|

시장보고서

상품코드

1788515

스위치기어 모니터링 시스템 시장(-2030년) : 스위치기어 유형별, 전압별, 서비스별, 컴포넌트별, 최종 사용자별, 지역별 예측Switchgear Monitoring System Market by Switchgear Type (Gas-insulated, Air-insulated), Voltage (Low, Medium, and High and Extra High), End User (Utilities, Industrial, Commercial, Residential), Component, Service, and Region - Global Forecast to 2030 |

||||||

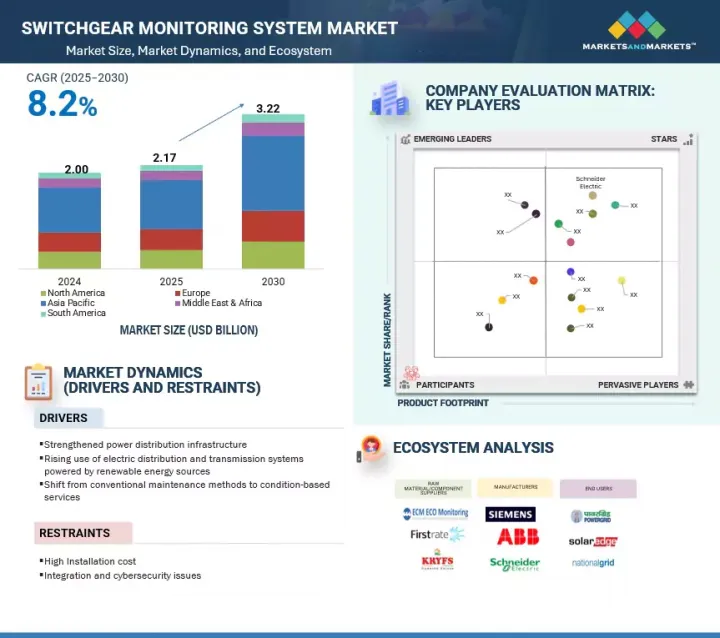

세계의 스위치기어 모니터링 시스템 시장 규모는 2025년 21억 7,000만 달러에서 2030년에는 32억 2,000만 달러로 성장할 전망이며 CAGR은 8.2%를 달성할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 조사 단위 | 금액(100만 달러) 및 수량(개수) |

| 부문 | 스위치기어 유형별, 전압별, 서비스별, 컴포넌트별, 최종 사용자별 : 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

신뢰성 있는 배전 시스템, 송전망의 현대화, 예측 유지보수에 대한 수요 증가가 스위치기어 모니터링 시스템 시장의 확대에 박차를 가하고 있습니다. 또한 기술의 발전과 에너지 효율화 정책의 구현으로 스위치기어 모니터링 시스템은 산업용 고객 사이에서도 인기를 얻고 있습니다.

예측 기간 동안 변전소와 송배전망으로 구성된 중요한 인프라에서 선진적인 스위치기어 모니터링 시스템의 채용이 증가하고 있으며 따라서 스위치기어 모니터링 시스템 시장에서 가장 큰 비율을 차지하는 것은 유틸리티 부문입니다. 스위치기어 모니터링 시스템은 실시간 진단, 신뢰성 향상, 유지보수 요구사항 감소 등의 특징을 갖추고 있으므로 유틸리티 운영에 적합합니다. 송전망의 안정성, 정전 방지, 에너지 효율에 대한 관심 고조에 따라 이러한 시스템의 채용은 꾸준히 증가하고 있습니다. 또한 스마트 모니터링 기술의 도입과 스마트 그리드로의 전환을 장려하는 정부 정책은 이러한 시스템의 도입을 더욱 강화하고 가속화하고 있습니다.

유럽은 산업 자동화 시스템 내 스위치기어 모니터링 시스템의 대규모 보급, 재생에너지원의 채용 증가, 스마트 그리드의 개발에 의해 스위치기어 모니터링 시스템 시장에서 2위를 차지할 것으로 예상됩니다. 이 지역은 기존의 확립된 산업, 에너지 효율적인 기술에 대한 높은 설비 투자, 청정에너지와 전기에 관한 유리한 정부 정책을 자랑하고 있습니다. 게다가 독일 및 프랑스와 같은 국가의 주요 전력회사와 제조업체들은 보다 높은 신뢰성과 지속 가능성을 실현하기 위해 개폐기 모니터링 시스템 시스템의 통합 노력을 강화하고 있습니다. 이러한 적극적인 노력은 이 지역 수요를 더욱 밀어 올리고 있습니다. 중요한 정성적 및 정량적 정보를 입수 및 검증하고 향후 시장 전망을 평가하기 위해 다양한 주요 시장 진출 기업, 전문가, 주요 시장 진출기업의 경영진, 업계 컨설턴트 등 전문가들에 대해 상세한 인터뷰를 실시했습니다.

이 보고서는 세계의 스위치기어 모니터링 시스템 시장을 스위치기어 유형, 구성 요소, 서비스, 전압, 최종 사용자 및 지역별로 정의, 설명 및 예측합니다. 또한 시장의 상세한 질적 및 양적 분석도 실시했습니다. 주요 시장 성장 촉진요인 및 억제요인, 기회, 과제를 종합적으로 검토하였으며 시장의 다양한 주요 측면을 다룹니다. 여기에는 경쟁 구도, 시장 역학, 금액 기준 시장 추정, 스위치기어 모니터링 시스템 시장 전망 동향 등의 분석이 포함됩니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객 사업에 영향을 주는 동향/혼란

- 생태계 분석

- 밸류체인 분석

- 기술 분석

- 가격 분석

- 관세 및 규제 상황

- 무역 분석

- Porter's Five Forces 분석

- 주요 이해 관계자와 구매 기준

- 사례 연구 분석

- 생성형 AI/AI가 스위치기어 모니터링 시스템 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 개요

제6장 스위치기어 모니터링 시스템 시장(스위치기어 유형별)

- 소개

- 공기 단열

- 가스 단열

제7장 스위치기어 모니터링 시스템 시장(전압별)

- 소개

- 저전압

- 중전압

- 고전압, 초고전압

제8장 스위치기어 모니터링 시스템 시장(서비스별)

- 소개

- 부분 방전 모니터링 시스템

- 가스 모니터링 시스템

- 온도 모니터링 시스템

- 기타

제9장 스위치기어 모니터링 시스템 시장(컴포넌트별)

- 소개

- 하드웨어

- 소프트웨어

제10장 스위치기어 모니터링 시스템 시장(최종 사용자별)

- 소개

- 유틸리티

- 공업

- 상업

- 기타

제11장 스위치기어 모니터링 시스템 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

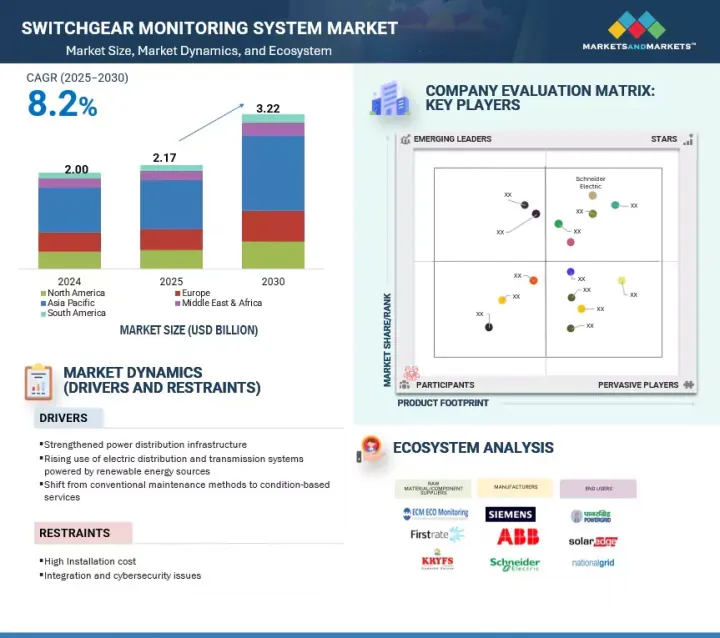

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- SIEMENS

- ABB

- SCHNEIDER ELECTRIC

- EATON

- GE VERNOVA

- MITSUBISHI ELECTRIC CORPORATION

- EMERSON ELECTRIC CO.

- HITACHI, LTD.

- PT. TIARA VIBRASINDO PRATAMA

- SENSEOR-WIKA GROUP

- BLUE JAY TECHNOLOGY CO. LTD.

- DYNAMIC RATINGS

- OSENSA INNOVATIONS

- MEGGER

- IPEC LTD.

- 기타 기업

- MONITRA LTD.

- RUGGED MONITORING

- PDS

- DOBLE ENGINEERING COMPANY

- NUVENTURA

제14장 부록

CSM 25.08.19The global switchgear monitoring system market is estimated to grow from USD 2.17 billion in 2025 to USD 3.22 billion by 2030, at a CAGR of 8.2%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | Switchgear Type, Voltage, Component, Service, and End User |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The growing demand for highly reliable power distribution systems, grid modernization, and predictive maintenance is fueling the expansion of the switchgear monitoring system market. Switchgear monitoring systems are also gaining momentum across industrial users due to ongoing technological advancements and the implementation of energy efficiency policies.

"By end user, utilities segment to capture most significant share of switchgear monitoring system

market throughout forecast period"

The utilities segment accounts for the most significant portion of the switchgear monitoring system market, due to the rising adoption of advanced switchgear monitoring systems in critical infrastructure consisting of substations, and transmission and distribution networks. Switchgear monitoring systems are well-suited for utility operations due to their capabilities in real-time diagnostics, enhanced reliability, and reduced maintenance requirements. Growing interest in grid stability, outage prevention, and energy efficiency has led to a steady rise in the adoption of these systems. Additionally, government policies that encourage the implementation of smart monitoring technologies and the transition to smart grids further support and accelerate their deployment.

"Europe to be second-largest market during forecast period"

Europe is set to become the second-largest switchgear monitoring system market because of the massive penetration of these systems in industrial automation systems, the rising adoption of renewable energy sources, and smart grid development. The region already boasts established industry, deep capital investment into energy-efficient technology, and advantageous government policies regarding clean energy and electrification. Moreover, leading utility and manufacturing companies in countries such as Germany and France are intensifying their efforts to integrate switchgear monitoring systems to achieve greater reliability and sustainability. This proactive approach is further driving regional demand. In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: North America - 20%, Europe - 8%, Asia Pacific - 55%, Middle East & Africa - 13%, and South America - 4%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million. Other designations include sales managers, engineers, and regional managers.

Schneider Electric, ABB, Siemens, GE Vernova, and Mitsubishi Electric Corporation are some major players in the switchgear monitoring system market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage

The report defines, describes, and forecasts the global switchgear monitoring system market, by switchgear type, component, service, voltage, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the switchgear monitoring system market.

Key Benefits of Buying the Report

- Key drivers (strengthened power distribution infrastructure), restraints (high installation cost), opportunities (growing deployment of smart grids), and challenges (inadequate data storage and management concerns) influence the growth of the switchgear monitoring system market.

- Market Development: In May 2024, ABB introduced digital, low-voltage switchgear, which allows users to access data on electrical distribution in real time. This enables users to be Industry 4.0 ready and explore the potential of intelligent devices, IoT, and cloud technology. The company will apply this technology to its low-voltage switchgear range.

- Product Innovation/Development: Significant product innovation existed in the switchgear monitoring system market. However, the innovation of IoT-enabled diagnostics and predictive maintenance capabilities of the most advanced systems is notable. These trends are geared toward improving reliability, minimizing downtime, and increasing efficiency standards among end users.

- Market Diversification: In June 2024, IPEC Ltd. entered Asia by establishing a regional office in Kuala Lumpur. This growth acted as a platform to collaborate, assist, and interact with customers in the area. This business decision helped the company serve its clients, establish new relationships, and become more market-informed to propel innovations.

- Competitive Assessment: The report includes an in-depth assessment of market shares, growth strategies, and service offerings of leading market players, such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), GE Vernova (US), and Mitsubishi Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key primary insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET DATA TRIANGULATION

- 2.3.1 FORECAST

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SWITCHGEAR MONITORING SYSTEM MARKET

- 4.2 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 4.3 SWITCHGEAR MONITORING SYSTEM MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 4.4 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE

- 4.5 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT

- 4.6 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE

- 4.7 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE

- 4.8 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift from conventional maintenance methods to condition-based services

- 5.2.1.2 Strengthened power distribution infrastructure

- 5.2.1.3 Rising use of electric distribution and transmission systems powered by renewable energy sources

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation cost

- 5.2.2.2 Integration- and cybersecurity-related challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment of smart grids

- 5.2.3.2 Expansion of renewable energy infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate data storage and management concerns

- 5.2.4.2 Susceptibility of switchgear monitoring systems to cyber threats

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.2 ADJACENT TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF SWITCHGEAR TYPES, 2021-2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF SWITCHGEAR MONITORING SYSTEMS, BY REGION, 2021-2024

- 5.8 TARIFFS AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF ANALYSIS (HS 853590)

- 5.8.2 REGULATORY LANDSCAPE

- 5.8.3 GLOBAL STANDARDS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE-853590)

- 5.9.2 EXPORT SCENARIO (HS CODE-853590)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF SUBSTITUTES

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 MAINTAINING OPERATIONAL INTEGRITY AND REDUCING UNPLANNED DOWNTIME ACROSS GRID BY DEPLOYING DYNAMIC RATINGS' PARTIAL DISCHARGE MONITORING SYSTEM

- 5.12.2 ENHANCING GRID RELIABILITY AND MINIMIZING SF6 EMISSIONS THROUGH WIKA'S IOT-BASED GIS MONITORING SYSTEM

- 5.12.3 REDUCING THERMAL-RELATED FAILURES AND ENHANCING PLANT RESILIENCE WITH MARTEC'S IOT-BASED MONITORING SOLUTION

- 5.13 IMPACT OF GENERATIVE AI/AI ON SWITCHGEAR MONITORING SYSTEM MARKET

- 5.13.1 ADOPTION OF GENERATIVE AI/AI BY SWITCHGEAR MONITORING SYSTEM MANUFACTURERS

- 5.13.2 IMPACT OF GENERATIVE AI/AI ON KEY END USERS, BY REGION

- 5.13.3 IMPACT OF AI ON SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 5.14 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 IMPACT ON COUNTRIES/REGIONS

- 5.14.3.1 North America

- 5.14.3.2 Europe

- 5.14.3.3 Asia Pacific

- 5.14.3.4 South America

- 5.14.3.5 Middle East & Africa

- 5.14.4 IMPACT ON END USERS

6 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE

- 6.1 INTRODUCTION

- 6.2 AIR-INSULATED

- 6.2.1 DESIGN SIMPLICITY, AFFORDABILITY, EASY MAINTENANCE TO ACCELERATE DEMAND

- 6.3 GAS-INSULATED

- 6.3.1 SURGING UTILIZATION IN HIGH-VOLTAGE APPLICATIONS TO AUGMENT MARKET GROWTH

7 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- 7.2 LOW

- 7.2.1 RISING DEMAND FOR HOME AUTOMATION AND ENERGY MANAGEMENT SOLUTIONS TO PROPEL SEGMENTAL GROWTH

- 7.3 MEDIUM

- 7.3.1 INCLINATION TOWARD DEPLOYMENT OF SMART GRIDS AND DIGITAL SUBSTATIONS TO SPUR DEMAND

- 7.4 HIGH AND EXTRA HIGH

- 7.4.1 RAPID DEVELOPMENT OF POWER TRANSMISSION NETWORKS IN DEVELOPING COUNTRIES TO BOOST DEMAND

8 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 PARTIAL DISCHARGE MONITORING

- 8.2.1 INCREASING REQUIREMENT FOR HIGH-PERFORMANCE AND RELIABLE ELECTRICAL ASSETS TO ACCELERATE ADOPTION

- 8.3 GAS MONITORING

- 8.3.1 OPERATIONAL NECESSITY TO DETECT SF6 LEAKAGE TO ELEVATE DEMAND

- 8.4 TEMPERATURE MONITORING

- 8.4.1 EMPHASIS ON EARLY FAULT DETECTION TO FOSTER SEGMENTAL GROWTH

- 8.5 OTHER SERVICES

9 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 RISING DEMAND FOR REAL-TIME MONITORING OF TEMPERATURE, INSULATION INTEGRITY AND VOLTAGE LEVELS TO DRIVE MARKET

- 9.2.2 INTELLIGENT EQUIPMENT DEVICES

- 9.2.3 DISTRIBUTION NETWORK FEEDERS

- 9.2.4 OTHER HARDWARE COMPONENTS

- 9.3 SOFTWARE

- 9.3.1 PRESSING NEED TO HANDLE DATA PROCESSING AND EXECUTION TO BOOST DEMAND FOR SECURE AND EMBEDDED SOFTWARE

10 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 UTILITIES

- 10.2.1 SURGING ADOPTION OF ML-INTEGRATED SWITCHGEAR MONITORING SYSTEMS TO GET REAL-TIME INSIGHTS TO FOSTER MARKET GROWTH

- 10.3 INDUSTRIAL

- 10.3.1 FOCUS ON PREVENTING FINANCIAL LOSSES DUE TO POWER DISRUPTIONS AND EQUIPMENT DAMAGE TO BOOST DEMAND

- 10.4 COMMERCIAL

- 10.4.1 ONGOING INFRASTRUCTURAL DEVELOPMENTS DUE TO RAPID URBANIZATION IN DEVELOPING COUNTRIES TO STIMULATE DEMAND

- 10.5 OTHER END USERS

11 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Increasing investments in renewable energy projects to support market growth

- 11.2.2 JAPAN

- 11.2.2.1 Surging microgrid deployments to fuel market growth

- 11.2.3 INDIA

- 11.2.3.1 Emphasis on electrification projects to elevate demand

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Commitment to carbon neutrality to create growth opportunities

- 11.2.5 AUSTRALIA

- 11.2.5.1 Deployment of hybrid solar-wind microgrids to elevate demand

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Increasing government investment in expanding wind and solar infrastructure to fuel demand

- 11.3.2 UK

- 11.3.2.1 AI-driven maintenance and offshore wind projects to escalate demand

- 11.3.3 FRANCE

- 11.3.3.1 Greater emphasis on grid modernization to contribute to market growth

- 11.3.4 ITALY

- 11.3.4.1 Increasing green energy projects to augment adoption

- 11.3.5 RUSSIA

- 11.3.5.1 Rising investments in hydrogen energy projects to support market growth

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Strong focus on increasing renewable energy output to support market growth

- 11.4.2 CANADA

- 11.4.2.1 Rising investments in wind energy projects to foster market growth

- 11.4.3 MEXICO

- 11.4.3.1 Expansion of power generation, transmission, and distribution networks to contribute to market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 SAUDI ARABIA

- 11.5.1.1.1 Pressing need to upgrade power infrastructure to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Growing emphasis on improving onshore power grids to accelerate market growth

- 11.5.1.3 Kuwait

- 11.5.1.3.1 Increasing transition toward clean energy to boost adoption

- 11.5.1.4 Rest of GCC

- 11.5.1.1 SAUDI ARABIA

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Northern Cape solar initiative and innovations in power monitoring to fuel market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Surging power demand and need for electrification to propel market

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing government investments in offshore gas production projects to contribute to market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.1.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.1.2 MARKET SHARE ANALYSIS, 2024

- 12.1.3 REVENUE ANALYSIS, 2020-2024

- 12.2 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.2.1 STARS

- 12.2.2 EMERGING LEADERS

- 12.2.3 PERVASIVE PLAYERS

- 12.2.4 PARTICIPANTS

- 12.2.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.2.5.1 Company footprint

- 12.2.5.2 Region footprint

- 12.2.5.3 Switchgear type footprint

- 12.2.5.4 Voltage footprint

- 12.2.5.5 End user footprint

- 12.3 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.3.1 PROGRESSIVE COMPANIES

- 12.3.2 RESPONSIVE COMPANIES

- 12.3.3 DYNAMIC COMPANIES

- 12.3.4 STARTING BLOCKS

- 12.3.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.3.5.1 Detailed list of key startups/SMEs

- 12.3.5.2 Competitive benchmarking of key startups/SMEs

- 12.4 COMPETITIVE SCENARIO

- 12.4.1 PRODUCT LAUNCHES

- 12.4.2 DEALS

- 12.4.3 EXPANSIONS

- 12.4.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIEMENS

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 ABB

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 SCHNEIDER ELECTRIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 EATON

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Expansions

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 GE VERNOVA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 MITSUBISHI ELECTRIC CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.6.3.2 Other developments

- 13.1.7 EMERSON ELECTRIC CO.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 HITACHI, LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 PT. TIARA VIBRASINDO PRATAMA

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SENSEOR - WIKA GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 BLUE JAY TECHNOLOGY CO. LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 DYNAMIC RATINGS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.13 OSENSA INNOVATIONS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.14 MEGGER

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Expansions

- 13.1.15 IPEC LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Expansions

- 13.1.1 SIEMENS

- 13.2 OTHER PLAYERS

- 13.2.1 MONITRA LTD.

- 13.2.2 RUGGED MONITORING

- 13.2.3 PDS

- 13.2.4 DOBLE ENGINEERING COMPANY

- 13.2.5 NUVENTURA

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS