|

시장보고서

상품코드

1795415

크로마토그래피 수지 시장(-2030년) : 유형별(천연, 합성, 무기 매체), 방법별(이온 교환(양이온, 음이온), 어피니티(소수성 상호작용, 혼합 모드)), 용도별(의약품, 바이오테크놀러지), 지역별Chromatography Resin Market by Type (Natural, Synthetic, Inorganic Media), Technique (Ion Exchange (Cation and Anion), Affinity (Hydrophobic Interaction, Mixed Mode)), Application (Pharmaceutical & Biotechnology), and Region - Global Forecast to 2030 |

||||||

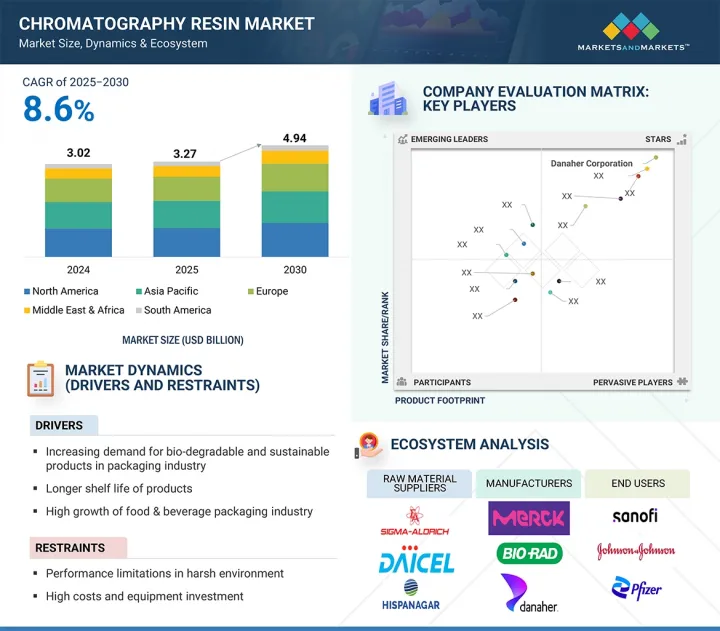

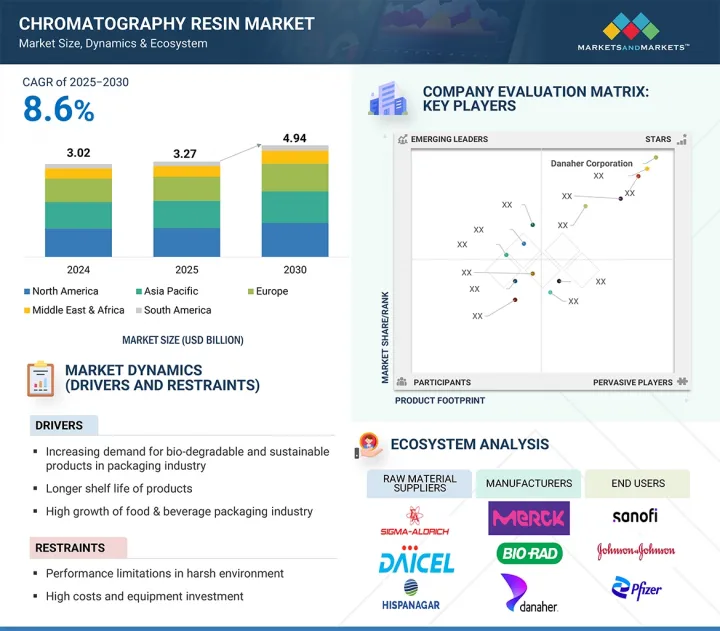

세계의 크로마토그래피 수지 시장 규모는 2024년 30억 2,000만 달러에서 예측 기간 동안 CAGR 8.6%로 성장하여 2030년에는 49억 4,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 리터 |

| 부문 | 유형, 기술, 용도, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

크로마토그래피 수지는 의약품 세척, 식품첨가물, 환경, 산업용 화학제품 등의 섬세한 공정에 이용되고 있습니다. 이들은 복잡한 혼합물에서 유용한 성분을 분리 및 분리하여 제품의 순도, 안전성 및 규제 준수를 보장하는 데 사용됩니다. 크로마토그래피 수지는 분리 공정의 효율을 높일 뿐만 아니라 처리 시간을 단축하고 분리 과정에서 강력한 화학제품의 사용을 최소화하는 역할을 합니다.

"유형별로는 천연 고분자 부문이 예측 기간 동안 두 번째로 높은 CAGR을 기록할 것으로 예상됩니다."

아가로스, 셀룰로오스, 덱스트런은 특히 바이오 제약 산업에서 단백질, 효소, 항체와 같은 섬세한 생체분자의 정제에 사용되는 이상적인 재료입니다. 이 폴리머는 높은 친수성과 낮은 비특이적 결합을 가지고 있어 더 높은 순도와 수율로 분리할 수 있습니다. 단클론항체, 유전자 치료, 기타 바이오의약품에 대한 수요가 증가함에 따라 천연 고분자 수지의 응용이 크게 증가하고 있습니다. 또한, 재생 가능하고 친환경적인 특성으로 인해 산업계의 지속가능성 및 친환경 제조 방식 도입에 대한 관심이 높아지고 있습니다. 천연 고분자의 개질 및 가교 관련 기술 개발의 발전은 기계적 강도와 적용성을 향상시켜 보다 광범위한 산업 분야에 적용이 가능해져 시장 확대를 더욱 촉진하고 있습니다.

"용도별로는 제약 및 바이오테크놀러지 부문이 2030년 가장 큰 CAGR을 기록할 것으로 예상됩니다."

이 부문은 바이오의약품, 단클론항체, 백신, 유전자 치료에 대한 전반적인 수요 증가로 인해 예측 기간 동안 가장 큰 CAGR을 기록할 것으로 예상됩니다. 크로마토그래피 수지는 순도와 제품의 무결성이 가장 중요한 다운스트림 공정에서 이러한 복잡한 생체분자의 정제에 중요한 역할을 하고 있습니다. 만성질환의 증가, 의료 서비스 비용의 상승, 맞춤형 의료의 확대는 첨단 의약품 개발 및 생산 공정의 활용을 가속화하고 있으며, 그 중 크로마토그래피는 핵심적인 역할을 담당하고 있습니다. 또한, 바이오시밀러 개발 파이프라인의 증가와 규제 당국이 의약품 제조의 품질과 일관성을 강조하는 것도 수요를 증가시키고 있습니다. 세계 각지, 특히 신흥 시장에서 생명공학 및 제약회사들의 연구개발 활동과 생산능력 확대가 진행되고 있으며, 이러한 요소와 더불어 수지화학 및 정제기술의 지속적인 혁신이 이 응용 분야의 강력한 성장을 뒷받침할 것으로 보입니다.

세계의 크로마토그래피 수지 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

제6장 업계 동향

- 공급망 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 생태계 분석

- 무역 분석

- 가격 분석

- 기술 분석

- 사례 연구 분석

- 규제 상황

- 2025-2026년의 주요 회의와 이벤트

- 투자와 자금 조달 시나리오

- 특허 분석

- AI/생성형 AI가 크로마토그래피 수지 시장에 미치는 영향

- 2025년 미국 관세가 크로마토그래피 수지 시장에 미치는 영향

제7장 크로마토그래피 수지 시장 : 기술별

- 이온 교환 크로마토그래피

- 양이온 교환 크로마토그래피

- 음이온 교환 크로마토그래피

- 어피니티 크로마토그래피

- 생체 특이적 리간드 기반 어피니티 크로마토그래피

- 유사 생체 특이적 리간드 기반 어피니티 크로마토그래피

- 사이즈 배제 크로마토그래피

- 소수성 상호작용 크로마토그래피

- 혼합 모드 크로마토그래피

- 기타

- 분배 크로마토그래피

- 흡착 크로마토그래피

제8장 크로마토그래피 수지 시장 : 용도별

- 의약품·바이오테크놀러지

- 생산

- 학술·연구

- 식품 및 음료

- 물과 환경 분석

- 기타

제9장 크로마토그래피 수지 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 뉴질랜드

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 스칸디나비아

- 오스트리아

- 스위스

- 중동 및 아프리카

- GCC 국가

- 남미

- 브라질

제10장 경쟁 구도

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 브랜드/제품 비교 분석

- 기업 평가와 재무 지표

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- BIO-RAD LABORATORIES, INC.

- MERCK KGAA

- DANAHER CORPORATION

- TOSOH CORPORATION

- SARTORIUS STEDIM BIOTECH S.A.

- BIO-WORKS TECHNOLOGIES AB

- AVANTOR, INC.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- PUROLITE

- REPLIGEN CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- 기타 기업

- SEPRAGEN CORPORATION

- STEROGENE BIOSEPARATIONS, INC.

- JACOBI GROUP

- CHEMRA GMBH

- SUNRESIN NEW MATERIALS CO. LTD.

- BIOTOOLOMICS LIMITED

- CUBE BIOTECH GMBH

- JSR LIFE SCIENCES, LLC

- NINGBO ZHENGGUANG RESIN CO., LTD.

- CONCISE SEPARATIONS

- GENSCRIPT BIOTECH CORPORATION

- EICHROM TECHNOLOGIES, LLC

- AGILENT TECHNOLOGIES, INC.

- KANEKA CORPORATION

제12장 인접 시장과 관련 시장

제13장 부록

KSM 25.08.29The global chromatography resin market size is projected to reach USD 4.94 billion by 2030 from USD 3.02 billion in 2024, at a CAGR of 8.6% between 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Liter) |

| Segments | Type, Technique, Application, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Chromatography resins are utilized in sensitive processes like cleaning drugs, food additives, environmental, and industrial chemicals. They are used to give separation and isolation of valuable components of a complex mixture to guarantee product purity, safety, and compliance. These resins enhance the efficiency of the separation processes, as well as reduce the processing time, and minimize the use of harsh chemicals involved in the separation processes.

Chromatography resins are designed in such a way that they can be reused, exerted to different pressures and certain pH levels, and still remain effective. Besides, more industries are turning to use these resins as interest and demand in safer and high-quality biologics increases, and the enforcement of purity and contaminants involved with pharmaceuticals, food, and environmental testing. Advances in resin chemistry and functional ligands are increasing the selectivity and stability of resins, and this is increasing market penetration. With the growing separation and purification requirements being experienced in different fields, chromatography resins are of much importance in the attainment of high-performance results. Chromatography resins are now being demanded more because of the fast industrialization and increasing food processing and online retail activities across the globe.

"Natural polymers type segment is projected to register the second-highest CAGR of chromatography resins market, in terms of value, during the forecast period."

During the forecast period, natural polymers are estimated to have the highest CAGR in terms of value, in the chromatography resin market due to their biocompatibility, high porosity, and the prevalence of their use in bioseparation processes. Agarose, cellulose, and dextran are ideal materials used in purification of delicate biomolecules such as proteins, enzymes, and antibodies, particularly in the biopharmaceutical industry. These polymers present a high hydrophilicity and low nonspecific binding, producing separation with greater purity and yield. With the increasing need to have monoclonal antibodies, gene therapies, and other biologics, there is a massive increase in the application of natural polymer-based resins. Moreover, they have a renewable nature and eco-friendly reputation, which could also help increase the rate of industry interest in being more sustainable and implementing green approaches to manufacturing. Continued technology development in the areas of natural polymer modification and crosslinking are also increasing their mechanical strength and applicability, and further opening them up to wider industry applicability, and further increasing their market expansion.

"Pharmaceutical & biotechnology segment is projected to register the highest CAGR in the chromatography market, in terms of value, in 2030."

The pharmaceuticals and biotechnology application segment is estimated to register the highest CAGR in the chromatography resin market in the forecast period because of the all-inclusive increase in the demand for biologics, monoclonal antibodies, vaccines, and gene therapies. Chromatographic resins play an important role in the purification of those complex biomolecules in downstream processing, where purity and product integrity are paramount when it comes to chromatography resins. The booming number of cases of chronic illnesses, the growing cost of healthcare services, and the increase in personalized medicine have expedited the use of advanced drug development and production processes, of which chromatography plays a pivotal role. The increase in the pipeline of biosimilars and the quality and consistency in drug manufacturing emphasized by regulatory authorities are also driving the demand. Due to the rise in R&D and development activities worldwide by biotechnology firms and pharmaceutical companies, more biomanufacturing capacities are being established in various parts of the world, especially in emerging markets. These factors, along with ongoing innovation in resin chemistry and purification technologies, are likely to support strong growth in this application sector.

"Europe is projected to register the third-highest CAGR during the forecast period in the chromatography resin market, in terms of value."

Europe is expected to record the third-highest CAGR in the chromatography resin market during the forecast period, due to its mature but continuously developing pharmaceutical and biotechnology industry. Some of the worldwide biopharma corporations, contract research organizations (CROs), and research universities extensively apply chromatography procedures to develop drugs, manage quality, and conduct clinical research. Government funding of innovation and research & development is encouraging growth in the chromatography resin market, and because of this, there is an increasing level of investment taking place in biologics and also in biosimilars. Also, on the one hand, high regulatory requirements imposed by the European Medicines Agency (EMA) promote the necessity of a high-performance purification process, and chromatography resins cannot be avoided. Despite a rather moderate rate of growth in comparison with the one observed in emerging markets in Asia Pacific, the constant improvement of life sciences, environmental and food safety testing, etc., still maintains the consistent demand. The high rates of quality, safety, and environmental friendliness make Europe a major contributor to the growth of the worldwide chromatography resin market.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

The key players profiled in the report include Bio-Rad Laboratories, Inc. (US), Merck KgaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Sartorius Stedim Biotech S.A. (France), Bio-Works Technologies AB (Sweden), Avantor, Inc. (US), Purolite (US), Repligen Corporation (US), Mitsubishi Chemical Group Corporation (Japan), and Thermo Fisher Scientific Inc. (US), among others.

Research Coverage

This report segments the market for chromatography resin based on type, technique, application, and region, and provides estimations in terms of value (USD million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for chromatography resin.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the chromatography resin market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on chromatography resin offered by top players in the global market

- Analysis of key drivers (increasing pharmaceutical & biotech R&D activities, rising demand for therapeutic antibodies, mounting demand for biosimilars, rising concern for food safety, and growing use of liquid chromatography-mass spectrometry in analytics), restraints (Absence of suitable skilled professionals), opportunities (increase in contract manufacturing organizations and CROs in pharmaceutical industry, increasing demand for disposable pre-packed columns, mounting demand for chromatography in drug development and omics research, rising use of chromatography in proteomics), and challenges (accessible alternative technologies to chromatography) influencing the growth of chromatography resin market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the chromatography resin market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for chromatography resin across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global chromatography resin market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the chromatography resin market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand side and supply side

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CHROMATOGRAPHY RESINS MARKET

- 4.2 CHROMATOGRAPHY RESINS MARKET, BY REGION

- 4.3 NORTH AMERICA: CHROMATOGRAPHY RESINS MARKET, BY TECHNIQUE AND COUNTRY

- 4.4 CHROMATOGRAPHY RESINS MARKET, BY TECHNIQUE

- 4.5 REGIONAL ANALYSIS: CHROMATOGRAPHY RESINS MARKET, B TECHNIQUE

- 4.6 CHROMATOGRAPHY RESINS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing pharmaceutical and biopharmaceutical R&D activities

- 5.2.1.2 Increasing demand for therapeutic antibodies

- 5.2.1.3 Increasing demand for biosimilars

- 5.2.1.4 Rising food safety concerns

- 5.2.1.5 Increasing use of liquid chromatography-mass spectrometry in analytics and research

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of CMOs and CROs in pharmaceutical industry

- 5.2.3.2 Growing demand for disposable pre-packed columns

- 5.2.3.3 Growing demand for chromatography in drug development and omics research

- 5.2.3.4 Growing use of chromatography in proteomics

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of alternative technologies to chromatography

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 391400)

- 6.4.2 EXPORT SCENARIO (HS CODE 391400)

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF CHROMATOGRAPHY RESINS OFFERED BY KEY PLAYERS, BY TECHNIQUE, 2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Jetting

- 6.6.1.2 Microfluidics

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Surface modification via click chemistry

- 6.6.2.2 3D printing of chromatographic structures

- 6.6.1 KEY TECHNOLOGIES

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 BIO-WORKS TECHNOLOGIES - WORKBEADS AFFIMAB FOR MONOCLONAL ANTIBODY PURIFICATION

- 6.7.2 CYTIVA - PROTEIN SELECT RESIN FOR TAG-BASED PROTEIN PURIFICATION

- 6.7.3 REPLIGEN - COVID-19 SPIKE PROTEIN AFFINITY RESIN FOR VACCINE DEVELOPMENT

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATIONS

- 6.8.2.1 REACH Regulations (EC) No. 1907/2006 - European Union (ECHA)

- 6.8.2.2 USP <665>, <661.1>, and <661.2> - United States Pharmacopeia

- 6.8.2.3 WHO GMP Guidelines for Biological Products

- 6.8.2.4 ICH Q7 - GMP for Active Pharmaceutical Ingredients

- 6.8.2.5 21 CFR Part 210 & 211 - US (FDA)

- 6.8.2.6 EudraLex Volume 4 - EU GMP Guidelines (EMA)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 PATENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON CHROMATOGRAPHY RESINS MARKET

- 6.13 IMPACT OF 2025 US TARIFF ON CHROMATOGRAPHY RESINS MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON END-USE INDUSTRY

- 6.13.5.1 Food & beverage industry

- 6.13.5.2 Pharmaceutical & biotechnology industry

7 CHROMATOGRAPHY RESINS MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 ION EXCHANGE CHROMATOGRAPHY

- 7.2.1 HIGH DEMAND IN BIOPHARMACEUTICAL PROCESSES TO DRIVE MARKET

- 7.2.2 CATION EXCHANGE CHROMATOGRAPHY

- 7.2.3 ANION EXCHANGE CHROMATOGRAPHY

- 7.3 AFFINITY CHROMATOGRAPHY

- 7.3.1 INCREASING DEMAND FOR THERAPEUTIC PROTEINS TO DRIVE MARKET

- 7.3.2 BIOSPECIFIC LIGAND-BASED AFFINITY CHROMATOGRAPHY

- 7.3.2.1 Protein A affinity

- 7.3.2.2 Protein G affinity

- 7.3.2.3 Protein L affinity

- 7.3.2.4 Lectin affinity

- 7.3.2.5 Others

- 7.3.3 PSEUDO-BIOSPECIFIC LIGAND-BASED AFFINITY CHROMATOGRAPHY

- 7.3.3.1 IMAC

- 7.3.3.2 Dye-based ligands

- 7.3.3.3 Others

- 7.4 SIZE-EXCLUSION CHROMATOGRAPHY

- 7.4.1 WIDE APPLICATION IN LABORATORIES TO SUPPORT MARKET GROWTH

- 7.5 HYDROPHOBIC INTERACTION CHROMATOGRAPHY

- 7.5.1 RISING DEMAND FOR BIOSIMILARS TO DRIVE DEMAND

- 7.6 MIXED-MODE CHROMATOGRAPHY

- 7.6.1 BETTER DEGREE OF PURIFICATION THAN OTHER TECHNIQUES TO DRIVE MARKET

- 7.7 OTHER TECHNIQUES

- 7.7.1 PARTITION CHROMATOGRAPHY

- 7.7.2 ADSORPTION CHROMATOGRAPHY

8 CHROMATOGRAPHY RESINS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY

- 8.2.1 INCREASED R&D EXPENDITURE OF BIOTECHNOLOGY COMPANIES TO DRIVE DEMAND

- 8.2.2 PRODUCTION

- 8.2.3 ACADEMICS & RESEARCH

- 8.3 FOOD & BEVERAGE

- 8.3.1 STRINGENT REGULATIONS FOR FOOD SAFETY TO DRIVE MARKET

- 8.4 WATER & ENVIRONMENTAL ANALYSIS

- 8.4.1 RISING DEMAND FOR SAFE WATER AND STRINGENT REGULATIONS TO DRIVE GROWTH

- 8.5 OTHER APPLICATIONS

9 CHROMATOGRAPHY RESINS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Investments by companies in innovative drugs to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Increasing demand for generic drugs and monoclonal antibody biosimilars to drive resin consumption

- 9.2.3 SOUTH KOREA

- 9.2.3.1 Government initiatives to boost production of biosimilars to drive market

- 9.2.4 INDIA

- 9.2.4.1 Growth of pharmaceutical & biotechnology industry to drive market

- 9.2.5 AUSTRALIA

- 9.2.5.1 Rising demand for monoclonal antibodies to drive market

- 9.2.6 NEW ZEALAND

- 9.2.6.1 Increasing demand for purification techniques in food industry to drive market

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Increasing R&D investments in healthcare industry to drive demand

- 9.3.2 CANADA

- 9.3.2.1 Increased R&D activities in biopharmaceutical sector to support market growth

- 9.3.3 MEXICO

- 9.3.3.1 Initiatives to encourage biosimilars and biopharmaceutical research to drive demand

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Increasing R&D investments by biotechnology companies to drive market

- 9.4.2 FRANCE

- 9.4.2.1 Increasing investments by pharmaceutical companies to drive market

- 9.4.3 UK

- 9.4.3.1 Top companies with therapeutic mAbs in different stages of R&D to drive market

- 9.4.4 ITALY

- 9.4.4.1 Established pharmaceutical industry to increase demand

- 9.4.5 SPAIN

- 9.4.5.1 Increasing R&D activities in pharmaceutical companies to drive market

- 9.4.6 SCANDINAVIA

- 9.4.6.1 Growing pharmaceutical industry to drive market

- 9.4.7 AUSTRIA

- 9.4.7.1 Increasing demand for monoclonal antibodies to drive market

- 9.4.8 SWITZERLAND

- 9.4.8.1 High investment in pharmaceutical research to have positive impact on market

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Growth in pharmaceutical industry to increase demand

- 9.5.1.2 UAE

- 9.5.1.2.1 Investments in R&D facilities for production of innovative biological and generic drugs to drive demand

- 9.5.1.1 Saudi Arabia

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Rising demand for low-cost biosimilars to drive demand

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 Technique footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 BIO-RAD LABORATORIES, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MERCK KGAA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 DANAHER CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TOSOH CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SARTORIUS STEDIM BIOTECH S.A.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BIO-WORKS TECHNOLOGIES AB

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 AVANTOR, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.7.4 MnM view

- 11.1.7.4.1 Key strengths

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Expansions

- 11.1.9 PUROLITE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.10 REPLIGEN CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.3.3 Expansions

- 11.1.11 THERMO FISHER SCIENTIFIC INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Expansions

- 11.1.1 BIO-RAD LABORATORIES, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 SEPRAGEN CORPORATION

- 11.2.2 STEROGENE BIOSEPARATIONS, INC.

- 11.2.3 JACOBI GROUP

- 11.2.4 CHEMRA GMBH

- 11.2.5 SUNRESIN NEW MATERIALS CO. LTD.

- 11.2.6 BIOTOOLOMICS LIMITED

- 11.2.7 CUBE BIOTECH GMBH

- 11.2.8 JSR LIFE SCIENCES, LLC

- 11.2.9 NINGBO ZHENGGUANG RESIN CO., LTD.

- 11.2.10 CONCISE SEPARATIONS

- 11.2.11 GENSCRIPT BIOTECH CORPORATION

- 11.2.12 EICHROM TECHNOLOGIES, LLC

- 11.2.13 AGILENT TECHNOLOGIES, INC.

- 11.2.14 KANEKA CORPORATION

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 CHROMATOGRAPHY REAGENTS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 CHROMATOGRAPHY REAGENTS MARKET, BY REGION

- 12.4.1 NORTH AMERICA

- 12.4.2 EUROPE

- 12.4.3 ASIA PACIFIC

- 12.4.4 LATIN AMERICA

- 12.4.5 MIDDLE EAST & AFRICA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS