|

시장보고서

상품코드

1787260

적외선(IR) 이미징 시장 : 유형별, 파장별, 컴포넌트별, 기술별, 용도별 예측(-2030년)Infrared Imaging Market by Type, Wavelength, Component, Technology, Application - Global Forecast to 2030 |

||||||

세계의 적외선(IR) 이미징 기술은 안전, 자동화, 에너지 효율에 대한 수요가 증가함에 따라 자동차 부문에서 큰 지지를 얻고 있습니다.

서멀 카메라는 특히 야간 주행이나 안개 등의 시야 불량시에 보행자나 동물을 검지하는 ADAS(첨단 운전 지원 시스템)에 탑재가 진행되고 있습니다. 이러한 시스템은 상황 인식을 강화하고 사고의 위험을 줄이고 안전 규제 증가와 소비자의 기대에 부합합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 구성 요소, 파장, 용도, 기술, 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

또한 적외선 이미징은 전기자동차(EV) 배터리 모니터링 및 열 관리를 지원하며 성능과 안전에 중요한 역할을 합니다. 제조에서 적외선 카메라는 자동차 조립 라인에서 품질 보증, 용접 무결성 검사, 구성 요소 정렬에 사용됩니다. 또한, 자동 운전 차량의 상승으로 열 센서는 LiDAR, 레이더, 가시 카메라와 통합되어 다양한 환경에서 작동할 수 있는 멀티모달 인식 시스템이 구축되고 있습니다. 이 기술은 운전자의 피로 감지 및 에어컨 제어 최적화를 목적으로 하는 차량 탑승자 모니터링에도 적용됩니다. 자동차 OEM 및 Tier 1 공급업체가 이러한 기능을 점점 추구하는 가운데, IR 이미징은 모빌리티 에코시스템의 기술 혁신, 파트너십, 시장 확대의 선호가 되고 있습니다.

"파장 부문 SWIR 시장은 예측 기간 동안 최고의 CAGR로 성장할 전망입니다."

단파장 적외선(SWIR) 기술은 산업 품질 검사, 반도체 제조 및 군용 이미징 용도에서의 사용 증가로 인해 파장 부문 내에서 최고의 CAGR을 기록할 전망입니다. 장파장 및 중파장 적외선과 달리 SWIR은 유리 및 실리콘 재료를 통해 고해상도 이미징을 가능하게 하므로 태양전지, 전자 웨이퍼, 식품 검사에 이상적입니다. SWIR은 눈에 보이지 않는 수분, 오염물질, 눈에 보이지 않는 결함을 가시 및 열화상으로 효과적으로 감지합니다. 또한, SWIR 카메라는 연기, 안개, 저조도 환경과 같은 가혹한 환경 조건 하에서 이미징을 강화하여 감시 및 항공우주 적용에 유리합니다. SWIR은 저조도 환경에서도 위치를 밝히지 않고 레이저 조명을 지원하기 때문에 군이 은밀 작전에 활용하고 있습니다. 또한 저비용 인듐 갈륨 비소(InGaAs) 센서의 등장으로 SWIR의 가용성이 향상되어 폭넓은 부문에서 이용할 수 있게 되었습니다. 정밀 제조, 재료 선별, 고성능 감시에 대한 주목의 고조가 SWIR의 채용을 가속하고 있으며, 파장별 적외선 이미징 시장에서 가장 급성장하고 있는 부문 중 하나가 되고 있습니다.

"용도별로 모니터링 및 검사 부문은 적외선 이미징 시장에서 예측 기간 동안 최고의 CAGR을 나타낼 것으로 보입니다."

산업계가 예지보전, 프로세스 최적화, 안전보증으로 적외선 이미징에 대한 의존도를 높이고 있기 때문에 모니터링 및 검사 부문이 적외선 이미징 시장에서 최고의 CAGR을 나타낼 것으로 예측되고 있습니다. 적외선 카메라는 장비 고장을 식별하고, 전기 시스템의 핫스팟을 감지하고, 열 성능을 실시간으로 모니터링하는 데 필수적입니다. 제조, 석유, 가스, 발전, 유틸리티 등의 산업에서는 비용이 많이 드는 가동 중단을 방지하고 자산의 수명을 연장하기 위해 적외선 이미징을 사용합니다. Industry 4.0의 출현으로 IR 이미징은 자동 검사 시스템과 IoT 지원 장비에도 통합되어 지속적인 원격 진단이 가능합니다. 이러한 시스템은 구성 요소의 악화 징후를 조기에 파악하고, 계획 외 종료를 줄이고 운영 효율성을 향상시킬 수 있습니다. 또한 열검사는 비접촉 및 비파괴이므로 고전압 기기와 고온 기기의 안전한 평가가 가능합니다. 운전 신뢰성, 에너지 효율, 안전 규제 준수를 선호하는 기업이 늘어남에 따라 첨단 적외선 모니터링 솔루션 수요가 증가하고 있습니다. 이 때문에 모니터링 및 검사 용도는 적외선 이미징 상황에서 가장 역동적이고 급속히 확대되고 있는 분야의 하나가 되고 있습니다.

"북미가 예측 기간에 가장 큰 시장 점유율을 얻을 것으로 예상됩니다."

북미는 엄청난 방위 투자, 첨단 산업 인프라, 견조한 혁신으로 예측 기간 동안 적외선 이미징 시장에서 가장 큰 점유율을 유지할 전망입니다. 특히 미국은 군사 감시, 국경 경비, 법 집행을 목적으로 적외선 이미징 기술을 널리 전개하고, 이 지역을 주도하고 있습니다. FLIR Systems, Teledyne, RTX와 같은 주요 기업들은 이 지역에 깊이 뿌리를 두고 있으며 제품 개발과 신속한 상업화에 기여하고 있습니다.

이 보고서는 세계 적외선 이미징 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 적외선 이미징 시장의 기업에게 매력적인 성장 기회

- 적외선 이미징 시장 : 유형별

- 적외선 이미징 시장 : 컴포넌트별

- 적외선 이미징 시장 : 용도별

- 적외선 이미징 시장 : 파장별

- 북미의 적외선 이미징 시장 : 국가별, 용도별

- 적외선 이미징 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 공급망 분석

- 적외선 이미징 에코시스템

- 고객사업에 영향을 주는 동향/혼란

- 가격 설정 분석

- 적외선 이미징 카메라의 평균 판매 가격 : 주요 제조업체별(2024년)

- 반사 적외선 이미징 카메라의 평균 판매 가격의 동향 : 지역별(2021-2024년)

- 열적외선 이미징 카메라의 평균 판매 가격의 동향 : 지역별(2021-2024년)

- 기술 동향

- IR 이미징 기술을 이용한 유기 퇴비의 분석

- 차의 품질과 안전성을 분석하기 위한 진동 분광 기술의 도입

- 보안 및 검사 용도로 서멀 카메라 채용

- 클라우드 통합에 의한 적외선 이미징 기술의 변화

- AI 기반의 적외선 이미징의 진보

- 적외선 이미징 시장에 대한 AI/생성형 AI의 영향

- Porter's Five Forces 분석

- 구매 과정에서 주요 이해관계자와 구매 기준

- 사례 연구 분석

- ROCKWOOL GROUP, 단열 효과를 평가하고 건물의 분석을 실시하기 위해 TELEDYNE FLIR의 열 이미징 기술을 사용

- VICENZA COURT, Multites SRL의 열 이미징 전문가의 서비스를 채용하여 건설 분쟁을 해결

- HIGHLAND HELICOPTERS, INFRATEC의 서멀 카메라를 산불 대책에 전개

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 무역 분석

- 수입 시나리오(HS 902750)

- 수출 시나리오(HS 902750)

- 관세 분석

- 기준과 규제 상황

- 규제기관, 정부기관, 기타 조직

- 정부 규제

- 규제 상황

- 정부기준

- 적외선 이미징 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 각국 및 지역에의 주된 영향

- 산업에 미치는 영향

제6장 적외선 이미징 장치 유형

- 소개

- 이동식

- 고정식

제7장 적외선 이미징 시장 : 유형별

- 소개

- 반사

- 열

제8장 적외선 이미징 시장 : 컴포넌트별

- 소개

- 카메라

- 스코프

- 모듈

제9장 적외선 이미징 시장 : 기술별

- 소개

- 냉각

- 비냉각

제10장 적외선 이미징 시장 : 파장별

- 소개

- NIR

- SWIR

- MWIR

- LWIR

제11장 적외선 이미징 시장 : 용도별

- 소개

- 보안 및 감시

- 모니터링 및 검사

- 감지

제12장 적외선 이미징 시장 : 업계별

- 소개

- 공업

- 비공업

제13장 적외선 이미징 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시 경제 전망

- 남미

- 중동

- 아프리카

제14장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2020-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

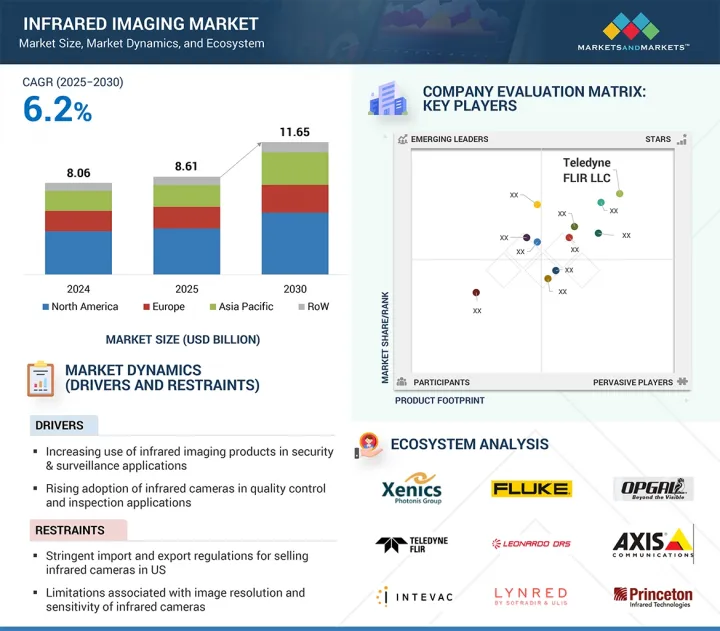

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 스타트업/중소기업(2024년)

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 기업

- TELEDYNE FLIR LLC

- FLUKE CORPORATION

- LEONARDO SPA

- AXIS COMMUNICATIONS AB

- RTX

- L3HARRIS TECHNOLOGIES, INC.

- EXOSENS

- OPGAL OPTRONIC INDUSTRIES LTD.

- LYNRED

- ALLIED VISION TECHNOLOGIES GMBH

- BAE SYSTEMS

- TESTO SE & CO. KGAA

- 기타 주요 기업

- INTEVAC, INC.

- ZHEJIANG DALI TECHNOLOGY CO., LTD.

- C-THERM TECHNOLOGIES LTD.

- IRCAMERAS LLC

- HGH

- RAPTOR PHOTONICS

- EPISENSORS

- INFRATEC GMBH

- PRINCETON INFRARED TECHNOLOGIES, INC.

- SIERRA-OLYMPIA TECH.

- COX CO., LTD.

- TONBO IMAGING

- OPTOTHERM, INC.

- SEEK THERMAL

- INFRARED CAMERAS, INC.

- LAND INSTRUMENTS INTERNATIONAL LTD

- DIAS INFRARED GMBH

- MOVITHERM

제16장 부록

JHS 25.08.14Infrared (IR) imaging technology is gaining significant traction in the automotive sector, driven by the growing demand for safety, automation, and energy efficiency. Thermal cameras are increasingly integrated into advanced driver-assistance systems (ADAS) for pedestrian and animal detection, especially in low-visibility conditions such as night-time driving or fog. These systems enhance situational awareness and reduce the risk of accidents, aligning with rising safety regulations and consumer expectations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By type, component, wavelength, application, technology, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, infrared imaging supports electric vehicle (EV) battery monitoring and thermal management, which are critical for performance and safety. In manufacturing, IR cameras are used in automotive assembly lines for quality assurance, checking weld integrity, and component alignment. Moreover, with the rise of autonomous vehicles, thermal sensors are being integrated alongside LiDAR, radar, and visible cameras to create a multi-modal perception system capable of operating in various environments. The technology also finds applications in in-cabin occupant monitoring for driver fatigue detection and climate control optimization. As automotive OEMs and Tier 1 suppliers increasingly explore these capabilities, IR imaging presents lucrative opportunities for innovation, partnerships, and market expansion within the mobility ecosystem.

"Market for SWIR in wavelength segment to grow at highest CAGR during forecast period."

Short-wave Infrared (SWIR) technology is expected to record the highest CAGR within the wavelength segment due to its increasing use in industrial quality inspection, semiconductor manufacturing, and military imaging applications. Unlike long-wave or mid-wave IR, SWIR enables high-resolution imaging through glass and silicon materials, making it ideal for inspecting solar cells, electronic wafers, and food products. It effectively detects invisible moisture, contaminants, and invisible defects under visible or thermal imaging. Additionally, SWIR cameras provide enhanced imaging under harsh environmental conditions, including smoke, fog, and low-light environments, which is advantageous in surveillance and aerospace applications. Military forces utilize SWIR for covert operations, as it supports laser illumination in low-light scenarios without revealing positions. Moreover, the emergence of lower-cost indium gallium arsenide (InGaAs) sensors is improving SWIR affordability and broadening its accessibility across sectors. The growing emphasis on precision manufacturing, material sorting, and high-performance surveillance is accelerating the adoption of SWIR, making it one of the fastest-growing segments within the infrared imaging market, by wavelength.

"Monitoring & inspection segment to exhibit highest CAGR in infrared imaging market, by application, during forecast period"

The monitoring & inspection segment is projected to witness the highest CAGR in the infrared imaging market, as industries increasingly rely on thermal imaging for predictive maintenance, process optimization, and safety assurance. Infrared cameras are essential for identifying equipment failures, detecting hotspots in electrical systems, and monitoring thermal performance in real time. Industries such as manufacturing, oil & gas, power generation, and utilities use IR imaging to prevent costly downtimes and enhance asset longevity. With the rise of Industry 4.0, IR imaging is also being integrated into automated inspection systems and IoT-enabled devices, offering continuous and remote diagnostics. These systems can identify early signs of component degradation, reduce unplanned shutdowns, and improve operational efficiency. Furthermore, thermal inspection is non-contact and non-destructive, allowing for safe evaluation of high-voltage or high-temperature equipment. Demand for advanced IR monitoring solutions continues to grow as more companies prioritize operational reliability, energy efficiency, and compliance with safety regulations. This makes the monitoring and inspection application one of the most dynamic and rapidly expanding areas in the infrared imaging landscape.

"North America to capture largest market share throughout forecast period"

North America is expected to maintain the largest share of the infrared imaging market throughout the forecast period, driven by substantial defense investments, advanced industrial infrastructure, and robust technology innovation. The US, in particular, leads the region with widespread deployment of IR imaging technologies in military surveillance, border security, and law enforcement. Major players such as FLIR Systems, Teledyne, and RTX have deep roots in the region, contributing to product development and rapid commercialization. In addition to defense, IR imaging is highly adopted in electrical inspection, smart manufacturing, building diagnostics, and healthcare applications. Government funding for R&D and a favorable regulatory framework supporting critical infrastructure protection and industrial safety accelerate market adoption. The region's leadership in AI, IoT, and automation technologies further strengthens its position, as infrared imaging increasingly integrates with intelligent systems for real-time data analysis and decision-making. With high purchasing power, early technology adoption, and an established ecosystem of end users and innovators, North America remains the most mature and dominant region in the global infrared imaging market.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the infrared imaging marketplace. The breakup of the profile of primary participants in the infrared imaging market is as follows:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Directors - 30%, and Others - 30%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 35%, and RoW - 10%

Teledyne FLIR LLC (US), Fluke Corporation (US), Leonardo S.p.A. (US), Axis Communications AB. (Sweden), L3Harris Technologies, Inc. (US), RTX (US), Exosens (France), Opgal, Optronic Industries Ltd. (Israel), Lynred (France), Allied Vision Technologies GmbH (Germany), BAE Systems (UK), and Testo SE & Co. KGaA (Germany) are some major players in the infrared imaging market.

The study includes an in-depth competitive analysis of these key players in the infrared imaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the infrared imaging market, by type (reflective, thermal), component (cameras, scopes, modules), technology (cooled, uncooled), wavelength (NIR, SWIR, MWIR, LWIR), application (security & surveillance, monitoring & inspection, detection), vertical (industrial, non-industrial), and region (North America, Europe, Asia Pacific, RoW). It analyzes major factors influencing market growth, including drivers, restraints, challenges, and opportunities. The report also provides insights into key industry players, their strategies, contract activities, and recent developments, along with a competitive analysis of emerging startups in the market.

Reasons to Buy This Report:

The report will help market leaders and new entrants with information on the closest approximations of the infrared imaging market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report:

- Analysis of key drivers increasing use of infrared imaging products in security & surveillance applications, rising adoption of infrared cameras in quality control and inspection applications, growing popularity of uncooled infrared cameras, boosting demand for SWIR cameras in machine vision applications), restraints (stringent import and export regulations for selling infrared cameras in US, limitations associated with image resolution and sensitivity of infrared cameras), opportunities (emerging applications of IR imaging technology in automotive sector, newer application areas of SWIR cameras, integration of infrared imaging technology into consumer electronics), and challenges (high cost associated with infrared cameras, designing highly accurate IR imaging products, integration and compatibility challenges pertaining to infrared imaging technology) influencing the growth of the infrared imaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product and service launches in the infrared imaging market

- Market Development: Comprehensive information about lucrative markets by analyzing the infrared imaging market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the infrared imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading companies, such as Teledyne FLIR LLC (US), Fluke Corporation (US), Leonardo S.p.A. (US), and Axis Communications AB. (Sweden), L3Harris Technologies, Inc. (US), RTX (US), Exosens (France), Opgal, Optronic Industries Ltd. (Israel), Lynred (France), Allied Vision Technologies GmbH (Germany), BAE Systems. (UK), and Testo SE & Co. KGaA (Germany) in the infrared imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Estimating market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INFRARED IMAGING MARKET

- 4.2 INFRARED IMAGING MARKET, BY TYPE

- 4.3 INFRARED IMAGING MARKET, BY COMPONENT

- 4.4 INFRARED IMAGING MARKET, BY APPLICATION

- 4.5 INFRARED IMAGING MARKET, BY WAVELENGTH

- 4.6 INFRARED IMAGING MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- 4.7 INFRARED IMAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of infrared imaging products in security & surveillance applications

- 5.2.1.2 Rising adoption of infrared cameras in quality control and inspection applications

- 5.2.1.3 Growing popularity of uncooled infrared cameras

- 5.2.1.4 Boosting demand for SWIR cameras in machine vision applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent import and export regulations for selling infrared cameras in US

- 5.2.2.2 Limitations associated with image resolution and sensitivity of infrared cameras

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging applications of IR imaging technology in automotive sector

- 5.2.3.2 Newer application areas of SWIR cameras

- 5.2.3.3 Integration of infrared imaging technology into consumer electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost associated with infrared cameras

- 5.2.4.2 Designing highly accurate IR imaging products

- 5.2.4.3 Integration and compatibility challenges pertaining to infrared imaging technology

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 INFRARED IMAGING ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF INFRARED IMAGING CAMERA TYPES, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF REFLECTIVE INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF THERMAL INFRARED IMAGING CAMERAS, BY REGION, 2021-2024

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 USE OF IR IMAGING TECHNOLOGY TO ANALYZE ORGANIC COMPOST

- 5.7.2 IMPLEMENTATION OF VIBRATIONAL SPECTROSCOPIC TECHNIQUES TO ANALYZE TEA QUALITY AND SAFETY

- 5.7.3 ADOPTION OF THERMAL CAMERAS IN SECURITY AND INSPECTION APPLICATIONS

- 5.7.4 TRANSFORMATION IN INFRARED IMAGING TECHNOLOGY WITH CLOUD INTEGRATION

- 5.7.5 ADVANCEMENTS IN AI-BASED INFRARED IMAGING

- 5.8 IMPACT OF AI/GEN AI ON INFRARED IMAGING MARKET

- 5.8.1 TOP USE CASES AND MARKET POTENTIAL

- 5.8.1.1 Anomaly detection

- 5.8.1.2 Medical diagnostics fever screening

- 5.8.1.3 Surveillance & border security

- 5.8.1.4 Smart city infrastructure monitoring

- 5.8.1.5 Automotive driver-assistance and EV battery monitoring

- 5.8.1 TOP USE CASES AND MARKET POTENTIAL

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ROCKWOOL GROUP USED TELEDYNE FLIR'S THERMAL IMAGING TECHNOLOGY TO ASSESS INSULATION EFFECTIVENESS AND CONDUCT BUILDING ANALYSIS

- 5.11.2 VICENZA COURT RESOLVED CONSTRUCTION DISPUTE BY HIRING SERVICES OF THERMAL IMAGING EXPERTS FROM MULTITES SRL

- 5.11.3 HIGHLAND HELICOPTERS DEPLOYED THERMAL CAMERAS FROM INFRATEC TO COMBAT WILDFIRES

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO (HS 902750)

- 5.14.2 EXPORT SCENARIO (HS 902750)

- 5.15 TARIFF ANALYSIS

- 5.16 STANDARDS AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 GOVERNMENT REGULATIONS

- 5.16.3 REGULATORY LANDSCAPE

- 5.16.4 GOVERNMENT STANDARDS

- 5.17 2025 US TARIFF IMPACT ON INFRARED IMAGING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON VARIOUS COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 INFRARED IMAGING DEVICE TYPES

- 6.1 INTRODUCTION

- 6.2 PORTABLE 95 6.2.1 USE OF PORTABLE CAMERAS FOR CONVENIENCE AND EFFORTLESS IMAGING

- 6.2.2 AERIAL

- 6.2.2.1 Deployment of aerial cameras for thermographic view and improved visibility of objects to be monitored or inspected

- 6.2.3 HANDHELD

- 6.2.3.1 Implementation of handheld cameras in buildings to inspect heat loss and detect insulation issues

- 6.2.2 AERIAL

- 6.3 FIXED

- 6.3.1 ADOPTION OF FIXED CAMERAS TO ENSURE CONSISTENT AND RELIABLE IMAGING OUTPUT

7 INFRARED IMAGING MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 REFLECTIVE

- 7.2.1 RISING USE IN SEMICONDUCTOR INSPECTION AND SECURITY APPLICATIONS TO SUPPORT MARKET GROWTH

- 7.3 THERMAL

- 7.3.1 PRESSING NEED FOR ENHANCED SAFETY AND OPERATIONAL EFFICIENCY ACROSS INDUSTRIES TO BOOST DEMAND

8 INFRARED IMAGING MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 CAMERAS

- 8.2.1 SIGNIFICANT USE IN PUBLIC SAFETY, MEDICAL, AND INDUSTRIAL APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 8.3 SCOPES

- 8.3.1 DEFENSE, OUTDOOR SPORTS, AND TACTICAL SURVEILLANCE APPLICATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.4 MODULES

- 8.4.1 SURGING USE OF MODULAR INFRARED IMAGING SYSTEMS IN DRONES, ROBOTICS, AND SMART DEVICES TO FOSTER SEGMENTAL GROWTH

9 INFRARED IMAGING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 COOLED

- 9.2.1 NEED TO REDUCE SENSOR NOISE AND IMPROVE SENSITIVITY TO ENCOURAGE ADOPTION

- 9.3 UNCOOLED

- 9.3.1 INCREASING ADOPTION IN HIGH-VOLUME APPLICATIONS OWING TO LOW COST AND EASY INSTALLATION TO FOSTER SEGMENTAL GROWTH

10 INFRARED IMAGING MARKET, BY WAVELENGTH

- 10.1 INTRODUCTION

- 10.2 NIR

- 10.2.1 HIGH ADOPTION OF NIR CCTV CAMERAS FOR SECURITY & SURVEILLANCE TO DRIVE MARKET

- 10.3 SWIR

- 10.3.1 INCREASED USE OF SWIR IMAGING TECHNOLOGY IN NON-DESTRUCTIVE TESTING TO PROPEL MARKET

- 10.4 MWIR

- 10.4.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN MWIR TO BOOST SEGMENTAL GROWTH

- 10.5 LWIR

- 10.5.1 SIGNIFICANT USE IN WEARABLES, DRONES, AND HANDHELD DEVICES TO FUEL SEGMENTAL GROWTH

11 INFRARED IMAGING MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 SECURITY & SURVEILLANCE

- 11.2.1 SURGING DEPLOYMENT OF INFRARED CAMERAS DUE TO INCREASED TERRORISM TO DRIVE MARKET

- 11.3 MONITORING & INSPECTION

- 11.3.1 RISING USE OF INFRARED CAMERAS IN ENERGY AUDITS, BUILDING DIAGNOSTICS, AND INDUSTRIAL FAULT DETECTION TO PROPEL MARKET

- 11.3.2 CONDITION MONITORING

- 11.3.3 STRUCTURAL HEALTH MONITORING

- 11.3.4 QUALITY CONTROL

- 11.4 DETECTION

- 11.4.1 INCREASING IMPORTANCE OF SITUATIONAL AWARENESS TO SPIKE DEMAND

- 11.4.2 GAS DETECTION

- 11.4.3 FIRE/FLARE DETECTION

- 11.4.4 BODY TEMPERATURE MEASUREMENT

12 INFRARED IMAGING MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 INDUSTRIAL

- 12.2.1 ELEVATING USE OF SWIR CAMERAS TO ENSURE PRECISION IN GLASS, SEMICONDUCTOR, AND METAL PROCESSING TO FAVOR MARKET GROWTH

- 12.2.2 AUTOMOTIVE

- 12.2.3 AEROSPACE

- 12.2.4 ELECTRONICS & SEMICONDUCTOR

- 12.2.5 OIL & GAS

- 12.2.6 FOOD & BEVERAGES

- 12.2.7 GLASS

- 12.2.8 OTHER INDUSTRIAL VERTICALS

- 12.3 NON-INDUSTRIAL

- 12.3.1 RISING ADOPTION IN PUBLIC SAFETY, RESEARCH, AND HEALTHCARE TO PROPEL MARKET

- 12.3.2 MILITARY & DEFENSE

- 12.3.3 CIVIL INFRASTRUCTURE

- 12.3.4 MEDICAL

- 12.3.5 SCIENTIFIC RESEARCH

13 INFRARED IMAGING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Government focus on safety and security of country to fuel market growth

- 13.2.3 CANADA

- 13.2.3.1 Growing focus on safeguarding assets and ensuring public safety to boost demand

- 13.2.4 MEXICO

- 13.2.4.1 Increasing challenges related to border security, drug trafficking, and organized crime to spike demand

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Booming automotive sector to accelerate demand

- 13.3.3 UK

- 13.3.3.1 Medical and pharmaceutical companies to contribute most to market growth

- 13.3.4 FRANCE

- 13.3.4.1 Technology advancements in automotive sector to propel market growth

- 13.3.5 ITALY

- 13.3.5.1 Government focus on strengthening military surveillance capabilities to propel market

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Border control, critical infrastructure protection, and public safety applications to create opportunities

- 13.4.3 JAPAN

- 13.4.3.1 Consumer electronics, automotive, and healthcare sectors to strengthen market momentum

- 13.4.4 INDIA

- 13.4.4.1 Increasing use in predictive maintenance and quality control applications by industry players to support market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Greater emphasis on addressing urban crime and supporting border security operations to stimulate demand

- 13.5.3 MIDDLE EAST

- 13.5.3.1 Bahrain

- 13.5.3.1.1 Government initiatives to modernize surveillance and border control to drive market

- 13.5.3.2 Kuwait

- 13.5.3.2.1 Strong focus on modernizing oil, defense, and health infrastructure to accelerate demand

- 13.5.3.3 Oman

- 13.5.3.3.1 Rising emphasis on advanced safety protocols and sustainable operations to create opportunities

- 13.5.3.4 Qatar

- 13.5.3.4.1 Smart city development initiatives to fuel market growth

- 13.5.3.5 Saudi Arabia

- 13.5.3.5.1 Pressing need to monitor high-temperature processes in oil and petrochemical plants to boost demand

- 13.5.3.6 UAE

- 13.5.3.6.1 Vision of becoming global innovation hub to support market growth

- 13.5.3.7 Rest of Middle East

- 13.5.3.1 Bahrain

- 13.5.4 AFRICA

- 13.5.4.1 Urban infrastructure development to create opportunities

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Type footprint

- 14.5.5.4 Vertical footprint

- 14.6 STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPETITIVE SCENARIOS

- 14.7.1 PRODUCT LAUNCHES

- 14.7.2 DEALS

- 14.7.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TELEDYNE FLIR LLC

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 FLUKE CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 LEONARDO S.P.A.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 AXIS COMMUNICATIONS AB

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 RTX

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 L3HARRIS TECHNOLOGIES, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 EXOSENS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.8 OPGAL OPTRONIC INDUSTRIES LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.9 LYNRED

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.10 ALLIED VISION TECHNOLOGIES GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.11 BAE SYSTEMS

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.12 TESTO SE & CO. KGAA

- 15.1.12.1 Products offered

- 15.1.12.2 Recent developments

- 15.1.12.2.1 Product launches

- 15.1.1 TELEDYNE FLIR LLC

- 15.2 OTHER KEY PLAYERS

- 15.2.1 INTEVAC, INC.

- 15.2.2 ZHEJIANG DALI TECHNOLOGY CO., LTD.

- 15.2.3 C-THERM TECHNOLOGIES LTD.,

- 15.2.4 IRCAMERAS LLC

- 15.2.5 HGH

- 15.2.6 RAPTOR PHOTONICS

- 15.2.7 EPISENSORS

- 15.2.8 INFRATEC GMBH

- 15.2.9 PRINCETON INFRARED TECHNOLOGIES, INC.

- 15.2.10 SIERRA-OLYMPIA TECH.

- 15.2.11 COX CO., LTD.

- 15.2.12 TONBO IMAGING

- 15.2.13 OPTOTHERM, INC.

- 15.2.14 SEEK THERMAL

- 15.2.15 INFRARED CAMERAS, INC.

- 15.2.16 LAND INSTRUMENTS INTERNATIONAL LTD

- 15.2.17 DIAS INFRARED GMBH

- 15.2.18 MOVITHERM

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS