|

시장보고서

상품코드

1781106

자동 출입국 심사 시장 : 솔루션 유형별, 구성요소 유형별, 용도별 - 예측(-2030년)Automated Border Control Market by Solution Type (E-gates, Kiosks), Component Type [Hardware (Document Verification, Biometrics (Facial, Iris Recognition)), Software, Services], Application (Airports, Seaports, Land Ports) - Global Forecast to 2030 |

||||||

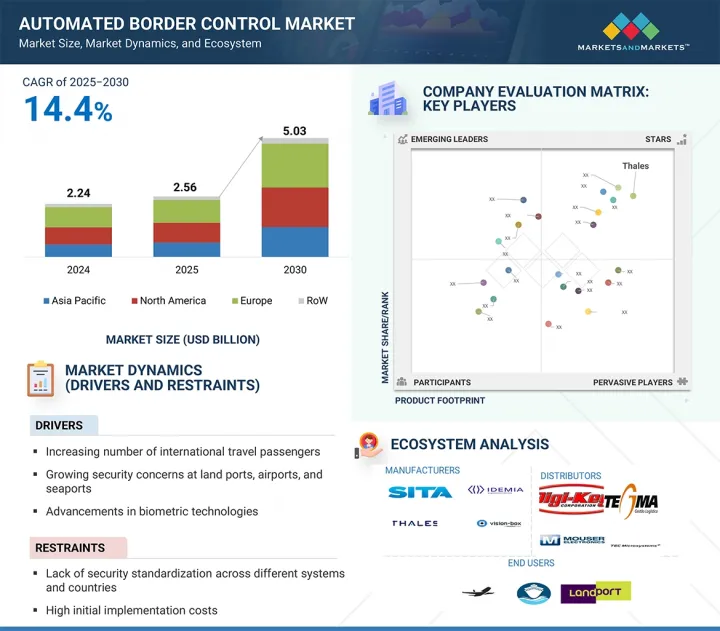

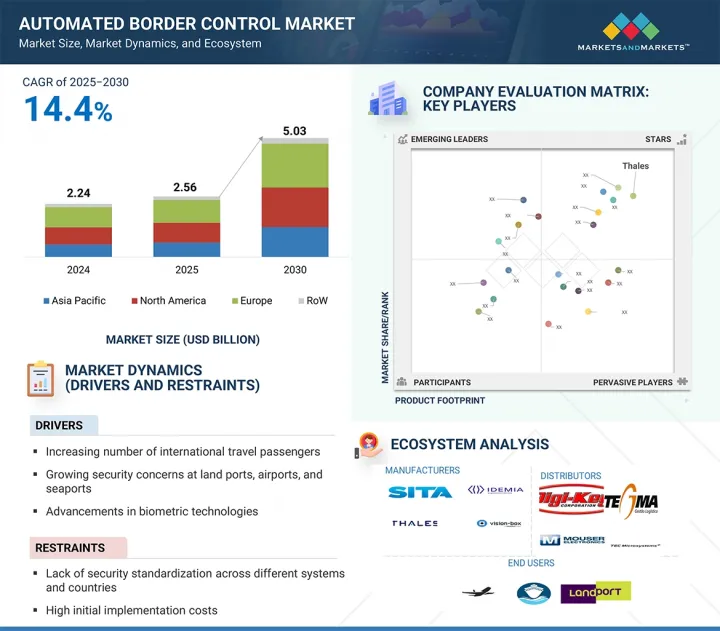

세계의 자동 출입국 심사 시장 규모는 2025년 25억 6,000만 달러에서 2030년까지 50억 3,000만 달러에 달할 것으로 예상되며, 2025-2030년 14.4%의 연평균 성장률을 보일 것으로 예측됩니다. 주요 촉진 요인 중 하나는 국제 여객 운송의 급증으로 국경 관리 당국은 안전을 해치지 않고 여행자를 보다 효율적으로 처리해야 할 필요성이 대두되고 있습니다. 공항, 항구 및 육지 국경에서 혼잡과 대기 시간을 줄이기 위해 전자 게이트 및 생체 인식 키오스크와 같은 자동화 솔루션에 대한 관심이 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 솔루션 유형, 컴포넌트 유형, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

특히 COVID-19의 여파로 비접촉식 위생적인 출입국 절차의 필요성이 높아지면서 ABC 시스템 도입이 크게 가속화되고 있습니다. 생체인식 기술(얼굴 인식, 지문, 홍채 스캔)은 건강 및 보안 프로토콜에 부합하는 안전하고 빠른 신원 확인을 제공합니다. 유럽연합(EU)의 EES(Entry/Exit System), ICAO의 TRIP 전략 등 정부의 의무화 및 규제 프레임워크도 각국의 국경 인프라 현대화를 촉진하고 있습니다. 동시에 수작업 처리의 높은 비용과 전 세계적인 인력 부족으로 인해 자동화가 더욱 매력적이고 비용 효율적인 선택이 되고 있습니다. 또한, IDEMIA, Thales, Vision-Box와 같은 벤더들의 기술 발전과 지원, 스마트 공항 및 스마트 국경에 대한 노력이 시장을 주도하고 있습니다. 이러한 복합적인 요인으로 인해 자동 출입국 심사 시장은 차세대 국경 보안 및 여행 효율성의 중요한 요소로 부상하고 있습니다.

"하드웨어 부문은 2025-2030년 자동 출입국 시장에서 큰 CAGR을 기록할 것으로 예상됩니다."

하드웨어 부문은 국경 통과 지점의 자동화에 따른 물리적 인프라 요구 사항으로 인해 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다. 주요 하드웨어 구성요소에는 전자 게이트, 생체인식 스캐너(얼굴, 지문, 홍채), 여권 판독기, 감시 카메라, 여행자를 효율적이고 안전하게 처리할 수 있는 통합형 키오스크 단말기 등이 있습니다. 전 세계 여객 수송이 회복됨에 따라 각국은 혼잡을 완화하고 보안을 강화하기 위해 자동 출입국 관리(ABC) 하드웨어에 대한 투자를 가속화하고 있습니다. 예를 들어, 2024년 7월 뭄바이 차트라파티시바지마할라지 국제공항은 68개의 전자게이트를 새로 도입하여 인도 최대 규모의 자동 출입국 심사 시설을 갖추게 됩니다. 마찬가지로 미국은 마이애미, 댈러스, 애틀랜타의 교통량이 많은 터미널을 포함한 50개 이상의 공항에 생체인식 하드웨어를 확장하여 처리 시간을 크게 단축했습니다. 또한, 육지와 항구에서는 차량 스캐너, 생체인식 부스 등 하드웨어 시스템의 통합이 진행되고 있으며, 유럽과 북미가 채택을 주도하고 있습니다. EU가 자금을 지원하는 Smart Borders Initiative는 쉥겐 국가 전체, 특히 프랑크푸르트와 파리 CDG와 같은 주요 공항에서 하드웨어를 많이 사용하는 ABC 시스템을 구축하고 있습니다. 안전하고 비접촉식이며 더 빠른 출입국 관리 솔루션에 대한 필요성이 증가함에 따라 정부와 공항 당국은 하드웨어 설치에 우선순위를 두고 있습니다. 높은 자본 지출과 수명주기 교체로 인해 하드웨어는 여전히 ABC 시장의 핵심 수익 부문입니다.

"항만 부문은 2025-2030년 자동 출입국 시장에서 두드러진 점유율을 차지할 것으로 예상됩니다."

항만 부문은 승객 수 증가, 신속한 처리의 필요성, 해상 보안 강화로 인해 자동 출입국 심사 시장의 주요 기여자로 부상하고 있습니다. 특히 교통량이 많은 지역의 국제 항구와 페리 터미널은 증가하는 여행객의 흐름을 관리하기 위해 ABC 시스템을 채택하고 있습니다. 그 대표적인 예가 인도네시아의 바탐 센터로, 5개의 대형 항구를 합쳐 연간 약 50만 명의 승객을 처리하고 있습니다. 2024년, 인도네시아 출입국 관리 당국은 이들 항구에 HID Global의 Autogate 시스템을 도입하여 ATOM 여권 판독기와 얼굴 인식 카메라를 통합했습니다. 이를 통해 국경 처리 시간이 크게 단축되고, 여객 처리 능력이 향상되었으며, 인터폴과 같은 국제 보안 데이터베이스와 연결하여 실시간 위협을 감지할 수 있게 되었습니다. 그 후, 당국은 대기열이 단축되고 업무 효율성이 향상되었다고 보고하고 있습니다. 전 세계적으로 항만 부문은 현재 시장에서 두 번째로 빠르게 성장하는 분야로 인식되고 있습니다. 해상 여행과 화물 운송의 증가로 인해 안전한 자동 출입국 심사에 대한 수요가 증가하고 있기 때문입니다. 온디바이스 AI, 생존 감지, 멀티 스펙트럼 바이오 이미징 등 첨단 기술 도입으로 항만에서 원활한 도입이 가능합니다. 이러한 발전은 시범 프로젝트의 성공과 정부의 지원으로 인해 전 세계 자동 출입국 심사 시장에서 항만 부문의 중요성이 커지고 있음을 입증합니다.

세계의 자동 출입국 심사 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 자동 출입국 심사 시장의 매력적인 성장 기회

- 자동 출입국 심사 시장 : 솔루션 유형별

- 자동 출입국 심사 시장 : 제공별

- 자동 출입국 심사 시장 : 용도별

- 자동 출입국 심사 시장 : 지역별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 공급망 분석

- 생태계 분석

- 가격 분석

- 주요 기업이 제공하는 자동 출입국 심사 시스템 가격대 : 솔루션 유형별(2024년)

- 자동 출입국 심사 시스템 가격대 : 솔루션 유형별(2024년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 기술 분석

- 주요 기술

- 인접 기술

- 보완 기술

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 무역 분석

- 특허 분석

- 주요 회의와 이벤트(2025-2026년)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 기준과 규제

제6장 국경 통과 자동 절차

- 소개

- 1 스텝 프로세스

- 통합 2 스텝 프로세스

- 분리 2 스텝 프로세스

제7장 자동 출입국 심사 시장 : 솔루션별

- 소개

- ABC e게이트

- ABC 키오스크

제8장 자동 출입국 심사 시장 : 제공별

- 소개

- 하드웨어

- 소프트웨어

- 서비스

제9장 자동 출입국 심사 시장 : 용도별

- 소개

- 공항

- 해항

- 육상 항구

제10장 자동 출입국 심사 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 북유럽

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 인도네시아

- 호주

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동

- 아프리카

- 남미

제11장 경쟁 구도

- 소개

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- VISION-BOX

- SITA

- SECUNET SECURITY NETWORKS AG

- IDEMIA

- THALES

- NEC CORPORATION

- INDRA SISTEMAS, S.A.

- GUNNEBO AB

- HID GLOBAL CORPORATIONS

- ATOS SE

- DORMAKABA GROUP

- UNISYS

- 기타 기업

- BIOLINK SOLUTIONS

- BIOID

- COGNITEC SYSTEMS GMBH

- DERMALOG IDENTIFICATION SYSTEM GMBH

- IER

- INTERNATIONAL SECURITY TECHNOLOGY LTD.

- M2SYS TECHNOLOGY

- MAGNETIC AUTOCONTROL GMBH

- MUHLBAUER GROUP

- SECURIPORT

- VERIDOS GMBH

- ZETES

- MORPHO DYS

제13장 부록

ksm 25.08.06The automated border control market is projected to grow from USD 2.56 billion in 2025 to USD 5.03 billion by 2030, growing at a CAGR of 14.4% from 2025 to 2030. One of the primary drivers is the sharp increase in international passenger traffic, which has put immense pressure on border control authorities to process travelers more efficiently without compromising security. Airports, seaports, and land borders increasingly turn to automated solutions, such as eGates and biometric kiosks, to reduce congestion and waiting times.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution Type, Component Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growing need for contactless and hygienic border procedures, especially in the aftermath of COVID-19, has significantly accelerated the adoption of ABC systems. Biometric technologies-facial recognition, fingerprint, and iris scanning-offer secure and fast identity verification, aligning with health and security protocols. Government mandates and regulatory frameworks, such as the European Union's Entry/Exit System (EES) and ICAO's TRIP strategy, also push countries to modernize their border infrastructure. At the same time, the high cost of manual processing and global staff shortages make automation a more attractive and cost-efficient option. In addition, technological advancements and support from vendors such as IDEMIA, Thales, and Vision-Box, along with smart airport and smart border initiatives, drive the market. These combined factors make the automated border control market a critical component of next-generation border security and travel efficiency.

"Hardware segment is expected to record a significant CAGR in the automated border market from 2025 to 2030."

The hardware segment is expected to witness the highest CAGR during the forecast period due to the physical infrastructure requirements involved in automating border crossing points. Key hardware components include eGates, biometric scanners (facial, fingerprint, and iris), passport readers, surveillance cameras, and integrated kiosks for processing travelers efficiently and securely. As global passenger traffic rebounds, countries are accelerating investments in automated border control (ABC) hardware to reduce congestion and enhance security. For instance, in July 2024, Mumbai's Chhatrapati Shivaji Maharaj International Airport deployed 68 new eGates, becoming India's largest automated immigration setup. Similarly, the US expanded biometric hardware deployment at over 50 airports, including high-traffic terminals at Miami, Dallas, and Atlanta, significantly reducing processing times. Additionally, land and seaports are integrating hardware systems such as vehicle scanners and biometric booths, with Europe and North America leading in adoption. The EU-funded Smart Borders Initiative is deploying hardware-heavy ABC systems across Schengen countries, especially at major airports like Frankfurt and Paris-CDG. The increasing need for secure, contactless, faster border control solutions pushes governments and airport authorities to prioritize hardware installations. With high capital expenditure and lifecycle replacements, hardware remains the core revenue-generating segment in the ABC market.

"Seaports segment is projected to hold a commendable share of the automated border market from 2025 to 2030."

The seaport segment is emerging as a considerable contributor to the automated border control market, driven by increasing passenger volumes, the need for faster processing, and enhanced maritime security. International seaports and ferry terminals, particularly in high-traffic regions, are adopting ABC systems to manage growing traveler flows. A notable example is Indonesia's Batam Center, where five major seaports collectively handle around 500,000 passengers annually. In 2024, Indonesian immigration authorities implemented HID Global's Autogate system at these ports, integrating ATOM passport readers with facial recognition cameras. This deployment significantly reduced border processing times, improved passenger throughput, and connected to international security databases like Interpol for real-time threat detection. Following this, authorities reported shorter queues and greater operational efficiency. Globally, the seaport segment is now recognized as the second-fastest growing area in the market, as increasing maritime travel and cargo movement heighten the demand for secure, automated border control. The introduction of advanced technologies such as on-device AI, liveness detection, and multispectral biometric imaging has enabled seamless implementation at seaports. These developments, coupled with successful pilot projects and government support, underscore the growing importance of the seaport segment in the global automated border control market.

"Europe contributed largest share of automated border control market in 2024."

Europe is set to contribute a significant share to the automated border control market in 2024, driven by robust infrastructure, regulatory initiatives, and widespread adoption of biometric systems. A major catalyst is the European Union's upcoming Entry/Exit System (EES), scheduled to launch in October 2025. The EES will require non-EU travelers to register biometric data, such as facial images and fingerprints, at self-service kiosks across all Schengen borders, leading to a rapid increase in ABC deployments. Airports across Europe are expanding their capabilities in anticipation of this shift. For instance, Frankfurt Airport boosted its eGate capacity by 40% in 2023 to manage over 70 million passengers annually, while France's major airports, including Nice, CDG, Orly, and Marseille, have rolled out facial recognition eGates under the PARAFE system. Additionally, manufacturers such as Vision-Box, IDEMIA, Thales, and Secunet are securing contracts with European airport authorities, enhancing regional ABC infrastructure. Security concerns related to illegal migration and overstays are also pushing adoption. Pilot programs in countries such as Germany and Croatia have reduced undocumented overstays by 40%. Despite some delays in EES rollout due to technical challenges in countries such as Germany and the Netherlands, phased implementation is underway, positioning Europe as a global leader in the market.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Managers -45%, and Others - 20%

- By Region: North America -25%, Europe - 40%, Asia Pacific- 25%, and RoW - 10%

Prominent players profiled in this report include Thales (France), Secunet Security Networks AG (Germany), IDEMIA (France), and SITA (Switzerland).

Report Coverage

The report defines, describes, and forecasts the automated border control market based on solution type (e-gates, kiosks), component type (hardware, software, services), application (airports, seaports, land ports), and region (North America, Europe, Asia Pacific, and RoW. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall automated border control market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (increasing number of international passengers traveling across borders; growing security concerns at land ports, airports, and seaports; advancements in biometrics), restraints (lack of security standardization across different systems and countries; high initial implementation cost for automated border control systems), opportunities (growing implementation of digital ID verification systems by governments and transportation organizations; rising integration of artificial intelligence in automated border control systems), and challenges (increasing risks of cyberattacks) in the automated border control market

- Product development /Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the automated border control market

- Market Development: Comprehensive information about lucrative markets; the report analyses the automated border control market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the automated border control market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Thales (France), Secunet Security Networks AG (Germany), IDEMIA (France), NEC Corporation (Japan), and SITA (Switzerland) in the automated border control market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AUTOMATED BORDER CONTROL MARKET

- 4.2 AUTOMATED BORDER CONTROL MARKET, BY SOLUTION TYPE

- 4.3 AUTOMATED BORDER CONTROL MARKET, BY OFFERING

- 4.4 AUTOMATED BORDER CONTROL MARKET, BY APPLICATION

- 4.5 AUTOMATED BORDER CONTROL MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of international passengers traveling across borders

- 5.2.1.2 Growing security concerns at land ports, airports, and seaports

- 5.2.1.3 Ongoing advancements in biometric technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inconsistent security protocols across jurisdictions

- 5.2.2.2 Limited adoption in emerging economies due to substantial setup and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing implementation of digital ID verification systems by governments and transportation organizations

- 5.2.3.2 Rising integration of artificial intelligence in automated border control systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Vulnerability to cyber threats

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AUTOMATED BORDER CONTROL SYSTEMS PROVIDED BY KEY PLAYERS, BY SOLUTION TYPE, 2024

- 5.5.2 PRICING RANGE OF AUTOMATED BORDER CONTROL SYSTEMS, BY SOLUTION TYPE, 2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Artificial intelligence

- 5.7.1.2 Internet of Things

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Blockchain technology

- 5.7.3 COMPLIMENTARY TECHNOLOGIES

- 5.7.3.1 Biometrics technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 BARGAINING POWER OF SUPPLIERS

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 THREAT OF NEW ENTRANTS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NIGERIA'S SMART AIRPORT INITIATIVE: COMBATING IDENTITY FRAUD THROUGH IDEMIA'S BIOMETRIC SOLUTION

- 5.10.2 SOUTH AFRICA'S SMART AIRPORT REVOLUTION: ELIMINATING QUEUES THROUGH VISION-BOX'S AI-POWERED BORDER CONTROL SOLUTION

- 5.10.3 INDIA'S SMART AIRPORT TRANSFORMATION: CUTTING IMMIGRATION TIME BY 73% THROUGH THALES GROUP'S AI-POWERED E-GATES

- 5.10.4 SULAYMANIYAH'S BORDER SECURITY REVOLUTION: ELIMINATING 20-MINUTE DELAYS THROUGH M2SYS' BIOMETRIC INNOVATION

- 5.10.5 PHILADELPHIA'S SMART AIRPORT INNOVATION: REVOLUTIONIZING US EXIT IMMIGRATION THROUGH SITA'S BIOMETRIC TECHNOLOGY

- 5.11 TRADE ANALYSIS

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS

6 AUTOMATED PROCEDURES FOR BORDER CROSSING

- 6.1 INTRODUCTION

- 6.2 ONE-STEP PROCESS

- 6.3 INTEGRATED TWO-STEP PROCESS

- 6.4 SEGREGATED TWO-STEP PROCESS

7 AUTOMATED BORDER CONTROL MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.2 ABC E-GATES

- 7.2.1 RISING ADOPTION OF ABC E-GATES AT AIRPORTS FOR GREATER SECURITY TO DRIVE MARKET

- 7.2.1.1 Automated boarding e-gates

- 7.2.1.2 Security checkpoint e-gates

- 7.2.1 RISING ADOPTION OF ABC E-GATES AT AIRPORTS FOR GREATER SECURITY TO DRIVE MARKET

- 7.3 ABC KIOSKS

- 7.3.1 URGENT NEED FOR FAST, EFFICIENT, AND SECURE BORDER CROSSING PROCESSES TO SUPPORT MARKET GROWTH

8 AUTOMATED BORDER CONTROL MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 RISING DEMAND FOR ENHANCED BORDER SECURITY TO ACCELERATE SEGMENTAL GROWTH

- 8.2.1.1 Document authentication system

- 8.2.1.1.1 Optical character recognition solution

- 8.2.1.1.2 Barcode reader

- 8.2.1.1.3 Signature scanner

- 8.2.1.2 Biometric verification system

- 8.2.1.2.1 Face recognition solution

- 8.2.1.2.2 Fingerprint recognition solution

- 8.2.1.2.3 Iris recognition system

- 8.2.1.2.4 Other biometric verification systems

- 8.2.1.3 Baggage scanner

- 8.2.1.3.1 RFID tags

- 8.2.1.4 Digital ID verification system

- 8.2.1.1 Document authentication system

- 8.2.1 RISING DEMAND FOR ENHANCED BORDER SECURITY TO ACCELERATE SEGMENTAL GROWTH

- 8.3 SOFTWARE

- 8.3.1 PRESSING NEED FOR REAL-TIME DECISION-MAKING AT BORDER CONTROL TO ACCELERATE DEMAND

- 8.4 SERVICES

- 8.4.1 INSTALLATION

- 8.4.1.1 Necessity to address regulatory compliance requirements to support demand

- 8.4.2 MAINTENANCE

- 8.4.2.1 Significant focus on preventive maintenance to spike demand

- 8.4.1 INSTALLATION

9 AUTOMATED BORDER CONTROL MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 AIRPORTS

- 9.2.1 RISING NUMBER OF INTERNATIONAL TRAVELERS TO SURGE DEMAND

- 9.3 SEAPORTS

- 9.3.1 NECESSITY TO FACILITATE SMOOTH MOVEMENT OF GOODS AND PASSENGERS TO SPIKE DEMAND

- 9.4 LAND PORTS

- 9.4.1 NEED TO DETECT FORGED OR TAMPERED DOCUMENTS TO INCREASE ADOPTION

10 AUTOMATED BORDER CONTROL MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Significant focus on expediting immigration process, reducing wait times, and improving overall traveler experience to stimulate adoption

- 10.2.3 CANADA

- 10.2.3.1 Elevating deployment of e-gates at airports to propel market

- 10.2.4 MEXICO

- 10.2.4.1 Substantial increase in border traffic to drive demand

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Release of EasyPASS-RTP program to fuel market growth

- 10.3.3 UK

- 10.3.3.1 Expansion of e-passport gates to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Passport verification program by government to faster market growth

- 10.3.5 ITALY

- 10.3.5.1 Surging security threats with growing number of irregular migrants to elevate demand

- 10.3.6 SPAIN

- 10.3.6.1 Early adoption of EU EES standards to augment deployment

- 10.3.7 POLAND

- 10.3.7.1 Widespread rollout of biometric e-gates and modernized visa screening to support market growth

- 10.3.8 NORDICS

- 10.3.8.1 Government focus on enhancing cross-border travel efficiency to drive market

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Implementation of smart travel initiative to create growth opportunities

- 10.4.3 JAPAN

- 10.4.3.1 Commitment to improve overall travel experience to contribute to market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Airport modernization with deployment of biometric smart pass and e-gates to facilitate demand

- 10.4.5 INDIA

- 10.4.5.1 Deployment of integrated immigration check posts at various land borders to support market growth

- 10.4.6 INDONESIA

- 10.4.6.1 Investment in implementation of facial recognition systems at seaports to promote market growth

- 10.4.7 AUSTRALIA

- 10.4.7.1 Strong focus on deployment of fully biometric-enabled border processing infrastructure to strengthen market momentum

- 10.4.8 MALAYSIA

- 10.4.8.1 Elevating deployment of integrated QR systems, biometric autogates, and cross-border pilot programs to accelerate market progress

- 10.4.9 THAILAND

- 10.4.9.1 Launch of facial-recognition biometric system across several airports to fuel market growth

- 10.4.10 VIETNAM

- 10.4.10.1 Modernization initiatives in border control with biometric autogates and VNeID eKYC expansion to boost demand

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Increase in number of high-profile events, summits, and global conferences in UAE to fuel demand

- 10.5.3 AFRICA

- 10.5.3.1 Need to manage influx of rising number of tourists to fuel market growth

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 High volume of travelers to expedite demand

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 REVENUE ANALYSIS, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- 11.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.4.5.1 Region footprint

- 11.4.5.2 Solution type footprint

- 11.4.5.3 Application footprint

- 11.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- 11.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.5.5.1 Detailed list of key startups/SMEs

- 11.5.5.2 Competitive benchmarking of key startups/SMEs

- 11.6 COMPETITIVE SCENARIO

- 11.6.1 PRODUCT LAUNCHES

- 11.6.2 DEALS

- 11.6.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 VISION-BOX

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SITA

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 SECUNET SECURITY NETWORKS AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 IDEMIA

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 THALES

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 NEC CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 INDRA SISTEMAS, S.A.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 GUNNEBO AB

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 HID GLOBAL CORPORATIONS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 ATOS SE

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 DORMAKABA GROUP

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 UNISYS

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Developments

- 12.1.1 VISION-BOX

- 12.2 OTHER PLAYERS

- 12.2.1 BIOLINK SOLUTIONS

- 12.2.2 BIOID

- 12.2.3 COGNITEC SYSTEMS GMBH

- 12.2.4 DERMALOG IDENTIFICATION SYSTEM GMBH

- 12.2.5 IER

- 12.2.6 INTERNATIONAL SECURITY TECHNOLOGY LTD.

- 12.2.7 M2SYS TECHNOLOGY

- 12.2.8 MAGNETIC AUTOCONTROL GMBH

- 12.2.9 MUHLBAUER GROUP

- 12.2.10 SECURIPORT

- 12.2.11 VERIDOS GMBH

- 12.2.12 ZETES

- 12.2.13 MORPHO DYS

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS