|

시장보고서

상품코드

1782040

군용 커넥터 시장 예측(-2030년) : 형상별, 유형별, 플랫폼별, 판매 시점별, 지역별Military Connectors Market by Shape {Circular [Mil-DTL-(38999,26482,5015)], Rectangular [MIL-DTL-(24308, 83513, 55302)]}, Type (Power, Signal, Data, RF & Microwave, Fiber Optic, Hybrid), Platform, Point of Sale and Region - Global Forecast to 2030 |

||||||

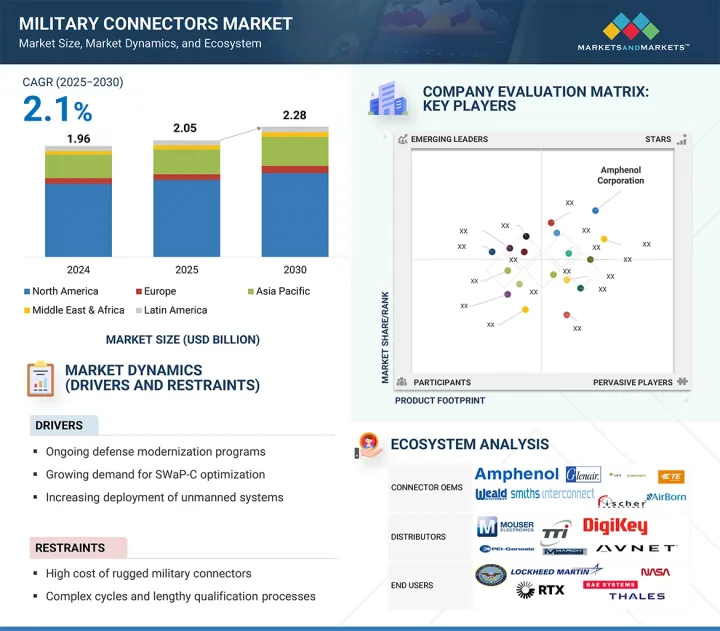

세계의 군용 커넥터 시장 규모는 2025년 20억 5,000만 달러에서 2030년까지 22억 8,000만 달러에 달할 것으로 예측되며, CAGR로 2.1%의 성장이 전망됩니다.

C4ISR, 전자전, 무인항공기 등 첨단 방어 시스템에 사용되는 강력하고 탄력적인 상호연결 솔루션이 시장을 주도하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 형상, 유형, 플랫폼, 판매 시점, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

군용 자산의 현대화, 열악한 환경에서의 안전한 데이터 전송 및 전력 전송에 대한 필요성이 증가하고 있는 것도 성장을 가속하고 있습니다. 국방비 증가와 자율 플랫폼에 대한 투자는 소형 고성능 커넥터에 대한 수요를 유발하고 있습니다.

"원형 부문은 예측 기간 중 군용 커넥터 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. "

원형 부문은 육상, 항공, 해상 방위 차량에 널리 사용되므로 군용 커넥터 시장에서 가장 큰 점유율을 차지하고 있습니다. 원형 커넥터는 작고 내구성이 뛰어나며, 미션 크리티컬한 용도에서 쉽게 결합할 수 있다는 점에서 선택됩니다. 원형 커넥터는 통신, 항공전자, 레이더, 군인이 착용하는 장비 등의 전력, 신호, 데이터를 전송합니다. 충격, 진동, EMI 등 가혹한 환경에 대한 내구성이 뛰어나 국방용으로 적합합니다.

"우주 부문은 예측 기간 중 군용 커넥터 시장에서 가장 빠른 성장세를 보일 것으로 예측됩니다. "

우주 부문이 군용 커넥터 시장에서 급성장하고 있는 이유는 위성, 우주 감시 시스템, 국방 페이로드에서 소형 고성능 커넥터에 대한 요구가 증가하고 있기 때문입니다. 우주 작전을 위한 군용 커넥터는 극한의 온도, 진공 상태, 방사선을 견뎌야 하며, 지속적인 신호와 전력 공급을 보장해야 합니다. 이 커넥터는 군용 통신 위성, 조기 경보 시스템, 안전한 우주 기반 데이터 링크에 필수적인 역할을 하고 있습니다.

"유럽은 예측 기간 중 군용 커넥터 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

유럽은 국방비 지출, 지역 안보 우려, 강력한 산업 기반 등으로 인해 군용 커넥터 시장에서 가장 빠르게 성장하고 있습니다. 각국은 지상, 해상, 항공 시스템 업그레이드에 많은 투자를 하고 있으며, 이러한 시스템에는 견고하고 고성능의 커넥터가 필요합니다. 현재와 미래의 국방 프로젝트는 모두 디지털 병사 시스템, 네트워크 통신, 자율 플랫폼에 초점을 맞추고 있으며, 신호 및 전력 상호 연결에 대한 안정적인 수요를 유지하고 있습니다.

세계의 군용 커넥터 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 군용 커넥터 시장의 기업에 매력적인 기회

- 군 커넥터 시장 : 플랫폼별

- 군용 커넥터 시장 : 해상 플랫폼별

- 군 커넥터 시장 : 항공 플랫폼별

- 군용 커넥터 시장 : 판매 시점별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 밸류체인 분석

- 가격 분석

- 주요 기업이 제공하는 군용 커넥터의 평균 판매 가격

- 평균 판매 가격 : 지역별

- 운영 데이터

- 에코시스템 분석

- 유명 기업

- 민간기업과 중소기업

- 최종사용자

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 무역 분석

- 수입 시나리오(HS 코드 853690)

- 수출 시나리오(HS 코드 853690)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 비즈니스 모델

- OEM 생산

- 커스텀 디자인 서비스

- MRO 서비스

- 투자와 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 거시경제 전망

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 라틴아메리카

- 미국 관세(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

- AI/생성형 AI의 영향

- 기술 동향

- 원형 하이브리드 커넥터

- 나노/피코 커넥터

- 내열성 재료

- EMP 강화 커넥터

- 메가트렌드의 영향

- 디지털 트윈 시뮬레이션

- 커넥터 헬스 모니터링

- 디지털 스레드 통합

- AI 주도 전장의 수요

- 테크놀러지 로드맵

- 특허 분석

제6장 군용 커넥터 시장 : 형상별

- 서론

- 원형

- 장방형

제7장 군용 커넥터 시장 : 유형별

- 서론

- 전원 커넥터

- 신호 커넥터

- 데이터 커넥터

- RF·마이크로파 커넥터

- 광섬유 커넥터

- 하이브리드 커넥터

제8장 군용 커넥터 시장 : 플랫폼별

- 서론

- 육상

- 항공

- 해상

- 우주

제9장 군용 커넥터 시장 : 판매 시점별

- 서론

- OEM

- 애프터마켓

제10장 군용 커넥터 시장 : 지역별

- 서론

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- PESTLE 분석

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- PESTLE 분석

- GCC

- 이스라엘

- 튀르키예

- 남아프리카공화국

- 라틴아메리카

- PESTLE 분석

- 브라질

- 기타 라틴아메리카

제11장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점(2020-2024년)

- 매출 분석(2021-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업의 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- AMPHENOL CORPORATION

- TE CONNECTIVITY

- ITT INC.

- GLENAIR, INC.

- FISCHER CONNECTORS SA

- EATON

- SMITHS GROUP PLC

- NICOMATIC

- WINCHESTER INTERCONNECT

- MILNEC INTERCONNECT SYSTEMS

- WEALD ELECTRONICS LTD

- OMNETICS CONNECTOR CORP

- TURCK, INC

- CONESYS

- RAY SERVICE, A.S.

- ROJONE PTY LTD

- ALLIED ELECTRONICS CORPORATION

- 기타 기업

- HIREL CONNECTORS INC.

- AIRBORN LLC

- SAMTEC

- SUNKYE INTERNATIONAL CO., LTD.

- LEMO

- HARWIN

- ODU GMBH & CO. KG

- MIL-CON, INC.

- CRISTEK INTERCONNECTS, LLC

- CONNECTIVE DESIGN, INC.

제13장 부록

KSA 25.08.11The military connectors market is expected to reach USD 2.28 billion by 2030, from USD 2.05 billion in 2025, at a CAGR of 2.1%. The market is led by strong and resilient interconnect solutions used in cutting-edge defense systems, including C4ISR, electronic warfare, and unmanned aerial vehicles.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Shape, Type, Platform, and Point of Sale and Region |

| Regions covered | North America, Europe, APAC, RoW |

Increasing military asset modernization and the need for secure data and power transmission in extreme environments are also propelling growth. Increasing defense spending and investment in autonomous platforms are compelling demand for miniature, high-performance connectors.

"The circular segment is expected to account for the largest share in the military connectors market during the forecast period."

The circular segment accounts for the largest share of the military connectors market because it is widely used on ground, air, and naval defense vehicles. Circular connectors are chosen for their small size, durability, and easy coupling in mission-critical applications. They transmit power, signals, and data for communications, avionics, radar, and soldier-wearable devices. Their durability against harsh environments like shock, vibration, and EMI makes them perfect for defense applications.

"The space segment is expected to exhibit the fastest growth in the military connectors market during the forecast period."

The space segment is rapidly growing in the military connectors market because the need for small, high-performance connectors in satellites, space-based surveillance systems, and defense payloads is rising. Military connectors for space missions must withstand extreme temperatures, vacuum conditions, and radiation, while ensuring continuous signal and power supply. These connectors have become essential to military communications satellites, early warning systems, and secure space-based data links.

"Europe is expected to record the highest CAGR in the military connectors market during the forecast period."

Europe is the fastest-growing market for military connectors due to defense spending, regional security concerns, and strong industrial bases. Countries are heavily investing in upgrading ground, water, and air systems, which require rugged, high-performance connectors. Both current and upcoming defense projects focus on digital soldier systems, networking communications, and autonomous platforms, which maintain steady demand for signal and power interconnects.

Breakdown of primaries

The study includes insights from various industry experts, from component suppliers to Tier-1 companies and OEMs. The breakdown of the primary sources is as follows:

- By Company Type: Tier 1-45%; Tier 2-35%; Tier 3-20%

- By Designation: C-level-50%; D-level-25%; Others-25%

- By Region: North America-40%; Europe-25%; Asia Pacific-15%; Middle East & Africa-10%; Latin America-10%

Amphenol Corporation (US), TE Connectivity (Ireland), ITT Inc. (US), Glenair, Inc (US), Fischer Connectors SA (Switzerland), Eaton (Ireland), and Smiths Group Plc (US) are some of the leading players in the military connectors market.

Research coverage

The study covers the military connectors market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on shape, type, platform, point of sale, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted them.

Key benefits of buying this report:

This report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall military connectors market and its subsegments. The report covers the entire ecosystem of the military connectors market. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers such as high demand for water quality monitoring and ocean data mapping, surging asymmetric threats, the need for maritime security, and increasing capital expenditure in offshore oil and gas industries in the military connectors market

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets - the report analyses the military connectors market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the military connectors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Amphenol Corporation (US), ITT Inc. (US), Glenair, Inc (US), and Fischer Connectors SA (Switzerland), among others in the military connectors market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MILITARY CONNECTORS MARKET

- 4.2 MILITARY CONNECTORS MARKET, BY PLATFORM

- 4.3 MILITARY CONNECTORS MARKET, BY NAVAL PLATFORM

- 4.4 MILITARY CONNECTORS MARKET, BY AIRBORNE PLATFORM

- 4.5 MILITARY CONNECTORS MARKET, BY POINT OF SALE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Modernization of defense electronics

- 5.2.1.2 Elevated demand for SWaP-C optimization

- 5.2.1.3 Rapid deployment of unmanned systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of ruggedized military connectors

- 5.2.2.2 Complex and lengthy qualification process

- 5.2.2.3 Supply chain disruptions and material dependencies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digitization of military platforms and shift toward network-centric warfare

- 5.2.3.2 Increased defense budgets in Asia Pacific and Middle East

- 5.2.3.3 Retrofit and upgrade programs for legacy platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Risk of counterfeit components

- 5.2.4.2 Stringent export control regulations

- 5.2.4.3 Adherence to harsh operating environment requirements

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF MILITARY CONNECTORS OFFERED BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 OPERATIONAL DATA

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 KEY REGULATIONS

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Middle East & Africa

- 5.8.2.5 Latin America

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 853690)

- 5.9.2 EXPORT SCENARIO (HS CODE 853690)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 AMPHENOL'S MIL-DTL-38999 SERIES III CIRCULAR CONNECTORS

- 5.12.2 TE'S MULTIGIG RT 2-R AND ARINC 836A CONNECTOR SOLUTIONS

- 5.12.3 HUBER+SUHNER'S QMA WATERPROOF RF CONNECTORS AND SENCITY SHIELDED CABLING SYSTEM

- 5.13 BUSINESS MODELS

- 5.13.1 OEM PRODUCTION

- 5.13.2 CUSTOM DESIGN SERVICES

- 5.13.3 MRO SERVICES

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Shielding

- 5.15.1.2 Ruggedized cable assemblies

- 5.15.1.3 Contact plating

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 High-speed data transmission

- 5.15.2.2 Miniaturization

- 5.15.2.3 Fiber optic connectors

- 5.15.1 KEY TECHNOLOGIES

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 NORTH AMERICA

- 5.16.2 EUROPE

- 5.16.3 ASIA PACIFIC

- 5.16.4 MIDDLE EAST & AFRICA

- 5.16.5 LATIN AMERICA

- 5.17 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 EU

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Army

- 5.17.5.2 Navy

- 5.17.5.3 Airforce

- 5.18 IMPACT OF AI/GEN AI

- 5.19 TECHNOLOGY TRENDS

- 5.19.1 CIRCULAR HYBRID CONNECTORS

- 5.19.2 NANO AND PICO CONNECTORS

- 5.19.3 HIGH-TEMPERATURE TOLERANT MATERIALS

- 5.19.4 EMP-HARDENED CONNECTORS

- 5.20 IMPACT OF MEGATRENDS

- 5.20.1 DIGITAL TWIN SIMULATION

- 5.20.2 CONNECTOR HEALTH MONITORING

- 5.20.3 DIGITAL THREAD INTEGRATION

- 5.20.4 AI-DRIVEN BATTLEFIELD DEMANDS

- 5.21 TECHNOLOGY ROADMAP

- 5.22 PATENT ANALYSIS

6 MILITARY CONNECTORS MARKET, BY SHAPE

- 6.1 INTRODUCTION

- 6.2 CIRCULAR

- 6.2.1 LARGE-SCALE ADOPTION BY GLOBAL DEFENSE SECTOR

- 6.2.2 MIL-DTL-38999

- 6.2.3 MIL-DTL-26482

- 6.2.4 MIL-DTL-5015

- 6.2.5 OTHERS

- 6.3 RECTANGULAR

- 6.3.1 SHIFT TOWARD DIGITAL AND ELECTRONIC WARFARE CAPABILITIES

- 6.3.2 MIL-DTL-24308

- 6.3.3 MIL-DTL-83513

- 6.3.4 MIL-DTL-55302

- 6.3.5 OTHERS

7 MILITARY CONNECTORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POWER CONNECTORS

- 7.2.1 ABILITY TO WITHSTAND HARSH MILITARY ENVIRONMENTS

- 7.3 SIGNAL CONNECTORS

- 7.3.1 EXTENSIVE USE IN AVIONICS AND VEHICLE CONTROL UNITS

- 7.4 DATA CONNECTORS

- 7.4.1 ONGOING DIGITALIZATION IN DEFENSE PLATFORMS

- 7.5 RF & MICROWAVE CONNECTORS

- 7.5.1 NEED FOR HIGH-FREQUENCY SIGNAL TRANSMISSION ACROSS MILITARY APPLICATIONS

- 7.6 FIBER OPTIC CONNECTORS

- 7.6.1 RAPID DEPLOYMENT IN NETWORK-CENTRIC WARFARE AND SENSOR SYSTEMS

- 7.7 HYBRID CONNECTORS

- 7.7.1 FOCUS ON ENHANCING MODULARITY IN MILITARY PLATFORMS

8 MILITARY CONNECTORS MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 LAND

- 8.2.1 TREND OF MODULAR VEHICLE ARCHITECTURES AND DIGITAL BATTLEFIELD INTEGRATION

- 8.2.2 COMMAND CENTERS

- 8.2.3 SOLDIER SYSTEMS

- 8.2.4 ARMORED VEHICLES

- 8.2.4.1 Combat vehicles

- 8.2.4.2 Combat support vehicles

- 8.2.4.3 Unmanned ground vehicles

- 8.3 AIRBORNE

- 8.3.1 NEED FOR HIGH-SPEED DATA TRANSMISSION ACROSS MISSION-CRITICAL APPLICATIONS

- 8.3.2 MILITARY AIRCRAFT

- 8.3.3 HELICOPTERS

- 8.3.4 UNMANNED AERIAL VEHICLES

- 8.4 NAVAL

- 8.4.1 RAPID INTEGRATION OF MODULAR COMBAT SYSTEMS AND ADVANCED SENSORS

- 8.4.2 SHIPS

- 8.4.2.1 Aircraft carriers

- 8.4.2.2 Amphibious

- 8.4.2.3 Destroyers

- 8.4.2.4 Frigates

- 8.4.2.5 Corvettes

- 8.4.2.6 Patrol vehicles

- 8.4.3 SUBMARINES

- 8.4.4 UNMANNED MARINE VEHICLES

- 8.5 SPACE

- 8.5.1 SHIFT IN DEFENSE PRIORITIES FOR RESPONSIVE LAUNCH CAPABILITIES

- 8.5.2 SATELLITE

9 MILITARY CONNECTORS MARKET, BY POINT OF SALE

- 9.1 INTRODUCTION

- 9.2 OEM

- 9.2.1 RISING CONNECTOR DEMAND AMID NEW SYSTEM PRODUCTION AND INTEGRATION

- 9.3 AFTERMARKET

- 9.3.1 STRATEGIC FOCUS ON EXTENDING LIFE OF LEGACY PLATFORMS

10 MILITARY CONNECTORS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Defense modernization programs to drive market

- 10.2.3 CANADA

- 10.2.3.1 Arctic defense expansion and NORAD modernization to drive market

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 UK

- 10.3.2.1 Tempest program advancements and NATO interoperability upgrades to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Eurofighter upgrade programs and green defense push to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Rafale fleet expansion and strategic push for autonomy to drive market

- 10.3.5 ITALY

- 10.3.5.1 Naval feet modernization and Eurofighter upgrades to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 JAPAN

- 10.4.2.1 F-X fighter development and domestic industrial policy to drive market

- 10.4.3 INDIA

- 10.4.3.1 Indigenous fighter programs, border defense expansion, and Make-in-India push to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Indigenous defense system development and export-focused production strategy to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Defense force modernization and AUKUS technology alignment to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Vision 2030 and defense self-reliance goals to drive market

- 10.5.2.2 UAE

- 10.5.2.2.1 Autonomous system adoption and naval ISR expansion to drive market

- 10.5.2.1 Saudi Arabia

- 10.5.3 ISRAEL

- 10.5.3.1 Emphasis on multi-domain network-centric warfare to drive market

- 10.5.4 TURKEY

- 10.5.4.1 Rise in drone swarm integration and air defense autonomy to drive market

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Focus on modernizing border security systems to drive market

- 10.6 LATIN AMERICA

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 BRAZIL

- 10.6.2.1 International defense industrial partnerships to drive market

- 10.6.3 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Platform footprint

- 11.7.5.4 Type footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AMPHENOL CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 TE CONNECTIVITY

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ITT INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 GLENAIR, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 FISCHER CONNECTORS SA

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EATON

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Other developments

- 12.1.7 SMITHS GROUP PLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.8 NICOMATIC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/developments

- 12.1.9 WINCHESTER INTERCONNECT

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches/developments

- 12.1.9.3.2 Deals

- 12.1.10 MILNEC INTERCONNECT SYSTEMS

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 WEALD ELECTRONICS LTD

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches/developments

- 12.1.12 OMNETICS CONNECTOR CORP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches/developments

- 12.1.13 TURCK, INC

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 CONESYS

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 RAY SERVICE, A.S.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.16 ROJONE PTY LTD

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.17 ALLIED ELECTRONICS CORPORATION

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.1 AMPHENOL CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 HIREL CONNECTORS INC.

- 12.2.2 AIRBORN LLC

- 12.2.3 SAMTEC

- 12.2.4 SUNKYE INTERNATIONAL CO., LTD.

- 12.2.5 LEMO

- 12.2.6 HARWIN

- 12.2.7 ODU GMBH & CO. KG

- 12.2.8 MIL-CON, INC.

- 12.2.9 CRISTEK INTERCONNECTS, LLC

- 12.2.10 CONNECTIVE DESIGN, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS