|

시장보고서

상품코드

1795414

감압 점착 테이프 시장 : 유형별, 점착제 유형별, 백킹재별, 기술별, 최종 이용 산업별, 지역별 예측(-2030년)Pressure-Sensitive Adhesive Tapes Market by Type (Single-Sided, Double-Sided), Adhesive Type (Acrylic, Rubber), Technology (Solvent, Hot-Melt, Water-Based), Backing (PP, Paper), End-use Industry (Medical & Hygiene), and Region - Global Forecast to 2030 |

||||||

세계의 감압 접착 테이프 시장 규모는 2024년에 703억 달러에 달했습니다.

이 시장은 2025년부터 2030년까지 4.64%의 연평균 복합 성장률(CAGR)로 확대되며, 2030년에는 924억 1,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러) 및 100만 평방미터 |

| 부문 | 유형별, 점착제 유형별, 백킹재별, 기술별, 최종용도 산업별, 지역별 |

| 대상 지역 | 중화권, 아시아태평양, 북미, 중동, 아프리카, 남미 |

일렉트로닉스의 소형화 및 고도화에 따라 복잡하고 섬세한 부품을 유지할 수 있는 접착제의 요구가 급속히 높아지고 있습니다. 감압 접착 테이프는 스마트폰, 태블릿, 컴퓨터, 웨어러블 및 기타 가전제품의 조립에 자주 사용됩니다. 이 테이프는 소형 부품의 고정, 회로 보호, 열 관리 등에 필수적인 역할을 담당합니다. 오염을 주의 깊게 관리해야 하는 클린룸용으로 만들어진 테이프는 잔류물을 남기지 않고 작은 부품으로 절단할 수 있어 그 가치를 더욱 높여줍니다. 5G, AI, 스마트 커넥티드 디바이스의 급성장으로 효율적이고 신뢰성 있는 제조를 가능하게 하는 고성능 감압 접착 테이프 수요가 가속화되고 있습니다. 이 테이프는 제조 속도를 높이고 재료 낭비를 줄이고 제품의 안전성과 품질을 향상시켜 오늘날의 전자 제품 생산에 필수적입니다. 혁신이 소비자 일렉트로닉스 분야를 계속 정의함에 따라 감압 접착 테이프는 설계 유연성, 탁월한 운영 및 지속적인 성능에서 더욱 중요해질 것입니다.

예측 기간 동안 세계 감압 접착 테이프 시장에서 양면 테이프 부문은 금액 기준으로 두 번째로 큰 유형이었습니다. 이 성장은 명확한 커뮤니케이션, 안정성, 표면의 청정성이 가장 중요시되는 간판 및 그래픽 업계에서 수요 증가에 크게 지지되고 있습니다. 양면 감압 접착 테이프는 보통 눈에 보이지 않는 접착을 제공한다는 점에서 유용하며 디스플레이 설치, 포스터 설치, 배너 라미네이트, 판촉품 조립 등에 쉽게 사용할 수 있습니다. 일반적으로, 두께가 일정하고, 점착력이 강하고, 내습성이 뛰어나기 때문에 소매점이나 교통기관, 이벤트 등에서 사용되는 간판의 실내외에서의 위치 확인에 적합합니다. 이 테이프는 기계식 패스너 나 눈에 보이는 접착제가 아닌 접착제를 사용하지만 접착제는 프로젝트의 디자인 아름다움을 손상시키지 않는다는 큰 이점이 있습니다.

2024년 감압 접착 테이프 시장에서 커스텀 인쇄 및 브랜딩 용도에 대한 높은 적합성이 주된 이유로 종이 백킹 카테고리가 2위 점유율을 차지했습니다. 종이는 플라스틱이나 호일의 뒷면에 비해 잉크 접착에 우수한 표면 품질을 제공하여 선명한 텍스트, 브랜드 라벨, 바코드 정보를 테이프에 직접 인쇄할 수 있습니다. 이 기능은 전자상거래, 소매 포장의 다양한 분야, 생산물류, 기타 식별, 추적성, 마케팅 메시지가 중요한 분야에서 특히 중요합니다. 변조 방지 씰이든, 그래픽이 있는 브랜드 포장 테이프이든, 라벨링 보호이든, 종이를 뒷받침하는 감압 접착 테이프는 정보를 전달하거나 브랜드의 가시성을 높이는 유연하고 비용 효율적인 옵션입니다. 또한 직렬화 및 배치 추적에 필수적인 가변 데이터 인쇄 기술과의 통합이 용이합니다. 제품의 정체성이 패키징과 더 밀접하게 연결되어 패키징이 마케팅 도구 및 커뮤니케이션 미디어로 변모함에 따라 인쇄되고 맞춤형으로 설계된 종이 구조는 다른 기판에 비해 제조업체에게 매우 큰 가치를 갖게 됩니다. 이 특성은 제품의 기능과 시각적 매력을 모두 향상시켜보다 상업적인 가치를 높입니다.

중동 및 아프리카의 성장은 특히 UAE, 사우디아라비아, 이집트, 나이지리아의 대규모 인프라 개발과 도시화에 기인합니다. NEOM, 비전 2030 프로젝트, 스마트 시티 구상 등 정부가 지원하는 100여 개의 거대한 프로젝트가 새로운 건축자재에 대한 엄청난 수요를 창출하고 있습니다. 감압식 점착 테이프는 깨끗하고 습기에 강하고 신속하게 시공할 수 있기 때문에 공조 용도, 실링 및 단열 용도, 접합부 용도, 글레이징 용도, 바닥재 용도에의 채용이 증가하고 있습니다. 감압 접착 테이프는 걸프 지역과 사하라 이남의 아프리카에서 일반적인 고온 다습한 환경에서 우수한 열 안정성과 내후성을 발휘하므로 기존 접착 시스템보다 매력적이고 사용하기 쉽습니다. 특히 걸프 지역의 국가에서는 녹색인증을 얻고자 하며, 지속가능성 요구가 성숙함에 따라 에너지 효율이 높고 무해한 감압 접착 테이프에 대한 요구가 높아지고 있습니다. 건설 부문은이 지역의 감압 접착 테이프 시장에서 중요한 성장의 기둥이 될 것으로 보입니다.

본 보고서에서는 세계의 감압 점착 테이프 시장에 대해 조사했으며, 유형별, 점착제 유형별, 백킹재별, 기술별, 최종용도 산업별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제 전망

제6장 업계 동향

- 공급망 분석

- 원재료 공급자

- 제조업체

- 유통 네트워크

- 최종 이용 산업

- 가격 분석

- 고객사업에 영향을 주는 동향/혼란

- 생태계 분석

- 사례 연구 분석

- 기술 분석

- 무역 분석

- 규제 상황

- 주요 회의 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- 2025년 미국 관세의 영향-개요

- AI 및 생성형 AI가 점착 테이프 시장에 미치는 영향

제7장 점착 테이프 시장(유형별)

- 소개

- 단면 테이프

- 양면 테이프

- 기타

제8장 점착 테이프 시장(점착제 유형별)

- 소개

- 아크릴

- 고무

- 실리콘

- 기타

제9장 점착 테이프 시장(백킹재별)

- 소개

- 폴리프로필렌

- 종이

- 폴리염화비닐

- 기타

제10장 감압 접착 테이프 시장(기술별)

- 소개

- 용매 기반 기술

- 물 기반 기술

- 핫멜트 기반 기술

제11장 점착 테이프 시장(최종 이용 산업별)

- 소개

- 가전

- 일렉트로닉스

- 자동차

- 전기 시스템 및 와이어 하네스

- 산업유통

- 플렉소 인쇄 및 종이

- 의료 및 위생

- 포장

- 기타

제12장 점착 테이프 시장(지역별)

- 소개

- 중화권

- 중국

- 대만

- 홍콩

- 아시아태평양

- 일본

- 인도

- 한국

- ASEAN

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 네덜란드

- 폴란드

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 남미

- 브라질

- 아르헨티나

- 칠레

제13장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 시장 점유율 분석, 2024년

- 2020-2024년에 있어서의 톱 5사의 수익 분석

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교 분석

- 기업평가와 재무지표

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- 3M COMPANY

- TESA SE

- NITTO DENKO CORPORATION

- LINTEC CORPORATION

- INTERTAPE POLYMER GROUP INC.

- AVERY DENNISON CORPORATION

- LOHMANN GMBH & CO. KG

- BERRY GLOBAL GROUP, INC.

- SCAPA GROUP PLC(MATIV HOLDINGS)

- SAINT-GOBAIN SA

- 스타트업/중소기업

- NICHIBAN CO., LTD.

- SHURTAPE TECHNOLOGIES, LLC

- ROGERS CORPORATION

- GERGONNE INDUSTRIE

- ORAFOL EUROPE GMBH

- PPI ADHESIVE PRODUCTS(CE) SRO

- AMERICAN BILTRITE INC.

- TERAOKA SEISAKUSHO CO., LTD.

- ADVANCE TAPES INTERNATIONAL

- CCT TAPES

- BOLEX(SHENZHEN) ADHESIVE PRODUCTS CO., LTD.

- AJIT INDUSTRIES

- SUN CHEMICAL(DIC CORPORATION)

- PPM INDUSTRIES SPA

- LOUIS TAPE

제15장 인접 시장과 관련 시장

제16장 부록

JHS 25.08.28The pressure-sensitive adhesive tapes market size was USD 70.30 billion in 2024 and is projected to reach USD 92.41 billion by 2030, at a CAGR of 4.64%, between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Square Meter) |

| Segments | Type, Adhesive Type, Backing, Technology, End-Use Industry, and Region |

| Regions covered | Greater China, Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Increasing Demand for High-Precision Adhesive Solutions to Drive Market in Electronics Sector."

As electronics get tinier and more advanced, the need for adhesives that can hold complicated and sensitive components is growing rapidly. Pressure-sensitive adhesive tapes are more frequently used in the assembly of smartphones, tablets, computers, wearables, and other consumer electronics. These tapes have essential roles in securing small components, circuit protection, and thermal management. Made for cleanrooms, where contamination must be carefully controlled, makes them even more valuable, as they do not leave residue and can be cut into mini parts. The fast growth of 5G, AI, and smart connected devices is accelerating the demand for high-performance pressure-sensitive adhesive tapes that enable efficient and reliable manufacturing. These tapes allow faster manufacturing, reducing material waste, and increasing product safety and quality; they are becoming essential in today's electronics production. As innovation continues to define the consumer electronics space, pressure-sensitive adhesive tapes will become more crucial in design flexibility, operational excellence, and sustained performance.

The double-sided tapes segment was the second-largest segment, in terms of value, of the global pressure-sensitive adhesive tapes market.

The double-sided tapes segment was the second-largest type in the global market for pressure-sensitive adhesive tapes, in terms of value, during the forecast period. This growth is largely supported by increased demand in the signage and graphics industry, where clarity of communication, stability, and cleanliness of the surface are paramount. Double-sided pressure-sensitive adhesive tapes are useful in that they typically provide a non-visible bond, and they can easily be used in display mounting, poster installation, banner lamination, and promotional product assembly. They are commonly constructed with consistent thickness, have aggressive tack, and are moisture resistant, making them able to offer both indoor and outdoor locating capabilities for signage used in retail stores, transportation, and events. Although these tapes use adhesives rather than mechanical fasteners or visible adhesives, one major advantage is that adhesives will not compromise the design aesthetic of a project, and in addition, double-sided tapes allow for fast and bubble-free application.

In 2024, the paper backing segment had the second-largest value share in the pressure-sensitive adhesive tapes market.

The paper backing category held the second-largest share of the pressure-sensitive adhesive tapes market in 2024, largely due to its highly compatible qualities with custom printing and branding applications. Paper offers better surface qualities for ink adhesion compared to plastic or foil backings, where clear text, brand labels, or barcode information can be printed directly onto the tape. This feature is especially important in e-commerce, various sectors of retail packaging, manufacturing logistics, and other areas where identification, traceability, or marketing messages matter. Whether it is tamper-evident seals, branded packaging tapes with graphics, or labeling protection, paper-backed pressure-sensitive adhesive tapes remain a flexible and cost-effective option for conveying information or enhancing brand visibility. They also facilitate integration with variable data printing technologies, which are essential for serialization or batch tracking. As product identity becomes more linked to packaging-transforming it into a marketing tool and communication medium-printed and custom-designed paper structures hold significantly more value for manufacturers compared to other substrates. This characteristic enhances both the functionality and visual appeal of products, making them more commercially relevant.

"The Middle East & Africa is estimated to be the third fastest-growing pressure-sensitive adhesive tapes market, in terms of value."

The growth of the Middle East & Africa is attributed to the large-scale development of new infrastructure and urbanization, especially in the UAE, Saudi Arabia, Egypt and Nigeria. Hundreds of government-backed megaprojects such as NEOM, Vision 2030 projects, and smart city initiatives create enormous demand for new building materials. Pressure-sensitive adhesive tapes are increasingly employed in HVAC applications, sealing and insulating, bonding joints, glazing and flooring applications since they're clean to deliver, moisture resistant and can be installed quickly. Pressure-sensitive adhesive tapes provide excellent thermal stability and weather-resistant value in hot and humid environments that are prevalent in Gulf and Sub-Saharan African regions, making them more attractive and useable than traditional adhesive systems. As sustainability mandates mature especially in Gulf region countries striving for green certifications, there are growing requirements for energy-efficient and non-toxic pressure-sensitive adhesive tapes. The construction sector will be an important growth pillar in the region's pressure sensitive adhesive tapes market.

- By Company Type: Tier 1 - 55%, Tier 2-25%, and Tier 3-20%

- By Designation: Directors- 50%, Managers-30%, and Others-20%

- By Region: North America- 40%, Europe-35%, Asia Pacific-20%, Rest of World - 5%

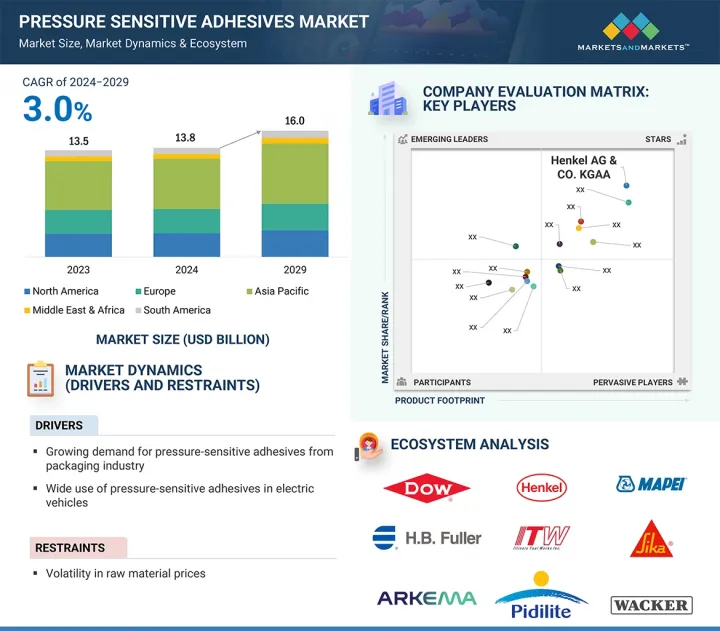

The key players profiled in the report include 3M Company (US), Tesa SE (Germany), Nitto Denko Corporation (Japan), LINTEC Corporation (Japan), Intertape Polymer Group, Inc. (Canada), Avery Dennison Corporation (US), Lohmann GmbH & Co. KG (Germany), Berry Global Group, Inc. (US), Scapa Group plc (Mativ Holdings) (US), and Saint-Gobain S.A. (France).

Research Coverage

This report segments the market for pressure sensitive adhesive tapes based on type, adhesive type, backing, technology, end-use industry and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for pressure sensitive adhesive tapes.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the pressure sensitive adhesive tapes market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on pressure-sensitive adhesive tapes offered by top players in the global market

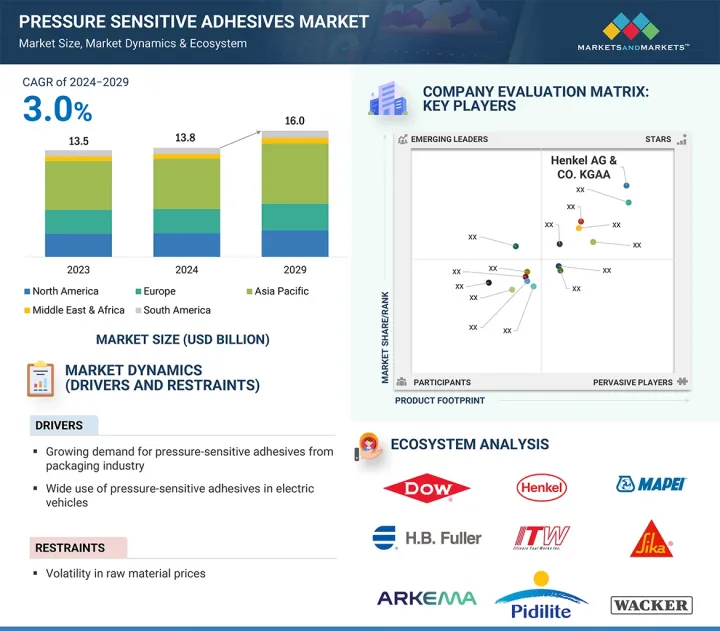

- Analysis of key drivers (Growing demand for pressure-sensitive adhesive tapes from packaging industry, increasing emphasis on environmental sustainability across various industries, and wide use of tapes in electric vehicles), restraints (volatility in raw material prices), opportunities (Potential substitutes to traditional fastening systems and advancement in pressure-sensitive adhesive tape technology), and challenges (Implementation of stringent regulatory policies) influencing the growth of pressure sensitive adhesive tapes market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the pressure-sensitive adhesive tapes market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for pressure-sensitive adhesive tapes across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global pressure-sensitive adhesive tapes market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the pressure-sensitive adhesive tapes market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRESSURE-SENSITIVE ADHESIVE TAPES MARKET

- 4.2 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION

- 4.3 GREATER CHINA: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.4 REGIONAL ANALYSIS: PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE

- 4.5 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for PSA tapes from packaging industry

- 5.2.1.2 Increasing emphasis on environmental sustainability across various industries

- 5.2.1.3 Wide use of PSA tapes in electric vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential substitutes to traditional fastening systems

- 5.2.3.2 Advancements in PSA tape technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Implementation of stringent regulatory policies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF PRESSURE-SENSITIVE ADHESIVE TAPES OFFERED BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF PRESSURE-SENSITIVE ADHESIVE TAPES, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 STREAMLINING PACKAGING AT MAJOR CHEMICAL MANUFACTURER WITH SPECTAPE

- 6.5.2 REDUCING VOCS IN AUTOMOTIVE LABELING THROUGH CIRCULAR PSA INNOVATION

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Adhesive formulation technology

- 6.6.1.2 Coating and lamination technology

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Application and dispensing equipment

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 3919)

- 6.7.2 EXPORT SCENARIO (HS CODE 3919)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ISO 13485 - Quality Management Systems for Medical Devices

- 6.8.2.2 RoHS Directive (2011/65/EU) - Restriction of Hazardous Substances

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES:

- 6.13 IMPACT OF AI/GEN AI ON PRESSURE-SENSITIVE ADHESIVE TAPES MARKET

7 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SINGLE-SIDED TAPES

- 7.2.1 EXPANDING USAGE IN LABELING AND PACKAGING TO DRIVE MARKET

- 7.3 DOUBLE-SIDED TAPES

- 7.3.1 DEMAND FOR AESTHETIC AND SEAMLESS BONDING TO BOOST MARKET

- 7.4 OTHER TYPES

8 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE

- 8.1 INTRODUCTION

- 8.2 ACRYLIC

- 8.2.1 RISING DEMAND FOR HIGH-PERFORMANCE BONDING SOLUTIONS TO DRIVE DEMAND

- 8.3 RUBBER

- 8.3.1 COST-EFFECTIVENESS OF RUBBER TO BOOST DEMAND

- 8.4 SILICONE

- 8.4.1 ADVANCED INDUSTRIAL APPLICATIONS TO ACCELERATE SILICONE TAPE ADOPTION

- 8.5 OTHER ADHESIVE TYPES

9 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL

- 9.1 INTRODUCTIONS

- 9.2 POLYPROPYLENE

- 9.2.1 STRENGTH AND VERSATILITY ACROSS INDUSTRIES TO FUEL MARKET GROWTH

- 9.3 PAPER

- 9.3.1 ECO-FRIENDLY PACKAGING AND PROCESS EFFICIENCY TO DRIVE MARKET

- 9.4 POLYVINYL CHLORIDE

- 9.4.1 DURABILITY AND ELECTRICAL INSULATION PROPERTIES TO DRIVE DEMAND

- 9.5 OTHER BACKING MATERIALS

10 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 SOLVENT-BASED TECHNOLOGY

- 10.2.1 HIGH BOND STRENGTH AND MATERIAL COMPATIBILITY TO DRIVE MARKET

- 10.3 WATER-BASED TECHNOLOGY

- 10.3.1 ECO-FRIENDLY FORMULATIONS AND SAFER PRODUCTION TO BOOST MARKET DEMAND

- 10.4 HOT MELT-BASED TECHNOLOGY

- 10.4.1 RAPID PROCESSING AND HIGH TACK EFFICIENCY TO FUEL MARKET GROWTH

11 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 CONSUMER

- 11.2.1 RISING DEMAND FOR FUNCTIONAL AND DECORATIVE ADHESIVE SOLUTIONS TO DRIVE MARKET

- 11.3 ELECTRONICS

- 11.3.1 ELECTRONICS MINIATURIZATION AND ASSEMBLY EFFICIENCY TO FUEL DEMAND

- 11.4 AUTOMOTIVE

- 11.4.1 LIGHTWEIGHT AND DURABLE BONDING SOLUTIONS TO DRIVE MARKET

- 11.5 ELECTRICAL SYSTEM/WIRE HARNESSING

- 11.5.1 SAFE AND DURABLE WIRE MANAGEMENT TO BOOST MARKET DEMAND

- 11.6 INDUSTRIAL DISTRIBUTION

- 11.6.1 RELIABLE SUPPLY CHAIN OPERATIONS TO FUEL GROWTH

- 11.7 FLEXO PRINTING & PAPER

- 11.7.1 PRINTING PRECISION AND OPERATIONAL UPTIME TO FUEL MARKET DEMAND

- 11.8 MEDICAL & HYGIENE

- 11.8.1 ADVANCED HEALTHCARE AND HYGIENE NEEDS TO FUEL ADOPTION

- 11.9 PACKAGING

- 11.9.1 SUSTAINABLE AND TAMPER-PROOF SOLUTIONS TO DRIVE DEMAND

- 11.10 OTHER END-USE INDUSTRIES

12 PRESSURE-SENSITIVE ADHESIVE TAPES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 GREATER CHINA

- 12.2.1 CHINA

- 12.2.1.1 Rapidly expanding economy to boost market

- 12.2.2 TAIWAN

- 12.2.2.1 Strong semiconductor and electronics base to drive demand

- 12.2.3 HONG KONG

- 12.2.3.1 Active re-export trade to boost demand

- 12.2.1 CHINA

- 12.3 ASIA PACIFIC

- 12.3.1 JAPAN

- 12.3.1.1 Strong presence of automobile manufacturers to drive market

- 12.3.2 INDIA

- 12.3.2.1 Growing healthcare industry to drive demand

- 12.3.3 SOUTH KOREA

- 12.3.3.1 Government initiatives in industrial sector to drive market

- 12.3.4 ASEAN

- 12.3.4.1 Growing electronics manufacturing ecosystem to fuel growth

- 12.3.1 JAPAN

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Strong industrial infrastructure to fuel growth

- 12.4.2 CANADA

- 12.4.2.1 Focus on advanced research and development to drive demand

- 12.4.3 MEXICO

- 12.4.3.1 Expanding manufacturing sector to support market growth

- 12.4.1 US

- 12.5 EUROPE

- 12.5.1 GERMANY

- 12.5.1.1 Automotive industry leadership to boost market

- 12.5.2 FRANCE

- 12.5.2.1 Emphasis on sustainable packaging to fuel demand

- 12.5.3 UK

- 12.5.3.1 Stringent regulatory framework to propel market

- 12.5.4 SPAIN

- 12.5.4.1 Growing aerospace industry to drive market

- 12.5.5 NETHERLANDS

- 12.5.5.1 Advanced logistics and export activities to drive demand

- 12.5.6 POLAND

- 12.5.6.1 Robust industrial base to drive demand

- 12.5.1 GERMANY

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 SAUDI ARABIA

- 12.6.1.1 Growth in local manufacturing to fuel demand

- 12.6.2 UAE

- 12.6.2.1 Foreign investments and rapid urbanization to drive market

- 12.6.3 TURKEY

- 12.6.3.1 Rising automotive parts manufacturing to boost demand

- 12.6.4 SOUTH AFRICA

- 12.6.4.1 Cheap labor and raw material cost to drive market

- 12.6.1 SAUDI ARABIA

- 12.7 SOUTH AMERICA

- 12.7.1 BRAZIL

- 12.7.1.1 Rising infrastructure investments to drive demand

- 12.7.2 ARGENTINA

- 12.7.2.1 Expansion of public healthcare services to drive demand

- 12.7.3 CHILE

- 12.7.3.1 Packaging and food exports growth to fuel demand

- 12.7.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Adhesive type footprint

- 13.5.5.5 Backing material footprint

- 13.5.5.6 Technology footprint

- 13.5.5.7 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMES

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 3M COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 TESA SE

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 NITTO DENKO CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 LINTEC CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 INTERTAPE POLYMER GROUP INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 AVERY DENNISON CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 LOHMANN GMBH & CO. KG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BERRY GLOBAL GROUP, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 SCAPA GROUP PLC (MATIV HOLDINGS)

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 SAINT-GOBAIN S.A.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 3M COMPANY

- 14.2 STARTUP/SMES

- 14.2.1 NICHIBAN CO., LTD.

- 14.2.2 SHURTAPE TECHNOLOGIES, LLC

- 14.2.3 ROGERS CORPORATION

- 14.2.4 GERGONNE INDUSTRIE

- 14.2.5 ORAFOL EUROPE GMBH

- 14.2.6 PPI ADHESIVE PRODUCTS (C.E.) S.R.O.

- 14.2.7 AMERICAN BILTRITE INC.

- 14.2.8 TERAOKA SEISAKUSHO CO., LTD.

- 14.2.9 ADVANCE TAPES INTERNATIONAL

- 14.2.10 CCT TAPES

- 14.2.11 BOLEX (SHENZHEN) ADHESIVE PRODUCTS CO., LTD.

- 14.2.12 AJIT INDUSTRIES

- 14.2.13 SUN CHEMICAL (DIC CORPORATION)

- 14.2.14 PPM INDUSTRIES SPA

- 14.2.15 LOUIS TAPE

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 ADHESIVE TAPES MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 ADHESIVE TAPES MARKET, BY REGION

- 15.4.1 EUROPE

- 15.4.2 NORTH AMERICA

- 15.4.3 ASIA PACIFIC

- 15.4.4 MIDDLE EAST & AFRICA

- 15.4.5 SOUTH AMERICA

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS