|

시장보고서

상품코드

1796194

기업 이미징 IT 시장 예측(-2030년) : 기능별, 모달리티별, 용도별, 치료별, 최종사용자별, 지역별Enterprise Imaging IT Market by Function (VNA, PACS, Universal Viewer, Analytics), Modality (X-ray, MRI, CT, PET, SPECT, Mammo), Application (Diagnosis, Therapeutic, Theranostic), Therapy (Onco, Cardio, Neuro), End User, Region - Global Forecast to 2030 |

||||||

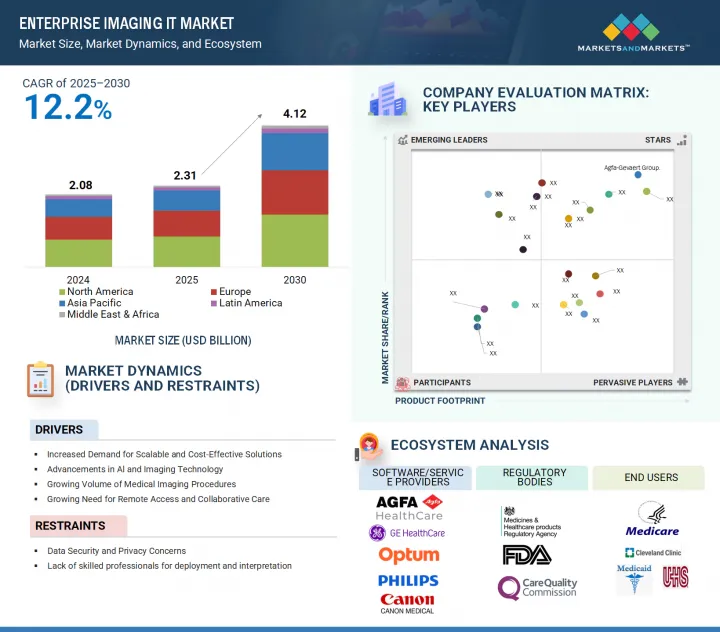

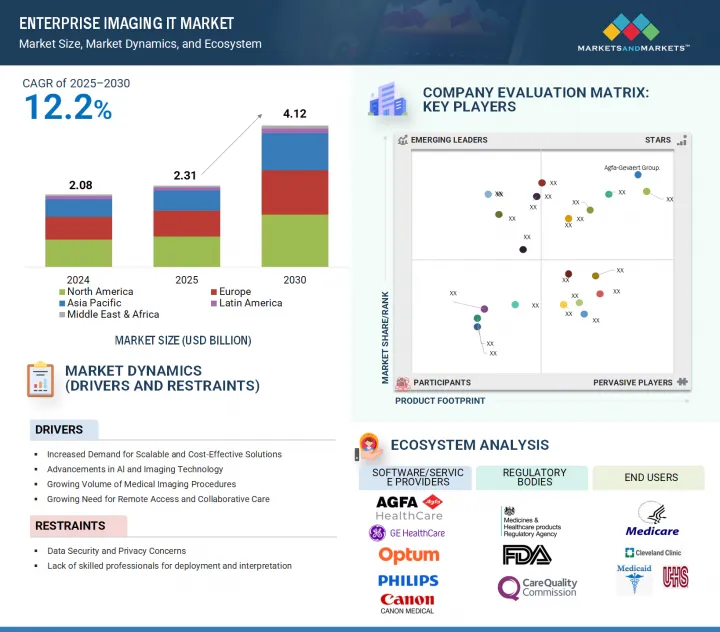

세계의 기업 이미징 IT 시장 규모는 2025년 23억 1,000만 달러에서 2030년까지 41억 2,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 12.2%의 성장이 전망됩니다.

자본에 편중된 라이선스 모델에서 클라우드 네이티브 SaaS 배포로 전환하여 초기 비용을 낮추고 업그레이드를 가속화함으로써 수요를 촉진하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 기능, 모달리티, 용도, 제공, 배포 방식, 치료 영역, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

블록체인을 기반으로 한 이미지 증명 플랫폼의 등장으로 멀티 벤더 생태계에서 데이터의 무결성과 감사 가능성이 강화되고 있습니다. 의료관광 네트워크의 확장으로 표준화된 국경 간 영상 교환 허브의 필요성이 증가하고 있으며, POC(Point-Of-Care) 초음파 영상 장치 및 웨어러블 영상 장치의 보급으로 기업의 워크플로우가 병상에서의 실시간 획득을 포함하여 확대되고 있습니다. 확대되고 있습니다.

"진단 부문은 예측 기간 중 기업 이미징 IT 시장에서 가장 빠르게 성장하는 부문입니다. "

진단 부문이 기업 이미징 IT 시장에서 가장 큰 점유율을 차지하고 있습니다. 이 부문의 높은 점유율과 높은 성장세는 폐암 검진 프로그램의 전국적인 확산으로 저선량 CT 수가 급증하면서 기업 아카이브에 대한 수요가 급증했기 때문인 것으로 분석됩니다. 또한 두개내 출혈, 폐색전증과 같은 중요한 소견에 자동으로 플래그를 표시하는 AI 기반 분류 엔진의 통합은 의료 서비스 프로바이더의 진단 플랫폼 업그레이드를 촉진하고 있습니다. 또한 종양학 영상 및 신경학 영상에서 정량적 방사성동위원소 및 텍스처 분석 워크플로우가 증가함에 따라 고차원 피처셋을 대규모로 저장, 처리 및 추출할 수 있는 솔루션에 대한 수요가 증가하고 있습니다.

"2024년 기업 이미징 IT 시장에서 치료 영역별로는 순환기 분야가 가장 큰 점유율을 차지할 것으로 추정됩니다. "

순환기 부문은 계산 모델과 고충실도 CT 아카이브의 원활한 통합을 필요로 하는 CT 기반 관상동맥 혈류 예비율(FFR CT) 워크플로우의 급증으로 인해 2024년 가장 큰 점유율을 차지했습니다. 하이브리드 카테터 랩/수술실(Hybrid Catheter Lab/Or Suite)의 급속한 확장은 경피적 카테터 판막 중재술 및 구조적 중재술 중 실시간으로 3D 혈관 재구성을 중첩할 수 있는 기업 뷰어에 대한 수요를 촉진하고 있습니다. AI를 통한 박출률 정량화 및 심실 용적 측정을 위한 새로운 CPT 코드도 병원이 심혈관 분석이 통합된 플랫폼을 개발하도록 동기를 부여하고 있습니다. 또한 웨어러블 ECG와 이식형 디바이스의 데이터 스트림이 급증함에 따라 순환기내과에서는 종합적인 심혈관 위험 계층화를 위해 영상 검사와 다중 소스 신호를 통합하는 기업 솔루션을 채택하고 있습니다.

세계의 기업 이미징 IT 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 기업 이미징 IT 시장의 개요

- 북미의 기업 이미징 IT 시장 : 용도별, 지역별

- 기업 이미징 IT 시장 : 지역적 스냅숏

- 기업 이미징 IT 시장 : 선진국과 신흥 국가

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 산업 동향

- AI를 활용한 진단과 예측 분석

- 통합 영상 데이터 통합과 공동 진단

- 클라우드 기반 이미징 IT 플랫폼과 디지털 전환

- 에코시스템 분석

- 공급망 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 상황

- 가격결정 분석

- 기업 IT 이미징 솔루션의 참고 가격 : 기능별(2024년)

- 기업 IT 이미징 솔루션의 참고 가격 : 지역별(2024년)

- Porter's Five Forces 분석

- 특허 분석

- 기업 이미징 IT 시장에서 특허 공보의 동향

- 인사이트 : 관할과 주요 신청자의 분석

- 주요 이해관계자와 구입 기준

- 최종사용자 분석

- 미충족 요구

- 최종사용자 기대

- 2025년 - 주요 컨퍼런스와 이벤트(2026년)

- 사례 연구 분석

- 투자와 자금조달 시나리오

- 비즈니스 모델 분석

- 기업 이미징 IT 시장에 대한 생성형 AI의 영향

- 주요 사용 사례와 시장의 장래성

- AI/생성형 AI 실장 사례 연구

- 상호접속된 인접 시장

- 사용자 준비 상황과 영향의 평가

- 기업 이미징 IT 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종사용자에 대한 영향

제6장 기업 IT 시장 : 기능별

- 서론

- VNA

- PACS

- 영상 교환

- 유니버설 뷰어

- 워크플로우 오케스트레이션

- 애널리틱스

- 기타 기능

제7장 기업 이미징 IT 시장 : 용도별

- 서론

- 진단

- 치료

- 임상 연구

제8장 기업 이미징 IT 시장 : 모달리티별

- 서론

- X선

- 자기공명영상(MRI)

- 컴퓨터단층촬영(CT)

- 초음파

- 핵이미징

- 내시경검사

- 맘모그래피

- 투시 검사

- 심장 초음파 검사

- 기타 모달리티

제9장 기업 이미징 IT 시장 : 제공별

- 서론

- 소프트웨어

- 서비스

제10장 기업 이미징 IT 시장 : 배포 방식별

- 서론

- 온프레미스 솔루션

- 클라우드 기반 솔루션

- 하이브리드 솔루션

제11장 기업 이미징 IT 시장 : 치료 영역별

- 서론

- 신경

- 순환기

- 종양

- 정형외과

- 기타 치료 영역

제12장 기업 이미징 IT 시장 : 최종사용자별

- 서론

- 병원

- 진단 센터

- 진료소·외래 진료

- 제약·바이오테크놀러지 기업

- 의료 기술 기업

- 연구·학술기관

- 기타 최종사용자

제13장 기업 이미징 IT 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제14장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020년 - 2024년

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 브랜드/소프트웨어의 비교

- 경쟁 시나리오

제15장 기업 개요

- 주요 기업

- AGFA-GEVAERT GROUP

- FUJIFILM HOLDINGS CORPORATION

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- SIEMENS HEALTHINEERS AG

- OPTUM, INC.

- SECTRA AB

- CANON MEDICAL SYSTEMS CORPORATION

- MERATIVE

- PRO MEDICUS, LTD.

- INTELERAD MEDICAL SYSTEMS INCORPORATED

- HYLAND SOFTWARE, INC.

- INFINITT HEALTHCARE CO., LTD.

- NOVARAD

- MACH7 TECHNOLOGIES

- HERMES MEDICAL SOLUTIONS

- KONICA MINOLTA, INC.

- BRIDGEHEAD SOFTWARE LTD.

- SCIMAGE, INC.

- VISUS HEALTH IT GMBH

- 기타 기업

- DICOM SYSTEMS, INC.

- POSTDICOM

- QAELUM

- ADVAHEALTH SOLUTIONS

- PAXERAHEALTH

- RAD AI

제16장 부록

KSA 25.08.29The global enterprise imaging IT market is projected to reach USD 4.12 billion by 2030 from USD 2.31 billion in 2025, at a CAGR of 12.2% during the forecast period. Demand is propelled by the shift from capital-heavy license models to cloud native SaaS deployments, which lower upfront costs and accelerate upgrades.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Function, Modality, Application, Offering, Deployment Mode, Therapeutic Area, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The emergence of blockchain-backed image provenance platforms is enhancing data integrity and auditability across multi-vendor ecosystems. Growing medical tourism networks are driving the need for standardized, cross-border image exchange hubs, while the proliferation of point-of-care ultrasound and wearable imaging devices is expanding enterprise workflows to include real-time, bedside acquisitions.

"The diagnostics segment is the fastest-growing segment in the enterprise imaging IT market within the forecast period."

Based on applications, the enterprise imaging IT market has been divided into diagnostics, therapeutics, and clinical research. The diagnostics segment accounts for the largest share of the enterprise imaging IT market. This segment's large share and high growth can be attributed to the nationwide rollout of lung cancer screening programs, which has surged low-dose CT volumes and driven enterprise archive demand. The integration of AI-driven triage engines that automatically flag critical findings such as intracranial hemorrhages or pulmonary emboli has also pushed providers to upgrade diagnostic platforms. Additionally, the rise of quantitative radiomics and texture analysis workflows for oncology and neurology imaging is creating demand for solutions that can store, process, and mine high-dimensional feature sets at scale.

"The cardiology segment is estimated to hold the largest share of the enterprise imaging IT market in 2024, by therapeutic area."

Based on therapeutic area, the enterprise imaging IT market is segmented into neurology, cardiology, oncology, orthopedics, and other therapeutic areas. The cardiology segment held the largest share in 2024 due to the surge in CT-derived fractional flow reserve (FFR CT) workflows, which require seamless integration of computational models and high-fidelity CT archives. The rapid expansion of hybrid cath lab/OR suites is driving the demand for enterprise viewers that can overlay 3D vessel reconstructions in real time during transcatheter valve and structural interventions. New CPT codes for AI-quantified ejection fraction and chamber volumetrics are also incentivizing hospitals to deploy platforms with built-in cardiac analytics. Additionally, the proliferation of wearable ECG and implantable device data streams is pushing cardiology departments to adopt enterprise solutions that fuse multi source signals with imaging studies for comprehensive cardiac risk stratification.

"The Asia Pacific region is expected to register the highest growth rate in the enterprise imaging IT market during the forecast period."

The global enterprise imaging IT market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific is expected to register the highest growth for enterprise imaging IT in the forecast period. Factors such as India's National Digital Health Mission integrating imaging data into its Health Locker for unified patient records, the rise of medical tourism hubs in Malaysia and Thailand demanding seamless cross border image exchange, public-private partnerships deploying mobile CT and MRI units in rural China, and the explosive uptake of low cost, AI powered handheld ultrasound devices in South Korea and India are all fueling Asia Pacific's rapid enterprise imaging IT adoption.

The breakdown of primary participants is as mentioned below:

- By Company Type: Tier 1 (41%), Tier 2 (31%), and Tier 3 (28%)

- By Designation: C-level Executives (44%), Directors (31%), and Others (25%)

- By Region: North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), and the Middle East & Africa (3%)

Key Players

The prominent players in this market are Agfa-Gevaert Group (Belgium), FUJIFILM Corporation (Japan), Merative (US), Pro Medicus, Ltd. (Australia), Optum, Inc. (US), GE HealthCare (US), Intelerad (Canada), Sectra AB (Sweden), CANON MEDICAL SYSTEMS CORPORATION (Japan), Hyland Software, Inc. (US), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers AG (Germany), INFINITT Healthcare Co., Ltd. (South Korea), Novarad (US), Mach7 Technologies (US), Hermes Medical Solutions (Sweden), Konica Minolta, Inc. (Japan), BridgeHead Software Ltd. (England), Sclmage, Inc. (US), VISUS Health IT GmbH (Germany), Dicom Systems, Inc. (US), PostDICOM (Netherlands), Qaelum (Belgium), AdvaHealth Solutions (Singapore), PaxeraHealth (US), and Rad AI (US). Players adopted organic and inorganic growth strategies such as solution launches, enhancements, and upgrades; collaborations; partnerships; acquisitions; agreements; and expansions to increase their offerings, cater to customers' unmet needs, increase their profitability, and expand their presence in the global market.

Research Coverage

- The report studies the enterprise imaging IT market based on function, modality, application, offering, deployment mode, therapeutic area, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micromarkets with respect to their growth trends, prospects, and contributions to the total enterprise imaging IT market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms, as well as new entrants/smaller firms, gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the enterprise imaging IT market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the enterprise imaging IT market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of enterprise imaging IT solutions across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the enterprise imaging IT market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the enterprise imaging IT market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary sources

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH APPROACH

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 MARKET SIZING ASSUMPTIONS

- 2.5.2 OVERALL STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ENTERPRISE IMAGING IT MARKET OVERVIEW

- 4.2 NORTH AMERICA: ENTERPRISE IMAGING IT MARKET, BY APPLICATION & REGION

- 4.3 ENTERPRISE IMAGING IT MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 ENTERPRISE IMAGING IT MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased demand for scalable and cost-effective solutions

- 5.2.1.2 Advancements in AI and imaging technologies

- 5.2.1.3 Growing volume of medical imaging procedures

- 5.2.1.4 Growing need for remote access and collaborative care

- 5.2.1.5 Government initiatives and favorable policies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data security and privacy concerns

- 5.2.2.2 Lack of skilled professionals for deployment and interpretation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion into emerging markets

- 5.2.3.2 Multi modality and advanced visualization

- 5.2.3.3 Partnerships with AI and analytics providers

- 5.2.3.4 Value-based care and population health management

- 5.2.3.5 Cloud native and edge computing innovations

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability with legacy and vendor-specific systems

- 5.2.4.2 High upfront integration and deployment costs

- 5.2.4.3 Workflow disruption and user adoption

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 AI-ENABLED DIAGNOSTICS AND PREDICTIVE ANALYTICS

- 5.4.2 UNIFIED IMAGING DATA INTEGRATION AND COLLABORATIVE DIAGNOSTICS

- 5.4.3 CLOUD-BASED IMAGING IT PLATFORMS AND DIGITAL TRANSFORMATION

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Imaging analytics platforms

- 5.7.1.2 Artificial intelligence and machine learning

- 5.7.1.3 Multi modality fusion & co registration engines

- 5.7.1.4 Zero footprint viewers

- 5.7.1.5 Mobile enterprise imaging and workflow bots

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Radiology information systems (RIS)

- 5.7.2.2 Electronic health record (EHR/EMR) integration

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Cloud computing & storage

- 5.7.3.2 Blockchain & distributed ledger technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY ANALYSIS

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 5.8.2 REGULATORY LANDSCAPE

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Latin America

- 5.8.2.5 Middle East & Africa

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING FOR ENTERPRISE IT IMAGING SOLUTIONS, BY FUNCTION (2024)

- 5.9.2 INDICATIVE PRICING FOR ENTERPRISE IT IMAGING SOLUTIONS, BY REGION (2024)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 BARGAINING POWER OF SUPPLIERS

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF SUBSTITUTES

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR ENTERPRISE IMAGING IT MARKET

- 5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 END-USER ANALYSIS

- 5.13.1 UNMET NEEDS

- 5.13.2 END-USER EXPECTATIONS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 BUSINESS MODEL ANALYSIS

- 5.18 IMPACT OF GENERATIVE AI ON ENTERPRISE IMAGING IT MARKET

- 5.18.1 TOP USE CASES & MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.2.1 Case Study 1: Enabling interoperability and scalability across enterprise imaging networks with Dicom Systems' Unifier Platform

- 5.18.2.2 Case Study 2: More images, more insight, more collaboration - San Gerardo Hospital transforms radiology with Agfa HealthCare's Enterprise Imaging

- 5.18.3 INTERCONNECTED & ADJACENT MARKETS

- 5.18.3.1 Vendor Neutral Archive (VNA) & PACS Market

- 5.18.3.2 Medical Image Analysis Software Market

- 5.18.3.3 Healthcare IT Market

- 5.18.4 USER READINESS & IMPACT ASSESSMENT

- 5.18.4.1 User readiness

- 5.18.4.1.1 User A: Hospitals

- 5.18.4.1.2 User B: Diagnostic centers

- 5.18.4.2 Impact assessment

- 5.18.4.2.1 User A: Hospitals

- 5.18.4.2.1.1 Implementation

- 5.18.4.2.1.2 Impact

- 5.18.4.2.2 User B: Diagnostic centers

- 5.18.4.2.2.1 Implementation

- 5.18.4.2.2.2 Impact

- 5.18.4.2.1 User A: Hospitals

- 5.18.4.1 User readiness

- 5.18.1 TOP USE CASES & MARKET POTENTIAL

- 5.19 IMPACT OF 2025 US TARIFFS ON ENTERPRISE IMAGING IT MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.3.1 Increased costs of hardware components

- 5.19.3.2 Software & licensing inflation

- 5.19.3.3 Supply chain disruption

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END USERS

- 5.19.5.1 Hospitals (large, mid-sized, and academic medical centers)

- 5.19.5.2 Diagnostic centers (independent and chain-based)

- 5.19.5.3 Teleradiology providers

6 ENTERPRISE IMAGING IT MARKET, BY FUNCTION

- 6.1 INTRODUCTION

- 6.2 VENDOR NEUTRAL ARCHIVES (VNA)

- 6.2.1 ADVANCING SEAMLESS INFORMATION EXCHANGE THROUGH VNA SOLUTIONS TO BOOST MARKET GROWTH

- 6.3 PICTURE ARCHIVING AND COMMUNICATION SYSTEMS (PACS)

- 6.3.1 GROWING INTEGRATION OF AI WITHIN PACS FOR OPTIMIZED RADOIOLOGY WORKFLOWS TO SUPPORT MARKET GROWTH

- 6.4 IMAGE EXCHANGE

- 6.4.1 GROWING POPULARITY OF INTEROPERABLE IMAGING NETWORKS FOR PATIENT-CENTERED DATA SHARING TO DRIVE GROWTH

- 6.5 UNIVERSAL VIEWERS

- 6.5.1 GROWING UNIVERSAL VIEWER DEPLOYMENT FOR MULTI-DISCIPLINARY IMAGING TO FUEL MARKET

- 6.6 WORKFLOW ORCHESTRATION

- 6.6.1 AI-POWERED IMAGING WORKFLOW AUTOMATION AND CROSS-MODALITY COORDINATION TO PROPEL MARKET

- 6.7 ANALYTICS

- 6.7.1 GROWING NEED FOR ANALYTICS PLATFORMS FOR VALUE-BASED IMAGING AND OPERATIONAL OPTIMIZATION TO DRIVE MARKET

- 6.8 OTHER FUNCTIONS

7 ENTERPRISE IMAGING IT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 DIAGNOSTICS

- 7.2.1 AI-ENABLED QUANTIFICATION AND INTEGRATED THERANOSTIC WORKFLOWS TO DRIVE DIAGNOSTIC IMAGING TRANSFORMATION

- 7.3 THERAPEUTICS

- 7.3.1 ADVANTAGES SUCH AS MULTIMODAL TREATMENT INTEGRATION TO OPTIMIZE ENTERPRISE IMAGING FOR THERAPEUTIC WORKFLOWS

- 7.4 CLINICAL RESEARCH

- 7.4.1 AI-ENABLED QUANTIFICATION AND RAPID-RESPONSE IMAGING WORKFLOWS TO ACCELERATE CLINICAL RESEARCH

8 ENTERPRISE IMAGING IT MARKET, BY MODALITY

- 8.1 INTRODUCTION

- 8.2 X-RAY

- 8.2.1 GROWTH IN ENTERPRISE IMAGING THROUGH AI-ENABLED X-RAY SOLUTIONS TO BOOST MARKET

- 8.3 MAGNETIC RESONANCE IMAGING (MRI)

- 8.3.1 EXPANDING MRI ENTERPRISE IT TO MEET RISING NEUROLOGICAL IMAGING DEMANDS TO SUPPORT MARKET GROWTH

- 8.4 COMPUTED TOMOGRAPHY (CT)

- 8.4.1 REGULATORY AND VALUE-BASED INCENTIVES TO FUEL CT IMAGING IT ADOPTION

- 8.5 ULTRASOUND

- 8.5.1 AI-POWERED ULTRASOUND AND POCUS TO ACCELERATE ENTERPRISE IMAGING TRANSFORMATION

- 8.6 NUCLEAR IMAGING

- 8.6.1 POSITRON EMISSION TOMOGRAPHY (PET)

- 8.6.1.1 Rising PET scan volumes to drive demand for scalable, intelligent Imaging IT

- 8.6.2 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT)

- 8.6.2.1 Driving diagnostic accuracy with automated SPECT workflows to contribute to growth

- 8.6.1 POSITRON EMISSION TOMOGRAPHY (PET)

- 8.7 ENDOSCOPY

- 8.7.1 ENABLING REAL-TIME ENDOSCOPIC INSIGHTS THROUGH CLOUD-NATIVE VIDEO ORCHESTRATION TO DRIVE MARKET

- 8.8 MAMMOGRAPHY

- 8.8.1 NEED FOR ENTERPRISE IMAGING SOLUTIONS FOR HIGH-VOLUME, HIGH-RESOLUTION MAMMOGRAPHY WORKFLOWS TO FUEL GROWTH

- 8.9 FLUOROSCOPY

- 8.9.1 STRATEGIC CLOUD-NATIVE IMAGING FOR ADVANCED FLUOROSCOPY USE CASES TO AID WITH GROWTH

- 8.10 ECHOCARDIOGRAPHY

- 8.10.1 ABILITY TO ENHANCE FLUOROSCOPY IMAGING EFFICIENCY WITH AI-INTEGRATED ENTERPRISE IT SOLUTIONS TO BOOST MARKET

- 8.11 OTHER MODALITIES

9 ENTERPRISE IMAGING IT MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 SOFTWARE

- 9.2.1 ADVANCING UNIFIED IMAGING ECOSYSTEMS THROUGH CLOUD-NATIVE SOFTWARE TO BOOST MARKET GROWTH

- 9.3 SERVICES

- 9.3.1 ADVANTAGES SUCH AS EXPERT SERVICES, CLOUD MIGRATION, AND WORKFLOW OPTIMIZATION TO SUPPORT MARKET GROWTH

10 ENTERPRISE IMAGING IT MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- 10.2 ON-PREMISE SOLUTIONS

- 10.2.1 GROWING NEED FOR IMAGING PERFORMANCE AND DATA CONTROL THROUGH ON-PREMISE DEPLOYMENT TO SUPPORT MARKET GROWTH

- 10.3 CLOUD-BASED SOLUTIONS

- 10.3.1 RISING NEED FOR COST-EFFICIENT, SCALABLE INFRASTRUCTURE TO DRIVE DEMAND FOR CLOUD-BASED DEPLOYMENT

- 10.4 HYBRID SOLUTIONS

- 10.4.1 ABILITY TO BRIDGE DATA CONTROL AND CLOUD INNOVATION THROUGH HYBRID DEPLOYMENT TO BOOST GROWTH

11 ENTERPRISE IMAGING IT MARKET, BY THERAPEUTIC AREA

- 11.1 INTRODUCTION

- 11.2 NEUROLOGY

- 11.2.1 INTEGRATION OF AI-DRIVEN MULTIMODAL NEUROIMAGING FOR PERSONALIZED NEUROLOGICAL CARE TO BOOST MARKET

- 11.3 CARDIOLOGY

- 11.3.1 CLOUD-ENABLED, AI-DRIVEN ENTERPRISE IMAGING PLATFORMS TO ACCELERATE ADVANCED CARDIAC DIAGNOSTICS

- 11.4 ONCOLOGY

- 11.4.1 AI-DRIVEN, MULTIMODAL ENTERPRISE IMAGING PLATFORMS TO ADVANCE PRECISION ONCOLOGY

- 11.5 ORTHOPEDICS

- 11.5.1 ABILITY OF AI-ENABLED ENTERPRISE IMAGING PLATFORMS TO TRANSFORM ORTHOPEDIC CARE TO DRIVE DEMAND

- 11.6 OTHER THERAPEUTIC AREAS

12 ENTERPRISE IMAGING IT MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 HOSPITALS

- 12.2.1 HOSPITALS TO DRIVE DEMAND FOR UNIFIED IMAGING INFRASTRUCTURE TO SUPPORT INTEGRATED CARE DELIVERY

- 12.3 DIAGNOSTIC CENTERS

- 12.3.1 GROWING ADOPTION OF ENTERPRISE IMAGING IT TO ENHANCE WORKFLOW EFFICIENCY IN DIAGNOSTIC CENTERS TO BOOST MARKET

- 12.4 CLINICS & OUTPATIENT SETTINGS

- 12.4.1 GROWING POPULARITY OF LIGHTWEIGHT ENTERPRISE IMAGING IT TO BOOST EFFICIENCY AND PATIENT THROUGHPUT TO FUEL GROWTH

- 12.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 12.5.1 GROWING USE OF ENTERPRISE IMAGING IT FOR TRANSLATIONAL RESEARCH AND DRUG DEVELOPMENT TO DRIVE MARKET

- 12.6 MEDTECH COMPANIES

- 12.6.1 ABILITY OF ENTERPRISE IMAGING IT TO ACCELERATE DEVICE INNOVATION AND CLINICAL INTEGRATION TO FUEL ADOPTION

- 12.7 RESEARCH & ACADEMIC INSTITUTES

- 12.7.1 GROWING NEED TO POWER DATA-DRIVEN DISCOVERY AND COLLABORATION TO SUPPORT MARKET GROWTH

- 12.8 OTHER END USERS

13 ENTERPRISE IMAGING IT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 AI integration, cloud adoption, and regulatory push to accelerate enterprise imaging IT transformation in US

- 13.2.3 CANADA

- 13.2.3.1 Provincial interoperability mandates and cloud-enabled AI to drive growth in Canada's imaging IT market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Hospital modernization and ePA adoption to propel Germany's enterprise imaging IT growth

- 13.3.3 UK

- 13.3.3.1 NHS push for AI-driven imaging and cloud integration to fuel market growth

- 13.3.4 FRANCE

- 13.3.4.1 France to accelerate cloud-native, interoperable imaging platforms with focus on data sovereignty

- 13.3.5 ITALY

- 13.3.5.1 Growing VNA and teleradiology adoption in Italy to modernize imaging infrastructure

- 13.3.6 SPAIN

- 13.3.6.1 Spain to scale cloud imaging and VNA for regional collaboration

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 AI diagnostic approvals to accelerate market growth

- 13.4.3 JAPAN

- 13.4.3.1 Aging demographics to drive demand for scalable imaging solutions

- 13.4.4 INDIA

- 13.4.4.1 Government-led digitization to fuel imaging infrastructure expansion

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Government investments to accelerate public health digitization drives

- 13.5.3 MEXICO

- 13.5.3.1 Accelerating imaging modernization through nationwide digital integration in Mexico to boost market

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Enterprise imaging adoption accelerates across GCC amid workforce gaps and digital health push to support growth

- 13.6.3 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ENTERPRISE IMAGING IT MARKET

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Function footprint

- 14.5.5.4 Application footprint

- 14.5.5.5 Therapeutic area footprint

- 14.5.5.6 Deployment mode footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of startups/SMEs

- 14.7 COMPANY VALUATION & FINANCIAL METRICS

- 14.7.1 FINANCIAL METRICS

- 14.7.2 COMPANY VALUATION

- 14.8 BRAND/SOFTWARE COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 SOLUTION LAUNCHES, APPROVALS, AND ENHANCEMENTS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AGFA-GEVAERT GROUP

- 15.1.1.1 Business overview

- 15.1.1.2 Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 FUJIFILM HOLDINGS CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 GE HEALTHCARE

- 15.1.3.1 Business overview

- 15.1.3.2 Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Solution launches & approvals

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 KONINKLIJKE PHILIPS N.V.

- 15.1.4.1 Business overview

- 15.1.4.2 Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Solution launches & approvals

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 SIEMENS HEALTHINEERS AG

- 15.1.5.1 Business overview

- 15.1.5.2 Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Solution launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 OPTUM, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses & competitive threats

- 15.1.7 SECTRA AB

- 15.1.7.1 Business overview

- 15.1.7.2 Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Solution launches & approvals

- 15.1.7.3.2 Deals

- 15.1.8 CANON MEDICAL SYSTEMS CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansions

- 15.1.9 MERATIVE

- 15.1.9.1 Business overview

- 15.1.9.2 Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Expansions

- 15.1.10 PRO MEDICUS, LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Solution launches

- 15.1.10.3.2 Deals

- 15.1.11 INTELERAD MEDICAL SYSTEMS INCORPORATED

- 15.1.11.1 Business overview

- 15.1.11.2 Solutions offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Solution launches

- 15.1.11.3.2 Deals

- 15.1.12 HYLAND SOFTWARE, INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Solution launches

- 15.1.12.3.2 Deals

- 15.1.13 INFINITT HEALTHCARE CO., LTD.

- 15.1.13.1 Business overview

- 15.1.13.2 Solutions offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Solution launches & approvals

- 15.1.13.3.2 Deals

- 15.1.14 NOVARAD

- 15.1.14.1 Business overview

- 15.1.14.2 Solutions offered

- 15.1.15 MACH7 TECHNOLOGIES

- 15.1.15.1 Business overview

- 15.1.15.2 Solutions offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Solution launches

- 15.1.15.3.2 Deals

- 15.1.16 HERMES MEDICAL SOLUTIONS

- 15.1.16.1 Business overview

- 15.1.16.2 Solutions offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Solution launches, approvals, and enhancements

- 15.1.16.3.2 Deals

- 15.1.17 KONICA MINOLTA, INC.

- 15.1.17.1 Business overview

- 15.1.17.2 Solutions offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Solution launches & enhancements

- 15.1.17.3.2 Deals

- 15.1.18 BRIDGEHEAD SOFTWARE LTD.

- 15.1.18.1 Business overview

- 15.1.18.2 Solutions offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Deals

- 15.1.19 SCIMAGE, INC.

- 15.1.19.1 Business overview

- 15.1.19.2 Solutions offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Solution launches

- 15.1.19.3.2 Deals

- 15.1.20 VISUS HEALTH IT GMBH

- 15.1.20.1 Business overview

- 15.1.20.2 Solutions offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Solution enhancements

- 15.1.1 AGFA-GEVAERT GROUP

- 15.2 OTHER PLAYERS

- 15.2.1 DICOM SYSTEMS, INC.

- 15.2.2 POSTDICOM

- 15.2.3 QAELUM

- 15.2.4 ADVAHEALTH SOLUTIONS

- 15.2.5 PAXERAHEALTH

- 15.2.6 RAD AI

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS