report

The report will assist market leaders and new entrants by providing accurate revenue estimates for the overall botulinum toxins market and its subsegments. It will help stakeholders understand the competitive landscape, allowing them to position their businesses more effectively and develop appropriate go-to-market strategies. Additionally, the report offers insights into the market dynamics, including key drivers, restraints, challenges, and opportunities.

This report provides insightful data on the following points:

- Market Penetration: In-depth coverage of product portfolios offered by the top players in the botulinum toxins market.

- Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the botulinum toxins market.

- Market Development: Insightful data on profitable developing areas.

- Market Diversification: Details about recent developments and advancements in the botulinum toxins market.

- Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Primary interviews

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BOTULINUM TOXINS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: BOTULINUM TOXINS MARKET, BY APPLICATION AND COUNTRY, 2024 (USD MILLION)

- 4.3 BOTULINUM TOXINS MARKET: EMERGING VS. DEVELOPED MARKETS, 2025 VS. 2030 (USD MILLION)

- 4.4 BOTULINUM TOXINS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased adoption in therapeutic indications

- 5.2.1.2 Reduced out-of-pocket expenditure due to sufficient reimbursement schemes

- 5.2.1.3 Aesthetic consciousness among adults

- 5.2.1.4 Greater acceptance and normalization of botulinum toxins among millennials and Gen Z

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risk of infection and safety concerns

- 5.2.2.2 Complex regulatory framework and compliance standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging economies

- 5.2.3.2 Formulation advancements and innovations for improved safety

- 5.2.4 CHALLENGES

- 5.2.4.1 High treatment costs

- 5.2.4.2 Social and cultural barriers

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF BOTULINUM TOXINS, BY KEY PLAYER, 2022-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF BOTULINUM TOXINS, BY REGION, 2022-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.5.3 DISTRIBUTION AND MARKETING & SALES

- 5.5.4 AFTER-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Jet-based delivery systems

- 5.9.1.2 Facial imaging and mapping systems

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Laser, RF, & ultrasound-based devices

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 3D imaging and AI-based facial mapping

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INNOVATIONS AND PATENT REGISTRATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 300290, 2020-2024

- 5.11.2 EXPORT DATA FOR HS CODE 300290, 2020-2024

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 COMMERCIAL PARTNERSHIPS BY ANIKA THERAPEUTICS TO INCREASE MEDICAL AESTHETIC PRODUCT SALES

- 5.13.2 DIVISION OF BUSINESS BY MERZ BIOPHARMA TO HELP EFFECIENTLY MEET CUSTOMER DEMANDS

- 5.13.3 COLLABORATIONS BETWEEN CANDELA CORPORATION AND SMES TO STREAMLINE LASER-BASED DEVICES

- 5.14 REGULATORY ANANLYSIS

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 KEY REGULATORY GUIDELINES

- 5.14.2.1 North America

- 5.14.2.1.1 US

- 5.14.2.1.2 Canada

- 5.14.2.2 Europe

- 5.14.2.2.1 UK

- 5.14.2.2.2 France

- 5.14.2.2.3 Germany

- 5.14.2.3 Asia Pacific

- 5.14.2.3.1 China

- 5.14.2.3.2 Japan

- 5.14.2.3.3 India

- 5.14.2.4 Latin America

- 5.14.2.4.1 Brazil

- 5.14.2.5 Middle East & Africa

- 5.14.2.5.1 UAE

- 5.14.2.1 North America

- 5.14.3 REGULATORY STANDARDS/APPROVALS

- 5.15 REIMBURSEMENT SCENARIO ANALYSIS

- 5.15.1 NORTH AMERICA

- 5.15.1.1 US

- 5.15.1.2 Canada

- 5.15.2 EUROPE

- 5.15.2.1 UK

- 5.15.2.2 Germany

- 5.15.2.3 France

- 5.15.2.4 Italy

- 5.15.2.5 Spain

- 5.15.3 ASIA PACIFIC

- 5.15.3.1 China

- 5.15.3.2 Japan

- 5.15.3.3 India

- 5.15.3.4 Australia

- 5.15.4 LATIN AMERICA

- 5.15.4.1 Brazil

- 5.15.4.2 Mexico

- 5.15.5 MIDDLE EAST & AFRICA

- 5.15.5.1 GCC Countries

- 5.15.5.2 Africa (Major Economies)

- 5.15.1 NORTH AMERICA

- 5.16 PORTER'S FIVE FORCE ANALYSIS

- 5.16.1 THREAT OF NEW ENTRANTS

- 5.16.2 THREAT OF SUBSTITUTES

- 5.16.3 BARGAINING POWER OF SUPPLIERS

- 5.16.4 BARGAINING POWER OF BUYERS

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS

- 5.19 IMPACT OF 2025 US TARIFF ON BOTULINUM TOXINS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 North America

- 5.19.4.1.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.4.1 North America

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.20 IMPACT OF AI/GEN AI ON BOTULINUM TOXINS MARKET

- 5.20.1 MARKET POTENTIAL OF AI/GEN AI

- 5.20.2 AI USE CASES

- 5.20.3 KEY COMPANIES IMPLEMENTING AI/GEN AI

- 5.20.4 FUTURE OF AI/GEN AI

6 BOTULINUM TOXINS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 BOTOX

- 6.2.1 USE IN THERAPEUTIC AND COSMETIC PROCEDURES TO AUGMENT MARKET GROWTH

- 6.3 DYSPORT

- 6.3.1 FASTER ONSET DURATION AND LONG-LASTING EFFECT TO BOOST MARKET ADOPTION

- 6.4 JEUVEAU

- 6.4.1 INTRODUCTION OF TECH-ENABLED PLATFORMS FOR CONSUMER SUPPORT TO FUEL MARKET GROWTH

- 6.5 MYOBLOC

- 6.5.1 WIDE THERAPEUTIC PROFILE TO DRIVE MARKET

- 6.6 XEOMIN

- 6.6.1 STABLE THERAPEUTIC PERFORMANCE AND EFFECTIVE FORMULATION TO FAVOR MARKET GROWTH

- 6.7 OTHER PRODUCTS

7 BOTULINUM TOXINS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE A BOTULINUM TOXINS

- 7.2.1 GLOBAL CLINICAL ACCEPTANCE AND PROVEN EFFICACY TO SUPPORT MARKET GROWTH

- 7.3 TYPE B BOTULINUM TOXINS

- 7.3.1 WIDE THERAPEUTIC UTILITY AND DISTINCT CLINICAL PROFILE TO PROPEL MARKET GROWTH

8 BOTULINUM TOXINS MARKET, BY AGE GROUP

- 8.1 INTRODUCTION

- 8.2 17 YEARS OR YOUNGER

- 8.2.1 INCREASING THERAPEUTIC USE OF BOTOX TO PROPEL MARKET GROWTH AMONG YOUNGER PEOPLE

- 8.3 18-34 YEARS

- 8.3.1 GOOD TOLERABILITY AND IMPROVED PATIENT-REPORTED OUTCOMES TO DRIVE ADOPTION OF BOTOX TREATMENT

- 8.4 35-50 YEARS

- 8.4.1 NEED FOR APPEARANCE MAINTENANCE AND BETTER SOCIAL ENGAGEMENT TO FUEL MARKET GROWTH

- 8.5 51-64 YEARS OLD

- 8.5.1 SUSTAINED DEMAND FOR COSMETIC AND THERAPEUTIC INDICATIONS TO AUGMENT MARKET GROWTH

- 8.6 65 YEARS OR OLDER

- 8.6.1 HIGH DEMAND FOR FUNCTIONAL IMPROVEMENTS AND CONSERVATIVE AESTHETIC ENHANCEMENTS TO DRIVE MARKET

9 BOTULINUM TOXINS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 COSMETIC APPLICATIONS

- 9.2.1 WRINKLE REMOVAL

- 9.2.1.1 Surge in beauty clinics and medical spas to support segment growth

- 9.2.2 FACIAL CONTOURING

- 9.2.2.1 Rising desire for natural results and growing appeal of minimally invasive procedures to propel segment growth

- 9.2.3 SKIN REJUVENATION

- 9.2.3.1 Increased adoption of minimally invasive facial enhancement procedures to boost market growth

- 9.2.1 WRINKLE REMOVAL

- 9.3 THERAPEUTIC APPLICATIONS

- 9.3.1 PAIN MANAGEMENT

- 9.3.1.1 Rising need for pain management techniques to drive segment

- 9.3.2 OVERACTIVE BLADDER

- 9.3.2.1 Localized mechanism, strong efficacy, and long-lasting relief to spur demand for botulinum toxins among neurogenic patients

- 9.3.1 PAIN MANAGEMENT

- 9.4 OTHER APPLICATIONS

10 BOTULINUM TOXINS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 DERMATOLOGY CLINICS & HOSPITALS

- 10.2.1 RISING TREND OF MEDICAL TOURISM AND INCREASING POPULARITY OF PLASTIC SURGERY TO SUPPORT MARKET GROWTH

- 10.3 BEAUTY CENTERS

- 10.3.1 GROWING INCLINATION TOWARD CUSTOMIZED TREATMENTS TO BOOST MARKET GROWTH

- 10.4 MEDICAL SPAS

- 10.4.1 INCREASING FOCUS ON CONVENIENCE, TREATMENT FLEXIBILITY, AND COST EFFECTIVENESS TO SPUR MARKET GROWTH

- 10.5 OTHER END USERS

11 BOTULINUM TOXINS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate North American botulinum toxins market during study period

- 11.2.3 CANADA

- 11.2.3.1 Preference for minimally invasive cosmetic procedures among aging individuals to drive market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Selective reimbursement regimes and large number of cosmetic procedures to spur market demand

- 11.3.3 UK

- 11.3.3.1 Increased demand for Botox for cosmetic enhancements to propel market growth

- 11.3.4 FRANCE

- 11.3.4.1 Increased awareness and broader societal acceptance of cosmetic treatments to augment market growth

- 11.3.5 ITALY

- 11.3.5.1 Rising number of medical aesthetic procedures to aid market growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing availability of safe and effective minimally invasive or non-invasive aesthetic treatments to aid market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Popularity of medical tourism to increase demand for cosmetic treatments

- 11.4.3 CHINA

- 11.4.3.1 Surging demand for non-surgical aesthetic procedures to support market growth

- 11.4.4 INDIA

- 11.4.4.1 Lack of reimbursements for aesthetic treatments alongside social and ethical concerns to limit market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased number of aesthetic procedures to grow market for botulinum toxins

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Rising availability of safe and effective minimally invasive and non-invasive aesthetic procedures and products to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Rapid growth in medical tourism and high disposable incomes to expedite market growth

- 11.5.3 MEXICO

- 11.5.3.1 Rising influx of medical tourists from US to drive adoption of cost-effective cosmetic procedures

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Favorable government policies to propel market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BOTULINUM TOXINS MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING OF KEY PLAYERS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.5.1 FINANCIAL METRICS

- 12.5.2 COMPANY VALUATION

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 PERVASIVE PLAYERS

- 12.7.3 EMERGING LEADERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 End-user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABBVIE INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 IPSEN BIOPHARMACEUTICALS, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product approvals

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 GALDERMA

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 HUGEL, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product approvals

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 REVANCE

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & approvals

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 EVOLUS, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & approvals

- 13.1.6.3.2 Deals

- 13.1.7 MEDYTOX

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product approvals

- 13.1.7.3.2 Deals

- 13.1.8 MERZ PHARMA

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product approvals

- 13.1.9 SUPERNUS PHARMACEUTICALS, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 DAEWOONG PHARMACEUTICAL CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches & approvals

- 13.1.11 HUONS

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches & approvals

- 13.1.12 EISAI CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 HUGH SOURCE (INTERNATIONAL) LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.1 ABBVIE INC.

- 13.2 OTHER PLAYERS

- 13.2.1 DERMAX CO., LTD.

- 13.2.2 GUFIC BIOSCIENCES

- 13.2.3 OCEAN PHARMACEUTICAL

- 13.2.4 CROMA-PHARMA GMBH

- 13.2.5 MICROGEN

- 13.2.6 JDBIO CO., LTD.

- 13.2.7 CKD BIO

- 13.2.8 ATRAZIST ARAY CO.

- 13.2.9 GUANGZHOU AOMA BUSINESS CO., LTD.

- 13.2.10 JETEMA CO., LTD.

- 13.2.11 SINOPHARM GROUP CO., LTD.

- 13.2.12 QUFU HANTANG BIOTECHNOLOGY CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS