|

시장보고서

상품코드

1780348

의료용 분석 시험 서비스 시장 예측(-2030년) : 시험 유형별, 최종사용자별, 지역별Healthcare Analytical Testing Services Market By Testing Type, End User, Region - Global Forecast to 2030 |

||||||

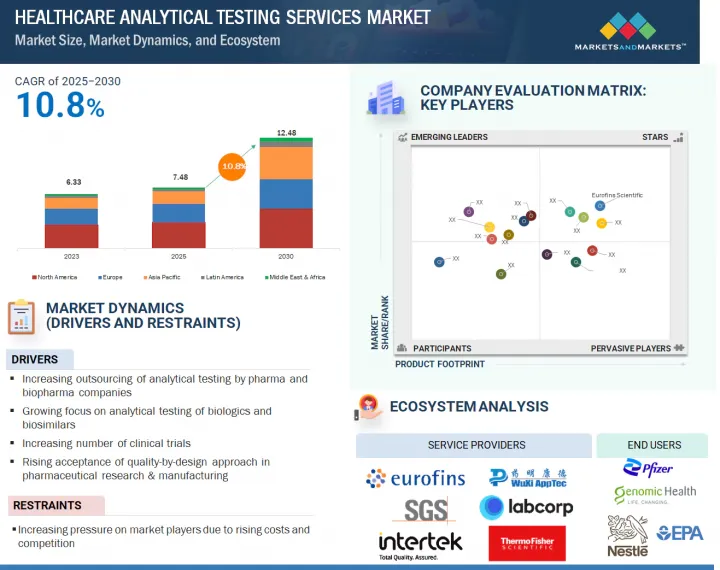

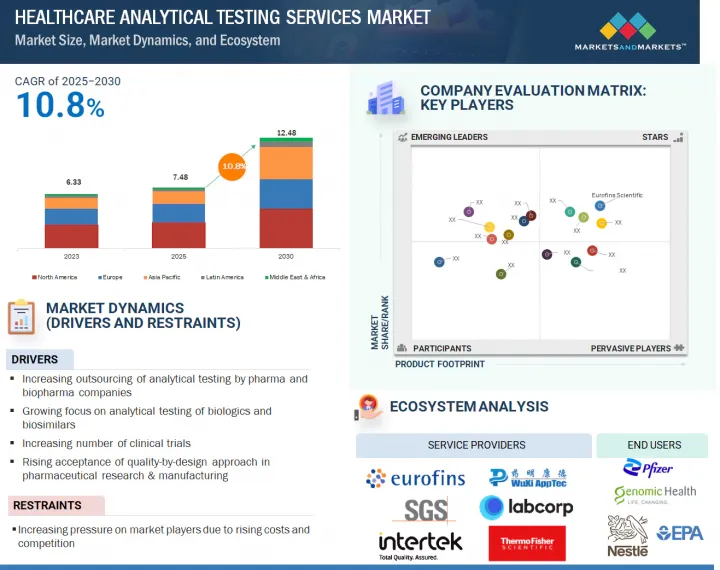

세계의 의료용 분석 시험 서비스 시장 규모는 2025년 74억 8,000만 달러에서 2030년까지 124억 8,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 10.8%의 성장이 전망됩니다.

산업 전반에 걸친 품질 보증 및 규정 준수에 대한 수요 증가, 분석 기술 향상, 투자 및 기술 혁신에 대한 정부 지원은 시장 성장을 가속할 것으로 예상되는 주요 요인입니다. 또한 새로운 시장에서의 맞춤형 테스트 솔루션에 대한 수요와 규제 환경의 진화는 분석 테스트 서비스에 대한 수요 증가에 크게 기여하는 요인입니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2023-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

유형별로는 바이오 분석 테스트 서비스 부문이 2024년 시장에서 가장 큰 점유율을 차지했습니다.

생명공학 및 제약 기업의 R&D 지출 증가와 바이오의약품에 대한 수요 증가는 조사 기간 중 시장 성장을 가속할 것으로 예측됩니다.

최종사용자별로는 제약 회사 부문이 2024년 가장 큰 시장 점유율을 차지했습니다.

이 부문의 성장은 제약-바이오 기업의 연구개발비 증가, 신약개발 및 임상시험 프로젝트 증가에 따른 것으로 보입니다.

아시아태평양이 예측 기간 중 가장 높은 성장률을 나타낼 것으로 예측됩니다.

신흥 경제국에 대한 신약 개발 및 개발 활동의 아웃소싱 증가와 바이오 제약 산업의 성장 증가는 예측 기간 중 이 지역의 성장을 가속할 것으로 예측됩니다.

세계의 의료용 분석 시험 서비스 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 의료용 분석 시험 서비스 시장의 개요

- 유럽의 의료용 분석 시험 서비스 시장 : 유형별, 국가별(2024년)

- 의료용 분석 시험 서비스 시장 : 지역적 성장 기회

- 의료용 분석 시험 서비스 시장 : 지역 구성(2023-2030년)

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 에코시스템 분석

- 규제 시나리오

- 규제기관, 정부기관, 기타 조직

- 규제 동향

- 북미

- 유럽

- 아시아태평양

- 밸류체인 분석

- 샘플 관리·조제

- 분석 시험 절차

- 데이터 애널리틱스·통합

- 품질 보증·관리

- 고객과의 커뮤니케이션·서비스 제공

- 사례 연구 분석

- 사례 연구 1 : 분석 시험 아웃소싱에 의한 바이오의약품 개발의 잠재성 해방

- 사례 연구 2 : 의약품 시험의 혁명

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 주요 컨퍼런스와 이벤트(2024-2025년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 미충족 요구/최종사용자 기대

- 의료용 분석 시험 서비스 시장에 대한 AI/생성형 AI의 영향

- 의료용 분석 시험 시장에 대한 트럼프 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 다양한 지역에 대한 중요한 영향

제6장 의료용 분석 시험 서비스 시장 : 유형별

- 서론

- 바이오 분석 시험 서비스

- 물리적 특성 평가 서비스

- 방법 개발·검증 서비스

- 원재료 시험 서비스

- 배치 릴리스 시험 서비스

- 안정성 시험 서비스

- 미생물 시험 서비스

- 환경 모니터링 서비스

- 게놈 시험 서비스

- 기타 분석 시험 서비스

제7장 의료용 분석 시험 서비스 시장 : 최종사용자별

- 서론

- 제약 기업

- 바이오의약품 기업

- 의료기기 기업

- 병원·진료소

- 법의학 연구소

- 화장품·뉴트라슈티컬 기업

- 기타 최종사용자

제8장 의료용 분석 시험 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스위스

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제9장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 재무 지표

- 기업의 평가

- 브랜드/서비스의 비교

- 경쟁 시나리오

제10장 기업 개요

- 주요 기업

- EUROFINS SCIENTIFIC SE

- LABCORP HOLDINGS INC.

- INTERTEK GROUP PLC

- ICON PLC

- IQVIA INC.

- WUXI APPTEC CO., LTD.

- CHARLES RIVER LABORATORIES

- SGS SA

- THERMO FISHER SCIENTIFIC INC.

- MEDPACE HOLDINGS, INC.

- SARTORIUS AG

- MERCK KGAA

- SOURCE BIOSCIENCE(SUBSIDIARY OF SOURCEBIO INTERNATIONAL PLC)

- ALS

- FRONTAGE LABORATORIES, INC.

- STERIS PLC

- ELEMENT MATERIALS TECHNOLOGY

- PACE ANALYTICAL SERVICES

- ALMAC GROUP

- PHARMARON BEIJING CO., LTD.

- 기타 기업

- SYNEOS HEALTH

- PAREXEL INTERNATIONAL(MA) CORPORATION

- LGC LIMITED

- CELERION

- BIOAGILYTIX

- ALCAMI CORPORATION

- SAMSUNG BIOLOGICS

- CURIA GLOBAL, INC.

- BA SCIENCES

- AVANCE BIOSCIENCES

제11장 부록

KSA 25.08.07The global healthcare analytical testing services market is projected to grow from USD 7.48 billion in 2025 to USD 12.48 billion by 2030, at a CAGR of 10.8% during the forecast period. The growing demand for quality assurance and compliance across industries, improvements in analytical techniques, and support from the government for investment and innovation are major factors anticipated to boost market growth. Additionally, the demand for customized testing solutions in new markets and the evolution in the regulatory environment are factors that contribute enormously to the increase in demand for analytical testing services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

By type, the bioanalytical testing services segment accounted for the largest share of the market in 2024.

Based on type, the healthcare analytical testing services market is segmented into physical characterization services, method development & validation services, stability testing services, bioanalytical testing services, batch-release testing services, raw material testing services, microbial testing services, genomic testing services, environmental monitoring services, and other analytical testing services. The bioanalytical testing services segment is further segmented into immunogenicity & neutralizing antibody testing, pharmacokinetic & toxicokinetic testing, biomarker testing, bioassay testing, and other bioanalytical testing services. The increasing R&D expenditure by biotechnology & pharmaceutical companies and the growing demand for biopharmaceuticals are expected to boost market growth in the study period.

By end user, the pharmaceutical companies segment accounted for the largest market share in 2024.

By end user, the market is segmented into pharmaceutical companies, biopharmaceutical companies, medical device companies, hospitals & clinics, forensic labs, cosmetic & nutraceutical companies, and other end users. The pharmaceutical companies segment accounted for the largest share of the market in 2024. The growth of this segment can be attributed to the increasing R&D expenditure of pharma & biopharma companies and the growing number of drug discovery & clinical trial projects.

The Asia Pacific region is expected to register the highest growth rate during the forecast period.

By region, the healthcare analytical testing services market covers North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific market is estimated to register the highest growth rate during the forecast period. The increasing outsourcing of drug discovery & development activities to emerging economies and the rising growth in the biopharmaceutical industry are expected to fuel growth in this region during the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (45%), Tier 2 (30%), and Tier 3 (25%)

- By Designation: Directors (42%), Managers (31%), and Others (27%)

- By Region: North America (32%), Europe (32%), Asia Pacific (26%), Latin America (6%), Middle East & Africa (4%)

The prominent players in the healthcare analytical testing services market are Eurofins Scientific SE (Luxembourg), LabCorp Holdings Inc. (US), WuXi AppTec (China), Charles River Laboratories (US), SGS SA (Switzerland), Thermo Fisher Scientific Inc. (US), Medpace Holdings, Inc. (US), Sartorius AG (Germany), Intertek Group Plc (UK), Merck KGaA (Germany), SourceBio International Limited (UK), ICON Plc (Ireland), ALS (Australia), Frontage Labs (US), STERIS Plc (US), IQVIA (US), Element Materials Technology (UK), Pace Analytical Services (US), Almac Group (UK), and Pharmaron Beijing Co., Ltd. (China), among others.

Research Coverage

This report studies the healthcare analytical testing services market based on type, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help both established companies and newcomers/smaller businesses understand the market dynamics, enabling them to increase their market share. Companies that purchase the report can use one or a combination of the strategies listed below to enhance their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (stringent regulatory guidelines, growing focus on analytical testing of biologics & biosimilars, increasing outsourcing of analytical testing by pharmaceutical & medical device companies, increasing number of clinical trials, growing R&D expenditure in pharmaceutical & biopharmaceutical industry, and rising acceptance of quality-by-design approach in pharmaceutical research & manufacturing), restraints (increasing pressure on market players due to rising costs and market competition), opportunities (adoption of new techniques and technologies and growing focus on emerging economies), and challenges (shortage of skilled professionals, specific requirements for innovative formulations and medical devices, and need to improve sensitivity of bioanalytical methods) influencing the growth of the healthcare analytical testing services market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the healthcare analytical testing services market.

- Analytical Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and developments in the healthcare analytical testing services market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new services, growing geographies, and recent developments in the healthcare analytical testing services market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS & REGIONS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.3.5 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.4.1 METHODOLOGY-RELATED LIMITATIONS

- 1.4.2 SCOPE-RELATED LIMITATIONS

- 1.5 MARKET STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY STEPS

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Insights from primary experts

- 2.2.1 SECONDARY DATA

- 2.3 MARKET ESTIMATION METHODOLOGY

- 2.3.1 PRIMARY RESEARCH VALIDATION

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HEALTHCARE ANALYTICAL TESTING SERVICES MARKET OVERVIEW

- 4.2 EUROPE: HEALTHCARE ANALYTICAL TESTING SERVICES MARKET, BY TYPE & COUNTRY (2024)

- 4.3 HEALTHCARE ANALYTICAL TESTING SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 HEALTHCARE ANALYTICAL TESTING SERVICES MARKET: REGIONAL MIX, 2023-2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent regulatory guidelines

- 5.2.1.2 Growing focus on analytical testing of biologics & biosimilars

- 5.2.1.3 Increasing outsourcing of analytical testing services by pharmaceutical & medical device companies

- 5.2.1.4 Rising number of clinical trials

- 5.2.1.5 Growing R&D expenditure in pharmaceutical & biopharmaceutical industry

- 5.2.1.6 Rising acceptance of quality-by-design approach in pharmaceutical research & manufacturing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing pressure on market players due to rising costs and market competition

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of new techniques and technologies

- 5.2.3.2 Growing focus on emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.2.4.2 Specific requirements for innovative formulations and medical devices

- 5.2.4.3 Challenges associated with ensuring bioanalytical testing sensitivity

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.4 REGULATORY SCENARIO

- 5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.4.2 REGULATORY TRENDS

- 5.4.3 NORTH AMERICA

- 5.4.4 EUROPE

- 5.4.5 ASIA PACIFIC

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 SAMPLE MANAGEMENT & PREPARATION

- 5.5.2 ANALYTICAL TESTING PROCEDURES

- 5.5.3 DATA ANALYTICS & INTEGRATION

- 5.5.4 QUALITY ASSURANCE & CONTROL

- 5.5.5 CLIENT COMMUNICATION & SERVICE DELIVERY

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: UNLOCKING POTENTIAL OF BIOPHARMACEUTICAL DEVELOPMENT THROUGH ANALYTICAL TESTING OUTSOURCING

- 5.6.2 CASE STUDY 2: REVOLUTIONIZING PHARMACEUTICAL TESTING

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 THREAT OF SUBSTITUTES

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 KEY BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Chromatography

- 5.9.1.2 Mass spectrometry (MS)

- 5.9.1.3 Spectroscopy

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Laboratory Information Management Systems (LIMS)

- 5.9.2.2 Automation & robotics

- 5.9.2.3 AI/ML in data analytics

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Single-use bioreactors

- 5.9.3.2 mRNA technology

- 5.9.3.3 Next-generation Sequencing (NGS)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 KEY CONFERENCES & EVENTS, 2024-2025

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 INVESTMENT & FUNDING SCENARIO

- 5.13 UNMET NEEDS/END-USER EXPECTATIONS

- 5.14 IMPACT OF AI/GENERATIVE AI ON HEALTHCARE ANALYTICAL TESTING SERVICES MARKET

- 5.15 TRUMP TARIFF IMPACT ON HEALTHCARE ANALYTICAL TESTING MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 KEY IMPACT ON VARIOUS REGIONS

- 5.15.4.1 North America

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

6 HEALTHCARE ANALYTICAL TESTING SERVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 BIOANALYTICAL TESTING SERVICES

- 6.2.1 PHARMACOKINETIC & TOXICOKINETIC TESTING SERVICES

- 6.2.1.1 Essential role in drug individualized dosing and therapeutic monitoring to drive market

- 6.2.2 IMMUNOGENICITY & NEUTRALIZING ANTIBODY TESTING SERVICES

- 6.2.2.1 Increasing requirement for drug safety approvals to fuel uptake

- 6.2.3 BIOMARKER TESTING SERVICES SERVICES

- 6.2.3.1 Growing preference for personalized medicine to fuel market

- 6.2.4 BIOASSAY TESTING SERVICES

- 6.2.4.1 Growing adoption of high-content screening for cytotoxicity testing to boost demand

- 6.2.5 OTHER BIOANALYTICAL TESTING SERVICES

- 6.2.1 PHARMACOKINETIC & TOXICOKINETIC TESTING SERVICES

- 6.3 PHYSICAL CHARACTERIZATION SERVICES

- 6.3.1 LASER PARTICLE SIZE ANALYSIS SERVICES

- 6.3.1.1 Growing importance of pharmaceutical dosage manufacturing to drive market

- 6.3.2 THERMAL ANALYSIS SERVICES

- 6.3.2.1 Advancements in thermal analysis techniques to support market growth

- 6.3.3 OPTICAL CHARACTERIZATION SERVICES

- 6.3.3.1 Increasing complexities of biological structures to boost demand

- 6.3.4 SURFACE AREA ANALYSIS SERVICES

- 6.3.4.1 Growing focus on streamlining drug development processes to fuel uptake

- 6.3.5 OTHER PHYSICAL CHARACTERIZATION SERVICES

- 6.3.1 LASER PARTICLE SIZE ANALYSIS SERVICES

- 6.4 METHOD DEVELOPMENT & VALIDATION SERVICES

- 6.4.1 EXTRACTABLES/LEACHABLES METHOD DEVELOPMENT & VALIDATION SERVICES

- 6.4.1.1 Adoption of parenterally administered drugs and biologics products to drive market

- 6.4.2 PROCESS IMPURITY METHOD DEVELOPMENT & VALIDATION SERVICES

- 6.4.2.1 Increasing emphasis on impurity testing to boost market

- 6.4.3 STABILITY-INDICATING METHOD VALIDATION SERVICES

- 6.4.3.1 Growing need to ensure safety & efficacy of drugs to drive market

- 6.4.4 CLEANING VALIDATION & METHOD DEVELOPMENT SERVICES

- 6.4.4.1 Focus on contamination reduction to fuel market

- 6.4.5 ANALYTICAL STANDARD CHARACTERIZATION SERVICES

- 6.4.5.1 Assessment of quantitative & qualitative accuracy to fuel uptake

- 6.4.6 TECHNICAL CONSULTING SERVICES

- 6.4.6.1 Stringent regulatory compliance to boost demand

- 6.4.7 OTHER METHOD DEVELOPMENT & VALIDATION SERVICES

- 6.4.1 EXTRACTABLES/LEACHABLES METHOD DEVELOPMENT & VALIDATION SERVICES

- 6.5 RAW MATERIAL TESTING SERVICES

- 6.5.1 COMPLETE COMPENDIAL TESTING SERVICES

- 6.5.1.1 Need to determine efficacy & safety of therapeutic products to drive market

- 6.5.2 CONTAINER TESTING SERVICES

- 6.5.2.1 Optimization of sealing & evaluation of temperature impact to fuel uptake

- 6.5.3 HEAVY METAL TESTING SERVICES

- 6.5.3.1 Uptake of specialized equipment to support market growth

- 6.5.4 WATER CONTENT ANALYSIS SERVICES

- 6.5.4.1 Adequate moisture content analysis to fuel market

- 6.5.5 OTHER RAW MATERIAL TESTING SERVICES

- 6.5.1 COMPLETE COMPENDIAL TESTING SERVICES

- 6.6 BATCH-RELEASE TESTING SERVICES

- 6.6.1 DISSOLUTION TESTING SERVICES

- 6.6.1.1 Wide usage across formulation development & manufacturing applications to drive market

- 6.6.2 ELEMENTAL IMPURITY TESTING SERVICES

- 6.6.2.1 Rising need to minimize cost of in-house analysis to fuel market

- 6.6.3 DISINTEGRATION TESTING SERVICES

- 6.6.3.1 Ability to ensure batch-to-batch consistency of pharmaceutical dosage forms to fuel market

- 6.6.4 HARDNESS TESTING SERVICES

- 6.6.4.1 Measurement of tablet quality to support market growth

- 6.6.5 FRIABILITY TESTING SERVICES

- 6.6.5.1 Resistance measurement of tablets & granules to fuel market

- 6.6.6 OTHER BATCH-RELEASE TESTING SERVICES

- 6.6.1 DISSOLUTION TESTING SERVICES

- 6.7 STABILITY TESTING SERVICES

- 6.7.1 DRUG SUBSTANCE STABILITY TESTING SERVICES

- 6.7.1.1 Evidence testing on quality of pharmaceutical stability to fuel market

- 6.7.2 FORMULATION EVALUATION STABILITY TESTING SERVICES

- 6.7.2.1 Analysis of shelf life to fuel adoption

- 6.7.3 ACCELERATED STABILITY TESTING SERVICES

- 6.7.3.1 High stress conditions to provide enhanced results

- 6.7.4 PHOTOSTABILITY TESTING SERVICES

- 6.7.4.1 Systemic approach for ICH guideline adherence to propel market

- 6.7.5 FORCED DEGRADATION TESTING SERVICES

- 6.7.5.1 Rising need for comprehensive stability testing to drive market

- 6.7.6 OTHER STABILITY TESTING SERVICES

- 6.7.1 DRUG SUBSTANCE STABILITY TESTING SERVICES

- 6.8 MICROBIAL TESTING SERVICES

- 6.8.1 MICROBIAL LIMIT TESTING SERVICES

- 6.8.1.1 Microbial quality efficacy testing to boost demand

- 6.8.2 VIROLOGY TESTING SERVICES

- 6.8.2.1 Increasing outbreaks of viral diseases to drive market

- 6.8.3 STERILITY TESTING SERVICES

- 6.8.3.1 Rising development of parenteral preparations and immunological products to drive market

- 6.8.4 ENDOTOXIN TESTING SERVICES

- 6.8.4.1 Endoxin-free testing to fuel market

- 6.8.5 PRESERVATIVE EFFICACY TESTING SERVICES

- 6.8.5.1 PET testing for toxicity to fuel uptake

- 6.8.6 OTHER MICROBIAL TESTING SERVICES

- 6.8.1 MICROBIAL LIMIT TESTING SERVICES

- 6.9 ENVIRONMENTAL MONITORING SERVICES

- 6.9.1 AIR TESTING SERVICES

- 6.9.1.1 Air contamination testing for quality checks to fuel market

- 6.9.2 WASTEWATER/ETP TESTING SERVICES

- 6.9.2.1 Need to minimize water contamination to fuel market

- 6.9.3 OTHER ENVIRONMENTAL MONITORING TESTING SERVICES

- 6.9.1 AIR TESTING SERVICES

- 6.10 GENOMIC TESTING SERVICES

- 6.10.1 DETECTION OF DISEASE MECHANISMS AND TREATMENT RESPONSES TO PROPEL MARKET

- 6.11 OTHER ANALYTICAL TESTING SERVICES

7 HEALTHCARE ANALYTICAL TESTING SERVICES MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 PHARMACEUTICAL COMPANIES

- 7.2.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO PROPEL MARKET

- 7.3 BIOPHARMACEUTICAL COMPANIES

- 7.3.1 INCREASING R&D INVESTMENTS TO FUEL MARKET

- 7.4 MEDICAL DEVICE COMPANIES

- 7.4.1 STRINGENT PRODUCT COMMERCIALIZATION GUIDELINES TO DRIVE MARKET

- 7.5 HOSPITALS & CLINICS

- 7.5.1 INCREASING INCIDENCE OF CHRONIC DISEASES TO BOOST DEMAND

- 7.6 FORENSIC LABS

- 7.6.1 RISING UTILIZATION OF ANALYTICAL TESTING TO FUEL MARKET

- 7.7 COSMETIC & NUTRACEUTICAL COMPANIES

- 7.7.1 RISING FOCUS ON QUALITY CONTROL TESTING TO FUEL UPTAKE

- 7.8 OTHER END USERS

8 HEALTHCARE ANALYTICAL TESTING MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.2.2 US

- 8.2.2.1 High number of pre-registration drugs in pipeline to drive market

- 8.2.3 CANADA

- 8.2.3.1 Presence of well-established CROs to support market growth

- 8.3 EUROPE

- 8.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.3.2 GERMANY

- 8.3.2.1 Government support and flexible labor laws to boost demand

- 8.3.3 FRANCE

- 8.3.3.1 Favorable government regulations to drive market

- 8.3.4 UK

- 8.3.4.1 Increasing outsourcing of biopharmaceutical R&D to drive market

- 8.3.5 ITALY

- 8.3.5.1 Availability of drug discovery funding investments to fuel market

- 8.3.6 SWITZERLAND

- 8.3.6.1 High production of pharma drugs to fuel uptake

- 8.3.7 SPAIN

- 8.3.7.1 Rising number of clinical trials to boost demand

- 8.3.8 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.4.2 JAPAN

- 8.4.2.1 Expanding geriatric population and increasing incidence of chronic diseases to propel market

- 8.4.3 CHINA

- 8.4.3.1 Increasing incidence of infectious diseases to boost demand

- 8.4.4 INDIA

- 8.4.4.1 Growing focus on establishment of genomic testing centers to drive market

- 8.4.5 AUSTRALIA

- 8.4.5.1 Large number of research institutes to support market uptake

- 8.4.6 SOUTH KOREA

- 8.4.6.1 Launch of innovative pharma drugs to boost demand

- 8.4.7 REST OF ASIA PACIFIC

- 8.5 LATIN AMERICA

- 8.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 8.5.2 BRAZIL

- 8.5.2.1 Rising adoption of emerging medical technologies to drive market

- 8.5.3 MEXICO

- 8.5.3.1 Favorable regulatory environment for API products to fuel market

- 8.5.4 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 8.6.2 GCC COUNTRIES

- 8.6.2.1 Improvements in healthcare infrastructure to boost demand

- 8.6.3 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET

- 9.3 REVENUE ANALYSIS, 2020-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Type footprint

- 9.5.5.4 End-user footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of startups/SMEs

- 9.6.5.2 Competitive benchmarking of emerging players/startups

- 9.7 COMPANY VALUATION & FINANCIAL METRICS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/SERVICE COMPARISON

- 9.8.1 BRAND/SERVICE COMPARATIVE ANALYSIS

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 SERVICE LAUNCHES

- 9.9.2 DEALS

- 9.9.3 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 EUROFINS SCIENTIFIC SE

- 10.1.1.1 Business overview

- 10.1.1.2 Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Deals

- 10.1.1.3.2 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 LABCORP HOLDINGS INC.

- 10.1.2.1 Business overview

- 10.1.2.2 Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Services launches

- 10.1.2.3.2 Deals

- 10.1.2.3.3 Expansions

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 INTERTEK GROUP PLC

- 10.1.3.1 Business overview

- 10.1.3.2 Services offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.3.2 Expansions

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses & competitive threats

- 10.1.4 ICON PLC

- 10.1.4.1 Business overview

- 10.1.4.2 Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Deals

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 IQVIA INC.

- 10.1.5.1 Business overview

- 10.1.5.2 Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Expansions

- 10.1.5.3.2 Other developments

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses & competitive threats

- 10.1.6 WUXI APPTEC CO., LTD.

- 10.1.6.1 Business overview

- 10.1.6.2 Services offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Service launches

- 10.1.6.3.2 Deals

- 10.1.6.3.3 Expansions

- 10.1.7 CHARLES RIVER LABORATORIES

- 10.1.7.1 Business overview

- 10.1.7.2 Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Service launches & approvals

- 10.1.7.3.2 Deals

- 10.1.7.3.3 Expansions

- 10.1.8 SGS SA

- 10.1.8.1 Business overview

- 10.1.8.2 Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Service launches

- 10.1.8.3.2 Deals

- 10.1.8.3.3 Expansions

- 10.1.8.3.4 Other developments

- 10.1.9 THERMO FISHER SCIENTIFIC INC.

- 10.1.9.1 Business overview

- 10.1.9.2 Services offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.9.3.2 Expansions

- 10.1.10 MEDPACE HOLDINGS, INC.

- 10.1.10.1 Business overview

- 10.1.10.2 Services offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Deals

- 10.1.10.3.2 Expansions

- 10.1.11 SARTORIUS AG

- 10.1.11.1 Business overview

- 10.1.11.2 Services offered

- 10.1.11.3 Recent developments

- 10.1.11.3.1 Deals

- 10.1.11.3.2 Expansions

- 10.1.12 MERCK KGAA

- 10.1.12.1 Business overview

- 10.1.12.2 Services offered

- 10.1.12.3 Recent developments

- 10.1.12.3.1 Service launches

- 10.1.12.3.2 Deals

- 10.1.12.3.3 Expansions

- 10.1.12.3.4 Other developments

- 10.1.13 SOURCE BIOSCIENCE (SUBSIDIARY OF SOURCEBIO INTERNATIONAL PLC)

- 10.1.13.1 Business overview

- 10.1.13.2 Services offered

- 10.1.13.3 Recent developments

- 10.1.13.3.1 Service launches

- 10.1.13.3.2 Expansions

- 10.1.14 ALS

- 10.1.14.1 Business overview

- 10.1.14.2 Services offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Deals

- 10.1.15 FRONTAGE LABORATORIES, INC.

- 10.1.15.1 Business overview

- 10.1.15.2 Services offered

- 10.1.15.3 Recent developments

- 10.1.15.3.1 Deals

- 10.1.15.3.2 Expansions

- 10.1.16 STERIS PLC

- 10.1.16.1 Business overview

- 10.1.16.2 Services offered

- 10.1.16.3 Recent developments

- 10.1.16.3.1 Service launches

- 10.1.16.3.2 Expansions

- 10.1.16.3.3 Other developments

- 10.1.17 ELEMENT MATERIALS TECHNOLOGY

- 10.1.17.1 Business overview

- 10.1.17.2 Services offered

- 10.1.17.3 Recent developments

- 10.1.17.3.1 Service launches

- 10.1.17.3.2 Deals

- 10.1.17.3.3 Expansions

- 10.1.17.3.4 Other developments

- 10.1.18 PACE ANALYTICAL SERVICES

- 10.1.18.1 Business overview

- 10.1.18.2 Services offered

- 10.1.18.3 Recent developments

- 10.1.18.3.1 Deals

- 10.1.18.3.2 Expansions

- 10.1.19 ALMAC GROUP

- 10.1.19.1 Business overview

- 10.1.19.2 Services offered

- 10.1.19.3 Recent developments

- 10.1.19.3.1 Service approvals

- 10.1.19.3.2 Deals

- 10.1.19.3.3 Expansions

- 10.1.20 PHARMARON BEIJING CO., LTD.

- 10.1.20.1 Business overview

- 10.1.20.2 Services offered

- 10.1.20.3 Recent developments

- 10.1.20.3.1 Deals

- 10.1.1 EUROFINS SCIENTIFIC SE

- 10.2 OTHER PLAYERS

- 10.2.1 SYNEOS HEALTH

- 10.2.2 PAREXEL INTERNATIONAL (MA) CORPORATION

- 10.2.3 LGC LIMITED

- 10.2.4 CELERION

- 10.2.5 BIOAGILYTIX

- 10.2.6 ALCAMI CORPORATION

- 10.2.7 SAMSUNG BIOLOGICS

- 10.2.8 CURIA GLOBAL, INC.

- 10.2.9 BA SCIENCES

- 10.2.10 AVANCE BIOSCIENCES

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS