|

시장보고서

상품코드

1780345

서비스형 와이파이(WaaS) 시장(-2030년) : 서비스 유형, 로케이션 유형, 기업 규모, 최종 사용자 및 지역별Wi-Fi as a Service Market by Service Type (Fully Managed, Partially Managed, Subscription-based), Location Type (Indoor, Outdoor), Enterprise Size (Large Enterprises, SMEs), End User (Consumer, Enterprise) - Global Forecast to 2030 |

||||||

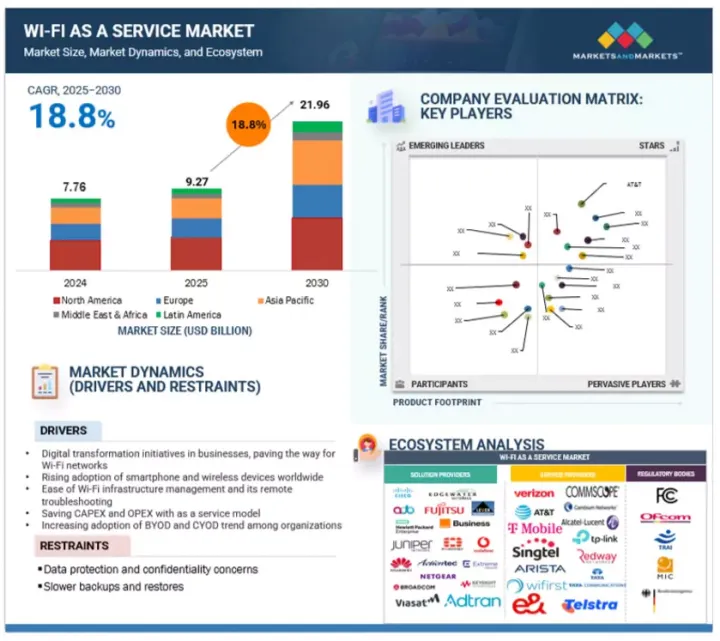

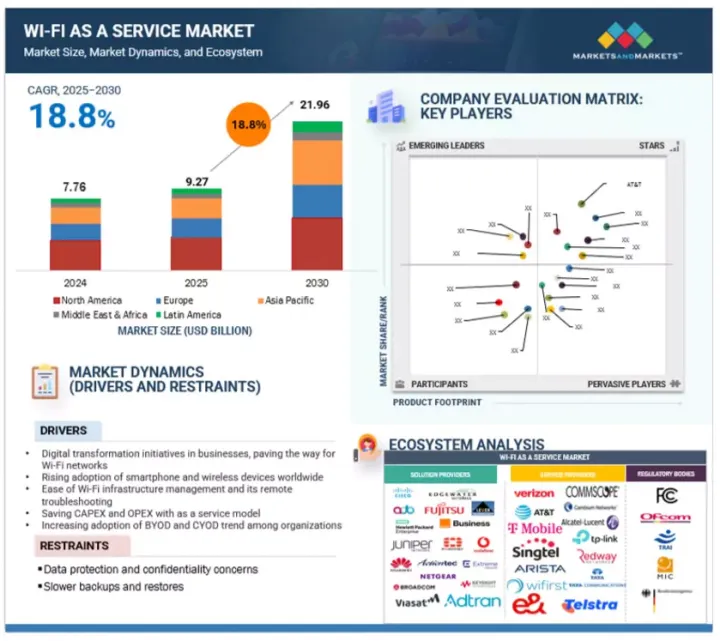

전 세계 서비스형 와이파이(WaaS) 시장 규모는 2025년 92억 7,000만 달러에서 2030년에는 219억 6,000만 달러로 성장할 것으로 예측되며, 예측 기간 동안 CAGR 18.8%로 성장할 전망입니다.

WaaS 시장은 몇 가지 주요 요인들로 인해 강력한 성장을 이루고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-203년 0 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(달러) |

| 부문별 | 서비스 유형, 로케이션 유형, 기업 유형, 최종 사용자 및 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴 아메리카 |

하이브리드 업무 환경에서 안전한 확장 가능한 연결성에 대한 수요 증가와 IoT 기기의 급속한 확산은 WaaS 채택을 더욱 촉진하고 있습니다. 소매, 교육, 의료 등 산업은 디지털 전환, 중앙 집중식 제어, 개선된 사용자 경험을 위해 WaaS를 활용하고 있습니다. 그러나 시장에는 특정 도전 과제가 존재합니다. 특히 제3자가 관리하는 네트워크에서의 데이터 보안 및 개인정보 보호에 대한 우려가 광범위한 채택을 방해하고 있습니다. 또한, 고속 인터넷에 대한 의존도, 레거시 시스템과의 통합 문제, 대기업에 대한 제한된 맞춤화 옵션, 잠재적인 벤더 종속성 등이 시장 성장의 장애물로 작용하고 있습니다. 이러한 장애물에도 불구하고 WaaS 모델은 민첩성, 확장성 및 관리형 네트워크 효율성을 추구하는 기업들에게 여전히 매력적인 모델입니다.

아시아태평양 지역은 예측 기간 동안 가장 높은 CAGR은 성장할 것으로 예상됩니다.

아시아태평양의 WaaS 시장은 빠르게 성장하고 있으며, 전 세계에서 가장 빠르게 확장되는 지역 시장이 되고 있습니다. 이러한 확장은 중국, 인도, 일본, 한국과 같은 국가에서 빠른 도시화, 인터넷 접속의 확대, 신흥 경제국의 디지털 기술 발전에 힘입어 디지털 전환이 가속화되고 있기 때문에 촉진되고 있습니다. 중국, 인도, 일본은 스마트 기기의 사용 증가, 모바일 연결성 개선, 광범위한 기업 디지털화 노력에 힘입어 WaaS를 적극적으로 도입하고 있습니다. 지역 내 수많은 중소기업(SME)은 대규모 초기 투자 없이 확장 가능하고 비용 효율적인 네트워크 솔루션을 제공하기 위해 WaaS로 전환하고 있습니다. 또한 정부 지원 스마트 시티 프로젝트, 5G 도입, 공공 Wi-Fi 인프라 확장 등도 시장 성장을 가속화하고 있습니다. APAC 지역의 기업들이 클라우드 우선 전략과 적응력이 뛰어난 네트워킹 모델을 채택함에 따라, 이 지역은 앞으로 WaaS 시장의 주요 성장 중심지가 될 것으로 보입니다.

본 보고서에서는 세계의 서비스형 와이파이(WaaS) 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 업계 동향

제6장 서비스형 와이파이(WaaS) 시장 : 서비스 유형별

- 구독 기반

- 실내

- 실외

제8장 서비스형 와이파이(WaaS) 시장 : 기업 규모별

- 대기업

- 중소기업

제9장 서비스형 와이파이(WaaS) 시장 : 최종 사용자별

- 소비자

- 기업

- 교육

- 소매

- 여행 및 접객업

- 의료 및 생명과학

- 제조

- BFSI

- IT 및 ITES

- 운송 및 물류

- 정부 및 공공 부문

- 기타

제10장 서비스형 와이파이(WaaS) 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 기타

- 중동 및 아프리카

- 거시경제 전망

- 중동

- 아프리카

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제11장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 주요 기업의 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 스타트업 및 중소기업 평가 매트릭스

- 경쟁 벤치마킹

- 브랜드/제품 비교

- 기업평가

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- AT&T

- VERIZON

- T-MOBILE

- E&

- SINGTEL

- TATA COMMUNICATIONS

- COMMSCOPE

- ARISTA NETWORKS

- TP-LINK

- WIFIRST

- 기타 기업

- ALCATEL LUCENT ENTERPRISE

- JIO

- SPECTRA

- TELSTRA

- VIASAT

- ADTRAN

- ALLIED TELESIS

- 4IPNET

- 스타트업 및 SME

- LANCOM SYSTEMS

- RUIJIE NETWORKS

- DATTO

- SUPERLOOP

- CAMBIUM NETWORKS

- REDWAY NETWORKS

- CUCUMBER TONY

- TANAZA

- EDGECORE NETWORKS

제13장 인접 시장 및 부록

제14장 부록

HBR 25.08.07The global Wi-Fi as a Service market is projected to grow from USD 9.27 billion in 2025 to USD 21.96 billion by 2030, with a compounded annual growth rate (CAGR) of 18.8% during the forecast period. The Wi-Fi as a Service (WaaS) market is experiencing strong growth, driven by several key factors. Organizations are increasingly shifting from CapEx-heavy infrastructure models to more flexible OpEx-based subscription models, allowing for predictable costs and easier network management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Service Type, Location Type, Enterprise Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rising demand for secure, scalable connectivity in hybrid work settings and the rapid spread of IoT devices are further boosting adoption. Industries such as retail, education, and healthcare are utilizing WaaS to enable digital transformation, centralized control, and improved user experiences. However, the market faces certain challenges. Concerns about data security and privacy, especially with networks managed by third parties, continue to hinder widespread adoption. Additionally, reliance on high-speed internet, integration issues with legacy systems, limited customization options for large enterprises, and potential vendor lock-in act as barriers to market growth. Despite these hurdles, the WaaS model remains appealing for businesses seeking agility, scalability, and managed network efficiency.

Based on enterprise size, the large enterprises segment is expected to hold the largest market share during the forecast period.

Large enterprises are key adopters of Wi-Fi as a Service (WaaS) because of their extensive operations, high user density, and complex IT setups. They use WaaS to simplify wireless network management across many locations, ensuring consistent and secure connectivity. This model supports bring-your-own-device (BYOD) policies, promotes workforce mobility, and seamlessly integrates with cloud-based enterprise applications. Large enterprises also depend on WaaS to meet strict security and compliance standards, manage IoT devices, and track network performance with advanced analytics. Additionally, WaaS provides scalability during mergers, acquisitions, or geographic growth, enabling enterprises to quickly deploy wireless infrastructure without heavy capital costs.

Based on service type, the subscription-based segment is expected to grow at the highest CAGR during the forecast period.

Subscription-based Wi-Fi services provide a cost-effective and flexible solution for organizations to access Wi-Fi infrastructure by paying a recurring fee-monthly, quarterly, or annually-eliminating the need for large upfront investments. This typically includes a complete package from the provider, covering hardware, software licenses, network setup, security features, remote monitoring, and technical support. It is especially suitable for SMEs, co-working spaces, SOHOs, and temporary setups like events or pop-up shops, where limited IT resources and rapid deployment are crucial. The increasing demand for consumption-based IT services and the ongoing digital transformation of SMBs are fueling adoption, as these services offer enterprise-grade connectivity without complexity or high costs.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific Wi-Fi as a Service market is rapidly growing, making it the fastest-expanding regional market worldwide. This expansion is driven by increased digital transformation in countries like China, India, Japan, and South Korea, supported by quick urbanization, wider internet access, and advancing digital technologies in emerging economies. China, India, and Japan are experiencing strong WaaS adoption, fueled by the rising use of smart devices, improved mobile connectivity, and extensive enterprise digitalization efforts. The region's large number of small and medium-sized enterprises (SMEs) is increasingly turning to WaaS for scalable, cost-effective network solutions that eliminate the need for large upfront investments. Additionally, initiatives such as government-backed smart city projects, 5G rollouts, and the expansion of public Wi-Fi infrastructure are further boosting market growth. As businesses in APAC adopt cloud-first strategies and more adaptable networking models, the region is set to become a major growth center for the WaaS market in the future.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant Wi-Fi as a Service market were interviewed.

- By Company: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, Rest of World: 10%

Some of the significant Wi-Fi as a Service vendors are AT&T (US), Verizon (US), T-Mobile (US), e& (UAE), Singtel (Singapore), Tata Communications (India), CommScope (US), Arista Networks (US), TP-Link (China), Wifirst (UK).

Research coverage:

The report covers the Wi-Fi as a Service market across various segments. We estimate the market size and growth potential for many segments based on service type, location type, enterprise size, end user, and region. It includes a comprehensive analysis of the major market players, details about their businesses, key observations on their product offerings, current trends, and vital market strategies.

Reasons to buy this report:

With data on the most accurate revenue estimates for the entire Wi-Fi as a Service industry and its subsegments, the research will benefit market leaders and new entrants. Stakeholders will gain a better understanding of the competitive landscape through this report, helping them position their companies more effectively and develop go-to-market strategies. The research provides insights into the main market drivers, constraints, opportunities, and challenges, as well as helps players grasp the industry's current trends.

The report provides insights on the following:

Analysis of key drivers includes digital transformation initiatives in businesses that pave the way for Wi-Fi networks, rising adoption of smartphones and wireless devices worldwide, the ease of Wi-Fi infrastructure management and remote troubleshooting, and cost savings on CAPEX and OPEX through a service model. It also considers increasing adoption of BYOD and CYOD trends among organizations. Restraints involve data protection and confidentiality concerns, as well as slower backups and restores. Opportunities arise from the emergence of Wi-Fi 6, which is expected to boost the growth of the as-a-service model across various industries, increasing demand for Wi-Fi as a service in small, medium, and distributed companies, along with the expansion of smart cities. Challenges include poor user experience in high-density environments and a lack of skilled workforce.

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the Wi-Fi as a Service market

- Market Development: In-depth details regarding profitable markets - the paper examines the global Wi-Fi as a Service market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the Wi-Fi as a Service market

- Competitive Assessment: In-depth analysis of the market share, expansion strategies, and service offerings of leading competitors in the Wi-Fi as a Service industry, including AT&T (US), Verizon (US), T-Mobile (US), e& (UAE), Singtel (Singapore), Tata Communications (India), CommScope (US), Arista Networks (US), TP-Link (China), Wifirst (UK), Alcatel-Lucent Enterprise (France), Jio (India), Spectra (India), Telstra (Australia), Viasat (US), Adtran (US), Allied Telesis (Japan), 4ipnet (Taiwan), LANCOM Systems (Germany), Ruijie Networks (China), Datto (US), Superloop (Australia), Cambium Networks (US), Redway Networks (England), Cucumber Tony (UK), Tanaza (Italy), and Edgecore Networks (Taiwan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF WI-FI AS A SERVICE MARKET

- 4.2 NORTH AMERICA: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE AND COUNTRY

- 4.3 ASIA PACIFIC: WI-FI AS A SERVICE MARKET, BY LOCATION TYPE AND COUNTRY

- 4.4 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE

- 4.5 WI-FI AS A SERVICE MARKET, BY END USER

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digital transformation initiatives in businesses

- 5.2.1.2 Rising adoption of smartphones and wireless devices

- 5.2.1.3 Ease of Wi-Fi infrastructure management and remote troubleshooting

- 5.2.1.4 Savings in CapEx and OpEx with 'as a service' model

- 5.2.1.5 Increasing adoption of BYOD and CYOD trend among organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data protection and confidentiality concerns

- 5.2.2.2 Slower backups and restores

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift from CapEx to OpEx models

- 5.2.3.2 Increasing demand for WaaS in small, medium, and distributed companies

- 5.2.3.3 Expansion of smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 Poor user experience in high-density environments

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 HISTORY OF WI-FI AS A SERVICE MARKET

- 5.3.1.1 2000-2010

- 5.3.1.2 2010-2020

- 5.3.1.3 2021-present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.3 PRICING ANALYSIS

- 5.3.3.1 Average selling price of key players, by service type

- 5.3.3.2 Indicative pricing analysis of Wi-Fi as a service

- 5.3.4 SUPPLY CHAIN ANALYSIS

- 5.3.5 ECOSYSTEM ANALYSIS

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key technologies

- 5.3.6.1.1 Network analytics and monitoring tools

- 5.3.6.1.2 Cloud networking platforms

- 5.3.6.2 Complementary technologies

- 5.3.6.2.1 Edge computing

- 5.3.6.2.2 5G network

- 5.3.6.3 Adjacent technologies

- 5.3.6.3.1 Artificial intelligence and machine learning

- 5.3.6.3.2 Cloud-based IT service management

- 5.3.6.1 Key technologies

- 5.3.7 PORTER'S FIVE FORCES ANALYSIS

- 5.3.7.1 Threat of new entrants

- 5.3.7.2 Threat of substitutes

- 5.3.7.3 Bargaining power of suppliers

- 5.3.7.4 Bargaining power of buyers

- 5.3.7.5 Intensity of competitive rivalry

- 5.3.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.8.1 Key stakeholders in buying process

- 5.3.8.2 Buying criteria

- 5.3.9 PATENT ANALYSIS

- 5.3.9.1 Methodology

- 5.3.10 USE CASES

- 5.3.10.1 Case study 1: Deployment of Extreme Networks Wi-Fi service to support digital learning

- 5.3.10.2 Case study 2: Ghelamco stadium deploys Wi-Fi to improve fan experience

- 5.3.10.3 Case study 3: Deployment of Wi-Fi service provided by ADTRAN to support BYOD policy

- 5.3.10.4 Case study 4: Deployment of Extreme Networks Wi-Fi service to support digital learning

- 5.3.10.5 Case study 5: Anord Mardix uses Redway Networks Wi-Fi to create city-wide network access

- 5.3.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.3.12 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.13 BEST PRACTICES OF WI-FI AS A SERVICE MARKET

- 5.3.14 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.15.1 North America

- 5.3.15.1.1 US

- 5.3.15.1.2 Canada

- 5.3.15.2 Europe

- 5.3.15.2.1 Germany

- 5.3.15.2.2 Spain

- 5.3.15.2.3 Italy

- 5.3.15.2.4 UK

- 5.3.15.3 Asia Pacific

- 5.3.15.3.1 South Korea

- 5.3.15.3.2 China

- 5.3.15.3.3 India

- 5.3.15.4 Middle East & Africa

- 5.3.15.4.1 UAE

- 5.3.15.4.2 KSA

- 5.3.15.4.3 South Africa

- 5.3.15.5 Latin America

- 5.3.15.5.1 Brazil

- 5.3.15.5.2 Mexico

- 5.3.15.1 North America

- 5.3.16 FUTURE LANDSCAPE OF WI-FI AS A SERVICE MARKET

- 5.3.16.1 Wi-Fi as a service: Technology roadmap till 2030

- 5.3.16.2 Short-term roadmap (2025-2026)

- 5.3.16.3 Mid-term roadmap (2027-2028)

- 5.3.16.4 Long-term roadmap (2029-2030)

- 5.3.17 INVESTMENT AND FUNDING SCENARIO

- 5.3.18 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.18.1 Impact of generative AI on Wi-Fi as a service

- 5.3.18.2 Use cases of generative AI in Wi-Fi as a service

- 5.3.18.3 Future of generative AI in Wi-Fi as a service

- 5.3.19 IMPACT OF 2025 US TARIFF - WI-FI AS A SERVICE MARKET

- 5.3.19.1 Introduction

- 5.3.19.2 Key tariff rates

- 5.3.19.3 Price impact analysis

- 5.3.19.4 Impact on country/region

- 5.3.19.4.1 US

- 5.3.19.4.2 Europe

- 5.3.19.4.3 Asia Pacific

- 5.3.19.5 Impact on verticals

- 5.3.1 HISTORY OF WI-FI AS A SERVICE MARKET

6 WI-FI AS A SERVICE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: WI-FI AS A SERVICE MARKET DRIVERS

- 6.2 FULLY MANAGED

- 6.2.1 ENHANCED NEED FOR SEAMLESS, SECURE, AND HIGH-PERFORMANCE CONNECTIVITY TO DRIVE MARKET

- 6.3 PARTIALLY MANAGED

- 6.3.1 NEED FOR CUSTOMIZABLE NETWORK CONTROL FOR INFRASTRUCTURE AND SUPPORT TO BOOST MARKET

- 6.4 SUBSCRIPTION-BASED

- 6.4.1 FLEXIBILITY OF PAY-AS-YOU-GO MODELS FOR AFFORDABLE AND SCALABLE WI-FI ACCESS - KEY DRIVER

7 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 LOCATION TYPE: WI-FI AS A SERVICE MARKET DRIVERS

- 7.2 INDOOR

- 7.2.1 NEED FOR HIGH-SPEED, RELIABLE WI-FI IN DENSE ENVIRONMENTS TO DRIVE MARKET GROWTH

- 7.3 OUTDOOR

- 7.3.1 SMART CITY PROJECTS AND WI-FI DEPLOYMENT IN OPEN SPACES AND TRANSPORT HUBS TO FUEL GROWTH

8 WI-FI AS A SERVICE MARKET, BY ENTERPRISE SIZE

- 8.1 INTRODUCTION

- 8.1.1 ENTERPRISE SIZE: WI-FI AS A SERVICE MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 DEMAND FOR SCALABLE, SECURE WIRELESS NETWORKS ACROSS MULTIPLE SITES TO DRIVE MARKET

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 RISING NEED FOR AFFORDABLE, EASY-TO-MANAGE WI-FI WITHOUT HEAVY IT INVESTMENT TO DRIVE MARKET

9 WI-FI AS A SERVICE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USER: WI-FI AS A SERVICE MARKET DRIVERS

- 9.2 CONSUMER

- 9.2.1 INCREASING SURGE IN SMART HOME AND IOT DEVICE USAGE TO DRIVE MARKET

- 9.3 ENTERPRISE

- 9.3.1 RISING DEMAND FOR SCALABLE, CENTRALLY MANAGED WI-FI NETWORKS TO DRIVE MARKET GROWTH

- 9.3.2 EDUCATION

- 9.3.3 RETAIL

- 9.3.4 TRAVEL & HOSPITALITY

- 9.3.5 HEALTHCARE & LIFE SCIENCES

- 9.3.6 MANUFACTURING

- 9.3.7 BFSI

- 9.3.8 IT & ITES

- 9.3.9 TRANSPORTATION & LOGISTICS

- 9.3.10 GOVERNMENT & PUBLIC SECTOR

- 9.3.11 OTHER ENTERPRISES

10 WI-FI AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.3 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.3 GERMANY

- 10.3.4 FRANCE

- 10.3.5 ITALY

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.3 JAPAN

- 10.4.4 SOUTH KOREA

- 10.4.5 INDIA

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.3 AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.2 BRAZIL

- 10.6.3 MEXICO

- 10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES /RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Service type footprint

- 11.5.5.4 Location type footprint

- 11.6 STARTUP/SME EVALUATION MATRIX, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

- 11.7.1 WAAS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.7.2 WAAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 AT&T

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 VERIZON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 T-MOBILE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 E&

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SINGTEL

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TATA COMMUNICATIONS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 COMMSCOPE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 ARISTA NETWORKS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 TP-LINK

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 WIFIRST

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.1 AT&T

- 12.2 OTHER PLAYERS

- 12.2.1 ALCATEL LUCENT ENTERPRISE

- 12.2.2 JIO

- 12.2.3 SPECTRA

- 12.2.4 TELSTRA

- 12.2.5 VIASAT

- 12.2.6 ADTRAN

- 12.2.7 ALLIED TELESIS

- 12.2.8 4IPNET

- 12.3 STARTUPS/SMES

- 12.3.1 LANCOM SYSTEMS

- 12.3.2 RUIJIE NETWORKS

- 12.3.3 DATTO

- 12.3.4 SUPERLOOP

- 12.3.5 CAMBIUM NETWORKS

- 12.3.6 REDWAY NETWORKS

- 12.3.7 CUCUMBER TONY

- 12.3.8 TANAZA

- 12.3.9 EDGECORE NETWORKS

13 ADJACENT MARKETS AND APPENDIX

- 13.1 INTRODUCTION

- 13.2 WI-FI MARKET - GLOBAL FORECAST TO 2029

- 13.2.1 MARKET DEFINITION

- 13.3 NETWORK AS A SERVICE MARKET - GLOBAL FORECAST TO 2027

- 13.3.1 MARKET DEFINITION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS