|

시장보고서

상품코드

1786129

좌제 시장 : 유형별, 기제별, 처방별, 용도별, 환자별(-2030년)Suppositories Market by Type, Base, Prescription, Application, Patient - Global Forecast to 2030 |

||||||

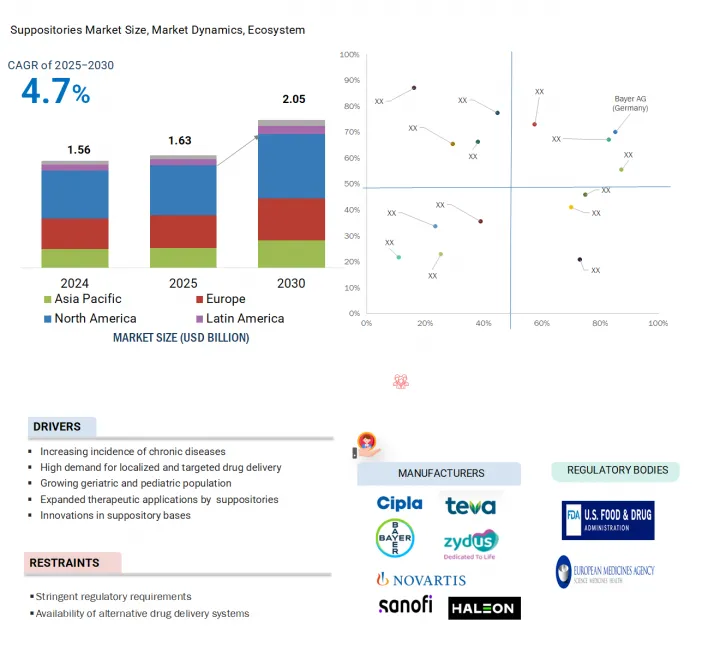

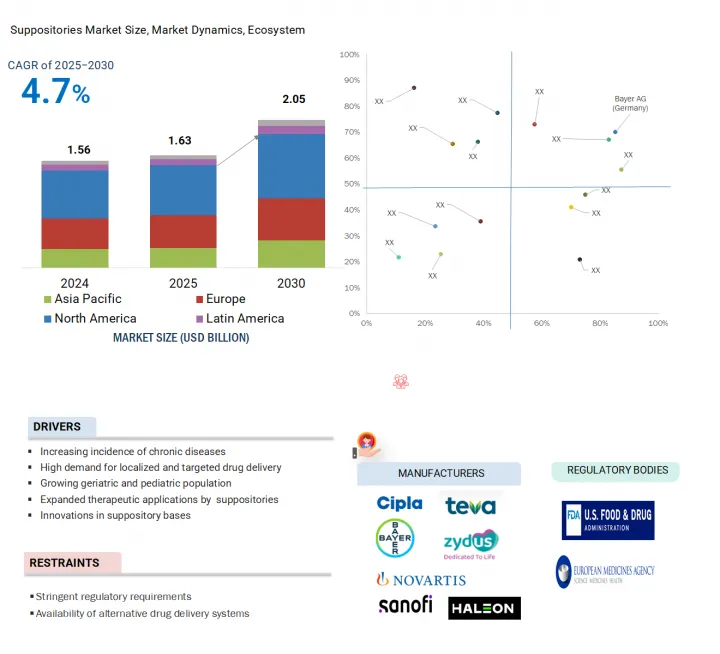

세계의 좌제 시장 규모는 2025년 16억 3,000만 달러로 추정되고, 예측 기간 동안 CAGR 4.7%로 추이할 전망이며, 2030년에는 25억 6,000만 달러에 달할 것으로 예측되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 유형별, 기제별, 처방별, 용도별, 환자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

세계적으로 고령자 인구가 대폭 증가하고 있는 것에 더해, 소화기 질환, 치질, 염증성 장 질환 등의 만성 질환의 유병률이 상승하고 있는 것이, 좌제 시장 수요를 밀어올릴 전망입니다. 또한, 예방의료에 대한 관심 증가, 의료비 증가, 각 지역의 의료 인프라 개선도 시장 성장을 가속하고 있습니다. 의료 인프라에 대한 투자와 좌제의 가용성 및 가격의 합리성을 향상시키는 노력도 좌제 시장의 성장을 뒷받침할 것으로 예측됩니다.

'직장 좌제 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 전망'

이 성장은 주로 통증, 발열, 염증, 변비와 같은 일반적인 증상에 신속한 완화 효과를 발휘하기 때문입니다. 삼키는 장애가 있는 노인과 소아 환자에게 널리 사용되고 있으며, 환자 친화적인 표적 약물 전달 제제에 대한 수요가 증가함에 따라 다양한 장면에서 직장 좌제의 채용을 촉진하고 시장 성장을 뒷받침하고 있습니다.

'일반의약품(OTC) 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 전망'

처방 구분에 근거하여, 일반의약품(OTC) 부문은 셀프 케어 지향 증가 및 일반적인 치료 수단에 쉽게 접근함으로써 더 빠른 성장이 예상됩니다. 변비용 글리세린 좌제과 치질용 허브 좌제와 같은 OTC 제품은 소매점과 온라인 플랫폼에서 널리 이용 가능합니다. 게다가 집에서의 셀프메디케이션에 대한 인지도 향상으로 OTC 좌제 수요가 높아져 세계 시장의 성장을 가속하고 있습니다.

'2024년 시장에서는 북미가 최대 지역 점유율을 차지합니다.'

북미 시장이 뚜렷한 이점을 보이는 것은 여러 상호 관련 요인 때문입니다. 첫째, 급성 및 만성 질환의 발병률이 증가하고 있으며, 이는 긴급 공중 보건 문제가 되고 관련 의료 서비스 및 제품에 대한 수요를 높이고 있습니다. 게다가, 이러한 수요 증가는 이러한 건강 과제에 대응하기 위한 의료 케어와 자원을 효율적으로 제공할 수 있는 견고하고 정비된 의료 인프라에 의해 지원되고 있습니다. 또한 미국 및 캐나다에 본사를 둔 주요 제약 회사 및 제조업체가 지역 내 제품 공급 안정화 및 지속 방출 기술의 보급을 이끌고 있습니다. 이러한 요인들이 함께 좌제 시장의 성장에 견고한 기반을 형성하고 있습니다.

본 보고서에서는 세계의 좌제 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이 및 예측, 각종 구분, 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 사업에 영향을 미치는 동향 및 혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 회의 및 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 언멧 니즈 및 최종 사용자의 기대

- AI 및 생성형 AI의 영향

- 미국 관세의 영향(2025년)

제6장 좌제 시장 : 유형별

- 직장 좌제

- 질 좌제

- 요도 좌제

제7장 좌제 시장 : 기제별

- 유성 및 친유성

- 수성 및 친수성

- 유화기제

제8장 좌제 시장 : 처방별

- 처방약

- 일반의약품(OTC)

제9장 좌제 시장 : 용도별

- 치질 치료

- 항균 및 항진균 용도

- 진통제 및 해열제

- 완하제

- 제토제

- 기타

제10장 좌제 시장 : 환자별

- 성인 환자

- 소아 환자

- 노인 환자

제11장 좌제 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 거시경제 전망

- GCC 국가

- 기타

제12장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 브랜드 및 제품 비교

- 기업평가 및 재무지표

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 및 중소기업

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- SANDOZ GROUP AG

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- CIPLA

- SANOFI

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- BAYER AG

- NOVARTIS AG

- ZYDUS GROUP

- BLISS GVS PHARMA LIMITED

- CHURCH & DWIGHT CO., INC.

- BAUSCH HEALTH COMPANIES INC.

- ADCOCK INGRAM

- ASPEN HOLDINGS

- JULPHAR

- HALEON GROUP OF COMPANIES

- LES LABORATOIRES SERVIER

- PRESTIGE CONSUMER HEALTHCARE INC.

- VIATRIS INC.

- GALEN LIMITED

- MERIDIAN ENTERPRISES PVT. LTD.

- 기타 기업

- COSETTE PHARMACEUTICALS

- FLAGSHIP

- OUBARI PHARMA

- LAVINA PHARMACEUTICALS PVT. LTD.

- NORWELL

제14장 부록

AJY 25.08.18The global suppositories market is projected to reach USD 2.56 billion by 2030 from USD 1.63 billion in 2025, at a CAGR of 4.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, base, prescription, application, patient type, and region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

The significant expansion of the geriatric demographic worldwide, coupled with the escalating prevalence of chronic conditions such as gastrointestinal diseases, hemorrhoids, and inflammatory bowel diseases, is poised to drive the demand for the suppositories market. Additionally, the increasing focus on preventive healthcare, coupled with rising healthcare expenditures and improvements in healthcare infrastructure across various regions, also facilitates market growth. Investments in healthcare infrastructure and initiatives to improve the accessibility and affordability of suppositories are also likely to bolster the market growth of suppositories.

The rectal suppositories segment is expected to grow at the highest CAGR during the forecast period.

The rectal suppositories segment is projected to grow with the highest CAGR in the suppositories market. The growth is primarily attributed to the effectiveness of the rectal suppositories in delivering rapid relief for common conditions such as pain, fever, inflammation, and constipation. They are widely used by geriatric and pediatric patients who often face swallowing problems. Moreover, the increasing demand for patient-friendly, targeted drug delivery formulations are boosting the adoption of rectal suppositories in various settings, thereby driving the market growth.

The over-the-counter (OTC) segment is expected to command the highest CAGR during the forecast period.

Based on prescription, the suppositories market is segmented into over-the-counter (OTC) and prescribed suppositories. The over-the-counter (OTC) segment is anticipated to grow at a faster rate due to increasing preferences for self-care solutions and easy accessibility of common treatment options. OTC suppositories, such as glycerin for constipation, and herbal hemorrhoid suppositories are widely available through retailers and online platforms. Moreover, increasing awareness about self-medication at home care increasingly demands OTC suppositories, thereby fueling the global market growth.

The aqueous/hydrophilic base segment is expected to have the highest CAGR during the forecast period.

The suppositories market by base is categorized into oleaginous/lipophilic bases, aqueous/hydrophilic bases, and emulsifying bases. The aqueous/ hydrophilic base segment accounted for the fastest growth rate during the forecast period. Compared to the traditional oleaginous (fat-based) bases, hydrophilic bases (e.g., polyethylene glycol (PEG) and glycerinated gelatins) provide a lot of flexibility and stability in formulations, especially for drugs that cannot tolerate melting. Hydrophilic bases are not greasy and constitute higher acceptability for the patient, driving their demand and market growth.

North America accounted for the largest regional share of the suppositories market in 2024.

The global suppositories market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is the largest regional market for suppositories, whereas the Asia Pacific market is estimated to grow at the highest CAGR during the forecast period.

The significant predominance of the North American market can largely be attributed to several interrelated factors. Firstly, a rising incidence of acute and chronic diseases has become a pressing public health concern and is driving demand for related healthcare services and products. This increase is further supported by a robust and well-established healthcare infrastructure that efficiently provides medical care and resources to address these health challenges. Furthermore, leading pharmaceutical companies and manufacturers based in the US and Canada drive consistent product availability and sustained-release technologies in the region. Together, these factors create a strong environment for market growth for suppositories.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3- 25%

- By Designation: C-level-30%, Director-level-23%, and Other Designations-47%

- By Region: North America-35%, Europe-20%, Asia Pacific-25%, Latin America-13%, and Middle East & Africa-7%

The major players operating in the suppositories market are Bayer AG (Germany), Novartis AG (Switzerland), Sanofi (France), Zydus Group (India), Bliss GVS Pharma Limited (India), Church & Dwight Co., Inc. (US), Bausch Health Companies Inc. (Canada), Teva Pharmaceutical Industries Ltd. (Israel), Sun Pharmaceutical Industries Ltd. (India), Adcock Ingram (South Africa), Aspen Holdings (South Africa), Julphar (UAE), Cipla (India), Haleon Group of Companies (UK), and Prestige Consumer Healthcare (US).

Research Coverage

This report studies the suppositories market based on type, base, prescription, application, patient type, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies for strengthening their market presence.

This report provides insights into the following points:

- Analysis of key drivers (rise in prevalence of acute and chronic disorders, rapidly expanding global aging population and subsequent surge in chronic disorders, ability to bypass the hepatic first-pass metabolism and therapeutic advantages, and growing demand for targeted drug delivery solutions), restraints (stringent regulatory requirements, development of innovative and more targeted drug delivery technologies, low patient and caregiver acceptance), opportunities (advancements in formulation technologies to offer high-growth opportunities, and expanding therapeutic applications), challenges (complexity of formulation and drug delivery, and limited shelf life of suppositories)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the suppositories market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the suppositories market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the suppositories market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.3 TOP-DOWN APPROACH

- 2.2.4 BOTTOM-UP APPROACH

- 2.2.5 PRIMARY INTERVIEWS

- 2.3 GROWTH FORECAST MODEL

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SUPPOSITORIES MARKET OVERVIEW

- 4.2 NORTH AMERICA: SUPPOSITORIES MARKET, BY TYPE AND COUNTRY

- 4.3 SUPPOSITORIES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- 4.4 SUPPOSITORIES MARKET, BY BASE, 2025 VS. 2030 (USD MILLION)

- 4.5 SUPPOSITORIES MARKET, BY PRESCRIPTION, 2025 VS. 2030 (USD MILLION)

- 4.6 SUPPOSITORIES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of acute and chronic disorders

- 5.2.1.2 Booming geriatric population worldwide

- 5.2.1.3 Pharmacokinetic advantages of suppositories

- 5.2.1.4 Growing demand for targeted and localized drug delivery solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory requirements

- 5.2.2.2 Rapid development of innovative drug delivery technologies

- 5.2.2.3 Low patient and caregiver acceptance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging formulations and 3D techniques

- 5.2.3.2 Expanding therapeutic applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex formulation and drug delivery

- 5.2.4.2 Limited shelf life of suppositories

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 3D printed multi-drug-loaded suppositories

- 5.8.1.2 Self-microemulsifying suppository systems

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Mucoadhesive and bioadhesive polymers

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Form-fill-seal (FFS) machine technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR SUPPOSITORIES

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.1.1 US

- 5.12.1.1.2 Canada

- 5.12.1.2 Europe

- 5.12.1.2.1 Germany

- 5.12.1.2.2 Italy

- 5.12.1.2.3 France

- 5.12.1.2.4 UK

- 5.12.1.3 Asia Pacific

- 5.12.1.3.1 China

- 5.12.1.3.2 Japan

- 5.12.1.3.3 India

- 5.12.1.3.4 South Korea

- 5.12.1.3.5 Australia

- 5.12.1.4 Latin America

- 5.12.1.5 Middle East & Africa

- 5.12.1.1 North America

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 UNMET NEEDS/END-USER EXPECTATIONS

- 5.16 IMPACT OF AI/GEN AI

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI ON SUPPOSITORIES MARKET

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF GENERATIVE AI IN SUPPOSITORIES MARKET

- 5.17 IMPACT OF 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.5 IMPACT ON END-USER INDUSTRIES

6 SUPPOSITORIES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 RECTAL SUPPOSITORIES

- 6.2.1 EASE OF USE, AFFORDABILITY, AND QUICK RELIEF TO PROMOTE GROWTH

- 6.3 VAGINAL SUPPOSITORIES

- 6.3.1 SHORT-TERM THERAPY AND QUICK SYMPTOM RELIEF TO AUGMENT GROWTH

- 6.4 URETHRAL SUPPOSITORIES

- 6.4.1 NEED FOR LOCALIZED, FAST-ACTING THERAPY TO CONTRIBUTE TO GROWTH

7 SUPPOSITORIES MARKET, BY BASE

- 7.1 INTRODUCTION

- 7.2 OLEAGINOUS/ LIPOPHILIC BASES

- 7.2.1 RISING PATIENT PREFERENCE FOR EASY-TO-USE, NON-ORAL DOSAGE FORMS TO FACILITATE GROWTH

- 7.3 AQUEOUS/HYDROPHILIC BASES

- 7.3.1 NEED TO MAINTAIN DRUG STABILITY TO SPUR GROWTH

- 7.4 EMULSIFYING BASES

- 7.4.1 CONSISTENT DRUG RELEASE AND ABSORPTION TO BOLSTER GROWTH

8 SUPPOSITORIES MARKET, BY PRESCRIPTION

- 8.1 INTRODUCTION

- 8.2 PRESCRIBED SUPPOSITORIES

- 8.2.1 INCREASED RELIANCE ON PRESCRIPTION SUPPOSITORIES FOR HORMONE REPLACEMENT AND ANTIEMETIC TREATMENT TO SUPPORT GROWTH

- 8.3 OVER-THE-COUNTER SUPPOSITORIES

- 8.3.1 GROWING PREFERENCE FOR CONVENIENT, NON-INVASIVE RELIEF FROM COMMON HEALTH CONCERNS TO FUEL MARKET

9 SUPPOSITORIES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 HEMORRHOID TREATMENTS

- 9.2.1 INCREASING OBESITY AND SEDENTARY LIFESTYLE TO EXPEDITE GROWTH

- 9.3 ANTI-BACTERIAL AND ANTI-FUNGAL APPLICATIONS

- 9.3.1 GROWING BURDEN OF VAGINAL INFECTIONS TO PROPEL MARKET

- 9.4 ANALGESICS & ANTIPYRETICS

- 9.4.1 INCREASING INCIDENCE OF CHRONIC PAIN CONDITIONS TO ACCELERATE GROWTH

- 9.5 LAXATIVES

- 9.5.1 LOW DIETARY FIBER INTAKE AND RISING PREVALENCE OF CONSTIPATION TO BOOST MARKET

- 9.6 ANTI-EMETICS

- 9.6.1 GROWING USE OF ANTI-EMETIC SUPPOSITORIES FOR CHEMOTHERAPY, RADIATION THERAPY, OR POST-OPERATIVE RECOVERY TO DRIVE MARKET

- 9.7 OTHER APPLICATIONS

10 SUPPOSITORIES MARKET, BY PATIENT TYPE

- 10.1 INTRODUCTION

- 10.2 ADULT PATIENTS

- 10.2.1 GROWING FOCUS ON CHRONIC CONDITION MANAGEMENT TO DRIVE MARKET

- 10.3 PEDIATRIC PATIENTS

- 10.3.1 INCREASING NEED FOR ALTERNATIVE DRUG DELIVERY TO SUPPORT GROWTH

- 10.4 GERIATRIC PATIENTS

- 10.4.1 NEED FOR RELIABLE, EFFECTIVE, AND WELL-TOLERATED DRUG DELIVERY IN ELDERLY PATIENTS TO AID GROWTH

11 SUPPOSITORIES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Rising demand for non-oral therapeutics among aging and chronic patient groups to augment growth

- 11.2.3 CANADA

- 11.2.3.1 Government support and public health campaigns to encourage growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 High healthcare spending and prescription culture to support growth

- 11.3.3 FRANCE

- 11.3.3.1 Increasing use of suppositories in pediatrics, gynecology, and internal medicine to propel market

- 11.3.4 UK

- 11.3.4.1 Growing use of suppositories for pediatric fever, antiemetic needs, and constipation management to drive market

- 11.3.5 ITALY

- 11.3.5.1 Increasing pediatric patient population to contribute to growth

- 11.3.6 SPAIN

- 11.3.6.1 Rising adoption of non-invasive, self-administered dosage forms to spur growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Geriatric population and regulatory guidelines to drive market

- 11.4.3 CHINA

- 11.4.3.1 Expanding elderly population to boost market

- 11.4.4 INDIA

- 11.4.4.1 Increasing healthcare penetration across urban and semi-urban areas to promote growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased patient volume and favorable government initiatives to sustain growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Favorable insurance policy to accelerate growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Expanding public healthcare access and domestic manufacturing to bolster growth

- 11.5.3 MEXICO

- 11.5.3.1 Growing consumer preference for self-medication to propel market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.2.1.1 Substantial public healthcare investment to facilitate growth

- 11.6.2.2 United Arab Emirates (UAE)

- 11.6.2.2.1 Favorable environment for drug import and local manufacturing to aid growth

- 11.6.2.3 Rest of GCC Countries

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SUPPOSITORIES MARKET

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Base footprint

- 12.7.5.5 Prescription footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SANDOZ GROUP AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 CIPLA

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 SANOFI

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SUN PHARMACEUTICAL INDUSTRIES LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 BAYER AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 NOVARTIS AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 ZYDUS GROUP

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product approvals

- 13.1.9 BLISS GVS PHARMA LIMITED

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 CHURCH & DWIGHT CO., INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 BAUSCH HEALTH COMPANIES INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 ADCOCK INGRAM

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 ASPEN HOLDINGS

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 JULPHAR

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 HALEON GROUP OF COMPANIES

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.16 LES LABORATOIRES SERVIER

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.17 PRESTIGE CONSUMER HEALTHCARE INC.

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 VIATRIS INC.

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 GALEN LIMITED

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.20 MERIDIAN ENTERPRISES PVT. LTD.

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.1 SANDOZ GROUP AG

- 13.2 OTHER PLAYERS

- 13.2.1 COSETTE PHARMACEUTICALS

- 13.2.2 FLAGSHIP

- 13.2.3 OUBARI PHARMA

- 13.2.4 LAVINA PHARMACEUTICALS PVT. LTD.

- 13.2.5 NORWELL

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS