|

시장보고서

상품코드

1788516

법 집행 소프트웨어 시장 : 제공별, 전개 방식별, 최종 사용자별, 지역별 예측(-2030년)Law Enforcement Software Market by Offering (Solutions, Services), Deployment Mode (On-premises, Cloud), End User (Police Department, Federal & State Agencies, Correctional Institutions, Law Enforcement Agencies), and Region - Global Forecast to 2030 |

||||||

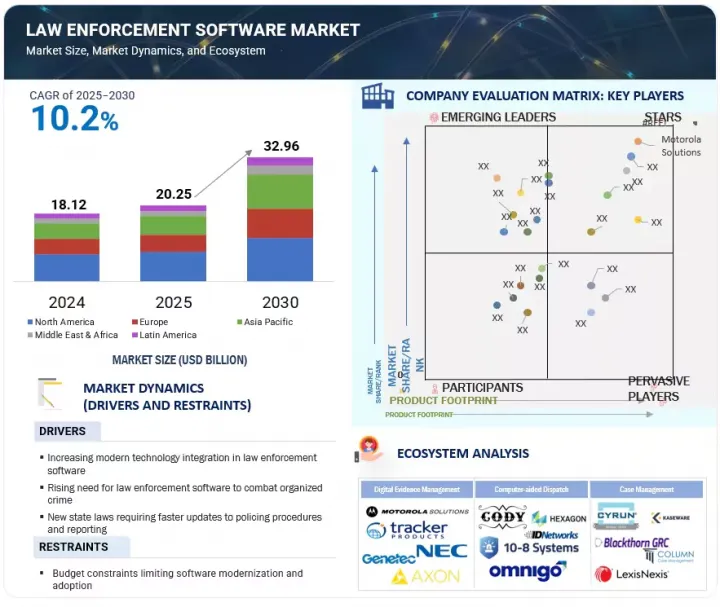

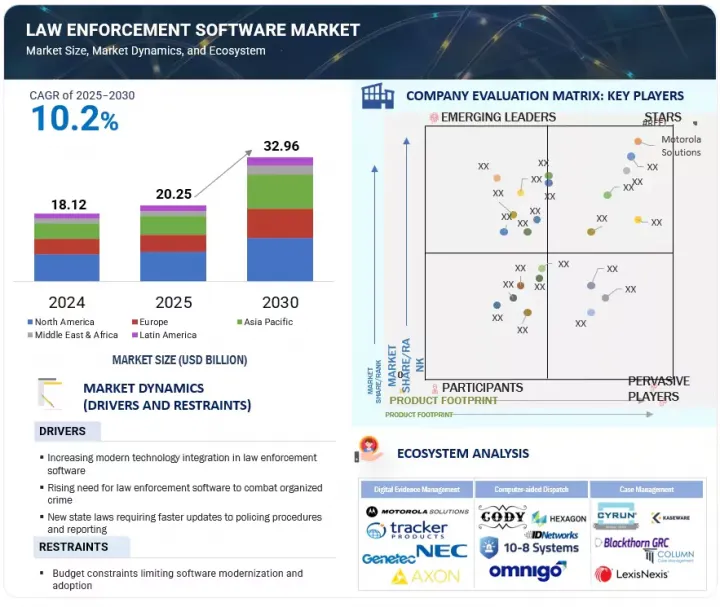

세계의 법 집행 소프트웨어 시장 규모는 2025년 202억 5,000만 달러에서 2030년까지 329억 6,000만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR 10.2%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 제공, 배포 방법, 최종 사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

정부 예산 증가와 지원 정책은 세계 법 집행 소프트웨어 채택의 가속화에 매우 중요합니다. 많은 정부는 범죄율 상승, 보안 문제, 투명성 요구에 대응하기 위해 스마트 폴리싱 노력을 우선시하고 있습니다. 자금 조달은 AI 분석, 디지털 증거 관리 및 클라우드 기록 시스템을 통합하여 보안 유지를 현대화합니다. 이러한 투자는 업무를 간소화하고 의사결정을 개선하며 커뮤니티 참여를 강화합니다.

법 집행 기관은 종종 오래된 레거시 시스템과 확립된 워크플로우에 의존하며, 이는 큰 억제요인이 되고 있습니다. 최신 플랫폼으로 전환하려면 상당한 시간, 기술 전문 지식 및 재정 투자가 필요합니다. 따라서 통합의 복잡성과 비용은 법 집행 소프트웨어 시장의 성장에 큰 장애가 될 가능성이 높습니다.

"전개 방식별로는 2025년 On-Premise 부문이 가장 큰 시장 점유율을 차지할 것으로 추정됩니다."

법 집행 기관은 관리 강화, 보안 및 데이터 프라이버시 규정 준수의 필요성으로 소프트웨어 솔루션의 On-Premise 배포를 선호합니다. 이러한 기관은 범죄 기록, 수사 데이터, 개인 정보 등의 기밀 정보를 관리하기 때문에 안전한 보관 및 시스템 액세스 제한이 필요합니다. On-Premise 배포는 IT 인프라의 완전한 소유를 제공하고 중요한 데이터를 외부 클라우드 플랫폼에 호스팅하는 대신 안전한 내부 서버에 남겨두도록 보장합니다.

또한 여러 지역에서는 규제 정책을 통해 로컬 데이터 호스팅과 사내 시스템 관리를 의무화하고 On-Premise 솔루션의 채택을 강화하고 있습니다. 기존 IT 리소스가 있는 기관은 시스템 사용자 지정, 보다 강력한 보안 프로토콜, 기존 인프라와의 원활한 통합 등의 이점을 누릴 수 있습니다. On-Premise 솔루션은 데이터 보호, 규제 준수 및 운영 관리에 중점을 두고 있으며, 이를 통해 예측 기간 동안 법 집행 소프트웨어 시장의 주요 부문이 되었습니다.

"서비스 유형별로는 지원 및 유지 보수 부문이 예측 기간에 가장 높은 CAGR로 성장할 것으로 예측됩니다."

법 집행 기관은 소프트웨어 시스템의 지속적이고 효과적인 운영을 보장하기 위해 지원 및 유지 보수 서비스를 선호하는 경향이 커지고 있습니다. 이러한 기관은 기록 관리, 사건 관리, 범죄 분석 플랫폼 등의 복잡한 솔루션에 의존하기 때문에 정기적인 업데이트, 기술 지원 및 시스템 최적화가 필수적입니다. 지원 및 유지보수 서비스는 일상 업무를 중단하지 않고도 소프트웨어 문제를 해결하고, 보안 패치를 구현하고, 기능을 업그레이드할 수 있도록 지원합니다.

컴플라이언스 요건의 변화와 기술의 진보에 따라 법 집행 기관은 시스템을 최신 및 안전하게 유지하기 위해 지속적인 지원이 필요합니다. 따라서 소프트웨어의 성능을 유지하고 원활한 운영을 보장하기 위해 전문 서비스 제공 업체에 대한 의존도가 높아짐에 따라 지원 유지 보수 서비스에 대한 수요가 촉진됩니다. 결과적으로 지원 및 유지 보수 부문은 신뢰성, 시스템 수명 연장 및 규제 준수의 필요성을 지원하며 예측 기간 동안 법 집행 소프트웨어 시장에서 가장 높은 CAGR로 성장할 것으로 예측됩니다.

이 보고서는 세계의 법 집행 소프트웨어 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 법 집행 소프트웨어 시장의 기업에게 매력적인 기회

- 법 집행 소프트웨어 시장 : 제공별(2025년 및 2030년)

- 법 집행 소프트웨어 시장 : 솔루션별(2025년 및 2030년)

- 법 집행 소프트웨어 시장 : 서비스별(2025년 및 2030년)

- 법 집행 소프트웨어 시장 : 전개 방식별(2025년 및 2030년)

- 법 집행 소프트웨어 시장 : 최종 사용자별(2025년 및 2030년)

- 법 집행 소프트웨어 시장 : 지역별

제5장 시장 개요와 산업 동향

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 사례 연구 분석

- 졸리엣 경찰, AXON VR로 훈련을 근대화

- 키시미 경찰의 인텔리전스 주도의 치안 유지

- 경찰관과 지역사회의 안전을 지키는 인텔리전스 주도 법 집행 프로그램

- 범죄를 해결하고, 사건을 보다 빨리 종결시키기 위한 프로세스의 합리화

- 레드랜즈 경찰과 현지 기업, 쇼핑객의 안전을 지키기 위해 GIS를 활용

- 생태계 분석

- 공급망 분석

- 가격 설정 분석

- 솔루션 제공업체의 평균 판매 가격 : 지역별(2025년)

- 서비스 제공업체의 참고 가격 : 솔루션별(2025년)

- 특허 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 : 지역별

- 규제의 영향과 산업표준

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 구입 기준

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 법 집행 소프트웨어 시장에 대한 AI/생성형 AI의 영향

- 사례 연구

- 고객사업에 영향을 주는 동향/혼란

제6장 법 집행 소프트웨어 시장 : 제공별

- 소개

- 솔루션

- 서비스

제7장 법 집행 소프트웨어 시장 : 전개 방식별

- 소개

- 클라우드

- On-Premise

제8장 법 집행 소프트웨어 시장 : 최종 사용자별

- 소개

- 경찰

- 법 집행 기관

- 연방 및 주 정부 기관

- 지자체

- 교정 시설

- 기타 최종 사용자

제9장 법 집행 소프트웨어 시장 : 지역별

- 소개

- 북미

- 북미의 법 집행 소프트웨어 시장 성장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 법 집행 소프트웨어 시장 성장 촉진요인

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 법 집행 소프트웨어 시장 성장 촉진요인

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 법 집행 소프트웨어 시장 성장 촉진요인

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 법 집행 소프트웨어 시장 성장 촉진요인

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제10장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 브랜드/제품 비교

- MOTOROLA SOLUTIONS(COMMANDCENTRAL SUITE)

- AXON(AXON RECORDS)

- NICE(EVIDENCENTRAL)

- NEC CORPORATION(EVIDENCEWORKS)

- HEXAGON(HXGN ONCALL SUITE)

- 기업 실적 : 주요 기업(2025년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 주요 벤더 기업의 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 프로파일

- 소개

- 주요 기업

- MOTOROLA SOLUTIONS

- AXON

- NICE

- NEC CORPORATION

- HEXAGON

- PALANTIR

- IBM

- NUANCE COMMUNICATIONS

- ESRI

- GENETEC

- 기타 기업

- LEXISNEXIS RISK SOLUTIONS

- CYRUN

- MATRIX POINTE SOFTWARE

- TRACKER PRODUCTS

- CODY SYSTEMS

- OMNIGO

- COLUMN CASE MANAGEMENT

- BLACKTHORN GRC

- KASEWARE

- 10-8 SYSTEMS

- MARK43

- ID NETWORKS

- CPI OPENFOX

- CIVICEYE

- BELKASOFT

제12장 인접 시장/관련 시장

- 소개

- 관련 시장

- 제한 사항

- 모바일 비디오 감시 시장

제13장 부록

JHS 25.08.20The global law enforcement software market is expected to grow from USD 20.25 billion in 2025 to USD 32.96 billion by 2030 at a compounded annual growth rate (CAGR) of 10.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Deployment Mode, End User |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Increased government budgets and supportive policies are pivotal in accelerating the adoption of law enforcement software globally. Many governments are prioritizing smart policing initiatives to address rising crime rates, public safety challenges, and demand for transparency. Funding will modernize policing by integrating AI analytics, digital evidence management, and cloud records systems. These investments streamline operations, improve decision-making, and enhance community engagement.

Law enforcement agencies often depend on outdated legacy systems and established workflows, which present a significant restraint. Moving to modern platforms demands considerable time, technical expertise, and financial investment. Consequently, the complexity and expense of integration are likely to be major obstacles to the growth of the law enforcement software market.

"Based on the deployment mode, the on-premises segment is estimated to hold the largest market share in 2025"

Law enforcement agencies prefer on-premises deployment of software solutions due to the need for enhanced control, security, and compliance with data privacy regulations. These agencies manage sensitive information such as criminal records, investigation data, and personal details, requiring secure storage and restricted system access. On-premises deployment provides full ownership of the IT infrastructure, ensuring that critical data remains within the agency's secured internal servers rather than being hosted on external cloud platforms.

Additionally, regulatory policies in several regions mandate local data hosting and in-house system management, reinforcing the adoption of on-premises solutions. Agencies with established IT resources benefit from system customization, stronger security protocols, and seamless integration with existing infrastructure. On-premises solutions focus on data protection, regulatory compliance, and operational control, making it the leading segment in the law enforcement software market during the forecast period.

"Based on the service type, the support & maintenance segment is expected to grow at the highest CAGR during the forecast period"

Law enforcement agencies increasingly prioritize support and maintenance services to ensure their software systems' continuous and effective operation. Regular updates, technical support, and system optimization become essential as these agencies rely on complex solutions such as record management, case management, and crime analytics platforms. Support and maintenance services help agencies address software issues, implement security patches, and upgrade functionalities without disrupting daily operations.

With changing compliance requirements and advancements in technology, law enforcement agencies require continuous support to keep their systems updated and secure. This increasing dependence on specialized service providers to maintain software performance and ensure smooth operations is driving the demand for support and maintenance services. As a result, the support and maintenance segment is expected to grow at the highest CAGR in the law enforcement software market during the forecast period, supported by the need for reliability, system longevity, and regulatory compliance.

"North America will lead in the market share, while Asia Pacific emerges as the fastest-growing market during the forecast period"

North America holds the leading position in the global law enforcement software market, driven by advanced technological infrastructure, high levels of public safety funding, and early adoption of digital tools by law enforcement agencies. The United States, in particular, has been at the forefront, with numerous agencies deploying data analytics, AI-powered surveillance, computer-aided dispatch (CAD), and records management systems (RMS) to improve operational efficiency and public safety outcomes. The presence of established software vendors, strong government initiatives to modernize policing, and increasing investments in cybersecurity also contribute to the region's dominance. Additionally, the ongoing emphasis on transparency and accountability in policing fuels demand for body-worn cameras, digital evidence management systems, and real-time data sharing platforms.

In contrast, Asia Pacific is the fastest-growing law enforcement software market. Rapid urbanization, increasing crime rates, and rising concerns over national security are prompting India, China, and Southeast Asian nations to invest in modern law enforcement technologies. Governments across the region are prioritizing smart city initiatives, which integrate law enforcement systems with traffic management, surveillance, and emergency response solutions. Although the region still faces budget constraints and technological gaps in rural areas, growing collaborations with global vendors, rising adoption of cloud-based solutions, and digital transformation initiatives are accelerating market growth. As a result, the Asia Pacific region is expected to see strong demand for law enforcement software, making it a high-potential area in the coming years.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant law enforcement software market companies were interviewed to gain insights into this market.

- By Company: Tier I: 32%, Tier II: 49%, and Tier III: 19%

- By Designation: C-Level Executives: 33%, Director Level: 22%, and Others: 45%

- By Region: North America: 40%, Europe: 20%, Asia Pacific: 35%, Rest of World: 5%

Some of the significant law enforcement software market vendors are Motorola Solutions (US), Axon Enterprise (US), NICE (Israel), NEC Corporation (Japan), Hexagon (Sweden), Palantir Technologies (US), IBM (US), Nuance Communications (US), Esri (US), and Gentec (Canada).

Research Coverage

The market report covered the law enforcement software market across segments. We estimated the market size and growth potential for many segments based on solution type, service type, deployment mode, end user, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

This research provides the most accurate revenue estimates for the entire law enforcement industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to better position their companies and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights on the following pointers:

- Analysis of key drivers (law enforcement technology aids in maintaining lower crime rates), restraints (lack of skilled professionals), opportunities (incorporation of big data analytics in public safety), and challenges (integration of logical and physical components of security systems) influencing the growth of the law enforcement software market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the law enforcement software market

- Market Development: In-depth details regarding profitable markets, examining the global law enforcement software market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new software and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the law enforcement software industry, such as Motorola Solutions (US), Axon Enterprise (US), NICE (Israel), NEC Corporation (Japan), Hexagon (Sweden), Palantir Technologies (US), IBM (US), Nuance Communications (US), Esri (US), Gentec (Canada), LexisNexis Risk Solutions (US), Cyran (US), Matrix Pointe Software (US), Tracker Products (US), CODY Systems (US), Omnigo (US), Column Case Management (US), Kaseware (US), 10-8 Systems (US), Mark43 (US), ID Networks (US), CPI Open Fox (US), Belkasoft (US), and Civic Eye (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAW ENFORCEMENT SOFTWARE MARKET

- 4.2 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING(2025 VS 2030

- 4.3 LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTION (2025 VS 2030

- 4.4 LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICE (2025 VS 2030)

- 4.5 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE (2025 VS 2030)

- 4.6 LAW ENFORCEMENT SOFTWARE MARKET, BY END USER (2025 VS 2030)

- 4.7 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of modern technology in law enforcement software

- 5.2.1.2 Deployment of modern law enforcement software in maintaining lower crime rates

- 5.2.1.3 New state laws requiring faster updates to policing procedures and reporting

- 5.2.1.4 Rising need for law enforcement software to combat organized crime

- 5.2.2 RESTRAINTS

- 5.2.2.1 Budget constraints limit software modernization and adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI and ML technologies

- 5.2.3.2 Enhanced international incident response through CAD-enabled intelligence sharing

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of logical and physical components of security systems

- 5.2.4.2 Lack of efficient storage and data management capacities

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 JOLIET PD MODERNIZED TRAINING WITH AXON VR

- 5.3.2 KISSIMMEE PD INTELLIGENCE-LED POLICING

- 5.3.3 INTELLIGENCE-DRIVEN LAW ENFORCEMENT PROGRAM KEEPING OFFICERS AND COMMUNITIES SAFE

- 5.3.4 STREAMLINING PROCESSES TO SOLVE CRIMES AND CLOSE CASES FASTER

- 5.3.5 REDLANDS POLICE AND LOCAL BUSINESSES USE GIS TO KEEP SHOPPERS SAFE

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF SOLUTION PROVIDERS, BY REGION, 2025

- 5.6.2 INDICATIVE PRICING OF SERVICE PROVIDERS, BY SOLUTIONS, 2025

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud-Native Architecture

- 5.8.1.2 AI/ML Frameworks

- 5.8.1.3 Geospatial Information Systems

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Robotic process automation

- 5.8.2.2 Natural Language Processing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Body-worn Cameras

- 5.8.3.2 Digital Forensics and Mobile Extraction Tools

- 5.8.3.3 Facial Recognition Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS BASED ON REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON LAW ENFORCEMENT SOFTWARE MARKET

- 5.16.1 CASE STUDY

- 5.16.1.1 Bank Fraud Task Force Member Identifies ATM Theft Suspect

- 5.16.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.16.2.1 Real-Time Crime Centers Drive Faster, Informed Emergency Response

- 5.16.2.2 AI-Powered Wearables Revolutionize Field Operations

- 5.16.2.3 AI and GIS Integration Enhances Event Security and Risk Response

- 5.16.1 CASE STUDY

6 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 OPTIMIZING LAW ENFORCEMENT OPERATIONS THROUGH INTELLIGENT SOFTWARE SOLUTIONS

- 6.2.2 DIGITAL EVIDENCE MANAGEMENT

- 6.2.2.1 Securing integrity and speed in investigations to drive market

- 6.2.2.2 Metadata management

- 6.2.2.3 Chain-of-Custody Tracking

- 6.2.2.4 Evidence presentation & analytics

- 6.2.3 COMPUTER AIDED DISPATCH

- 6.2.3.1 Handles full cycle of incident response by enhancing response efficiency

- 6.2.3.2 Back-end call-taking and incident entry

- 6.2.3.3 Incident tracking and status updates

- 6.2.3.4 Reporting and data analysis

- 6.2.3.5 GIS mapping and tracking

- 6.2.4 CASE MANAGEMENT

- 6.2.4.1 Driving Consistency and Closure with Intelligent Case Management Solutions

- 6.2.4.2 Investigation lifecycle management

- 6.2.4.3 Victim/Witness tracking & contact management

- 6.2.4.4 Court case preparation & disposition tracking

- 6.2.5 INCIDENT MANAGEMENT

- 6.2.5.1 Improves operational readiness and response with smart incident management

- 6.2.5.2 Pre-incident planning & risk assessment

- 6.2.5.3 Post-incident investigation

- 6.2.5.4 Resource & Personnel Allocation Planning

- 6.2.6 RECORD MANAGEMENT

- 6.2.6.1 Centralizes law enforcement data for accuracy, accountability, and compliance

- 6.2.6.2 Incident Reporting

- 6.2.6.3 Evidence & property tracking

- 6.2.6.4 Arrest & booking records

- 6.2.7 JAIL MANAGEMENT

- 6.2.7.1 Streamlines correctional operations with smart jail management systems

- 6.2.7.2 Inmate tracking

- 6.2.7.3 Cell assignment

- 6.2.7.4 Visitation Scheduling

- 6.2.7.5 Court Scheduling

- 6.2.8 DIGITAL POLICING

- 6.2.8.1 Transforms public safety with real-time, predictive, and community-focused tools

- 6.2.8.2 Real-Time Crime Center

- 6.2.8.3 Predictive Policing/Crime Mapping

- 6.2.8.4 Community Policing Tools

- 6.3 SERVICES

- 6.3.1 MAXIMIZING SOLUTION IMPACT THROUGH COMPREHENSIVE LAW ENFORCEMENT SERVICES

- 6.3.2 IMPLEMENTATION & SYSTEM INTEGRATION

- 6.3.3 TRAINING & CONSULTING

- 6.3.4 SUPPORT & MAINTENANCE

7 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 ENABLING AGILE LAW ENFORCEMENT THROUGH CLOUD DEPLOYMENT

- 7.3 ON-PREMISES

- 7.3.1 ENSURING CONTROL AND CUSTOMIZATION IN LAW ENFORCEMENT OPERATIONS WITH ON-PREMISES SOLUTIONS

8 LAW ENFORCEMENT SOFTWARE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USERS: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 8.2 POLICE DEPARTMENTS

- 8.2.1 ENHANCING DAILY POLICING THROUGH SMART SOFTWARE SOLUTIONS

- 8.2.2 POLICE DEPARTMENTS: USE CASES

- 8.2.2.1 Patrol Route Optimization with Real-Time Crime Heatmaps

- 8.2.2.2 In-Field Mobile Reporting for Traffic Stops and Incidents

- 8.2.2.3 K-9 Unit Deployment and Activity Logging

- 8.3 LAW ENFORCEMENT AGENCIES

- 8.3.1 DRIVING INTERAGENCY EFFICIENCY THROUGH SCALABLE LAW ENFORCEMENT PLATFORMS

- 8.3.2 LAW ENFORCEMENT AGENCIES: USE CASES

- 8.3.2.1 Centralized Case Collaboration across Units

- 8.3.2.2 Digital Chain-of-Custody for Evidence Handling

- 8.3.2.3 Criminal Intelligence Analysis & Link Mapping

- 8.3.2.4 Multi-Jurisdictional Arrest Warrant Management

- 8.4 FEDERAL & STATE AGENCIES

- 8.4.1 STRENGTHENING NATIONAL SAFETY THROUGH SCALABLE INTELLIGENCE AND COMPLIANCE PLATFORMS

- 8.4.2 FEDERAL & STATE AGENCIES: USE CASES

- 8.4.2.1 Nationwide Criminal Data Integration and Analytics

- 8.4.2.2 Policy Enforcement and Compliance Auditing Tools

- 8.4.2.3 Counterterrorism Intelligence Fusion Platforms

- 8.4.2.4 Statewide Warrant and Offender Registry Management

- 8.5 MUNICIPALITIES

- 8.5.1 EMPOWERING LOCAL LAW ENFORCEMENT WITH COMMUNITY-CENTRIC DIGITAL SOLUTIONS

- 8.5.2 MUNICIPALITIES: USE CASES

- 8.5.2.1 Community Policing Activity Tracker

- 8.5.2.2 Parking and Traffic Violation Software Integration

- 8.5.2.3 Smart City Surveillance and Public Safety Alerts

- 8.5.2.4 Local Ordinance Enforcement Automation

- 8.6 CORRECTIONAL INSTITUTIONS

- 8.6.1 ENHANCING CORRECTIONAL OPERATIONS THROUGH SMART SOFTWARE SYSTEMS

- 8.6.2 CORRECTIONAL INSTITUTIONS: USE CASES

- 8.6.2.1 Inmate Monitoring & Movement Tracking

- 8.6.2.2 Digital Inmate Case Management

- 8.6.2.3 Visitor Scheduling & Background Check Automation

- 8.6.2.4 Emergency Response Simulation and Drill Tracking

- 8.7 OTHER END USERS

9 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Rising adoption of advanced technologies and solutions for security purposes to drive market

- 9.2.4 CANADA

- 9.2.4.1 Increased security concerns due to rising cyberattacks to fuel adoption of law enforcement services

- 9.3 EUROPE

- 9.3.1 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Increasing rate of crime and terrorism to drive market

- 9.3.4 GERMANY

- 9.3.4.1 Effective law management and increasing need for airport security and border control to boost demand

- 9.3.5 FRANCE

- 9.3.5.1 Focus of government and regulatory authorities on law and safety to drive market

- 9.3.6 ITALY

- 9.3.6.1 Law enforcement modernization through AI, video analytics, and national data integration to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Extensive industrialization and adoption of cutting-edge technologies to drive demand for law enforcement solutions

- 9.4.4 JAPAN

- 9.4.4.1 Government initiatives enhancing law enforcement and need to add a systematic approach to boost market

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Continuous upgrades in IT infrastructure by law agencies to ensure public safety and manage tourist inflow

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 GULF COOPERATION COUNCIL COUNTRIES

- 9.5.3.1 UAE

- 9.5.3.1.1 Need for enabling resilient growth through scalable colocation to boost demand for enforcement software

- 9.5.3.2 Saudi Arabia

- 9.5.3.2.1 Use of AI and real-time intelligence to advance digital transformation of public security and policing systems

- 9.5.3.3 Rest of GCC countries

- 9.5.3.1 UAE

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Low costs and on-demand availability of law enforcement software to drive market

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Increasing crimes against property and rising intrusions to boost market

- 9.6.4 MEXICO

- 9.6.4.1 Increasing number of government projects and rising instances of data theft and crimes to boost market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.6.1 MOTOROLA SOLUTIONS (COMMANDCENTRAL SUITE)

- 10.6.2 AXON (AXON RECORDS)

- 10.6.3 NICE (EVIDENCENTRAL)

- 10.6.4 NEC CORPORATION (EVIDENCEWORKS)

- 10.6.5 HEXAGON (HXGN ONCALL SUITE)

- 10.6.6 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 10.6.6.1 Company footprint

- 10.6.6.2 Region footprint

- 10.6.6.3 Offering footprint

- 10.6.6.4 End User footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 10.8.1 COMPANY VALUATION

- 10.8.2 FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 MAJOR PLAYERS

- 11.2.1 MOTOROLA SOLUTIONS

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches and enhancements

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Right to win

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 AXON

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches and enhancements

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Right to win

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 NICE

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches and enhancements

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Right to win

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 NEC CORPORATION

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent Developments

- 11.2.4.3.1 Product launches and enhancements

- 11.2.4.3.2 Deals

- 11.2.4.4 MnM view

- 11.2.4.4.1 Right to win

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 HEXAGON

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Deals

- 11.2.5.4 MnM view

- 11.2.5.4.1 Right to win

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses and competitive threats

- 11.2.6 PALANTIR

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.6.3.2 Other Deals/Developments

- 11.2.7 IBM

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches and enhancements

- 11.2.7.3.2 Deals

- 11.2.8 NUANCE COMMUNICATIONS

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches and enhancements

- 11.2.9 ESRI

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches and enhancements

- 11.2.9.3.2 Deals

- 11.2.10 GENETEC

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches and enhancements

- 11.2.10.3.2 Deals

- 11.2.1 MOTOROLA SOLUTIONS

- 11.3 OTHER PLAYERS

- 11.3.1 LEXISNEXIS RISK SOLUTIONS

- 11.3.2 CYRUN

- 11.3.3 MATRIX POINTE SOFTWARE

- 11.3.4 TRACKER PRODUCTS

- 11.3.5 CODY SYSTEMS

- 11.3.6 OMNIGO

- 11.3.7 COLUMN CASE MANAGEMENT

- 11.3.8 BLACKTHORN GRC

- 11.3.9 KASEWARE

- 11.3.10 10-8 SYSTEMS

- 11.3.11 MARK43

- 11.3.12 ID NETWORKS

- 11.3.13 CPI OPENFOX

- 11.3.14 CIVICEYE

- 11.3.15 BELKASOFT

12 ADJACENT/RELATED MARKET

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.1.2 LIMITATIONS

- 12.2 MOBILE VIDEO SURVEILLANCE MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS