|

시장보고서

상품코드

1784318

세포 배양 시장 : 제품별, 용도별, 최종 사용자별 예측(-2030년)Cell Culture Market by Product (Consumables (Media, Sera, Reagent, Vessels ), Equipment ), Application, End User - Global Forecast to 2030 |

||||||

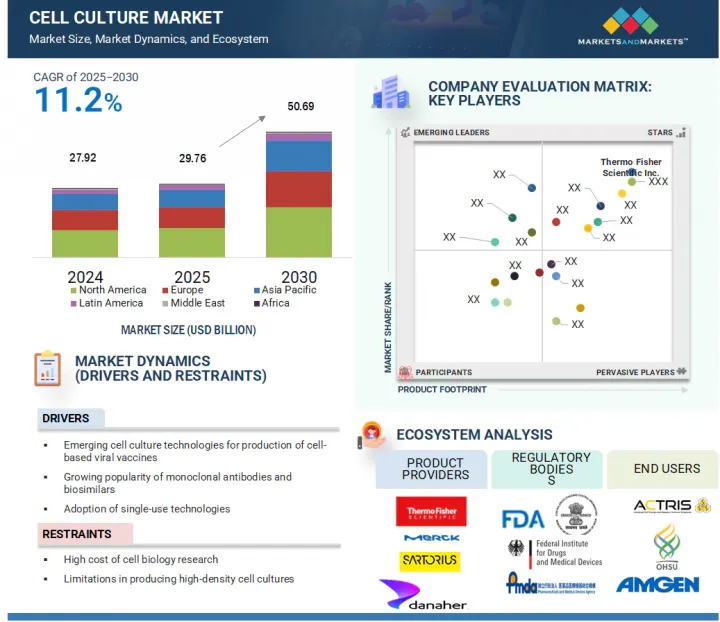

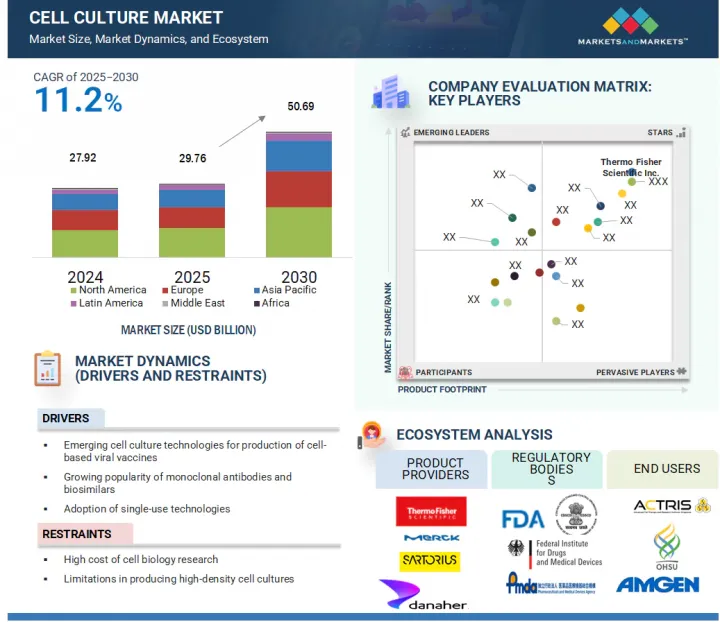

세계의 세포 배양 시장 규모는 2025년 297억 6,000만 달러에서 2030년까지 506억 9,000만 달러에 이를 것으로 예측되며, 2025-2030년 예측 기간에 CAGR로 11.2%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 용도, 최종 사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 시장의 성장은 세포 생물학 분야 연구에 대한 투자 및 자금 지원의 증가에 기인할 수 있습니다. 암과 같은 만성 질환의 발병률이 증가하면서 조직 공학 및 재생 의학과 같은 첨단 치료법에 대한 수요가 증가하고 있습니다. 이러한 동향은 향후 몇 년 동안 세포 배양 시장의 성장을 촉진할 것으로 예상됩니다.

2024년에는 바이오 의약품 생산 부문이 응용 부문에서 가장 큰 비중을 차지했습니다.

2024년에는 바이오 의약품 생산 부문이 전 세계 세포 배양 시장에서 응용 부문에서 가장 큰 비중을 차지했습니다. 바이오 의약품 생산 부문은 백신 생산, 단일 클론 항체 생산 및 기타 치료용 단백질 생산으로 더 세분화됩니다. 전염병의 유행이 증가함에 따라 백신, 단일 클론 항체 및 치료용 단백질과 같은 바이오 의약품에 대한 수요가 증가하고 있으며, 이는 세포 배양 시장에서 바이오 의약품 생산의 성장을 촉진하고 있습니다.

혈청, 배지 및 시약 부문은 2024년에 소모품 시장의 주요 점유율을 차지했습니다.

세포 배양 소모품 시장은 유형에 따라 혈청, 배지 및 시약, 용기, 액세서리로 분류됩니다. 혈청, 배지 및 시약 부문은 2024년 세포 배양 소모품 시장에서 가장 큰 점유율을 차지했습니다. 이 부문의 큰 점유율은 생명 공학 및 의약품 산업에서 소모품의 반복적인 대량 구매 및 요구 사항에 기인합니다. 연구실과 생산 시설은 지속적인 세포 배양 활동을 유지하기 위해 혈청, 배지, 시약, 용기, 액세서리 등 대량의 소모품을 필요로 합니다. 이는 실험, 테스트, 제조 과정에 따른 빈번하고 대규모 구매로 이어집니다.

2024년 세포 배양 시장은 미국이 주도했습니다.

2024년 북미 세포 배양 시장은 미국이 주도했습니다. 바이오 의약품에 대한 연구 및 투자를 중시하는 세계 최대의 바이오 의약품 시장인 미국은 이 분야에서 중요한 위치를 차지하고 있습니다. 또한, 미국에는 하버드 대학, 스탠포드 대학, 매사추세츠 공과 대학(MIT) 등 생명 과학 분야에서 획기적인 연구로 유명한 유명 학술 연구 기관이 많으며, 이러한 기관들은 세포 배양 기술을 광범위하게 활용하고 있어 시장 확장에 기여하고 있습니다. 또한 조직 공학 및 재생 의학 연구 개발(R&D)에 대한 투자 증가가 세포 배양 시장 성장에 기여하고 있습니다.

이 보고서는 세계의 세포 배양 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 세포 배양 시장 기업에게 매력적인 기회

- 북미의 세포 배양 시장 : 제품별, 국가별

- 세포 배양 시장 점유율 : 용도별

- 세포 배양 시장 점유율 : 최종 사용자별

- 세포 배양 시장 : 지리적 성장 기회

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 고객사업에 영향을 주는 동향 및 혼란

- 가격 설정 분석

- 주요 기업의 평균 판매 가격 동향 : 제품별

- 제품의 평균 판매 가격 : 지역별

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 무역 분석

- 수입 데이터

- 수출 데이터

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 관세 및 규제 상황

- 세포 배양 제품에 관한 관세

- 규제 틀

- 규제기관, 정부기관, 기타 조직

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 세포 배양 제품 시장에 대한 AI/생성형 AI의 영향

- 소개

- 세포 배양 용도에 있어서의 AI 시장의 장래성

- AI의 이용 사례

- AI를 도입하고 있는 주요 기업

- 세포 배양 생태계에서 생성형 AI의 미래

- 세포 배양 시장에 대한 미국 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 세포 배양 시장 : 제품별

- 소개

- 소모품

- 혈청, 배지 및 시약

- 용기

- 액세서리

- 기기

- 바이오 리액터

- 보관 기기

- 기타 기기

제7장 세포 배양 시장 : 용도별

- 소개

- 바이오 의약품 생산

- 단일 클론 항체 생산

- 백신 생산

- 기타 치료용 단백질 생산

- 진단

- 조직 공학 및 재생 의학

- 세포 및 유전자 치료

- 기타 조직 공학및 재생 의학 용도

- 의약품 스크리닝 및 개발

- 기타 용도

제8장 세포 배양 시장 : 최종 사용자별

- 소개

- 제약 및 생명공학 기업

- 병원 및 진단실험실

- 연구 및 학술기관

- 기타 최종 사용자

제9장 세포 배양 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동

- 중동의 거시 경제 전망

- GCC 국가

- 기타 중동

- 아프리카

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 소개

- 주요 기업

- THERMO FISHER SCIENTIFIC INC.

- DANAHER

- MERCK KGAA

- SARTORIUS AG

- CORNING INCORPORATED

- FUJIFILM HOLDINGS CORPORATION

- BD

- EPPENDORF SE

- LONZA

- GETINGE

- AGILENT TECHNOLOGIES, INC.

- HIMEDIA LABORATORIES

- BIO-TECHNE

- 기타 기업

- MILTENYI BIOTEC

- STEMCELL TECHNOLOGIES

- SOLIDA BIOTECH GMBH

- CAISSON LABS

- PROMOCELL GMBH

- INVIVOGEN

- PAN-BIOTECH

- CELLEXUS

- MEISSNER FILTRATION PRODUCTS, INC.

- ADOLF KUHNER AG

- ADVANCION CORPORATION

- BIOSPHERIX LLC

제12장 부록

HBR 25.08.13The cell culture market is projected to reach USD 50.69 billion by 2030 from an estimated USD 29.76 billion in 2025, at a CAGR of 11.2% during the forecast period of 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The growth of this market can be attributed to growing investments and funding for research in the field of cell biology. The rising incidence of chronic diseases such as cancer is boosting the demand for advanced therapies such as tissue engineering and regenerative medicine. This trend is expected to drive the growth of the cell culture market in the coming years.

The biopharmaceutical production segment accounted for the largest share of the application segment in 2024.

In 2024, the biopharmaceutical production segment accounted for the largest share of the application segment in the global cell culture market. The biopharmaceutical production segment is further categorized into vaccine production, monoclonal antibody production, and other therapeutic protein production. The growing prevalence of infectious diseases is boosting the demand for biopharmaceuticals such as vaccines, monoclonal antibodies, and therapeutic proteins, which is promoting the growth of biopharmaceutical production in the cell culture market.

The sera, media, and reagents segment accounted for a major share of the consumables market in 2024.

The cell culture consumables market is categorized by type into sera, media, and reagents; vessels; and accessories. The sera, media, and reagents segment accounted for the largest share of the cell culture consumables market in 2024. The large share of this segment is attributed to the repeated bulk purchase and requirement for consumables in the biotechnology and pharmaceutical industries. Research labs and production facilities often require large quantities of sera, media, reagents, vessels, and accessories to sustain continuous cell culture activities. This leads to frequent and substantial procurement for experimentation, testing, and manufacturing processes.

The US dominated the cell culture market in 2024.

In 2024, the cell culture market in North America was led by the US. As the world's largest biopharmaceutical market with a strong emphasis on research and investment in biopharmaceuticals, the US holds a prominent position. Moreover, the country hosts renowned academic research institutions such as Harvard University, Stanford University, and the Massachusetts Institute of Technology (MIT), renowned for their groundbreaking work in life sciences, including drug discovery and biotechnology, which extensively employ cell culture techniques, thereby fueling market expansion. Furthermore, increasing investments in tissue engineering and regenerative medicine R&D are contributing to the growth of the cell culture market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, Asia-Pacific -25%, Latin America -5% and Middle East & Africa- 5%

List of Companies Profiled in the Report:

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Corning Incorporated (US)

- FUJIFILM Holdings Corporation (Japan)

- BD (US)

- Eppendorf SE (Germany)

- Lonza (Switzerland)

- Getinge AB (Sweden)

- Agilent Technologies, Inc. (US)

- HiMedia Laboratories (India)

- Miltenyi Biotec (Germany)

- STEMCELL Technologies (Canada)

- Solida Biotech GmbH (Germany)

- Caisson Labs (US)

- PromoCell GmbH (Germany)

- InvivoGen (France)

- PAN-Biotech (Germany)

- Cellexus (Scotland)

- Meissner Filtration Products Inc. (US)

- Adolf Kuhner AG (Switzerland)

- Bio-Techne (US)

- Advancion Corporation (US)

- BioSpherix, Ltd. (US)

Research Coverage

This research report categorizes the cell culture market by product ((equipment (bioreactors, storage equipment, and other equipment), consumables (sera, media, reagents; vessels, and accessories)), by application (biopharmaceutical production (vaccine production, monoclonal antibody production, and other therapeutic protein production), diagnostics, tissue engineering & regenerative medicine (cell & gene therapy and other tissue engineering & regenerative medicine applications), drug screening & development, and other applications), by end user (pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, research & academic institutes, and other end users), and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the cell culture market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are the recent developments associated with the cell culture market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall cell culture market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing prevalence of infectious diseases, rising adoption of single-use technologies, and growing strategic alliances for the development of advanced therapy medicine products), restraints (high cost of cell biology research and limitations regarding production of high density cell culture), opportunities (growing opportunities in emerging economies, rising demand for 3D cell culture), and challenges (ethical concern regarding cell usage) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly launched products of the cell culture market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the cell culture market

- Competitive Assessment: Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Sartorius AG (Germany), Merck KGaA (Germany), Corning Incorporated (US), FUJIFILM Holdings Corporation (Japan), BD (US), Eppendorf SE (Germany), Lonza (Switzerland), Getinge AB (Sweden), Agilent Technologies, Inc. (US), HiMedia Laboratories (India), Miltenyi Biotec (Germany), STEMCELL Technologies (Canada), Solida Biotech GmbH (Germany), Caisson Labs (US), PromoCell GmbH (Germany), InvivoGen (France), PAN-Biotech (Germany), Cellexus (Scotland), Meissner Filtration Products Inc. (US), Adolf Kuhner AG (Switzerland), Bio-Techne (US), Advancion Corporation (US), and BioSpherix, Ltd. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Insights from primary sources

- 2.2.2 SEGMENTAL MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CELL CULTURE MARKET

- 4.2 NORTH AMERICA: CELL CULTURE MARKET, BY PRODUCT AND COUNTRY

- 4.3 CELL CULTURE MARKET SHARE, BY APPLICATION

- 4.4 CELL CULTURE MARKET SHARE, BY END USER

- 4.5 CELL CULTURE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing support and funding for cell-based research

- 5.2.1.2 Emerging cell culture technologies

- 5.2.1.3 Growing popularity of monoclonal antibodies and biosimilars

- 5.2.1.4 Increasing adoption of single-use technologies

- 5.2.1.5 Rise in product launches

- 5.2.1.6 Growth in advanced therapy medicinal products

- 5.2.1.7 Increasing incidence of infectious diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of cell biology research

- 5.2.2.2 Limitations in producing high-density cell cultures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for 3D cell culture

- 5.2.3.2 Growth opportunities in emerging economies

- 5.2.3.3 Increasing focus on next-generation therapeutics

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal of plastic consumables

- 5.2.4.2 Ethical concerns related to cell usage

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE OF PRODUCTS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Single-use technology

- 5.8.1.2 Flow cytometry

- 5.8.1.3 Microscopy

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 High-throughput screening

- 5.8.2.2 Mass spectrometry

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Microfluidics and organ-on-a-chip

- 5.8.3.2 3D bioprinting

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF RELATED TO CELL CULTURE PRODUCTS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 North America

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.4 Latin America

- 5.12.2.5 Middle East & Africa

- 5.12.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 IMPACT OF AI/GENERATIVE AI ON CELL CULTURE PRODUCTS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 MARKET POTENTIAL OF AI IN CELL CULTURE APPLICATIONS

- 5.15.3 AI USE CASES

- 5.15.4 KEY COMPANIES IMPLEMENTING AI

- 5.15.5 FUTURE OF GENERATIVE AI IN CELL CULTURE ECOSYSTEM

- 5.16 IMPACT OF 2025 US TARIFF ON CELL CULTURE MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.16.5.1 Pharmaceutical & biotech companies

- 5.16.5.2 Hospitals & diagnostic laboratories

- 5.16.5.3 Academic & research institutes

- 5.16.5.4 Contract research organizations & contract development and manufacturing organizations

6 CELL CULTURE MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 SERA, MEDIA, AND REAGENTS

- 6.2.1.1 Media

- 6.2.1.1.1 Serum-free media

- 6.2.1.1.1.1 Enhanced control, reproducibility, and decreased batch-to-batch variability to aid growth

- 6.2.1.1.2 Classical media & salts

- 6.2.1.1.2.1 Need for efficient and scalable vaccine production to bolster growth

- 6.2.1.1.3 Stem cell culture media

- 6.2.1.1.3.1 Rising funding and support for stem cell-based research and therapy to augment growth

- 6.2.1.1.4 Chemically-defined media

- 6.2.1.1.4.1 Rising need for reproducibility, regulatory compliance, and precise control in cell culture systems to aid growth

- 6.2.1.1.5 Specialty media

- 6.2.1.1.5.1 Suitability for use in selective cell types in bioprocessing and biomanufacturing industries to boost market

- 6.2.1.1.6 Other media

- 6.2.1.1.1 Serum-free media

- 6.2.1.2 Reagents

- 6.2.1.2.1 Growth factors

- 6.2.1.2.1.1 Need to regulate cell proliferation, differentiation, and migration to sustain growth

- 6.2.1.2.2 Supplements

- 6.2.1.2.2.1 Growing acquisitions and expansions by cell culture vendors to propel market

- 6.2.1.2.3 Buffers & chemicals

- 6.2.1.2.3.1 Ability to maintain stable pH levels to facilitate growth

- 6.2.1.2.4 Cell dissociation reagents

- 6.2.1.2.4.1 Ability to minimize cell stress and reduce cell damage to foster growth

- 6.2.1.2.5 Balanced salt solutions

- 6.2.1.2.5.1 Ability to maintain optimal physiological conditions for cell growth and experimentation to assist growth

- 6.2.1.2.6 Attachment & matrix factors

- 6.2.1.2.6.1 Rising adoption of 3D cell culture models to support growth

- 6.2.1.2.7 Antibiotics/Antimycotics

- 6.2.1.2.7.1 Ability to mitigate growth of contaminating bacteria, fungi, and mycoplasma to drive market

- 6.2.1.2.8 Cryoprotective reagents

- 6.2.1.2.8.1 Ability to preserve cell viability during freezing and thawing to aid growth

- 6.2.1.2.9 Contamination detection kits

- 6.2.1.2.9.1 Need for rapid identification of microbial contaminants to promote growth

- 6.2.1.2.10 Other reagents

- 6.2.1.2.1 Growth factors

- 6.2.1.3 Sera

- 6.2.1.3.1 Fetal bovine sera

- 6.2.1.3.1.1 Increasing role of fetal bovine sera in cell proliferation to favor growth

- 6.2.1.3.2 Adult bovine sera

- 6.2.1.3.2.1 Cost-effectiveness to contribute to growth

- 6.2.1.3.3 Other animal sera

- 6.2.1.3.1 Fetal bovine sera

- 6.2.1.1 Media

- 6.2.2 VESSELS

- 6.2.2.1 Cell factory systems/cell stacks

- 6.2.2.1.1 Efficient and scalable solutions for large-scale expansion to drive adoption

- 6.2.2.2 Roller/roux bottles

- 6.2.2.2.1 Scalability, cost-effectiveness, and ease of handling to support growth

- 6.2.2.3 Flasks

- 6.2.2.3.1 Growing advancements in cell culture flasks to boost market

- 6.2.2.4 Multiwell plates

- 6.2.2.4.1 Increasing adoption of multiwell plates in high-throughput or high-content screening to aid growth

- 6.2.2.5 Petri dishes

- 6.2.2.5.1 Rising use of petri dishes as sterile containers to sustain growth

- 6.2.2.1 Cell factory systems/cell stacks

- 6.2.3 ACCESSORIES

- 6.2.3.1 Reduced preparation time and equipment performance improvements to augment growth

- 6.2.1 SERA, MEDIA, AND REAGENTS

- 6.3 EQUIPMENT

- 6.3.1 BIOREACTORS

- 6.3.1.1 Conventional bioreactors

- 6.3.1.1.1 Utilization in large-scale manufacturing of drugs to drive market

- 6.3.1.2 Single-use bioreactors

- 6.3.1.2.1 Lower operational costs and increased flexibility to boost market

- 6.3.1.1 Conventional bioreactors

- 6.3.2 STORAGE EQUIPMENT

- 6.3.2.1 Refrigerators & freezers

- 6.3.2.1.1 Increasing need for storage solutions to propel market

- 6.3.2.2 Cryostorage systems

- 6.3.2.2.1 Benefits of long-term preservation of cell cultures to support growth

- 6.3.2.1 Refrigerators & freezers

- 6.3.3 OTHER EQUIPMENT

- 6.3.3.1 Filtration systems

- 6.3.3.1.1 Growing use in bioprocessing industry to boost market

- 6.3.3.2 Cell counters

- 6.3.3.2.1 Growing adoption of automated cell counters to propel market

- 6.3.3.3 Carbon dioxide incubators

- 6.3.3.3.1 Increasing focus of research institutes on developing lab-scale incubators to drive market

- 6.3.3.4 Centrifuges

- 6.3.3.4.1 Increasing demand for bioproduction applications to drive adoption of centrifuges

- 6.3.3.5 Autoclaves

- 6.3.3.5.1 Reliance on single-use labware and equipment to affect demand for autoclaves

- 6.3.3.6 Microscopes

- 6.3.3.6.1 Enhanced imaging capabilities to augment growth

- 6.3.3.7 Biosafety cabinets

- 6.3.3.7.1 Increasing launches of biosafety cabinets to promote growth

- 6.3.3.8 Other supporting equipment

- 6.3.3.1 Filtration systems

- 6.3.1 BIOREACTORS

7 CELL CULTURE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BIOPHARMACEUTICAL PRODUCTION

- 7.2.1 MONOCLONAL ANTIBODY PRODUCTION

- 7.2.1.1 Increasing approval and launch of mAb candidates to amplify growth

- 7.2.2 VACCINE PRODUCTION

- 7.2.2.1 Rising incidence of infectious diseases to support growth

- 7.2.3 OTHER THERAPEUTIC PROTEIN PRODUCTION

- 7.2.1 MONOCLONAL ANTIBODY PRODUCTION

- 7.3 DIAGNOSTICS

- 7.3.1 GROWING ADVANCEMENTS AND ADOPTION OF NEW TECHNIQUES TO FUEL MARKET

- 7.4 TISSUE ENGINEERING & REGENERATIVE MEDICINE

- 7.4.1 CELL & GENE THERAPY

- 7.4.1.1 Rising investments in developing cell-based immunotherapies to foster growth

- 7.4.2 OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS

- 7.4.1 CELL & GENE THERAPY

- 7.5 DRUG SCREENING & DEVELOPMENT

- 7.5.1 INCREASING FOCUS ON BIOLOGIC DRUGS TO FAVOR GROWTH

- 7.6 OTHER APPLICATIONS

8 CELL CULTURE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 8.2.1 INCREASING DEMAND FOR CULTURE CELL LINES FOR DRUG SCREENING AND R&D TO AID GROWTH

- 8.3 HOSPITALS & DIAGNOSTIC LABORATORIES

- 8.3.1 GROWING USE OF CELL CULTURE FOR CELLULAR PHYSIOLOGY, DISEASE MECHANISMS, AND DRUG RESPONSES TO BOOST MARKET

- 8.4 RESEARCH & ACADEMIC INSTITUTES

- 8.4.1 RISING FUNDING ACTIVITIES TO CONTRIBUTE TO GROWTH

- 8.5 OTHER END USERS

9 CELL CULTURE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Advanced healthcare infrastructure and government support to bolster growth

- 9.2.3 CANADA

- 9.2.3.1 Increasing funding and investments for cell-based therapies to boost market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising R&D investments and strategic alliances to promote growth

- 9.3.3 UK

- 9.3.3.1 Growth in life science industry and favorable government investments to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Rising number of cell-based research projects to enhance growth

- 9.3.5 ITALY

- 9.3.5.1 Strong government support for R&D activities to spur growth

- 9.3.6 SPAIN

- 9.3.6.1 Booming biotechnology industry to bolster growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rising focus on stem cell & regenerative medicine research to expedite growth

- 9.4.3 JAPAN

- 9.4.3.1 Rising government initiatives and increasing investments in biotech to intensify growth

- 9.4.4 INDIA

- 9.4.4.1 Favorable government support and expansion by key cell culture players to augment growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Growing pharmaceutical sector to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Increasing prevalence of chronic diseases to accelerate growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Rising prevalence of cancer and related research activities to support growth

- 9.5.3 MEXICO

- 9.5.3.1 Increasing advancements in biotechnology industry to spur growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Saudi Arabia

- 9.6.2.1.1 Increasing focus of key players on expansion to drive market

- 9.6.2.2 UAE

- 9.6.2.2.1 Increasing shift from importing to manufacturing pharmaceuticals to boost market

- 9.6.2.3 Rest of GCC Countries

- 9.6.2.1 Saudi Arabia

- 9.6.3 REST OF MIDDLE EAST

- 9.7 AFRICA

- 9.7.1 RISING GRANTS AND FUNDING FOR CELL AND GENE THERAPY PRODUCTS TO FOSTER GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN CELL CULTURE MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 THERMO FISHER SCIENTIFIC INC.

- 11.2.1.1 Business overview

- 11.2.1.2 Products offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.3.3 Expansions

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 DANAHER

- 11.2.2.1 Business overview

- 11.2.2.2 Products offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.3.3 Expansions

- 11.2.2.3.4 Other developments

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 MERCK KGAA

- 11.2.3.1 Business overview

- 11.2.3.2 Products offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.3.3 Expansions

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 SARTORIUS AG

- 11.2.4.1 Business overview

- 11.2.4.2 Products offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches

- 11.2.4.3.2 Deals

- 11.2.4.3.3 Expansions

- 11.2.5 CORNING INCORPORATED

- 11.2.5.1 Business overview

- 11.2.5.2 Products offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.6 FUJIFILM HOLDINGS CORPORATION

- 11.2.6.1 Business overview

- 11.2.6.2 Products offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Product launches

- 11.2.6.3.2 Deals

- 11.2.6.3.3 Expansions

- 11.2.6.3.4 Other developments

- 11.2.7 BD

- 11.2.7.1 Business overview

- 11.2.7.2 Product offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product Launches

- 11.2.7.3.2 Deals

- 11.2.8 EPPENDORF SE

- 11.2.8.1 Business overview

- 11.2.8.2 Products offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches

- 11.2.8.3.2 Deals

- 11.2.8.3.3 Expansions

- 11.2.9 LONZA

- 11.2.9.1 Business overview

- 11.2.9.2 Products offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches

- 11.2.9.3.2 Deals

- 11.2.10 GETINGE

- 11.2.10.1 Business overview

- 11.2.10.2 Products offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches

- 11.2.10.3.2 Deals

- 11.2.10.3.3 Expansions

- 11.2.11 AGILENT TECHNOLOGIES, INC.

- 11.2.11.1 Business overview

- 11.2.11.2 Products offered

- 11.2.11.3 Recent developments

- 11.2.11.3.1 Product launches

- 11.2.11.3.2 Deals

- 11.2.11.3.3 Expansions

- 11.2.12 HIMEDIA LABORATORIES

- 11.2.12.1 Business overview

- 11.2.12.2 Products offered

- 11.2.13 BIO-TECHNE

- 11.2.13.1 Business overview

- 11.2.13.2 Products offered

- 11.2.13.3 Recent developments

- 11.2.13.3.1 Product launches

- 11.2.13.3.2 Deals

- 11.2.13.3.3 Expansions

- 11.2.1 THERMO FISHER SCIENTIFIC INC.

- 11.3 OTHER PLAYERS

- 11.3.1 MILTENYI BIOTEC

- 11.3.2 STEMCELL TECHNOLOGIES

- 11.3.3 SOLIDA BIOTECH GMBH

- 11.3.4 CAISSON LABS

- 11.3.5 PROMOCELL GMBH

- 11.3.6 INVIVOGEN

- 11.3.7 PAN-BIOTECH

- 11.3.8 CELLEXUS

- 11.3.9 MEISSNER FILTRATION PRODUCTS, INC.

- 11.3.10 ADOLF KUHNER AG

- 11.3.11 ADVANCION CORPORATION

- 11.3.12 BIOSPHERIX LLC

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS