|

시장보고서

상품코드

1790686

세무 관리 시장(-2030년) : 솔루션 유형별(세무 컴플라이언스 및 최적화, 문서 관리 및 아카이브, 세무 신고서 준비 및 보고, 세무 분석 툴, 감사 및 리스크 관리 툴), 세 유형별(간접세, 직접세)Tax Management Market by Solution Type (Tax Compliance & Optimization, Document Management & Archiving, Tax Preparation & Reporting, Tax Analytics Tools, Audit & Risk Management Tools), Tax Type (Indirect Tax and Direct Tax) - Global Forecast to 2030 |

||||||

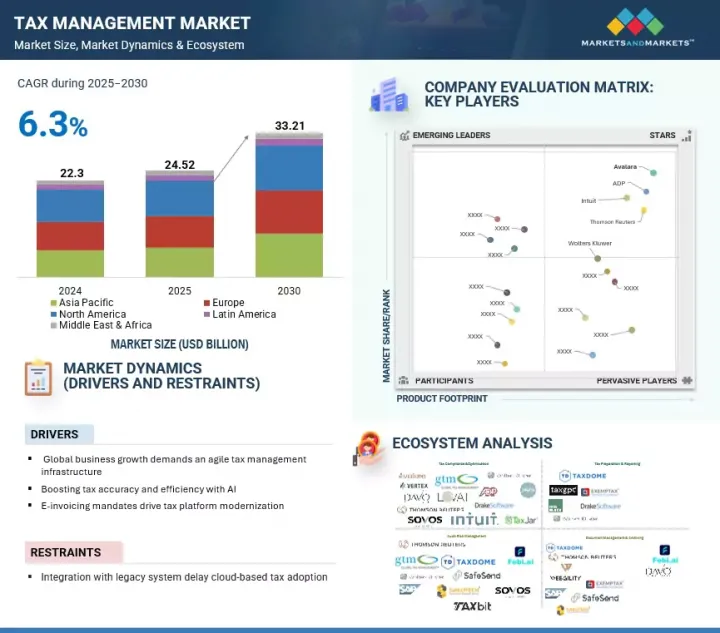

세무 관리 시장은 빠르게 확대하고 있으며, 시장 규모는 2025년 245억 2,000만 달러에서 예측 기간 동안 CAGR 6.3%로 성장하여 2030년에는 332억 1,000만 달러에 달할 것으로 예측됩니다.

세무 관리 시장을 형성하는 주요 촉진요인으로는 세계 사업 확장의 가속화와 여러 관할권의 컴플라이언스를 지원할 수 있는 민첩하고 확장 가능한 세무 인프라의 필요성을 들 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러 |

| 부문 | 제공, 전개 방식, 세 유형, 조직 규모, 산업 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

AI의 통합은 세무의 정확성을 더욱 높이고, 실시간 이상 징후 감지, 자동화된 규칙 적용, 더 빠른 보고 주기를 가능하게 합니다. 또한, 전 세계적으로 전자 송장 의무화가 확대됨에 따라 기업들은 구조화된 데이터 및 규제 당국에 대한 제출 요건을 충족하기 위해 기존 세금 플랫폼을 현대화해야 하는 상황에 직면해 있습니다. 그러나 시장도 뚜렷한 억제요인에 직면해 있습니다. 그 중 하나는 최신 세무 솔루션을 기존 기업 시스템에 통합하는 데 어려움이 있어 클라우드 기반 플랫폼의 도입이 지연되고 분산된 환경 전반에 걸쳐 첨단 기술을 배포할 수 있는 능력을 제한하고 있다는 점입니다.

"세금 유형별로는 간접세 부문이 예측 기간 동안 가장 큰 성장세를 보일 것으로 예측됩니다."

부가가치세, 상품 및 서비스세, 판매세, 관세, 기타 거래세 등 간접세는 규제 요건이 실시간 컴플라이언스 및 디지털화된 보고로 결정적으로 전환됨에 따라 가장 큰 성장세를 보일 것으로 예측됩니다. 2024년 4월, Sovos는 70개 이상의 관할권에서 복잡성을 해결하기 위해 과세 판정, 전자 송장, 자동 신고를 단일 클라우드 네이티브 플랫폼에 통합한 Indirect Tax Suite를 발표했습니다. 같은 해 10월에는 SAP 환경을 위한 클린코어 대응 솔루션을 출시하여 VAT, GST, 판매세 제도 전반에 걸친 ERP와의 긴밀한 통합과 확장성 있는 설정의 필요성을 입증했습니다. 이러한 추세는 세계 기업들이 재무의 핵심 프로세스에서 간접세 자동화를 실제 운영해야 하는 시급성을 보여주고 있습니다. 이는 벤더들에게 국가별 세법 규칙을 적용하고, 인보이스 의무를 구조적으로 준수하며, 계속 진화하는 규제 변화에 동적으로 적응할 수 있는 전용 플랫폼을 제공할 수 있는 큰 기회를 제공합니다. 고성장이 예상되는 간접세 부문에서 경쟁력을 유지하기 위해 벤더는 관할권별 인보이스 인증, 국경 간 관세 자동화, 실시간 정책 변경에 대응하는 룰 엔진으로 차별화를 꾀해야 합니다. 성공의 열쇠는 사전 인증된 전자 송장 모듈, 지능형 매칭 워크플로우, 지속적인 설정 업데이트를 제공할 수 있는지에 달려있습니다. 기업이 민첩성과 정확성을 우선시하는 가운데, 실시간 예외 처리를 가능하게 하고 공동 설계를 통한 도입 지원을 제공하는 공급자는 핵심 세무 업무에 대한 심층적인 통합을 촉진하고, 장기적인 혁신 파트너로 자리매김하며, 복잡한 컴플라이언스 환경에서 지속적인 수익을 창출할 수 있습니다.

세계의 세무 관리 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 사례 연구 분석

- 생태계 분석

- 공급망 분석

- 가격 분석

- 특허 분석

- 기술 분석

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 2025-2026년의 주요 회의와 이벤트

- 고객의 사업에 영향을 미치는 동향과 혼란

- 투자와 자금 조달 시나리오

- 세무 관리에서 생성형 AI의 영향

제6장 세무 관리 시장 : 제공별

- 솔루션

- 컴플라이언스와 최적화

- 세무 신고 준비와 보고

- 감사 및 리스크 관리 툴

- 세무 분석 툴

- 문서 관리와 아카이브

- 기타

- 서비스

- 구현과 시스템 통합

- 세무 설정 및 자문 서비스

- 지원 및 규정 유지 관리

제7장 세무 관리 시장 : 전개 형태별

- 온프레미스

- 클라우드

제8장 세무 관리 시장 : 조직 규모별

- 대기업

- 중소기업

제9장 세무 관리 시장 : 세 유형별

- 간접세

- 부가가치세(VAT)

- 물품 서비스세(GST)

- 판매세

- 관세

- 기타

- 직접세

- 법인세

- 자본 이득세

- 고정 자산세

- 기타

제10장 세무 관리 시장 : 산업별

- BFSI

- IT·통신

- 제조

- 소매·E-Commerce

- 헬스케어 및 생명과학

- 정부 및 공공 부문

- 에너지 및 유틸리티

- 기타

제11장 세무 관리 시장 : 지역별

- 북미

- 시장 성장 촉진요인

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 시장 성장 촉진요인

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 시장 성장 촉진요인

- 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 시장 성장 촉진요인

- 거시경제 전망

- GCC 국가

- 남아프리카공화국

- 기타

- 라틴아메리카

- 시장 성장 촉진요인

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제12장 경쟁 구도

- 주요 기업의 전략/유력 기업

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- WOLTERS KLUWER

- THOMSON REUTERS

- AVALARA

- ADP

- VERTEX

- SOVOS

- INTUIT

- H&R BLOCK

- SAP

- XERO

- 기타 기업

- TAXBIT

- SAILOTECH

- EXEMPTAX

- CLEAR

- DRAKE SOFTWARE

- TAXCLOUD

- LOVAT SOFTWARE

- WEBGILITY

- GLOBAL TAX MANAGEMENT INC.

- TAXDOME

- TAXGPT

- FEBI.AI

- TAXBUDDY

- TAXCALC

- CAPIUM

제14장 인접 시장/관련 시장

제15장 부록

KSM 25.08.22The tax management market is expanding rapidly, with a projected size of USD 24.52 billion in 2025 to reach USD 33.21 billion by 2030, at a CAGR of 6.3% during the forecast period. The key drivers shaping the tax management market include the accelerating pace of global business operations, which requires agile, scalable tax infrastructure capable of supporting multi-jurisdictional compliance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Million |

| Segments | Offering, deployment mode, tax type, organization size, and vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Artificial intelligence integration further enhances tax accuracy, enabling real-time anomaly detection, automated rule application, and faster reporting cycles. Additionally, the global rollout of e-invoicing mandates pushes enterprises to modernize legacy tax platforms to meet structured data and regulatory submission requirements. However, the market also faces notable restraints. Among them is the challenge of integrating modern tax solutions with legacy enterprise systems, which slows the adoption of cloud-based platforms and limits the ability to deploy advanced technologies across distributed environments.

"Indirect tax type is expected to account for the fastest growth during the forecast period."

Indirect tax, comprising value-added tax, goods and services tax, sales tax, customs duties, and other transactional levies, is expected to emerge as the fastest-growing segment in the tax management market as regulatory mandates shift decisively toward real-time compliance and digitalized reporting. In April 2024, Sovos launched its Indirect Tax Suite to address growing complexity in over 70 jurisdictions, integrating determination, e-invoicing, and automated filings into a single cloud-native platform. The October 2024 release of a clean-core, ready solution for SAP environments demonstrated the need for deep ERP integration and scalable configuration across VAT, GST, and sales tax regimes. These developments reflect the urgency among global enterprises to operationalize indirect tax automation across core finance processes. This creates a strong opportunity for vendors to deliver purpose-built platforms that apply country-specific tax rules, ensure structured compliance with invoicing mandates, and adapt dynamically to ongoing regulatory changes. To stay competitive in the high-growth indirect tax segment, vendors must differentiate through jurisdiction-specific invoice clearance, cross-border duty automation, and rule engines that adapt to real-time policy changes. Success will depend on delivering pre-certified e-invoicing modules, intelligent reconciliation workflows, and continuous configuration updates. As enterprises prioritize agility and accuracy, providers that enable real-time exception handling and offer co-engineered deployment support will drive deeper integration into core tax operations, positioning themselves as long-term transformation partners and unlocking sustained revenue in complex compliance environments.

"Large enterprises are expected to hold the largest market share during the forecast period."

Large enterprises require advanced tax solutions to manage complex, multi-jurisdictional compliance and integration with ERP systems. Their scale and regulatory exposure drive demand for automation, real-time calculation, and audit-ready reporting. In October 2024, Sovos partnered with IFS to integrate its indirect tax suite into IFS Cloud, enabling embedded, real-time compliance across more than 20,000 global jurisdictions, tailored explicitly for large multinational entities. Reinforcing this shift, the April 2025 Thomson Reuters Generative AI in Professional Services Report confirmed that 21% of tax and accounting firms now deploy GenAI at scale, while 92% of corporate tax professionals expect it to be part of daily tax operations within five years. These trends signal a decisive enterprise push toward intelligent, high-capacity platforms that combine automation, compliance, and strategic insight. Providers that align with large enterprises' priorities, which are accuracy, agility, and control, will gain a competitive advantage, expand recurring revenue streams, and position themselves as core infrastructure partners in global tax modernization.

"North America is expected to lead the tax management market with established regulatory frameworks, advanced digital infrastructure, and high adoption among large enterprises, while Asia Pacific is the fastest-growing region driven by accelerated e-invoicing mandates, expanding cross-border trade and government-led digitalization of tax administration systems."

North America is expected to lead the tax management market, driven by complex regulatory frameworks, high enterprise demand for automation, and early adoption of AI-powered compliance platforms. In April 2025, Intuit enhanced its TurboTax Business suite with generative AI, improving real-time tax insights and filing accuracy for corporate users. This reflects the region's focus on intelligent, large-scale tax automation. In contrast, Asia Pacific is the fastest-growing region, fueled by rapid tax digitization, cross-border trade, and government-mandated e-invoicing initiatives across India, Indonesia, and Vietnam. Enterprises actively invest in scalable, cloud-based tax platforms, creating strong opportunities for vendors to deliver localized rule engines, real-time reporting tools, and pre-integrated ERP connectors.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the tax management market.

- By Company: Tier I - 40%, Tier II - 25%, and Tier III - 35%

- By Designation: C-Level Executives - 25%, D-Level Executives -37%, and others - 38%

- By Region: North America - 38%, Europe - 24%, Asia Pacific - 40%, and Rest of the World - 6%

The report includes a study of key players offering tax management services. It profiles major vendors in the tax management market. The major market players include Avalara (US), Intuit (US), ADP (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), H&R Block (US), SAP (Germany), Sovos (US), Vertex (US), TaxBit (US), Sailotech (US), TaxCalc (UK), Clear (India), Xero (Australia), Exemptax (US), Taxbuddy (India), Feb.ai (India), Drake Software (US), Tax Cloud (US), Lovat Software (UK), Webgility (US), Global Tax Management Inc. (US), Taxdome (US), and TaxGPT (US).

Research Coverage

This research report categorizes the tax management market based on Offering (Solutions (Tax Compliance & Optimization, Tax Preparation & Reporting, Audit & Risk Management Tools, Tax Analytics Tools, Document Management & Archiving), Services (Implementation & System Integration, Tax Configuration & Advisory Services, Support & Regulatory Maintenance)), Deployment Mode (Cloud, On-premises), Tax Type (Direct Taxes (Corporate Tax, Capital Gains Tax, Property Tax, Other Direct Taxes), Indirect Taxes (Value-Added Tax (VAT), Goods & Services Tax (GST), Sales Tax, Customs Duties, Other Indirect Taxes)), Organization Size (Large Enterprises, SMEs), Vertical (Banking, Financial Services & Insurance (BFSI), IT & Telecom, Retail & E-commerce, Manufacturing, Healthcare & Life Sciences, Government & Public Sector, Energy & Utilities, Other Verticals (Transportation & Logistics, Education, Construction & Real Estate)), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the tax management market. A thorough analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the tax management market. This report also covered the competitive analysis of upcoming startups in the tax management market ecosystem.

Reason to Buy This Report

The report would provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall tax management market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (Global business growth demands an agile tax management infrastructure, Boosting tax accuracy & efficiency with AI, E-invoicing mandates drive tax platform modernization), restraints (Integration with legacy system delay cloud-based tax adoption), opportunities (Automation adoption by SMEs fuels tax management expansion, Advisory services boost innovation in tax management), and challenges (Shortage of skilled workforce slows tax tech adoption, Multi-system complexity hampers tax automation).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the tax management market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the tax management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the tax management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such Avalara (US), Intuit (US), ADP (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), H&R Block (US), SAP (Germany), Sovos (US), Vertex (US), TaxBit (US), Sailotech (US), TaxCalc (UK), Clear (India), Xero (Australia), Exemptax (US), Taxbuddy (India), Feb.ai (India), Drake Software (US), Tax Cloud (US), Lovat Software (UK), Webgility (US), Global Tax Management Inc. (US), Taxdome (US), and TaxGPT (US). The report also helps stakeholders understand the pulse of the tax management market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TAX MANAGEMENT MARKET

- 4.2 TAX MANAGEMENT MARKET, BY OFFERING, 2025 VS 2030

- 4.3 TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025 VS 2030

- 4.4 TAX MANAGEMENT MARKET, BY TAX TYPE, 2025 VS 2030

- 4.5 TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025 VS 2030

- 4.6 TAX MANAGEMENT MARKET, BY VERTICAL, 2025 VS 2030

- 4.7 TAX MANAGEMENT MARKET, BY REGION, 2025-2030

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global business growth demands agile tax management infrastructure

- 5.2.1.2 Adoption of AI tools boosts tax accuracy and efficiency

- 5.2.1.3 E-invoicing mandates drive tax platform modernization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration with legacy systems delays cloud-based tax adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Automation adoption by SMEs fuels tax management expansion

- 5.2.3.2 Advisory services boost innovation in tax management

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled workforce hinders adoption of tax technologies

- 5.2.4.2 Multi-system complexity hampers tax automation

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 INOVONICS SIMPLIFIES MULTI-STATE TAX COMPLIANCE WITH AVALARA

- 5.3.2 CCH PROSYSTEM FX AND AXCESS BOOST ACCURACY AND EFFICIENCY OF TAX SYSTEMS

- 5.3.3 WESLEYAN UNIVERSITY MANAGES CONFORMITY WITH ADP SMARTCOMPLIANCE

- 5.3.4 VERTEX DELIVERS REAL-TIME TAX ACCURACY FOR LEGO'S ONLINE SALES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY OFFERING, 2025

- 5.7 PATENT ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud-native architecture

- 5.8.1.2 Tax determination logic modules

- 5.8.1.3 Compliance filing engine

- 5.8.1.4 GenAI Copilot for tax

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Machine learning & AI

- 5.8.2.2 Robotic process automation

- 5.8.2.3 Digital signature & archival solutions

- 5.8.2.4 Low-code/no-code configuration platform

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Streamlining real estate tax compliance with ONESOURCE solutions

- 5.8.3.2 API management platform

- 5.8.3.3 Geolocation & IP mapping

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS BY REGION

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 IMPACT OF GEN AI IN TAX MANAGEMENT

- 5.15.1 TOP CLIENTS ADAPTING GEN AI

- 5.15.1.1 H&R Block

- 5.15.1.2 Febi.ai

- 5.15.2 CASE STUDY

- 5.15.2.1 Streamlining Real Estate Tax Compliance with ONESOURCE Solutions

- 5.15.1 TOP CLIENTS ADAPTING GEN AI

6 TAX MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: TAX MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 COMPLIANCE AND OPTIMIZATION

- 6.2.1.1 Improve operational efficiency in tax compliance and reduce tax liabilities

- 6.2.1.2 Monitor real-time regulatory compliance

- 6.2.1.3 Manage tax exemptions and certificates

- 6.2.1.4 Automate tax calculation for transactions

- 6.2.2 TAX PREPARATION & REPORTING

- 6.2.2.1 Reduce manual efforts & filing errors while ensuring compliance across jurisdictions

- 6.2.2.2 Tax return preparation & filing

- 6.2.2.3 E-audit file generation

- 6.2.2.4 Multi-jurisdiction filing support

- 6.2.3 AUDIT & RISK MANAGEMENT TOOLS

- 6.2.3.1 Enhance audit readiness with real-time data checks

- 6.2.3.2 Data validation and cleansing

- 6.2.3.3 Compliance verification

- 6.2.3.4 Automated data validation

- 6.2.4 TAX ANALYTICS TOOLS

- 6.2.4.1 Improve tax transparency with analytic tools and manage risks through data-driven insights

- 6.2.4.2 Tax data quality assurance

- 6.2.4.3 Data-driven tax decisioning

- 6.2.4.4 Real-time tax risk identification

- 6.2.5 DOCUMENT MANAGEMENT & ARCHIVING

- 6.2.5.1 Automate document organization & categorization

- 6.2.5.2 Tax document repository

- 6.2.5.3 Audit-ready document management

- 6.2.5.4 E-invoicing and certificate archiving

- 6.2.6 OTHERS

- 6.2.1 COMPLIANCE AND OPTIMIZATION

- 6.3 SERVICES

- 6.3.1 IMPLEMENTATION & SYSTEM INTEGRATION

- 6.3.1.1 Configure tax software to match organizational needs and ensure smooth deployment of tax management solutions

- 6.3.2 TAX CONFIGURATION AND ADVISORY SERVICES

- 6.3.2.1 Advise on regulatory changes and compliance strategies

- 6.3.3 SUPPORT & REGULATORY MAINTENANCE

- 6.3.3.1 Adapt tax systems to new regulatory mandates

- 6.3.1 IMPLEMENTATION & SYSTEM INTEGRATION

7 TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: TAX MANAGEMENT MARKET DRIVERS

- 7.1.2 ON-PREMISES

- 7.1.2.1 Integrates legacy systems with on-premises tax platforms

- 7.1.3 CLOUD

- 7.1.3.1 Automates tax processes with cloud-based platforms

8 TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: TAX MANAGEMENT MARKET DRIVERS

- 8.1.2 LARGE ENTERPRISES

- 8.1.2.1 Implement enterprise-scale tax automation solutions with complex financial structures

- 8.1.3 SMALL & MEDIUM SIZED ENTERPRISES

- 8.1.3.1 Seek cost-effective, easy-to-deploy tax management solutions that address essential needs

9 TAX MANAGEMENT MARKET, BY TAX TYPE

- 9.1 INTRODUCTION

- 9.1.1 TAX TYPE: TAX MANAGEMENT MARKET DRIVERS

- 9.2 INDIRECT TAXES

- 9.2.1 HELP BUSINESSES GENERATE COMPLIANT INVOICES AND FILE RETURNS

- 9.2.2 VALUE-ADDED TAX (VAT)

- 9.2.3 GOODS & SERVICES TAX (GST)

- 9.2.4 SALES TAX

- 9.2.5 CUSTOM DUTIES

- 9.2.6 OTHER INDIRECT TAXES

- 9.3 DIRECT TAXES

- 9.3.1 INTEGRATE WITH ENTERPRISE FINANCIAL SYSTEMS TO AUTOMATE DATA COLLECTION AND ENSURE ACCURATE FILINGS

- 9.3.2 CORPORATE TAX

- 9.3.3 CAPITAL GAIN TAX

- 9.3.4 PROPERTY TAX

- 9.3.5 OTHER DIRECT TAXES

10 TAX MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: TAX MANAGEMENT MARKET DRIVERS

- 10.2 BFSI

- 10.2.1 AUTOMATE FINANCIAL TRANSACTION TAX MANAGEMENT IN BANKING AND INSURANCE

- 10.2.2 BFSI: USE CASES

- 10.2.2.1 Automated regulatory tax compliance

- 10.2.2.2 Tax audit & risk management

- 10.3 IT & TELECOM

- 10.3.1 INTEGRATE TAX MANAGEMENT SOLUTIONS WITH TELECOM BILLING SYSTEMS

- 10.3.2 IT & TELECOM: USE CASES

- 10.3.2.1 Digital service tax

- 10.3.2.2 Subscription billing taxation

- 10.3.2.3 Infrastructure asset taxation

- 10.4 MANUFACTURING

- 10.4.1 INTEGRATE TAX MANAGEMENT PLATFORMS WITH MANUFACTURING ERP SYSTEMS

- 10.4.2 MANUFACTURING: USE CASES

- 10.4.2.1 Excise duty and indirect tax compliance

- 10.4.2.2 Transfer pricing compliance

- 10.4.2.3 Tax provisioning & reporting

- 10.5 RETAIL & E-COMMERCE

- 10.5.1 IMPROVE AUDIT READINESS THROUGH REAL-TIME TAX COMPLIANCE IN RETAIL

- 10.5.2 RETAIL & E-COMMERCE: USE CASES

- 10.5.2.1 Automated sales tax calculations

- 10.5.2.2 Multi-channel sales tax integration

- 10.5.2.3 Inventory stock management

- 10.6 HEALTHCARE & LIFE SCIENCES

- 10.6.1 OPTIMIZE TAX COMPLIANCE FOR HEALTHCARE & LIFE SCIENCES

- 10.6.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.6.2.1 VAT exemption management for medical products

- 10.6.2.2 Cross-border tax handling

- 10.6.2.3 Hospital payroll tax processing

- 10.7 GOVERNMENT & PUBLIC SECTOR

- 10.7.1 CENTRALIZE TAX MANAGEMENT OPERATIONS ACROSS PUBLIC SECTOR DEPARTMENTS

- 10.7.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 10.7.2.1 Real-time revenue monitoring

- 10.7.2.2 Automated tax compliance

- 10.7.2.3 E-invoicing compliance automation

- 10.8 ENERGY & UTILITIES

- 10.8.1 AUTOMATING EXCISE AND FUEL TAX COMPLIANCE IN ENERGY & UTILITIES OPERATIONS

- 10.8.2 ENERGY & UTILITIES: USE CASES

- 10.8.2.1 Excise & fuel tax automation

- 10.8.2.2 Renewable energy incentive management

- 10.8.2.3 Multi-jurisdictional tax compliance

- 10.9 OTHERS

11 TAX MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Tax software adoption to surge with e-filing growth

- 11.2.4 CANADA

- 11.2.4.1 CRA-driven digital filing to spur demand for tax management solutions

- 11.3 EUROPE

- 11.3.1 EUROPE: MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 HMRC mandates to drive cloud-based tax software adoption

- 11.3.4 GERMANY

- 11.3.4.1 Regulatory changes, digital adoption, and increased automation to drive transformation in tax administration

- 11.3.5 FRANCE

- 11.3.5.1 Fueling expansion of tax management market via e-governance innovation to drive market

- 11.3.6 ITALY

- 11.3.6.1 Rising multinational compliance demand to drive adoption of Cloud-based tax solutions

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Strong government initiatives for online learning to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Enhancing indirect tax management with cloud technology to drive market

- 11.4.5 INDIA

- 11.4.5.1 Accelerating digital tax compliance through TIN 2.0 and e-Filing platforms to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: TAX MANAGEMENT MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GCC

- 11.5.3.1 Transforming tax operations through automation to boost demand for tax management

- 11.5.3.2 KSA

- 11.5.3.3 UAE

- 11.5.3.4 Rest of GCC countries

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Strengthening tax compliance through automation at SARS to drive market

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: TAX MANAGEMENT MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Increasing regulatory demands and enhancing digital transformation goals to drive market

- 11.6.4 MEXICO

- 11.6.4.1 Need for digital invoices in real-time to push companies to adopt tax software for accurate reporting

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6.1 COMPANY VALUATION

- 12.6.2 FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Deployment mode footprint

- 12.7.5.5 Tax type footprint

- 12.7.5.6 Organization size footprint

- 12.7.5.7 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 WOLTERS KLUWER

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 THOMSON REUTERS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 AVALARA

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 ADP

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 VERTEX

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 SOVOS

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches

- 13.2.6.3.2 Deals

- 13.2.7 INTUIT

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches

- 13.2.7.3.2 Deals

- 13.2.8 H&R BLOCK

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.2.1 Product launches

- 13.2.8.2.2 Deals

- 13.2.9 SAP

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 XERO

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Deals

- 13.2.1 WOLTERS KLUWER

- 13.3 OTHER PLAYERS

- 13.3.1 TAXBIT

- 13.3.2 SAILOTECH

- 13.3.3 EXEMPTAX

- 13.3.4 CLEAR

- 13.3.5 DRAKE SOFTWARE

- 13.3.6 TAXCLOUD

- 13.3.7 LOVAT SOFTWARE

- 13.3.8 WEBGILITY

- 13.3.9 GLOBAL TAX MANAGEMENT INC.

- 13.3.10 TAXDOME

- 13.3.11 TAXGPT

- 13.3.12 FEBI.AI

- 13.3.13 TAXBUDDY

- 13.3.14 TAXCALC

- 13.3.15 CAPIUM

14 ADJACENT/RELATED MARKET

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 CLOUD ERP MARKET

- 14.3 TAX TECH MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS