|

시장보고서

상품코드

1782034

안티몬 프리 폴리에스테르 시장 예측(-2030년) : 제품 유형별, 촉매별, 최종 용도 산업별, 지역별Antimony-free Polyesters Market by Product Type (Polyethylene Terephthalate, Polytrimethylene Terephthalate, Polybutylene Terephthalate ), Catalyst, End-use Industry, & Region - Global Forecast to 2030 |

||||||

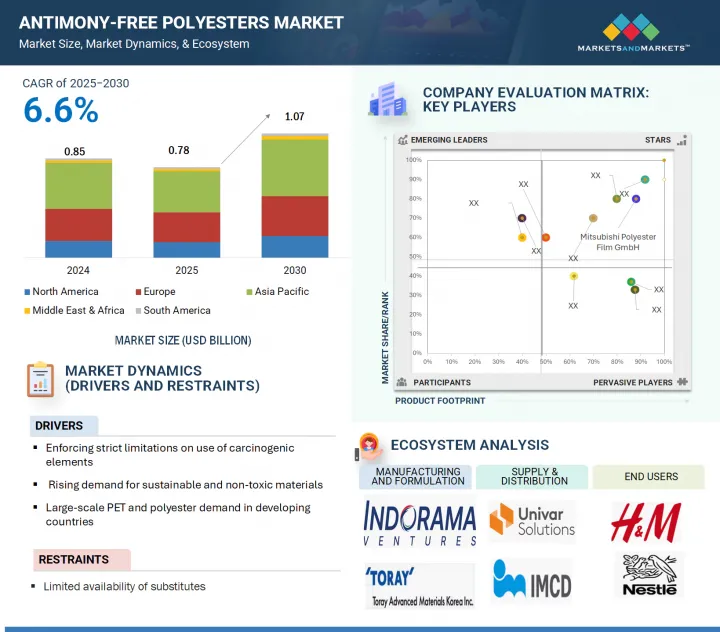

세계의 안티몬 프리 폴리에스테르 시장 규모는 2025년 7억 8,000만 달러에서 2030년까지 10억 7,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 6.6%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(100만 달러/10억 달러), 킬로톤 |

| 부문 | 제품 유형, 촉매, 최종 용도 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미 |

안티몬 프리 폴리에스테르에 대한 수요는 최종 제품에 독성 잔류물을 남길 수 있는 기존 안티몬 기반 촉매와 관련된 건강 및 환경 문제로 인해 증가하고 있습니다. 북미와 유럽의 규제 압력에 대응하고 식품 포장, 섬유, 의료기기 및 기타 무독성 및 지속가능성을 우선시하는 용도에서 폴리에스테르의 사용이 증가함에 따라 제조업체는 적극적으로 대안을 찾고 있습니다. 안티몬이 없는 폴리에스터는 재활용성이 뛰어나 전 세계의 지속가능성을 위한 노력을 지원하고 있습니다. 소비자의 인식이 높아지고 각 브랜드가 친환경 제품을 지향함에 따라 포장, 섬유, 자동차, 전자 등 다양한 산업에서 안티몬 프리 폴리에스테르에 대한 수요가 증가할 것으로 예측됩니다.

"폴리트리메틸렌 테레프탈레이트(PTT) 부문은 예측 기간 중 안티몬 프리 폴리에스테르 시장에서 금액 기준으로 가장 빠른 성장을 기록할 것으로 예측됩니다. "

폴리트리메틸렌 테레프탈레이트(PTT)는 고성능성 및 지속가능한 섬유 용도에서의 사용 증가로 인해 안티몬 프리 폴리에스테르 시장에서 빠르게 성장하고 있는 분야입니다. PTT는 우수한 신축성, 부드러운 질감, 선명한 염색성 등 여러 가지 중요한 장점을 가지고 있으며, 카펫, 스포츠웨어, 홈텍스타일에 이상적입니다. 더 부드럽고, 더 오래가고, 더 아름다운 섬유에 대한 소비자의 요구가 증가함에 따라 제조업체들은 이러한 요구를 충족시키기 위해 PTT에 주목하고 있습니다. 섬유 가공 기술의 발전으로 PTT 생산의 비용 효율성과 효율성이 높아진 것도 이러한 성장에 힘을 실어주고 있습니다. 또한 제조 공정에서 안티몬과 같은 독성 물질을 제거하는 것에 대한 규제에 대한 관심이 높아짐에 따라 PTT는 현재 티타늄계 시스템과 같은 보다 안전한 촉매를 사용하여 대규모로 생산되고 있습니다.

"티타늄 기반 촉매 부문은 예측 기간 중 안티몬 프리 폴리에스테르 시장에서 금액 기준으로 가장 빠른 성장을 기록할 것으로 예측됩니다. "

티타늄계 촉매는 안전성, 효율성, 기존 생산 방식과의 적합성으로 인해 안티몬 프리 폴리에스터 시장에서 가장 빠르게 성장하는 분야입니다. 특히 섬유, 식품 포장 등의 분야에서 안티몬의 독성에 대한 우려가 커지면서 산업계는 무독성 촉매로 빠르게 전환하고 있습니다. 티타늄계 촉매는 건강과 환경에 대한 위험이 없기 때문에 특히 선호되고 있습니다. 티타늄계 촉매는 열 안정성이 높고, 폴리머의 투명성을 유지합니다. 또한 보다 원활한 가공을 가능하게 하여 투명병, 고성능성 섬유, 의료용 소재 생산에 필수적인 높은 품질을 보장합니다. 다른 촉매와 달리 티타늄 촉매는 최소한의 수정으로 기존 생산 라인에 쉽게 통합할 수 있으므로 제조업체에게 경제적인 선택이 될 수 있습니다.

"포장 부문은 예측 기간 중 안티몬 프리 폴리에스테르 시장에서 금액 기준으로 가장 빠른 성장을 보일 것으로 예측됩니다. "

안티몬 프리 폴리에스테르 포장재는 기존 안티몬 촉매 PET와 관련된 건강, 안전, 환경 문제가 대두되면서 시장에서 가장 빠르게 성장하는 분야입니다. 식품 및 음료 용기, 특히 플라스틱 병에 안티몬이 함유되어 있으며, 규제 당국과 소비자들 사이에서 경각심이 높아지고 있습니다. 이 문제를 해결하기 위해 유럽연합(EU), 일본, 한국 등의 국가에서는 엄격한 규제를 마련하고 보다 안전한 대체품의 채택을 장려하고 있습니다. 이러한 규제 움직임과 무해하고 지속가능한 포장에 대한 소비자의 인식과 수요 증가로 인해 안티몬 프리 폴리에스테르의 사용이 빠르게 증가하고 있습니다. 주요 일용소비재(FMCG) 및 음료 제조업체들도 지속가능성 전략의 일환으로 지속가능하고 표준에 부합하는 포장 형태로의 전환을 추진하고 있습니다. 안티몬이 없는 폴리에스테르, 특히 티타늄계 촉매를 사용하여 생산된 PET는 건강 기준을 충족하면서 동일한 성능 특성을 유지합니다.

세계의 안티몬 프리 폴리에스테르 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 안티몬 프리 폴리에스테르 시장에서의 매력적인 기회

- 안티몬 프리 폴리에스테르 시장 : 제품 유형별

- 안티몬 프리 폴리에스테르 시장 : 최종 용도 산업별

- 안티몬 프리 폴리에스테르 시장 : 촉매별

- 안티몬 프리 폴리에스테르 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 안티몬 프리 폴리에스테르 시장에서 생성형 AI의 영향

- 서론

- 안티몬 프리 폴리에스테르 산업의 형성에서 생성형 AI의 역할

제6장 산업 동향

- 서론

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 안티몬 프리 폴리에스테르 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 주요 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

- 공급망 분석

- 가격 분석

- 평균 판매 가격 동향 : 지역별(2021-2024년)

- 평균 판매 가격 동향 : 제품 유형별(2021-2024년)

- 평균 판매 가격 동향 : 촉매별(2021-2024년)

- 평균 판매 가격 동향 : 최종 용도 산업별(2021-2024년)

- 주요 기업의 평균 판매 가격 동향 : 제품 유형별(2024년)

- 투자와 자금조달 시나리오

- 에코시스템 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 조사 방법

- 전 세계에서 취득된 특허

- 특허 공보 동향

- 인사이트

- 특허 법적 지위

- 관할 분석

- 주요 출원자

- 주요 특허 리스트

- 무역 분석

- 수입 시나리오(HS 코드 282300)

- 수출 시나리오(HS 코드 282300)

- 주요 컨퍼런스와 이벤트

- 관세와 규제 상황

- 안티몬 프리 폴리에스테르에 관한 관세

- 규제기관, 정부기관, 기타 조직

- 안티몬 프리 폴리에스테르에 관한 규제와 기준

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

제7장 안티몬 프리 폴리에스테르 시장 : 제품 유형별

- 서론

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리트리메틸렌 테레프탈레이트(PTT)

- 폴리부틸렌 테레프탈레이트(PBT)

제8장 안티몬 프리 폴리에스테르 시장 : 촉매별

- 서론

- 티타늄계 촉매

- 알루미늄계 촉매

- 티타늄 마그네슘계 촉매

- 기타 촉매

- 아연계 촉매

- 게르마늄계 촉매

- 코발트계 촉매

- 유기 금속 화합물

- 비스무트계 촉매

제9장 안티몬 프리 폴리에스테르 시장 : 최종 용도 산업별

- 서론

- 텍스타일

- 포장

- 자동차

- 건설

- 기타 최종 용도 산업

- 의료

- 항공우주

- 재생에너지

- CE(Consumer Electronics)

제10장 안티몬 프리 폴리에스테르 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 기타 유럽

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제11장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- MITSUBISHI POLYESTER FILM GMBH

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- TORAY ADVANCED MATERIALS KOREA INC.

- TEIJIN LIMITED

- RELIANCE INDUSTRIES LIMITED

- FATRA, A.S.

- POLYPLEX

- NAN YA PLASTICS CORPORATION

- UFLEX LIMITED

- CHANG CHUN GROUP

- 기타 기업

- HUBEI DECON POLYESTER CO., LTD.

- TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD

- PT ASIA PACIFIC FIBERS TBK.

- HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD.

- ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.

- LEADEX & CO.

- ESTER

- JBF BAHRAIN W.L.L.

- SUZHOU CHUNSHENG ENVIRONMENTAL PROTECTION FIBER CO., LTD.

- HANGZHOU DENGTE TEXTILE MACHINERY CO., LTD.

- JUNISH

- TMMFA LIMITED

- NANTONG YANHUANG IMPORT & EXPORT CO., LTD.

제13장 부록

KSA 25.08.11The antimony-free polyesters market size is projected to grow from usd 0.78 billion in 2025 to USD 1.07 billion by 2030, registering a CAGR of 6.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Product Type, Catalyst, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The demand for antimony-free polyesters has increased due to health and environmental concerns related to traditional antimony-based catalysts, which can leave toxic residues in the final products. Manufacturers are actively seeking alternatives in response to regulatory pressures from North America and Europe, as well as the growing use of polyester in food packaging, textiles, medical devices, and other applications that prioritize non-toxicity and sustainability. Antimony-free polyesters offer a greater degree of recyclability and support global sustainability initiatives. As consumer awareness grows and brands increasingly align themselves with eco-friendly products, the demand for antimony-free polyesters is expected to rise across various industries, including packaging, textiles, automotive, and electronics.

"Polytrimethylene terephthalate (PTT) segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Polytrimethylene terephthalate (PTT) is rapidly becoming the fastest-growing segment in the antimony-free polyester market due to its increasing use in high-performance and sustainable textile applications. PTT offers several key advantages, including excellent elasticity, a soft texture, and vibrant dyeability, making it ideal for carpets, sportswear, and home textiles. As consumer demand for softer, longer-lasting, and visually appealing fabrics rises, manufacturers are turning to PTT to meet these needs. This growth is also fueled by advancements in fiber processing technologies, which have enhanced the cost-effectiveness and efficiency of PTT production. Furthermore, with a growing regulatory focus on eliminating toxic materials like antimony from manufacturing processes, PTT is now being produced on a larger scale using safer catalysts, such as titanium-based systems.

"The titanium-based catalysts segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Titanium-based catalysts are the fastest-growing segment of the antimony-free polyesters market due to their safety, efficiency, and compatibility with current manufacturing practices. With increasing concerns about the toxicity of antimony-especially in applications like textiles and food packaging-industries are rapidly shifting toward non-toxic catalysts. Titanium-based catalysts are particularly favored because they do not present health or environmental risks. They offer high thermal stability and maintain polymer clarity. Additionally, they facilitate smoother processing and ensure high product quality, which is essential for producing clear bottles, high-performance fibers, and medical-grade materials. Unlike other catalysts, titanium catalysts can be easily integrated into existing production lines with minimal modifications, making them an economical choice for manufacturers.

"Packaging segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Antimony-free polyester packaging is the fastest-growing segment within the market due to heightened health, safety, and environmental concerns associated with conventional antimony-catalyzed PET. The presence of antimony in food and beverage containers, particularly PET bottles, has raised alarms among regulators and consumers. To address this issue, strict regulations in countries such as the European Union, Japan, and South Korea are encouraging the adoption of safer alternatives. This regulatory movement, combined with a growing consumer awareness and demand for non-toxic and sustainable packaging, is driving the rapid increase in the use of antimony-free polyester. Major fast-moving consumer goods (FMCG) and beverage companies are also transitioning to sustainable and compliant packaging formats as part of their sustainability strategies. Antimony-free polyester, especially PET produced with titanium-based catalysts, maintains the same performance attributes while complying with health standards.

"Asia Pacific is projected to be the fastest-growing region in the antimony-free polyesters market, in terms of value, during the forecast period.

The Asia Pacific region is the fastest-growing market for antimony-free polyesters, driven by a combination of industrial, consumer, and regulatory factors. Countries like China, Japan, and South Korea are implementing stricter environmental and health regulations aimed at reducing the use of heavy metals, such as antimony, in manufacturing processes. As a result, polyester manufacturers are turning to safer alternatives, such as titanium- and aluminum-based catalysts. Additionally, Asia Pacific is home to some of the world's largest textile and packaging production centers, which create significant downstream demand for antimony-free polyesters. The rising middle class and increased awareness of environmental issues are also influencing consumer preferences toward sustainable and non-toxic products. Furthermore, urbanization, industrialization, and regional exports are driving the demand for compliant and environmentally friendly materials, including antimony-free polyesters.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the antimony-free polyesters market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, Middle East & Africa- 5%, and South America - 5%

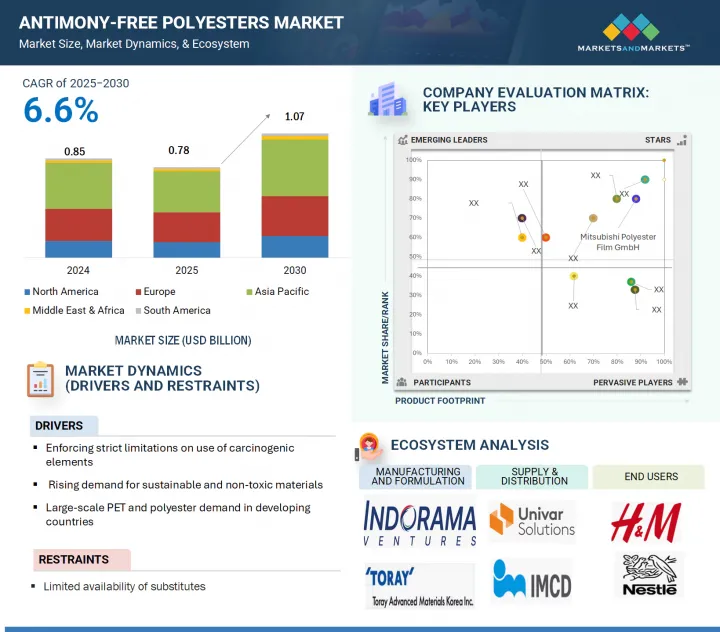

The antimony-free polyesters market comprises major players such as Mitsubishi Polyester Film GmbH (Germany), Ester Industries Ltd. (India), Indorama Ventures Public Company Limited (Thailand), Toray Advanced Materials Korea Inc. (South Korea), NAN YA PLASTICS CORPORATION (Taiwan), HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD. (China), PT Asia Pacific Fibers Tbk (Indonesia), TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD (China), Amerex Hubei Decon Polyester Co., Ltd. (China), and ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.. (China). The study includes an in-depth competitive analysis of these key players in the antimony-free polyesters market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for antimony-free polyesters on the basis of product type, catalyst, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the antimony-free polyesters market.

Key Benefits of Buying This Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the antimony-free polyesters market; high-growth regions; and market drivers, restraints, opportunities, and challenges. The report provides insights on the following pointers:

- Analysis of drivers: (rising demand for sustainable and non-toxic materials), restraints (limited availability of substitutes against antimony), opportunities (expanding use of PET in high-growth regions), and challenges (performance optimization in the production of antimony-free catalysts) influencing the growth of the antimony-free polyesters market.

- Market Penetration: Comprehensive information on antimony-free polyesters offered by top players in the antimony-free polyesters market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, expansions, investments, collaborations, and partnerships in the market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the antimony-free polyesters market across regions.

- Market Capacity: Production capacities of companies producing antimony-free polyesters are provided wherever available, with upcoming capacities for the antimony-free polyesters market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the antimony-free polyesters market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key primary participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANTIMONY-FREE POLYESTERS MARKET

- 4.2 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE

- 4.3 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY

- 4.4 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST

- 4.5 ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strict limitations on use of carcinogenic elements

- 5.2.1.2 Rising demand for sustainable and non-toxic materials

- 5.2.1.3 Large-scale PET and polyester demand in developing countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in catalyst development

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory compliance across regions for use of toxic chemicals

- 5.2.4.2 Performance optimization in production of antimony-free polyesters

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON ANTIMONY-FREE POLYESTERS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 ROLE OF GENERATIVE AI IN SHAPING ANTIMONY-FREE POLYESTERS INDUSTRY

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 IMPACT OF 2025 US TARIFF ON ANTIMONY-FREE POLYESTERS MARKET

- 6.3.1 INTRODUCTION

- 6.3.2 KEY TARIFF RATES

- 6.3.3 PRICE IMPACT ANALYSIS

- 6.3.4 IMPACT ON KEY COUNTRY/REGION

- 6.3.4.1 US

- 6.3.4.2 Europe

- 6.3.4.3 Asia Pacific

- 6.3.5 IMPACT ON END-USE INDUSTRIES

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE TREND, BY CATALYST, 2021-2024

- 6.5.4 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2021-2024

- 6.5.5 AVERAGE SELLING PRICE TREND OF KEY PLAYER, BY PRODUCT TYPE, 2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 282300)

- 6.10.2 EXPORT SCENARIO (HS CODE 282300)

- 6.11 KEY CONFERENCES AND EVENTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFFS RELATED TO ANTIMONY-FREE POLYESTERS

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS AND STANDARDS RELATED TO ANTIMONY-FREE POLYESTERS

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 INNOVATING SUSTAINABILITY WITH HUBEI DECON POLYESTER CO., LTD.

- 6.16.2 TWD FIBRES GMBH'S SUSTAINABLE YARN REVOLUTION

- 6.16.3 INDORAMA VENTURES' GLOBAL EXPANSION IN ANTIMONY-FREE PET

7 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 POLYETHYLENE TEREPHTHALATE (PET)

- 7.2.1 EXTENSIVE USE IN VARIOUS SECTORS TO DRIVE MARKET

- 7.3 POLYTRIMETHYLENE TEREPHTHALATE (PTT)

- 7.3.1 ELASTICITY, RESILIENCE, AND STAIN RESISTANCE TO DRIVE ADOPTION

- 7.4 POLYBUTYLENE TEREPHTHALATE (PBT)

- 7.4.1 GROWING DEMAND FOR ECO-FRIENDLY ENGINEERING PLASTICS TO DRIVE MARKET

8 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST

- 8.1 INTRODUCTION

- 8.2 TITANIUM-BASED CATALYSTS

- 8.2.1 HIGH THERMAL STABILITY, LOW TOXICITY, AND ABILITY TO PRODUCE HIGH-QUALITY, FOOD-SAFE POLYESTER PRODUCTS TO DRIVE MARKET

- 8.3 ALUMINUM-BASED CATALYSTS

- 8.3.1 COST-EFFECTIVE AND ECO-FRIENDLY NATURE TO DRIVE ADOPTION

- 8.4 TITANIUM-MAGNESIUM-BASED CATALYSTS

- 8.4.1 NON-TOXICITY, COMPLIANCE WITH ENVIRONMENTAL REGULATIONS, AND ABILITY TO REDUCE SIDE REACTIONS TO DRIVE MARKET

- 8.5 OTHER CATALYSTS

- 8.5.1 ZINC-BASED CATALYSTS

- 8.5.2 GERMANIUM-BASED CATALYSTS

- 8.5.3 COBALT-BASED CATALYSTS

- 8.5.4 ORGANOMETALLIC COMPOUNDS

- 8.5.5 BISMUTH-BASED CATALYSTS

9 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 TEXTILE

- 9.2.1 COST-EFFECTIVE AND ECO-FRIENDLY TEXTILE PRODUCTION WITH ALUMINUM CATALYSTS TO DRIVE MARKET

- 9.3 PACKAGING

- 9.3.1 INCREASING FOCUS ON FOOD SAFETY AND REGULATORY COMPLIANCE TO PROPEL MARKET

- 9.4 AUTOMOTIVE

- 9.4.1 RISING DEMAND FOR LIGHTWEIGHT, THERMALLY STABLE MATERIALS TO ENHANCE FUEL EFFICIENCY AND COMPLY WITH ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 9.5 CONSTRUCTION

- 9.5.1 GROWING PREFERENCE FOR SUSTAINABLE, LOW-TOXICITY BUILDING MATERIALS TO SUPPORT MARKET GROWTH

- 9.6 OTHER END-USE INDUSTRIES

- 9.6.1 MEDICAL AND HEALTHCARE

- 9.6.2 AEROSPACE

- 9.6.3 RENEWABLE ENERGY

- 9.6.4 CONSUMER ELECTRONICS

10 ANTIMONY-FREE POLYESTERS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Regulatory push for sustainability to drive adoption

- 10.2.2 JAPAN

- 10.2.2.1 Technological advancements to propel market growth

- 10.2.3 INDIA

- 10.2.3.1 Sustainability focus to boost market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Technological innovation to accelerate market growth

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Stringent regulatory framework to drive market growth

- 10.3.2 CANADA

- 10.3.2.1 Sustainability focus to propel market

- 10.3.3 MEXICO

- 10.3.3.1 Industrial growth to fuel demand

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Sustainable packaging solutions to drive demand

- 10.4.2 ITALY

- 10.4.2.1 Green transition to drive demand

- 10.4.3 FRANCE

- 10.4.3.1 Growing demand for PET across packaging, textile, and automotive industries to propel market

- 10.4.4 UK

- 10.4.4.1 Growing focus on renewable energy and alignment with stringent European regulatory standards to drive market

- 10.4.5 SPAIN

- 10.4.5.1 Adherence to stringent European regulations to drive demand

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Strong incentives and policies supporting sustainability initiatives to drive market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Vision 2030 and regulatory reforms to propel market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Expanding industrial sector to propel market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Health and safety concerns to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Sustainability and circular economy support to propel market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Product type footprint

- 11.6.5.3 End-use industry footprint

- 11.6.5.4 Catalyst footprint

- 11.6.5.5 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MITSUBISHI POLYESTER FILM GMBH

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 INDORAMA VENTURES PUBLIC COMPANY LIMITED

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 TORAY ADVANCED MATERIALS KOREA INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 TEIJIN LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 RELIANCE INDUSTRIES LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 FATRA, A.S.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Key strengths

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 POLYPLEX

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 NAN YA PLASTICS CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 UFLEX LIMITED

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 CHANG CHUN GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Key strengths

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 MITSUBISHI POLYESTER FILM GMBH

- 12.2 OTHER PLAYERS

- 12.2.1 HUBEI DECON POLYESTER CO., LTD.

- 12.2.2 TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD

- 12.2.3 PT ASIA PACIFIC FIBERS TBK.

- 12.2.4 HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD.

- 12.2.5 ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.

- 12.2.6 LEADEX & CO.

- 12.2.7 ESTER

- 12.2.8 JBF BAHRAIN W.L.L.

- 12.2.9 SUZHOU CHUNSHENG ENVIRONMENTAL PROTECTION FIBER CO., LTD.

- 12.2.10 HANGZHOU DENGTE TEXTILE MACHINERY CO., LTD.

- 12.2.11 JUNISH

- 12.2.12 TMMFA LIMITED

- 12.2.13 NANTONG YANHUANG IMPORT & EXPORT CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS