|

시장보고서

상품코드

1780347

환자 등록 소프트웨어 시장(-2030년) : 질환, 제품, 이용 사례, 최종 사용자 및 지역별Patient Registry Software Market by Disease (Diabetes, Cancer, Rare, Asthma, Kidney), Product (Drugs, Device), Use Case (Population Health, Research), End User [(Profit: Pharma, Payer, Hospital), (Non-Profit: Govt)] & Region - Global Forecast to 2030 |

||||||

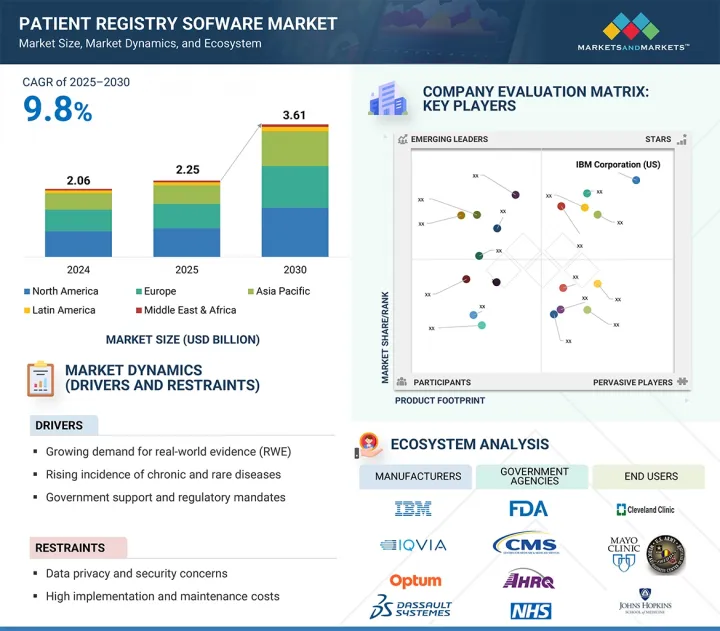

세계의 환자 등록 소프트웨어 시장 규모는 2025년 22억 5,000만 달러로 평가되었고, 2030년에는 36억 1,000만 달러에 이를 것으로 예측되며, CAGR 9.8%로 성장할 전망입니다.

의료 시스템은 케어의 질을 향상시키고 규제 요구 사항을 충족하기 위해 환자 데이터 수집 및 분석에 점점 더 많은 노력을 기울이고 있습니다. 건강 관리를 지원합니다.이 플랫폼은 의약품 평가 및 가치 기반 관리를 지원하는 실제 세계 데이터를 창출하는 데 필수적이며 궁극적으로 의료 비용을 줄이고 시장 성장을 가속하는 역할을합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제품, 이용 사례, 등록 유형, 도입 모델 및 최종 사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴 아메리카, 중동 및 아프리카 |

환자 직접 등록 부문은 예측 기간 동안 가장 높은 성장을 보일 것으로 예상됩니다.

환자 등록 소프트웨어 시장은 환자 직접 등록과 사이트 기반 및 임상 데이터 등록으로 나뉩니다. 환자 직접 등록 시스템은 환자 참여 증가, 디지털 헬스케어 도구(ePRO 및 모바일 앱 등)의 채택, 환자 기반 실세계 증거에 대한 수요, 환자 보고 결과에 초점을 맞춘 분산형 임상 시험의 확산으로 인해 가장 높은 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 가상 플랫폼은 데이터 수집을 간소화하여 의료 제공자의 부담을 줄이고 장기적 추적 관리 및 다양한 환자 모집을 가능하게 합니다.

2024년에는 의료 연구 및 임상 연구 부문이 이용 사례별로 환자 등록 소프트웨어 시장에서 가장 큰 점유율을 차지할 것입니다.

2024년에는 의료 연구 및 임상 연구 부문이 환자 등록 소프트웨어 시장을 지배할 것입니다. 이러한 성장은 임상 시험 및 의약품 개발에 실제 데이터(RWD) 및 실제 증거(RWE)의 사용이 증가함에 따라 크게 촉진될 것입니다. 환자 등록 소프트웨어는 구조화되고 종단적인 환자 데이터를 캡처하여 연구자가 결과를 분석하고 안전성을 모니터링하는 데 도움을 줍니다. 맞춤형 의약품의 부상과 생명 과학 기업, 학술 센터 및 공중 보건 기관 간의 협력이 강화되면서 강력한 등록 인프라에 대한 필요성이 더욱 높아지고 있습니다. 분산형 임상 시험 및 시판 후 감시로 전환되는 추세도 이 부문의 선도적 위치를 강화하고 있습니다.

2024년에 북미는 환자 등록 소프트웨어 시장에서 가장 큰 점유율을 차지했습니다.

2024년에는 강력한 규제 프레임워크와 디지털 헬스케어의 조기 채택에 힘입어 북미가 환자 등록 소프트웨어 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다. MRO Corp 및 ImageTrend와 같은 주요 업체들은 경쟁과 혁신을 강화하고 있습니다. 미국 HHS의 데이터 현대화 및 CDC의 만성 질환 감시에 대한 집중과 같은 연방 정부의 이니셔티브는 등록 플랫폼에 대한 수요를 증가시키고 있습니다. 특히, 2025년 2월, Veradigm과 HealthVerity는 심혈관 및 대사 데이터를 HealthVerity의 개인 정보 보호 준수 플랫폼과 통합하기 위해 제휴를 맺어 환자 여정에 대한 종합적인 연구를 가능하게 했습니다. 또한, 2024년 4월, ESO Solutions는 데이터 기반의 응급 대응을 개선하고 상호 운용성과 환자 치료 결과를 향상시키기 위해 Logis Solutions를 인수했습니다. 이러한 발전은 환자 등록 소프트웨어 혁신 및 데이터 통합 분야에서 북미의 리더십을 더욱 공고히 할 것입니다.

본 보고서에서는 세계의 환자 등록 소프트웨어 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 시장 역학

- 시장 성장 억제요인

- 시장 기회

- 시장의 과제

- 고객의 사업에 영향을 미치는 동향 및 혼란

- 업계 동향

- 생태계 분석

- 밸류체인 분석

- 기술 분석

- 규제 분석

- 가격 분석

- Porter's Five Forces 분석

- 특허 분석

- 주요 이해관계자와 구매 기준

- 최종 사용자 분석

- 주요 회의 및 이벤트

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 비즈니스 모델 분석

- AI/생성형 AI가 환자 등록 소프트웨어 시장에 미치는 영향

- 미국 관세가 환자 등록 소프트웨어 시장에 미치는 영향(2025년)

제6장 환자 등록 소프트웨어 시장 : 등록 유형별

- 질병 등록

- 당뇨병 등록

- 심장혈관 등록

- 암 등록

- 희소질환 등록

- 천식 등록

- 만성 신질환 등록

- 정형외과 등록

- 예방접종 등록

- 선천성 이상 등록

- 기타 질환 등록

- 제품 등록

- 의료기기 등록

- 의약품 등록

제7장 환자 등록 소프트웨어 시장 : 제품별

- 환자 직접 등록(환자 기록 등록)

- 사이트 기반 및 임상 데이터(공급자 기록) 등록

제8장 환자 등록 소프트웨어 시장 : 이용 사례별

- 의료 연구 및 임상 연구

- 품질 향상

- 환자 케어 관리

- 집단건강(포퓰레이션헬스)

- 포인트 오브 케어 서포트

- 공중 위생 감시

- 환자의 셀프 케어

- 환자 참여

- 기타

제9장 환자 등록 소프트웨어 시장 : 도입 모델별

- 온프레미스 모델

- 클라우드 기반 모델

제10장 환자 등록 소프트웨어 시장 : 최종 사용자별

- 영리목적 등록

- 제약, 생명공학, 의료기기 기업

- 의료보험자

- 의료 제산업체

- 비영리목적 등록

- 의료전문학회

- 환자 단체

- 정부 및 타사 관리 기관

- 기타

제11장 환자 등록 소프트웨어 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 일본

- 중국

- 인도

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업평가 매트릭스 : 스타트업 및 중소기업

- 기업평가와 재무지표

- 브랜드/소프트웨어 비교

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- IBM

- IQVIA HOLDINGS INC.

- HEALTH CATALYST, INC.

- ORACLE

- UNITEDHEALTH GROUP

- CONDUENT INCORPORATED

- ELEKTA

- NEC CORPORATION(NEC SOFTWARE SOLUTIONS UK LIMITED)

- DASSAULT SYSTEMES(MEDIDATA)

- EVIDENTIQ(DACIMA SOFTWARE INC.)

- MRO(FIGMD, INC.)

- IMAGETREND

- GLOBAL VISION TECHNOLOGIES, INC.

- SYNEOS HEALTH

- VERADIGM LLC

- ESO

- ORDINAL DATA INC.

- CEDARON MEDICAL

- FIVOS HEALTH

- ACROSS HEALTHCARE

- 기타 기업

- VERANA HEALTH

- PULSE INFOFRAME INC.

- AMPLITUDE CLINICAL OUTCOMES

- NPHASE, INC.(REDCAP CLOUD)

- OM1

제14장 부록

HBR 25.08.07The global patient registry software market is expected to reach USD 3.61 billion by 2030 from USD 2.25 billion in 2025, at a CAGR of 9.8%. Healthcare systems are increasingly focused on capturing and analyzing patient data to enhance care quality and meet regulatory requirements. Patient registry software collects disease, procedure, and population data, facilitating clinical research and population health management. These platforms are vital for generating real-world evidence to support drug assessments and value-based care, ultimately reducing healthcare costs and driving market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Use Case, Registry Type, Deployment Model, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

"The direct-to-patient registries segment is expected to witness the highest growth during the forecast period."

The patient registry software market is divided into direct-to-patient and site-based/clinical data registries. Direct-to-patient registries are expected to register the highest CAGR due to increased patient engagement, adoption of digital health tools (like ePRO and mobile apps), demand for real-world evidence from patients, and the rise of decentralized clinical trials that focus on patient-reported outcomes. Virtual platforms simplify data collection, easing the burden on healthcare providers and allowing for better longitudinal follow-up and diverse patient recruitment.

"The medical research & clinical studies segment held the largest share of the patient registry software market, by use case, in 2024."

In 2024, the medical research & clinical studies segment dominated the patient registry software market. This growth is largely driven by the increasing use of real-world data (RWD) and real-world evidence (RWE) for clinical trials and drug development. Patient registry software captures structured and longitudinal patient data, helping researchers analyze outcomes and monitor safety. The rise of personalized medicine and collaborations among life science companies, academic centers, and public health agencies further enhances the need for robust registry infrastructure. The shift toward decentralized trials and post-marketing surveillance also reinforces this segment's leading position.

"North America accounted for the largest share of the patient registry software market in 2024."

In 2024, North America held the largest share of the patient registry software market, driven by strong regulatory frameworks and early digital health adoption. Key players like MRO Corp and ImageTrend enhance competition and innovation. Federal initiatives, such as the US HHS's data modernization and the CDC's focus on chronic disease surveillance, increase the demand for registry platforms. Notably, in February 2025, Veradigm and HealthVerity partnered to integrate cardiovascular and metabolic data with HealthVerity's privacy-compliant platform, enabling comprehensive research on patient journeys. Additionally, in April 2024, ESO Solutions acquired Logis Solutions to improve data-driven emergency response, enhancing interoperability and patient outcomes. These developments solidify North America's leadership in patient registry software innovation and data integration.

The breakdown of primary participants is listed below:

- By Company Type: Tier 1 (45%), Tier 2 (30%), and Tier 3 (25%)

- By Designation: C-level Executives (42%), Directors (31%), and Others (27%)

- By Region: North America (35%), Europe (30%), Asia Pacific (25%), the Middle East & Africa (5%), and Latin America (5%)

Key Players in the Patient Registry Software Market

The key players in the patient registry software market include IBM (US), IQVIA Holdings Inc. (US), Health Catalyst Inc. (US), Oracle (US), UnitedHealth Group (US), Conduent Inc. (US), Elekta (Sweden), Dassault Systemes (France), EvidentIQ (Dacima Software Inc.) (Germany), MRO (Figmd, Inc.) (US), ImageTrend, Inc. (US), Global Vision Technologies, Inc. (US), Syneos Health (US), Veradigm LLC (US), ESO (US), Ordinal Data, Inc. (US), NEC Corporation (NEC Software Solutions UK Limited) (Japan), Cedaron Medical (US), Fivos Health (US), and Across Health (US).

Research Coverage

The report analyzes the patient registry software market. Its objective is to estimate the market size and future growth potential of various segments, categorized by product, registry type, use case, deployment model, end user, and region. Additionally, the report includes a competitive analysis of the key players in this market, featuring their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will help both established companies and new or smaller firms assess the market's current state, enabling them to capture a larger market share. Organizations that purchase this report can utilize one or more of the strategies outlined below to enhance their market positions.

This report provides insights on:

- Analysis of Key Drivers: Drivers (growing demand for real-world evidence (RWE) and rising incidence of chronic and rare diseases), restraints (high setup and operational costs and limited access in low-resource settings), opportunities [integration with AI and analytics tools and expanding use in decentralized clinical trials (DCTs)], and challenges (inconsistent data quality and completeness and limited workforce expertise) influencing the growth of the patient registry software market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the patient registry software market.

- Market Development: Comprehensive information on the lucrative emerging markets, products, use cases, registry types, deployment models, end users, and regions.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the patient registry software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the patient registry software market, such as IBM (US), IQVIA Holdings Inc. (US), Health Catalyst Inc. (US), Oracle (US), UnitedHealth Group (US), Conduent Inc. (US), and Elekta (Sweden).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary sources

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 MARKET SIZING ASSUMPTIONS

- 2.5.2 OVERALL STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PATIENT REGISTRY SOFTWARE MARKET OVERVIEW

- 4.2 NORTH AMERICA: PATIENT REGISTRY SOFTWARE MARKET, BY PRODUCT & REGION

- 4.3 PATIENT REGISTRY SOFTWARE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 PATIENT REGISTRY SOFTWARE MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 MARKET DYNAMICS

- 5.2.1.1 Rising burden of chronic and rare diseases

- 5.2.1.2 Shift toward value-based and patient-centered care

- 5.2.1.3 Expansion of real-world evidence (RWE) and post-marketing surveillance needs

- 5.2.1.4 Increasing use of digital health technologies and interoperable EHRs

- 5.2.1.5 Government and regulatory incentives for registry implementation

- 5.2.2 MARKET RESTRAINTS

- 5.2.2.1 Shortage of trained and skilled resources

- 5.2.2.2 High implementation and maintenance costs

- 5.2.3 MARKET OPPORTUNITIES

- 5.2.3.1 Expansion of population health management and outcomes tracking

- 5.2.3.2 Rising demand for pregnancy and congenital anomaly registries for maternal-fetal safety monitoring

- 5.2.3.3 Growing preference for subscription-based deployment models

- 5.2.4 MARKET CHALLENGES

- 5.2.4.1 Privacy- and data security-related concerns

- 5.2.4.2 Reluctance to adopt advanced patient registry solutions

- 5.2.4.3 Limited awareness among healthcare stakeholders

- 5.2.1 MARKET DYNAMICS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 STRENGTHENED FUNDING FOR PATIENT-CENTERED RESEARCH AND RARE DISEASE REGISTRIES

- 5.4.2 RISE IN AUTOMATED DATA ENTRY AND REGISTRY INTELLIGENCE

- 5.4.3 CLOUD-BASED REGISTRIES AND DECENTRALIZED ACCESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Electronic data capture (EDC) systems

- 5.7.1.2 Cloud computing & SaaS architecture

- 5.7.1.3 Data privacy & security technologies

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Electronic health record (EHR) systems

- 5.7.2.2 Clinical trial management systems (CTMS)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Digital therapeutics (DTx) platforms

- 5.7.3.2 Wearable devices & remote monitoring tools

- 5.7.3.3 Blockchain for health data management

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY ANALYSIS

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY LANDSCAPE

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Middle East & Africa

- 5.8.2.5 Latin America

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE COST OF PATIENT REGISTRY SOFTWARE, BY END USER (2024)

- 5.9.2 INDICATIVE PRICE OF PATIENT REGISTRY SOFTWARE, BY REGION (2024)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF SUBSTITUTES

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 BARGAINING POWER OF SUPPLIERS

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR PATIENT REGISTRY SOFTWARE MARKET

- 5.11.2 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR PATIENT REGISTRY SOFTWARE

- 5.11.3 MAJOR PATENTS IN PATIENT REGISTRY SOFTWARE MARKET

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 KEY BUYING CRITERIA

- 5.13 END-USER ANALYSIS

- 5.13.1 UNMET NEEDS

- 5.13.2 END-USER EXPECTATIONS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 BUSINESS MODEL ANALYSIS

- 5.18 IMPACT OF AI/GEN AI ON PATIENT REGISTRY SOFTWARE MARKET

- 5.18.1 TOP USE CASES & MARKET POTENTIAL

- 5.18.2 KEY USE CASES

- 5.18.3 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.3.1 Case study: AI-powered data summarization improves registry utilization efficiency

- 5.18.4 ELECTRONIC HEALTH RECORD (EHR) MARKET

- 5.18.5 REAL WORLD EVIDENCE (RWE) MARKET

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 User readiness

- 5.18.6.1.1 Hospitals & research networks

- 5.18.6.2 Impact assessment

- 5.18.6.2.1 Hospitals & academic research institutes

- 5.18.6.2.1.1 Implementation

- 5.18.6.2.1.2 Impact

- 5.18.6.2.1 Hospitals & academic research institutes

- 5.18.6.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON PATIENT REGISTRY SOFTWARE MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.3.1 Cloud hosting infrastructure

- 5.19.3.2 AI & analytics modules

- 5.19.3.3 Offshore development & support services

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.19.5.1 For-profit registries

- 5.19.5.2 Nonprofit registries

- 5.19.5.3 Government & third-party administrators

- 5.19.5.4 Others

6 PATIENT REGISTRY SOFTWARE MARKET, BY REGISTRY TYPE

- 6.1 INTRODUCTION

- 6.2 DISEASE REGISTRIES

- 6.2.1 DIABETES REGISTRIES

- 6.2.1.1 Need to monitor disease prevalence, treatment adherence, and long-term complications to boost adoption

- 6.2.2 CARDIOVASCULAR REGISTRIES

- 6.2.2.1 Ability of cardiovascular registries to enable healthcare systems to benchmark care quality and identify treatment gaps to boost growth

- 6.2.3 CANCER REGISTRIES

- 6.2.3.1 Critical tools for understanding cancer epidemiology and evaluating screening programs to drive market

- 6.2.4 RARE DISEASE REGISTRIES

- 6.2.4.1 Essential tools for advancing knowledge about rare diseases to support market growth

- 6.2.5 ASTHMA REGISTRIES

- 6.2.5.1 Improving asthma management and reducing exacerbations to fuel growth

- 6.2.6 CHRONIC KIDNEY REGISTRIES

- 6.2.6.1 Ability of registries to collect detailed data on disease progression, lab results, and treatment adherence to boost adoption

- 6.2.7 ORTHOPEDIC REGISTRIES

- 6.2.7.1 Ability to monitor implant performance, surgical outcomes, and complication rates to drive growth

- 6.2.8 IMMUNIZATION REGISTRIES

- 6.2.8.1 Strengthening vaccine coverage and safety monitoring to propel market

- 6.2.9 BIRTH DEFECT REGISTRIES

- 6.2.9.1 Need to track and prevent congenital anomalies through birth defect registries to propel market growth

- 6.2.10 OTHER DISEASE REGISTRIES

- 6.2.1 DIABETES REGISTRIES

- 6.3 PRODUCT REGISTRIES

- 6.3.1 MEDICAL DEVICE REGISTRIES

- 6.3.1.1 Ability of these registries to enhance safety, performance monitoring, and regulatory compliance to boost growth

- 6.3.2 DRUG REGISTRIES

- 6.3.2.1 Ability to support long-term safety, real-world evidence, and optimal therapy use to propel growth

- 6.3.1 MEDICAL DEVICE REGISTRIES

7 PATIENT REGISTRY SOFTWARE MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 DIRECT-TO-PATIENT (PATIENT-RECORDED) REGISTRIES

- 7.2.1 INCREASING PATIENT ENGAGEMENT AND DEMAND FOR SELF-REPORTED DATA TO BOOST MARKET GROWTH

- 7.3 SITE-BASED/CLINICAL DATA (PROVIDER-RECORDED) REGISTRIES

- 7.3.1 GROWING NEED FOR ACCURATE, CLINICIAN-VERIFIED DATA AND SEAMLESS EHR INTEGRATION TO SUPPORT GROWTH

8 PATIENT REGISTRY SOFTWARE MARKET, BY USE CASE

- 8.1 INTRODUCTION

- 8.2 MEDICAL RESEARCH & CLINICAL STUDIES

- 8.2.1 GROWING NEED TO LEVERAGE REGISTRIES TO ENHANCE REAL-WORLD EVIDENCE AND CLINICAL TRIAL EFFICIENCY TO FUEL GROWTH

- 8.3 QUALITY IMPROVEMENT

- 8.3.1 ADVANTAGES SUCH AS EVIDENCE-BASED PRACTICE AND PERFORMANCE BENCHMARKING TO DRIVE SEGMENTAL GROWTH

- 8.4 PATIENT CARE MANAGEMENT

- 8.4.1 ABILITY TO EMPOWER PROACTIVE CHRONIC DISEASE MANAGEMENT THROUGH CENTRALIZED REGISTRIES TO SUPPORT GROWTH

- 8.5 POPULATION HEALTH

- 8.5.1 EXPANDING ROLE OF PATIENT MANAGEMENT SYSTEMS IN DRIVING DIGITAL TRANSFORMATION TO CONTRIBUTE TO GROWTH

- 8.6 POINT-OF-CARE SUPPORT

- 8.6.1 NEED FOR PERSONALIZED TREATMENT PLANS AND SHARED DECISION-MAKING TO DRIVE EFFICIENCY AND QUALITY IN HEALTHCARE

- 8.7 PUBLIC HEALTH SURVEILLANCE

- 8.7.1 ABILITY OF REGISTRIES TO ENHANCE PREPAREDNESS AND RESPONSE CAPABILITIES TO DRIVE SEGMENTAL GROWTH

- 8.8 PATIENT SELF-CARE

- 8.8.1 GROWING EMPHASIS ON PATIENT EMPOWERMENT AND SELF-MANAGEMENT TO PROPEL GROWTH

- 8.9 PATIENT ENGAGEMENT

- 8.9.1 ADVANTAGES SUCH AS BETTER DATA ACCURACY AND MORE MEANINGFUL OUTCOMES TO BOOST GROWTH

- 8.10 OTHER USE CASES

9 PATIENT REGISTRY SOFTWARE MARKET, BY DEPLOYMENT

- 9.1 INTRODUCTION

- 9.2 ON-PREMISE MODELS

- 9.2.1 GROWING DEMAND FOR SECURITY, CONTROL, AND COMPLIANCE TO DRIVE MARKET GROWTH

- 9.3 CLOUD-BASED MODELS

- 9.3.1 SCALABILITY, INTEROPERABILITY, AND COST-EFFECTIVENESS OF CLOUD-BASED MODELS TO DRIVE GROWTH

10 PATIENT REGISTRY SOFTWARE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 FOR-PROFIT REGISTRIES

- 10.2.1 PHARMACEUTICAL, BIOTECHNOLOGY, AND MEDTECH COMPANIES

- 10.2.1.1 Need for robust evidence generation, enhanced patient safety, and competitive differentiation to drive adoption

- 10.2.2 HEALTHCARE PAYERS

- 10.2.2.1 Need to improve population health management, control costs, and assess treatment value to drive demand

- 10.2.3 HEALTHCARE PROVIDERS

- 10.2.3.1 Hospitals

- 10.2.3.1.1 Ability of registries to help hospitals collect detailed data on procedures, outcomes, and complications to boost market

- 10.2.3.2 Clinics & outpatient settings

- 10.2.3.2.1 Ability of registries to enable data-driven decision-making and streamlined documentation to drive demand

- 10.2.3.3 Other healthcare providers

- 10.2.3.1 Hospitals

- 10.2.1 PHARMACEUTICAL, BIOTECHNOLOGY, AND MEDTECH COMPANIES

- 10.3 NONPROFIT REGISTRIES

- 10.3.1 MEDICAL SPECIALTY SOCIETIES

- 10.3.1.1 Advantages such as defined best practices and improved care delivery to propel growth

- 10.3.2 PATIENT ORGANIZATIONS

- 10.3.2.1 Importance of facilitating clinical trial recruitment and fostering collaboration with researchers to support growth

- 10.3.1 MEDICAL SPECIALTY SOCIETIES

- 10.4 GOVERNMENT & THIRD-PARTY ADMINISTRATORS

- 10.4.1 ABILITY OF GOVERNMENT-RUN REGISTRIES TO EVALUATE SUCCESS OF HEALTHCARE INITIATIVES TO FUEL MARKET

- 10.5 OTHER END USERS

11 PATIENT REGISTRY SOFTWARE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate global market for patient registry software

- 11.2.3 CANADA

- 11.2.3.1 Government investment, collaborative initiatives, and strong push to standardize rare disease registries to drive growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Growing incidence of cancer to drive market growth

- 11.3.3 GERMANY

- 11.3.3.1 National rollout of e-patient files and rare disease registries to strengthen patient care and research

- 11.3.4 FRANCE

- 11.3.4.1 Growing patient registry adoption with national data platforms and rare disease initiatives to support market growth

- 11.3.5 ITALY

- 11.3.5.1 Growing number of national networks and disease-specific registries to drive growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing need to address rising chronic and cardiovascular disease prevalence to drive adoption

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Japan's aging population and advanced digital strategies to drive growth in patient registry software market

- 11.4.3 CHINA

- 11.4.3.1 Robust national registries and expanding pharmaceutical approvals to drive patient registry software market

- 11.4.4 INDIA

- 11.4.4.1 Digital health advances to boost India's patient registry software market

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Brazil to dominate patient registry software market in Latin America

- 11.5.3 MEXICO

- 11.5.3.1 Increase in focus of digital health to boost market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Rising healthcare investments to fuel uptake

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PATIENT REGISTRY SOFTWARE MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Use case footprint

- 12.5.5.5 Registry type footprint

- 12.5.5.6 Deployment footprint

- 12.5.5.7 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of startups/Smes

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/SOFTWARE COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES, APPROVALS, UPGRADES, AND ENHANCEMENTS

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 IBM

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product enhancements

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 IQVIA HOLDINGS INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 HEALTH CATALYST, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 ORACLE

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 UNITEDHEALTH GROUP

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 CONDUENT INCORPORATED

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 ELEKTA

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 NEC CORPORATION (NEC SOFTWARE SOLUTIONS UK LIMITED)

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 DASSAULT SYSTEMES (MEDIDATA)

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 EVIDENTIQ (DACIMA SOFTWARE INC.)

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 DEALS

- 13.1.11 MRO (FIGMD, INC.)

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Other developments

- 13.1.12 IMAGETREND

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product upgrades

- 13.1.12.3.2 Deals

- 13.1.13 GLOBAL VISION TECHNOLOGIES, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Other developments

- 13.1.14 SYNEOS HEALTH

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 VERADIGM LLC

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.16 ESO

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 ORDINAL DATA INC.

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 CEDARON MEDICAL

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 FIVOS HEALTH

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Deals

- 13.1.20 ACROSS HEALTHCARE

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Deals

- 13.1.1 IBM

- 13.2 OTHER PLAYERS

- 13.2.1 VERANA HEALTH

- 13.2.2 PULSE INFOFRAME INC.

- 13.2.3 AMPLITUDE CLINICAL OUTCOMES

- 13.2.4 NPHASE, INC. (REDCAP CLOUD)

- 13.2.5 OM1

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS