|

시장보고서

상품코드

1794022

환경 복원 시장 : 환경 매체별, 토지 유형별, 기술별 - 예측(-2030년)Environmental Remediation Market by Environmental Medium (Soil, Groundwater), Site Type (Private, Public), Technology (Air Sparging, Soil Washing, Chemical Treatment, Bioremediation, Electrokinetic Remediation, Excavation) - Global Forecast to 2030 |

||||||

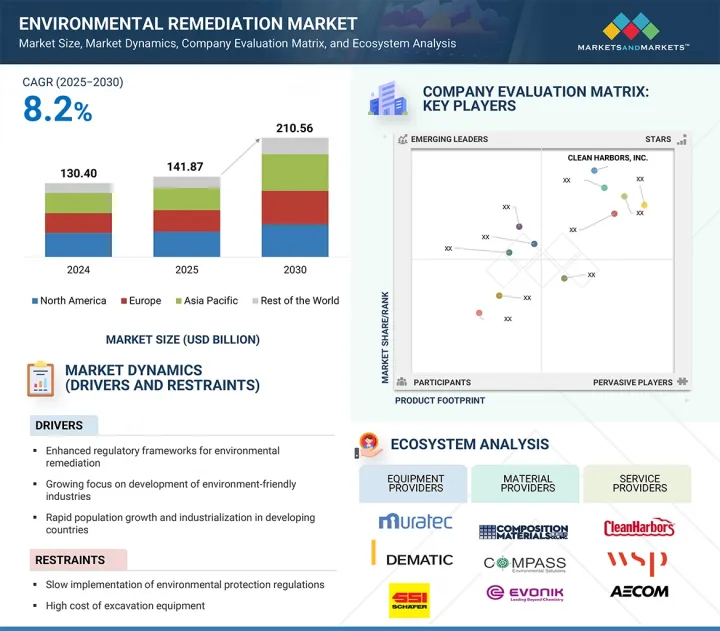

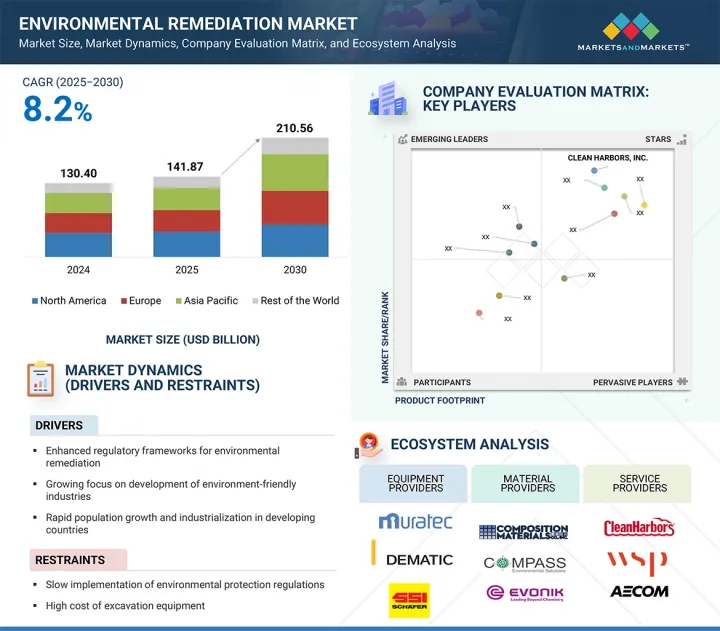

세계의 환경 복원 시장 규모는 2025년 1,418억 7,000만 달러에서 2030년까지 2,105억 6,000만 달러에 달할 것으로 예측되며, CAGR로 8.2%의 성장이 전망됩니다.

시장은 토지와 수자원에 대한 압력이 증가하고 있는 개발도상국의 급속한 인구 증가와 산업화 진행에 힘입어 확대되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 오염물질 유형, 환경 매체, 토지 유형, 기술, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

이러한 도시개발과 산업개발로 인해 오염이 확산되고 있어 토양과 지하수 정화가 시급한 실정입니다. 또한, 석유 및 가스 산업은 유출, 누출, 토지 황폐화 등 지속적인 환경 리스크로 인해 정화 서비스를 지속적으로 요구하고 있습니다.

"지하수 부문은 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다."

지하수 부문은 식수 안전과 지하수 오염의 장기적 영향에 대한 우려가 높아지면서 환경 복원 시장에서 급성장할 것으로 예상됩니다. 지하 저장 탱크 누출, 산업폐수, 화학제품 유출 등의 원인으로 휘발성유기화합물(VOC), 중금속, PFAS 등의 오염물질로 인한 지하수 오염이 확산되고 있습니다. 이에 따라 지하수 모니터링, 위험성 평가, 정화 기술(펌프 앤 트리트먼트, in-situ 화학적 산화, 생물학적 정화 등)에 대한 투자가 확대되고 있습니다. 환경의 긴급성과 규제 압력이 결합하여 지하수 부문은 정화 시장 중 가장 빠르게 성장하는 분야가 되었습니다.

"화학 처리 기술은 예측 기간 동안 크게 성장할 것입니다."

화학처리 기술은 토양 및 지하수 내 유해 오염물질을 빠르게 중화할 수 있는 능력을 가지고 있어 환경 복원 시장에서 큰 성장이 기대되고 있습니다. 특히 산업용 용제, 중금속, PFAS, 기타 잔류성 오염물질의 영향을 받은 복잡한 토지에 효과적입니다. 특히 도시 지역과 브라운필드 지역의 신속한 토지 정화에 대한 수요 증가와 규제 압력이 증가함에 따라 화학적 방법이 더욱 보편화되고 있습니다. 현장 화학적 산화 및 안정화의 발전은 효율을 향상시키고 이차적 위험을 감소시켜 화학적 처리를 다양한 오염 문제에 대한 확장 가능한 솔루션으로 만들고 있습니다.

"유럽은 2025년 환경 복원 시장에서 시장 점유율 2위를 차지했습니다."

유럽은 엄격한 환경 정책, 산업 활동의 역사, 지속가능성과 순환 경제 원칙을 중시하는 지역성으로 인해 환경 복원 시장이 고도로 발달하고 규제가 잘 되어 있습니다. 유럽연합(EU)은 ELD(Environmental Liability Directive), 폐기물 프레임워크 지침(Waste Framework Directive) 등의 지침을 통해 종합적인 환경법을 시행하고 있으며, 오염자에게 환경파괴의 예방, 저감, 복원을 의무화하고 있습니다. 유럽의 많은 국가들은 브라운필드 재개발, 산업폐기물 정화, 생태적으로 영향을 받기 쉬운 지역 복원 등 오염된 토지를 관리하기 위한 국가 및 지역 시스템을 구축하고 있습니다.

세계의 환경 복원 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 환경 복원 시장 기업에서 매력적인 기회

- 환경 복원 시장 : 환경 매체별, 토지 유형별

- 환경 복원 시장 : 기술별

- 환경 복원 시장 : 용도별

- 환경 복원 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 버크셔 주 콤프턴의 주택 재개발을 위한 구 PIRBRIGHT INSTITUTE의 철거, 복원 및 개선

- PLUMSTEAD WEST THAMESMEAD의 LOMBARD SQUARE의 복원 및 정비 공사

- MONTROSE, 캐서린의 안전한 식수 회복을 위해 신속하고 확장된 가능한 PFAS 처리 실시

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 가격 설정 분석

- 참고 가격 분석 : 토지 유형별

- 평균판매가격 동향 : 지역별

- 특허 분석

- 주요 회의와 이벤트(2025-2026년)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 표준

- 규제

- 무역 분석

- HS 코드 8430 수출 데이터

- HS 코드 8430 수입 데이터

- 2025년 미국 관세의 영향 - 환경 복원 시장

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가·지역에 대한 영향

- 용도 산업에 대한 영향

- 환경 복원 시장에서 AI의 영향

제6장 환경 복원 시장 : 오염물질 유형별

- 소개

- 미생물 오염물질

- 유기 오염물질

- 무기 오염물질

제7장 환경 복원 시장 : 환경 매체별

- 소개

- 토양

- 지하수

제8장 환경 복원 시장 : 토지 유형별

- 소개

- 사유

- 공공

제9장 환경 복원 시장 : 기술별

- 소개

- 에어 스파징

- 토양 세정

- 화학 처리

- 생물정화

- 동전기정화

- 발굴

- 투과성 반응성 배리어

- in situ 그라우팅

- 식물정화

- 양수 및 처리

- 토양증기추출

- in situ 유리화

- 열처리

제10장 환경 복원 시장 : 용도별

- 소개

- 광업·임업

- 석유 및 가스

- 농업

- 자동차

- 매립지·폐기물 처리장

- 제조·산업·화학 생산/가공

- 건설·토지 개발

제11장 환경 복원 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주·뉴질랜드

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동 및 아프리카

- 남미

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점(2021-2025년)

- 매출 분석(2021-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- CLEAN HARBORS, INC.

- WSP

- AECOM

- JACOBS SOLUTIONS INC.

- TETRA TECH, INC.

- DEME GROUP NV

- ENTACT

- TERRA SYSTEMS

- HDR, INC.

- BECHTEL CORPORATION

- FLUOR CORPORATION

- 기타 기업

- ENVIRONMENTAL LOGIC

- MONTROSE ENVIRONMENTAL GROUP, INC.

- OXYLE

- ECOSPEARS INC.

- ALLONNIA

- CARBOGENICS

- ALLIED MICROBIOTA

- ACLARITY, INC.

- EKOLIVE S.R.O.

- NOVOBIOM S.P.R.L

- OXI AMBIENTAL SA

- WEBER AMBIENTAL

- AMENTUM SERVICES, INC.

- NORTHSTAR ENVIRONMENTAL SERVICES

- IN-SITU OXIDATIVE TECHNOLOGIES, INC.(ISOTEC)

제14장 부록

KSM 25.08.27The environmental remediation market is expected to expand from USD 141.87 billion in 2025 to USD 210.56 billion by 2030, growing at a CAGR of 8.2%. The environmental remediation market is expanding, fueled by rapid population growth and increasing industrialization in developing countries, which are intensifying pressure on land and water resources.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type of Contaminant, Environmental Medium, Site Type, Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

This urban and industrial development is causing widespread contamination, creating an urgent need for soil and groundwater cleanup. Furthermore, the oil & gas industry continues to consistently demand remediation services due to ongoing environmental risks like spills, leaks, and site deterioration.

"Groundwater segment is projected to record the highest CAGR during the forecast period"

The groundwater segment is expected to grow rapidly within the environmental remediation market, driven by increasing concerns over drinking water safety and the long-term effects of subsurface contamination. Sources such as leaking underground storage tanks, industrial discharges, and chemical spills have caused widespread groundwater pollution with contaminants like volatile organic compounds (VOCs), heavy metals, and PFAS. This has led to greater investments in groundwater monitoring, risk assessment, and remediation technologies such as pump-and-treat, in-situ chemical oxidation, and bioremediation. The combination of environmental urgency and regulatory pressure makes the groundwater segment a quickly expanding field within the remediation market.

"Chemical treatment technology will grow at a significant rate during the forecast period"

Chemical treatment technology is expected to see significant growth in the environmental remediation market because of its ability to quickly neutralize toxic contaminants in soil and groundwater. It is especially effective for complex sites affected by industrial solvents, heavy metals, PFAS, and other persistent pollutants. With increasing demand for rapid site cleanup, particularly in urban and brownfield areas, and rising regulatory pressures, chemical methods are becoming more popular. Advances in in-situ chemical oxidation and stabilization are improving efficiency and lowering secondary risks, making chemical treatment a preferred and scalable solution for various contamination challenges.

"Europe will hold the second-largest market share in the environmental remediation market in 2025"

Europe has a highly developed and well-regulated market for environmental remediation, driven by strict environmental policies, a history of industrial activity, and a strong regional emphasis on sustainability and circular economy principles. The European Union (EU) enforces comprehensive environmental laws through directives like the Environmental Liability Directive (ELD) and the Waste Framework Directive, which require polluters to prevent, reduce, and repair environmental damage. Many European countries have created national and regional systems for managing contaminated sites, including brownfield redevelopment, post-industrial cleanup, and restoring ecologically sensitive areas.

Extensive primary interviews were conducted with key industry experts in the environmental remediation market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from equipment suppliers to Tier 1 companies and service providers. The break-up of the primaries is as follows:

- By Company Type: Tier 1-50%, Tier 2-20%, and Tier 3-30%

- By Designation: C-level Executives-20%, Directors-30%, and Others-50%

- By Region: Asia Pacific-40%, Europe-30%, North America-20%, and RoW-10%

The environmental remediation market is led by several globally established players, including CLEAN HARBORS, INC. (US), WSP (Canada), AECOM (US), Jacobs Solutions Inc. (US), Tetra Tech, Inc. (US), DEME Group NV. (Belgium), ENTACT (US), Terra Systems (US), HDR, Inc. (US), Bechtel Corporation (US), Fluor Corporation (US), Environmental Logic (US), Montrose Environmental Group, Inc. (US), Oxyle (Switzerland), ecoSPEARS Inc. (US), Allonnia (US), Carbogenics (Scotland), Allied Microbiota (US), Aclarity, Inc. (US), Ecolive s.r.o. (Slovakia), Novobiom S.P.R.L (Belgium), Oxi Ambiental SA (Brazil), Weber Ambiental (Brazil), Amentum Services, Inc. (US), Northstar Environmental Services (US), and In-Situ Oxidative Technologies, Inc. (ISOTEC) (US).

The study includes an in-depth competitive analysis of these key players in the environmental remediation market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the environmental remediation market based on type of contaminant (microbial, organic, inorganic), environmental medium (soil, groundwater), site type (private, public), technology (air sparging, soil washing, chemical treatment, bioremediation, electrokinetic remediation, excavation, permeable reactive barriers, in situ grouting, phytoremediation, pump and treat, soil vapor extraction, in-situ vitrification, thermal treatment), and application (mining & forestry, oil & gas, agriculture, automotive, landfills and waste disposal sites, manufacturing, industrial, and chemical production/processing, construction and land development). It also covers the market's drivers, restraints, opportunities, and challenges. The report provides a detailed overview of the market across four main regions (North America, Europe, Asia Pacific, and RoW). Additionally, it includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (enhanced regulatory frameworks for environmental remediation, growing focus on development of environment-friendly industries, rapid population growth and industrialization in developing countries), restraints (slow implementation of environmental protection regulations, high cost of excavation equipment), opportunities (development of advanced remediation technologies, continuous demand generation from oil & gas industry), challenges (inconsistencies in government regulations in many countries, technical and non-technical challenges at complex sites)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product & service launches

- Market Development: Comprehensive information about lucrative markets through the analysis of the environmental remediation market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the environmental remediation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as CLEAN HARBORS, INC. (US), WSP (Canada), AECOM (US), Jacobs Solutions Inc. (US), Tetra Tech, Inc. (US), DEME Group NV. (Belgium), ENTACT (US), Terra Systems (US), HDR, Inc. (US), Bechtel Corporation (US), Fluor Corporation (US), Environmental Logic (US), Montrose Environmental Group, Inc. (US), Oxyle (Switzerland), ecoSPEARS Inc. (US), and Allonnia (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENVIRONMENTAL REMEDIATION MARKET

- 4.2 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM AND SITE TYPE

- 4.3 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY

- 4.4 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION

- 4.5 ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Enhanced regulatory frameworks for environmental remediation

- 5.2.1.2 Growing focus on development of environment-friendly industries

- 5.2.1.3 Rapid population growth and industrialization in developing countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Slow implementation of environmental protection regulations

- 5.2.2.2 High cost of excavation equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced remediation technologies

- 5.2.3.2 Continuous demand generation from oil & gas industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Inconsistencies in government regulations in many countries

- 5.2.4.2 Technical and non-technical challenges at complex sites

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 DEMOLITION, REMEDIATION, AND ENHANCEMENT OF FORMER PIRBRIGHT INSTITUTE FOR RESIDENTIAL REDEVELOPMENT IN COMPTON, BERKSHIRE

- 5.8.2 REMEDIATION AND ENABLING WORKS FOR LOMBARD SQUARE, PLUMSTEAD WEST THAMESMEAD

- 5.8.3 MONTROSE DELIVERS RAPID AND SCALABLE PFAS TREATMENT TO RESTORE SAFE DRINKING WATER IN KATHERINE

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Geosynthetics

- 5.9.1.2 Excavation and Disposal

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Nanoremediation

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Microbial remediation

- 5.9.3.2 Heterogeneous photocatalysis

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY SITE TYPE

- 5.10.1.1 Indicative pricing analysis of environmental remediation for private sites, by key player (2024)

- 5.10.1.2 Indicative pricing analysis of environmental remediation for public sites, by key player (2024)

- 5.10.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10.2.1 Average selling price of environmental remediation for private sites, by region (2021-2024)

- 5.10.2.2 Pricing trend of environmental remediation for private sites, by region (2021-2024)

- 5.10.2.3 Average selling price of environmental remediation for public sites, by region (2021-2024)

- 5.10.2.4 Pricing trend of environmental remediation for public sites, by region (2021-2024)

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY SITE TYPE

- 5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.3 REGULATIONS

- 5.13.3.1 North America

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.13.3.4 RoW

- 5.14 TRADE ANALYSIS

- 5.14.1 EXPORT DATA FOR HS CODE 8430

- 5.14.2 IMPORT DATA FOR HS CODE 8430

- 5.15 IMPACT OF 2025 US TARIFFS-ENVIRONMENTAL REMEDIATION MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON APPLICATION INDUSTRIES

- 5.16 IMPACT OF AI ON ENVIRONMENTAL REMEDIATION MARKET

6 ENVIRONMENTAL REMEDIATION MARKET, BY TYPE OF CONTAMINANT

- 6.1 INTRODUCTION

- 6.2 MICROBIOLOGICAL CONTAMINANTS

- 6.3 ORGANIC CONTAMINANTS

- 6.4 INORGANIC CONTAMINANTS

7 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM

- 7.1 INTRODUCTION

- 7.2 SOIL

- 7.2.1 INCREASING DEMAND FOR SOIL REMEDIATION IN MANUFACTURING AND ENERGY INDUSTRIES TO DRIVE MARKET GROWTH

- 7.3 GROUNDWATER

- 7.3.1 GROWING NEED FOR REMEDIATION MEASURES TO IMPROVE GROUNDWATER QUALITY TO BOOST MARKET GROWTH

8 ENVIRONMENTAL REMEDIATION MARKET, BY SITE TYPE

- 8.1 INTRODUCTION

- 8.2 PRIVATE

- 8.2.1 STRICT ENVIRONMENTAL REGULATIONS BOOST DEMAND FOR ENVIRONMENTAL REMEDIATION SERVICES

- 8.3 PUBLIC

- 8.3.1 GOVERNMENT INITIATIVES BOOST DEMAND FOR ENVIRONMENTAL REMEDIATION SERVICES

9 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 AIR SPARGING

- 9.2.1 GROUNDWATER CLEANUP PROGRAMS FUEL EXPANSION OF AIR SPARGING SOLUTIONS IN ENVIRONMENTAL REMEDIATION MARKET

- 9.3 SOIL WASHING

- 9.3.1 RISING BROWNFIELD REDEVELOPMENT AND LAND REUSE PROJECTS ACCELERATE DEMAND FOR SOIL WASHING TECHNOLOGY

- 9.4 CHEMICAL TREATMENT

- 9.4.1 RISING EMPHASIS ON IN SITU CHEMICAL TECHNOLOGIES IN LONG-TERM GROUNDWATER CONTAMINATION MANAGEMENT TO DRIVE GROWTH

- 9.4.2 CHEMICAL PRECIPITATION

- 9.4.3 ION EXCHANGE

- 9.4.4 CARBON ABSORPTION/ADSORPTION

- 9.4.5 CHEMICAL REDUCTION

- 9.4.6 CHEMICAL OXIDATION

- 9.4.7 PFAS (PFOS AND PFOA) REMEDIATION

- 9.5 BIOREMEDIATION

- 9.5.1 GROWING R&D IN MICROBIAL REMEDIATION AND SYSTEMS BIOLOGY SPURS MARKET EXPANSION FOR BIOREMEDIATION TECHNOLOGIES

- 9.5.2 BIOAUGMENTATION

- 9.5.3 BIODEGRADATION

- 9.5.4 BIOSTIMULATION

- 9.5.5 BIOVENTING

- 9.5.6 BIOREACTORS

- 9.5.7 COMPOSTING

- 9.6 ELECTROKINETIC REMEDIATION

- 9.6.1 ELECTROKINETIC REMEDIATION GAINING MOMENTUM AS A SCALABLE SOLUTION FOR HEAVY METAL AND HYDROCARBON-CONTAMINATED SITES

- 9.7 EXCAVATION

- 9.7.1 ADVANCED MAPPING AND REAL-TIME MONITORING STRENGTHEN ROLE OF EXCAVATION IN HIGH-RISK SITE REMEDIATION

- 9.8 PERMEABLE REACTIVE BARRIERS

- 9.8.1 ADVANCED MATERIALS AND TRENCHLESS TECHNOLOGIES PROPEL GROWTH OF PRBS IN COMPLEX GROUNDWATER REMEDIATION

- 9.9 IN SITU GROUTING

- 9.9.1 COST-EFFECTIVE REMEDIATION FOR HEAVY METALS, PFAS, AND NAPL-IMPACTED SITES DRIVING IMPORTANCE

- 9.10 PHYTOREMEDIATION

- 9.10.1 PHYTOREMEDIATION GAINS TRACTION AS ECO-FRIENDLY CLEANUP METHOD FOR METAL AND RADIOLOGICAL CONTAMINATION

- 9.11 PUMP AND TREAT

- 9.11.1 RISING VOC CONTAMINATION SPURS GROWTH IN PUMP AND TREAT GROUNDWATER SOLUTIONS

- 9.12 SOIL VAPOR EXTRACTION

- 9.12.1 LEGACY WASTE SITE CLEANUPS ACCELERATE MARKET ADOPTION OF SOIL VAPOR EXTRACTION SYSTEMS

- 9.13 IN SITU VITRIFICATION

- 9.13.1 ISV ADOPTION GROWING IN HIGH-RISK CONTAMINATED SITES AMID RISING NUCLEAR AND CHEMICAL CLEANUP NEEDS

- 9.14 THERMAL TREATMENT

- 9.14.1 HIGH-IMPACT SOLUTION FOR DEEP SOIL AND GROUNDWATER REMEDIATION IN COMPLEX SITES

- 9.14.2 THERMAL DESORPTION

10 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MINING & FORESTRY

- 10.2.1 GROWING NEED TO CONSERVE ABANDONED MINING SITES DRIVING DEMAND FOR REMEDIATION

- 10.3 OIL & GAS

- 10.3.1 TECHNOLOGICAL ADVANCEMENTS ACCELERATE PRECISION AND EFFICIENCY IN OIL & GAS SITE CLEANUP

- 10.4 AGRICULTURE

- 10.4.1 RISING NEED TO RESTORE SOIL FERTILITY TO CREATE LUCRATIVE OPPORTUNITIES IN AGRICULTURE

- 10.5 AUTOMOTIVE

- 10.5.1 FEDERAL FUNDING INITIATIVES DRIVE AUTOMOTIVE CONTAMINATION CLEANUP

- 10.6 LANDFILLS & WASTE DISPOSAL SITES

- 10.6.1 RISING URBAN REDEVELOPMENT AND LAND REUSE FUEL REMEDIATION OF LEGACY LANDFILL SITES

- 10.7 MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING

- 10.7.1 STRICTER INDUSTRIAL POLLUTION STANDARDS PROPEL DEMAND FOR REMEDIATION SOLUTIONS IN MANUFACTURING AND CHEMICAL PRODUCTION

- 10.8 CONSTRUCTION & LAND DEVELOPMENT

- 10.8.1 BROWNFIELD REDEVELOPMENT AND URBAN EXPANSION DRIVE DEMAND FOR PRE-CONSTRUCTION REMEDIATION

11 ENVIRONMENTAL REMEDIATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Federal funding and legal settlements catalyze growth in US market

- 11.2.3 CANADA

- 11.2.3.1 Large-scale infrastructure and industrial waste projects propel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Industrial modernization and global partnerships propel growth of Mexico's environmental remediation market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Legacy industrial pollution and river restoration projects drive expansion of Germany's environmental cleanup sector

- 11.3.3 UK

- 11.3.3.1 Rising urban waste and regulatory pressure spur expansion of environmental remediation

- 11.3.4 FRANCE

- 11.3.4.1 Government-led water pollution control initiatives drive market growth in France

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Strategic ecosystem restoration and infrastructure projects fuel demand for remediation in China

- 11.4.3 JAPAN

- 11.4.3.1 Increasing government initiatives to curb pollutants

- 11.4.4 INDIA

- 11.4.4.1 National Green Tribunal and river revitalization projects boost India's push toward proactive environmental remediation

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 High-impact restoration projects to drive ANZ environmental remediation market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Oil spill recovery and mining waste management fuel demand for environmental remediation in MEA

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Natural resource contamination and growing industrial activities fuel South America's environmental remediation market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Environmental medium footprint

- 12.7.5.4 Site type footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CLEAN HARBORS, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 WSP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 AECOM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 JACOBS SOLUTIONS INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 TETRA TECH, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 DEME GROUP NV

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.7 ENTACT

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 TERRA SYSTEMS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 HDR, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BECHTEL CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 FLUOR CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Other developments

- 13.1.1 CLEAN HARBORS, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 ENVIRONMENTAL LOGIC

- 13.2.2 MONTROSE ENVIRONMENTAL GROUP, INC.

- 13.2.3 OXYLE

- 13.2.4 ECOSPEARS INC.

- 13.2.5 ALLONNIA

- 13.2.6 CARBOGENICS

- 13.2.7 ALLIED MICROBIOTA

- 13.2.8 ACLARITY, INC.

- 13.2.9 EKOLIVE S.R.O.

- 13.2.10 NOVOBIOM S.P.R.L

- 13.2.11 OXI AMBIENTAL SA

- 13.2.12 WEBER AMBIENTAL

- 13.2.13 AMENTUM SERVICES, INC.

- 13.2.14 NORTHSTAR ENVIRONMENTAL SERVICES

- 13.2.15 IN-SITU OXIDATIVE TECHNOLOGIES, INC. (ISOTEC)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS