|

시장보고서

상품코드

1781109

사기 감지 및 예방(FDP) 시장 : 사기 유형별, 제공별, 업계별, 지역별 예측(-2030년)Fraud Detection and Prevention (FDP) Market by Fraud Type (Identity, Payment, Insider, Investment), Offering (Solutions (Fraud Analytics, Authentication, and GRC) and Services), Vertical (BFSI, Healthcare, Retail), and Region - Global forecast to 2030 |

||||||

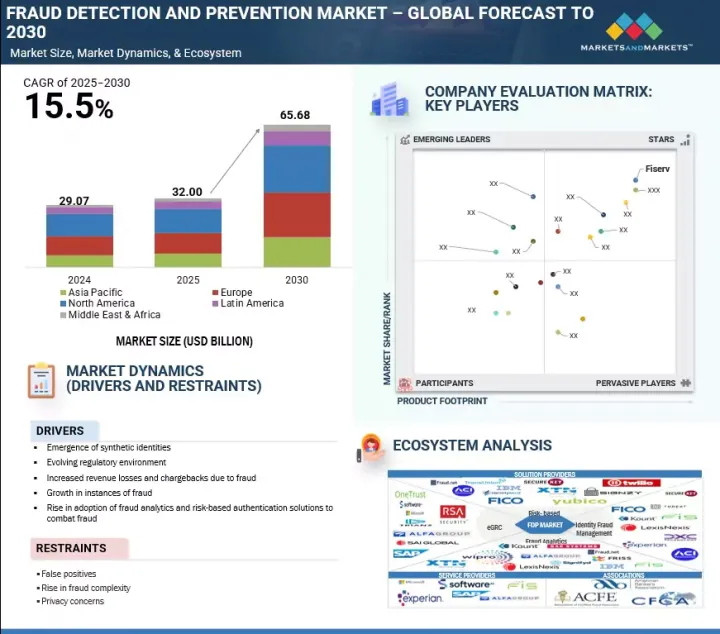

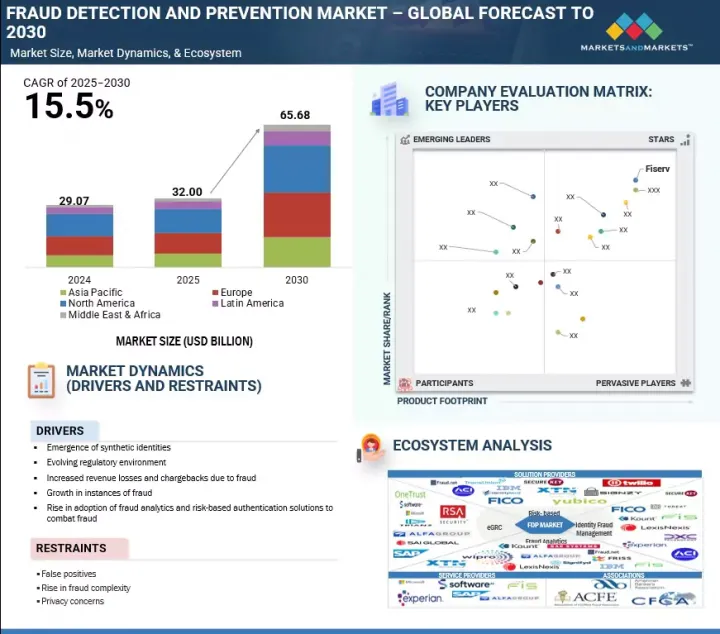

세계의 사기 감지 및 예방 시장 규모는 2025년 320억 달러에서 2030년까지 656억 8,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR은 15.5%로 성장할 전망입니다.

거래 사기 보호 서비스(Transaction Fraud Protection-as-a-Service)에 대한 수요 증가가 사기 감지 및 예방 시장 성장의 주요 촉진요인으로 부상하고 있습니다. 특히 디지털 결제 제공업체에서 이 추세가 두드러집니다. 실시간 및 카드 미소지 거래의 증가로 인해 많은 기업들이 복잡한 인프라 관리 부담을 줄이면서 즉각적인 위험 평가와 유연한 배포를 제공하는 클라우드 기반 솔루션을 도입하고 있습니다. 이 접근 방식은 고속 디지털 결제 보안에 이상적이며, 위협 대응 속도를 높이는 동시에 인프라 관리 부담을 줄여줍니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 사기 유형, 제공, 배포 방식, 기능, 조직 규모, 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

그러나 지역 간 사기 분류, 보고 및 대응에 대한 표준화된 프레임워크가 부족하기 때문에 전 세계 기업들이 FDP 운영을 간소화하고 국경 간 위협 완화를 조정하기 어렵기 때문에 시장 성장이 제한되고 있습니다.

온프레미스 배포 부문이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것입니다.

그러나 지역 간 사기 분류, 보고 및 대응에 대한 표준화된 프레임워크가 부족하기 때문에 전 세계 기업들이 FDP 운영을 간소화하고 국경 간 위협 완화를 조정하기 어렵기 때문에 시장 성장이 제한되고 있습니다.

의료 부문은 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다.

의료 부문은 디지털 건강 기록의 양이 증가하고, 원격 의료가 채택되고, 민감한 환자 데이터를 표적으로 하는 사이버 공격이 증가함에 따라 FDP 시장에서 가장 빠른 속도로 성장할 것으로 예상됩니다. 의료 시스템이 클라우드 플랫폼과 연결된 기기로 빠르게 전환됨에 따라 신원 도용, 보험 사기, 데이터 침해와 관련된 취약성이 급증했습니다. 특히 의료 신원 사기는 주요 위협이 되고 있으며, 도난당한 환자 정보는 종종 금융 데이터보다 더 높은 가격에 다크 웹에서 판매되고 있습니다. 또한, 허위 청구, 처방전 사기, 전자 건강 기록에 대한 무단 액세스로 인해 의료 서비스 제공자와 보험사는 실시간 사기 감지 도구를 채택해야 할 압박을 받고 있습니다. HIPAA 및 GDPR과 같은 데이터 보호 규정을 준수해야 하는 압박도 행동 분석, 생체 인식 인증, AI 기반 이상 감지 기술에 대한 투자를 가속화하고 있습니다. 의료 서비스의 디지털화가 진행됨에 따라 환자의 신뢰를 보호하고 재정적 손실과 평판 손상을 방지하기 위해 안전하고 확장 가능하며 지능적인 FDP 솔루션에 대한 수요가 중요해지고 있습니다.

아시아태평양 지역은 예측 기간 동안 가장 높은 CAGR을 기록할 것입니다.

아시아태평양 지역은 디지털 활동의 급증과 복잡한 사기 위협에 힘입어 사기 감지 및 방지 노력의 중심지로 부상하고 있습니다. 2023년 말, 이 지역의 60% 이상의 기업이 매월 결제 및 디지털 뱅킹 사기를 경험했다고 보고했으며, 약 65%는 전년에 비해 사기 시도가 급격히 증가했다고 밝혔습니다. 모바일 우선 경제가 호황을 누리고 실시간 결제 시스템이 확대됨에 따라 사기꾼들은 속도, 신원 확인 및 거래 모니터링의 취약점을 악용하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 사기 감지 및 예방 시장 기업에 있어서 매력적인 기회

- 사기 감지 및 예방 시장 : 사기 유형별

- 사기 감지 및 예방 시장 : 제공별

- 사기 감지 및 예방 시장 : 솔루션별

- 사기 감지 및 예방 시장 : 서비스별

- 사기 감지 및 예방 시장 : 배포 방식별

- 사기 감지 및 예방 시장 : 조직 규모별

- 사기 감지 및 예방 시장 : 기능별

- 사기 감지 및 예방 시장 : 업계별

- 사기 감지 및 예방 시장 : BFSI 유형별

- 시장투자 시나리오

제5장 시장 개요와 업계 동향

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 생태계 분석/시장지도

- 밸류체인 분석

- 계획과 설계

- FDP 솔루션 제산업체

- 시스템 통합

- 유통

- 최종 사용자

- 특허 분석

- 규제 상황

- 소개

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 가격 분석

- 주요 기업의 평균 판매 가격 동향 : 제품별(2025년)

- 참고 가격 분석 : 솔루션별

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 사례 연구 분석

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 투자 상황

- 사기 감지 및 예방 시장에 대한 생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 상호접속된 인접 생태계에 대한 생성형 AI의 영향

- 고객사업에 영향을 주는 동향 및 혼란

- 기술 로드맵

- 사기 감지 및 예방 시장의 역사

- 1990년대

- 2000-2010년

- 2010-2020년

- 2020-현재

- 사기 감지 및 방지 시장의 모범 사례

제6장 미국 관세의 영향(2025년) - 개요

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 북미

- 유럽

- 아시아태평양

- 산업

제7장 사기 감지 및 예방 시장 : 사기 유형별

- 소개

- 수표 사기

- 개인정보 사기

- 내부자 사기

- 투자 사기

- 결제 사기

- 보험 사기

- 친절한 사기

- 기타 사기 유형

제8장 사기 감지 및 예방 시장 : 제공별

- 소개

- 솔루션

- 서비스

제9장 사기 감지 및 예방 시장 : 배포 방식별

- 소개

- 클라우드

- 온프레미스

제10장 사기 감지 및 예방 시장 : 기능별

- 소개

- 실시간 감지

- 법의학 분석

제11장 사기 감지 및 예방 시장 : 조직 규모별

- 소개

- 대기업

- 중소기업

제12장 사기 감지 및 예방 시장 : 업계별

- 소개

- BFSI

- 소매 및 전자상거래

- 정부

- 의료

- 제조

- 여행?수송

- 부동산

- 통신

- 기타 산업

제13장 사기 감지 및 예방 시장 : 지역별

- 소개

- 북미

- 북미 : 사기 감지 및 예방 시장 성장 촉진요인

- 북미 : 거시경제 전망

- 북미 : MNM의 전략적 지견

- 북미 : 규제정세

- 미국

- 캐나다

- 유럽

- 유럽 : 사기 감지 및 예방 시장 성장 촉진요인

- 유럽 : 거시경제 전망

- 유럽 : MNM의 전략적 지견

- 유럽 : 규제 상황

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 폴란드

- 아일랜드

- 체코 공화국

- 기타 유럽

- 아시아태평양

- 아시아태평양 : 사기 감지 및 예방 시장 성장 촉진요인

- 아시아태평양 : 거시경제 전망

- 아시아태평양 : MNM의 전략적 지견

- 아시아태평양 : 규제 상황

- 중국

- 일본

- 호주 및 뉴질랜드

- 인도

- 싱가포르

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카 : 사기 감지 및 예방 시장 성장 촉진요인

- 중동 및 아프리카 : 거시경제의 전망

- 중동 및 아프리카 : MNM의 전략적 지견

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카 : 사기 감지 및 예방 시장 성장 촉진요인

- 라틴아메리카 : 거시경제 전망

- 라틴아메리카 : MNM의 전략적 지견

- 브라질

- 멕시코

- 콜롬비아

- 기타 라틴아메리카

제14장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 수익 분석(2019-2024년)

- 시장 점유율 분석(2024년)

- 제품/브랜드 비교

- FISERV

- LEXISNEXIS

- TRANSUNION

- FIS GLOBAL

- NICE ACTIMIZE

- 기업 평가 및 재무 지표

- 기업 평가(2025년)

- EV/EBIDTA를 이용한 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오와 동향

제15장 기업 프로파일

- 주요 기업

- FISERV

- LEXISNEXIS RISK SOLUTIONS

- TRANSUNION

- FIS GLOBAL

- NICE ACTIMIZE

- EXPERIAN

- IBM

- ACI WORLDWIDE

- SAS INSTITUTE

- RSA SECURITY

- SAP

- FICO

- MICROSOFT

- F5

- AWS

- BOTTOMLINE TECHNOLOGIES

- CLEARSALE

- GENPACT

- SECURONIX

- ACCERTIFY

- FEEDZAI

- CASEWARE

- ONESPAN

- SIGNIFYD

- BIOCATCH

- FRISS

- MAXMIND

- DATAVISOR

- CLEAFY

- GURUCUL

- RISKIFIED

- THOMSON REUTERS

- SIFT

- NOFRAUD

- FEATURESPACE

- XTN COGNITIVE SECURITY

- EQUIFAX

- ALFA GROUP

- PING IDENTITY

- GFT TECHNOLOGIES

- GBG

- KROLL

- 기타 주요 기업

- ALLOY

- CASTLE

- ENZOIC

- KUBIENT

- SPYCLOUD

- SEON

- DEDUCE

- INCOGNIA

- RESISTANT AI

- AMANI TECHNOLOGIES

- JUICYSCORE

- FUGU

- PIPL

제16장 인접 시장

- 인접 시장의 소개

- 자금 세탁 방지(AML) 시장

- EGRC 시장

제17장 부록

HBR 25.08.07The global fraud detection and prevention market size is projected to grow from USD 32.00 billion in 2025 to USD 65.68 billion by 2030 at a compound annual growth rate (CAGR) of 15.5% during the forecast period. The rising need for transaction fraud Protection-as-a-Service is emerging as a significant driver in the fraud detection and prevention market, particularly for digital payment providers. With an increase in real-time and card-not-present transactions, many companies are adopting cloud-based solutions that offer instant risk assessment and flexible deployment. This approach enables faster threat response while reducing the burden of managing complex infrastructure, making it ideal for securing high-speed digital payments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Fraud Type, Offering, Deployment Mode, Functionality, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

However, the lack of standardized frameworks for fraud classification, reporting, and response across regions makes it difficult for global enterprises to streamline FDP operations and coordinate cross-border threat mitigation, thus restraining the market growth.

"On-premises deployment segment will hold the largest market share during the forecast period"

On-premises deployment remains a strong choice in the fraud detection and prevention market, mainly for organizations in banking, insurance, and government that handle highly sensitive data. These sectors prioritize full control over data security, system performance, and regulatory compliance, which on-premises setups can better deliver. They also allow deeper customization and tighter integration with existing infrastructure, making them ideal for institutions with complex workflows and strict internal policies. Although cloud-based solutions are becoming increasingly popular due to their scalability and flexibility, many businesses continue to rely on on-premises systems. This preference is driven by the need to keep fraud detection tools under direct control, especially in environments where data privacy, latency, and operational risk are significant concerns.

"Healthcare vertical segment will likely account for the highest CAGR during the forecast period"

The healthcare segment is projected to grow at the fastest rate in the FDP market due to the rising volume of digital health records, telemedicine adoption, and increased cyberattacks targeting sensitive patient data. With healthcare systems rapidly shifting to cloud platforms and connected devices, vulnerabilities around identity theft, insurance fraud, and data breaches have surged. Medical identity fraud, in particular, has become a major threat, with stolen patient information often sold on the dark web at higher value than financial data. Additionally, false claims, prescription fraud, and unauthorized access to electronic health records are pushing providers and insurers to adopt real-time fraud detection tools. The pressure to comply with data protection regulations like HIPAA and GDPR is also accelerating investments in behavioral analytics, biometric authentication, and AI-driven anomaly detection. As healthcare digitization continues, the demand for secure, scalable, and intelligent FDP solutions is becoming critical to protect patient trust and prevent financial and reputational damage.

"Asia Pacific region will record highest CAGR during the forecast period"

Asia Pacific is emerging as a hotspot for fraud detection and prevention efforts, driven by a surge in digital activity and complex fraud threats. In late 2023, over 60% of businesses across the region reported encountering payment and digital banking fraud on a monthly basis, and nearly 65% noted a sharp rise in fraud attempts over the previous year. With mobile-first economies booming and real-time payment systems expanding, fraudsters are exploiting gaps in speed, identity verification, and transaction monitoring.

As a result, organizations in finance, telecom, and e-commerce are rapidly deploying AI-driven analytics, behavioral risk scoring, and real-time fraud prevention tools to stay ahead of evolving attack methods and protect customer trust. The growth of cross-border digital trade and digital wallet adoption in India, Indonesia, and Vietnam is further increasing the surface area for attacks. Enterprises are also under pressure to deliver faster, frictionless services while managing higher fraud risk, making advanced FDP solutions a business-critical investment.

Breakdown of Primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 40% and Managerial and Other Levels - 60%

- By Region: North America - 20%, Europe - 35%, and Asia Pacific - 45%

The key players in the fraud detection and prevention market include Fiserv (US), LexisNexis Risk Solutions (US), TransUnion (US), FIS Global (US), Experian (Ireland), IBM (US), NICE Actimize (Israel), ACI Worldwide (US), SAS Institute (US), RSA Security (US), SAP (Germany), FICO (US), Microsoft (US), F5 (US), AWS (US), Bottomline Technologies (US), ClearSale (Brazil), Genpact (US), Securonix (US), Accertify (US), Feedzai (Portugal), CaseWare (Canada), OneSpan (US), Signifyd (US), BioCatch (Israel), FRISS (Netherlands), MaxMind (US), DataVisor (US), Cleafy (Italy), Gurucul (US), Alloy (US), Castle (US), Enzoic (US), Kubient (US), SpyCloud (US), Seon (Hungary), Deduce (US), Incognia (US), Resistant AI (Czech Republic), Amani Technologies (UAE), JuicyScore (Russia), Fugu (India), and Pipl (US).

The study includes an in-depth competitive analysis of the key players in the fraud detection and prevention market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the fraud detection and prevention market and forecasts its size based on fraud type (check fraud, identity fraud, insider fraud, investment fraud, payment fraud, insurance fraud, friendly fraud, and others), offering (solutions and services), deployment mode (on-premises and cloud), organization size (large enterprises and small and medium enterprises (SMEs)), vertical (banking, financial services, and insurance (banking and financial institutes and insurance), retail & eCommerce, government, healthcare, manufacturing, travel & transportation, real estate, telecommunications, and others) and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall fraud detection and prevention market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rise of synthetic identities, evolving regulatory environment, increased revenue losses and chargebacks due to fraud, growth in instances of fraud, rise in adoption of fraud analytics and risk-based authentication solutions to combat fraud), restraints (rise of synthetic identities, evolving regulatory environment, increased revenue losses and chargebacks due to fraud, growth in instances of fraud, rise in adoption of fraud analytics and risk-based authentication solutions to combat fraud), opportunities (rising use of predictive analytics in FDP, increased adoption of advanced technologies, rising demand for transaction fraud protection-as-a-service among digital payment providers, expansion of application fraud detection solutions across online account onboarding channels, growing use of fraud detection tools by card issuers and payment processors to prevent payment fraud, emergence of crypto-focused fraud prevention use cases with growing DeFi and Web3 transactions) and challenges (cross-channel fraud, lack of trained professionals to analyze fraud attacks)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the fraud detection and prevention market

- Market Development: Comprehensive information about lucrative markets - analyzing the fraud detection and prevention market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Fraud Detection and Prevention market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Fiserv (US), LexisNexis Risk Solutions (US), TransUnion (US), FIS Global (US), Experian (Ireland), IBM (US), NICE Actimize (Israel), ACI Worldwide (US), SAS Institute (US), RSA Security (US), SAP (Germany), FICO (US), Microsoft (US), F5 (US), AWS (US), Bottomline Technologies (US), ClearSale (Brazil), Genpact (US), Securonix (US), Accertify (US), Feedzai (Portugal), CaseWare (Canada), OneSpan (US), Signifyd (US), BioCatch (Israel), FRISS (Netherlands), MaxMind (US), DataVisor (US), Cleafy (Italy), Gurucul (US), Alloy (US), Castle (US), Enzoic (US), Kubient (US), SpyCloud (US), Seon (Hungary), Deduce (US), Incognia (US), Resistant AI (Czech Republic), Amani Technologies (UAE), JuicyScore (Russia), Fugu (India), and Pipl (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR FRAUD DETECTION AND PREVENTION MARKET PLAYERS

- 4.2 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE

- 4.3 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING

- 4.4 FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION

- 4.5 FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE

- 4.6 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE

- 4.7 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE

- 4.8 FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY

- 4.9 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL

- 4.10 RAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE

- 4.11 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in synthetic identities

- 5.2.1.2 Evolving regulatory environment

- 5.2.1.3 Increased revenue losses and chargebacks due to fraud

- 5.2.1.4 Surge in fraudulent activities

- 5.2.1.5 Rise in adoption of fraud analytics and risk-based authentication solutions to combat fraud

- 5.2.2 RESTRAINTS

- 5.2.2.1 False positives with highly sensitive fraud detection systems

- 5.2.2.2 Rise in online fraud complexity

- 5.2.2.3 Privacy concerns related to fraud detection

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of predictive analytics in fraud detection and prevention

- 5.2.3.2 Increased adoption of advanced technologies

- 5.2.3.3 Rising demand for Transaction Fraud Protection-as-a-Service among digital payment providers

- 5.2.3.4 Expansion of application fraud detection solutions across online account onboarding channels

- 5.2.3.5 Growing use of fraud detection tools by card issuers and payment processors to prevent payment fraud

- 5.2.3.6 Emergence of crypto-focused fraud prevention use cases with growing DeFi and Web3 transactions

- 5.2.4 CHALLENGES

- 5.2.4.1 Multifaceted cross-channel fraud

- 5.2.4.2 Lack of trained professionals to analyze fraud attacks

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 ECOSYSTEM ANALYSIS/MARKET MAP

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 PLANNING AND DESIGNING

- 5.6.2 FDP SOLUTION PROVIDERS

- 5.6.3 SYSTEM INTEGRATION

- 5.6.4 DISTRIBUTION

- 5.6.5 END USERS

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF PATENTS IN FRAUD DETECTION AND PREVENTION MARKET, 2023-2025

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 INTRODUCTION

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 KEY REGULATIONS

- 5.8.3.1 Payment Service Directive/Strong Customer Authentication compliance

- 5.8.3.2 Payment card industry data security standard

- 5.8.3.3 Information Technology (IT) Act, 2000

- 5.8.3.4 General data protection regulation compliance

- 5.8.3.5 Anti-money laundering/combating financing of terrorism compliance

- 5.8.3.6 Bank Secrecy Act

- 5.8.3.7 Personal Information Protection and Electronic Documents Act

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING, 2025

- 5.9.2 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Machine learning and artificial intelligence

- 5.10.1.2 Big data analytics

- 5.10.1.3 Predictive analytics

- 5.10.2 COMPLEMENTARY TECHNOLOGY

- 5.10.2.1 Cloud computing

- 5.10.2.2 Authentication

- 5.10.2.3 Encryption

- 5.10.3 ADJACENT TECHNOLOGY

- 5.10.3.1 Internet of Things (IoT)

- 5.10.3.2 Real-time Authentication (RTA)

- 5.10.1 KEY TECHNOLOGY

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SIGNIFYD HELPED BHFO MANAGE FRAUD AND ELIMINATE UNNECESSARY CUSTOMER FRICTION

- 5.11.2 KOUNT HELPED GETTY IMAGES REDUCE CHARGEBACKS AND STAY AHEAD OF FRAUD

- 5.11.3 ACCERTIFY HELPED GUITAR CENTER DOUBLE FRAUD SAVINGS AND REDUCE FRAUD LOSSES BY 62%

- 5.11.4 RISKIFIED HELPED WAYFAIR REDUCE FRAUD COSTS BY 60%

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 INVESTMENT LANDSCAPE

- 5.14 IMPACT OF GENERATIVE AI ON FRAUD DETECTION AND PREVENTION MARKET

- 5.14.1 TOP USE CASES & MARKET POTENTIAL

- 5.14.1.1 Key use cases

- 5.14.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- 5.14.2.1 ANTI-MONEY LAUNDERING MARKET

- 5.14.2.2 EGRC market

- 5.14.2.3 Identity verification market

- 5.14.2.4 Identity and Access Management (IAM)

- 5.14.1 TOP USE CASES & MARKET POTENTIAL

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 TECHNOLOGY ROADMAP

- 5.16.1 FDP TECHNOLOGY ROADMAP TILL 2030

- 5.16.1.1 Short-term roadmap (2025-2026)

- 5.16.1.2 Mid-term roadmap (2027-2028)

- 5.16.1.3 Long-term roadmap (2029-2030)

- 5.16.1 FDP TECHNOLOGY ROADMAP TILL 2030

- 5.17 HISTORY OF FRAUD DETECTION AND PREVENTION MARKET

- 5.17.1 1990S

- 5.17.2 2000-2010

- 5.17.3 2010-2020

- 5.17.4 2020-PRESENT

- 5.18 BEST PRACTICES IN FRAUD DETECTION AND PREVENTION MARKET

6 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.1 INTRODUCTION

- 6.2 KEY TARIFF RATES

- 6.3 PRICE IMPACT ANALYSIS

- 6.4 IMPACT ON COUNTRY/REGION

- 6.4.1 NORTH AMERICA

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.2 EUROPE

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 United Kingdom

- 6.4.3 ASIA PACIFIC

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Australia

- 6.4.1 NORTH AMERICA

- 6.5 INDUSTRIES

7 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE

- 7.1 INTRODUCTION

- 7.1.1 FRAUD TYPE: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 7.1.2 MNM STRATEGIC INSIGHTS OF FRAUD TYPES

- 7.2 CHECK FRAUD

- 7.2.1 TECHNOLOGICAL ADVANCEMENTS AND EFFECTIVENESS OF SECURITY MEASURES TO INFLUENCE MARKET

- 7.3 IDENTITY FRAUD

- 7.3.1 SPIKE IN IDENTITY FRAUD WITH INCREASE IN DIGITAL TRANSACTIONS

- 7.4 INSIDER FRAUD

- 7.4.1 EFFECTIVE PREVENTION, DETECTION, AND RESPONSE MEASURES CRUCIAL FOR RISK MITIGATION

- 7.5 INVESTMENT FRAUD

- 7.5.1 INCREASING ADOPTION OF BLOCKCHAIN AND CRYPTOCURRENCIES TO BOOST MARKET

- 7.6 PAYMENT FRAUD

- 7.6.1 GROWING USE OF CREDIT AND DEBIT CARDS AND DIGITALIZATION OF MONETARY TRANSACTIONS TO ACCELERATE MARKET GROWTH

- 7.7 INSURANCE FRAUD

- 7.7.1 GROWING DEMAND FOR ANALYTICS AND COMPLIANCE SOLUTIONS TO SAFEGUARD POLICYHOLDERS

- 7.8 FRIENDLY FRAUD

- 7.8.1 IMPROVING CUSTOMER COMMUNICATION AND OPTIMIZING FRAUD DETECTION SYSTEMS TO PROPEL MARKET GROWTH

- 7.9 OTHER FRAUD TYPES

8 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.1.1 OFFERING: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 8.1.2 MNM STRATEGIC INSIGHTS OF OFFERING

- 8.2 SOLUTIONS

- 8.2.1 SURGE IN REVENUE LOSS TO DRIVE DEMAND FOR FDP SOLUTIONS

- 8.2.2 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 8.2.3 FRAUD ANALYTICS

- 8.2.3.1 Involves a set of analytical techniques that analyze enterprises' systems and databases to identify vulnerabilities

- 8.2.3.2 Predictive analytics

- 8.2.3.3 Descriptive analytics

- 8.2.3.4 Prescriptive analytics

- 8.2.3.5 Social network analysis

- 8.2.3.6 Text analytics

- 8.2.3.7 Behavioral analytics

- 8.2.4 AUTHENTICATION

- 8.2.4.1 Helps block unauthorized access and identify false user input

- 8.2.4.2 Single-factor authentication

- 8.2.4.3 Multi-factor authentication

- 8.2.4.4 Risk-based authentication

- 8.2.5 GOVERNANCE, RISK, AND COMPLIANCE

- 8.2.5.1 Detects identity fraud, payment fraud, and anti-money laundering scams

- 8.3 SERVICES

- 8.3.1 SERVICES: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 8.3.2 PROFESSIONAL SERVICES

- 8.3.2.1 Surging demand for identification, prevention, and mitigation of fraud risks

- 8.3.2.2 Risk assessment

- 8.3.2.3 Consulting services

- 8.3.2.4 Training and education

- 8.3.2.5 Implementation

- 8.3.3 MANAGED SERVICES

- 8.3.3.1 Help organizations focus on core operations while leveraging expertise of service providers

9 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 9.1.2 MNM STRATEGIC INSIGHTS OF DEPLOYMENT

- 9.2 CLOUD

- 9.2.1 COST-EFFECTIVENESS AND EASE OF SECURING APPLICATIONS ON CLOUD TO BOOST MARKET

- 9.3 ON-PREMISES

- 9.3.1 COMPLETE CONTROL OVER PLATFORMS, SYSTEMS, AND DATA TO BOOST DEMAND FOR ON-PREMISES SOLUTIONS

10 FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY

- 10.1 INTRODUCTION

- 10.1.1 FUNCTIONALITY: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 10.1.2 MNM STRATEGIC INSIGHTS OF FUNCTIONALITY

- 10.2 REAL-TIME DETECTION

- 10.2.1 RISING NEED FOR IDENTIFICATION AND PREVENTION OF FRAUDULENT TRANSACTIONS IN NEAR REAL-TIME TO FOSTER MARKET GROWTH

- 10.3 FORENSIC ANALYSIS

- 10.3.1 FORENSIC ANALYSIS TO HELP ORGANIZATIONS SAFEGUARD OPERATIONS AND ASSETS FROM FRAUDULENT ACTIVITIES

11 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE

- 11.1 INTRODUCTION

- 11.1.1 ORGANIZATION SIZE: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 11.1.2 MNM STRATEGIC INSIGHTS OF ORGANISATIONS

- 11.2 LARGE ENTERPRISES

- 11.2.1 SURGING DEMAND FOR EFFECTIVE MANAGEMENT OF BUSINESS APPLICATIONS TO BOOST MARKET

- 11.3 SMALL & MEDIUM-SIZED ENTERPRISES (SMES)

- 11.3.1 RISING NEED TO PROTECT APPLICATIONS FROM VULNERABILITIES AND ATTACKS TO DRIVE MARKET

12 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.1.1 VERTICAL: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 12.1.2 MNM STRATEGIC INSIGHTS OF VERTICALS

- 12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 12.2.1 RAPID DIGITIZATION OF BANKING AND FINANCIAL SERVICES TO BOOST MARKET GROWTH

- 12.2.2 BANKING

- 12.2.2.1 Tier I

- 12.2.2.2 Tier II

- 12.2.2.3 Tier III

- 12.2.3 FINANCIAL SERVICES

- 12.2.4 INSURANCE

- 12.3 RETAIL & ECOMMERCE

- 12.3.1 INCREASING MONETARY TRANSACTIONS THROUGH DIGITAL CHANNELS TO BOOST MARKET

- 12.4 GOVERNMENT

- 12.4.1 DEPLOYMENT OF DIGITAL APPLICATIONS HANDLING CRITICAL DATA BY GOVERNMENT INSTITUTES TO DRIVE MARKET

- 12.5 HEALTHCARE

- 12.5.1 NEED TO SECURE PRIVATE AND HIGHLY CONFIDENTIAL HEALTHCARE DATA AND PRESERVE TRUST AMONG PATIENTS TO PROPEL MARKET

- 12.6 MANUFACTURING

- 12.6.1 INCREASING INVESTMENTS IN FDP SOLUTIONS TO DRIVE MARKET

- 12.7 TRAVEL & TRANSPORTATION

- 12.7.1 SURGE TO PREVENT FRAUDSTERS FROM TARGETING LOYALTY ACCOUNTS TO BOOST MARKET

- 12.8 REAL ESTATE

- 12.8.1 GROWING PROPERTY FLIPPING FRAUD, MORTGAGE FRAUD, FORECLOSURE FRAUD, AND RENTAL FRAUD TO DRIVE MARKET

- 12.9 TELECOMMUNICATIONS

- 12.9.1 INCREASING DEMAND FOR MITIGATION OF FRAUDULENT ACTIVITIES AND PROTECTION OF CUSTOMER INTERESTS TO FOSTER MARKET GROWTH

- 12.10 OTHER VERTICALS

13 FRAUD DETECTION AND PREVENTION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 13.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.3 NORTH AMERICA: MNM STRATEGIC INSIGHTS

- 13.2.4 NORTH AMERICA: REGULATORY LANDSCAPE

- 13.2.5 US

- 13.2.5.1 Increased technological advancements, regulatory norms, and evolving fraud types to drive market

- 13.2.6 CANADA

- 13.2.6.1 Rise in fraudulent activities and increased threat of deepfakes to propel market

- 13.3 EUROPE

- 13.3.1 EUROPE: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 13.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.3 EUROPE: MNM STRATEGIC INSIGHTS

- 13.3.4 EUROPE: REGULATORY LANDSCAPE

- 13.3.5 UK

- 13.3.5.1 Increased government initiatives to combat fraud to boost market

- 13.3.6 GERMANY

- 13.3.6.1 Rising adoption of FDP solutions by banks and financial institutions to drive market

- 13.3.7 FRANCE

- 13.3.7.1 Implementation of stringent regulations to fuel market growth

- 13.3.8 SPAIN

- 13.3.8.1 Increased government initiatives and strict regulations to boost market growth

- 13.3.9 ITALY

- 13.3.9.1 Continued investment in technology and awareness regarding cybersecurity to propel market growth

- 13.3.10 POLAND

- 13.3.10.1 Government initiatives to combat fraud and investments in advanced technology to bolster market growth

- 13.3.11 IRELAND

- 13.3.11.1 Advancements in technologies and innovations in fraud prevention solutions to boost market

- 13.3.12 CZECH REPUBLIC

- 13.3.12.1 Spike in fraud, embezzlement, and money laundering in finance, insurance, and real estate sectors to drive market

- 13.3.13 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.3 ASIA PACIFIC: MNM STRATEGIC INSIGHTS

- 13.4.4 ASIA PACIFIC: REGULATORY LANDSCAPE

- 13.4.5 CHINA

- 13.4.5.1 Growing threat of online scammers and rising internet fraud to boost market

- 13.4.6 JAPAN

- 13.4.6.1 Implementation of robust internal controls for prevention of fraud incidents to boost market

- 13.4.7 AUSTRALIA AND NEW ZEALAND

- 13.4.7.1 Regulatory requirements aimed at improving data security and customer privacy to fuel market growth

- 13.4.8 INDIA

- 13.4.8.1 Increased internet penetration, improved telecom services, and government initiatives to drive market

- 13.4.9 SINGAPORE

- 13.4.9.1 Growing emphasis on cybersecurity measures to bolster market growth

- 13.4.10 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 13.5.3 MIDDLE EAST & AFRICA: MNM STRATEGIC INSIGHTS

- 13.5.4 GCC

- 13.5.4.1 UAE

- 13.5.4.1.1 Increased government initiatives with increasing prevalence of fraudulent activities to accelerate market growth

- 13.5.4.2 Saudi Arabia

- 13.5.4.2.1 Increasing fraud awareness to boost market

- 13.5.4.3 Rest of the GCC countries

- 13.5.4.1 UAE

- 13.5.5 SOUTH AFRICA

- 13.5.5.1 Rise in mobile and internet penetration and rapid digitalization to accelerate market growth

- 13.5.6 REST OF MIDDLE EAST & AFRICA

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

- 13.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.6.3 LATIN AMERICA: MNM STRATEGIC INSIGHTS

- 13.6.4 BRAZIL

- 13.6.4.1 Increased digitalization and adoption of digital payments to drive market

- 13.6.5 MEXICO

- 13.6.5.1 Increased requirement to protect sensitive information to drive adoption of FDP solutions

- 13.6.6 COLOMBIA

- 13.6.6.1 Increasing financial crimes and rapid investments in advanced technologies to drive market

- 13.6.7 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2019-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 PRODUCT/BRAND COMPARISON

- 14.5.1 FISERV

- 14.5.2 LEXISNEXIS

- 14.5.3 TRANSUNION

- 14.5.4 FIS GLOBAL

- 14.5.5 NICE ACTIMIZE

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6.1 COMPANY VALUATION, 2025

- 14.6.2 FINANCIAL METRICS USING EV/EBIDTA

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Offering footprint

- 14.7.5.3 Fraud type footprint

- 14.7.5.4 Vertical footprint

- 14.7.5.5 Region footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 MAJOR PLAYERS

- 15.1.1 FISERV

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 LEXISNEXIS RISK SOLUTIONS

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 TRANSUNION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 FIS GLOBAL

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 NICE ACTIMIZE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 EXPERIAN

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.7 IBM

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 ACI WORLDWIDE

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 SAS INSTITUTE

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 RSA SECURITY

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 SAP

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 FICO

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 MICROSOFT

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.13.3.2 Deals

- 15.1.14 F5

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.14.3.2 Deals

- 15.1.15 AWS

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Deals

- 15.1.16 BOTTOMLINE TECHNOLOGIES

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Product launches

- 15.1.16.3.2 Deals

- 15.1.17 CLEARSALE

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Solutions/Services offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Product launches

- 15.1.17.3.2 Deals

- 15.1.18 GENPACT

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Solutions/Services offered

- 15.1.19 SECURONIX

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Solutions/Services offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Product launches

- 15.1.19.3.2 Deals

- 15.1.20 ACCERTIFY

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Solutions/Services offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Deals

- 15.1.21 FEEDZAI

- 15.1.21.1 Business overview

- 15.1.21.2 Products/Solutions/Services offered

- 15.1.21.3 Recent developments

- 15.1.21.3.1 Product launches

- 15.1.21.3.2 Deals

- 15.1.22 CASEWARE

- 15.1.22.1 Business overview

- 15.1.22.2 Products/Solutions/Services offered

- 15.1.23 ONESPAN

- 15.1.23.1 Business overview

- 15.1.23.2 Products/Solutions/Services offered

- 15.1.23.3 Recent developments

- 15.1.23.3.1 Product launches

- 15.1.23.3.2 Deals

- 15.1.24 SIGNIFYD

- 15.1.24.1 Business overview

- 15.1.24.2 Products/Solutions/Services offered

- 15.1.24.3 Recent developments

- 15.1.24.3.1 Product launches

- 15.1.24.3.2 Deals

- 15.1.25 BIOCATCH

- 15.1.25.1 Business overview

- 15.1.25.2 Products/Solutions/Services offered

- 15.1.25.3 Recent developments

- 15.1.25.3.1 Product launches

- 15.1.25.3.2 Deals

- 15.1.26 FRISS

- 15.1.26.1 Business overview

- 15.1.26.2 Products/Solutions/Services offered

- 15.1.26.3 Recent developments

- 15.1.26.3.1 Deals

- 15.1.27 MAXMIND

- 15.1.27.1 Business overview

- 15.1.27.2 Products/Solutions/Services offered

- 15.1.28 DATAVISOR

- 15.1.28.1 Business overview

- 15.1.28.2 Products/Solutions/Services offered

- 15.1.28.3 Recent developments

- 15.1.28.3.1 Product launches

- 15.1.28.3.2 Deals

- 15.1.29 CLEAFY

- 15.1.29.1 Business overview

- 15.1.29.2 Products/Solutions/Services offered

- 15.1.30 GURUCUL

- 15.1.30.1 Business overview

- 15.1.30.2 Products/Solutions/Services offered

- 15.1.31 RISKIFIED

- 15.1.31.1 Business overview

- 15.1.31.2 Products/Solutions/Services offered

- 15.1.31.3 Recent developments

- 15.1.31.3.1 Product launches

- 15.1.31.3.2 Deals

- 15.1.32 THOMSON REUTERS

- 15.1.32.1 Business overview

- 15.1.32.2 Products/Solutions/Services offered

- 15.1.32.3 Recent developments

- 15.1.32.3.1 Product launches

- 15.1.32.3.2 Deals

- 15.1.33 SIFT

- 15.1.33.1 Business overview

- 15.1.33.2 Products/Solutions/Services offered

- 15.1.33.3 Recent developments

- 15.1.33.3.1 Deals

- 15.1.34 NOFRAUD

- 15.1.34.1 Business overview

- 15.1.34.2 Products/Solutions/Services offered

- 15.1.35 FEATURESPACE

- 15.1.35.1 Business overview

- 15.1.35.2 Products/Solutions/Services offered

- 15.1.35.3 Recent developments

- 15.1.35.3.1 Product launches

- 15.1.35.3.2 Deals

- 15.1.36 XTN COGNITIVE SECURITY

- 15.1.36.1 Business overview

- 15.1.36.2 Products/Solutions/Services offered

- 15.1.37 EQUIFAX

- 15.1.37.1 Business overview

- 15.1.37.2 Products/Solutions/Services offered

- 15.1.37.3 Recent developments

- 15.1.37.3.1 Product launches

- 15.1.37.3.2 Deals

- 15.1.38 ALFA GROUP

- 15.1.38.1 Business Overview

- 15.1.38.2 Products/Solutions/Services offered

- 15.1.39 PING IDENTITY

- 15.1.39.1 Business Overview

- 15.1.39.2 Products/Solutions/Services offered

- 15.1.39.3 Recent developments

- 15.1.39.3.1 Product launches

- 15.1.39.3.2 Deals

- 15.1.40 GFT TECHNOLOGIES

- 15.1.40.1 Business Overview

- 15.1.40.2 Products/Solutions/Services offered

- 15.1.40.3 Recent developments

- 15.1.40.3.1 Deals

- 15.1.41 GBG

- 15.1.41.1 Business Overview

- 15.1.41.2 Products/Solutions/Services offered

- 15.1.41.3 Recent developments

- 15.1.41.3.1 Product launches

- 15.1.41.3.2 Deals

- 15.1.42 KROLL

- 15.1.42.1 Business Overview

- 15.1.42.2 Products/Solutions/Services offered

- 15.1.42.3 Recent developments

- 15.1.42.3.1 Product launches

- 15.1.1 FISERV

- 15.2 OTHER KEY PLAYERS

- 15.2.1 ALLOY

- 15.2.2 CASTLE

- 15.2.3 ENZOIC

- 15.2.4 KUBIENT

- 15.2.5 SPYCLOUD

- 15.2.6 SEON

- 15.2.7 DEDUCE

- 15.2.8 INCOGNIA

- 15.2.9 RESISTANT AI

- 15.2.10 AMANI TECHNOLOGIES

- 15.2.11 JUICYSCORE

- 15.2.12 FUGU

- 15.2.13 PIPL

16 ADJACENT MARKETS

- 16.1 INTRODUCTION TO ADJACENT MARKETS

- 16.1.1 LIMITATIONS

- 16.2 ANTI-MONEY LAUNDERING (AML) MARKET

- 16.3 EGRC MARKET

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS