|

시장보고서

상품코드

1780341

배전용 변압기 시장(-2030년) : 설치 구분, 위상, 정격 전력, 절연, 최종 사용자 및 지역별Distribution Transformer Market by Mounting (Pad, Pole, Underground), Phase (Three and Single), Power Rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, above 10 MVA), Insulation (Oil-immersed, Dry), End User, and Region - Global Forecast to 2030 |

||||||

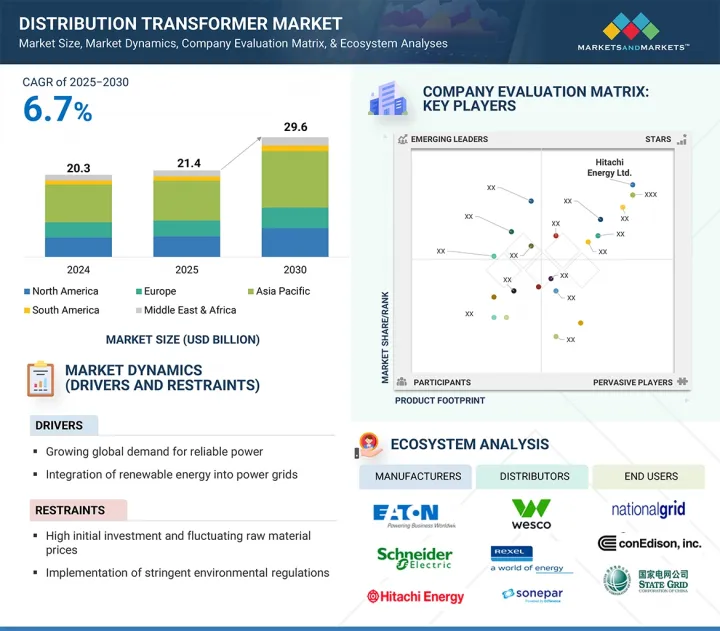

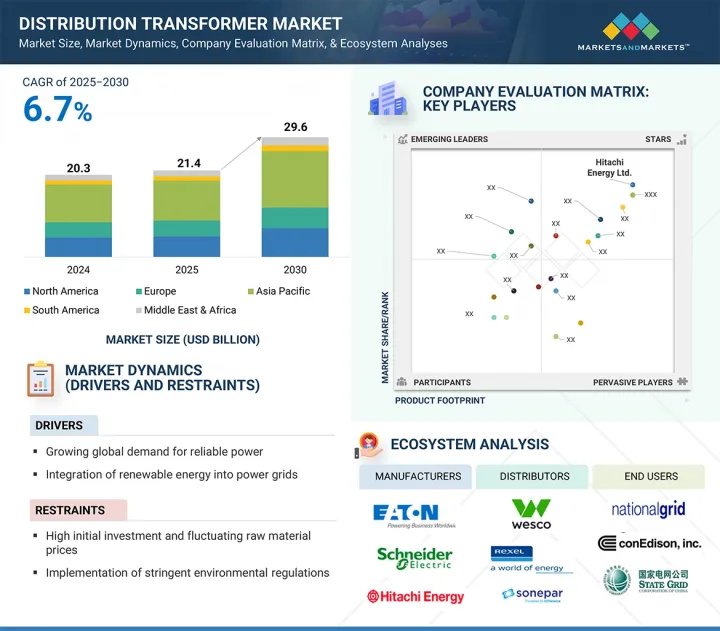

세계의 배전용 변압기 시장 규모는 2025년 214억 달러로 평가되었고, 2030년에는 296억 달러로 성장할 것으로 예측되며, CAGR 6.7%로 성장할 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 단위 |

| 부문별 | 설치 구분, 위상, 절연 유형, 정격 전력, 최종 사용자 및 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미 |

예측 기간 동안 신뢰성 있고 효율적인 전력 공급 인프라에 대한 수요 증가로 인해 시장이 상당한 성장을 기록할 것으로 예상됩니다. 스마트 및 연결형 변압기 기술에 대한 의존도가 증가함에 따라 전력 공급업체와 송전 시스템 소유주는 복원력을 강화하고 가동 시간을 확보하며 유지보수 비용을 절감할 수 있게 되었습니다. 디지털 모니터링, 상태 기반 진단, 예측 유지보수의 사용 증가로 인해 전력 공급업체의 자산 관리 방식이 변화하고 있습니다. 이를 통해 유틸리티는 변압기의 노화를 모니터링하고, 예기치 않은 고장을 방지하며, 레거시 장비를 최적의 성능 수준으로 유지할 수 있습니다. 재생 가능 에너지와 전기자동차(EV) 충전 인프라의 출현으로 모든 부문, 특히 주거, 상업 및 산업 시장에서 전기화가 진행되고 있습니다. 실시간 부하 관리 기능을 갖춘 자체 진단 및 열 감지 기능을 갖춘 첨단 배전 변압기에 대한 수요가 증가하고 있습니다. 건식 또는 오일 침지형에 상관없이 지능형 기능을 갖춘 차세대 배전 변압기 기술을 통해 유틸리티는 변화하는 조건에서 동적 부하 조건을 관리하는 동시에 장비의 수명을 연장할 수 있습니다. 전력망의 현대화 및 지속 가능성에 대한 강조가 커짐에 따라, 전력 품질, 신뢰성 및 다운타임 감소에 중요한 역할을 하는 예측 유지보수가 배전 변압기 시장의 주요 성장 동력이 되고 있습니다.

아시아태평양, 예측 기간 동안 가장 빠르게 성장하는 시장으로 부상

아시아태평양은 중국, 인도, 인도네시아, 베트남, 필리핀 등 신흥 경제국의 고속 경제 성장, 대규모 도시화, 적극적인 전기화 추진에 힘입어 예측 기간 동안 전 세계에서 가장 빠르게 성장하는 배전 변압기 시장으로 부상할 것으로 예상됩니다. 주거용, 상업용, 산업용 소비자의 전력 수요 증가를 충족시키기 위해 해당 지역은 송전 및 배전 네트워크 확장에 대한 상당한 투자가 진행 중입니다. 인도 정부의 Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), 중국의 Belt and Road Initiative (BRI), ASEAN 국가들의 농촌 전기화 사업 등은 변압기 설치 확대를 주도하는 주요 요인입니다. 또한 태양광과 풍력 등 재생에너지 사용의 급증은 간헐적 부하를 관리하고 스마트 그리드 인프라와 호환 가능한 고급형 효율적인 배전 변압기에 대한 수요를 창출하고 있습니다. 전기자동차(EV)의 사용 증가, 지하철 네트워크의 성장 전망, 변전소 시설의 디지털화도 이 지역의 시장을 촉진하고 있습니다. 또한, 국내 제조 능력의 증가, 정책 조치, 에너지 인프라 프로젝트에 대한 외국인 직접 투자(FDI)의 유입도 아시아태평양 지역의 시장 성장을 촉진하고 있습니다.

본 보고서에서는 세계의 배전용 변압기 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 고객의 사업에 영향을 미치는 동향 및 혼란

- 생태계 분석

- 투자 및 자금조달 시나리오

- 공급망 분석

- 기술 분석

- 가격 분석

- 주요 회의 및 이벤트(2025-2026년)

- 관세 및 규제 상황

- 무역 분석

- 특허 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 생성형 AI/AI가 배전용 변압기 시장에 미치는 영향

- 미국 관세가 배전용 변압기 시장에 미치는 영향(2025년)

제6장 배전용 변압기 시장 : 설치 구분별

- 패드

- 폴

- 지하

제7장 배전용 변압기 시장 : 위상별

- 3상

- 단상

제8장 배전용 변압기 시장 : 전력 정격별

- 0.5MVA 미만

- 0.5-2.5MVA

- 2.5-10MVA

- 10MVA 이상

제9장 배전용 변압기 시장 : 절연 구분별

- 유입

- 건식

제10장 배전용 변압기 시장 : 최종 사용자별

- 유틸리티

- 산업용

- 주거 및 상업용

제11장 배전용 변압기 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 중동 및 아프리카

- GCC

- 남아프리카

- 나이지리아

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 수익 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업평가 매트릭스 : 스타트업 및 중소기업

- 기업평가와 재무지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- HITACHI ENERGY LTD

- EATON

- SCHNEIDER ELECTRIC

- SIEMENS ENERGY

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- GE VERNOVA

- ORMAZABAL

- TRANSFORMERS AND RECTIFIERS INDIA LTD

- WILSON POWER SOLUTIONS LTD

- LEMI TRAFO TRANSFORMERS

- HYOSUNG HEAVY INDUSTRIES

- CELME

- EMERSON ELECTRIC CO.

- JST POWER EQUIPMENT

- HAMMOND POWER SOLUTIONS

- VANTRAN INDUSTRIES, INC.

- RAYCHEM RPG PRIVATE LIMITED

- SERVOKON

- EFACEC

- KOTSONS GLOBAL

- HD HYUNDAI ELECTRIC CO., LTD.

- 기타 기업

- VIJAY POWER

- VOLTAMP TRANSFORMER

- GTB

제14장 부록

HBR 25.08.07The global distribution transformer market is projected to grow from USD 21.4 billion by 2025 to USD 29.6 billion by 2030, at a CAGR of 6.7%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million), Volume (Units) |

| Segments | Distribution transformer market by mounting, phase, insulation, power rating, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The market is expected to experience considerable growth over the forecast period as demand for credible, reliable, and efficient power delivery infrastructure increases. Due to increasing reliance on smart and connected transformer technologies, utilities and transmission system owners are better able to improve resilience, ensure uptime, and lower maintenance costs. The increasing use of digital monitoring, condition-based diagnostics, and predictive maintenance is changing the practice of asset management for utilities. This allows utilities to monitor transformer aging, prevent unexpected failures, and maintain legacy equipment at optimal performance levels. Electrification is on the rise across all sectors, especially in the residential, commercial, and industrial markets, with the emergence of renewables and electric vehicle (EV) charging infrastructure. The demand for advanced distribution transformers with self-diagnostics and thermal sensing with real-time load management capabilities is on the rise. Next-generation distribution transformer technologies, whether dry-type or oil-immersed, and with intelligent capabilities, enable utilities to manage dynamic load conditions while extending the life of the equipment under changing conditions. With a growing emphasis on grid modernization and sustainability, predictive maintenance becomes a key growth driver of the distribution transformer market, as it plays an important role in power quality, reliability, and lowering downtime.

Utilities to be fastest-growing end user segment during forecast period

The utilities sector is expected to be the fastest-growing end user in the global distribution transformer market throughout the forecast period, supported by increased investment aimed at modernizing power infrastructure and increasing grid capacity in both developed and developing economies. As national grids age and electricity demand increase due to urbanization, industrialization, and digitalization, utilities are shifting toward replacing older versions of distribution systems with modern, highly efficient transformers with lower energy losses and higher reliability. In addition, the influx of more renewable energy (solar and wind) into utility-scale power systems requires flexible as well as smart transformer technology to manage variable load profiles, provide bi-directional power flow, and balance the grid in real-time. Significant government-led electrification and rural expansion programs across Asia Pacific, the Middle East, and Africa are based on deployed utility-toned (as opposed to independently deployable) transformer solutions, where the utility will ensure uninterrupted access to power. Additionally, the regulatory push towards decarbonization and the adoption of predictive maintenance technologies are simultaneously driving utilities towards digitally enabled and environmentally sustainable transformer units. In conclusion, the utility sector serves as a significant growth engine for the overall distribution transformer market.

2.5-10 MVA segment to exhibit highest CAGR during forecast period

The 2.5-10 MVA power rating range is expected to register the highest CAGR in the global distribution transformer market over the forecast period, primarily due to its suitability for medium-scale industrial, commercial, and urban utility loads. As emerging economies see increased urbanization and industrial growth, particularly in sectors like manufacturing, healthcare, and data centers, the demand for mid-capacity transformers that can support larger loads without compromising efficiency or stability has surged considerably. This segment is crucial for high-rise commercial buildings, metro systems, substations, and small to medium-sized renewable energy systems, where greater power output and a smaller footprint are essential. Additionally, the rising electrification of semi-urban and peri-urban areas in emerging nations such as India, China, Indonesia, and parts of Africa is driving the installation of 2.5-10 MVA units due to their cost-effectiveness and operational flexibility. These units also offer an optimal balance between power transfer capability and infrastructure costs, making them a preferred choice for utilities and EPC contractors looking to enhance grid infrastructure while minimizing investment. Moreover, the increasing adoption of decentralized energy systems and the necessity to meet dynamic and localized energy demands further accelerate the growth of this segment.

Asia Pacific to be the fastest-growing market during forecast period

Asia Pacific is anticipated to emerge as the fastest-growing market for distribution transformers globally during the forecast period with its high-speed economic growth, large-scale urbanization, and aggressive electrification drive in emerging economies like China, India, Indonesia, Vietnam, and the Philippines. In order to meet the growing demand for power from residential, commercial, and industrial consumers, the region is seeing significant investments in the expansion of transmission and distribution networks. Government programs such as India's Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), China's Belt and Road Initiative (BRI), and rural electrification schemes of the ASEAN nations are majorly propelling the installation of transformers. In addition, the surge in the use of renewable energy sources, such as solar and wind, is also generating a need for advanced, efficient distribution transformers with the ability to manage intermittent loads and be compatible with smart grid infrastructure. Growing use of electric vehicles (EVs), anticipated growth in metro rail networks, and digitalization of substation facilities are also driving the market in this region. Moreover, increasing indigenous manufacturing capacities, policy measures, and foreign direct investment (FDI) flows into energy infrastructure projects are also driving the market growth in Asia Pacific.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the distribution transformer market.

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: Asia Pacific - 40%, North America - 30%, Europe - 20%, Middle East & Africa - 5%, and South America - 5%

Note: Other designations include engineers and sales & regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

A few major players with extensive geographical presence dominate the distribution transformer market. The leading players are Hitachi Energy Ltd. (Switzerland), Eaton (Ireland), Siemens Energy (Germany), Schneider Electric (France), and Toshiba Energy Systems & Solutions Corporation (Japan).

Research Coverage:

The report defines, describes, and forecasts the distribution transformer market mounting (Pad, Pole, Underground), phase (Three and Single), power rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, above 10 MVA), insulation (Oil-immersed, Dry), end user (Industrial, commercial & residential, utilities), and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A comprehensive analysis of the key players in the distribution transformer market has been conducted. This analysis provides insights into their business overview, solutions and services, and key strategies. It also covers relevant contracts, partnerships, and agreements, along with new product launches, mergers, acquisitions, and other recent developments in the market. Additionally, the report includes a competitive analysis of emerging startups within the distribution transformer market ecosystem.

Reasons to Buy This Report:

This report is a strategic resource for industry leaders and new entrants, offering a comprehensive analysis of the market and its subsegments. It equips stakeholders with a thorough understanding of the competitive landscape, enabling them to refine their business positioning and devise effective go-to-market strategies. Additionally, the report elucidates the current market dynamics, highlighting critical drivers, constraints, challenges, and opportunities that inform strategic decision-making.

The report provides insights on the following points:

- Analysis of key drivers (Growing global demand for reliable power, Integration of renewable energy into power grids), restraints (High initial investment and fluctuating raw material prices, Implementation of stringent environmental regulations), opportunities (Rising annual smart grid investments to achieve global climate goals, High focus of utilities on achieving energy efficiency), and challenges (Disruptions in supply chain of grid technology) influencing the growth

- Product Development/Innovation: Competition in the transformation distribution industry is increasingly focused on technical innovation in insulation materials, energy efficiency, and digitization. Stakeholders are increasingly investing in solid dielectric insulation, advanced cooling technologies such as forced-air or hybrid systems, and IoT-driven condition monitoring solutions that enable predictive maintenance. Dry-type transformers are witnessing increased usage across commercial buildings and environmentally sensitive areas, whereas oil-immersed types are still the norm in utility-scale operations. Smart diagnostic integration, thermal monitoring, and self-healing capabilities into transformer cores and enclosures are assisting utilities in prolonging asset life along with enhanced grid stability.

- Market Development: Robust market growth is witnessed across developing regions such as Asia Pacific, Africa, and Latin America, driven by urban expansion, rural electrification, and infrastructure development. Large-scale government projects, such as India's Saubhagya Scheme, Africa's Power Africa initiative, and Southeast Asia's smart grid rollouts, are spurring demand for medium-voltage distribution transformers in both oil-immersed and dry-type categories. The expansion of solar microgrids and EV charging networks also demands compact pad-mounted and pole-mounted transformer solutions.

- Market Diversification: The application of distribution transformers is diversifying beyond conventional utilities into segments such as data centers, airports, commercial buildings, hospitals, renewable energy plants, and electric vehicle charging hubs. These end users require customized transformer solutions with reduced footprint, enhanced safety, and minimal operational noise. Manufacturers are responding by developing pre-assembled modular transformers with plug-and-play capabilities, fire-resistant casings, and intelligent fault diagnostics to meet the performance expectations of specialized sectors.

- Competitive Assessment: The competitive scenario of the distribution transformer market includes players such as Hitachi Energy Ltd. (Switzerland), Eaton (Ireland), Siemens Energy (Germany), Schneider Electric (France), and Toshiba Energy Systems & Solutions Corporation (Japan), all of which maintain a strong global footprint supported by diversified product portfolios and regional manufacturing hubs. These companies are actively engaging in strategic collaborations with EPC contractors and local utilities to enhance smart grid readiness, advance their dry-type transformer platforms, and localize production to meet the evolving demands of rapidly developing economies. By consistently investing in R&D for intelligent transformer technologies, eco-friendly insulation solutions, and energy-efficient designs, these industry leaders are positioning themselves to capitalize on emerging market opportunities and drive the modernization of the global power infrastructure.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 List of major secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 List of primary interview participants

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country-level analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISTRIBUTION TRANSFORMER MARKET

- 4.2 DISTRIBUTION TRANSFORMER MARKET, BY REGION

- 4.3 DISTRIBUTION TRANSFORMER MARKET IN ASIA PACIFIC, BY MOUNTING AND COUNTRY

- 4.4 DISTRIBUTION TRANSFORMER MARKET, BY MOUNTING

- 4.5 DISTRIBUTION TRANSFORMER MARKET, BY PHASE

- 4.6 DISTRIBUTION TRANSFORMER MARKET, BY POWER RATING

- 4.7 DISTRIBUTION TRANSFORMER MARKET, BY INSULATION

- 4.8 DISTRIBUTION TRANSFORMER MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Electrification of residential and transportation sectors

- 5.2.1.2 Aging global grid infrastructure

- 5.2.1.3 Integration of renewable energy into power grids

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and fluctuating raw material prices

- 5.2.2.2 Implementation of stringent environmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward intelligent and efficient power grid infrastructure

- 5.2.3.2 Emphasis on offering energy-efficient transformers

- 5.2.3.3 Growing demand of distribution transformers in developing economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Disruptions in supply chain of grid technology

- 5.2.4.2 Cybersecurity threats

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.6.2 COMPONENT MANUFACTURERS

- 5.6.3 DISTRIBUTION TRANSFORMER MANUFACTURERS/ASSEMBLERS

- 5.6.4 DISTRIBUTORS

- 5.6.5 END USERS

- 5.6.6 POST-SALES SERVICE PROVIDERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Smart digitized distribution transformers

- 5.7.1.2 Solid-state transformers (SSTs)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Smart grids

- 5.7.2.2 Advanced metering infrastructure (AMI)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Battery energy storage systems (BESS)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 PRICING RANGE OF DISTRIBUTION TRANSFORMERS, BY POWER RATING

- 5.8.2 AVERAGE SELLING PRICE TREND OF DISTRIBUTION TRANSFORMERS, BY REGION

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TARIFFS AND REGULATORY LANDSCAPE

- 5.10.1 TARIFFS RELATED TO DISTRIBUTION TRANSFORMERS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 REGULATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 8504)

- 5.11.2 EXPORT SCENARIO (HS CODE 8504)

- 5.12 PATENT ANALYSIS

- 5.12.1 LIST OF PATENTS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 HITACHI ENERGY INTRODUCES EASYDRY 550KV THAT ELIMINATES INGRESS AND OIL LEAK HAZARDS

- 5.15.2 HITACHI ENERGY ENABLES SMART TRANSFORMER MANAGEMENT WITH TXOERT HUB THAT BOOSTS RELIABILITY AND EFFICIENCY

- 5.15.3 HITACHI ENERGY PROTECTS TRANSFORMERS FROM INSULATION DAMAGE AND FAILURES USING TVP

- 5.16 IMPACT OF GEN AI/AI ON DISTRIBUTION TRANSFORMER MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN DISTRIBUTION TRANSFORMER MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON DISTRIBUTION TRANSFORMER MARKET, BY REGION

- 5.17 IMPACT OF 2025 US TARIFF ON DISTRIBUTION TRANSFORMER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 IMPACT ON COUNTRY/REGION

- 5.17.3.1 US

- 5.17.3.2 Europe

- 5.17.3.3 Asia pacific

- 5.17.4 IMPACT ON END USERS

6 DISTRIBUTION TRANSFORMER MARKET, BY MOUNTING

- 6.1 INTRODUCTION

- 6.2 PAD

- 6.2.1 DEPLOYMENT AT HIGH-TRAFFIC PUBLIC AREAS TO REDUCE RISK OF ACCIDENTAL CONTACTS TO FUEL MARKET GROWTH

- 6.3 POLE

- 6.3.1 INTEGRATION WITH SMART GRID TECHNOLOGIES TO ENHANCE MONITORING AND CONTROL CAPABILITIES TO DRIVE MARKET

- 6.4 UNDERGROUND

- 6.4.1 IMPROVED RELIABILITY AND REDUCED DOWNTIME TO SUPPORT MARKET GROWTH

7 DISTRIBUTION TRANSFORMER MARKET, BY PHASE

- 7.1 INTRODUCTION

- 7.2 THREE

- 7.2.1 DEPLOYMENT IN WIND AND SOLAR FARMS TO DRIVE MARKET

- 7.3 SINGLE

- 7.3.1 ONGOING INNOVATIONS IN LOW-LOSS CORE MATERIALS AND THERMAL MANAGEMENT TO SUPPORT MARKET GROWTH

8 DISTRIBUTION TRANSFORMER MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- 8.2 UP TO 0.5 MVA

- 8.2.1 DEPLOYMENT IN EMERGENCY RESPONSE SCENARIOS OR TEMPORARY GRID EXTENSIONS TO FOSTER MARKET GROWTH

- 8.3 0.5-2.5 MVA

- 8.3.1 EXPANDING ELECTRIC VEHICLE INFRASTRUCTURE TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.4 2.5-10 MVA

- 8.4.1 ABILITY TO MAINTAIN VOLTAGE STABILITY UNDER FLUCTUATING LOADS TO BOOST DEMAND

- 8.5 ABOVE 10 MVA

- 8.5.1 INTEGRATION WITH ADVANCED COOLING SYSTEMS AND REAL-TIME DIAGNOSTICS TO BOOST DEMAND

9 DISTRIBUTION TRANSFORMER MARKET, BY INSULATION

- 9.1 INTRODUCTION

- 9.2 OIL-IMMERSED

- 9.2.1 GROWING INTEGRATION WITH DIGITAL MONITORING SYSTEMS TO BOOST DEMAND

- 9.3 DRY

- 9.3.1 ONGOING ADVANCEMENTS IN EPOXY RESIN INSULATION AND ADVANCED COOLING TECHNIQUES TO FUEL MARKET GROWTH

10 DISTRIBUTION TRANSFORMER MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 UTILITIES

- 10.2.1 INCREASING EMPHASIS ON INCORPORATING SMART GRID TECHNOLOGIES INTO EXISTING INFRASTRUCTURE TO FOSTER MARKET GROWTH

- 10.3 INDUSTRIAL

- 10.3.1 ADOPTION OF GREEN TECHNOLOGIES AND ECO-FRIENDLY PRACTICES TO FUEL MARKET GROWTH

- 10.4 RESIDENTIAL & COMMERCIAL

- 10.4.1 ADVANCEMENTS IN SMART GRID TECHNOLOGY TO DRIVE MARKET

11 DISTRIBUTION TRANSFORMER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Emphasis on developing clean energy future to fuel market growth

- 11.2.2 CANADA

- 11.2.2.1 Increasing proportion of renewables in electricity mix to fuel market growth

- 11.2.3 MEXICO

- 11.2.3.1 Focus on modernizing national power grid to boost demand

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising focus on adopting renewable energy sources and grid upgrades to support market growth

- 11.3.2 UK

- 11.3.2.1 Regulatory initiatives to deploy digitally intelligent distribution infrastructure to drive market

- 11.3.3 ITALY

- 11.3.3.1 Increasing cross-border power flow to boost demand

- 11.3.4 FRANCE

- 11.3.4.1 Integration of renewable energy into grids to offer lucrative opportunities

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Deployment of ultra-high-voltage transmission lines, smart substations, and advanced metering infrastructure to fuel market growth

- 11.4.2 INDIA

- 11.4.2.1 Widespread grid expansion and increased interconnectivity to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Emphasis on grid modernization and EV infrastructure development to offer lucrative growth opportunities

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Decentralization of energy mix to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Rising commercial activity and increasing industrialization to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Rapid economic development to support market growth

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Presence of aging infrastructure to boost demand

- 11.5.3 NIGERIA

- 11.5.3.1 Growing investments in grid infrastructure to drive market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Increasing demand for electricity in residential, commercial, and industrial sectors to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Expanding urban population and industrial sectors to foster market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Mounting footprint

- 12.5.5.4 Insulation footprint

- 12.5.5.5 Phase footprint

- 12.5.5.6 Power rating footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 List of startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HITACHI ENERGY LTD

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 EATON

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 SCHNEIDER ELECTRIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 SIEMENS ENERGY

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Developments

- 13.1.7 GE VERNOVA

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.2.1 Developments

- 13.1.8 ORMAZABAL

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 TRANSFORMERS AND RECTIFIERS INDIA LTD

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent Developments

- 13.1.9.3.1 Developments

- 13.1.10 WILSON POWER SOLUTIONS LTD

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.11 LEMI TRAFO TRANSFORMERS

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 HYOSUNG HEAVY INDUSTRIES

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Developments

- 13.1.13 CELME

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 EMERSON ELECTRIC CO.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 JST POWER EQUIPMENT

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.16 HAMMOND POWER SOLUTIONS

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Deals

- 13.1.17 VANTRAN INDUSTRIES, INC.

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 RAYCHEM RPG PRIVATE LIMITED

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 SERVOKON

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Developments

- 13.1.20 EFACEC

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Developments

- 13.1.21 KOTSONS GLOBAL

- 13.1.21.1 Business overview

- 13.1.21.2 Products offered

- 13.1.22 HD HYUNDAI ELECTRIC CO., LTD.

- 13.1.22.1 Business overview

- 13.1.22.2 Products offered

- 13.1.1 HITACHI ENERGY LTD

- 13.2 OTHER PLAYERS

- 13.2.1 VIJAY POWER

- 13.2.2 VOLTAMP TRANSFORMER

- 13.2.3 GTB

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS