|

시장보고서

상품코드

1794023

컨트롤 밸브 시장 예측 : 구성요소별, 재질별, 유형별, 사이즈별, 업계별, 지역별(-2030년)Control Valve Market by Material (Stainless Steel, Cast Iron, Cryogenic, Alloy Based), Actuators (Pneumatic, Electrical, Hydraulic), Size, Rotary Valves (Ball, Butterfly, Plug), Linear Valves (Globe, Diaphragm), Industry - Global Forecast to 2030 |

||||||

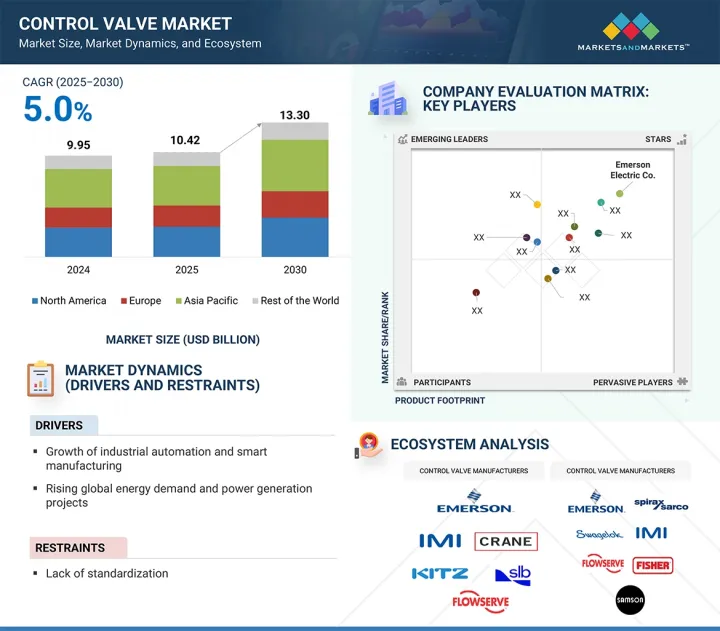

세계 컨트롤 밸브 시장 규모는 2025년 104억 2,000만 달러, 2030년에는 133억 달러로 성장하고, CAGR은 5.0%를 보일 것으로 예측됩니다.

이 시장은 스마트 자동화 기술의 채택이 증가하고 산업 프로세스 전체에서 에너지 효율이 중시되게 된 것이 원동력이 되어 큰 성장을 이루고 있습니다.

| 조사 범위 | |

|---|---|

| 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 구성요소별, 재질별, 유형별, 사이즈별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

산업용 사물인터넷(IIoT)과 예지보전 기능의 통합을 통해 최신 컨트롤 밸브는 실시간 모니터링, 다운타임 감소, 성능 최적화를 가능하게 합니다. 석유 및 가스, 발전, 수처리 등의 업계에서는 보다 엄격한 환경 규제를 충족하고 업무 효율을 향상시키기 위해 이러한 첨단 솔루션을 빠르게 도입하고 있습니다. 이러한 지능형 유량 제어 시스템으로의 전환은 경쟁 구도를 재구성하고 시장의 혁신을 가속화하고 있습니다.

밸브 본체 부문은 시장에서 강력한 성장을 이루고 있습니다. 밸브 어셈블리의 주요 구성요소인 밸브 본체는 모든 내부 구성요소를 통합하는 기능을 가지고 있습니다. 일반적으로 황동, 청동, 주철, 합금강, 스테인레스 스틸, 플라스틱 등의 금속으로 만들어져 밸브의 첫 번째 압력 장벽 역할을 하며 연결된 파이프라인의 유체 압력을 견딜 수 있습니다. 나사식, 볼트식 또는 용접 조인트를 통해 입구와 출구 배관에 해당합니다. 일반적으로 주조나 단조법에 의해 다양한 형상으로 제조됩니다.

컨트롤 밸브 시장은 스테인레스 스틸 재료의 사용에서 상당한 성장을 보여줍니다. 이 급성장은 스테인레스 스틸의 내식성, 내구성 및 다양한 산업 응용 분야에서의 다재다능함에 기인합니다. 견고한 특성은 신뢰성이 높고 오래 지속되는 밸브 시스템에 대한 수요가 증가함에 따라 시장에서 선호되는 옵션으로 자리를 잡고 있습니다.

로터리 밸브 부문은 시장에서 강력한 성장을 이루고 있습니다. 컨트롤 밸브 시장은 로터리 밸브의 인기가 높아짐에 따라 큰 성장을 이루고 있습니다. 정확한 제어와 신뢰할 수 있는 성능으로 알려진 로터리 밸브는 석유 및 가스, 화학, 발전 등 다양한 산업에서 지지되고 있습니다. 그 효과적인 유량 조정 기능은 설계와 재료의 진보와 함께 시장에서의 융성과 채택을 뒷받침하고 있습니다.

6-25인치 사이즈의 조절밸브 세계 시장은 특히 에너지, 석유 및 가스, 수처리 섹터에 있어서의 산업 인프라의 확대에 의해 현저한 성장을 이루고 있습니다. 자동화 요구 증가와 밸브 설계의 진보가 이러한 확대에 기여하여 세계의 다양한 산업 수요를 충족하고 있습니다.

석유 및 가스산업에서는 기술의 진보와 효율성, 안전성, 환경 컴플라이언스에 대한 요구가 높아짐에 따라 컨트롤 밸브가 대폭적인 성장을 이루고 있습니다. 이러한 밸브는 파이프라인 및 처리 시스템 내의 유체 흐름을 조정하고 유량, 압력, 온도 등의 파라미터를 정확하게 제어하는 데 중요한 역할을 합니다. 그 진화는 탐광, 생산, 정제, 유통을 포함한 다양한 부문에서의 운영의 신뢰성과 성능을 대폭 향상시켜 업계의 진화하는 요구에 효과적으로 대응하고 있습니다.

아시아태평양의 컨트롤 밸브 시장은 산업화, 인프라 확장, 석유 및 가스, 발전, 상하수도 처리 등의 분야에서 공정 자동화 수요 증가 등의 요인으로 인해 큰 성장을 이루고 있습니다. 기술의 발전과 스마트 밸브 솔루션의 보급이 이 확대에 더욱 박차를 가하고 있습니다. 산업계가 효율성, 신뢰성, 안전성 향상을 우선하고 있기 때문에 이 동향은 앞으로도 계속될 것으로 예측됩니다.

본 보고서에서는 세계의 컨트롤 밸브 시장에 대해 조사했으며, 구성요소별, 재질별, 유형별, 사이즈별, 업계별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 가격 분석

- 고객사업에 영향을 주는 동향/혼란

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 기술 분석

- 무역 분석

- 특허 분석

- 2025년-2026년의 주된 회의와 이벤트

- 관세 및 규제 상황

- AI/생성형 AI가 컨트롤 밸브 시장에 미치는 영향

- 2025년 미국 관세가 컨트롤 밸브 시장에 미치는 영향

- 산업 자동화에서의 흐름 제어의 미래

제6장 컨트롤 밸브 시장(구성요소별)

- 소개

- 액추에이터

- 밸브 본체

- 기타

제7장 컨트롤 밸브 시장(재질별)

- 소개

- 스테인레스 스틸

- 주철

- 합금 베이스

- 극저온

- 기타

제8장 컨트롤 밸브 시장(유형별)

- 소개

- 회전 밸브

- 선형 밸브

제9장 컨트롤 밸브 시장(사이즈별)

- 소개

- 1인치 미만

- 1-6인치

- 6-25인치

- 25-50인치

- 50인치 이상

제10장 컨트롤 밸브 시장(업계별)

- 소개

- 석유 및 가스

- 상하수도 처리

- 에너지 및 전력

- 의약품

- 식음료

- 화학약품

- 건축 및 건설

- 펄프 및 종이

- 금속 및 광업

- 기타

제11장 컨트롤 밸브 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타

- 기타 지역

- GCC

- 아프리카 등

- 남미

제12장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점, 2023년-2025년

- 2020-2024년에 있어서의 톱 5사의 수익 분석

- 시장 점유율 분석, 2024년

- 기업평가와 재무지표

- 브랜드/제품 비교

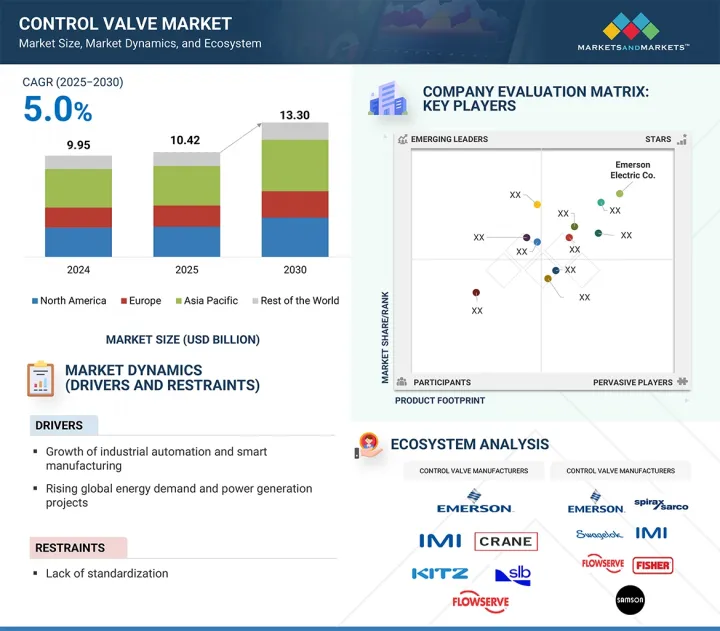

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- CRANE COMPANY

- EMERSON ELECTRIC CO.

- FLOWSERVE CORPORATION

- IMI

- SLB

- CHRISTIAN BURKERT GMBH & CO. KG

- CURTISS-WRIGHT CORPORATION

- VALMET

- SPIRAX GROUP PLC

- KITZ CORPORATION

- BAKER HUGHES COMPANY

- KSB SE & CO. KGAA

- ROTORK PLC

- BADGER METER, INC.

- 기타 기업

- SAMSONCONTROLS.NET

- TRILLIUM FLOW TECHNOLOGIES

- NEWAY VALVE

- ALFA LAVAL

- AVK HOLDING A/S

- AVCON CONTROLS PVT. LTD.

- HAM-LET GROUP

- DWYER INSTRUMENTS, LLC

- RICHARDS INDUSTRIAL

- SWAGELOK COMPANY

- RK CONTROL INSTRUMENTS PVT. LTD

- ARCA REGLER GMBH

- LAPAR CONTROL VALVE

- TAYLOR VALVE TECHNOLOGY

- HABONIM

제14장 부록

SHW 25.08.25The global control valve market is expected to grow from USD 10.42 billion in 2025 to USD 13.30 billion by 2030, registering a CAGR of 5.0%. The market is witnessing significant growth, driven by the rising adoption of smart automation technologies and the increasing emphasis on energy efficiency across industrial processes.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Material, Type, Size, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

With the integration of Industrial Internet of Things (IIoT) and predictive maintenance capabilities, modern control valves are enabling real-time monitoring, reduced downtime, and optimized performance. Industries such as oil & gas, power generation, and water treatment are rapidly embracing these advanced solutions to meet stricter environmental regulations and improve operational efficiency. This shift toward intelligent flow control systems is reshaping the competitive landscape and accelerating innovation in the market.

"Valve body segment to register highest CAGR during forecast period"

The valve body segment is experiencing robust growth in the market. The primary component of a valve assembly, the valve body, functions to consolidate all internal components. Typically crafted from metals like brass, bronze, cast iron, alloy steels, stainless steels, or plastics, it serves as the initial pressure barrier in a valve, withstanding fluid pressure from connected pipelines. Through threaded, bolted, or welded joints, it accommodates inlet and outlet piping. It is commonly manufactured through casting or forging methods in diverse configurations.

"Stainless steel material segment accounted for largest share of control valve market in 2024"

The control valve market has witnessed substantial growth in the utilization of stainless steel material. This surge is attributed to stainless steel's corrosion resistance, durability, and versatility across diverse industrial applications. Its robust properties meet the escalating demand for reliable and long-lasting valve systems, cementing its position as a preferred choice in the market.

"Rotary valves segment to grow at highest CAGR in control valve market during forecast period"

The rotary valves segment is experiencing robust growth in the market. The control valve market has experienced significant growth with the increasing popularity of rotary valves. Known for their precise control and dependable performance, rotary valves are favored in various industries, such as oil & gas, chemicals, and power generation. Their effective flow regulation capabilities, alongside advancements in design and materials, have propelled their prominence and adoption in the market.

>6"-25" segment accounted for largest share of control valve market in 2024"

The global market for control valves sized >6"-25" has experienced significant growth, spurred by expanding industrial infrastructure, particularly in energy, oil & gas, and water treatment sectors. Rising automation requirements and advancements in valve design have contributed to this expansion, meeting varied industrial demands across the globe.

"Oil & gas accounted for largest market share in 2024"

In the oil & gas industry, control valves have experienced substantial growth due to technological advancements and heightened demands for efficiency, safety, and environmental compliance. These valves play a crucial role in regulating fluid flow within pipelines and processing systems, ensuring precise control over parameters such as flow rates, pressures, and temperatures. Their evolution has significantly enhanced operational reliability and performance across various sectors, including exploration, production, refining, and distribution, meeting the industry's evolving needs effectively.

"Asia Pacific to be fastest-growing market during forecast period"

The control valve market in Asia Pacific has experienced substantial growth owing to factors like industrialization, infrastructure expansion, and rising demand for process automation in sectors such as oil & gas, power generation, and water & wastewater treatment. Technological advancements and the uptake of smart valve solutions have further fueled this expansion. The trend is anticipated to persist as industries prioritize improved efficiency, reliability, and safety measures in their operations.

Break-up of profiles of primary participants:

- By Company Type - Tier 1-35%, Tier 2-30%, and Tier 3-35%

- By Designation - C-level Executives-45%, Directors-35%, and Others-20%

- By Region - North America - 35%, Europe - 25%, Asia Pacific - 30%, RoW - 10%

The major players in the market are Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), and SLB (US).

Research Coverage:

The control valve market has been segmented based on component, material, type, size, industry, and region. The market is studied for North America, Europe, Asia Pacific, and the Rest of the World (RoW). The report describes the major drivers, restraints, challenges, and opportunities of the control valve market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the control valve ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the control valve market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- Analysis of Key Drivers (Rising demand for energy & power in Asia Pacific, Rising surge in control valve demand in the oil & gas industry, Adoption of automation to improve efficiency and new nuclear power plants and upscaling of existing ones), Restraints (Lack of standardized certifications and government policies, Complexity of installation and maintenance), Opportunities (Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues, Need for replacement of outdated valves and adoption of smart valves, Focus of industry players on offering improved customer services), Challenges (Rise in collaboration activities among industry players, Unplanned downtime due to malfunctioning or failure of valves)

- Product Development/Innovation: Detailed insights on research and development activities and new product launches in the control valve market

- Market Development: Comprehensive information about lucrative markets-the report analyses the control valve market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the control valve market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Christian Burkert GmbH & Co. KG (Germany), Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), and KITZ Corporation (Japan), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONTROL VALVE MARKET

- 4.2 CONTROL VALVE MARKET, BY COMPONENT

- 4.3 CONTROL VALVE MARKET, BY MATERIAL

- 4.4 CONTROL VALVE MARKET, BY TYPE

- 4.5 CONTROL VALVE MARKET, BY SIZE

- 4.6 CONTROL VALVE MARKET, BY INDUSTRY

- 4.7 CONTROL VALVE MARKET, BY REGION

- 4.8 CONTROL VALVE MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid industrial automation and energy infrastructure expansion

- 5.2.1.2 Increasing investment in oil and gas infrastructure in Middle East

- 5.2.1.3 Mounting electricity demand amid rapid urbanization in Southeast Asia

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardized certifications and government policies

- 5.2.2.2 Complications associated with installation and maintenance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising integration of advanced technologies into smart valves

- 5.2.3.2 Increasing green hydrogen production for industrial use

- 5.2.4 CHALLENGES

- 5.2.4.1 Risks associated with safety and operational efficiency due to leakage

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF CONTROL VALVES, 2020-2024

- 5.6.2 AVERAGE SELLING PRICE OF CONTROL VALVES OFFERED BY KEY PLAYERS, BY VALVE TYPE, 2024

- 5.6.3 PRICING RANGE OF CONTROL VALVES, BY REGION, 2020-2024

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HORIZON TRUCK & BODY ADOPTS SUR-FLO CONTROL VALVE FOR OIL LOADING AND UNLOADING AT ONE SPOT

- 5.10.2 SF10V MAINTAINS CONSISTENT PRESSURE WHILE ALLOWING PASSAGE OF PROCESS FLUIDS FROM SEPARATORS

- 5.10.3 HABONIM PROVIDES EXPERTISE TO LNG PROJECTS WITH CRYOGENIC FIRE-SAFE FLOATING BALL VALVES

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 IoT

- 5.11.1.2 3D printing

- 5.11.2 ADJACENT TECHNOLOGIES

- 5.11.2.1 Smart valve positioners

- 5.11.2.2 Predictive maintenance and condition monitoring

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 848110)

- 5.12.2 EXPORT SCENARIO (HS CODE 848110)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI/GEN AI ON CONTROL VALVE MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON CONTROL VALVE MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON INDUSTRIES

- 5.18 FUTURE OF FLOW CONTROL IN INDUSTRIAL AUTOMATION

- 5.18.1 STRATEGIC SHIFTS DRIVING VALVE ADOPTION

6 CONTROL VALVE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 ACTUATOR

- 6.2.1 PUSH TOWARD AUTOMATION AND SUSTAINABILITY TO FUEL SEGMENTAL GROWTH

- 6.3 VALVE BODY

- 6.3.1 MATERIAL INNOVATION AND AUTOMATION TREND TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.4 OTHER COMPONENTS

7 CONTROL VALVE MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 STAINLESS STEEL

- 7.2.1 NEED FOR CORROSION-RESISTANT MATERIALS TO TACKLE CHALLENGING SERVICE CONDITIONS IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 7.3 CAST IRON

- 7.3.1 ABILITY TO WITHSTAND SEVERE VIBRATIONS TO FOSTER SEGMENTAL GROWTH

- 7.4 ALLOY-BASED

- 7.4.1 STRONG FOCUS ON TACKLING PRESSURES AND TEMPERATURES IN STEAM POWER PLANTS TO SPUR DEMAND

- 7.5 CRYOGENIC

- 7.5.1 NEED FOR SAFE PRODUCTION AND STORAGE OF LIQUEFIED GASES TO ACCELERATE SEGMENTAL GROWTH

- 7.6 OTHER MATERIALS

8 CONTROL VALVE MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 ROTARY VALVES

- 8.2.1 BALL VALVES

- 8.2.1.1 Rising demand from metals & mining and water and wastewater treatment industries to fuel segmental growth

- 8.2.2 BUTTERFLY VALVES

- 8.2.2.1 Growing installation for high-pressure recovery applications to foster segmental growth

- 8.2.3 PLUG VALVES

- 8.2.3.1 Increasing application in water injection and metering stations to augment segmental growth

- 8.2.1 BALL VALVES

- 8.3 LINEAR VALVES

- 8.3.1 GLOBE VALVES

- 8.3.1.1 Ease of automation and availability with limit switches to drive market

- 8.3.2 DIAPHRAGM VALVES

- 8.3.2.1 Growing demand in food & beverages and pharmaceuticals industries to foster segmental growth

- 8.3.3 OTHER LINEAR VALVES

- 8.3.1 GLOBE VALVES

9 CONTROL VALVE MARKET, BY SIZE

- 9.1 INTRODUCTION

- 9.2 UP TO 1"

- 9.2.1 RISING NEED FOR LOW PRESSURE AND TEMPERATURE IN PROCESS INDUSTRIES TO BOLSTER SEGMENTAL GROWTH

- 9.3 >1-6"

- 9.3.1 GROWING DEMAND FROM OIL & GAS AND CHEMICALS INDUSTRIES TO DRIVE MARKET

- 9.4 >6-25"

- 9.4.1 RISING USE FOR HIGH-PRESSURE APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 9.5 >25-50"

- 9.5.1 INCREASING APPLICATIONS IN OIL & GAS, CHEMICAL, ENERGY & POWER, AND PHARMACEUTICAL PLANTS TO FUEL SEGMENTAL GROWTH

- 9.6 >50"

- 9.6.1 GROWING DEMAND FROM THERMAL POWER AND PETROCHEMICAL REFINERIES TO EXPEDITE SEGMENTAL GROWTH

10 CONTROL VALVE MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- 10.2 OIL & GAS

- 10.2.1 GROWING EMPHASIS ON REDUCING PRODUCTION COSTS TO BOOST SEGMENTAL GROWTH

- 10.3 WATER & WASTEWATER TREATMENT

- 10.3.1 RISING DEMAND FOR CLEAN WATER AND MODIFICATION IN OLD WATER INFRASTRUCTURE TO DRIVE MARKET

- 10.4 ENERGY & POWER

- 10.4.1 INCREASING NEED TO UTILIZE NON-RENEWABLE RESOURCES EFFICIENTLY TO BOOST SEGMENTAL GROWTH

- 10.5 PHARMACEUTICALS

- 10.5.1 ONGOING ADVANCEMENTS IN LIFE SCIENCES INDUSTRY TO FUEL SEGMENTAL GROWTH

- 10.6 FOOD & BEVERAGES

- 10.6.1 GROWING NEED FOR LEAK-PROOF AND CLEAN CONTAINERS TO BOLSTER SEGMENTAL GROWTH

- 10.7 CHEMICALS

- 10.7.1 RISING EMPHASIS ON ENHANCED STAFF SAFETY AND ASSURED PROCESS OF INTEGRITY TO ACCELERATE SEGMENTAL GROWTH

- 10.8 BUILDING & CONSTRUCTION

- 10.8.1 INCREASING IMPLEMENTATION IN HVAC AND FIRE PROTECTION SYSTEMS TO DRIVE MARKET

- 10.9 PULP & PAPER

- 10.9.1 RISING APPLICATIONS IN STOCK PREPARATION AND RE-PULPING TO ACCELERATE SEGMENTAL GROWTH

- 10.10 METALS & MINING

- 10.10.1 GROWING EMPHASIS ON REDUCING SCRAP AND DOWNTIME TO FOSTER SEGMENTAL GROWTH

- 10.11 OTHER INDUSTRIES

11 CONTROL VALVE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Modernization of wastewater treatment infrastructure and rising shale gas production to bolster market growth

- 11.2.2 CANADA

- 11.2.2.1 Implementation of large-scale geothermal heating projects to accelerate market growth

- 11.2.3 MEXICO

- 11.2.3.1 Growing demand for energy and water sanitation solutions to fuel market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Formulation of stringent regulatory frameworks to ensure environmental protection to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Advances in industrial automation and process control to expedite market growth

- 11.3.3 FRANCE

- 11.3.3.1 Nuclear investments and renewable energy ambitions to create lucrative growth opportunities

- 11.3.4 ITALY

- 11.3.4.1 Growing emphasis on reducing water wastage to contribute to market growth

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapid industrialization and infrastructure development projects to boost market growth

- 11.4.2 JAPAN

- 11.4.2.1 High dependence on nuclear programs to generate electricity to augment market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 High growth of semiconductor industry to drive market

- 11.4.4 INDIA

- 11.4.4.1 Expansion of oil & gas pipeline infrastructure to bolster market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Thriving oil & gas industry to contribute to market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Expansion of transportation network and increasing number of desalination plants to drive market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 AFRICA & REST OF MIDDLE EAST

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Growing demand for automation and process optimization to accelerate market growth

- 11.5.1 GCC

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 12.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CRANE COMPANY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 EMERSON ELECTRIC CO.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 FLOWSERVE CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 IMI

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 SLB

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 CHRISTIAN BURKERT GMBH & CO. KG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 CURTISS-WRIGHT CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 VALMET

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 SPIRAX GROUP PLC

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 KITZ CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Expansions

- 13.1.11 BAKER HUGHES COMPANY

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.12 KSB SE & CO. KGAA

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 ROTORK PLC

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 BADGER METER, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.1 CRANE COMPANY

- 13.2 OTHER PLAYERS

- 13.2.1 SAMSONCONTROLS.NET

- 13.2.2 TRILLIUM FLOW TECHNOLOGIES

- 13.2.3 NEWAY VALVE

- 13.2.4 ALFA LAVAL

- 13.2.5 AVK HOLDING A/S

- 13.2.6 AVCON CONTROLS PVT. LTD.

- 13.2.7 HAM-LET GROUP

- 13.2.8 DWYER INSTRUMENTS, LLC

- 13.2.9 RICHARDS INDUSTRIAL

- 13.2.10 SWAGELOK COMPANY

- 13.2.11 R.K. CONTROL INSTRUMENTS PVT. LTD

- 13.2.12 ARCA REGLER GMBH

- 13.2.13 LAPAR CONTROL VALVE

- 13.2.14 TAYLOR VALVE TECHNOLOGY

- 13.2.15 HABONIM

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS