|

시장보고서

상품코드

1794017

로봇 비전 시장 : 구성요소별, 유형별, 업계별, 지역별 예측(-2030년)Robotic Vision Market by Type, Component, Deployment - Global Forecast to 2030 |

||||||

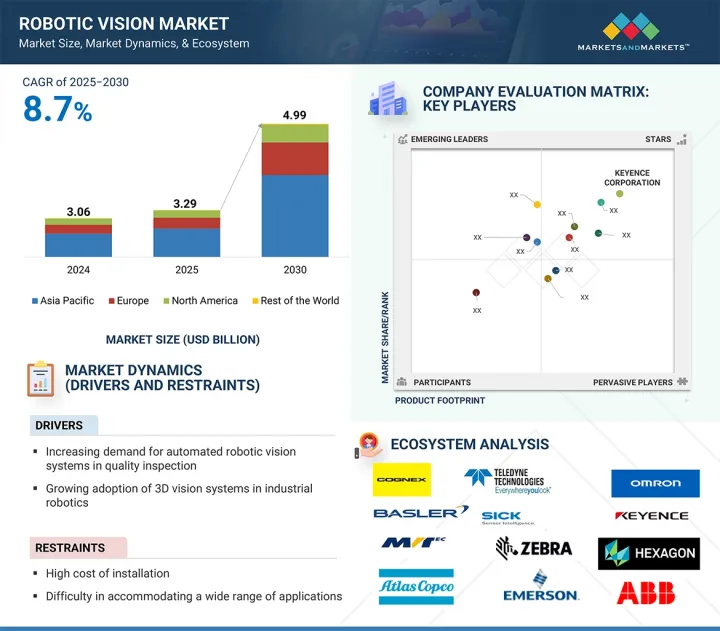

세계 로봇 비전 시장 규모는 8.7%의 연평균 복합 성장률(CAGR)로 성장하고, 2025년 32억 9,000만 달러, 2030년에는 49억 9,000만 달러로 성장할 것으로 예측됩니다.

3D 로봇 시스템은 빈 피킹, 검사, 측정 등 다양한 기능에 유연성을 제공하는 3D 비전 기술로부터 큰 혜택을 누리고 있습니다. 이 첨단 기술은 형상을 기준으로 대상을 식별하고 위치를 확인할 수 있으므로 대비가 낮은 대상과 복잡한 형상의 대상을 확실하게 감지할 수 있습니다.

| 조사 범위 | |

|---|---|

| 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 구성 요소별, 유형별, 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

카메라의 해상도가 높아지고 가격이 낮아짐에 따라 대형 데이터 세트를 실시간으로 처리할 수 있는 새로운 마이크로프로세서와 함께 3D 비전은 로봇 비전 시장을 확대하고 로봇 응용분야에 더욱 매력적이 되고 있습니다.

2차원(2D) 비전 시스템은 디지털 카메라로 이미지를 캡처하고 xy 평면으로 처리합니다. 2D 비전 시스템은 반사 강도와 대비의 평평한 2차원 맵을 생성하므로 이러한 카메라에서 조명이 중요한 요소가 됩니다. 일반적으로 머리 위에 설치되어 산업용 로봇을 내려다보고 로봇의 프로그램 경로를 만드는 데 도움이 됩니다. 2D 비전 시스템은 처리된 2D 이미지를 다양한 해상도로 캡처합니다. 3D 시스템에 대한 2D 시스템의 주요 장점은 보다 경제적이고 편리하다는 것입니다. 이러한 시스템은 식음료 산업과 건강 관리에서 점점 더 많이 사용되고 있습니다.

로봇 비전 시스템은 일렉트로닉스 반도체 산업에서의 처리량, 품질, 생산성을 향상시키고 생산을 변화시킬 가능성을 갖고 있습니다. 자재관리 및 자동 검사는 비전 시스템의 가장 흔한 용도입니다. 이러한 시스템은 반도체를 포함한 전자 부품의 검사에 혁명을 가져왔습니다. 용접, 패키징, 팔레타이징 등의 용도도 로봇 비전 시스템이 제공하는 고정밀도에 의존합니다. 또한 전자 칩과 전자 부품은 다양한 크기로 제조되므로 용접 및 팔레타이징에는 마이크로 레벨 정확도가 필요합니다.

유럽의 로봇 비전 시장은 이 지역이 많은 활발한 산업과 기업을 포함하고 있기 때문에 성장하고 있습니다. 특히 프랑스, 독일, 이탈리아, 스페인, 스위스, 네덜란드, 북유럽, 영국 등입니다. 이러한 강점은 이제 신흥 로봇 비전 시장으로 방향을 바꿀 수 있습니다. 또한 중소기업(SME)에서도 성장을 볼 수 있어 로봇 비전 시장이 확대되는 큰 기회가 되고 있습니다. 유럽 머신 비전 협회(EMVA)는 유럽에서 머신 비전 산업의 성공을 지원하고 이 시장의 밝은 전망을 예측합니다. EMVA는 더 많은 회원 혜택을 제공하고 유럽 머신 비전 커뮤니티의 대변자 역할을 함으로써 로봇 비전 기술을 계속 지원합니다.

본 보고서에서는 세계의 로봇 비전 시장에 대해 조사했으며, 구성요소별, 유형별, 업계별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객사업에 영향을 주는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025년-2026년의 주된 회의와 이벤트

- 사례 연구

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- AI/생성형 AI가 로봇 비전 시장에 미치는 영향

- 2025년 미국 관세가 로봇 비전 시장에 미치는 영향

제6장 로봇 비전 시스템 도입 분야

- 소개

- 로봇 유도 시스템

- ROBOTIC CELLS

제7장 로봇 시각 시스템을 위한 검출 알고리즘

- 소개

- 윤곽 베이스

- 상관관계 베이스

- 특징 추출

- CLOUD OF POINTS

제8장 로봇 비전 시장(구성요소별)

- 소개

- 카메라

- LED 조명 시스템

- 광학

- 프로세서와 컨트롤러

- 프레임 그래버

- 기타 하드웨어 구성요소

- 소프트웨어

제9장 로봇 비전 시장(유형별)

- 소개

- 2D 비전 시스템

- 3D 비전 시스템

제10장 로봇 비전의 응용

- 소개

- 용접과 납땜

- 자재관리

- 포장과 팔레타이징

- 페인팅

- 조립 및 분해

- 절단, 프레스, 연마, 버 제거

- 측정, 검사, 시험

제11장 로봇 비전 시장(업계별)

- 소개

- 자동차

- 일렉트로닉스 및 반도체

- 고무 플라스틱

- 금속 및 기계

- 식음료

- 헬스케어

- 물류

- 기타

제12장 로봇 비전 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 스위스

- 북유럽

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 싱가포르

- 기타

- 기타 지역

- 기타 지역의 거시 경제 전망

- 중동

- 남미

- 아프리카

제13장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점, 2021년-2025년

- 수익 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- COGNEX CORPORATION

- KEYENCE CORPORATION

- TELEDYNE TECHNOLOGIES INC.

- OMRON CORPORATION

- FANUC CORPORATION

- BASLER AG

- SICK AG

- ATLAS COPCO AB

- EMERSON ELECTRIC CO.

- ZEBRA TECHNOLOGIES CORP.

- HEXAGON AB

- ADVANTECH CO., LTD.

- ABB

- QUALCOMM TECHNOLOGIES, INC.

- 기타 기업

- QUALITAS TECHNOLOGIES

- BAUMER

- TORDIVEL AS

- OPTOTUNE

- MVTEC SOFTWARE GMBH

- INDUSTRIAL VISION SYSTEMS

- IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- WENGLOR SENSORIC GMBH

- ZIVID

- ADLINK TECHNOLOGY INC.

- LMI TECHNOLOGIES INC.

제15장 부록

SHW 25.08.25At a CAGR of 8.7%, the global robotic vision market is expected to grow from USD 3.29 billion in 2025 to USD 4.99 billion in 2030. 3D robotic systems greatly benefit from 3D vision technology, which offers flexibility for various functions like bin picking, inspection, and measurement. This advanced technology can identify and locate objects based on their shape, allowing for reliable detection of objects with low contrast or complex geometries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Component, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

As cameras improve in resolution and prices decrease, combined with new microprocessors capable of handling large data sets in real time, 3D vision is expanding the robotic vision market and becoming more attractive for robotic applications.

"2D vision systems will capture a prominent share of the robotic vision market"

A two-dimensional (2D) vision system uses a digital camera to capture an image and processes it into an x-y plane. 2D vision systems create flat, two-dimensional maps of reflected intensity or contrast, making lighting a crucial factor for these cameras. Usually mounted overhead, these systems look down on industrial robots and help in creating program paths for the robots. A 2D vision system captures the processed 2D image at various resolutions. The main advantage of a 2D system over a 3D system is that it is more economical and convenient. These systems are increasingly used in the food and beverage industry as well as in healthcare.

"Electronics & semiconductors will hold the second-largest market share in the robotic vision market, by industry, throughout the forecast period"

Robotic vision systems have the potential to transform production by increasing throughput, quality, and productivity in the electronics and semiconductors industry. Material handling and automated inspection are the most common applications of vision systems. These systems have revolutionized the inspection of electronic components, including semiconductors. Applications such as welding, packaging, and palletizing also rely on the high precision provided by robotic vision systems. Additionally, electronic chips and components are produced in various sizes, which requires micro-level precision in welding and palletizing.

"Industrial automation and growth concerns will position Europe as the third-largest market for robotic vision solutions"

The robotic vision market in Europe is growing as the region encompasses many active industries and companies. The European industry has strong technical and commercial expertise in the robotic vision sector in several Member States-especially France, Germany, Italy, Spain, Switzerland, the Netherlands, the Nordics, and the UK. It has developed skills for large manufacturing users. These strengths could now be redirected toward emerging robotic vision markets. Growth has also been seen in small and medium-sized enterprises (SMEs), creating a significant opportunity for the robotic vision market to expand. The European Machine Vision Association (EMVA) has supported the success of the machine vision industry in Europe and forecasts a positive outlook for this market. The EMVA continues to support robotic vision technology by offering more member benefits and serving as the voice of the machine vision community in Europe.

Breakdown of Primaries

Various executives from key organizations operating in the robotic vision market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 33%, C-level - 48%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

Major players profiled in this report are Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Omron Corporation (Japan), FANUC CORPORATION (Japan), Basler AG (Germany), SICK AG (Germany), Atlas Copco AB (Sweden), Emerson Electric Co. (US), Zebra Technologies Corp. (US), Hexagon AB (Sweden), Advantech Co., Ltd.(Taiwan), ABB (Switzerland), Qualcomm Technologies, Inc. (US), Qualitas Technologies (India), Baumer (Switzerland), Tordivel AS (Norway), Optotune (Switzerland), MVTec Software Gmbh (Germany), Industrial Vision Systems (UK), IDS Imaging Development Systems GmbH (Germany), Wenglor ( Germany), Zivid (Norway), ADLINK Technology Inc. (Taiwan), and LMI TECHNOLOGIES INC.(Canada). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key players in the robotic vision market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the robotic vision market based on deployment (robotic guidance systems and robotic cells), detection algorithm (counter-based, correlation-based, feature extraction, and cloud of point), application (welding and soldering; material handling; packaging and palletizing; painting; assembling and disassembling; cutting, pressing, grinding, and deburring; measurement, inspection, and testing), type (2D and 3D vision systems) and industry (automotive, electronics & semiconductors, rubber & plastics, metals & machinery, logistics, food & beverages, healthcare, and other industries). The market has been segmented into four regions-North America, Asia Pacific, Europe, and the Rest of the World (RoW).

Reasons to Buy the Report

The report will assist leaders and new entrants in this market by providing estimates of revenue figures for the overall market and its subsegments. It will also help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers insights into the robotic vision market's current dynamics and covers key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (increasing demand for automated robotic vision systems in quality inspection, growing adoption of 3D vision systems in industrial robotics, growing need for safety and high-quality products in industrial sector, rising adoption of smart cameras in robotic vision systems), restraints (high cost of installation, difficulty in accommodating a wide range of applications, limited awareness of robotic vision systems), opportunities (rising implementation of robotic vision systems in the food and beverage industry, government-driven programs to enhance industrial automation, incorporation of AI and deep learning technologies into robotic vision systems, personalization of robotic vision solutions), and challenges (challenges in producing robotic vision systems, configuring advanced inspection operations) influencing the growth of the robotic vision market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the robotic vision market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the robotic vision market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in robotic vision solutions

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Omron Corporation (Japan), and FANUC CORPORATION (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ROBOTIC VISION MARKET

- 4.2 ROBOTIC VISION MARKET, BY COMPONENT

- 4.3 ROBOTIC VISION MARKET, BY INDUSTRY

- 4.4 ROBOTIC VISION MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 4.5 ROBOTIC VISION MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising emphasis on machine automation to enhance industrial operations

- 5.2.1.2 Growing adoption of 3D vision systems in industrial robotics

- 5.2.1.3 Increasing need for safe and high-quality products in industrial sectors

- 5.2.1.4 Rising integration of smart cameras into robotic systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation costs

- 5.2.2.2 Complexities in creating standard vision systems for different manufacturing applications

- 5.2.2.3 Limited awareness of robotic vision systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising implementation of robotic vision systems in food & beverages industry

- 5.2.3.2 Government-driven programs to enhance industrial automation

- 5.2.3.3 Incorporation of AI and deep learning technologies into robotic vision systems

- 5.2.3.4 Growing demand for personalized robotic vision systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in integrating robots into vision systems

- 5.2.4.2 Issues related to complex inspections involving deviation and unpredictable defects

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF ROBOTIC VISION SYSTEMS OFFERED BY KEY PLAYERS, BY COMPONENT, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION SYSTEMS, BY HARDWARE COMPONENT, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF ROBOTIC VISION HARDWARE COMPONENTS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence

- 5.8.1.2 Deep learning

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Hyperspectral imaging

- 5.8.2.2 Edge computing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cloud computing

- 5.8.3.2 5G

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 852580)

- 5.10.2 EXPORT SCENARIO (HS CODE 852580)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY

- 5.12.1 MWES DESIGNS KAWASAKI RS007L ROBOTS FITTED WITH VACUUM GRIPPERS TO HELP CLIENT REDUCE DEPENDENCE ON HUMAN LABOR

- 5.12.2 PRESCRIPTIVE DATA USES TELEDYNE FLIR'S VISION SENSORS TO DELIVER ACCURATE OCCUPANCY DATA FOR SMART BUILDINGS

- 5.12.3 LEADING AUTOMOTIVE SUPPLIER IMPROVES INSPECTION EFFICIENCY WITH FUJIFILM'S 4D HIGH RESOLUTION LENSES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON ROBOTIC VISION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY INDUSTRIES

- 5.16.2.1 Electronics & semiconductors

- 5.16.2.2 Food & beverages

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN ROBOTIC VISION ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF ON ROBOTIC VISION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON INDUSTRIES

6 AREAS OF ROBOTIC VISION SYSTEM DEPLOYMENT

- 6.1 INTRODUCTION

- 6.2 ROBOTIC GUIDANCE SYSTEMS

- 6.3 ROBOTIC CELLS

7 DETECTION ALGORITHMS FOR ROBOTIC VISION SYSTEMS

- 7.1 INTRODUCTION

- 7.2 CONTOUR-BASED

- 7.3 CORRELATION-BASED

- 7.4 FEATURE EXTRACTION

- 7.5 CLOUD OF POINTS

8 ROBOTIC VISION MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 CAMERAS

- 8.2.1 BY FORMAT

- 8.2.1.1 Line scan

- 8.2.1.2 Area scan

- 8.2.2 BY SENSOR

- 8.2.2.1 CMOS

- 8.2.2.2 CCD

- 8.2.3 BY IMAGING SPECTRUM

- 8.2.3.1 Visible

- 8.2.3.1.1 Increasing use for discrete part inspection and other robotic vision applications to fuel segmental growth

- 8.2.3.2 Visible + IR

- 8.2.3.2.1 Rising application in large industrial sectors to contribute to segmental growth

- 8.2.3.1 Visible

- 8.2.1 BY FORMAT

- 8.3 LED LIGHTING SYSTEMS

- 8.3.1 BURGEONING DEMAND FOR STRUCTURED LIGHTING TO AUGMENT SEGMENTAL GROWTH

- 8.4 OPTICS

- 8.4.1 INCREASING INTEGRATION WITH CAMERAS FOR IMAGE ACQUISITION TO BOLSTER SEGMENTAL GROWTH

- 8.5 PROCESSORS & CONTROLLERS

- 8.5.1 HIGH COMPLEXITY IN VISION ALGORITHMS TO ACCELERATE SEGMENTAL GROWTH

- 8.5.2 FPGA

- 8.5.3 DSP

- 8.5.4 MICROCONTROLLERS & MICROPROCESSORS

- 8.5.5 VPU

- 8.6 FRAME GRABBERS

- 8.6.1 RISING INTEGRATION WITH DIGITAL CAMERAS TO ACHIEVE HIGH PROCESSING SPEEDS AND RESOLUTIONS TO DRIVE MARKET

- 8.7 OTHER HARDWARE COMPONENTS

- 8.8 SOFTWARE

- 8.8.1 FLEXIBILITY AND TRAIN CUSTOMIZED NEURAL NETWORKS TO EXPEDITE SEGMENTAL GROWTH

9 ROBOTIC VISION MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 2D VISION SYSTEMS

- 9.2.1 COST-EFFECTIVENESS AND CONVENIENT ATTRIBUTES TO BOOST SEGMENTAL GROWTH

- 9.3 3D VISION SYSTEMS

- 9.3.1 ADAPTABILITY AND FLEXIBILITY TO CHANGES TO ACCELERATE SEGMENTAL GROWTH

- 9.3.2 SINGLE- AND MULTI-CAMERA TRIANGULATION

- 9.3.3 STRUCTURED LIGHT

- 9.3.4 TIME-OF-FLIGHT (TOF)

- 9.3.5 STEREO VISION

- 9.3.6 LASER-BASED

10 ROBOTIC VISION APPLICATIONS

- 10.1 INTRODUCTION

- 10.2 WELDING & SOLDERING

- 10.3 MATERIAL HANDLING

- 10.4 PACKAGING & PALLETIZING

- 10.5 PAINTING

- 10.6 ASSEMBLING & DISASSEMBLING

- 10.7 CUTTING, PRESSING, GRINDING & DEBURRING

- 10.8 MEASUREMENT, INSPECTION & TESTING

11 ROBOTIC VISION MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE

- 11.2.1 SHORTAGE OF SKILLED LABORERS AND LOW MANUFACTURING COSTS TO BOOST SEGMENTAL GROWTH

- 11.3 ELECTRONICS & SEMICONDUCTORS

- 11.3.1 DEMAND FOR ENHANCED QUALITY CONTROL AND OBJECT RECOGNITION TO DRIVE MARKET

- 11.4 RUBBER & PLASTICS

- 11.4.1 APPLICATION IN MATERIAL HANDLING AND INSPECTION TASKS TO BOOST DEMAND FOR ROBOTIC VISION SYSTEMS

- 11.5 METALS & MACHINERY

- 11.5.1 INTEGRATION OF ROBOTIC VISION SYSTEMS INTO MANUFACTURING SYSTEMS TO ENHANCE PRODUCTION QUALITY TO FUEL SEGMENTAL GROWTH

- 11.6 FOOD & BEVERAGES

- 11.6.1 FOCUS ON ENHANCING SANITATION AND MATERIAL HANDLING OPERATIONS TO ACCELERATE SEGMENTAL GROWTH

- 11.7 HEALTHCARE

- 11.7.1 REQUIREMENT FOR HIGH LEVEL OF SCRUTINY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.8 LOGISTICS

- 11.8.1 NEED FOR FASTER, SMARTER, AND MORE RELIABLE OPERATIONS TO FUEL SEGMENTAL GROWTH

- 11.9 OTHER INDUSTRIES

12 ROBOTIC VISION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Increasing need for improved product inspection and quality control in manufacturing sector to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising adoption of automated inspection and monitoring solutions to augment market growth

- 12.2.4 MEXICO

- 12.2.4.1 Growing emphasis on manufacturing automation to contribute to market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Rising vehicle production and factory operations to bolster market growth

- 12.3.3 UK

- 12.3.3.1 Increasing focus on improving product quality and minimizing waste in automotive sector to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising deployment of electric and hybrid vehicles to drive market

- 12.3.5 ITALY

- 12.3.5.1 Growing emphasis on factory automation to contribute to market growth

- 12.3.6 SPAIN

- 12.3.6.1 Increasing government incentives for purchasing EVs and HEVs to foster market growth

- 12.3.7 NETHERLANDS

- 12.3.7.1 Rising adoption in logistics and electronics sectors to expedite market growth

- 12.3.8 SWITZERLAND

- 12.3.8.1 High expertise in precision engineering and high-tech manufacturing to boost market growth

- 12.3.9 NORDICS

- 12.3.9.1 Strong focus on predictive maintenance, quality assurance, and AI-based inspection to accelerate market growth

- 12.3.10 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rising manufacturing of electronics & semiconductor components and commercial vehicles to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Increasing export of robots to contribute to market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Thriving electronics industry and demand for automation to augment market growth

- 12.4.5 INDIA

- 12.4.5.1 Growing focus on automation and digitalization to stimulate market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Expanding applications in electronics and food & beverages industries to bolster market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rising need for efficiency, consistency, and quality in production processes to spur robotic vision system adoption

- 12.4.8 SINGAPORE

- 12.4.8.1 Rapid technological advances and well-developed infrastructure to foster market growth

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Growing emphasis on smart manufacturing, automation, and digital transformation to accelerate market growth

- 12.5.2.2 UAE

- 12.5.2.2.1 Rising initiatives to promote automation technology adoption to expedite market growth

- 12.5.2.3 Bahrain

- 12.5.2.3.1 National strategies to support industrial automation to accelerate market growth

- 12.5.2.4 Kuwait

- 12.5.2.4.1 Growing focus on modernizing manufacturing sector to contribute to market growth

- 12.5.2.5 Oman

- 12.5.2.5.1 High preference for smart manufacturing practices to bolster market growth

- 12.5.2.6 Qatar

- 12.5.2.6.1 Escalating adoption of smart automation technologies to fuel market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Saudi Arabia

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Brazil

- 12.5.3.1.1 Increasing investment in industrial automation and smart manufacturing technologies to drive market

- 12.5.3.2 Argentina

- 12.5.3.2.1 Rising emphasis on modernizing manufacturing facilities to boost market growth

- 12.5.3.3 Other South American countries

- 12.5.3.1 Brazil

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 Increasing focus on enhancing manufacturing competitiveness to fuel market growth

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 PRODUCT COMPARISON

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Component footprint

- 13.7.5.5 Industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 COGNEX CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 KEYENCE CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 TELEDYNE TECHNOLOGIES INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 OMRON CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 FANUC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 BASLER AG

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths/Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses/Competitive threats

- 14.1.7 SICK AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 ATLAS COPCO AB

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 EMERSON ELECTRIC CO.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 ZEBRA TECHNOLOGIES CORP.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 HEXAGON AB

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 ADVANTECH CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 ABB

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 QUALCOMM TECHNOLOGIES, INC.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.1 COGNEX CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 QUALITAS TECHNOLOGIES

- 14.2.2 BAUMER

- 14.2.3 TORDIVEL AS

- 14.2.4 OPTOTUNE

- 14.2.5 MVTEC SOFTWARE GMBH

- 14.2.6 INDUSTRIAL VISION SYSTEMS

- 14.2.7 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- 14.2.8 WENGLOR SENSORIC GMBH

- 14.2.9 ZIVID

- 14.2.10 ADLINK TECHNOLOGY INC.

- 14.2.11 LMI TECHNOLOGIES INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS