|

시장보고서

상품코드

1796190

폴리프로필렌 컴파운드 시장 예측(-2030년) : 제품 유형, 폴리머 유형, 최종사용자 산업, 가공법, 지역별Polypropylene Compounds Market by Product Type, Polymer Type, End-use Industry, Processing Method, and Region - Global Forecast to 2030 |

||||||

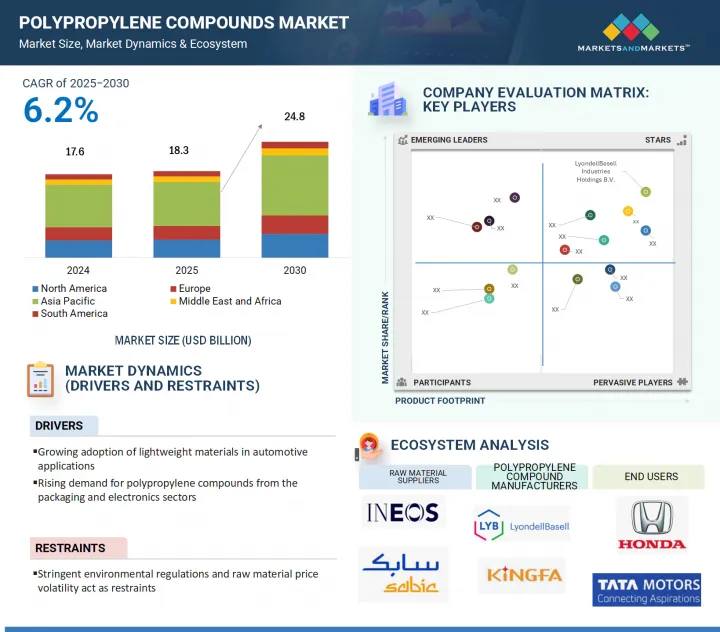

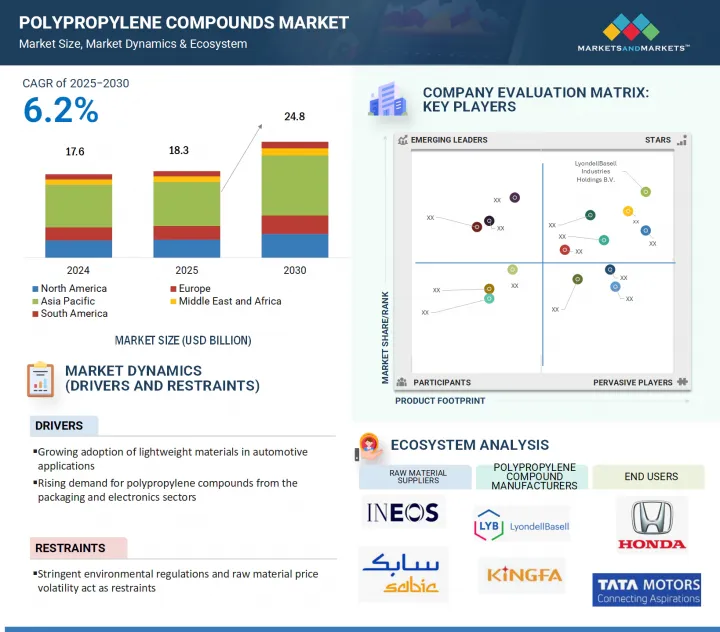

폴리프로필렌 컴파운드 시장 규모는 2024년 176억 달러에서 예측 기간 중 CAGR 6.2%로 추이하며, 2030년에는 248억 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제품 유형·폴리머 유형·가공법·최종사용자 산업·지역 |

| 대상 지역 | 아시아태평양·북미·유럽·중동 & 아프리카·남미 |

"제품 유형별로는 미네랄 충전 폴리프로필렌 컴파운드 부문이 가장 큰 성장세를 보이고 있습니다. "

미네랄 충전 폴리프로필렌은 광범위한 적용성, 비용 효율성, 기계적 특성의 향상으로 인해 가장 큰 유형이 될 것으로 예측됩니다. 활석, 탄산칼슘, 운모와 같은 광물질을 함유하여 높은 강성, 치수 안정성, 내열성, 까다로운 용도에 적합합니다. 그 지배적 지위의 큰 이유 중 하나는 자동차 산업에서 광범위하게 사용되고 있으며, 경량화 및 비용 절감의 요구를 충족시키기 위해 내부 및 후드 아래 용도에 채택되고 있습니다.

또한 미네랄 충전 폴리프로필렌 컴파운드는 성능과 경제성의 균형이 잘 맞아 가전제품, 건설, 소비재 등에도 널리 사용되고 있습니다. 사출성형 및 압출 성형과의 높은 호환성은 제조업체에게 확장 가능하고 효율적인 제품 제조를 가능하게 하여 매력을 더합니다. 전 세계에서 지속가능하고 에너지 효율적인 운송 수단에 대한 움직임은 가볍고 고성능 소재인 미네랄 충전 폴리프로필렌에 대한 수요를 더욱 증가시키고 있습니다. 특히 아시아태평양의 산업화가 진전됨에 따라 이들 재료의 소비는 앞으로도 꾸준히 증가하여 이 시장에서 가장 큰 제품 유형으로서의 지위를 공고히할 것으로 예측됩니다.

"폴리머 유형별로는 호모폴리머 부문이 가장 큰 성장세를 보이고 있습니다. "

이는 우수한 기계적 특성과 산업적 응용성에 기인합니다. 단일 단량체(프로파일렌)에서 얻은 호모폴리머는 매우 높은 인장강도, 강성, 우수한 내화학성을 가지고 있습니다. 사출성형, 압출성형 등의 가공법에 적합하며 자동차 부품, 생활용품, 산업용 용기, 섬유제품 등 다양한 분야에서 사용되고 있습니다.

용도에 따라서는 높은 견고성이 요구되는 한편, 경량화도 중요시되는데, 호모폴리머는 가볍지만 강성이 우수하여 다양한 요구에 대응할 수 있습니다. 특히 자동차 분야에서는 배터리 케이스, 엔진 주변 부품, 내장 부품 등에 사용되고 있습니다. 또한 호모폴리머는 미네랄 충전 및 유리섬유 강화 폴리프로필렌과 같은 복합재료의 기질로도 활용되어 그 활용도를 넓혀가고 있습니다. 이러한 요인은 앞으로도 수요를 증가시켜 호모폴리머가 주도적인 지위를 유지할 것으로 예측됩니다.

"지역별로는 아시아태평양이 예측 기간 중 급성장할 것으로 보입니다. "

아시아태평양은 산업 기반 확대, 도시화, 자동차, 전자, 건설, 포장 등 주요 최종사용자 산업에서의 소비 증가로 인해 가장 빠르게 성장하는 지역이 될 것으로 예측됩니다. 중국과 인도에서 전기자동차로의 전환이 진행됨에 따라 구조용 및 인테리어용 고성능 폴리프로필렌 컴파운드에 대한 수요가 지속적으로 증가하고 있습니다.

또한 아시아태평양은 저렴한 노동력, 원자재 수급의 용이성, 정부의 적극적인 노력으로 세계 제조 거점으로 자리매김하고 있으며, 세계 유수 기업의 투자가 이어지고 있습니다. 특히 동남아시아에서는 인프라 확장과 건축 증가로 인해 미네랄 충전 폴리프로필렌 컴파운드와 유리섬유 강화 폴리프로필렌 컴파운드에 대한 수요가 점점 더 증가하고 있습니다. 강력한 산업 성장과 양호한 경제 상황을 배경으로 아시아태평양은 폴리프로필렌 컴파운드 세계 시장 성장에서 우위를 차지할 것으로 보입니다.

세계의 폴리프로필렌 컴파운드 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 폴리프로필렌 컴파운드 시장에서 생성형 AI의 영향

제6장 업계 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 2025년 미국 관세의 영향

- 국가/지역에 대한 영향

- 최종사용자 산업에 대한 영향

- 투자와 자금조달 시나리오

- 가격 분석

- 에코시스템 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스와 이벤트

- 관세와 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

제7장 폴리프로필렌 컴파운드 시장 : 제품 유형별

- 미네랄 충전 폴리프로필렌 컴파운드

- 유리섬유 강화

- 폴리프로필렌계 TPO

- 폴리프로필렌계 TPV

- 첨가제 농축물

제8장 폴리프로필렌 컴파운드 시장 : 폴리머 유형별

- 호모폴리머

- 랜덤 코폴리머

- 임팩트 코폴리머

제9장 폴리프로필렌 컴파운드 시장 : 가공법별

- 사출성형

- 블로우 성형

제10장 폴리프로필렌 컴파운드 시장 : 최종사용자 산업별

- 자동차·운송

- 건설

- 전기·전자

- 포장

- 의료

- 섬유

- 기타

- 수산업

- 에너지 산업

제11장 폴리프로필렌 컴파운드 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 이집트

- 튀르키예

- 남아프리카공화국

- 기타

제12장 경쟁 구도

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 브랜드/제품 비교 분석

- 기업 평가 매트릭스 : 주요 기업

- 스타트업/중소기업용 기업 평가 매트릭스

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- SABIC

- REPSOL

- SUMITOMO CHEMICAL CO., LTD.

- BOREALIS GMBH

- GS CALTEX CORPORATION

- LOTTE CHEMICAL CORPORATION

- TOTALENERGIES

- KINGFA SCI.&TECH. CO., LTD.

- LG CHEM

- TASNEE

- MITSUI CHEMICALS, INC.

- WASHINGTON PENN

- MITSUBISHI CHEMICAL GROUP CORPORATION

- 기타 기업

- NATPET SCHULMAN SPECIALITY PLASTIC COMPOUNDS

- CHEMSOURCE EGYPT

- EUP EGYPT

- RAVAGO

- SILON

- RTP COMPANY

- ECOBAT

- SHAMS JAVAID ARVAND

- ARAD EXIR POLYMER COMPANY

- INNO-COMP KFT.

- A.D. COMPOUND S.P.A.

- MACOMASS VERKAUFS AG

제14장 부록

KSA 25.09.01The polypropylene compounds market size is projected to grow from USD 17.6 billion in 2024 to USD 24.8 billion by 2030, registering a CAGR of 6.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Product Type, Polymer Type, Processing Method, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

Polypropylene compounds have become the preferred choice for industries because they provide cost-effective solutions with versatile applications. Polypropylene functions as a thermoplastic polymer which delivers optimal performance at affordable prices to support large-scale manufacturing in automotive, packaging, construction, and consumer goods industries. The flexibility of polypropylene to accept fillers, fibers, and additives allows producers to develop customized mechanical and thermal and esthetic properties for particular applications at low production expenditures. Through their budget-friendly nature, polypropylene compounds enable manufacturers to reduce weight while replacing materials in price-sensitive applications so they can meet performance requirements and regulations without exceeding their financial limits.

"Mineral-filled polypropylene compounds accounted for the largest growth in the product type segment of polypropylene compounds market in terms of value"

Mineral filled polypropylene are poised to be the largest type in the polypropylene compounds market due to their broad connection, cost-effectiveness, and enhanced mechanical properties. By incorporating minerals, such as talc, calcium carbonate, or mica, these composites show higher stiffness, dimensional stability, and thermal resistance - making them largely suitable for demanding operations. One of the crucial reasons for their dominance is their wide use in the automotive industry, wherein they are employed in interior and under-the-hood applications to meet lightweighting and cost-reduction requirements. Mineral filled polypropylene composites are used considerably in home appliances, construction, and consumer goods, due to their balance between performance and affordability. Their compatibility with injection molding and extrusion processes further enhances their appeal to manufacturers, enabling scalable and effective products. The global drive toward further sustainable and energy-effective transportation results has further amplified the demand for featherlight, high-performance accoutrements like mineral filled polypropylene composites. With growing industrialization, particularly across the Asia Pacific, the consumption of these accoutrements is anticipated to remain strong, buttressing their position as the largest product type in the polypropylene compounds market.

"Homopolymer accounted for the largest growth of the polymer type segment of the market in terms of volume"

Homopolymers hold the leading position in the polypropylene compounds market because of their better mechanical properties and industrial applicability. One source of monomer -known as propylene gives homopolymers of polypropylene really high tensile strength, stiffness, and excellent chemical resistance. Injection molding and extrusion are processes many other industries use to manufacture various underground automotive parts, household items, industrial containers, and textiles. Some applications demand sturdy qualities, while others need some weightlessness; considering this, it is the ability of being lightweight yet offering very good rigidity that best wins the job for them. These polypropylene types fill their niches in the broad automotive sector for the production of cells in battery hard cases, certain selections of under-the-hood parts, and interior trims. These operations are made easier and less expensive by these compounds. Homopolymers can also serve as a more basic type of compound, usually mineral filled or glass fiber-reinforced polypropylene, thereby expanding the versatility thereof. This factor will continue to foster demand, keeping them at the forefront in polypropylene compounds.

"Automotive & transportation accounted for the for the fastest-growing end-use industry segment of the polypropylene compounds market in terms of value"

The automotive sector is expected to be the fastest-growing end user segment, and this is attributed to the booming worldwide demand for lightweight, durable, and cost-efficient materials for vehicle manufacturing. Polypropylene compounds are increasingly being used in automobile applications in place of traditional metals that help in reducing vehicle weight and fuel efficiency or battery range extension in EVs, in particular, glass fiber-reinforced and mineral-filled types. These materials provide good mechanical strength, impact resistance, and dimensional stability, making them excellent choices for use in bumpers, dashboards, interior trims, under-the-hood parts, and structural components. The polypropylene compounds are sought by OEMs, who need the materials to be recyclable and highly design-flexible, due to stricter emission norms and the trend of consumers toward fuel-efficient and green vehicles. Faster growth in the market for electric vehicles is projected for polymers, in particular, in the Asia Pacific, Europe, and North America. As vehicle designing moves ahead, the demand for polypropylene compounds will witness sustained growth, being the fastest-growing and most vibrant end-use segment.

"Asia Pacific is projected to be the fastest-growing market for polypropylene compounds during the forecast period"

Asia Pacific will be the fastest-growing region in the polypropylene compounds market on account of its growing industrial base, urbanization, and growing consumption in major end-use industries, including automotive, electronics, construction, and packaging. The increasing move toward electric vehicles (EVs) in China and India continues to drive demand for high-performance polypropylene compounds in structural and interior usage.

Besides, Asia Pacific's low-cost labor, ready availability of raw materials, and favorable government initiatives position it as a manufacturing hub of the world, with investments flowing in from leading global players. Infrastructure expansion and construction growth, especially in Southeast Asia, increasingly drive demand for mineral-filled and glass-fiber-reinforced polypropylene compounds. With strong industrial growth and supportive economic conditions, the Asia Pacific will dominate the worldwide market for polypropylene compounds in terms of growth.

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, and Tier 3 - 35%

- By Designation: Managers- 20%, Directors - 30%, and Others - 50%

- By Region: North America - 20%, Europe - 15%, APAC - 30%, South America-10%, Middle East & Africa- 25%

The polypropylene compounds market comprises major players like LyondellBasell Industries Holdings B.V. (US), Kingfa Sci.&Tech. Co.,Ltd. (China), LG Chem (South Korea), Mitsui Chemicals, Inc. (Japan), Washington Penn (US), Mitsubishi Chemical Group Corporation (Japan), SABIC (Saudi Arabia), Repsol (Spain), Sumitomo Chemical Co., Ltd. (Japan), Borealis GmbH (Austria), GS Caltex Corporation (South Korea), LOTTE Chemical Corporation (South Korea), TotalEnergies (France), and TASNEE (Saudi Arabia).

The study includes in-depth competitive analysis of these key players in the polypropylene compounds market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for polypropylene compounds on the basis of product type, polymer type, processing method, end-use industry, and region and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for polypropylene compounds.

Key benefits of buying this report

This research report is focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the polypropylene compounds market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of Drivers: (Growing adoption of lightweight materials in automotive applications), restraints ( Strict environmental regulations and raw material price volatility act as restraint ), opportunities (Increasing emphasis on sustainable and recyclable polypropylene compounds due to their environmental benefits), and challenges (High reliance on petroleum feedstocks and complex recycling needs pose key sustainability and waste management challenges) influencing the growth of the polypropylene compounds market.

- Market Penetration: Comprehensive information on the polypropylene compounds offered by top players in the global polypropylene compounds market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, and partnerships in the polypropylene compounds market.

- Market Development: Comprehensive information about lucrative emerging markets, the report analyzes the markets for polypropylene compounds across regions.

- Market Capacity: Production capacities of companies producing polypropylene compounds are provided wherever available with upcoming capacities for the polypropylene compounds market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polypropylene compounds market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key interview participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYPROPYLENE COMPOUNDS MARKET

- 4.2 POLYPROPYLENE COMPOUNDS MARKET, BY POLYMER TYPE

- 4.3 POLYPROPYLENE COMPOUNDS MARKET, BY PRODUCT TYPE

- 4.4 POLYPROPYLENE COMPOUNDS MARKET, BY END-USE INDUSTRY

- 4.5 POLYPROPYLENE COMPOUNDS MARKET, BY PROCESSING METHOD

- 4.6 POLYPROPYLENE COMPOUNDS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for polypropylene compounds from packaging and electronics sectors

- 5.2.1.2 Growing adoption of lightweight materials in automotive applications

- 5.2.1.3 Low cost and versatility of polypropylene compounds

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strict environmental regulations and raw material price volatility

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing focus on sustainable and recyclable polypropylene compounds due to their environmental benefits

- 5.2.3.2 Surging demand for polypropylene compounds in developing nations

- 5.2.4 CHALLENGES

- 5.2.4.1 Reliance on petroleum feedstocks causing sustainability and environmental concerns

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON POLYPROPYLENE COMPOUNDS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 CHEMICAL COMPANIES EMBRACING AI ACROSS VARIOUS BUSINESS AREAS

- 5.3.3 USE OF GENERATIVE AI IN POLYPROPYLENE COMPOUNDS MARKET

- 5.3.4 IMPACT OF AI ON POLYPROPYLENE COMPOUNDS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 IMPACT OF 2025 US TARIFF- POLYPROPYLENE COMPOUNDS MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.5 IMPACT ON COUNTRY/REGION

- 6.5.1 NORTH AMERICA

- 6.5.2 EUROPE

- 6.5.3 ASIA PACIFIC

- 6.6 IMPACT ON END-USE INDUSTRIES

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF POLYPROPYLENE COMPOUNDS, BY REGION

- 6.8.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- 6.8.3 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- 6.8.4 AVERAGE SELLING PRICE TREND OF PRODUCT TYPE, BY KEY PLAYER

- 6.9 ECOSYSTEM ANALYSIS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.11 PATENT ANALYSIS

- 6.11.1 METHODOLOGY

- 6.11.2 GRANTED PATENTS

- 6.11.2.1 Patent publication trends

- 6.11.3 INSIGHTS

- 6.11.4 LEGAL STATUS

- 6.11.5 JURISDICTION ANALYSIS

- 6.11.6 TOP APPLICANTS

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT SCENARIO (HS CODE 390210)

- 6.12.2 EXPORT SCENARIO (HS CODE 390210)

- 6.13 KEY CONFERENCES AND EVENTS

- 6.14 TARIFF AND REGULATORY LANDSCAPE

- 6.14.1 TARIFF ANALYSIS

- 6.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14.3 STANDARDS AND REGULATIONS

- 6.15 PORTER'S FIVE FORCES ANALYSIS

- 6.15.1 THREAT OF NEW ENTRANTS

- 6.15.2 THREAT OF SUBSTITUTES

- 6.15.3 BARGAINING POWER OF SUPPLIERS

- 6.15.4 BARGAINING POWER OF BUYERS

- 6.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

- 6.17 MACROECONOMIC OUTLOOK

- 6.17.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.18 CASE STUDY ANALYSIS

- 6.18.1 EXCEED TOUGH PP HELPS KINGFA DEVELOP HIGH-PERFORMANCE, LIGHTWEIGHT MATERIALS TO MEET VALUE CHAIN DEMANDS

- 6.18.2 MAKING CARD GAMES MORE CIRCULAR WITH BORCYCLE M

- 6.18.3 RECYCLING OF POLYPROPYLENE RECOVERED FROM A COMPOSTING PLANT: MECHANICAL BEHAVIOR OF COMPOUNDS WITH VIRGIN PLASTIC

7 POLYPROPYLENE COMPOUNDS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 MINERAL-FILLED POLYPROPYLENE COMPOUNDS

- 7.2.1 REINFORCED WITH FILLERS LIKE TALC OR CALCIUM CARBONATE TO ENHANCE STIFFNESS, DIMENSIONAL STABILITY, AND HEAT RESISTANCE FOR AUTOMOTIVE, APPLIANCE, AND INDUSTRIAL APPLICATIONS

- 7.3 GLASS FIBER REINFORCED

- 7.3.1 OFFER HIGH STRENGTH, STIFFNESS, AND THERMAL STABILITY IDEAL FOR STRUCTURAL COMPONENTS IN AUTOMOTIVE, ELECTRICAL, AND INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 7.4 POLYPROPYLENE-BASED TPO

- 7.4.1 EXCELLENT IMPACT RESISTANCE, FLEXIBILITY, AND WEATHERABILITY TO MAKE THEM IDEAL FOR AUTOMOTIVE AND OUTDOOR APPLICATIONS

- 7.5 POLYPROPYLENE-BASED TPV

- 7.5.1 GROWING DEMAND FOR HIGH-PERFORMANCE ELASTOMERIC COMPOUNDS OFFERING RUBBER-LIKE FLEXIBILITY AND DURABILITY WITH THERMOPLASTIC PROCESSABILITY

- 7.6 ADDITIVE CONCENTRATES

- 7.6.1 POLYPROPYLENE MATERIALS WITH HIGH LEVELS OF FUNCTIONAL ADDITIVES LIKE UV STABILIZERS, FLAME RETARDANTS, OR ANTIMICROBIALS TO IMPROVE PERFORMANCE ACROSS DIVERSE APPLICATIONS

8 POLYPROPYLENE COMPOUNDS MARKET, BY POLYMER TYPE

- 8.1 INTRODUCTION

- 8.2 HOMOPOLYMER

- 8.2.1 RIGID, HIGH-STRENGTH POLYPROPYLENE IDEAL FOR STRUCTURAL APPLICATIONS REQUIRING STIFFNESS, CHEMICAL RESISTANCE, AND HEAT STABILITY

- 8.3 RANDOM COPOLYMER

- 8.3.1 ENHANCED CLARITY, FLEXIBILITY, AND LOW-TEMPERATURE IMPACT RESISTANCE MAKING THEM IDEAL FOR PACKAGING, MEDICAL, AND CONSUMER APPLICATIONS

- 8.4 IMPACT COPOLYMERS

- 8.4.1 HIGH TOUGHNESS AND LOW-TEMPERATURE IMPACT RESISTANCE MAKING THEM IDEAL FOR VARIOUS INDUSTRIAL APPLICATIONS

9 POLYPROPYLENE COMPOUNDS MARKET, BY PROCESSING METHOD

- 9.1 INTRODUCTION

- 9.2 INJECTION MOLDING

- 9.2.1 PRECISION, SCALABILITY, AND COMPATIBILITY WITH DIVERSE POLYPROPYLENE COMPOUND FORMULATIONS TO DRIVE SEGMENT

- 9.3 BLOW MOLDING

- 9.3.1 RISING DEMAND FOR LIGHTWEIGHT, HOLLOW, AND CHEMICALLY RESISTANT PARTS IN PACKAGING AND INDUSTRIAL SECTORS TO DRIVE SEGMENT

10 POLYPROPYLENE COMPOUNDS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE & TRANSPORTATION

- 10.2.1 RISING EV PRODUCTION AND LIGHTWEIGHTING INITIATIVES TO MEET FUEL EFFICIENCY AND EMISSION REGULATIONS

- 10.3 CONSTRUCTION

- 10.3.1 RISING INFRASTRUCTURE INVESTMENTS, URBANIZATION, AND DEMAND FOR DURABLE, COST-EFFECTIVE, AND SUSTAINABLE BUILDING MATERIALS TO DRIVE CONSTRUCTION MARKET

- 10.4 ELECTRICAL & ELECTRONICS

- 10.4.1 FLAME-RETARDANT AND INSULATING PROPERTIES ESSENTIAL FOR HOUSINGS, CONNECTORS, AND COMPONENT CASINGS TO DRIVE MARKET

- 10.5 PACKAGING

- 10.5.1 LOW WEIGHT, DURABILITY, AND RECYCLABILITY TO DRIVE APPLICATIONS IN CONTAINERS, CLOSURES, AND FLEXIBLE PACKAGING

- 10.6 MEDICAL

- 10.6.1 STERILE, LOW WEIGHT, AND CHEMICAL RESISTANCE TO DRIVE DEMAND IN DEVICES AND DIAGNOSTIC EQUIPMENT

- 10.7 TEXTILE

- 10.7.1 HIGH DEMAND FOR LIGHTWEIGHT, DURABLE, AND MOISTURE-RESISTANT FIBERS AND FABRICS FOR NON-WOVENS AND INDUSTRIAL TEXTILES TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

- 10.8.1 WATER INDUSTRY

- 10.8.2 ENERGY INDUSTRY

11 POLYPROPYLENE COMPOUNDS, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Increasing EV production, electronics manufacturing, and solar investments to drive market

- 11.2.2 JAPAN

- 11.2.2.1 Strong demand from semiconductors, electronics, automotive, and medical industries to drive market

- 11.2.3 INDIA

- 11.2.3.1 Growing automotive production, electronics manufacturing, and packaging sector to drive market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Rapid EV production, electronics manufacturing, and presence of major compound producers to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Surging EV production, booming electronics exports, and growing demand for lightweight, sustainable materials to drive market

- 11.3.2 CANADA

- 11.3.2.1 Increasing investments in EVs, electronics manufacturing, and government-backed clean mobility initiatives to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Rising EV production, strong FDI in electronics manufacturing, and expanding automotive industry to drive market

- 11.3.1 US

- 11.4 SOUTH AMERICA

- 11.4.1 BRAZIL

- 11.4.1.1 Rapid automotive production, infrastructure expansion, and booming electronics and appliance sectors to drive market

- 11.4.2 ARGENTINA

- 11.4.2.1 Automotive manufacturing strength, construction activity, and rising demand in packaging and appliances to drive market

- 11.4.3 REST OF SOUTH AMERICA

- 11.4.1 BRAZIL

- 11.5 EUROPE

- 11.5.1 GERMANY

- 11.5.1.1 Powerful automotive, medical, and electronics industries to drive market

- 11.5.2 FRANCE

- 11.5.2.1 Rapid automotive production, sustainable packaging laws, and globally competitive healthcare sector to drive market

- 11.5.3 ITALY

- 11.5.3.1 Luxury automotive production, advanced electronics manufacturing, robust medical device sector, and growing infrastructure development to drive market

- 11.5.4 UK

- 11.5.4.1 Strong automotive production, large-scale construction activities, and competitive medical technology sector to drive market

- 11.5.5 SPAIN

- 11.5.5.1 Rising demand in medical, packaging, and electronics applications to drive market

- 11.5.6 REST OF EUROPE

- 11.5.1 GERMANY

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 Saudi Arabia

- 11.6.1.1.1 Rapid automotive production, booming construction projects, rising electronics consumption, and expanding packaging demand to drive market

- 11.6.1.2 UAE

- 11.6.1.2.1 Growth in manufacturing, construction, and automotive development to drive market

- 11.6.1.3 Rest of GCC countries

- 11.6.1.1 Saudi Arabia

- 11.6.2 EGYPT

- 11.6.2.1 Strategic investments and favorable trade positioning to drive market

- 11.6.3 TURKIYE

- 11.6.3.1 Growth in automotive manufacturing, construction development, white goods production, and presence of global compounders to drive market

- 11.6.4 SOUTH AFRICA

- 11.6.4.1 Automotive production, growing electronics consumption, and steady construction activities to drive market

- 11.6.5 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 MARKET SHARE OF KEY PLAYERS

- 12.4 REVENUE ANALYSIS, 2021-2025

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT

- 12.6.6 REGION FOOTPRINT

- 12.6.7 POLYMER TYPE FOOTPRINT

- 12.6.8 PRODUCT TYPE FOOTPRINT

- 12.6.9 END-USE INDUSTRY FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.7.6 VALUATION AND FINANCIAL METRICS OF KEY POLYPROPYLENE COMPOUNDS VENDORS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

- 12.8.4 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SABIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 REPSOL

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SUMITOMO CHEMICAL CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 BOREALIS GMBH

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 GS CALTEX CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Others

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 LOTTE CHEMICAL CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 TOTALENERGIES

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 KINGFA SCI.&TECH. CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 LG CHEM

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.10.3.1 Right to win

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses and competitive threats

- 13.1.11 TASNEE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.11.3.1 Right to win

- 13.1.11.3.2 Strategic choices

- 13.1.11.3.3 Weaknesses and competitive threats

- 13.1.12 MITSUI CHEMICALS, INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.12.4 MnM view

- 13.1.12.4.1 Right to win

- 13.1.12.4.2 Strategic choices

- 13.1.12.4.3 Weaknesses and competitive threats

- 13.1.13 WASHINGTON PENN

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.13.4 MnM view

- 13.1.13.4.1 Right to win

- 13.1.13.4.2 Strategic choices

- 13.1.13.4.3 Weaknesses and competitive threats

- 13.1.14 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.3.2 Expansions

- 13.1.14.4 MnM view

- 13.1.14.4.1 Right to win

- 13.1.14.4.2 Strategic choices

- 13.1.14.4.3 Weaknesses and competitive threats

- 13.1.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 13.2 OTHER PLAYERS

- 13.2.1 NATPET SCHULMAN SPECIALITY PLASTIC COMPOUNDS

- 13.2.2 CHEMSOURCE EGYPT

- 13.2.3 EUP EGYPT

- 13.2.4 RAVAGO

- 13.2.5 SILON

- 13.2.6 RTP COMPANY

- 13.2.7 ECOBAT

- 13.2.8 SHAMS JAVAID ARVAND

- 13.2.9 ARAD EXIR POLYMER COMPANY

- 13.2.10 INNO-COMP KFT.

- 13.2.11 A.D. COMPOUND S.P.A.

- 13.2.12 MACOMASS VERKAUFS AG

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS